Key Insights

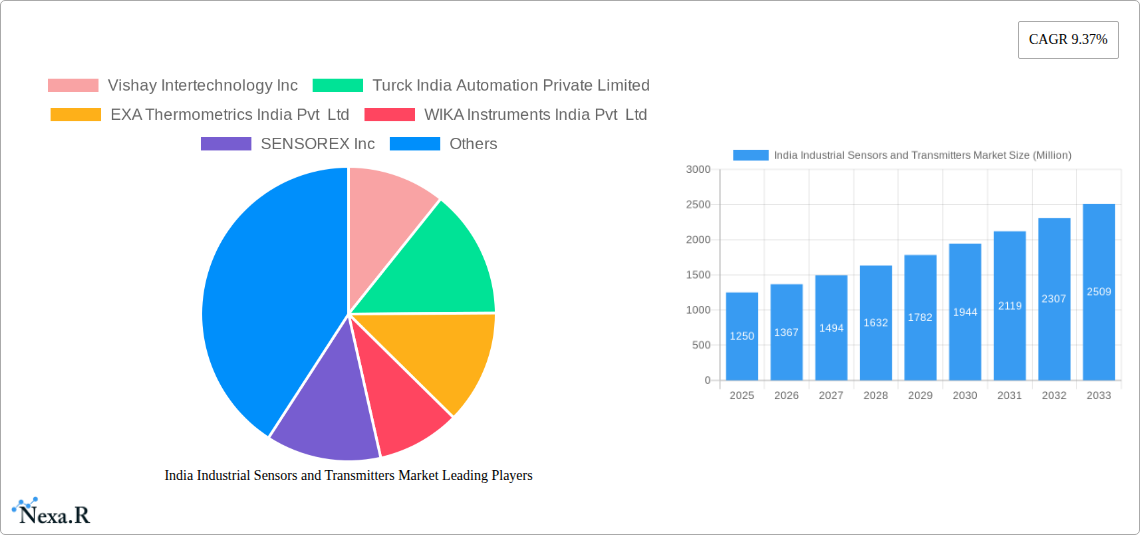

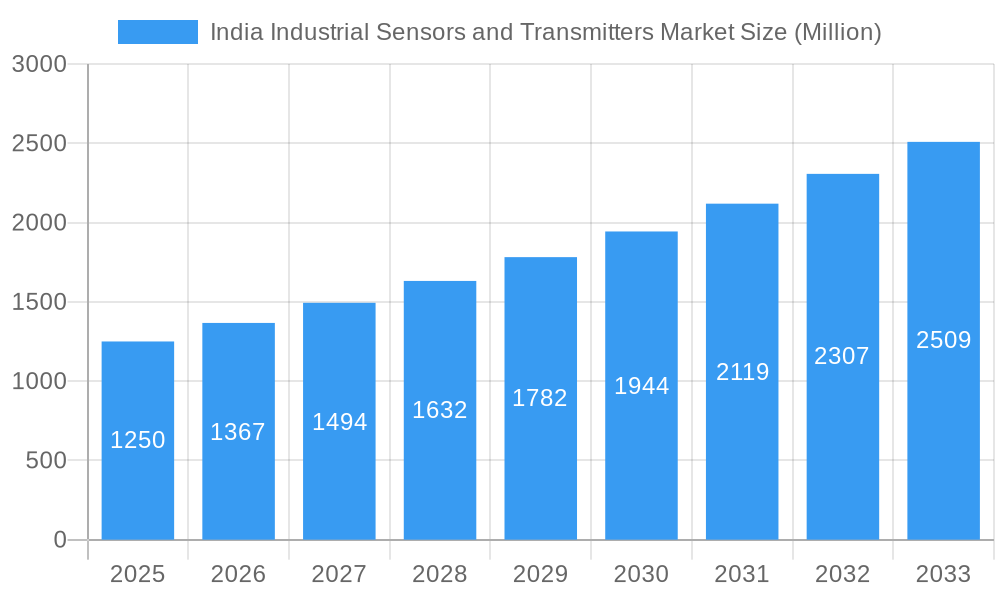

The Indian Industrial Sensors and Transmitters Market is poised for significant expansion, driven by robust industrialization and technological advancements across key sectors. Valued at 1250 Million in 2025, the market is projected to witness a CAGR of 9.37% during the forecast period of 2025-2033. This growth is propelled by several key factors, including the increasing adoption of automation and IIoT (Industrial Internet of Things) across manufacturing facilities, the rising demand for precision and efficiency in production processes, and the growing need for real-time data monitoring and control for enhanced operational intelligence. The energy sector, particularly power generation and renewable energy, alongside the burgeoning petrochemicals and chemicals industries, are key demand centers. Furthermore, the stringent regulatory landscape in sectors like water and wastewater treatment is necessitating advanced sensing technologies for compliance and environmental protection.

India Industrial Sensors and Transmitters Market Market Size (In Billion)

The market's trajectory is also shaped by evolving trends such as the miniaturization of sensors, enhanced connectivity through wireless technologies, and the integration of AI and machine learning for predictive maintenance and improved analytics. While the market is experiencing strong headwinds, potential restraints such as high initial investment costs for advanced systems and the need for skilled personnel for deployment and maintenance could pose challenges. However, the continuous innovation in sensor types, including sophisticated flow, temperature, pressure, and level sensors, alongside advanced transmitters, is addressing these concerns by offering more cost-effective and user-friendly solutions. The food and beverage and life sciences industries are also emerging as significant growth areas, driven by demands for quality control and safety. This dynamic market environment presents substantial opportunities for stakeholders to capitalize on the digital transformation of Indian industries.

India Industrial Sensors and Transmitters Market Company Market Share

India Industrial Sensors and Transmitters Market: Comprehensive Market Outlook & Growth Forecast (2019-2033)

This in-depth report provides a definitive analysis of the India Industrial Sensors and Transmitters Market, offering critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this study delves into market size evolution, technological advancements, and key growth drivers. Leveraging extensive data and expert analysis, the report forecasts market expansion in Million units, detailing segment-specific growth rates and regional dominance. This report is essential for understanding the competitive landscape, identifying emerging opportunities, and formulating robust market strategies within India's burgeoning industrial automation ecosystem.

India Industrial Sensors and Transmitters Market Market Dynamics & Structure

The India Industrial Sensors and Transmitters Market is characterized by a moderately concentrated landscape, driven by continuous technological innovation and an increasing demand for automation across diverse industrial sectors. Key drivers include the adoption of Industry 4.0 principles, the growing need for real-time data acquisition for process optimization, and stringent quality control requirements. Regulatory frameworks, particularly those promoting energy efficiency and environmental compliance, also play a significant role in shaping market demand. Competitive product substitutes, though present, are increasingly being outpaced by the superior performance and integration capabilities of advanced sensors and transmitters. End-user demographics are shifting towards higher sophistication, with a greater emphasis on reliability, accuracy, and connectivity. Mergers and acquisitions (M&A) trends are observed, driven by companies seeking to expand their product portfolios and geographical reach, thereby consolidating market share. While market entry barriers exist due to the need for specialized R&D and adherence to industry standards, the overall ecosystem fosters innovation.

- Market Concentration: Moderately concentrated, with a few leading players holding significant market share.

- Technological Innovation Drivers: Industry 4.0, IIoT integration, AI/ML for predictive maintenance.

- Regulatory Frameworks: Emphasis on energy efficiency, environmental monitoring, and safety standards.

- Competitive Product Substitutes: Limited by the increasing complexity and precision demands of modern industries.

- End-User Demographics: Growing demand for smart, connected, and high-precision sensing solutions.

- M&A Trends: Strategic acquisitions to enhance product offerings and market presence.

India Industrial Sensors and Transmitters Market Growth Trends & Insights

The India Industrial Sensors and Transmitters Market is poised for substantial expansion, driven by the nation's robust industrial growth and the accelerating adoption of automation and digitalization. The market size is projected to evolve significantly, with adoption rates of advanced sensing technologies steadily increasing across all major end-user industries. Technological disruptions, such as the miniaturization of sensors, the development of wireless sensing capabilities, and the integration of AI and machine learning for predictive analytics, are reshaping the market landscape. Consumer behavior is shifting towards a greater reliance on real-time data for decision-making, leading to increased demand for intelligent sensors and transmitters that offer enhanced functionality and connectivity. The CAGR is estimated to be robust, reflecting the burgeoning demand from sectors like Power, Petrochemicals, and Food & Beverage. Market penetration is expected to deepen as more small and medium-sized enterprises (SMEs) embrace automation to remain competitive. The transition from traditional sensing methods to more sophisticated, data-driven solutions is a defining trend, underscoring the market's trajectory towards higher value and intelligence.

Dominant Regions, Countries, or Segments in India Industrial Sensors and Transmitters Market

Within the India Industrial Sensors and Transmitters Market, the Power end-user segment is emerging as a dominant force, propelling significant growth and demand for advanced sensing solutions. This dominance is attributed to several key factors, including the Indian government's ambitious renewable energy targets, the continuous expansion of power generation capacity, and the critical need for efficient and reliable power distribution and transmission infrastructure. Industrial sensors and transmitters are indispensable for monitoring critical parameters such as temperature, pressure, flow, and level in power plants, substations, and renewable energy installations. The Flow sensor segment, specifically, is experiencing elevated demand within the Power sector, essential for managing fuel intake, coolant flow, and emission controls.

Key drivers for this segment's growth include:

- Infrastructure Development: Massive investments in new power projects, including thermal, hydro, solar, and wind, necessitate extensive sensor deployment.

- Operational Efficiency: Real-time monitoring of power generation and distribution processes optimizes efficiency, reduces energy loss, and minimizes downtime.

- Environmental Regulations: Increasing focus on emission monitoring and control in power generation plants drives the demand for specialized sensors.

- Smart Grid Initiatives: The implementation of smart grids requires sophisticated sensors for data acquisition and control across the entire electricity network.

- Renewable Energy Expansion: The rapid growth of solar and wind power, while seemingly different, still relies on robust monitoring of environmental conditions and operational parameters through sensors.

Geographically, Western India, with its high concentration of industrial hubs in states like Gujarat and Maharashtra, is leading the adoption of industrial sensors and transmitters, fueled by its strong presence in Petrochemicals, Chemicals and Fertilizers, and manufacturing sectors. This region's well-developed industrial infrastructure, supportive government policies, and a strong ecosystem of manufacturing and processing units contribute significantly to the demand for these critical components.

India Industrial Sensors and Transmitters Market Product Landscape

The India Industrial Sensors and Transmitters Market is witnessing a surge in product innovations focused on enhanced precision, reliability, and connectivity. Companies are introducing next-generation sensors and transmitters with advanced functionalities, catering to the evolving needs of diverse industries. Products are designed for seamless integration into Industry 4.0 environments, supporting protocols like IO-Link and MQTT for real-time data transmission. Applications range from critical process control in petrochemical plants to stringent quality monitoring in food and beverage manufacturing, and environmental monitoring in water and wastewater treatment facilities. Performance metrics are continuously improving, with greater accuracy, wider operating temperature ranges, and increased resistance to harsh industrial conditions. Unique selling propositions often revolve around miniaturization, low power consumption, and the ability to perform complex measurements with a single device, reducing installation complexity and costs for end-users.

Key Drivers, Barriers & Challenges in India Industrial Sensors and Transmitters Market

Key Drivers:

- Government Initiatives: Programs like 'Make in India' and the push for digitalization are significantly boosting industrial automation and, consequently, the demand for sensors and transmitters.

- Industry 4.0 Adoption: The increasing integration of smart manufacturing technologies, the Internet of Things (IoT), and artificial intelligence necessitates sophisticated sensing solutions for data collection and analysis.

- Growth in End-User Industries: Expansion in sectors such as Power, Petrochemicals, Food & Beverage, and Life Sciences directly fuels the demand for industrial sensors and transmitters.

- Focus on Operational Efficiency and Safety: Industries are investing in advanced sensors to optimize production processes, improve product quality, enhance worker safety, and reduce operational costs.

- Technological Advancements: Continuous innovation in sensor technology, leading to smaller, more accurate, and more connected devices.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of advanced sensors and integrated systems can be a deterrent for some small and medium-sized enterprises (SMEs).

- Lack of Skilled Workforce: A shortage of trained personnel capable of installing, maintaining, and operating complex sensor systems can hinder widespread adoption.

- Data Security and Privacy Concerns: As more data is collected and transmitted wirelessly, concerns around cybersecurity and data privacy need to be addressed.

- Integration Complexity: Integrating new sensor technologies with existing legacy systems can be challenging and time-consuming.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of critical components, affecting market growth.

Emerging Opportunities in India Industrial Sensors and Transmitters Market

The India Industrial Sensors and Transmitters Market presents several compelling emerging opportunities. The burgeoning growth of the electric vehicle (EV) sector creates a significant demand for specialized sensors for battery management, motor control, and charging infrastructure. Furthermore, the increasing focus on sustainable agriculture and precision farming opens avenues for sensors monitoring soil conditions, weather patterns, and crop health. The expansion of the healthcare sector, particularly in diagnostics and patient monitoring, also presents opportunities for advanced medical-grade sensors. The development of low-cost, high-performance sensors for emerging applications in the consumer electronics and smart home markets, although not strictly industrial, can have spillover effects. The increasing adoption of predictive maintenance strategies across industries is driving demand for sensors capable of early fault detection and performance monitoring, creating a niche for AI-integrated sensing solutions.

Growth Accelerators in the India Industrial Sensors and Transmitters Market Industry

Several key catalysts are accelerating the growth of the India Industrial Sensors and Transmitters Market. The government's sustained focus on infrastructure development, including smart cities and advanced manufacturing hubs, provides a fertile ground for increased sensor deployment. Strategic partnerships between domestic sensor manufacturers and international technology providers are fostering the transfer of cutting-edge technologies and best practices, leading to the development of more sophisticated and competitive products. The growing awareness among Indian industries about the benefits of automation, real-time data analytics, and IIoT integration for enhanced productivity and competitiveness is a significant growth accelerator. Furthermore, the increasing global demand for Indian manufactured goods is pushing local industries to adopt higher quality standards and advanced manufacturing processes, which are heavily reliant on precise industrial instrumentation. The shift towards a circular economy and enhanced environmental monitoring also drives the adoption of specialized sensors for pollution control and resource management.

Key Players Shaping the India Industrial Sensors and Transmitters Market Market

- Vishay Intertechnology Inc

- Turck India Automation Private Limited

- EXA Thermometrics India Pvt Ltd

- WIKA Instruments India Pvt Ltd

- SENSOREX Inc

- Arcotherm Pvt Ltd

- SRI Electronics

Notable Milestones in India Industrial Sensors and Transmitters Market Sector

- May 2022: Turck India's launch of its first combination air humidity/temperature sensor with an IO-Link interface, offering cost-effective condition monitoring for IIoT applications. This innovation simplifies integration and is ideal for machine and plant condition monitoring, as well as for climatic condition monitoring in production halls and warehouses across industries like automotive, semiconductor, food, and agriculture.

- October 2021: Vishay Intertechnology's optoelectronics group introduced an AEC-Q100 certified ambient light sensor for automotive and consumer applications. The Vishay Semiconductors VEML6031X00 features high sensitivity, low-noise amplifiers, 16-bit ADCs, and IR channels in a compact surface mount package, enabling detection of light through dark cover materials.

In-Depth India Industrial Sensors and Transmitters Market Market Outlook

The India Industrial Sensors and Transmitters Market is projected to witness robust and sustained growth in the coming years, driven by the nation's industrial evolution and the imperative for technological advancement. Future market potential is largely anchored in the deepening integration of Industry 4.0 principles, the widespread adoption of IIoT solutions, and the increasing demand for smart, data-driven industrial processes. Strategic opportunities lie in catering to emerging sectors like electric mobility and sustainable agriculture, alongside the continued expansion of established industries. The market's trajectory will be further shaped by continuous innovation in sensor technology, focusing on enhanced accuracy, miniaturization, and cost-effectiveness. As India continues its journey towards becoming a global manufacturing powerhouse, the role of industrial sensors and transmitters as the eyes and ears of automation will only become more critical, promising significant investment and development in this vital sector.

India Industrial Sensors and Transmitters Market Segmentation

-

1. Type of Sensor

- 1.1. Flow

- 1.2. Temperature

- 1.3. Pressure

- 1.4. Level

- 1.5. Transmitters and Other Sensors

-

2. End-User

- 2.1. Power

- 2.2. Petrochemicals, Chemicals and Fertilizers

- 2.3. Food and Beverage

- 2.4. Water and Wastewater

- 2.5. Life Sciences

- 2.6. Oil and Gas

- 2.7. Other End-Users

India Industrial Sensors and Transmitters Market Segmentation By Geography

- 1. India

India Industrial Sensors and Transmitters Market Regional Market Share

Geographic Coverage of India Industrial Sensors and Transmitters Market

India Industrial Sensors and Transmitters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities; Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention

- 3.3. Market Restrains

- 3.3.1. Cost and Operational Concerns

- 3.4. Market Trends

- 3.4.1. Flow Sensors are Expected to be Higher in Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Sensor

- 5.1.1. Flow

- 5.1.2. Temperature

- 5.1.3. Pressure

- 5.1.4. Level

- 5.1.5. Transmitters and Other Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Power

- 5.2.2. Petrochemicals, Chemicals and Fertilizers

- 5.2.3. Food and Beverage

- 5.2.4. Water and Wastewater

- 5.2.5. Life Sciences

- 5.2.6. Oil and Gas

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Sensor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vishay Intertechnology Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Turck India Automation Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EXA Thermometrics India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WIKA Instruments India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SENSOREX Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arcotherm Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SRI Electronics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: India Industrial Sensors and Transmitters Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Industrial Sensors and Transmitters Market Share (%) by Company 2025

List of Tables

- Table 1: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Type of Sensor 2020 & 2033

- Table 2: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Type of Sensor 2020 & 2033

- Table 3: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Type of Sensor 2020 & 2033

- Table 8: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Type of Sensor 2020 & 2033

- Table 9: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Sensors and Transmitters Market?

The projected CAGR is approximately 9.37%.

2. Which companies are prominent players in the India Industrial Sensors and Transmitters Market?

Key companies in the market include Vishay Intertechnology Inc, Turck India Automation Private Limited, EXA Thermometrics India Pvt Ltd, WIKA Instruments India Pvt Ltd, SENSOREX Inc, Arcotherm Pvt Ltd, SRI Electronics.

3. What are the main segments of the India Industrial Sensors and Transmitters Market?

The market segments include Type of Sensor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities; Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention.

6. What are the notable trends driving market growth?

Flow Sensors are Expected to be Higher in Demand.

7. Are there any restraints impacting market growth?

Cost and Operational Concerns.

8. Can you provide examples of recent developments in the market?

May 2022 - Turck India's first combination air humidity/temperature sensor, which is very easy to incorporate thanks to the IO-Link interface, provides cost-effective condition monitoring in the field and IIoT applications. The CMTH's combination of the two measured variables, air humidity, and temperature, in a single device, makes it ideal for use in machine and plant condition monitoring systems or for monitoring climatic conditions in production halls and warehouses in a wide range of industries, from the automobile industry to the semiconductor and food industries, all the way through to agriculture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Sensors and Transmitters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Sensors and Transmitters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Sensors and Transmitters Market?

To stay informed about further developments, trends, and reports in the India Industrial Sensors and Transmitters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence