Key Insights

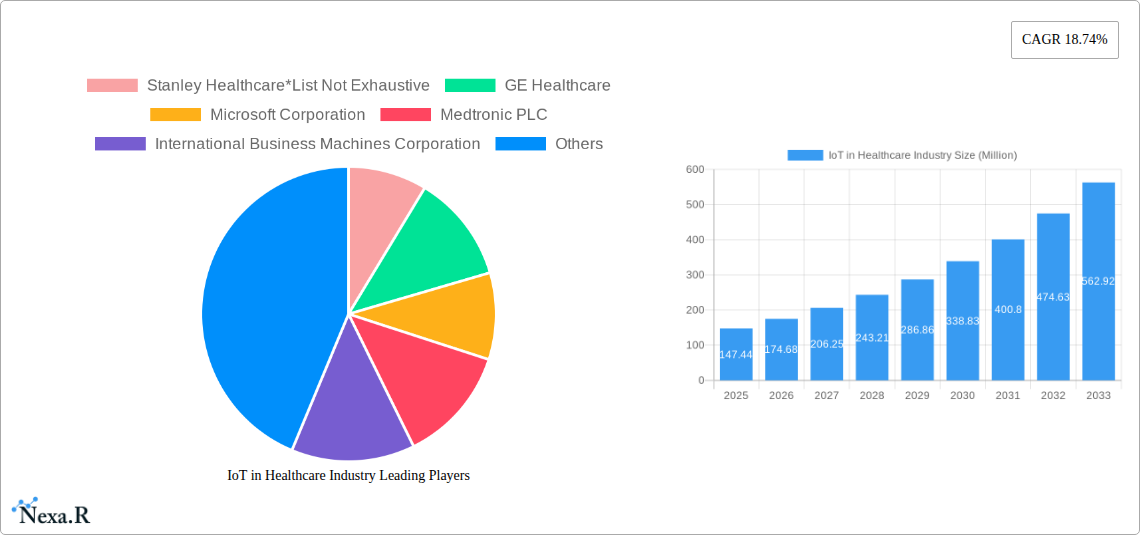

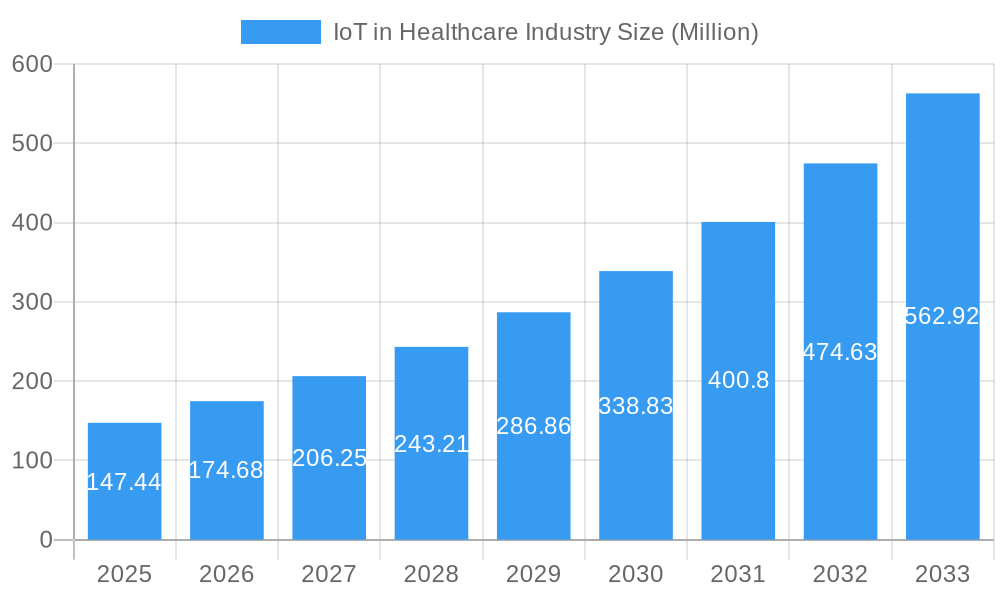

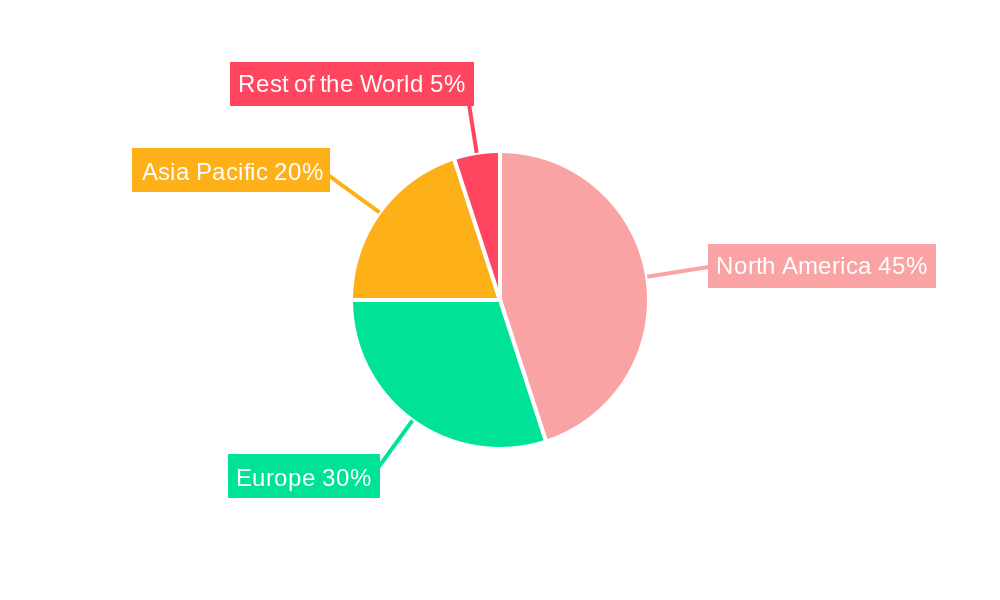

The Internet of Things (IoT) in Healthcare market is experiencing robust growth, projected to reach \$147.44 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 18.74% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of telehealth solutions, fueled by patient demand for convenient and remote healthcare access, is a major catalyst. Secondly, the imperative to improve patient outcomes through continuous monitoring and data-driven insights is driving investment in connected medical devices and systems. The integration of IoT technology in inpatient monitoring, medication management, and other applications enhances operational efficiency and reduces medical errors. Furthermore, the growing volume of healthcare data is pushing the need for sophisticated analytics platforms, creating opportunities for software and service providers. The market is segmented across various components (medical devices, systems & software, services), applications (telemedicine, inpatient monitoring, medication management, and others), and end-users (hospitals, clinical research organizations, etc.). Leading players like Stanley Healthcare, GE Healthcare, Microsoft, and Medtronic are actively shaping the market landscape through innovation and strategic partnerships. North America currently holds a significant market share, owing to advanced technological infrastructure and high healthcare expenditure. However, other regions like Asia-Pacific are witnessing rapid growth due to increasing healthcare investments and a rising adoption of digital healthcare solutions.

IoT in Healthcare Industry Market Size (In Million)

The continued growth of the IoT in healthcare market will be fueled by advancements in sensor technology, artificial intelligence (AI) integration for improved diagnostics and treatment planning, and the increasing focus on preventative care. However, challenges such as data security and privacy concerns, regulatory hurdles related to medical device connectivity, and the need for robust cybersecurity infrastructure remain crucial considerations. Overcoming these challenges will be key to unlocking the full potential of IoT in revolutionizing healthcare delivery and improving patient care globally. The market's trajectory indicates a significant expansion across all segments and regions, presenting lucrative opportunities for technology providers and healthcare organizations alike. This necessitates a collaborative approach involving technology developers, healthcare professionals, and policymakers to ensure ethical and effective implementation of IoT technologies within the healthcare ecosystem.

IoT in Healthcare Industry Company Market Share

IoT in Healthcare Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the IoT in Healthcare Industry market, covering market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes both quantitative and qualitative data to deliver actionable insights for industry professionals. The total market size in 2025 is estimated at $XX Million and is projected to reach $XX Million by 2033.

IoT in Healthcare Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and M&A activity within the IoT healthcare sector. The market is characterized by a moderately concentrated structure with key players holding significant market shares. The total market value in 2025 is estimated to be $XX Million.

- Market Concentration: The top 5 players account for approximately XX% of the market share in 2025.

- Technological Innovation: AI-powered medical devices, cloud-based data analytics, and advanced connectivity solutions are key innovation drivers. Barriers include data security concerns and interoperability challenges.

- Regulatory Frameworks: Stringent regulatory requirements related to data privacy (e.g., HIPAA) and device safety impact market growth.

- Competitive Product Substitutes: Traditional healthcare monitoring and management systems pose a competitive threat to IoT-based solutions.

- End-User Demographics: Hospitals and clinical research organizations represent the largest end-user segments. The market share for hospitals in 2025 is estimated at XX% while Clinical Research Organizations account for XX%.

- M&A Trends: The number of M&A deals in the IoT healthcare sector increased by XX% between 2020 and 2024, indicating strong consolidation and strategic partnerships among key players.

IoT in Healthcare Industry Growth Trends & Insights

This section analyzes the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts in the IoT healthcare sector. The market is experiencing robust growth driven by increasing demand for remote patient monitoring, improved healthcare efficiency, and the proliferation of connected medical devices.

The CAGR for the forecast period (2025-2033) is projected to be XX%. Market penetration in hospitals is expected to reach XX% by 2033. The growth is being fueled by factors such as:

- Rising prevalence of chronic diseases.

- Increasing adoption of telehealth and remote patient monitoring.

- Advancements in AI and machine learning for diagnostics and treatment.

- Growing investments in healthcare infrastructure and digital transformation initiatives.

- Government initiatives promoting the adoption of IoT technologies in healthcare.

Dominant Regions, Countries, or Segments in IoT in Healthcare Industry

North America is the dominant region in the IoT healthcare market, followed by Europe. Within the segments, the Medical Devices segment holds the largest market share, driven by high demand for connected medical devices and wearables.

- Dominant Region: North America ($XX Million in 2025)

- Key Growth Drivers (North America): Strong regulatory support, high healthcare expenditure, advanced technological infrastructure.

- Dominant Segment: Medical Devices ($XX Million in 2025)

- Key Growth Drivers (Medical Devices): Technological advancements, increasing demand for remote patient monitoring devices, and rising adoption of minimally invasive surgical procedures.

- Dominant Application: Inpatient Monitoring ($XX Million in 2025)

IoT in Healthcare Industry Product Landscape

The IoT healthcare product landscape includes a wide range of connected medical devices, software platforms, and data analytics tools. Key innovations focus on enhancing accuracy, improving connectivity, and enhancing user experience. Products are differentiated by features such as advanced data analytics capabilities, cloud-based connectivity, and seamless integration with existing healthcare systems. Miniaturization and improved battery life are significant advancements impacting market growth.

Key Drivers, Barriers & Challenges in IoT in Healthcare Industry

Key Drivers: Technological advancements (AI, cloud computing), rising demand for remote patient monitoring, increasing healthcare costs, and government support for digital health initiatives are key drivers of market growth.

Challenges: Data security and privacy concerns, high implementation costs, interoperability issues among different devices and systems, and regulatory hurdles pose significant challenges to market expansion. Estimated annual losses due to data breaches are around $XX Million.

Emerging Opportunities in IoT in Healthcare Industry

Emerging opportunities include expansion into untapped markets (e.g., developing countries), development of innovative applications (e.g., AI-powered diagnostics), and focus on personalized medicine using IoT devices. The integration of IoT with wearables and consumer health devices offers a significant growth potential.

Growth Accelerators in the IoT in Healthcare Industry Industry

Long-term growth will be driven by continuous technological advancements, strategic partnerships between technology providers and healthcare organizations, and expansion into new markets. Government initiatives promoting the adoption of digital health technologies will also play a crucial role.

Key Players Shaping the IoT in Healthcare Industry Market

Notable Milestones in IoT in Healthcare Industry Sector

- March 2023: NVIDIA and Medtronic collaborate to accelerate AI in healthcare, integrating NVIDIA's AI technologies into Medtronic's GI Genius intelligent endoscopy module.

- September 2022: Wipro GE Healthcare launches the AI-powered Optima IGS320 cath lab, improving imaging vision and surgical flexibility.

In-Depth IoT in Healthcare Industry Market Outlook

The IoT healthcare market is poised for significant growth, driven by increasing adoption of connected devices, advancements in AI and machine learning, and government initiatives promoting digital health. Strategic partnerships and market expansions into new geographical regions and healthcare segments will be crucial for long-term success. The focus will be on data security, interoperability, and personalized medicine.

IoT in Healthcare Industry Segmentation

-

1. Component

-

1.1. Medical Devices

- 1.1.1. Wearable External Medical Devices

- 1.1.2. Implanted Medical Devices

- 1.1.3. Stationary Medical Devices

- 1.2. Systems and Software

- 1.3. Services

-

1.1. Medical Devices

-

2. Application

- 2.1. Telemedicine

- 2.2. Inpatient Monitoring

- 2.3. Medication Management

- 2.4. Other Applications

-

3. End User

- 3.1. Hospital

IoT in Healthcare Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

IoT in Healthcare Industry Regional Market Share

Geographic Coverage of IoT in Healthcare Industry

IoT in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Data Analytics in the Healthcare Sector; Reduction of the Total Cost of Sensing Devices

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns; Requirement for High Initial Investments

- 3.4. Market Trends

- 3.4.1. Increased Digital Adoption in the Healthcare Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Medical Devices

- 5.1.1.1. Wearable External Medical Devices

- 5.1.1.2. Implanted Medical Devices

- 5.1.1.3. Stationary Medical Devices

- 5.1.2. Systems and Software

- 5.1.3. Services

- 5.1.1. Medical Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Telemedicine

- 5.2.2. Inpatient Monitoring

- 5.2.3. Medication Management

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Medical Devices

- 6.1.1.1. Wearable External Medical Devices

- 6.1.1.2. Implanted Medical Devices

- 6.1.1.3. Stationary Medical Devices

- 6.1.2. Systems and Software

- 6.1.3. Services

- 6.1.1. Medical Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Telemedicine

- 6.2.2. Inpatient Monitoring

- 6.2.3. Medication Management

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospital

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Medical Devices

- 7.1.1.1. Wearable External Medical Devices

- 7.1.1.2. Implanted Medical Devices

- 7.1.1.3. Stationary Medical Devices

- 7.1.2. Systems and Software

- 7.1.3. Services

- 7.1.1. Medical Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Telemedicine

- 7.2.2. Inpatient Monitoring

- 7.2.3. Medication Management

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospital

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Medical Devices

- 8.1.1.1. Wearable External Medical Devices

- 8.1.1.2. Implanted Medical Devices

- 8.1.1.3. Stationary Medical Devices

- 8.1.2. Systems and Software

- 8.1.3. Services

- 8.1.1. Medical Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Telemedicine

- 8.2.2. Inpatient Monitoring

- 8.2.3. Medication Management

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospital

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Medical Devices

- 9.1.1.1. Wearable External Medical Devices

- 9.1.1.2. Implanted Medical Devices

- 9.1.1.3. Stationary Medical Devices

- 9.1.2. Systems and Software

- 9.1.3. Services

- 9.1.1. Medical Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Telemedicine

- 9.2.2. Inpatient Monitoring

- 9.2.3. Medication Management

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospital

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Medical Devices

- 10.1.1.1. Wearable External Medical Devices

- 10.1.1.2. Implanted Medical Devices

- 10.1.1.3. Stationary Medical Devices

- 10.1.2. Systems and Software

- 10.1.3. Services

- 10.1.1. Medical Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Telemedicine

- 10.2.2. Inpatient Monitoring

- 10.2.3. Medication Management

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospital

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa IoT in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Medical Devices

- 11.1.1.1. Wearable External Medical Devices

- 11.1.1.2. Implanted Medical Devices

- 11.1.1.3. Stationary Medical Devices

- 11.1.2. Systems and Software

- 11.1.3. Services

- 11.1.1. Medical Devices

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Telemedicine

- 11.2.2. Inpatient Monitoring

- 11.2.3. Medication Management

- 11.2.4. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Hospital

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Stanley Healthcare*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GE Healthcare

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Microsoft Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Medtronic PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 International Business Machines Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Koninklijke Philips NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cisco Systems

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Resideo Technologies Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Capsule Technologies Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAP SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Stanley Healthcare*List Not Exhaustive

List of Figures

- Figure 1: Global IoT in Healthcare Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America IoT in Healthcare Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America IoT in Healthcare Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America IoT in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America IoT in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America IoT in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America IoT in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America IoT in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America IoT in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe IoT in Healthcare Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe IoT in Healthcare Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe IoT in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe IoT in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe IoT in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe IoT in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe IoT in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe IoT in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia IoT in Healthcare Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia IoT in Healthcare Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia IoT in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia IoT in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia IoT in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia IoT in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia IoT in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia IoT in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand IoT in Healthcare Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Australia and New Zealand IoT in Healthcare Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Australia and New Zealand IoT in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Australia and New Zealand IoT in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Australia and New Zealand IoT in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Australia and New Zealand IoT in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Australia and New Zealand IoT in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand IoT in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America IoT in Healthcare Industry Revenue (Million), by Component 2025 & 2033

- Figure 35: Latin America IoT in Healthcare Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Latin America IoT in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Latin America IoT in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Latin America IoT in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Latin America IoT in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Latin America IoT in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America IoT in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa IoT in Healthcare Industry Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East and Africa IoT in Healthcare Industry Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East and Africa IoT in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 45: Middle East and Africa IoT in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa IoT in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 47: Middle East and Africa IoT in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 48: Middle East and Africa IoT in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa IoT in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global IoT in Healthcare Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global IoT in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global IoT in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global IoT in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India IoT in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global IoT in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 30: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global IoT in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Global IoT in Healthcare Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Global IoT in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global IoT in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 36: Global IoT in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IoT in Healthcare Industry?

The projected CAGR is approximately 18.74%.

2. Which companies are prominent players in the IoT in Healthcare Industry?

Key companies in the market include Stanley Healthcare*List Not Exhaustive, GE Healthcare, Microsoft Corporation, Medtronic PLC, International Business Machines Corporation, Koninklijke Philips NV, Cisco Systems, Resideo Technologies Inc, Capsule Technologies Inc, SAP SE.

3. What are the main segments of the IoT in Healthcare Industry?

The market segments include Component, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 147.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Data Analytics in the Healthcare Sector; Reduction of the Total Cost of Sensing Devices.

6. What are the notable trends driving market growth?

Increased Digital Adoption in the Healthcare Sector.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns; Requirement for High Initial Investments.

8. Can you provide examples of recent developments in the market?

March 2023- NVIDIA announced a strategic collaboration with Medtronic to accelerate the development of AI in the healthcare system and bring new AI-based solutions into patient care. The companies will integrate NVIDIA healthcare and edge AI technologies into Medtronic's GI Genius intelligent endoscopy module, designed and manufactured by Cosmo Pharmaceuticals. GI Genius is the first FDA-cleared AI-powered colonoscopy tool to help physicians identify polyps that may lead to colon cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IoT in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IoT in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IoT in Healthcare Industry?

To stay informed about further developments, trends, and reports in the IoT in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence