Key Insights

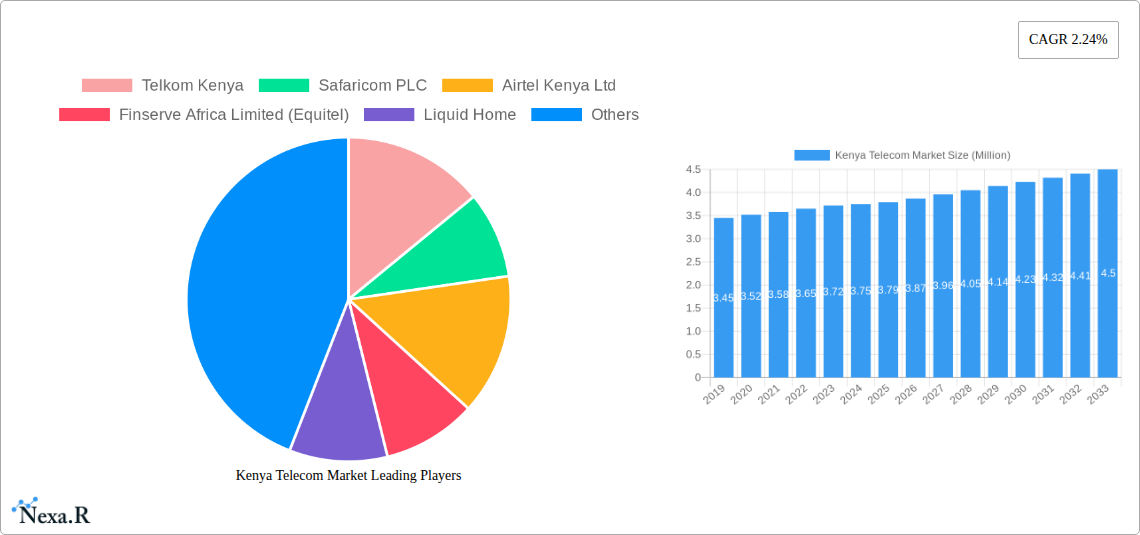

The Kenyan telecommunications market is poised for steady growth, projected to reach approximately USD 3.79 billion by 2025. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 2.24% from 2019 to 2033, indicating a robust and sustained upward trajectory. Key drivers fueling this market evolution include the escalating demand for high-speed data services, the increasing adoption of smartphones, and the continuous expansion of mobile network coverage across both urban and rural areas. Furthermore, the burgeoning digital economy, fueled by e-commerce, online education, and digital payments, acts as a significant catalyst, necessitating reliable and advanced telecommunications infrastructure. Government initiatives aimed at fostering digital inclusion and promoting ICT adoption further bolster the market's growth prospects.

Kenya Telecom Market Market Size (In Million)

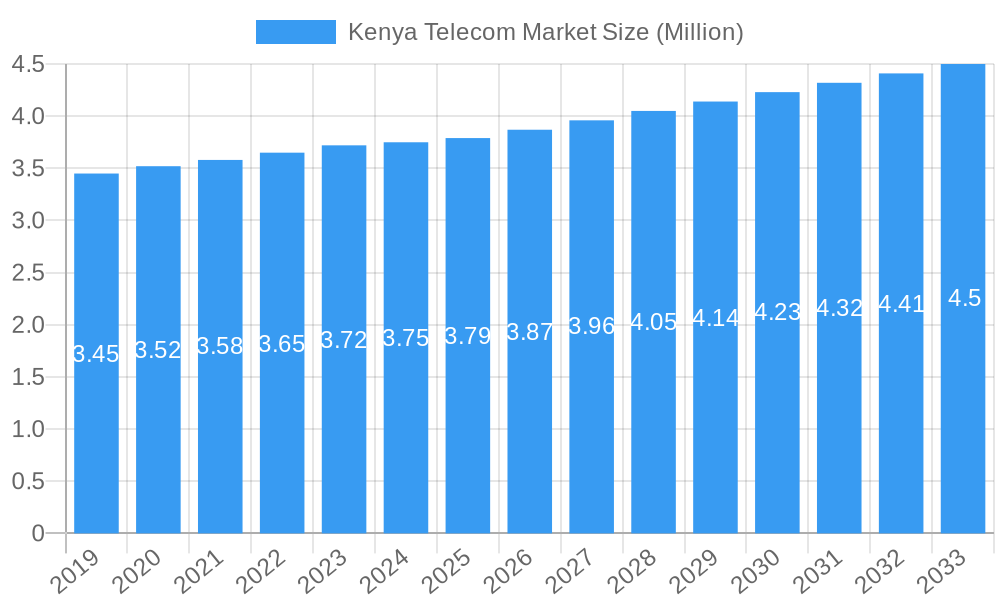

The telecommunications landscape in Kenya is characterized by a dynamic interplay of evolving consumer preferences and technological advancements. Within the Services segment, Data and Messaging Services are anticipated to witness the most substantial growth, driven by increased internet penetration and the widespread use of over-the-top (OTT) communication platforms. Voice Services, while mature, will continue to contribute to market revenue, with a gradual shift towards wireless solutions. The integration of PayTV services also presents an avenue for revenue diversification. Leading telecommunication providers such as Safaricom PLC, Airtel Kenya Ltd, and Telkom Kenya are actively innovating and expanding their offerings to capture market share. Emerging players and service providers like Liquid Home and Wananchi Group are also contributing to market competition and innovation, particularly in broadband and home entertainment solutions.

Kenya Telecom Market Company Market Share

Unlocking the Future: A Comprehensive Report on the Kenya Telecom Market (2019–2033)

This in-depth report provides an exhaustive analysis of the dynamic Kenya Telecom Market, offering critical insights for stakeholders, investors, and industry professionals. Spanning the historical period of 2019–2024 and projecting through the forecast period of 2025–2033, with the base and estimated year as 2025, this report leverages high-traffic keywords to ensure maximum visibility and deliver actionable intelligence. We meticulously dissect parent and child market segments, presenting all monetary values in millions of units for clarity and ease of comparison.

Kenya Telecom Market Market Dynamics & Structure

The Kenya Telecom Market is characterized by a dynamic interplay of market concentration, technological innovation, and evolving regulatory frameworks. Safaricom PLC continues to hold a dominant market share, driving significant competition and innovation across the sector. Technological advancements, particularly in 5G deployment and fiber optic expansion, are pivotal drivers, while the government's digital transformation agenda fosters an environment conducive to growth. Regulatory bodies play a crucial role in ensuring fair competition and consumer protection, impacting pricing strategies and service accessibility.

- Market Concentration: Dominated by a few key players, with Safaricom PLC leading the mobile and mobile money segments.

- Technological Innovation Drivers: Increasing demand for high-speed internet, expansion of mobile money services, and the rollout of 5G technology.

- Regulatory Frameworks: ARPU fluctuations and licensing requirements influence operator strategies.

- Competitive Product Substitutes: Over-the-Top (OTT) services continue to challenge traditional voice and messaging revenue streams.

- End-User Demographics: A young, increasingly digitally-literate population drives demand for data-centric services.

- M&A Trends: Strategic acquisitions and partnerships are observed, aimed at consolidating market presence and expanding service portfolios. For instance, the reported interest of Axian Telecom in acquiring Wananchi Group highlights this trend, seeking to integrate broadband, TV, and mobile services.

Kenya Telecom Market Growth Trends & Insights

The Kenya Telecom Market is poised for robust growth, fueled by escalating data consumption, digital inclusion initiatives, and expanding mobile financial services. The market size is projected to witness a significant expansion, driven by increasing smartphone penetration and the adoption of next-generation technologies like 5G. Our analysis, powered by proprietary data and forecasting models, reveals a compelling CAGR, indicating a healthy upward trajectory. Shifts in consumer behavior towards digital-first solutions, coupled with the increasing reliance on data and communication services for both personal and business needs, are fundamental to this growth narrative. Furthermore, the burgeoning digital economy, supported by government policies promoting ICT adoption, acts as a significant catalyst.

- Market Size Evolution: Witnessing a substantial increase in revenue driven by data and mobile money services. The projected market size for the forecast period is expected to reach USD 8,500 Million by 2033.

- Adoption Rates: High adoption rates for mobile internet and mobile money services are a key indicator of market maturity and potential.

- Technological Disruptions: The ongoing rollout of 5G technology and the expansion of fiber optic networks are set to redefine service delivery and user experience.

- Consumer Behavior Shifts: Increasing demand for bundled services, over-the-top (OTT) content, and cloud-based solutions.

- Market Penetration: Mobile subscriber penetration is estimated at 85% in the base year 2025, with steady growth anticipated.

Dominant Regions, Countries, or Segments in Kenya Telecom Market

The Data and Messaging Services segment is unequivocally the dominant force driving growth within the Kenya Telecom Market. This ascendancy is attributed to the burgeoning digital economy, the widespread adoption of smartphones, and the increasing reliance on data for communication, entertainment, and business operations. The expansion of high-speed internet infrastructure, including 4G and the nascent 5G networks, has significantly enhanced the accessibility and quality of data services, making them the primary revenue generator for telecom operators.

- Key Drivers for Data and Messaging Dominance:

- Economic Policies: Government initiatives promoting digital transformation and a digital economy directly boost data usage.

- Infrastructure Development: Significant investments in fiber optic networks and mobile base stations have expanded broadband reach and capacity.

- Consumer Demand: A young, tech-savvy population exhibits a high appetite for social media, streaming services, and online content, all heavily reliant on data.

- Mobile Money Integration: The deep integration of mobile money platforms with data services creates a synergistic growth environment, with transactions often facilitated through data connections.

- Business Solutions: The increasing adoption of cloud services, e-commerce, and remote work necessitates robust data connectivity.

While Voice Services (Wired and Wireless) remain foundational, their growth rate is outpaced by data services. Wireless voice, however, continues to benefit from broad mobile network coverage. OTT and PayTV Services present both competition and opportunity, with telecom operators increasingly integrating these offerings into their data packages to capture a larger share of consumer spending. The projected market share for Data and Messaging Services in 2025 is estimated at 55%, with a projected growth to 65% by 2033. This segment's growth potential is immense, underpinned by an expanding digital ecosystem and evolving consumer preferences.

Kenya Telecom Market Product Landscape

The Kenya Telecom Market is witnessing a surge in product innovation, focusing on delivering enhanced customer experiences and diversified service offerings. Telkom Kenya is actively expanding its fiber-to-the-home (FTTH) services, while Safaricom PLC continues to lead in mobile money innovations with M-PESA. Airtel Kenya Ltd is enhancing its data and voice packages to compete aggressively. Equitel (Finserve Africa Limited) leverages its unique banking integration for its mobile services. Liquid Home and Wananchi Group (Zuku) are key players in the broadband and PayTV space, continuously upgrading their network infrastructure and content offerings. Jamii Telecommunications Limited (Faiba) is a notable competitor in the broadband segment, offering competitive pricing.

Key Drivers, Barriers & Challenges in Kenya Telecom Market

Key Drivers:

- Expanding Mobile Penetration: High smartphone adoption fuels demand for data and value-added services.

- Digital Transformation Initiatives: Government and private sector focus on digitizing services.

- Growth of Mobile Money: M-PESA's ubiquity drives financial inclusion and transactional growth.

- Infrastructure Investment: Continued investment in fiber optics and 5G deployment.

- Young Demographics: A large, digitally-native youth population seeking data-rich services.

Barriers & Challenges:

- Regulatory Hurdles: Evolving regulations and licensing complexities can impact operational agility.

- Affordability and Income Disparity: Uneven income distribution can limit the uptake of premium services.

- Infrastructure Gaps in Rural Areas: Unequal distribution of network coverage, particularly in remote regions, presents a significant challenge.

- Cybersecurity Threats: Increasing reliance on digital services necessitates robust cybersecurity measures to build trust.

- Competition from OTT Players: Over-the-top services continue to erode traditional revenue streams. The competitive pressure is significant, with ARPU (Average Revenue Per User) for traditional voice services facing a projected decline of 8% by 2028.

Emerging Opportunities in Kenya Telecom Market

Emerging opportunities in the Kenya Telecom Market lie in the continued expansion of mobile broadband in unserved and underserved regions, the integration of IoT solutions across various industries, and the development of advanced digital payment ecosystems beyond basic mobile money transfers. The growing demand for cloud services and enterprise solutions presents a substantial revenue stream for operators adept at providing secure and reliable connectivity. Furthermore, the potential for further innovation in digital health, e-learning, and smart city applications offers significant untapped markets.

Growth Accelerators in the Kenya Telecom Market Industry

The Kenya Telecom Market industry's growth is significantly accelerated by strategic technological advancements, including the ongoing rollout of 5G networks and the expansion of fiber optic infrastructure, which dramatically increases data speeds and capacity. Key partnerships between telecom operators and content providers are crucial for bundling attractive service packages. Furthermore, the government's commitment to digital inclusion through policies promoting affordable internet access and digital literacy acts as a powerful catalyst, encouraging wider adoption of telecommunication services and fostering a vibrant digital economy.

Key Players Shaping the Kenya Telecom Market Market

- Safaricom PLC

- Airtel Kenya Ltd

- Telkom Kenya

- Finserve Africa Limited (Equitel)

- Liquid Home

- Wananchi Group (Zuku)

- Jamii Telecommunications Limited (Faiba)

Notable Milestones in Kenya Telecom Market Sector

- October 2024: Safaricom expands M-PESA Global to Ethiopia, facilitating mobile money transfers from Kenya to Ethiopia, aiming to stimulate local economies and create new prospects for businesses and individuals.

- September 2024: Axian Telecom reportedly initiates a bid to acquire Kenya-based mobile, internet, and TV provider Wananchi Group (Zuku). This potential acquisition, involving 99.63% of Wananchi, signals consolidation and strategic expansion within the East African telecom landscape.

In-Depth Kenya Telecom Market Market Outlook

The Kenya Telecom Market is projected for sustained and robust growth, with future potential heavily reliant on continued infrastructure development, particularly in expanding 5G and fiber optic networks. Strategic opportunities exist in leveraging these advanced networks for innovative applications such as the Internet of Things (IoT), enhanced cloud services, and the development of specialized enterprise solutions. Operators who can effectively navigate the evolving regulatory landscape and address the demand for affordable, high-quality digital services in both urban and rural areas will be best positioned for long-term success and market leadership. The focus will increasingly shift towards data-driven services and integrated digital ecosystems.

Kenya Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Kenya Telecom Market Segmentation By Geography

- 1. Kenya

Kenya Telecom Market Regional Market Share

Geographic Coverage of Kenya Telecom Market

Kenya Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 4G and 5G services; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising demand for 4G and 5G services; Growth of IoT usage in Telecom

- 3.4. Market Trends

- 3.4.1. The Demand for 4G and 5G Services is Rising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kenya Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Kenya

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telkom Kenya

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Safaricom PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airtel Kenya Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Finserve Africa Limited (Equitel)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liquid Home

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wananchi Group (Zuku)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jamii Telecommunications Limited (Faiba)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Telkom Kenya

List of Figures

- Figure 1: Kenya Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Kenya Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Kenya Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Kenya Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 3: Kenya Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Kenya Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Kenya Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Kenya Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 7: Kenya Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Kenya Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kenya Telecom Market?

The projected CAGR is approximately 2.24%.

2. Which companies are prominent players in the Kenya Telecom Market?

Key companies in the market include Telkom Kenya, Safaricom PLC, Airtel Kenya Ltd, Finserve Africa Limited (Equitel), Liquid Home, Wananchi Group (Zuku), Jamii Telecommunications Limited (Faiba)*List Not Exhaustive.

3. What are the main segments of the Kenya Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 4G and 5G services; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

The Demand for 4G and 5G Services is Rising.

7. Are there any restraints impacting market growth?

Rising demand for 4G and 5G services; Growth of IoT usage in Telecom.

8. Can you provide examples of recent developments in the market?

October 2024: Safaricom has expanded its M-PESA Global service to include Ethiopia, enabling users to transfer mobile money from Kenya to Ethiopia. With this growth, the two companies strive to enhance the utilization and reach of mobile money in Ethiopia, which can help stimulate local economies and provide new prospects for people and businesses in the area. This partnership reflects our dedication to providing creative financial options that meet the changing demands of our clients.September 2024: Axian Telecom was reportedly looking to acquire Kenya-based mobile, internet and TV provider Wananchi Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kenya Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kenya Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kenya Telecom Market?

To stay informed about further developments, trends, and reports in the Kenya Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence