Key Insights

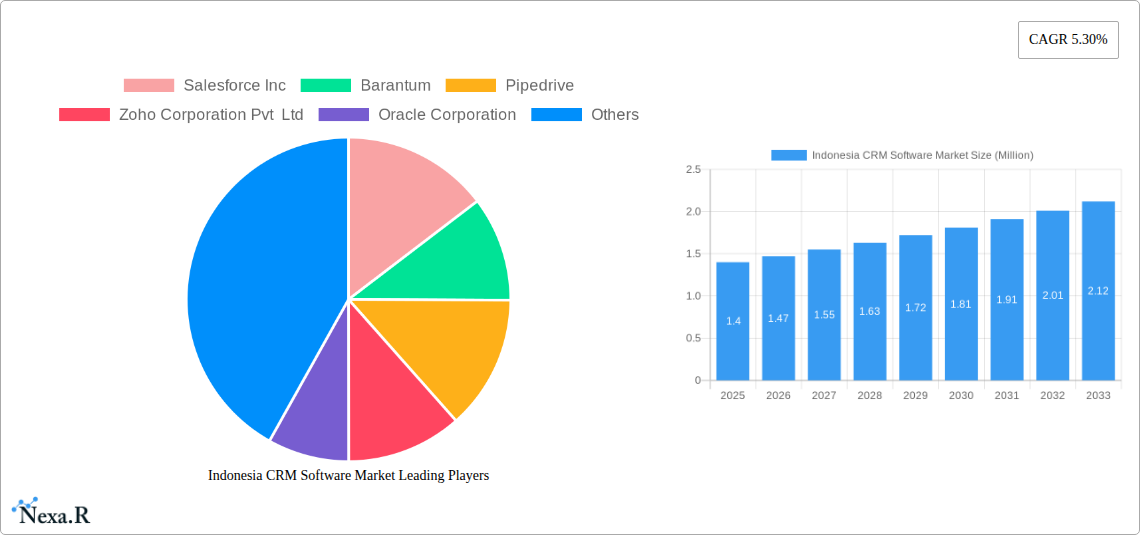

The Indonesia CRM Software Market is poised for significant expansion, projected to reach USD 1.40 Million by the end of 2025. This robust growth is fueled by a CAGR of 5.30%, indicating a sustained upward trajectory for the foreseeable future. A primary driver for this surge is the increasing adoption of digital transformation initiatives across various Indonesian industries, compelling businesses to seek advanced solutions for customer relationship management. The escalating need for enhanced customer engagement, streamlined sales processes, and improved marketing automation is pushing organizations, particularly Small and Medium Enterprises (SMEs), to invest in CRM platforms. These businesses recognize the strategic advantage of centralizing customer data, personalizing interactions, and gaining deeper insights into customer behavior to drive loyalty and revenue. The IT and Telecom, BFSI, and Retail & Ecommerce sectors are leading this adoption, leveraging CRM to manage vast customer bases and competitive landscapes.

Indonesia CRM Software Market Market Size (In Million)

Further strengthening the market’s growth are key trends such as the increasing demand for cloud-based CRM solutions, offering scalability, flexibility, and cost-effectiveness, especially appealing to SMEs in Indonesia. The proliferation of mobile CRM applications is also a significant factor, enabling sales and service teams to access critical customer information on the go, thereby boosting productivity and responsiveness. While the market enjoys strong growth, certain restraints such as initial implementation costs and the need for extensive employee training can pose challenges. However, the overwhelming benefits of improved customer retention, increased sales efficiency, and data-driven decision-making are outweighing these concerns. With a study period extending to 2033, the market is expected to witness continuous innovation and deeper integration of AI and machine learning capabilities within CRM software, further solidifying its importance in the Indonesian business ecosystem.

Indonesia CRM Software Market Company Market Share

This comprehensive report offers an in-depth analysis of the burgeoning Indonesia CRM software market. Delve into the intricate dynamics, growth trajectories, and strategic landscape of customer relationship management solutions in Southeast Asia's largest economy. With a focus on cloud CRM, SME CRM solutions, and enterprise CRM, this study leverages extensive market data from the historical period (2019-2024), the base year (2025), and projects future trends through the forecast period (2025-2033). Explore BFSI CRM, Retail CRM, and IT Telecom CRM adoption, understanding how key players like Salesforce, Microsoft Dynamics, and Zoho CRM are shaping the market.

Indonesia CRM Software Market Market Dynamics & Structure

The Indonesia CRM software market is characterized by a dynamic and evolving structure, driven by increasing digital transformation initiatives across various industries. Market concentration is moderately high, with global giants and several prominent local players vying for market share. Technological innovation remains a primary driver, with advancements in AI-powered analytics, automation, and customer data platforms significantly influencing product development and adoption. Regulatory frameworks are gradually maturing, fostering a more conducive environment for software adoption, although data privacy concerns continue to be a key consideration for businesses. Competitive product substitutes exist, ranging from basic contact management tools to more sophisticated integrated business solutions, necessitating continuous innovation and value proposition refinement from CRM providers. End-user demographics are shifting, with a growing demand for user-friendly, scalable, and data-driven CRM solutions, particularly from Small and Medium Enterprises (SMEs). Merger and acquisition (M&A) trends are emerging, as larger players seek to expand their reach and capabilities within the Indonesian market.

- Market Concentration: Dominated by a mix of global leaders and growing local vendors.

- Technological Innovation: Focus on AI, automation, and customer data platforms.

- Regulatory Frameworks: Evolving, with a strong emphasis on data privacy.

- Competitive Landscape: Diverse, from basic tools to comprehensive suites.

- End-User Demographics: Increasing demand for intuitive and data-centric solutions.

- M&A Trends: Growing activity to consolidate market presence and enhance offerings.

Indonesia CRM Software Market Growth Trends & Insights

The Indonesia CRM software market is poised for robust expansion, driven by the nation's rapid economic growth and accelerating digital adoption. The market size is projected to witness significant evolution, fueled by increasing awareness of the strategic importance of customer-centric approaches. Adoption rates for both cloud-based CRM and on-premise solutions are steadily rising, with cloud deployment emerging as the preferred choice for its scalability, cost-effectiveness, and ease of integration. Technological disruptions, such as the integration of Artificial Intelligence (AI) for predictive analytics and personalized customer experiences, are reshaping how businesses engage with their clientele. Consumer behavior shifts, including a heightened expectation for seamless, omnichannel customer journeys, are compelling organizations to invest in advanced CRM capabilities. This sustained growth is underscored by a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period, indicating a strong upward trajectory. The market penetration of CRM solutions is expected to deepen, moving beyond traditional sectors to encompass a wider array of industries seeking to optimize their customer interactions and drive operational efficiency.

Dominant Regions, Countries, or Segments in Indonesia CRM Software Market

The Indonesia CRM software market is experiencing dominant growth driven by key segments and regions that are rapidly embracing digital transformation. Among deployment modes, Cloud CRM is emerging as the undisputed leader, accounting for an estimated xx% market share in 2025. This dominance is attributed to its inherent scalability, flexibility, and cost-effectiveness, making it an attractive proposition for businesses of all sizes in Indonesia.

In terms of organization size, Small and Medium Enterprises (SMEs) represent a significant growth engine, projected to hold a substantial xx% market share. Their increasing adoption is fueled by the availability of affordable, feature-rich CRM solutions tailored to their specific needs, enabling them to compete effectively with larger enterprises. However, Large Enterprises also contribute significantly, seeking advanced customization and integration capabilities to manage complex customer relationships.

Industry-wise, the BFSI (Banking, Financial Services, and Insurance) sector is a prominent driver, demanding robust CRM solutions for enhanced customer service, risk management, and personalized product offerings. The Retail & Ecommerce industry is another major contributor, leveraging CRM to manage customer loyalty, personalize marketing campaigns, and streamline online sales processes. The IT and Telecom sector also shows strong adoption due to the need for efficient customer support and service management.

- Dominant Deployment Mode: Cloud CRM, expected to capture xx% of the market by 2025, driven by flexibility and scalability.

- Key Organization Size Segment: SMEs, projected to account for xx% of the market, benefiting from accessible and tailored solutions.

- Leading Industries:

- BFSI: High demand for customer service and risk management features.

- Retail & Ecommerce: Crucial for loyalty programs, personalized marketing, and sales optimization.

- IT and Telecom: Essential for customer support and service delivery.

Indonesia CRM Software Market Product Landscape

The Indonesia CRM software market product landscape is characterized by a wave of innovation focused on delivering enhanced customer engagement and operational efficiency. Products are increasingly incorporating advanced features such as AI-powered predictive analytics for sales forecasting, intelligent automation of repetitive tasks, and sophisticated customer data unification platforms. Unique selling propositions often revolve around intuitive user interfaces, seamless integration capabilities with existing business systems, and robust mobile accessibility. Technological advancements are pushing the boundaries of what CRM can achieve, with a growing emphasis on personalization engines, omnichannel communication capabilities, and real-time performance dashboards.

Key Drivers, Barriers & Challenges in Indonesia CRM Software Market

The Indonesia CRM software market is propelled by several key drivers. The escalating adoption of digital technologies across businesses, coupled with the growing recognition of customer-centricity as a competitive differentiator, is paramount. Government initiatives promoting digital transformation and the increasing penetration of the internet and mobile devices further fuel market growth. For SMEs, the availability of cost-effective, cloud-based CRM solutions is a significant catalyst.

However, the market also faces notable barriers and challenges. A primary restraint is the initial cost of implementation and ongoing subscription fees, which can be a concern for some smaller businesses. A lack of technical expertise and a shortage of skilled professionals to manage and leverage CRM systems can also hinder widespread adoption. Furthermore, concerns surrounding data security and privacy, especially in a developing regulatory landscape, can create hesitations. Intense competition among vendors, with an aggressive pricing environment, can also pose a challenge for profitability.

Emerging Opportunities in Indonesia CRM Software Market

Emerging opportunities in the Indonesia CRM software market lie in the untapped potential of specific industry verticals, such as Healthcare CRM and Energy & Utilities CRM, where sophisticated customer management can lead to significant operational improvements. The increasing demand for specialized CRM solutions tailored for specific business processes, like field service management or marketing automation, presents a fertile ground for innovation. Furthermore, the evolving consumer preferences for personalized and proactive customer service create a strong demand for AI-driven CRM capabilities that can anticipate needs and deliver tailored experiences. The growth of the Indonesian startup ecosystem also presents an opportunity for vendors offering scalable and adaptable CRM solutions.

Growth Accelerators in the Indonesia CRM Software Market Industry

Several catalysts are accelerating the long-term growth of the Indonesia CRM Software Market Industry. Technological breakthroughs, particularly in the realm of Artificial Intelligence and Machine Learning, are enabling more intelligent customer insights and personalized interactions, making CRM solutions increasingly indispensable. Strategic partnerships between CRM providers and local technology integrators or business consultants are crucial for expanding market reach and providing localized support. Furthermore, the increasing focus on customer retention and loyalty programs by businesses across various sectors, driven by intense market competition, acts as a significant growth accelerator. The continuous development of industry-specific CRM solutions addressing the unique challenges of sectors like Manufacturing CRM and BFSI CRM will also drive sustained expansion.

Key Players Shaping the Indonesia CRM Software Market Market

- Salesforce Inc

- Barantum

- Pipedrive

- Zoho Corporation Pvt Ltd

- Oracle Corporation

- SugarCRM Inc

- Creatio

- Microsoft Dynamics

- SAP SE

- HubSpot CRM

- Zendes

Notable Milestones in Indonesia CRM Software Market Sector

- July 2023: PanGrow launched its CRM & ERP solutions specifically designed for small and medium enterprises (SMEs), aiming to transform SME operations and customer management.

- July 2023: Salesforce announced the release of its 'Sales Planning' solution integrated into Sales Cloud, designed to streamline comprehensive sales planning using CRM data and empower organizations with better territory and quota management.

In-Depth Indonesia CRM Software Market Market Outlook

The Indonesia CRM Software Market is projected for sustained and accelerated growth, driven by an increasing digital imperative across the nation's economy. Future market potential lies in the deeper integration of AI and automation, offering predictive insights and hyper-personalized customer journeys. Strategic opportunities will emerge from catering to the specific needs of emerging industries and focusing on the seamless integration of CRM with other business-critical applications, such as ERP and marketing automation platforms. The ongoing digital transformation of Indonesian businesses, coupled with a growing emphasis on customer experience, ensures a bright and dynamic future for the CRM software market in the region.

Indonesia CRM Software Market Segmentation

-

1. Deployment Mode

- 1.1. On-premise

- 1.2. Cloud

-

2. Organization Size

- 2.1. Small and Medium Enterprises (SMEs)

- 2.2. Large Enterprises

-

3. Industry

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Manufacturing

- 3.4. Healthcare

- 3.5. Retail & Ecommerce

- 3.6. Energy & Utilities

- 3.7. Other Industries

Indonesia CRM Software Market Segmentation By Geography

- 1. Indonesia

Indonesia CRM Software Market Regional Market Share

Geographic Coverage of Indonesia CRM Software Market

Indonesia CRM Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of SaaS Model; Adoption of Customer Intensive Approach

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of SaaS Model; Adoption of Customer Intensive Approach

- 3.4. Market Trends

- 3.4.1. Cloud Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia CRM Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Manufacturing

- 5.3.4. Healthcare

- 5.3.5. Retail & Ecommerce

- 5.3.6. Energy & Utilities

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Salesforce Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Barantum

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pipedrive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zoho Corporation Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oracle Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SugarCRM Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Creatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Dynamics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SAP SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HubSpot CRM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zendes

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Salesforce Inc

List of Figures

- Figure 1: Indonesia CRM Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia CRM Software Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia CRM Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 2: Indonesia CRM Software Market Volume Billion Forecast, by Deployment Mode 2020 & 2033

- Table 3: Indonesia CRM Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Indonesia CRM Software Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: Indonesia CRM Software Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Indonesia CRM Software Market Volume Billion Forecast, by Industry 2020 & 2033

- Table 7: Indonesia CRM Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia CRM Software Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Indonesia CRM Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 10: Indonesia CRM Software Market Volume Billion Forecast, by Deployment Mode 2020 & 2033

- Table 11: Indonesia CRM Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Indonesia CRM Software Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: Indonesia CRM Software Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 14: Indonesia CRM Software Market Volume Billion Forecast, by Industry 2020 & 2033

- Table 15: Indonesia CRM Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia CRM Software Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia CRM Software Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Indonesia CRM Software Market?

Key companies in the market include Salesforce Inc, Barantum, Pipedrive, Zoho Corporation Pvt Ltd, Oracle Corporation, SugarCRM Inc, Creatio, Microsoft Dynamics, SAP SE, HubSpot CRM, Zendes.

3. What are the main segments of the Indonesia CRM Software Market?

The market segments include Deployment Mode, Organization Size, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of SaaS Model; Adoption of Customer Intensive Approach.

6. What are the notable trends driving market growth?

Cloud Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Adoption of SaaS Model; Adoption of Customer Intensive Approach.

8. Can you provide examples of recent developments in the market?

July 2023: PanGrow, a renowned provider of innovative business solutions, unveiled its long-awaited CRM & ERP solutions designed exclusively for small and medium enterprises (SMEs). With a firm dedication to empowering businesses to reach their maximum capabilities, PanGrow is prepared to transform the manner in which SMEs handle their operations, customer connections, and data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia CRM Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia CRM Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia CRM Software Market?

To stay informed about further developments, trends, and reports in the Indonesia CRM Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence