Key Insights

The Latin America IT Services Market is poised for substantial expansion, projected to reach $39,963.9 million in 2024, demonstrating robust growth with a compound annual growth rate (CAGR) of 12.1% through 2033. This dynamic market is primarily driven by the increasing adoption of digital transformation initiatives across various sectors, including BFSI, manufacturing, and retail. Companies are heavily investing in IT outsourcing, cloud services, and business process optimization to enhance operational efficiency, customer experience, and competitive advantage. The burgeoning demand for advanced IT solutions such as artificial intelligence, data analytics, and cybersecurity further fuels market growth. The segment of IT Consulting and Implementation is expected to witness significant traction as businesses seek expert guidance to navigate complex technological landscapes and integrate new solutions. Furthermore, the increasing penetration of cloud-based services and the growing need for robust IT infrastructure are also contributing factors to the market's upward trajectory.

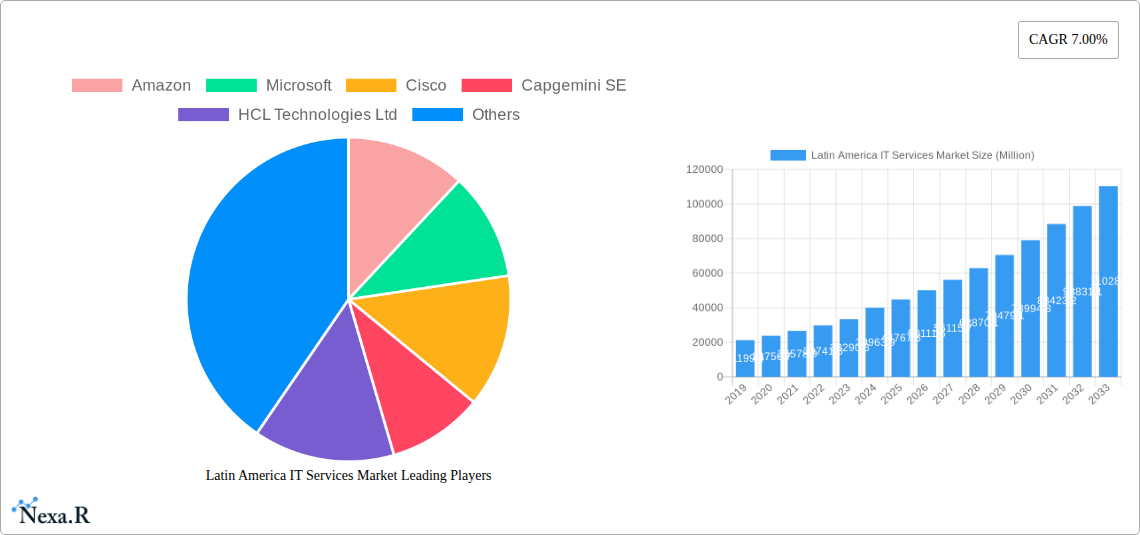

Latin America IT Services Market Market Size (In Billion)

The Latin America IT Services Market is experiencing a significant surge, largely propelled by the imperative for businesses to modernize their operations and embrace digital technologies. Key drivers include the escalating demand for cloud computing services, driven by their scalability and cost-effectiveness, and the critical need for advanced cybersecurity solutions to combat rising cyber threats. The IT Outsourcing segment is also a major growth engine, as companies across industries like manufacturing, government, and healthcare leverage external expertise to manage their IT operations, thereby focusing on core business functions. Emerging trends such as the adoption of AI and machine learning for predictive analytics and process automation, alongside the increasing application of IoT in logistics and retail, are shaping the market's future. While the market exhibits strong growth potential, challenges such as a shortage of skilled IT professionals and varying levels of digital infrastructure development across different regions within Latin America may present some restraints. However, the overall outlook remains exceptionally positive, with strong investments expected to continue throughout the forecast period.

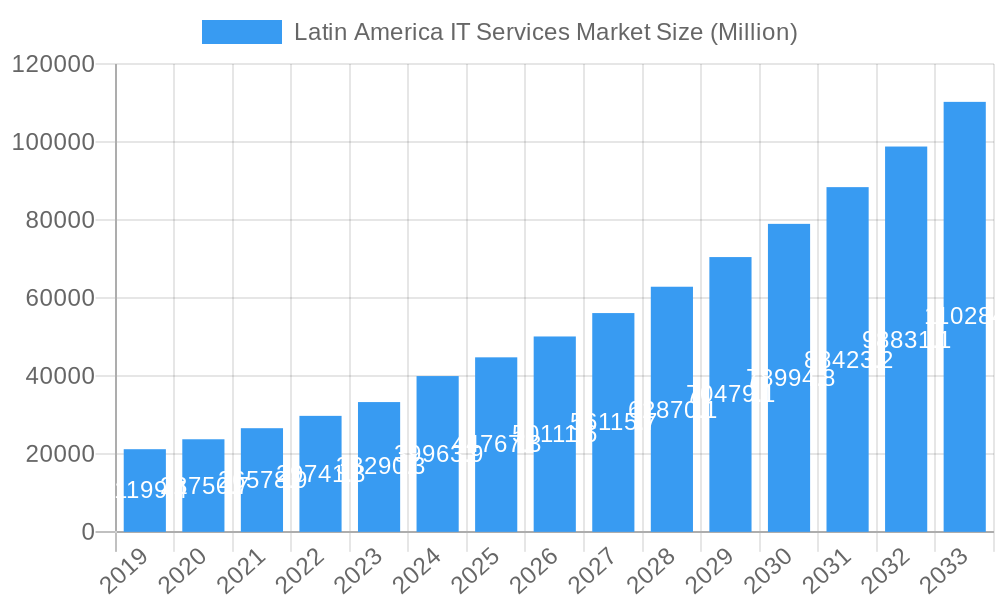

Latin America IT Services Market Company Market Share

SEO-Optimized Report Description: Latin America IT Services Market – Forecast 2025-2033

Unlock deep insights into the dynamic Latin America IT Services Market with this comprehensive report. Covering the period 2019–2033, with a base and estimated year of 2025, this study delves into the critical trends, growth drivers, and challenges shaping the region's IT landscape. We meticulously analyze key segments including IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, and Other Types, alongside crucial end-user industries such as Manufacturing, Government, BFSI, Healthcare, Retail and Consumer Goods, and Logistics. Discover the strategies of industry giants like Amazon, Microsoft, Cisco, Capgemini SE, HCL Technologies Ltd, Google, Wipro Limited, Atos SE, Dell Technologies Inc, and IBM. This report provides actionable intelligence for businesses seeking to capitalize on the burgeoning IT services demand across Latin America.

Latin America IT Services Market Market Dynamics & Structure

The Latin America IT Services Market is characterized by a moderate to high concentration, driven by the significant presence of global technology leaders and a growing number of regional players. Technological innovation is a paramount driver, fueled by the increasing adoption of cloud computing, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Regulatory frameworks, while evolving, generally favor digital transformation initiatives and foreign investment, though localized data privacy laws can present complexities. Competitive product substitutes are primarily influenced by in-house IT capabilities and the availability of skilled talent. End-user demographics reveal a strong demand from established sectors like BFSI and Manufacturing, with a notable surge in interest from the Government and Healthcare sectors due to digitalization mandates and public health initiatives. Mergers & Acquisitions (M&A) trends indicate strategic consolidation, with companies aiming to expand their service portfolios and geographical reach. For instance, the acquisition of Tenbu by Accenture in August 2022 signifies a trend towards acquiring specialized capabilities in cloud and data analytics. Deal volumes for the historical period (2019-2024) are estimated at approximately 50-70 significant M&A transactions, with an average deal value of $50-$150 million. Barriers to innovation often stem from the need for significant capital investment in new technologies and the challenge of finding and retaining specialized IT talent across the diverse Latin American labor markets.

- Market Concentration: Moderate to high, with a blend of global and regional players.

- Technological Drivers: Cloud adoption (estimated 65% penetration in key sectors), AI/ML (projected 30% growth YoY), IoT (estimated 40% increase in connected devices).

- Regulatory Influence: Favorable for digital transformation, with evolving data privacy regulations in countries like Brazil (LGPD) and Mexico.

- End-User Demand: Strongest from BFSI (estimated 25% of market share) and Manufacturing (estimated 20% of market share).

- M&A Activity: Significant consolidation trends, with an estimated 60 M&A deals in the historical period, averaging $80 million in value.

Latin America IT Services Market Growth Trends & Insights

The Latin America IT Services Market is poised for robust expansion, projected to grow from an estimated $70,000 million in 2025 to an impressive $150,000 million by 2033. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. The market evolution is being profoundly shaped by rapid digital transformation initiatives across all major economies in the region, spurred by increased government investment in digital infrastructure and private sector demands for enhanced operational efficiency and customer engagement. Adoption rates for cloud-based IT services have surged, with an estimated 65% of enterprises in key sectors leveraging cloud solutions by 2025, a significant increase from 40% in 2019. This trend is further amplified by the growing acceptance and integration of AI and ML technologies into business processes, aiming to automate tasks, gain deeper analytical insights, and personalize customer experiences. The market penetration of IT outsourcing services is expected to reach 75% in the BFSI and Retail sectors by 2028, reflecting a global shift towards specialized service providers.

Technological disruptions, including the widespread adoption of 5G networks, are facilitating the deployment of more sophisticated IT solutions, particularly in areas like IoT and edge computing, which are becoming critical for industries such as Manufacturing and Logistics. Consumer behavior shifts are also playing a crucial role, with heightened expectations for seamless digital interactions, personalized services, and secure online transactions, pushing businesses across all verticals to invest heavily in their IT infrastructure and digital capabilities. For instance, the e-commerce boom, accelerated by the pandemic, has necessitated significant investments in cloud scalability, cybersecurity, and data analytics. The historical period (2019-2024) witnessed a steady upward trajectory, with market size growing from approximately $45,000 million in 2019 to an estimated $68,000 million by the end of 2024. This sustained growth momentum is expected to continue as businesses across Latin America prioritize digital resilience and innovation to remain competitive in a rapidly evolving global economy. The increasing focus on cybersecurity solutions, driven by a rise in cyber threats, also contributes significantly to market expansion.

Dominant Regions, Countries, or Segments in Latin America IT Services Market

The IT Consulting and Implementation segment is emerging as a dominant force within the Latin America IT Services Market, exhibiting a projected market share of approximately 35% by 2028, surpassing other segments. This segment's ascendancy is driven by businesses across the region seeking expert guidance and hands-on support to navigate complex digital transformations, integrate new technologies like cloud, AI, and IoT, and optimize their existing IT infrastructures. Countries like Brazil, Mexico, and Colombia are leading this charge, fueled by proactive government initiatives promoting digital adoption and significant private sector investment in technological advancement.

In terms of end-user industries, the BFSI (Banking, Financial Services, and Insurance) sector continues to hold its position as a primary driver of demand, accounting for an estimated 28% of the market share. This dominance is attributed to the sector’s inherent need for robust, secure, and scalable IT solutions to manage vast amounts of data, comply with stringent regulations, enhance customer experience through digital banking channels, and combat sophisticated cyber threats. The ongoing digital transformation within BFSI, including the adoption of fintech solutions, blockchain, and advanced analytics, requires substantial IT consulting and implementation services.

However, the Manufacturing sector is demonstrating considerable growth potential, with an estimated CAGR of 10.5% during the forecast period, driven by the adoption of Industry 4.0 technologies. This includes the implementation of Industrial IoT (IIoT) for predictive maintenance and operational efficiency, automation solutions, and advanced data analytics for supply chain optimization. The increasing emphasis on smart manufacturing and the need to integrate complex IT systems with operational technology (OT) are creating substantial opportunities for IT service providers. Mexico and Brazil, with their strong manufacturing bases, are at the forefront of this trend.

- Dominant Segment: IT Consulting and Implementation (estimated 35% market share by 2028).

- Key Drivers: Demand for digital transformation expertise, cloud integration, AI/ML adoption.

- Leading Countries: Brazil, Mexico, Colombia.

- Leading End-User Industry: BFSI (estimated 28% market share).

- Key Drivers: Digital banking, regulatory compliance, cybersecurity, fintech integration.

- High-Growth End-User Industry: Manufacturing (estimated 10.5% CAGR).

- Key Drivers: Industry 4.0 adoption, IIoT, automation, supply chain optimization.

Latin America IT Services Market Product Landscape

The product landscape within the Latin America IT Services Market is characterized by a sophisticated array of offerings designed to meet the evolving digital needs of businesses. Cloud-based solutions, encompassing Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), represent a cornerstone, providing scalability, flexibility, and cost-efficiency. Companies are increasingly deploying advanced analytics and AI-driven platforms for business intelligence, customer insights, and process automation, with unique selling propositions often centered on predictive capabilities and personalized user experiences. Cybersecurity solutions are paramount, with innovations in threat detection, data encryption, and identity management offering robust protection against evolving cyber threats. Furthermore, the integration of IoT platforms is enabling real-time data collection and analysis, fostering smart manufacturing, logistics, and smart city initiatives across the region.

Key Drivers, Barriers & Challenges in Latin America IT Services Market

Key Drivers:

- Digital Transformation Imperative: Businesses across all sectors are compelled to adopt digital technologies to remain competitive, improve operational efficiency, and enhance customer experiences.

- Growing Cloud Adoption: Increasing reliance on cloud infrastructure for scalability, flexibility, and cost-effectiveness is a major growth catalyst.

- Government Initiatives: Supportive government policies and investments in digital infrastructure and innovation are propelling market growth.

- Rise of Emerging Technologies: The adoption of AI, ML, IoT, and Big Data analytics is creating new service demands and opportunities.

Barriers & Challenges:

- Talent Shortage: A significant scarcity of skilled IT professionals, particularly in specialized areas like AI, cybersecurity, and cloud architecture, poses a major impediment. Estimated deficit of 200,000 IT professionals by 2026.

- Cybersecurity Threats: The escalating sophistication and frequency of cyberattacks create significant risks and require continuous investment in robust security solutions, impacting budget allocation.

- Economic Volatility and Political Instability: Fluctuations in regional economies and political uncertainties can impact investment decisions and project timelines, leading to an estimated 10-15% slowdown in planned investments during periods of instability.

- Regulatory Complexity: Diverse and evolving regulatory landscapes across different Latin American countries can create compliance challenges for service providers operating regionally.

Emerging Opportunities in Latin America IT Services Market

Emerging opportunities abound in Latin America’s IT services sector, particularly in the digitalization of SMEs which represent a largely untapped market with a growing awareness of digital benefits. The expansion of fintech solutions beyond major financial hubs into less-served regions presents significant growth avenues. Furthermore, the increasing focus on sustainability and ESG (Environmental, Social, and Governance) initiatives is driving demand for IT solutions that enable greener operations and transparent reporting. The remote work trend continues to fuel opportunities in cloud-based collaboration tools, managed IT services for distributed workforces, and enhanced cybersecurity for remote access.

Growth Accelerators in the Latin America IT Services Market Industry

Several key catalysts are accelerating long-term growth in the Latin America IT Services Market. Strategic partnerships between global technology providers and local IT firms are crucial for knowledge transfer and market penetration. The ongoing investment in 5G infrastructure across several key countries will unlock new possibilities for high-bandwidth applications, IoT deployments, and edge computing, creating substantial demand for related IT services. Furthermore, the increasing maturity of the startup ecosystem in regions like Brazil, Mexico, and Colombia is fostering innovation and driving the adoption of cutting-edge IT solutions, which in turn creates a ripple effect for the broader IT services market.

Key Players Shaping the Latin America IT Services Market Market

- Amazon

- Microsoft

- Cisco

- Capgemini SE

- HCL Technologies Ltd

- Wipro Limited

- Atos SE

- Dell Technologies Inc

- IBM

Notable Milestones in Latin America IT Services Market Sector

- June 2022: Telefonica Tech signed an agreement with IBM/Red Hat to integrate Red Hat's OpenShift platform into a new cloud service marketed at enterprises across Telefonica's footprint in Europe and Latin America.

- August 2022: Accenture acquired Tenbu for intelligent decision-making and planning, expanding Accenture's first cloud capabilities through Latin America and globally.

In-Depth Latin America IT Services Market Market Outlook

The future outlook for the Latin America IT Services Market is exceptionally bright, propelled by a confluence of accelerating growth factors. The sustained push for digital transformation across all industries, coupled with increasing government support for technological advancement, forms the bedrock of this positive trajectory. Emerging technologies like AI, IoT, and advanced analytics are moving from nascent stages to mainstream adoption, creating substantial demand for specialized IT consulting, implementation, and managed services. Strategic collaborations and the growing prowess of regional tech startups will further fuel innovation and market expansion. As businesses continue to prioritize resilience, efficiency, and customer-centricity in an increasingly digital world, the Latin America IT Services Market is set to experience a period of unprecedented growth and opportunity.

Latin America IT Services Market Segmentation

-

1. Type

- 1.1. IT Consulting and Implementation

- 1.2. IT Outsourcing

- 1.3. Business Process Outsourcing

- 1.4. Other Types

-

2. End-user

- 2.1. Manufacturing

- 2.2. Government

- 2.3. BFSI

- 2.4. Healthcare

- 2.5. Retail and Consumer Goods

- 2.6. Logistics

- 2.7. Other End-users

Latin America IT Services Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America IT Services Market Regional Market Share

Geographic Coverage of Latin America IT Services Market

Latin America IT Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 3.3. Market Restrains

- 3.3.1 Data Security

- 3.3.2 Customization

- 3.3.3 and Data Migration

- 3.4. Market Trends

- 3.4.1. Growing Demand for Cloud Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America IT Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. IT Consulting and Implementation

- 5.1.2. IT Outsourcing

- 5.1.3. Business Process Outsourcing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Manufacturing

- 5.2.2. Government

- 5.2.3. BFSI

- 5.2.4. Healthcare

- 5.2.5. Retail and Consumer Goods

- 5.2.6. Logistics

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cisco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capgemini SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HCL Technologies Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wipro Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atos SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IBM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Latin America IT Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America IT Services Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America IT Services Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Latin America IT Services Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 3: Latin America IT Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Latin America IT Services Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Latin America IT Services Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 6: Latin America IT Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America IT Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America IT Services Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Latin America IT Services Market?

Key companies in the market include Amazon, Microsoft, Cisco, Capgemini SE, HCL Technologies Ltd, Google, Wipro Limited, Atos SE, Dell Technologies Inc, IBM.

3. What are the main segments of the Latin America IT Services Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations.

6. What are the notable trends driving market growth?

Growing Demand for Cloud Services.

7. Are there any restraints impacting market growth?

Data Security. Customization. and Data Migration.

8. Can you provide examples of recent developments in the market?

June 2022: Telefonica Tech has signed an agreement with IBM/Red Hat to integrate Red Hat's OpenShift platform into a new cloud service marketed at enterprises across Telefonica's footprint in Europe and Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America IT Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America IT Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America IT Services Market?

To stay informed about further developments, trends, and reports in the Latin America IT Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence