Key Insights

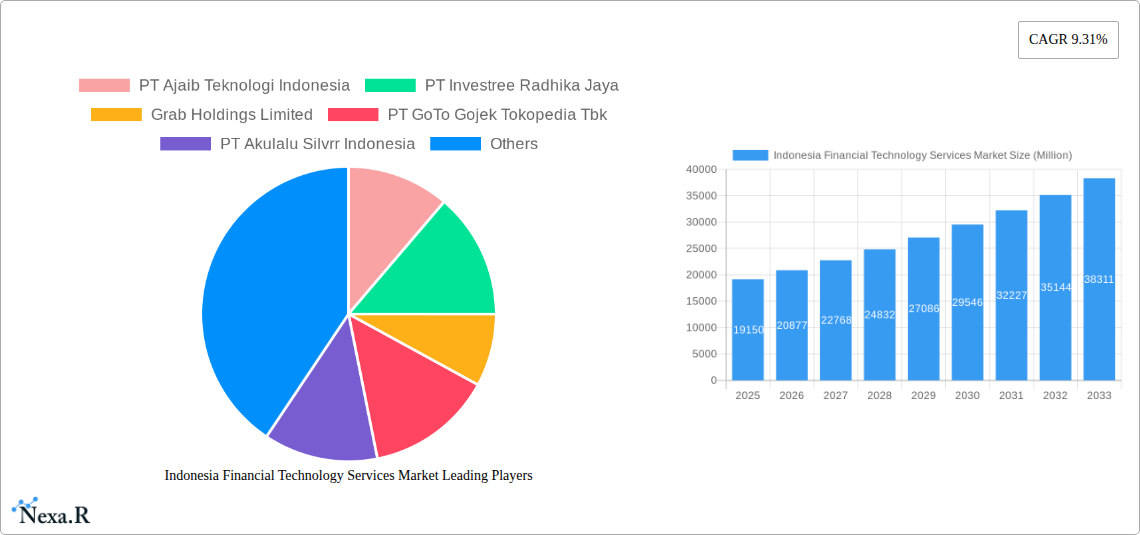

The Indonesian Financial Technology Services Market is poised for robust expansion, with a projected market size of USD 19.15 billion. This growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 9.31% expected over the forecast period. Key drivers underpinning this surge include the increasing digital literacy and smartphone penetration across the archipelago, a burgeoning unbanked and underbanked population seeking accessible financial solutions, and a supportive regulatory environment that encourages innovation within the fintech sector. The digital capital raising segment, encompassing crowd investing, crowd lending, and marketplace lending, is witnessing significant adoption as individuals and SMEs increasingly turn to alternative funding avenues. Simultaneously, digital payments are revolutionizing commerce, with digital commerce, digital remittances, and mobile PoS payments becoming integral to daily transactions. The rise of neobanks further complements this ecosystem, offering tailored digital banking experiences that cater to the evolving needs of Indonesian consumers.

Indonesia Financial Technology Services Market Market Size (In Billion)

The market's dynamism is further shaped by several key trends. A significant trend is the continuous innovation in digital payment solutions, driven by the demand for seamless and secure transactions. Furthermore, the growing acceptance and integration of fintech services into everyday life, from online shopping to peer-to-peer transfers, are accelerating market penetration. The expansion of buy now, pay later (BNPL) schemes is also contributing to the growth of digital lending and credit accessibility. While the market exhibits strong growth potential, certain restraints need to be navigated. These include evolving regulatory landscapes that require constant adaptation from fintech firms, concerns around data security and privacy among consumers, and the persistent challenge of digital infrastructure limitations in remote areas. Despite these challenges, the collaborative efforts between traditional financial institutions and fintech startups, alongside the active participation of major players like PT Ajaib Teknologi Indonesia, PT Investree Radhika Jaya, Grab Holdings Limited, and PT GoTo Gojek Tokopedia Tbk, are collectively propelling the Indonesian fintech market towards a future of widespread digital financial inclusion and economic empowerment.

Indonesia Financial Technology Services Market Company Market Share

Here's a compelling, SEO-optimized report description for the Indonesia Financial Technology Services Market, incorporating high-traffic keywords, parent/child market analysis, and all specified details.

Indonesia Financial Technology Services Market: Revolutionizing Finance with Digital Solutions (2019–2033)

Dive into the dynamic Indonesia Financial Technology Services Market, a rapidly evolving landscape poised for unprecedented growth. This comprehensive report analyzes the intricate interplay of digital payments, neobanking, and digital capital raising, revealing the key drivers, burgeoning opportunities, and formidable challenges shaping Indonesia's financial future. Explore critical segments like crowd investing, crowd lending, marketplace lending, digital commerce, digital remittances, and mobile PoS payments, and gain insights into the impact of innovative companies such as PT Ajaib Teknologi Indonesia, PT Investree Radhika Jaya, Grab Holdings Limited, PT GoTo Gojek Tokopedia Tbk, PT Akulalu Silvrr Indonesia, PT Dompet Anak Bangsa (GoPay), Jenius (PT Bank Tabungan Pensiunan Nasional Tbk), Kredivo Group Ltd, DANA (PT Espay Debit Indonesia Koe), and Xendit (PT Sinar Digital Terdepan). With a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on Indonesia's booming FinTech sector.

Indonesia Financial Technology Services Market Market Dynamics & Structure

The Indonesia Financial Technology Services Market is characterized by a dynamic and evolving market structure, driven by rapid technological advancements and a burgeoning digital economy. Market concentration is observed to be increasing, particularly within the digital payments segment, where established players are consolidating their positions. However, innovation remains a key driver, with numerous startups and established companies introducing novel solutions across digital capital raising, neobanking, and payments. Regulatory frameworks are continuously adapting to foster innovation while ensuring consumer protection and financial stability, influencing market entry and operational strategies. Competitive product substitutes are abundant, ranging from traditional banking services to peer-to-peer lending platforms, creating a competitive yet opportunities-rich environment. End-user demographics are increasingly tech-savvy, with a significant portion of the population embracing digital financial services, especially among the younger generation and in urban centers. Mergers and Acquisitions (M&A) trends are on the rise as larger entities seek to acquire innovative technologies or expand their market reach, further shaping the competitive landscape.

- Market Concentration: Increasing consolidation in digital payments, while new entrants drive competition in other segments.

- Technological Innovation Drivers: Rise of AI, blockchain, and mobile-first solutions are paramount.

- Regulatory Frameworks: Government initiatives aim to support FinTech growth while ensuring security and compliance.

- Competitive Product Substitutes: Diverse offerings from traditional banks, P2P lenders, and digital wallets.

- End-User Demographics: Young, urban, and increasingly mobile-first population driving adoption.

- M&A Trends: Strategic acquisitions and partnerships to enhance capabilities and market share.

Indonesia Financial Technology Services Market Growth Trends & Insights

The Indonesia Financial Technology Services Market is experiencing robust growth, propelled by a confluence of factors including increasing internet penetration, a large unbanked and underbanked population, and supportive government initiatives. Market size evolution indicates a consistent upward trajectory, with digital payments emerging as the largest segment, followed by digital capital raising and neobanking. Adoption rates for digital financial services are accelerating, particularly among millennials and Gen Z, who are more receptive to mobile-first solutions and digital platforms. Technological disruptions, such as the integration of AI for personalized financial advice and enhanced security, are transforming customer experiences and operational efficiencies. Consumer behavior shifts are evident, with a growing preference for convenient, accessible, and cost-effective financial solutions offered by FinTech companies. The CAGR for the overall market is projected to remain strong throughout the forecast period, reflecting sustained investor interest and consumer demand. Market penetration for digital wallets and online lending platforms has already surpassed significant milestones, with ample room for further expansion into rural and underserved areas. The base year 2025 sets a strong foundation for analyzing these trends, with the forecast period 2025–2033 anticipating continued exponential growth driven by digital transformation initiatives across various industries. The historical period 2019–2024 showcases the foundational growth and early adoption phases of the Indonesian FinTech ecosystem.

Dominant Regions, Countries, or Segments in Indonesia Financial Technology Services Market

The Digital Payments segment, encompassing Digital Commerce, Digital Remittances, and Mobile PoS Payments, is unequivocally the dominant force driving growth in the Indonesia Financial Technology Services Market. This dominance is underpinned by several key factors, including the nation's vast population, rapid urbanization, and an increasing reliance on mobile devices for everyday transactions. The sheer volume of e-commerce transactions, fueled by the growth of online marketplaces and the widespread adoption of digital wallets, contributes significantly to the segment's market share. Digital remittances are also playing a crucial role, facilitating the flow of funds both domestically and internationally, particularly important for a country with a large diaspora. Mobile PoS payments are gaining traction as businesses, especially small and medium-sized enterprises (SMEs), increasingly adopt digital payment solutions to cater to evolving consumer preferences and streamline their operations.

- Market Share: Digital Payments consistently commands the largest market share, estimated at over 60% of the total FinTech services market in the base year 2025.

- Growth Potential: While mature, segments like digital commerce and mobile PoS payments continue to exhibit significant growth potential due to ongoing digitalization efforts.

- Key Drivers:

- High Mobile Penetration: Over 85% of the Indonesian population owns a smartphone, facilitating easy access to digital payment services.

- Government Support: Initiatives like "Gerakan Nasional Bangga Buatan Indonesia" (National Movement Proudly Made in Indonesia) boost local digital commerce.

- Evolving Consumer Behavior: Increasing preference for cashless transactions and convenient online shopping experiences.

- MSME Digitalization: Government and private sector push to onboard SMEs onto digital payment platforms.

- Remittance Growth: Growing demand for efficient and cost-effective cross-border money transfer solutions.

The Digital Capital Raising segment, comprising Crowd Investing, Crowd Lending, and Marketplace Lending, represents the second-largest and fastest-growing segment. This is driven by the need for alternative funding sources for startups and SMEs, as well as investment opportunities for individuals seeking higher returns than traditional savings accounts. The Neobanking segment, though smaller in comparison, is rapidly expanding as more consumers seek digital-first banking experiences that offer greater convenience and lower fees. However, the established presence and widespread adoption of digital payment solutions ensure its continued leadership.

Indonesia Financial Technology Services Market Product Landscape

The product landscape of the Indonesia Financial Technology Services Market is characterized by rapid innovation and a focus on user-centric design. Digital payment solutions dominate, with feature-rich mobile wallets offering seamless transactions, bill payments, and integrated loyalty programs. Digital capital raising platforms provide sophisticated interfaces for both investors and fundraisers, utilizing data analytics to streamline due diligence and risk assessment. Neobanking services are introducing fully digital account management, personalized financial insights, and competitive interest rates, often integrated with other FinTech services. Key technological advancements include the implementation of AI for fraud detection and personalized recommendations, blockchain for enhanced security and transparency in certain transactions, and robust API integrations to foster an interconnected ecosystem. Unique selling propositions often revolve around ease of use, speed of service, competitive pricing, and accessibility for underserved segments of the population.

Key Drivers, Barriers & Challenges in Indonesia Financial Technology Services Market

The Indonesia Financial Technology Services Market is propelled by several key drivers. The nation's large, young, and digitally connected population is a primary catalyst, readily adopting innovative financial solutions. Government initiatives promoting financial inclusion and digital transformation, coupled with increasing internet and smartphone penetration, further accelerate adoption. The growing demand for convenient, accessible, and cost-effective financial services, particularly among the unbanked and underbanked population, is a significant growth engine. Technological advancements, such as AI, machine learning, and blockchain, are enabling the development of sophisticated and personalized FinTech products.

- Key Drivers:

- High smartphone and internet penetration.

- Government focus on financial inclusion and digitalization.

- Growing demand for convenient and accessible financial services.

- Rapid technological advancements and adoption.

- Large unbanked and underbanked population seeking alternatives.

However, the market faces significant barriers and challenges. Regulatory uncertainty and evolving compliance requirements can pose hurdles for new entrants and established players alike. Cybersecurity threats and data privacy concerns remain paramount, necessitating robust security measures and consumer trust-building efforts. Limited financial literacy among certain segments of the population can hinder the adoption of complex financial products. Intense competition from both FinTech startups and incumbent financial institutions requires continuous innovation and differentiation. Infrastructure limitations, particularly in remote areas, can also impact service delivery and accessibility.

- Key Barriers & Challenges:

- Evolving and complex regulatory landscape.

- Cybersecurity risks and data privacy concerns.

- Low financial literacy in certain demographics.

- Intense competition and need for constant innovation.

- Inadequate infrastructure in some regions.

Emerging Opportunities in Indonesia Financial Technology Services Market

Emerging opportunities within the Indonesia Financial Technology Services Market are vast and varied, largely driven by the untapped potential of underserved populations and specific industry needs. The expansion of embedded finance, where FinTech services are integrated into non-financial platforms, presents a significant avenue for growth. This includes offering financial solutions at the point of sale for e-commerce or within ride-hailing apps. There's also a growing opportunity in Sharia-compliant FinTech solutions, catering to Indonesia's large Muslim population. Furthermore, the development of specialized lending platforms for niche industries or specific borrower profiles, leveraging alternative data for credit scoring, offers a promising growth area.

- Embedded Finance: Integration of financial services into non-financial platforms.

- Sharia-Compliant FinTech: Catering to the large Muslim population with ethical financial products.

- Niche Lending Platforms: Specialized financing solutions for specific industries and borrower profiles.

- InsurTech Innovation: Development of accessible and affordable digital insurance products.

- Open Banking Initiatives: Fostering innovation through data sharing and collaboration.

Growth Accelerators in the Indonesia Financial Technology Services Market Industry

Several catalysts are accelerating the long-term growth of the Indonesia Financial Technology Services Market. Technological breakthroughs, particularly in AI and machine learning, are enabling more sophisticated risk assessment, personalized customer experiences, and enhanced fraud detection. Strategic partnerships between FinTech companies and traditional financial institutions, as well as collaborations with e-commerce giants and telecommunication providers, are expanding reach and customer acquisition. Market expansion strategies, including venturing into Tier 2 and Tier 3 cities, and offering tailored solutions for SMEs, are crucial for unlocking further growth potential. The increasing acceptance and demand for digital financial services by a growing digitally native population will continue to fuel this acceleration.

Key Players Shaping the Indonesia Financial Technology Services Market Market

- PT Ajaib Teknologi Indonesia

- PT Investree Radhika Jaya

- Grab Holdings Limited

- PT GoTo Gojek Tokopedia Tbk

- PT Akulalu Silvrr Indonesia

- PT Dompet Anak Bangsa (GoPay)

- Jenius (PT Bank Tabungan Pensiunan Nasional Tbk)

- Kredivo Group Ltd

- DANA (PT Espay Debit Indonesia Koe)

- Xendit (PT Sinar Digital Terdepan)

Notable Milestones in Indonesia Financial Technology Services Market Sector

- June 2024: Indonesian microfinance technology company Amartha received a USD 17.5 million equity investment from the Accion Digital Transformation Fund to enhance Amartha’s platform, which provides financial products and services to underserved women-led small businesses in rural areas across Indonesia, leveraging data and AI, showing the increasing demand for technology integrated financial services in the market.

- November 2023: Finfra, Indonesia's leading lending infrastructure provider, partnered with Xendit to use advanced payment gateways and infrastructure tailored for MSMEs to automate revenue-based financing collections for SMEs nationwide.

In-Depth Indonesia Financial Technology Services Market Market Outlook

The Indonesia Financial Technology Services Market is poised for sustained and robust growth, driven by a potent combination of demographic advantages, supportive government policies, and continuous technological innovation. The outlook is highly optimistic, with significant expansion anticipated across all key segments, particularly in digital payments and digital capital raising. Strategic partnerships and the ongoing digitalization of the economy will further fuel this trajectory. Emerging opportunities in embedded finance and specialized lending platforms are expected to unlock new revenue streams and cater to diverse market needs. As financial inclusion deepens and consumer trust in digital solutions solidifies, the Indonesian FinTech ecosystem will continue to be a beacon of opportunity and innovation in the Southeast Asian financial landscape.

Indonesia Financial Technology Services Market Segmentation

-

1. Type

-

1.1. Digital Capital Raising

- 1.1.1. Crowd investing

- 1.1.2. Crowd Lending

- 1.1.3. Marketplace Lending

-

1.2. Digital Payments

- 1.2.1. Digital Commerce

- 1.2.2. Digital Remittances

- 1.2.3. Mobile PoS Payments

- 1.3. Neobanking

-

1.1. Digital Capital Raising

Indonesia Financial Technology Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Financial Technology Services Market Regional Market Share

Geographic Coverage of Indonesia Financial Technology Services Market

Indonesia Financial Technology Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth in Low-cost

- 3.2.2 Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs

- 3.3. Market Restrains

- 3.3.1 Growth in Low-cost

- 3.3.2 Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs

- 3.4. Market Trends

- 3.4.1. Digital Payments Contribute Significantly to Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Financial Technology Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Digital Capital Raising

- 5.1.1.1. Crowd investing

- 5.1.1.2. Crowd Lending

- 5.1.1.3. Marketplace Lending

- 5.1.2. Digital Payments

- 5.1.2.1. Digital Commerce

- 5.1.2.2. Digital Remittances

- 5.1.2.3. Mobile PoS Payments

- 5.1.3. Neobanking

- 5.1.1. Digital Capital Raising

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Ajaib Teknologi Indonesia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Investree Radhika Jaya

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grab Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT GoTo Gojek Tokopedia Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Akulalu Silvrr Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Dompet Anak Bangsa (GoPay)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jenius (PT Bank Tabungan Pensiunan Nasional Tbk)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kredivo Group Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DANA (PT Espay Debit Indonesia Koe)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xendit (PT Sinar Digital Terdepan)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Ajaib Teknologi Indonesia

List of Figures

- Figure 1: Indonesia Financial Technology Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Financial Technology Services Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Financial Technology Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia Financial Technology Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Indonesia Financial Technology Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Financial Technology Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Indonesia Financial Technology Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Indonesia Financial Technology Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 7: Indonesia Financial Technology Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Indonesia Financial Technology Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Financial Technology Services Market?

The projected CAGR is approximately 9.31%.

2. Which companies are prominent players in the Indonesia Financial Technology Services Market?

Key companies in the market include PT Ajaib Teknologi Indonesia, PT Investree Radhika Jaya, Grab Holdings Limited, PT GoTo Gojek Tokopedia Tbk, PT Akulalu Silvrr Indonesia, PT Dompet Anak Bangsa (GoPay), Jenius (PT Bank Tabungan Pensiunan Nasional Tbk), Kredivo Group Ltd, DANA (PT Espay Debit Indonesia Koe), Xendit (PT Sinar Digital Terdepan)*List Not Exhaustive.

3. What are the main segments of the Indonesia Financial Technology Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Low-cost. Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs.

6. What are the notable trends driving market growth?

Digital Payments Contribute Significantly to Growth.

7. Are there any restraints impacting market growth?

Growth in Low-cost. Easy-to-use Investment Options; Rise of Cryptocurrencies and NFTs.

8. Can you provide examples of recent developments in the market?

June 2024: Indonesian microfinance technology company Amartha received a USD 17.5 million equity investment from the Accion Digital Transformation Fund to enhance Amartha’s platform, which provides financial products and services to underserved women-led small businesses in rural areas across Indonesia, leveraging data and AI, showing the increasing demand for technology integrated financial services in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Financial Technology Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Financial Technology Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Financial Technology Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Financial Technology Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence