Key Insights

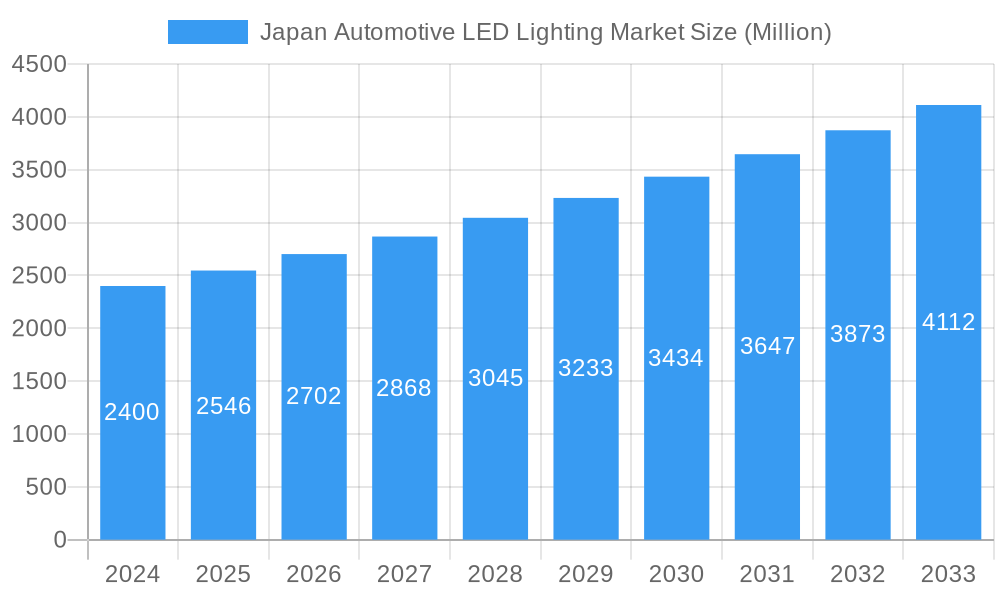

The Japan Automotive LED Lighting Market is poised for robust expansion, driven by increasing consumer demand for advanced safety features, enhanced vehicle aesthetics, and the growing adoption of electric and autonomous vehicles. In 2024, the market is valued at an estimated $2.4 billion. The primary catalysts for this growth include the mandatory implementation of advanced lighting systems for enhanced road safety, such as daytime running lights (DRLs) and adaptive headlights, alongside the rising popularity of customizable and energy-efficient LED solutions that contribute to improved vehicle performance and reduced fuel consumption. Technological advancements in LED, including miniaturization and higher luminous efficacy, are further fueling its integration across various automotive lighting applications, from headlights and tail lights to interior and signaling systems. The automotive utility lighting segment, encompassing DRLs, directional signal lights, and stop lights, is experiencing significant traction due to their crucial role in preventing accidents and improving traffic flow.

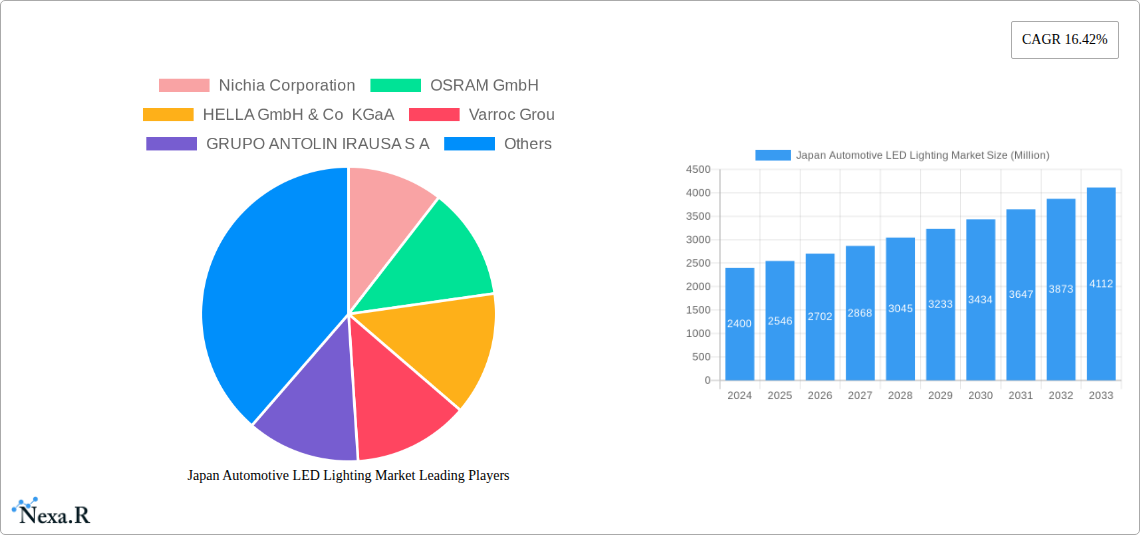

Japan Automotive LED Lighting Market Market Size (In Billion)

Projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033, the market will see a substantial increase in its valuation. This sustained growth is underpinned by ongoing innovation in smart lighting technologies, such as dynamic turning lights and matrix LED systems, which offer unparalleled illumination and adapt to varying driving conditions and traffic situations. The increasing preference for passenger cars and the expanding fleet of two-wheelers equipped with LED lighting solutions are also significant contributors. While the market benefits from strong government regulations promoting vehicle safety and energy efficiency, potential restraints could arise from the initial high cost of advanced LED components and the complexities associated with their integration and maintenance. Nevertheless, the overarching trend towards premiumization and the drive for cutting-edge automotive design and functionality are expected to propel the Japan Automotive LED Lighting Market to new heights, creating significant opportunities for key players and component manufacturers alike.

Japan Automotive LED Lighting Market Company Market Share

Japan Automotive LED Lighting Market Report: Illuminating the Future of Vehicle Illumination

This comprehensive report provides an in-depth analysis of the Japan Automotive LED Lighting Market, a dynamic sector characterized by rapid technological advancements and evolving consumer demands. Covering the period from 2019 to 2033, with a base year of 2025, this research delves into market dynamics, growth trends, product landscape, key players, and emerging opportunities. The report offers critical insights for automotive manufacturers, lighting suppliers, technology developers, and investors seeking to capitalize on the burgeoning demand for innovative and energy-efficient automotive lighting solutions in Japan.

Japan Automotive LED Lighting Market Market Dynamics & Structure

The Japan Automotive LED Lighting Market exhibits a moderately consolidated structure, with a few dominant players controlling a significant market share. Technological innovation remains the primary driver, fueled by advancements in LED chip technology, increased energy efficiency, and the integration of smart features like adaptive lighting and dynamic signaling. Stringent regulatory frameworks, particularly concerning vehicle safety and emissions, further mandate the adoption of advanced LED lighting solutions. While direct competitive product substitutes for LED lighting are minimal in terms of performance and efficiency, traditional lighting technologies are gradually being phased out. End-user demographics, driven by a preference for sophisticated aesthetics and enhanced safety features in vehicles, are increasingly influencing product development. Mergers and acquisitions (M&A) trends, though not as prolific as in other mature markets, indicate strategic moves by key players to expand their technological capabilities and market reach. For instance, recent investments by companies like Marelli Holdings in advanced automotive technologies signal a broader industry trend towards consolidation and strategic growth. The market is characterized by a high barrier to entry due to substantial R&D investment requirements and established supply chain relationships.

- Market Concentration: Moderately consolidated, with a focus on innovation-driven competition.

- Technological Innovation Drivers: Enhanced energy efficiency, superior illumination quality, miniaturization, and integration of smart functionalities.

- Regulatory Frameworks: Stringent safety standards and emissions regulations are key adoption drivers.

- Competitive Product Substitutes: Limited, with traditional lighting technologies rapidly becoming obsolete.

- End-User Demographics: Growing demand for premium, safe, and aesthetically pleasing vehicle lighting.

- M&A Trends: Strategic acquisitions and investments aimed at bolstering technological portfolios.

- Innovation Barriers: High R&D costs and the need for specialized manufacturing expertise.

Japan Automotive LED Lighting Market Growth Trends & Insights

The Japan Automotive LED Lighting Market is poised for significant expansion, driven by the relentless pursuit of enhanced vehicle safety, fuel efficiency, and sophisticated design aesthetics. The adoption rate of LED technology across all automotive lighting applications is accelerating, moving beyond premium segments to become a standard feature in mainstream vehicles. This growth is underpinned by continuous technological disruptions, including the development of more powerful and compact LED modules, advancements in thermal management, and the integration of advanced optical designs. Consumer behavior is shifting towards prioritizing vehicles equipped with cutting-edge lighting systems that offer improved visibility, customizable illumination patterns, and enhanced signaling capabilities. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025–2033). Penetration rates for LED lighting in headlights and taillights are already high, with significant growth expected in secondary lighting functions and interior illumination. The increasing complexity of vehicle architectures and the demand for distinctive brand identities further propel the adoption of customized LED lighting solutions. The market's trajectory is also influenced by global trends in automotive electrification and autonomous driving, where advanced lighting systems play a crucial role in sensor integration and human-machine interaction. The increasing average selling price (ASP) of vehicles equipped with advanced LED lighting, coupled with the growing demand for aftermarket upgrades, further contributes to market value.

Dominant Regions, Countries, or Segments in Japan Automotive LED Lighting Market

Within the Japan Automotive LED Lighting Market, Passenger Cars emerge as the dominant segment, driving substantial market growth. This dominance is attributed to several key factors including Japan's robust automotive manufacturing base for passenger vehicles, strong consumer preference for advanced automotive features, and high disposable incomes that facilitate the adoption of technologically sophisticated vehicles. Passenger cars represent a vast production volume, and the integration of LED lighting, from essential safety features like headlights and taillights to aesthetic elements like ambient interior lighting, is becoming a standard expectation rather than a premium option. The segment's growth is further propelled by stringent safety regulations mandating brighter and more effective lighting for improved road visibility, particularly in Japan's densely populated urban areas and diverse weather conditions.

- Passenger Cars: This segment leads due to high production volumes, advanced feature integration, and strong consumer demand for safety and aesthetics.

- Headlights: Evolving from basic illumination to adaptive and matrix LED systems for enhanced visibility and safety.

- Daytime Running Lights (DRL): Increasingly standardized for improved daytime visibility and vehicle recognition.

- Tail Lights: Incorporating dynamic signaling and advanced visual effects for enhanced safety and brand identity.

- Interior Lighting: Growing demand for customizable and ambient LED lighting to enhance cabin experience.

- Commercial Vehicles: While a smaller segment in terms of unit volume compared to passenger cars, commercial vehicles are witnessing a steady adoption of LED lighting, driven by the need for increased operational safety and efficiency, especially for fleet operators. Longer operational hours and the critical need for reliable illumination in various conditions contribute to the demand.

- 2 Wheelers: The 2-wheeler segment is also transitioning towards LED lighting, driven by regulations and the desire for improved safety and reduced power consumption. The miniaturization of LED technology makes it suitable for the compact designs of motorcycles and scooters.

Key drivers of dominance for the passenger car segment include:

- Economic Policies: Government incentives promoting vehicle upgrades and advanced safety features.

- Infrastructure: High-quality road infrastructure that supports the performance of advanced lighting systems.

- Consumer Behavior: A strong preference for innovation, safety, and premium vehicle features among Japanese consumers.

- Technological Advancements: Continuous innovation by domestic and international component suppliers catering to the high standards of Japanese automakers.

- Market Share: Passenger cars account for an estimated xx% of the total market share in the Japan Automotive LED Lighting Market.

Japan Automotive LED Lighting Market Product Landscape

The product landscape of the Japan Automotive LED Lighting Market is defined by continuous innovation, focusing on enhanced performance, energy efficiency, and integrated intelligence. Beyond standard illumination, LED lighting is increasingly employed for dynamic signaling, adaptive beam patterns, and sophisticated aesthetic enhancements. Key product categories include advanced headlight systems utilizing matrix LED technology for intelligent light distribution, energy-efficient Daytime Running Lights (DRLs) with distinctive designs, and high-visibility taillights featuring dynamic turn signals and brake lights. The integration of sensors within lamp units for functionalities like adaptive lighting and pedestrian detection is a significant technological advancement. These products offer superior illumination quality, longer lifespan, and greater design flexibility compared to traditional lighting.

Key Drivers, Barriers & Challenges in Japan Automotive LED Lighting Market

The Japan Automotive LED Lighting Market is propelled by several key drivers, including the relentless pursuit of enhanced vehicle safety standards, the growing demand for energy-efficient automotive components, and the increasing emphasis on distinctive vehicle aesthetics. Technological advancements in LED efficacy and miniaturization enable more complex and visually appealing lighting designs.

- Key Drivers:

- Stringent safety regulations mandating advanced lighting for improved visibility.

- Growing consumer preference for fuel-efficient and eco-friendly vehicles.

- Desire for sophisticated and customizable vehicle design elements.

- Technological advancements in LED performance and integration.

Conversely, the market faces certain barriers and challenges that can restrain growth. High initial investment costs for R&D and manufacturing, coupled with complex supply chain management for specialized components, pose significant hurdles. Intense competition among established players and emerging entrants can also exert pressure on pricing and profit margins.

- Barriers & Challenges:

- High R&D and manufacturing investment requirements.

- Complex global supply chain dynamics for specialized LED components.

- Intense competitive landscape leading to price pressures.

- The need for continuous adaptation to rapidly evolving automotive technologies.

Emerging Opportunities in Japan Automotive LED Lighting Market

Emerging opportunities within the Japan Automotive LED Lighting Market lie in the growing demand for smart lighting solutions, innovative interior illumination, and specialized lighting for autonomous and electric vehicles. The integration of LED lighting with advanced driver-assistance systems (ADAS) presents a significant avenue for growth. Furthermore, the aftermarket segment for performance and aesthetic upgrades offers untapped potential, catering to vehicle owners seeking to enhance their existing vehicles. The development of biodegradable or recyclable LED materials also aligns with the growing sustainability consciousness.

Growth Accelerators in the Japan Automotive LED Lighting Market Industry

Several factors are acting as significant growth accelerators for the Japan Automotive LED Lighting Market. Continuous technological breakthroughs, such as the development of higher-lumen density LEDs and more efficient thermal management solutions, are pushing the boundaries of performance. Strategic partnerships between automotive OEMs and lighting manufacturers foster innovation and ensure seamless integration of advanced lighting systems into new vehicle models. Furthermore, market expansion strategies, including the development of cost-effective LED solutions for entry-level vehicles and the exploration of new applications beyond traditional lighting, are driving sustained growth.

Key Players Shaping the Japan Automotive LED Lighting Market Market

- Nichia Corporation

- OSRAM GmbH

- HELLA GmbH & Co KGaA

- Varroc Group

- GRUPO ANTOLIN IRAUSA S A

- Valeo

- Marelli Holdings Co Ltd

- Stanley Electric Co Ltd

- Signify (Philips)

- KOITO MANUFACTURING CO LTD

Notable Milestones in Japan Automotive LED Lighting Market Sector

- November 2022: Marelli Holdings, a Japanese auto components supplier, announced plans to invest 260 billion yen (USD 1.76 billion) over the next five years in areas such as autonomous driving technologies and electric vehicles as it attempts to turn its fortunes around.

- August 2020: KOITO MANUFACTURING CO LTD launched its new development center in Aichi, Japan, signaling a commitment to future innovation in automotive lighting.

- October 2019: Stanley Electric Co Ltd introduced a lamp system with a built-in sensor designed to help reduce nighttime traffic accidents, highlighting a focus on safety-enhancing technologies.

In-Depth Japan Automotive LED Lighting Market Market Outlook

The Japan Automotive LED Lighting Market is poised for sustained and robust growth, driven by the synergistic forces of technological advancement, regulatory push, and evolving consumer preferences. Future market potential is significant, particularly in the integration of intelligent lighting systems that enhance safety and user experience. Strategic opportunities include the expansion of adaptive and matrix LED technologies, the development of customized interior ambient lighting solutions, and the design of lighting systems optimized for autonomous driving and electrification. The market is expected to see increased collaboration between technology providers and automotive manufacturers to deliver next-generation lighting innovations.

Japan Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

Japan Automotive LED Lighting Market Segmentation By Geography

- 1. Japan

Japan Automotive LED Lighting Market Regional Market Share

Geographic Coverage of Japan Automotive LED Lighting Market

Japan Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. Security Issues Associated with Mobile Payments

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Automotive LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nichia Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OSRAM GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HELLA GmbH & Co KGaA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Varroc Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GRUPO ANTOLIN IRAUSA S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marelli Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stanley Electric Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Signify (Philips)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KOITO MANUFACTURING CO LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nichia Corporation

List of Figures

- Figure 1: Japan Automotive LED Lighting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Automotive LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Automotive LED Lighting Market Revenue undefined Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 2: Japan Automotive LED Lighting Market Revenue undefined Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 3: Japan Automotive LED Lighting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Japan Automotive LED Lighting Market Revenue undefined Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 5: Japan Automotive LED Lighting Market Revenue undefined Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 6: Japan Automotive LED Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Automotive LED Lighting Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Japan Automotive LED Lighting Market?

Key companies in the market include Nichia Corporation, OSRAM GmbH, HELLA GmbH & Co KGaA, Varroc Grou, GRUPO ANTOLIN IRAUSA S A, Valeo, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, Signify (Philips), KOITO MANUFACTURING CO LTD.

3. What are the main segments of the Japan Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Security Issues Associated with Mobile Payments.

8. Can you provide examples of recent developments in the market?

November 2022: Marelli Holdings, a Japanese auto components supplier, wants to invest 260 billion yen (USD 1.76 billion) over the next five years in areas such as autonomous driving technologies and electric vehicles as it attempts to turn its fortunes around.August 2020: KOITO launched its new development center in Aichi, japan.October 2019: Stanley introduced a lamp system with a built-in sensor to help reduce nighttime traffic accidents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the Japan Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence