Key Insights

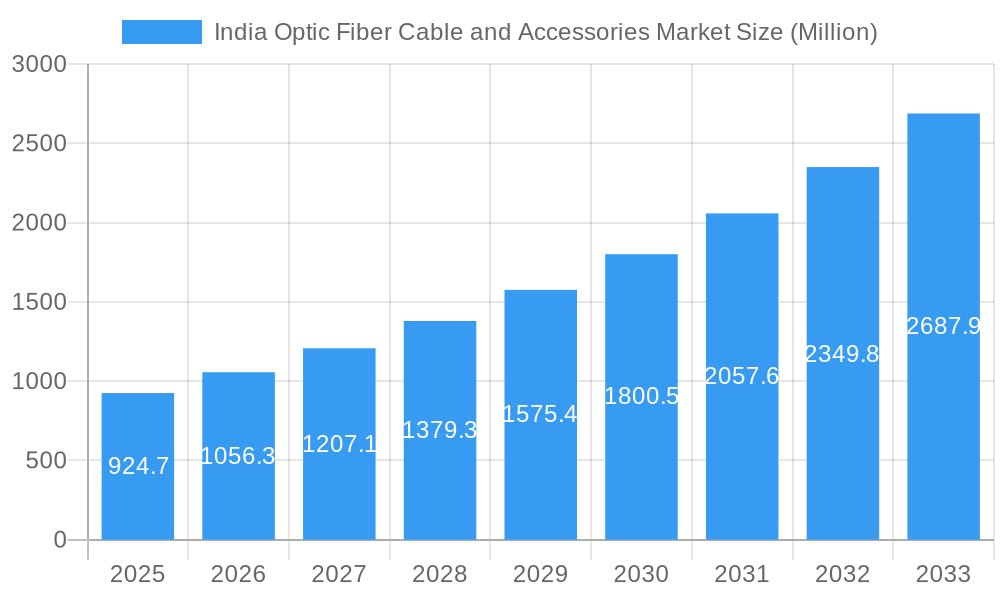

The Indian Optic Fiber Cable and Accessories Market is poised for substantial growth, driven by robust demand across telecommunication, industrial, and energy sectors. The market is projected to reach $924.7 million by 2025, expanding at a compelling Compound Annual Growth Rate (CAGR) of 14.27%. This rapid expansion is fueled by the ongoing digital transformation initiatives, including the widespread deployment of 5G networks, the expansion of broadband internet access, and the increasing adoption of smart technologies in various industries. Investments in infrastructure development, particularly in rural connectivity and smart city projects, are further bolstering market growth. The demand for high-speed data transmission, coupled with the need for reliable and efficient connectivity solutions, positions optic fiber cables and associated accessories as critical components for India's technological advancement.

India Optic Fiber Cable and Accessories Market Market Size (In Million)

The market's growth trajectory is further supported by increasing investments in renewable energy projects and the modernization of existing utility grids, which require sophisticated fiber optic infrastructure for seamless monitoring and control. While the optical fiber cables segment is expected to dominate, driven by the sheer volume of deployments, the optical fiber connectors and accessories segments will also witness significant expansion due to the increasing complexity and density of network infrastructure. Key players like Finolex Cables Limited, KEI Industries Limited, Polycab India Limited, and Sterlite Technologies Limited (STL Tech) are actively investing in research and development, expanding manufacturing capacities, and forging strategic partnerships to capitalize on this burgeoning market. Overcoming challenges related to skilled labor availability and the cost of deployment in remote areas will be crucial for sustained and accelerated market penetration.

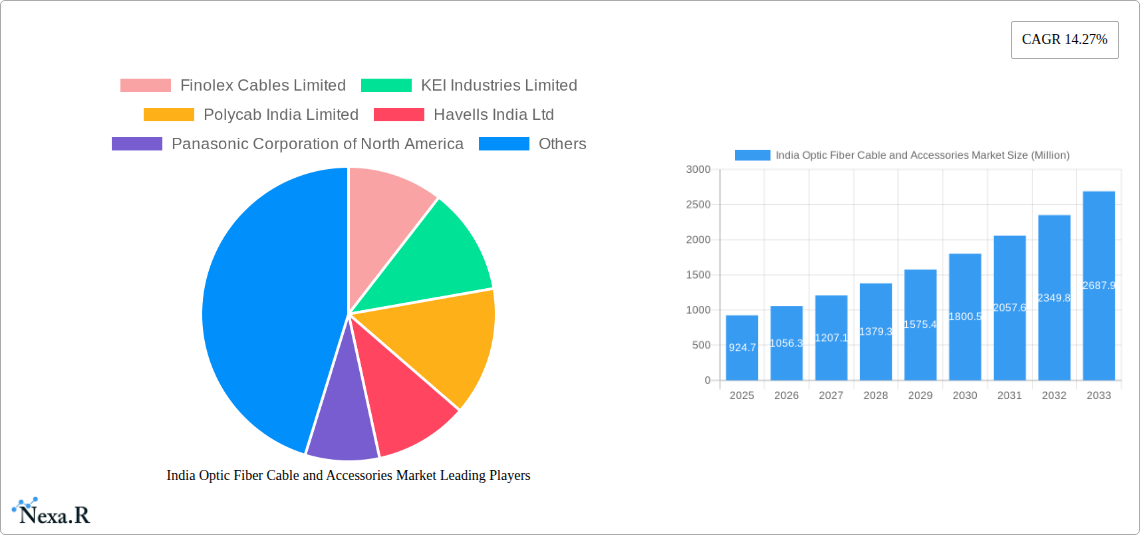

India Optic Fiber Cable and Accessories Market Company Market Share

This in-depth report provides a detailed analysis of the India Optic Fiber Cable (OFC) and Accessories Market, a critical sector underpinning the nation's digital transformation. With the rapid expansion of 5G networks, increasing demand for high-speed broadband, and significant government initiatives like Bharatnet, the market is poised for substantial growth. This report examines the intricate market dynamics, key growth trends, dominant segments, product innovations, influential players, and emerging opportunities. It offers a forward-looking perspective, essential for stakeholders seeking to navigate and capitalize on the evolving landscape of India's fiber optics industry. The study encompasses the parent market of Optical Fiber Cables and the child markets of Optical Fiber Connectors and Optical Fiber Accessories. All values are presented in million units.

India Optic Fiber Cable and Accessories Market Market Dynamics & Structure

The India Optic Fiber Cable and Accessories Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and shifting end-user demographics. Market concentration is moderate, with several key players vying for market share. Technological innovation is a primary driver, fueled by the relentless pursuit of higher bandwidth, increased fiber density, and more efficient installation methods to support the exponential growth in data consumption and the rollout of 5G. Regulatory frameworks, including government policies promoting digital infrastructure development and local manufacturing, significantly influence market entry and growth. Competitive product substitutes, while limited in core OFC technology, can emerge in accessory segments, necessitating continuous product enhancement. End-user verticals, primarily Telecommunication, Energy and Utilities, and Industrial sectors, exhibit distinct demand patterns and adoption rates. Mergers and acquisitions (M&A) are becoming more prevalent as larger entities seek to consolidate market presence and acquire technological expertise.

- Market Concentration: Moderate, with a mix of large established players and emerging local manufacturers.

- Technological Innovation Drivers: 5G rollout, fiber-to-the-home (FTTH) expansion, increased data traffic, and demand for high-density cabling solutions.

- Regulatory Frameworks: Government initiatives like Bharatnet, Digital India, and Production Linked Incentive (PLI) schemes are crucial.

- Competitive Product Substitutes: Primarily in accessories and specialized connectors, with limited alternatives for core optical fiber technology.

- End-User Demographics: Dominated by Telecommunication sector, with significant and growing contributions from Energy and Utilities and Industrial segments.

- M&A Trends: Increasing consolidation to achieve economies of scale and enhance competitive positioning.

India Optic Fiber Cable and Accessories Market Growth Trends & Insights

The India Optic Fiber Cable and Accessories Market is experiencing robust growth, propelled by the nation's ambitious digital infrastructure agenda. The market size evolution is marked by a significant upward trajectory, with increasing adoption rates of fiber optic technology across various sectors. Technological disruptions, such as the development of bend-insensitive fibers and higher density cables, are enhancing performance and expanding application possibilities. Consumer behavior shifts are evident, with an escalating demand for faster and more reliable internet connectivity for both residential and enterprise use, driving the need for extensive fiber optic deployment. The forecast period is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-20%, driven by the sustained push for broadband penetration and the continued rollout of advanced communication networks. Market penetration of fiber optics is projected to rise significantly as rural and semi-urban areas become increasingly connected.

Dominant Regions, Countries, or Segments in India Optic Fiber Cable and Accessories Market

The Telecommunication segment unequivocally dominates the India Optic Fiber Cable and Accessories Market, driven by the massive deployment of fiber optic networks for 5G, 4G expansion, and broadband services. This segment is characterized by high volume requirements and a constant demand for advanced cabling solutions to support increasing data traffic and network capacity. The Optical Fiber Cables offering is the largest contributor within the parent market, accounting for an estimated 75-80% of the overall market value.

Key drivers for this dominance include:

- Government Policies and Initiatives: The Bharatnet project, aimed at connecting rural villages with high-speed internet, has significantly boosted demand for OFCs and related accessories. The thrust towards Digital India and smart cities further fuels this growth.

- 5G Rollout: The rapid and widespread deployment of 5G infrastructure necessitates extensive fiberization, including the fiber-to-the-tower (FTTT) and fiber-to-the-home (FTTH) initiatives, directly impacting the OFC market.

- Increasing Data Consumption: The exponential rise in data consumption by individuals and businesses for entertainment, communication, and operational efficiency necessitates high-capacity, low-latency networks, achievable only with fiber optics.

- Infrastructure Development: Continuous expansion and upgrades of the national telecom backbone, including backhaul and metro networks, require substantial quantities of optical fiber cables.

- Energy and Utilities Sector Growth: While smaller than Telecommunication, this sector is a significant and growing contributor, with fiber optics being increasingly used for smart grid applications, SCADA systems, and data transmission in power distribution and renewable energy projects. The need for robust and reliable communication infrastructure in remote or challenging terrains amplifies the demand for OFCs.

- Industrial Sector Adoption: The Industrial segment, encompassing manufacturing, oil and gas, and mining, is increasingly adopting fiber optics for process automation, real-time monitoring, and secure data transfer within their facilities. The growing adoption of Industry 4.0 principles further fuels this trend.

India Optic Fiber Cable and Accessories Market Product Landscape

The product landscape of the India Optic Fiber Cable and Accessories Market is characterized by continuous innovation focused on enhancing performance, durability, and ease of installation. Key product innovations include ultra-high-density optical fiber cables that maximize fiber count within smaller diameters, catering to space-constrained deployments and increasing network capacity. Bend-insensitive fibers are becoming standard, allowing for more flexible installation in challenging environments without signal degradation. In accessories, advancements are seen in high-precision connectors, efficient splicing technologies, and robust protective enclosures that ensure network integrity. Applications span from backbone networks and metro deployments to last-mile connectivity for FTTH, supporting critical infrastructure in telecommunications, energy, and industrial sectors.

Key Drivers, Barriers & Challenges in India Optic Fiber Cable and Accessories Market

Key Drivers:

- Government Initiatives: Bharatnet, Digital India, and PLI schemes are significantly boosting demand and local manufacturing.

- 5G and Broadband Expansion: The relentless pace of 5G rollout and the push for universal broadband access are primary demand catalysts.

- Increasing Data Demand: Escalating consumption of data for various applications drives the need for high-capacity networks.

- Technological Advancements: Innovations in fiber technology and accessories enhance performance and deployment efficiency.

Barriers & Challenges:

- Supply Chain Disruptions: Global and domestic supply chain vulnerabilities can impact raw material availability and lead times.

- Skilled Workforce Shortage: A lack of adequately trained personnel for installation and maintenance can hinder rapid deployment.

- Infrastructure Development Costs: The substantial capital investment required for widespread fiber optic deployment can be a constraint.

- Competition and Pricing Pressures: Intense competition among manufacturers can lead to pricing pressures, impacting profitability for some players.

- Regulatory Hurdles: While supportive, complex and evolving regulations in certain areas can sometimes create implementation delays.

- Land Acquisition and Right-of-Way: Obtaining necessary permissions and land for cable laying can be a time-consuming process.

Emerging Opportunities in India Optic Fiber Cable and Accessories Market

Emerging opportunities in the India Optic Fiber Cable and Accessories Market lie in the expansion of fiber networks into underserved rural and semi-urban areas, driven by government initiatives. The increasing adoption of fiber optics for smart city infrastructure, including smart grids, intelligent transportation systems, and public safety networks, presents a significant growth avenue. Furthermore, the demand for specialized fiber optic solutions for industrial automation, data centers, and high-performance computing environments is on the rise. The development and deployment of advanced fiber optic sensors for environmental monitoring, industrial process control, and healthcare applications also represent untapped potential.

Growth Accelerators in the India Optic Fiber Cable and Accessories Market Industry

Several key factors are acting as growth accelerators for the India Optic Fiber Cable and Accessories Market. The accelerated pace of 5G network deployment across the country is a paramount driver, necessitating extensive fiber backbone and backhaul infrastructure. Government programs like Bharatnet continue to push for universal broadband connectivity, especially in rural areas, creating sustained demand for OFCs and associated components. The growing adoption of high-speed broadband for residential and enterprise use, fueled by remote work trends and digital content consumption, is another significant accelerator. Furthermore, strategic investments by telecom operators and infrastructure providers in upgrading their networks to support higher bandwidth and lower latency are continuously fueling market expansion.

Key Players Shaping the India Optic Fiber Cable and Accessories Market Market

- Finolex Cables Limited

- KEI Industries Limited

- Polycab India Limited

- Havells India Ltd

- Panasonic Corporation of North America

- Sterlite Technologies Limited (STL Tech)

- Birla Cable Limited

- Vindhya Telelinks Ltd

- HFCL Limited

- Aksh Optifibre Limited

Notable Milestones in India Optic Fiber Cable and Accessories Market Sector

- May 2024: Runaya, a manufacturer of optical fiber cable components, announced its strategic aim to double its capacity and scale revenues to INR 500 crore (~USD 60 million) within the next 3-4 years. This ambitious growth plan is propelled by the accelerated rollout of 5G, the fiberization of towers, the push for home broadband connectivity, and the government's Bharatnet Project. The company has invested INR 60 crore (~USD 7 million) since 2019 in manufacturing FRP (fiber-reinforced polymer) rods, crucial for optical fibers.

- July 2024: STL, a prominent player in the optical and digital solutions arena, introduced its 864F Micro Cables. These high-density cables are engineered for swift and seamless connectivity in compact fiber networks. The 864F Micro cable accommodates 864 fibers within an 11.4 mm diameter, offering 1.5 times the fiber capacity of standard micro cables of equivalent size. Utilizing STL's bend-insensitive HD A2 200-micron fiber, these cables are designed to benefit regional service providers.

In-Depth India Optic Fiber Cable and Accessories Market Market Outlook

The future outlook for the India Optic Fiber Cable and Accessories Market is exceptionally bright, driven by a confluence of factors that are reshaping the nation's digital infrastructure. The sustained momentum in 5G deployment and the ongoing commitment to achieving universal broadband penetration through initiatives like Bharatnet will continue to be primary growth engines. The increasing demand for high-bandwidth applications, cloud computing, and data center expansion will necessitate further upgrades and densification of fiber optic networks. Strategic investments by key industry players in expanding manufacturing capabilities and developing advanced fiber optic solutions will further accelerate market growth. Emerging applications in smart cities, IoT, and industrial automation will also contribute to a diversified and robust demand landscape, positioning India as a global leader in fiber optic technology adoption and deployment.

India Optic Fiber Cable and Accessories Market Segmentation

-

1. Offering

- 1.1. Optical Fiber Cables

- 1.2. Optical Fiber Connectors

- 1.3. Optical Fiber Accessories

-

2. End-user Vertical

- 2.1. Industrial

- 2.2. Telecommunication

- 2.3. Energy and Utilities

- 2.4. Other End-user Verticals

India Optic Fiber Cable and Accessories Market Segmentation By Geography

- 1. India

India Optic Fiber Cable and Accessories Market Regional Market Share

Geographic Coverage of India Optic Fiber Cable and Accessories Market

India Optic Fiber Cable and Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.3. Market Restrains

- 3.3.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and 5G Deployment to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Optic Fiber Cable and Accessories Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Optical Fiber Cables

- 5.1.2. Optical Fiber Connectors

- 5.1.3. Optical Fiber Accessories

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Industrial

- 5.2.2. Telecommunication

- 5.2.3. Energy and Utilities

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Finolex Cables Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KEI Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Polycab India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Havells India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation of North America

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sterlite Technologies Limited (STL Tech)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Birla Cable Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vindhya Telelinks Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HFCL Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aksh Optifibre Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Finolex Cables Limited

List of Figures

- Figure 1: India Optic Fiber Cable and Accessories Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Optic Fiber Cable and Accessories Market Share (%) by Company 2025

List of Tables

- Table 1: India Optic Fiber Cable and Accessories Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 2: India Optic Fiber Cable and Accessories Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 3: India Optic Fiber Cable and Accessories Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Optic Fiber Cable and Accessories Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 5: India Optic Fiber Cable and Accessories Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 6: India Optic Fiber Cable and Accessories Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Optic Fiber Cable and Accessories Market?

The projected CAGR is approximately 14.27%.

2. Which companies are prominent players in the India Optic Fiber Cable and Accessories Market?

Key companies in the market include Finolex Cables Limited, KEI Industries Limited, Polycab India Limited, Havells India Ltd, Panasonic Corporation of North America, Sterlite Technologies Limited (STL Tech), Birla Cable Limited, Vindhya Telelinks Ltd, HFCL Limited, Aksh Optifibre Limite.

3. What are the main segments of the India Optic Fiber Cable and Accessories Market?

The market segments include Offering , End-user Vertical .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

6. What are the notable trends driving market growth?

Rising Internet Penetration and 5G Deployment to Drive the Market.

7. Are there any restraints impacting market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

8. Can you provide examples of recent developments in the market?

May 2024 - Runaya, a manufacturer of optical fiber cable components, aimed to double its capacity and scale its revenues to INR 500 crore (~USD 60 million) within the next 3-4 years. This ambition is driven by the accelerated rollout of 5G, the fiberization of towers, the push for home broadband connectivity, and the government's Bharatnet Project. Since 2019, the company has channeled a capital expenditure of INR 60 crore (~USD 7 million) into manufacturing FRP (fiber-reinforced polymer) rods, essential for optical fibers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Optic Fiber Cable and Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Optic Fiber Cable and Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Optic Fiber Cable and Accessories Market?

To stay informed about further developments, trends, and reports in the India Optic Fiber Cable and Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence