Key Insights

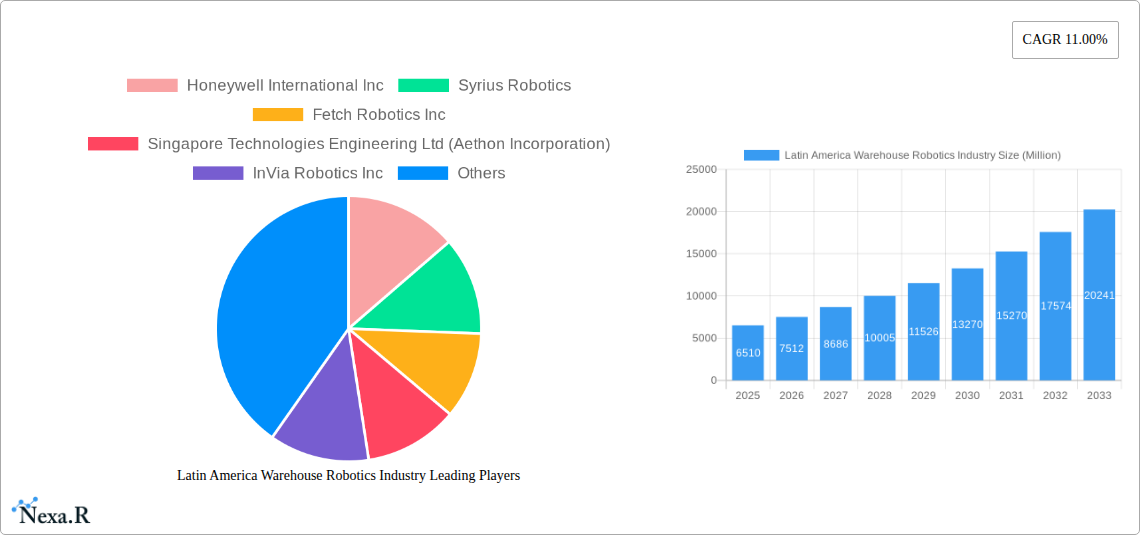

The Latin America warehouse robotics market is poised for significant expansion, driven by a pressing need to modernize aging supply chain infrastructure and enhance operational efficiency. With an estimated market size of $6.51 billion in 2025, the region is expected to witness robust growth, projecting a CAGR of 15.6% through 2033. This surge is propelled by increasing adoption of industrial robots, automated storage and retrieval systems (ASRS), and mobile robots (AGVs and AMRs) across key sectors. The food and beverage, automotive, and retail industries are leading this transformation, seeking to overcome challenges such as labor shortages, rising operational costs, and the demand for faster order fulfillment. Brazil, Mexico, and Chile are at the forefront of this adoption curve, channeling investments into automation to streamline warehousing processes, from storage and packaging to trans-shipments. The escalating e-commerce penetration in Latin America further amplifies the demand for efficient and scalable robotic solutions, pushing companies to embrace these technologies for competitive advantage.

Latin America Warehouse Robotics Industry Market Size (In Billion)

Further fueling this growth is the inherent value proposition of warehouse robotics in Latin America, which includes enhanced safety, improved inventory accuracy, and a significant reduction in operational errors. As companies navigate the complexities of a dynamic market, the integration of smart technologies like AI and IoT into warehouse robotics is becoming a crucial differentiator. While the initial investment cost and the need for skilled labor to manage and maintain these advanced systems present some restraining factors, the long-term benefits of increased productivity and cost savings are outweighing these concerns. The market is witnessing a strong trend towards collaborative robots and flexible automation solutions that can adapt to varying operational demands. Companies like Honeywell International Inc, ABB Limited, and Fanuc Corporation are key players contributing to this evolving landscape by offering innovative solutions tailored to the specific needs of the Latin American market.

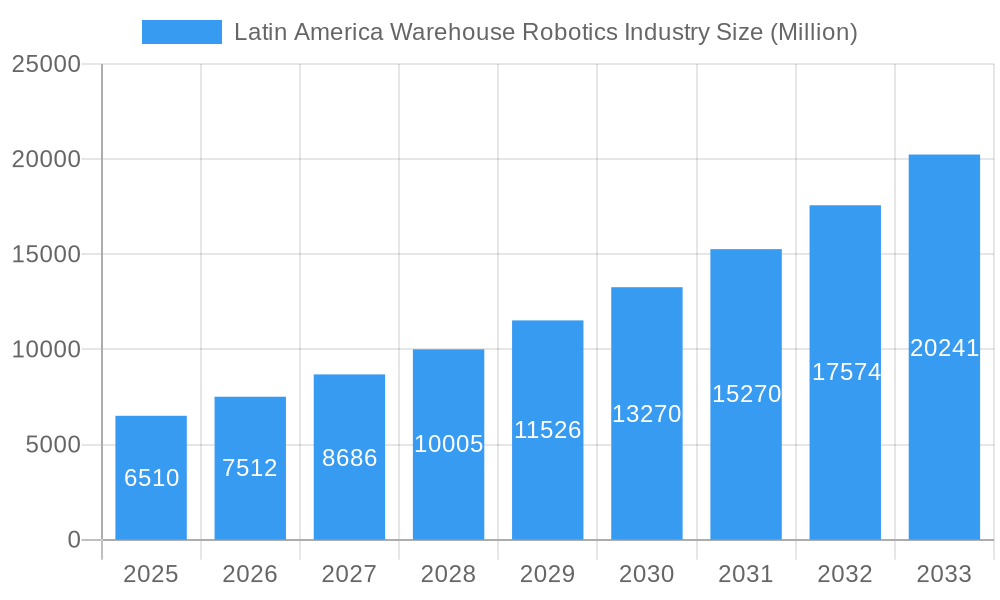

Latin America Warehouse Robotics Industry Company Market Share

Here's the SEO-optimized report description for the Latin America Warehouse Robotics Industry, designed for maximum visibility and engagement:

This comprehensive report offers an in-depth analysis of the Latin America warehouse robotics market, a rapidly expanding sector driven by increasing e-commerce penetration, the need for greater operational efficiency, and the adoption of advanced automation solutions. Explore market dynamics, growth trends, key players, and future opportunities within this vital industry. This report is structured to provide actionable insights for stakeholders seeking to understand and capitalize on the evolving landscape of warehouse automation in Latin America. The study period covers 2019–2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025–2033, building upon historical data from 2019–2024. All market values are presented in billion units.

Latin America Warehouse Robotics Industry Market Dynamics & Structure

The Latin America warehouse robotics market is characterized by increasing consolidation and a burgeoning technological innovation landscape. Driven by the escalating demand for e-commerce fulfillment, supply chain optimization, and labor cost reduction, the market is witnessing significant investment. Regulatory frameworks, while nascent in some regions, are gradually evolving to support automation adoption. Competitive product substitutes, such as manual labor and less sophisticated automation, are being systematically replaced by advanced robotics. End-user demographics, particularly in the retail, food and beverage, and automotive sectors, are pushing for greater throughput and accuracy. Mergers and acquisitions (M&A) are becoming more prevalent as larger players seek to expand their market reach and technological capabilities.

- Market Concentration: Moderate, with increasing consolidation expected.

- Technological Innovation Drivers: AI-powered robotics, IoT integration, advanced sensor technology, and cloud-based management systems.

- Regulatory Frameworks: Evolving but often fragmented across countries, with a growing focus on safety standards for autonomous systems.

- Competitive Product Substitutes: Traditional manual processes, semi-automated systems.

- End-User Demographics: Growing demand for flexible and scalable solutions from burgeoning e-commerce giants and established industrial players.

- M&A Trends: Increasing strategic acquisitions by global robotics leaders to secure market share and technological advancements in Latin America.

Latin America Warehouse Robotics Industry Growth Trends & Insights

The Latin America warehouse robotics market is poised for substantial expansion, driven by a confluence of factors. The continuous growth in online retail and the subsequent pressure on fulfillment centers to handle increased order volumes at faster speeds are primary accelerators. This surge in demand necessitates sophisticated automation solutions, leading to higher adoption rates for technologies such as mobile robots (AGVs and AMRs), automated storage and retrieval systems (ASRS), and advanced sortation systems. The report leverages market intelligence platforms to deliver a detailed analysis of market size evolution, demonstrating a strong upward trajectory in CAGR. Technological disruptions, including the integration of AI for predictive maintenance and route optimization in AMRs, are further enhancing the appeal of robotics. Consumer behavior shifts towards faster delivery expectations are directly impacting warehousing strategies, compelling businesses to invest in robotics for improved efficiency and accuracy. The market penetration of warehouse robotics is expected to witness significant growth as businesses across various sectors recognize the long-term ROI and competitive advantages offered by these solutions.

Dominant Regions, Countries, or Segments in Latin America Warehouse Robotics Industry

The Latin America warehouse robotics market is experiencing dynamic growth, with distinct regions and segments leading the charge. Brazil and Mexico are emerging as dominant countries due to their large economies, significant e-commerce penetration, and proactive industrial automation initiatives. Within the Segments breakdown, Mobile Robots (AGVs and AMRs) are currently the most significant growth driver, fueled by their versatility and adaptability to existing warehouse layouts. The Type segment of Industrial Robots also holds considerable sway, particularly in sectors like Automotive and Electrical and Electronics. The Function of Storage and Packaging are paramount, directly linked to the efficiency gains sought by businesses. The End User segment of Retail is a major contributor, with online retailers heavily investing in automation to meet consumer demand for quick deliveries.

- Dominant Country: Brazil, followed closely by Mexico, owing to robust industrial bases and expanding e-commerce markets.

- Leading Segment (Type): Mobile Robots (AGVs and AMRs) are experiencing rapid adoption for their flexibility and scalability in diverse warehouse environments.

- Key Function Drivers: Storage and Packaging are central to the demand for robotics, enabling higher throughput and reduced error rates.

- Primary End User Sector: Retail is at the forefront, driven by the exponential growth of e-commerce and the need for efficient order fulfillment.

- Growth Potential: Significant potential exists in the Pharmaceutical and Food and Beverage sectors as they increasingly adopt automation to meet stringent quality and safety standards.

Latin America Warehouse Robotics Industry Product Landscape

The product landscape within the Latin America warehouse robotics industry is characterized by rapid innovation and diverse applications. Companies are increasingly focusing on developing intelligent and collaborative robots that can seamlessly integrate with human workers. Innovations include advanced AI algorithms for enhanced decision-making in Mobile Robots (AGVs and AMRs), more sophisticated Sortation Systems for increased speed and accuracy, and modular Automated Storage and Retrieval System (ASRS) for flexible capacity management. These products offer unique selling propositions such as improved operational efficiency, reduced labor costs, enhanced safety, and greater flexibility. Technological advancements are enabling robots to perform a wider range of tasks, from delicate item handling to heavy-duty palletizing, thereby addressing the specific needs of various end-user industries.

Key Drivers, Barriers & Challenges in Latin America Warehouse Robotics Industry

Key Drivers:

- E-commerce Boom: The exponential growth of online retail necessitates efficient and scalable warehouse operations.

- Labor Cost Optimization: Rising labor expenses and shortages are pushing companies towards automation for cost-effective solutions.

- Increased Demand for Efficiency: Businesses are seeking to improve throughput, reduce errors, and shorten lead times.

- Technological Advancements: Continuous innovation in AI, IoT, and robotics hardware is making solutions more sophisticated and affordable.

- Government Initiatives: Supportive policies and incentives for industrial modernization in select Latin American countries.

Barriers & Challenges:

- High Initial Investment: The upfront cost of implementing warehouse robotics can be a significant barrier for smaller businesses.

- Infrastructure Limitations: Inadequate power supply, poor network connectivity, and less developed warehouse infrastructure in certain regions can hinder adoption.

- Skilled Workforce Gap: A shortage of trained personnel for operating, maintaining, and programming robotics systems.

- Regulatory Uncertainty: Evolving and sometimes inconsistent regulations regarding autonomous systems can create adoption hurdles.

- Integration Complexity: Integrating new robotic systems with existing legacy infrastructure can be challenging and time-consuming.

Emerging Opportunities in Latin America Warehouse Robotics Industry

Emerging opportunities in the Latin America warehouse robotics industry lie in the untapped potential of small and medium-sized enterprises (SMEs) seeking affordable automation solutions. The increasing demand for sustainable supply chains presents an opportunity for robotics that optimize energy consumption and reduce waste. Furthermore, the growing adoption of Internet of Things (IoT) and Artificial Intelligence (AI) in logistics is paving the way for more intelligent and predictive warehousing. Innovative applications in specialized sectors like cold chain logistics and pharmaceutical cold storage offer significant growth potential. Evolving consumer preferences for personalized products and faster delivery are also creating demand for flexible and responsive robotic systems.

Growth Accelerators in the Latin America Warehouse Robotics Industry Industry

Growth accelerators in the Latin America warehouse robotics industry are predominantly driven by rapid technological breakthroughs and strategic market expansion initiatives. The integration of advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms is making robots more autonomous, adaptive, and efficient, thereby lowering operational costs and increasing productivity. Strategic partnerships between robotics manufacturers and logistics providers are crucial for developing tailored solutions and expanding market reach into previously underserved regions. Furthermore, market expansion strategies, including the establishment of local service and support centers, are critical for building customer trust and facilitating widespread adoption. The increasing availability of robotics-as-a-service (RaaS) models is also significantly lowering the barrier to entry for businesses.

Key Players Shaping the Latin America Warehouse Robotics Industry Market

- Honeywell International Inc

- Syrius Robotics

- Fetch Robotics Inc

- Singapore Technologies Engineering Ltd (Aethon Incorporation)

- InVia Robotics Inc

- Omron Adept Technologies

- Toshiba Corporation

- Kiva Systems (Amazon Robotics LLC)

- Fanuc Corporation

- Geek+ Inc

- Grey Orange Pte Ltd

- Locus Robotic

- ABB Limited

Notable Milestones in Latin America Warehouse Robotics Industry Sector

- 2019: Increased investment in AMRs for e-commerce fulfillment centers across Brazil and Mexico.

- 2020: Launch of new AI-driven fleet management software for mobile robots, enhancing operational efficiency.

- 2021: Several major retail players announce significant investments in ASRS solutions to modernize their distribution networks.

- 2022: Expansion of robotic palletizing solutions into the food and beverage industry in Argentina and Colombia.

- 2023: Growing interest in collaborative robots for packaging applications in the pharmaceutical sector.

- 2024: Emergence of robotics-as-a-service (RaaS) models gaining traction, lowering adoption barriers.

In-Depth Latin America Warehouse Robotics Industry Market Outlook

The future outlook for the Latin America warehouse robotics industry is exceptionally strong, with sustained growth anticipated throughout the forecast period. Key growth accelerators include the continuous advancements in AI and IoT integration, leading to more intelligent and interconnected warehouse ecosystems. Strategic partnerships and collaborations between technology providers and end-users will further drive tailored solutions and market penetration. The increasing adoption of robotics-as-a-service (RaaS) models is set to democratize access to advanced automation, particularly for SMEs. Market expansion strategies focusing on localized support and customization will be vital for capturing market share in diverse Latin American economies, solidifying robotics as an indispensable component of modern logistics and supply chain management.

Latin America Warehouse Robotics Industry Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

- 1.7. Others

-

2. Function

- 2.1. Storage

- 2.2. Packaging

- 2.3. Trans-shipments

- 2.4. Other Functions

-

3. End User

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End Users

Latin America Warehouse Robotics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Warehouse Robotics Industry Regional Market Share

Geographic Coverage of Latin America Warehouse Robotics Industry

Latin America Warehouse Robotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of SKUs; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. The Adoption of Industrial Robotics Expected to Act as a Significant Driving Factor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Packaging

- 5.2.3. Trans-shipments

- 5.2.4. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syrius Robotics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fetch Robotics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Singapore Technologies Engineering Ltd (Aethon Incorporation)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 InVia Robotics Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omron Adept Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toshiba Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kiva Systems (Amazon Robotics LLC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fanuc Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Geek+ Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Grey Orange Pte Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Locus Robotic

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ABB Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Latin America Warehouse Robotics Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Warehouse Robotics Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by Function 2020 & 2033

- Table 3: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by Function 2020 & 2033

- Table 7: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Latin America Warehouse Robotics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Warehouse Robotics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Warehouse Robotics Industry?

The projected CAGR is approximately 15.6%.

2. Which companies are prominent players in the Latin America Warehouse Robotics Industry?

Key companies in the market include Honeywell International Inc, Syrius Robotics, Fetch Robotics Inc, Singapore Technologies Engineering Ltd (Aethon Incorporation), InVia Robotics Inc, Omron Adept Technologies, Toshiba Corporation, Kiva Systems (Amazon Robotics LLC), Fanuc Corporation, Geek+ Inc, Grey Orange Pte Ltd, Locus Robotic, ABB Limited.

3. What are the main segments of the Latin America Warehouse Robotics Industry?

The market segments include Type, Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of SKUs; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

The Adoption of Industrial Robotics Expected to Act as a Significant Driving Factor.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Warehouse Robotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Warehouse Robotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Warehouse Robotics Industry?

To stay informed about further developments, trends, and reports in the Latin America Warehouse Robotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence