Key Insights

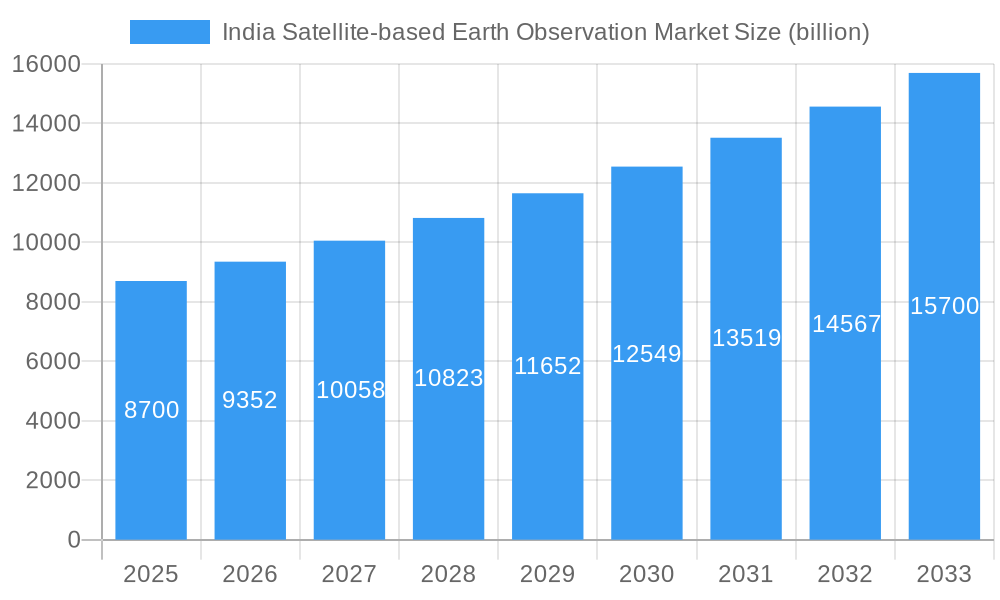

The Indian Satellite-based Earth Observation Market is poised for significant expansion, projected to reach USD 8.7 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated over the forecast period of 2025-2033. This burgeoning market is propelled by a confluence of factors, including the increasing demand for high-resolution satellite imagery for diverse applications, government initiatives promoting space technology and data utilization, and the growing adoption of Earth observation data by various end-use industries. Key growth drivers include the development of advanced satellite constellations, the proliferation of value-added services built upon raw satellite data, and the expanding accessibility of this technology to a wider range of users. The market's trajectory is also influenced by ongoing technological advancements in satellite design, sensor capabilities, and data processing, enabling more sophisticated analytical insights.

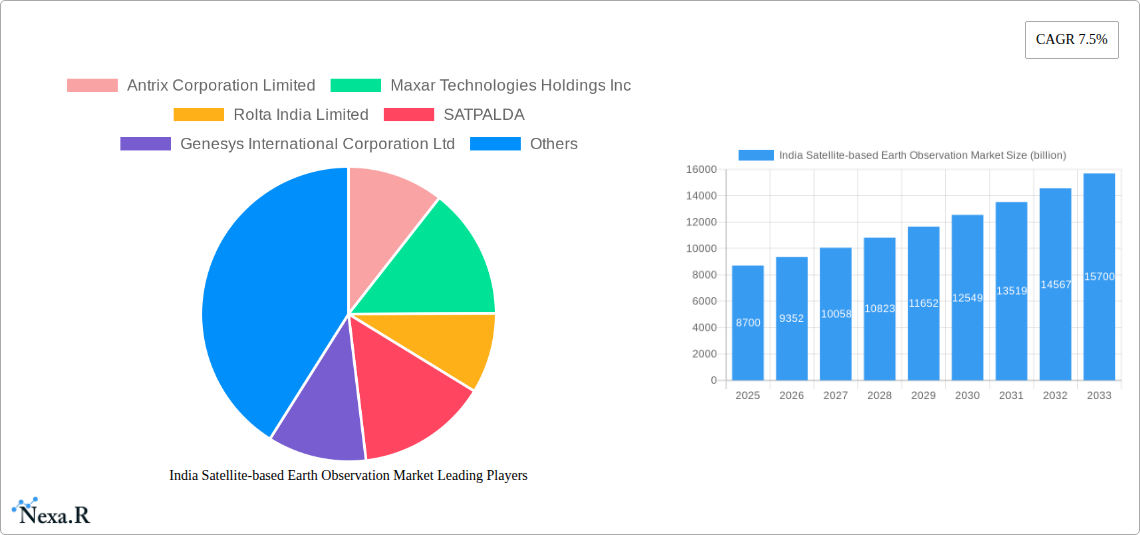

India Satellite-based Earth Observation Market Market Size (In Billion)

The market's segmentation reveals a dynamic landscape, with "Earth Observation Data" and "Value Added Services" emerging as core components. The dominance of "Low Earth Orbit" satellites is expected to continue, owing to their cost-effectiveness and suitability for high-frequency data acquisition. However, the increasing applications in sectors like climate services and infrastructure development are also driving demand for "Medium Earth Orbit" and "Geostationary Orbit" capabilities. End-use industries such as Urban Development and Cultural Heritage, Agriculture, Climate Services, and Energy and Raw Materials are increasingly leveraging satellite-based Earth Observation for enhanced decision-making, resource management, and monitoring. Leading companies and organizations, including Antrix Corporation Limited, Maxar Technologies Holdings Inc, ISRO, and Pixxel Space Technologies Inc, are actively contributing to market growth through innovation and strategic investments.

India Satellite-based Earth Observation Market Company Market Share

India Satellite-based Earth Observation Market: Comprehensive Growth Forecast & Strategic Analysis (2019-2033)

Explore the burgeoning India Satellite-based Earth Observation Market, a dynamic sector poised for significant expansion, driven by government initiatives, technological advancements, and diverse end-user applications. This in-depth report offers a definitive analysis of market size, growth trajectories, competitive landscapes, and emerging opportunities, providing invaluable insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into the nuances of this critical industry, from satellite orbits to value-added services.

India Satellite-based Earth Observation Market Dynamics & Structure

The India Satellite-based Earth Observation Market is characterized by a moderate concentration, with a blend of established government entities and agile private players driving innovation. Technological advancements in sensor technology, data processing algorithms, and artificial intelligence are key drivers, enabling more precise and actionable insights. Regulatory frameworks, primarily guided by the Indian Space Policy and ISRO's developmental roadmap, are fostering a conducive environment for growth, although licensing and data access policies continue to evolve. Competitive product substitutes, such as ground-based sensors and drone-based data acquisition, are present but often complement satellite-derived information rather than directly replacing it, especially for large-scale monitoring. End-user demographics are broadening, with increasing adoption across agriculture, urban planning, disaster management, and infrastructure development. Mergers and acquisitions (M&A) trends are nascent but expected to gain momentum as the market matures, with strategic partnerships aimed at enhancing capabilities and expanding market reach. For instance, ISRO's ongoing collaborations and Antrix Corporation Limited's role as the commercial arm of ISRO underscore the integrated nature of the market.

- Market Concentration: Moderate, with significant government influence and a growing private sector presence.

- Technological Innovation Drivers: Advancements in high-resolution imaging, hyperspectral sensors, AI-powered analytics, and cloud-based data platforms.

- Regulatory Frameworks: Evolving policies supporting private sector participation, data utilization, and space debris management.

- Competitive Product Substitutes: Drone-based imaging, ground sensors, and manual surveys, primarily for niche or localized applications.

- End-User Demographics: Expanding to include government agencies, private enterprises, research institutions, and NGOs across various sectors.

- M&A Trends: Emerging, with a focus on technology acquisition and market consolidation for enhanced service offerings.

India Satellite-based Earth Observation Market Growth Trends & Insights

The India Satellite-based Earth Observation Market is projected to witness robust growth driven by an escalating demand for geospatial data across a multitude of applications. Market size evolution is a testament to the increasing realization of satellite imagery's potential in informing critical decision-making processes. Adoption rates are steadily climbing, fueled by the decreasing cost of satellite data acquisition and processing, coupled with the development of user-friendly platforms. Technological disruptions, including the advent of constellation-based imaging for higher temporal resolution and the integration of synthetic aperture radar (SAR) for all-weather capabilities, are revolutionizing data availability and utility. Consumer behavior shifts are marked by a growing preference for integrated solutions that combine raw data with advanced analytics and actionable intelligence, moving beyond simple image provision. The market penetration is expected to deepen significantly as more industries recognize the economic and operational benefits of earth observation. The development of sophisticated analytical tools and machine learning algorithms is further enhancing the value proposition, transforming vast datasets into comprehensible and implementable insights. This trend is further amplified by the Indian government's focus on digital India and smart cities initiatives, which inherently rely on accurate geospatial information. The projected Compound Annual Growth Rate (CAGR) for the India Satellite-based Earth Observation Market is estimated to be significant, reflecting its transformative impact on various sectors.

Dominant Regions, Countries, or Segments in India Satellite-based Earth Observation Market

Within the India Satellite-based Earth Observation Market, the Earth Observation Data segment is currently the dominant force, accounting for a substantial portion of market revenue. This dominance is attributed to the fundamental need for raw satellite imagery across all end-use applications. The Low Earth Orbit (LEO) satellite constellation architecture is also a significant contributor, offering high revisit rates crucial for dynamic monitoring. Geographically, metropolitan and industrially developed regions within India are primary drivers of demand.

Dominant Segment: Earth Observation Data

- Key Drivers: The foundational requirement for high-resolution imagery and spectral data across all sectors.

- Market Share: Estimated to hold over 60% of the total market revenue in 2025.

- Growth Potential: Sustained demand from evolving applications in agriculture, urban planning, and environmental monitoring.

Dominant Satellite Orbit: Low Earth Orbit (LEO)

- Key Drivers: Facilitates frequent revisits, essential for monitoring time-sensitive phenomena like crop health and disaster impact.

- Market Share: Dominates satellite deployment for commercial Earth Observation, representing a significant portion of the infrastructure.

- Growth Potential: Continued expansion of LEO constellations by private players and government agencies.

Dominant End-Use (Emerging): Agriculture and Urban Development and Cultural Heritage

- Agriculture: High demand for crop yield prediction, precision farming, soil health monitoring, and irrigation management. Government initiatives like Digital India in Agriculture further boost adoption.

- Urban Development and Cultural Heritage: Crucial for city planning, infrastructure monitoring, land use analysis, disaster preparedness, and heritage site preservation. Smart City Mission projects significantly propel this segment.

India Satellite-based Earth Observation Market Product Landscape

The product landscape of the India Satellite-based Earth Observation Market is characterized by continuous innovation in data acquisition and processing capabilities. High-resolution optical imagery, hyperspectral sensors capturing detailed spectral signatures, and Synthetic Aperture Radar (SAR) for all-weather, day-and-night imaging are key offerings. Emerging products include fused data from multiple sensor types and advanced analytics platforms that derive actionable insights like land use classification, change detection, and environmental impact assessments. Performance metrics are increasingly defined by spatial resolution (sub-meter to decameter), temporal resolution (minutes to days), spectral resolution, and radiometric accuracy. Unique selling propositions lie in the ability to deliver customized data solutions and integrated platforms that simplify data interpretation for end-users. Technological advancements are pushing the boundaries of what can be observed from space, enabling more precise and efficient monitoring of the Earth's surface.

Key Drivers, Barriers & Challenges in India Satellite-based Earth Observation Market

Key Drivers:

- Government Initiatives: Strong support from ISRO and the Indian government's focus on space technology, digital infrastructure, and smart cities fuels market growth.

- Technological Advancements: Innovations in satellite technology, sensor capabilities, and data analytics are enhancing the utility and affordability of Earth Observation data.

- Growing Demand from End-Users: Increasing adoption across agriculture, urban planning, disaster management, infrastructure, and climate services.

- Cost-Effectiveness: Satellite-based solutions are becoming increasingly cost-effective compared to traditional ground-based methods for large-scale monitoring.

Barriers & Challenges:

- High Initial Investment: The cost of satellite development and launch remains a significant barrier, particularly for new entrants.

- Data Processing and Analysis Expertise: A shortage of skilled professionals capable of processing, analyzing, and interpreting vast amounts of satellite data.

- Regulatory Hurdles: Navigating complex licensing, data sharing, and export control regulations can be challenging.

- Competition from Global Players: Indian companies face competition from established international satellite imagery providers.

- Supply Chain Dependencies: Reliance on international suppliers for certain critical satellite components can pose risks.

Emerging Opportunities in India Satellite-based Earth Observation Market

Emerging opportunities within the India Satellite-based Earth Observation Market are abundant, driven by the demand for specialized applications and data fusion. The integration of AI and machine learning for predictive analytics in agriculture and climate change modeling presents a significant avenue. Untapped markets include detailed urban sprawl monitoring for efficient resource allocation, enhanced disaster response planning through real-time flood and wildfire mapping, and precision mapping for underground infrastructure. The development of small satellite constellations for high-frequency data acquisition and specialized data services for niche industries like insurance and real estate are also promising. Furthermore, fostering data sharing ecosystems and developing accessible platforms for small and medium-sized enterprises (SMEs) can unlock new growth potentials.

Growth Accelerators in the India Satellite-based Earth Observation Market Industry

Catalysts driving long-term growth in the India Satellite-based Earth Observation Market are multifaceted. Continuous technological breakthroughs in sensor miniaturization, increased launch cadence for constellations, and advancements in on-board processing will significantly reduce data latency and costs. Strategic partnerships between satellite operators, data analytics firms, and end-user industries will foster greater adoption and innovation. Market expansion strategies, including the development of specialized vertical solutions and capacity building initiatives for data utilization, will further accelerate growth. The increasing focus on sustainable development goals and climate resilience will create persistent demand for Earth Observation data and services, acting as a sustained growth engine.

Key Players Shaping the India Satellite-based Earth Observation Market Market

- Antrix Corporation Limited

- Maxar Technologies Holdings Inc

- Rolta India Limited

- SATPALDA

- Genesys International Corporation Ltd

- Galaxeye Space Solutions Pvt Ltd

- EagleView Technologies Inc

- Pixxel Space Technologies Inc

- Earth2Orbit (E2O)

- CE Info Systems Ltd (MapmyIndia)

- Indian Space Research Organisation (ISRO)

- Quantduo Technologies Private Limited (geoIQ)

- Karnataka State Remote Sensing Applications Centre (KSRSAC)

Notable Milestones in India Satellite-based Earth Observation Market Sector

- December 2022: GalaxEye Space, an India-based space tech business, raised USD 3.5 million in a seed fundraising round led by Speciale Invest. The funds are earmarked for talent acquisition and the accelerated deployment of their multi-sensor earth observation satellite, indicating growing private investment and innovation.

- October 2022: The Indian Space Research Organisation (ISRO) proposed the development of specialized satellites to enhance the nation's agricultural industry. The plan includes at least two satellites to ensure comprehensive coverage for critical farming tasks such as crop forecasts, pesticide application, irrigation, soil data collection, and drought monitoring, highlighting a strategic focus on a key sector.

In-Depth India Satellite-based Earth Observation Market Market Outlook

The India Satellite-based Earth Observation Market is poised for significant expansion, driven by a confluence of technological advancements and expanding application domains. Growth accelerators will include the development of more sophisticated AI-powered analytical tools for predictive modeling, the proliferation of commercial satellite constellations offering higher temporal and spatial resolution, and increased government and private sector investment in space infrastructure. Strategic opportunities lie in catering to the burgeoning demand for precision agriculture, smart city development, and effective climate change mitigation strategies. The market's future potential is intrinsically linked to its ability to provide actionable, real-time data solutions that empower informed decision-making across critical sectors of the Indian economy.

India Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-Use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Other End-Use

India Satellite-based Earth Observation Market Segmentation By Geography

- 1. India

India Satellite-based Earth Observation Market Regional Market Share

Geographic Coverage of India Satellite-based Earth Observation Market

India Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Investments; Increasing Demand for Geospatial Information

- 3.3. Market Restrains

- 3.3.1. Cost of Data and Infrastructure; Data Integration and Interoperability

- 3.4. Market Trends

- 3.4.1. Government Initiatives and Investments to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-Use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Other End-Use

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Antrix Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maxar Technologies Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rolta India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SATPALDA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genesys International Corporation Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Galaxeye Space Solutions Pvt Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EagleView Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pixxel Space Technologies Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Earth2Orbit (E2O)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CE Info Systems Ltd (MapmyIndia)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indian Space Research Organisation (ISRO)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Quantduo Technologies Private Limited (geoIQ)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Karnataka State Remote Sensing Applications Centre (KSRSAC)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Antrix Corporation Limited

List of Figures

- Figure 1: India Satellite-based Earth Observation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Satellite-based Earth Observation Market Share (%) by Company 2025

List of Tables

- Table 1: India Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 3: India Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 4: India Satellite-based Earth Observation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 7: India Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 8: India Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Satellite-based Earth Observation Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the India Satellite-based Earth Observation Market?

Key companies in the market include Antrix Corporation Limited, Maxar Technologies Holdings Inc, Rolta India Limited, SATPALDA, Genesys International Corporation Ltd, Galaxeye Space Solutions Pvt Ltd *List Not Exhaustive, EagleView Technologies Inc, Pixxel Space Technologies Inc, Earth2Orbit (E2O), CE Info Systems Ltd (MapmyIndia), Indian Space Research Organisation (ISRO), Quantduo Technologies Private Limited (geoIQ), Karnataka State Remote Sensing Applications Centre (KSRSAC).

3. What are the main segments of the India Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Investments; Increasing Demand for Geospatial Information.

6. What are the notable trends driving market growth?

Government Initiatives and Investments to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Cost of Data and Infrastructure; Data Integration and Interoperability.

8. Can you provide examples of recent developments in the market?

December 2022: GalaxEye Space, an India-based space tech business, raised USD 3.5 million in a seed fundraising round that Speciale Invest led. According to the earth observation firm, the newly received funds will support hiring talent and accelerate the deployment of the multi-sensor earth observation satellite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the India Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence