Key Insights

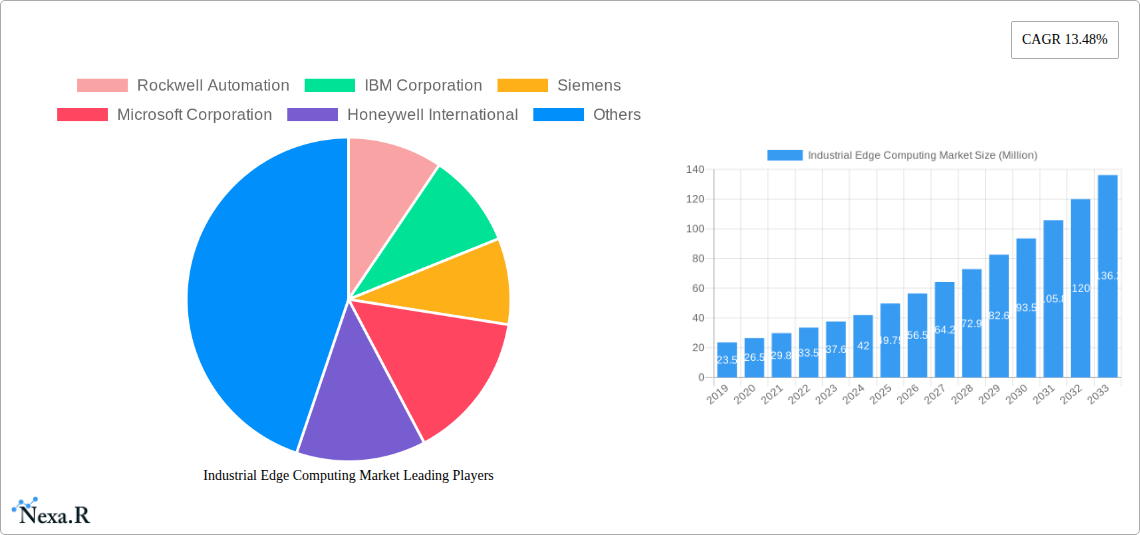

The Industrial Edge Computing market is experiencing robust expansion, projected to reach a substantial USD 49.75 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 13.48% anticipated throughout the forecast period of 2019-2033. This significant growth is underpinned by a confluence of powerful drivers, including the escalating demand for real-time data processing and analytics at the source of operations, the imperative to reduce latency for critical industrial applications, and the increasing adoption of Industrial Internet of Things (IIoT) devices across various sectors. Edge computing is pivotal in enabling advanced functionalities such as predictive maintenance, real-time quality control, and optimized resource allocation, thereby enhancing operational efficiency and driving down costs for industrial enterprises. The trend towards distributed intelligence, where data is processed closer to where it is generated, is a key enabler of this market surge.

Industrial Edge Computing Market Market Size (In Million)

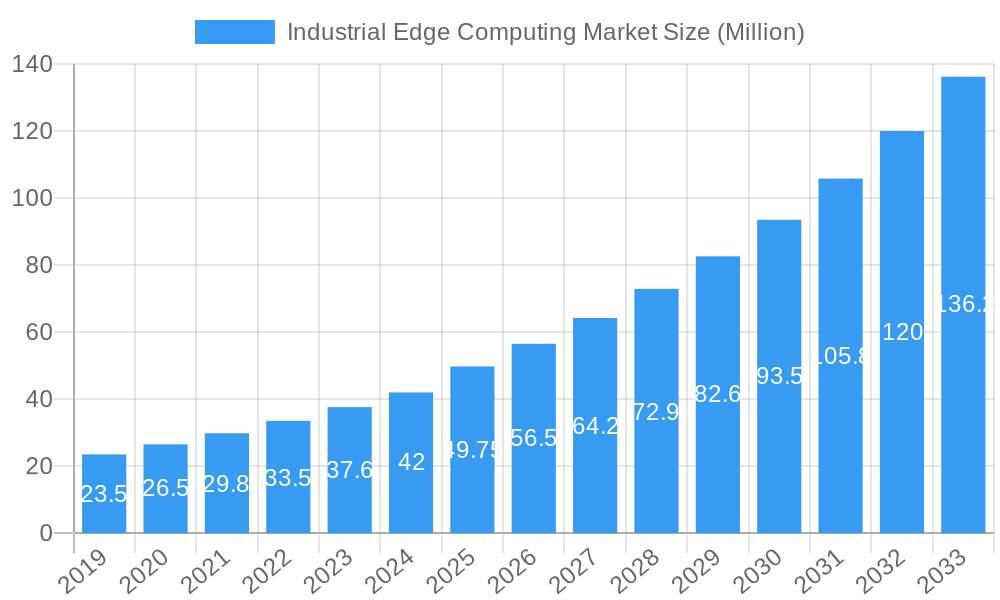

Key restraints that could temper this growth include the initial high implementation costs associated with deploying edge infrastructure, concerns surrounding data security and privacy at the edge, and the need for skilled personnel to manage and maintain these complex distributed systems. However, the sheer benefits in terms of performance, reliability, and cost savings are outweighing these challenges. The market is segmented into Hardware, Software, and Services, with each segment playing a crucial role in the end-to-end edge computing solution. End-user verticals like Manufacturing, Oil and Gas, and Mining are leading the adoption due to their inherent need for on-site, low-latency data processing. Major players such as Rockwell Automation, Siemens, and IBM Corporation are at the forefront, investing heavily in innovation and strategic partnerships to capture market share. Regional dominance is expected in North America and Europe due to established industrial bases and advanced technological infrastructure, with Asia Pacific showing rapid growth potential.

Industrial Edge Computing Market Company Market Share

This report delivers an in-depth analysis of the Industrial Edge Computing Market, a critical component of Industry 4.0 and Digital Transformation. We explore market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, and emerging opportunities from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. This research is designed for industry professionals, including those in manufacturing, oil and gas, and mining sectors, seeking to understand the evolving landscape of edge AI, IIoT, and smart factory solutions. The report quantifies market values in Million units and includes insights into parent and child markets for a holistic view.

Industrial Edge Computing Market Dynamics & Structure

The Industrial Edge Computing Market is characterized by dynamic growth fueled by rapid technological advancements and increasing adoption of Industry 4.0 principles. Market concentration is moderately fragmented, with key players investing heavily in research and development to drive innovation. The primary driver of technological innovation is the escalating demand for real-time data processing at the source, enabling immediate decision-making and enhanced operational efficiency. Regulatory frameworks, while still evolving, are increasingly supportive of data localization and cybersecurity measures, influencing deployment strategies. Competitive product substitutes, such as centralized cloud computing for less time-sensitive tasks, present a dynamic landscape. End-user demographics are shifting towards organizations prioritizing operational resilience, predictive maintenance, and optimized resource utilization. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to enhance their offerings and expand their market reach. For instance, the (xx) M&A deal volumes observed in the historical period (2019-2024) highlight strategic consolidation.

- Technological Innovation Drivers: Real-time analytics, low latency requirements, enhanced cybersecurity, AI/ML at the edge, and increasing device connectivity.

- Regulatory Frameworks: Data sovereignty, industrial IoT security standards, and environmental regulations influencing data processing needs.

- End-User Demographics: Shift towards proactive operational management, increased demand for automation, and sustainability initiatives.

- M&A Trends: Strategic acquisitions to expand product portfolios, gain market share, and integrate specialized edge capabilities.

Industrial Edge Computing Market Growth Trends & Insights

The Industrial Edge Computing Market is poised for substantial expansion, driven by the pervasive need for intelligent, distributed data processing within industrial environments. The market size is projected to grow from approximately USD 3,500 million in 2025 to an estimated USD 9,800 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period. This growth trajectory is underpinned by the accelerating adoption of Industrial Internet of Things (IIoT) devices and the increasing complexity of industrial operations that demand localized intelligence. Technological disruptions, including advancements in AI and machine learning algorithms specifically designed for edge deployment, are creating new application possibilities. Consumer behavior shifts are evident as industrial organizations move from reactive problem-solving to proactive, data-driven optimization, prioritizing predictive maintenance, anomaly detection, and enhanced worker safety. The market penetration of industrial edge solutions is rapidly increasing, particularly within the manufacturing sector, as businesses recognize the tangible benefits of reduced downtime and improved productivity.

Key Growth Metrics:

- Market Size (2025): USD 3,500 Million

- Market Size (2033): USD 9,800 Million

- CAGR (2025-2033): 13.5%

- Adoption Rates: High and steadily increasing across key industrial verticals.

- Technological Disruptions: AI/ML integration, 5G enablement, and advanced sensor technologies.

- Consumer Behavior Shifts: From reactive to proactive operational management, focus on real-time insights.

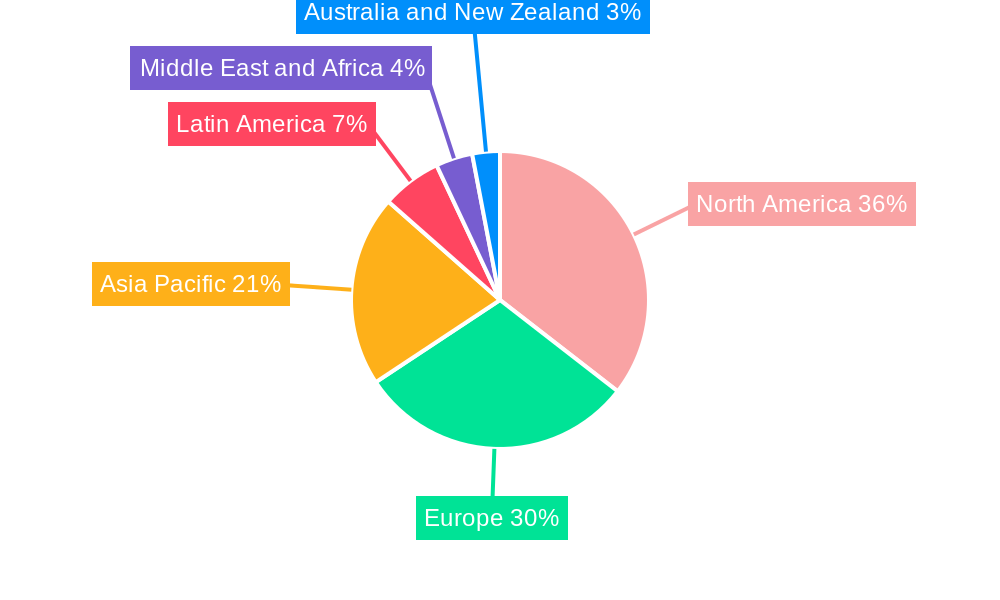

Dominant Regions, Countries, or Segments in Industrial Edge Computing Market

The Manufacturing vertical is the most dominant end-user segment in the Industrial Edge Computing Market, accounting for an estimated 45% of the market share in 2025. This dominance is driven by the inherent need for real-time operational control, process optimization, and quality assurance in modern factories. The Component: Software segment, with an estimated 35% market share in 2025, is a significant growth engine, providing the intelligence and analytics capabilities for edge devices. North America is the leading region, projected to hold approximately 38% of the global market share in 2025. This leadership is attributed to advanced industrial infrastructure, strong government support for Industry 4.0 initiatives, and a high concentration of large-scale manufacturing operations. The region benefits from economic policies that encourage technological adoption and substantial investments in smart factory technologies.

Key Segment Dominance Factors:

Manufacturing Vertical:

- Market Share (2025): ~45%

- Drivers: Real-time production monitoring, predictive maintenance, automation, quality control, supply chain visibility.

- Growth Potential: High due to ongoing digital transformation and the need for operational resilience.

Component: Software:

- Market Share (2025): ~35%

- Drivers: Edge analytics, AI/ML platforms, data management solutions, visualization tools, secure connectivity software.

- Growth Potential: Critical for enabling advanced functionalities and unlocking data value at the edge.

Dominant Region: North America:

- Market Share (2025): ~38%

- Drivers: Advanced industrial base, government incentives for innovation, high R&D spending, robust cybersecurity infrastructure.

- Growth Potential: Continual expansion driven by smart manufacturing initiatives and the adoption of advanced automation.

Industrial Edge Computing Market Product Landscape

The Industrial Edge Computing Market is witnessing a surge in innovative product developments focused on enhancing performance, reliability, and ease of deployment. Key advancements include ruggedized edge hardware designed for harsh industrial environments, compact and powerful edge gateways, and sophisticated software platforms for data aggregation, analysis, and AI inferencing. Unique selling propositions often lie in the seamless integration of Operational Technology (OT) and Information Technology (IT) data, enabling a holistic view of industrial operations. Performance metrics such as low latency processing, high data throughput, and secure communication protocols are paramount. Recent product launches emphasize modular designs, enabling scalability and customization to meet specific industry needs, from simple data acquisition to complex machine learning model deployment directly at the source.

Key Drivers, Barriers & Challenges in Industrial Edge Computing Market

Key Drivers:

- Industry 4.0 Adoption: The overarching trend of smart manufacturing and industrial automation is the primary catalyst.

- Real-time Data Analytics: The necessity for immediate insights for critical decision-making in production and operations.

- IIoT Growth: The proliferation of connected devices generating massive volumes of data at the edge.

- Demand for Reduced Latency: Mission-critical applications requiring sub-millisecond response times.

- Enhanced Cybersecurity: Edge computing offers improved data security by processing sensitive data locally.

Barriers & Challenges:

- Integration Complexity: Interoperability issues between legacy OT systems and modern IT infrastructure.

- Skilled Workforce Shortage: Lack of personnel with expertise in edge computing, AI, and cybersecurity.

- Initial Investment Costs: The upfront expenditure for hardware, software, and implementation can be substantial.

- Data Management and Governance: Establishing effective strategies for managing, storing, and governing distributed data.

- Scalability Concerns: Ensuring that edge solutions can scale effectively with growing operational needs.

- Supply Chain Volatility: Potential disruptions in the availability of critical edge computing components.

Emerging Opportunities in Industrial Edge Computing Market

Emerging opportunities in the Industrial Edge Computing Market lie in the burgeoning field of Edge AI for Predictive Maintenance, which promises to revolutionize asset management by enabling machines to predict their own failures. The expansion of 5G technology is unlocking new possibilities for high-bandwidth, low-latency communication at the edge, paving the way for real-time control of autonomous systems and remote operations. Furthermore, the increasing focus on sustainability and energy efficiency in industrial sectors presents opportunities for edge solutions that optimize energy consumption and resource utilization. The untapped potential in smaller and medium-sized enterprises (SMEs), who are increasingly looking to adopt digital technologies, also represents a significant growth avenue.

Growth Accelerators in the Industrial Edge Computing Market Industry

Growth accelerators in the Industrial Edge Computing Market are largely driven by continuous technological breakthroughs in areas like AI at the edge, advanced analytics, and miniaturization of powerful computing hardware. Strategic partnerships between hardware manufacturers, software providers, and system integrators are crucial for developing comprehensive end-to-end solutions and expanding market reach. Furthermore, government initiatives and industrial consortia promoting the adoption of Industry 4.0 technologies and smart manufacturing play a vital role in accelerating market growth by providing funding, setting standards, and fostering collaboration. The increasing emphasis on data-driven decision-making across all industrial sectors is a sustained accelerator.

Key Players Shaping the Industrial Edge Computing Market Market

- Rockwell Automation

- IBM Corporation

- Siemens

- Microsoft Corporation

- Honeywell International

- Intel Corporation

- Huawei Technologies

- General Electric Company

- SAP SE

Notable Milestones in Industrial Edge Computing Market Sector

- April 2024: Machine Inc. and Siemens AG announced a partnership bringing manufacturing AI to on-premises automation networks. Sight Machine’s Manufacturing Data Platform is an end-to-end software system for collecting, contextualizing, and analyzing all types of manufacturing data to improve production. It enables manufacturers to unlock the power of industrial data to increase profitability, productivity, and sustainability. Siemens Industrial Edge is an edge computing platform consisting of applications, OT and IT connectivity, devices, and a central management system.

- October 2023: Rockwell Automation introduces a new family of edge computing modules, ready for Allen-Bradley control networks and Industry 4.0 control innovation. These are microcontrollers that have access to the ControlLogix backplane, allowing programmers to collect and analyze data on the machine instead of using protocols that must exchange data with far-off servers on extended networks.

In-Depth Industrial Edge Computing Market Market Outlook

The future outlook for the Industrial Edge Computing Market is exceptionally bright, fueled by ongoing digital transformation initiatives across global industries. Growth accelerators, including the relentless pursuit of operational efficiency, enhanced cybersecurity imperatives, and the increasing demand for real-time data insights, will continue to propel market expansion. Strategic alliances and the integration of advanced AI and machine learning capabilities at the edge will unlock unprecedented levels of automation and predictive analytics. The market is poised for significant penetration into sectors beyond manufacturing, including energy, logistics, and healthcare, as the benefits of localized, intelligent processing become more apparent. This comprehensive report provides the actionable intelligence needed to navigate this dynamic and rapidly evolving market.

Industrial Edge Computing Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-user Vertical

- 2.1. Manufacturing

- 2.2. Oil and Gas

- 2.3. Mining

Industrial Edge Computing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Industrial Edge Computing Market Regional Market Share

Geographic Coverage of Industrial Edge Computing Market

Industrial Edge Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For Automation in the Industrial Sector; Organizations shifting from cloud computing and storage systems to edge computing

- 3.3. Market Restrains

- 3.3.1. Introduction of a new technology to an ageing workforce exposes the skills gap

- 3.4. Market Trends

- 3.4.1. Oil and Gas sector is expected to grow at a higher pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Manufacturing

- 5.2.2. Oil and Gas

- 5.2.3. Mining

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Manufacturing

- 6.2.2. Oil and Gas

- 6.2.3. Mining

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Manufacturing

- 7.2.2. Oil and Gas

- 7.2.3. Mining

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Manufacturing

- 8.2.2. Oil and Gas

- 8.2.3. Mining

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Manufacturing

- 9.2.2. Oil and Gas

- 9.2.3. Mining

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Manufacturing

- 10.2.2. Oil and Gas

- 10.2.3. Mining

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Industrial Edge Computing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.1.3. Services

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Manufacturing

- 11.2.2. Oil and Gas

- 11.2.3. Mining

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Rockwell Automation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IBM Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Siemens

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microsoft Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Honeywell International

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Intel Corporation*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huawei Technologies

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 General Electric Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SAP SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Rockwell Automation

List of Figures

- Figure 1: Global Industrial Edge Computing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Edge Computing Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Industrial Edge Computing Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Industrial Edge Computing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Industrial Edge Computing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Industrial Edge Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Industrial Edge Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Edge Computing Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Industrial Edge Computing Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Industrial Edge Computing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Industrial Edge Computing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Industrial Edge Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Industrial Edge Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Industrial Edge Computing Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Industrial Edge Computing Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Industrial Edge Computing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Industrial Edge Computing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Industrial Edge Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Industrial Edge Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Industrial Edge Computing Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Australia and New Zealand Industrial Edge Computing Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Australia and New Zealand Industrial Edge Computing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Australia and New Zealand Industrial Edge Computing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Australia and New Zealand Industrial Edge Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Industrial Edge Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Industrial Edge Computing Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America Industrial Edge Computing Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Industrial Edge Computing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Latin America Industrial Edge Computing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Latin America Industrial Edge Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Industrial Edge Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Industrial Edge Computing Market Revenue (Million), by Component 2025 & 2033

- Figure 33: Middle East and Africa Industrial Edge Computing Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East and Africa Industrial Edge Computing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 35: Middle East and Africa Industrial Edge Computing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 36: Middle East and Africa Industrial Edge Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Industrial Edge Computing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Industrial Edge Computing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Industrial Edge Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Industrial Edge Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Industrial Edge Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Industrial Edge Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Industrial Edge Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Industrial Edge Computing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 20: Global Industrial Edge Computing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Industrial Edge Computing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Edge Computing Market?

The projected CAGR is approximately 13.48%.

2. Which companies are prominent players in the Industrial Edge Computing Market?

Key companies in the market include Rockwell Automation, IBM Corporation, Siemens, Microsoft Corporation, Honeywell International, Intel Corporation*List Not Exhaustive, Huawei Technologies, General Electric Company, SAP SE.

3. What are the main segments of the Industrial Edge Computing Market?

The market segments include Component, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For Automation in the Industrial Sector; Organizations shifting from cloud computing and storage systems to edge computing.

6. What are the notable trends driving market growth?

Oil and Gas sector is expected to grow at a higher pace.

7. Are there any restraints impacting market growth?

Introduction of a new technology to an ageing workforce exposes the skills gap.

8. Can you provide examples of recent developments in the market?

April 2024 - Machine Inc. and Siemens AG announced a partnership bringing manufacturing AI to on-premises automation networks. Sight Machine’s Manufacturing Data Platform is an end-to-end software system for collecting, contextualizing, and analyzing all types of manufacturing data to improve production. It enables manufacturers to unlock the power of industrial data to increase profitability, productivity, and sustainability. Siemens Industrial Edge is an edge computing platform consisting of applications, OT and IT connectivity, devices, and a central management system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Edge Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Edge Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Edge Computing Market?

To stay informed about further developments, trends, and reports in the Industrial Edge Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence