Key Insights

The Latin American real-time payments market is poised for significant expansion, driven by increasing smartphone adoption, robust e-commerce growth, and the burgeoning digital financial services sector. The projected market size is expected to reach $787.74 billion by 2025, with a CAGR of 10.13%. Key growth drivers include government initiatives promoting financial inclusion and a rising consumer and business preference for expedited, convenient payment solutions. Person-to-Person (P2P) and Person-to-Business (P2B) transactions are pivotal segments, with Brazil and Mexico leading regional market development. The competitive environment features established entities such as Visa, Mastercard, and PayPal, alongside agile fintech innovators like SafetyPay and Paysend, competing through strategic alliances and technological advancements. Market expansion is, however, influenced by infrastructure constraints in certain areas, cybersecurity considerations, and diverse regulatory frameworks across the region.

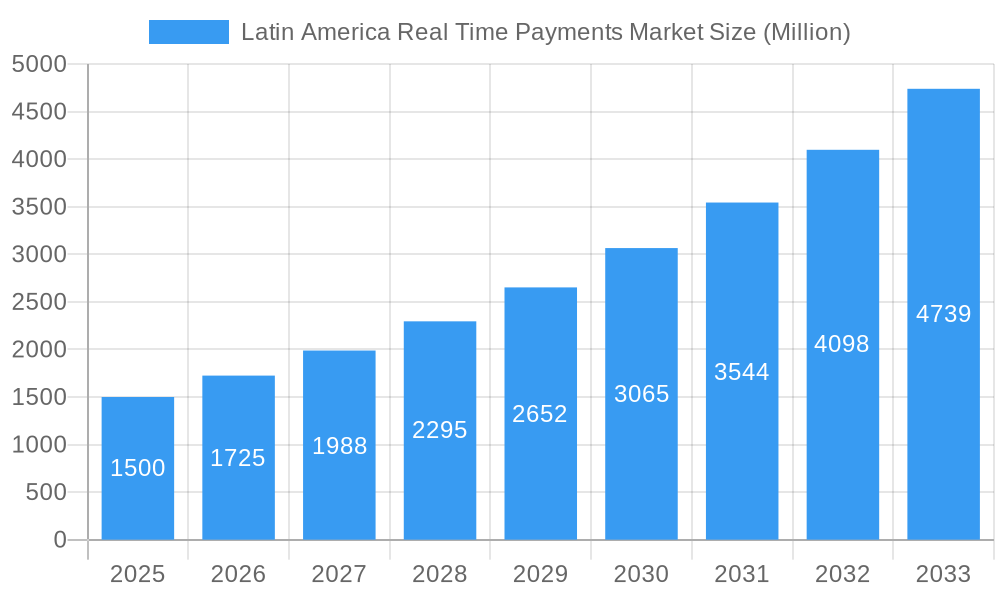

Latin America Real Time Payments Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained market growth, potentially with a moderated CAGR as adoption becomes more widespread. Continued investments in digital infrastructure, enhanced financial literacy, and the evolution of real-time payment technologies will foster positive market dynamics. The expansion of mobile money services and deeper integration into broader financial ecosystems will be critical growth catalysts. The proliferation of super-apps offering comprehensive financial services is also projected to impact market trends, particularly in regions with high mobile penetration.

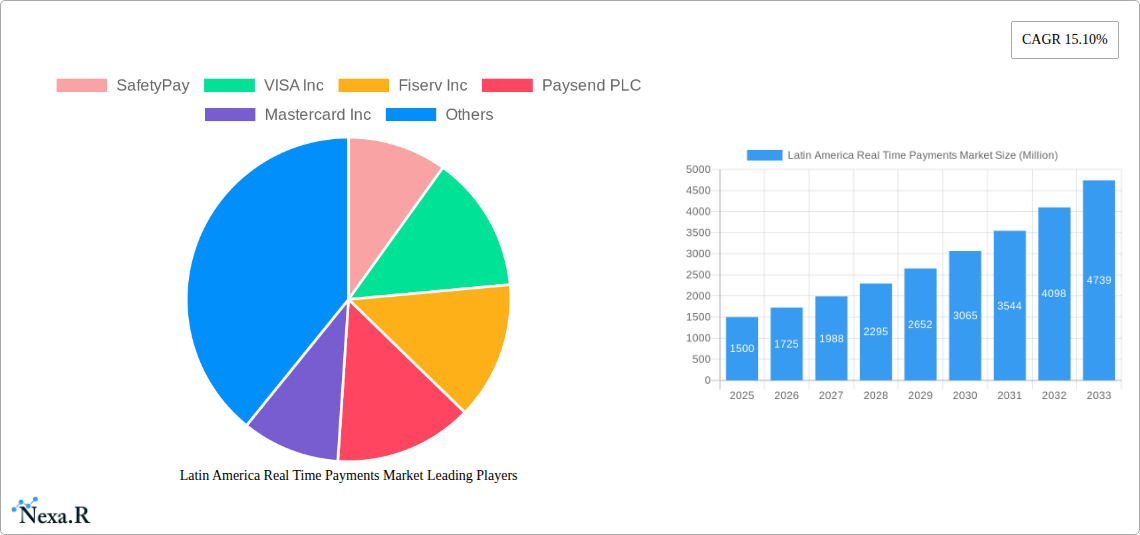

Latin America Real Time Payments Market Company Market Share

Latin America Real Time Payments Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America real-time payments market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) and projects future market evolution with a focus on parent markets (financial technology, digital payments) and child markets (P2P, P2B payments within specific Latin American countries). The market is projected to reach xx Million by 2033.

Latin America Real Time Payments Market Dynamics & Structure

The Latin American real-time payments market is characterized by increasing market concentration, driven by the expansion of major players like VISA Inc, Mastercard Inc, and Paypal Holdings Inc. Technological innovation, particularly in mobile payment solutions, is a key driver, alongside evolving regulatory frameworks aimed at promoting financial inclusion. Competition from traditional banking systems and the rise of fintechs create a dynamic landscape.

- Market Concentration: xx% of the market is controlled by the top 5 players in 2025.

- Technological Innovation: Focus on mobile wallets, biometric authentication, and AI-powered fraud detection.

- Regulatory Landscape: Varying regulations across countries impact market penetration and adoption rates.

- Competitive Landscape: Intense competition between established players and emerging fintechs.

- M&A Activity: A notable increase in mergers and acquisitions, with xx deals recorded between 2019 and 2024. Examples include Mastercard's acquisition of Arcus FI (2021).

Latin America Real Time Payments Market Growth Trends & Insights

The Latin American real-time payments market has witnessed significant growth from 2019 to 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by rising smartphone penetration, increasing internet access, and a growing preference for contactless and digital transactions. The market's expansion is further driven by a burgeoning e-commerce sector and the growing adoption of mobile wallets. Consumer behavior shifts towards cashless payments, coupled with technological disruptions like the rise of open banking, are accelerating market expansion. Market penetration is projected to reach xx% by 2033.

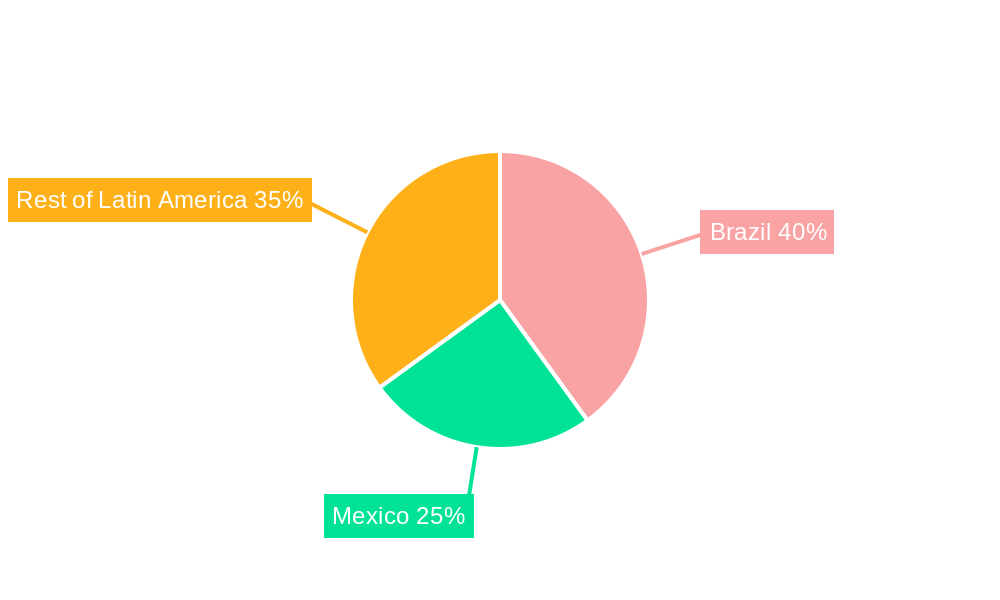

Dominant Regions, Countries, or Segments in Latin America Real Time Payments Market

Brazil and Mexico represent the largest markets within Latin America, driven by robust digital economies and high smartphone penetration. The P2P segment is experiencing rapid growth, fueled by the popularity of mobile messaging apps integrating payment functionalities.

- Brazil: High mobile penetration and government initiatives promoting digital finance fuel substantial growth.

- Mexico: Large population and strong e-commerce sector contribute to high transaction volumes.

- Rest of Latin America: Shows significant growth potential, albeit at a slower pace compared to Brazil and Mexico, due to varying levels of digital infrastructure development.

- P2P: Dominates the market due to the widespread use of social media and mobile apps for peer-to-peer transactions.

- P2B: Experiencing steady growth driven by the increasing adoption of e-commerce and online businesses.

Latin America Real Time Payments Market Product Landscape

Real-time payment solutions in Latin America showcase diverse offerings, including mobile wallets, bank-initiated transfers, and merchant payment platforms. These platforms incorporate advanced security features, such as biometric authentication and fraud detection mechanisms, to enhance user trust and transaction security. The focus is on user-friendly interfaces and seamless integration with existing financial systems.

Key Drivers, Barriers & Challenges in Latin America Real Time Payments Market

Key Drivers:

- Increasing smartphone penetration and internet access.

- Growing e-commerce activity and digitalization of businesses.

- Government initiatives promoting financial inclusion.

- Fintech innovation and expansion of mobile payment platforms.

Key Challenges:

- Varying levels of financial literacy and digital inclusion across the region.

- Cybersecurity threats and fraud risks associated with digital payments.

- Regulatory complexities and inconsistencies across different countries.

- Infrastructure limitations in certain areas, particularly in rural regions. This impacts approximately xx% of the population.

Emerging Opportunities in Latin America Real Time Payments Market

Untapped markets in rural areas present significant opportunities for expansion, particularly with the development of agent networks and mobile-based solutions. The growth of cross-border payments and the integration of real-time payments into other financial services, such as lending and investing, offer further potential. The increasing adoption of open banking frameworks could revolutionize the ecosystem, allowing for greater innovation and competition.

Growth Accelerators in the Latin America Real Time Payments Market Industry

Technological advancements in areas such as blockchain and AI will enhance security and efficiency. Strategic partnerships between banks, fintechs, and telecom companies will expand market reach. Expansion into previously underserved regions and the development of tailored solutions for specific market segments are pivotal for continued growth.

Key Players Shaping the Latin America Real Time Payments Market Market

- SafetyPay

- VISA Inc

- Fiserv Inc

- Paysend PLC

- Mastercard Inc

- ACI Worldwide Inc

- Paypal Holdings Inc

- FIS Global

- Apple Inc

- Riya Money Transfer

Notable Milestones in Latin America Real Time Payments Market Sector

- November 2021: Mastercard acquired Arcus FI, expanding its real-time payment capabilities in Latin America.

- March 2022: AstroPay expanded its Payment Links service across Latin America, empowering SMEs with instant payment solutions.

In-Depth Latin America Real Time Payments Market Market Outlook

The Latin America real-time payments market is poised for sustained growth, driven by increasing digital adoption and economic development. Strategic partnerships, technological advancements, and expansion into new markets will shape the sector's future. The continued focus on financial inclusion and the integration of real-time payments into broader financial services will unlock significant opportunities for market participants.

Latin America Real Time Payments Market Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

Latin America Real Time Payments Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Real Time Payments Market Regional Market Share

Geographic Coverage of Latin America Real Time Payments Market

Latin America Real Time Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration; Immediacy and Ease of Convenience of the Real Time Payments

- 3.3. Market Restrains

- 3.3.1. Operational Challenges Involving Cross-border Payments

- 3.4. Market Trends

- 3.4.1. P2B Segment is Expected to Gain Significant Traction in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Real Time Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SafetyPay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VISA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fiserv Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Paysend PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mastercard Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ACI Worldwide Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Paypal Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIS Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riya Money Transfer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SafetyPay

List of Figures

- Figure 1: Latin America Real Time Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Real Time Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Real Time Payments Market Revenue billion Forecast, by Type of Payment 2020 & 2033

- Table 2: Latin America Real Time Payments Market Volume K Unit Forecast, by Type of Payment 2020 & 2033

- Table 3: Latin America Real Time Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Real Time Payments Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Latin America Real Time Payments Market Revenue billion Forecast, by Type of Payment 2020 & 2033

- Table 6: Latin America Real Time Payments Market Volume K Unit Forecast, by Type of Payment 2020 & 2033

- Table 7: Latin America Real Time Payments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Latin America Real Time Payments Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Brazil Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Argentina Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Argentina Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Chile Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Chile Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Colombia Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Colombia Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Peru Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Peru Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Venezuela Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Venezuela Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Ecuador Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Ecuador Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Bolivia Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Bolivia Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Paraguay Latin America Real Time Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Paraguay Latin America Real Time Payments Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Real Time Payments Market?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Latin America Real Time Payments Market?

Key companies in the market include SafetyPay, VISA Inc, Fiserv Inc, Paysend PLC, Mastercard Inc, ACI Worldwide Inc, Paypal Holdings Inc, FIS Global, Apple Inc, Riya Money Transfer.

3. What are the main segments of the Latin America Real Time Payments Market?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 787.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration; Immediacy and Ease of Convenience of the Real Time Payments.

6. What are the notable trends driving market growth?

P2B Segment is Expected to Gain Significant Traction in the Market.

7. Are there any restraints impacting market growth?

Operational Challenges Involving Cross-border Payments.

8. Can you provide examples of recent developments in the market?

March 2022 - AstroPay, the online payment solution of choice of over five million users globally, announced the expansion of Payment Links across Latin America, now launching in Peru, Chile, Mexico, and Colombia. This is part of the company's plans to introduce it worldwide following the first launch in Brazil in December 2021. Payment Links is AstroPay's newest capability, designed for small and medium-sized enterprises (SMEs) to enable business owners to collect online and remote payments by simply sharing the link with their customers and get paid instantly, easily, and securely.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Real Time Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Real Time Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Real Time Payments Market?

To stay informed about further developments, trends, and reports in the Latin America Real Time Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence