Key Insights

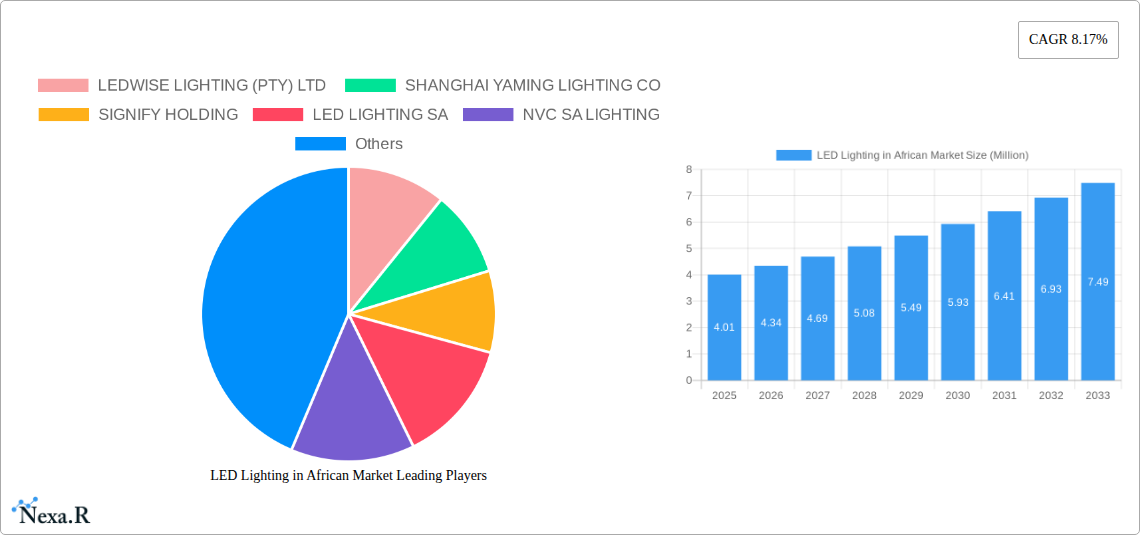

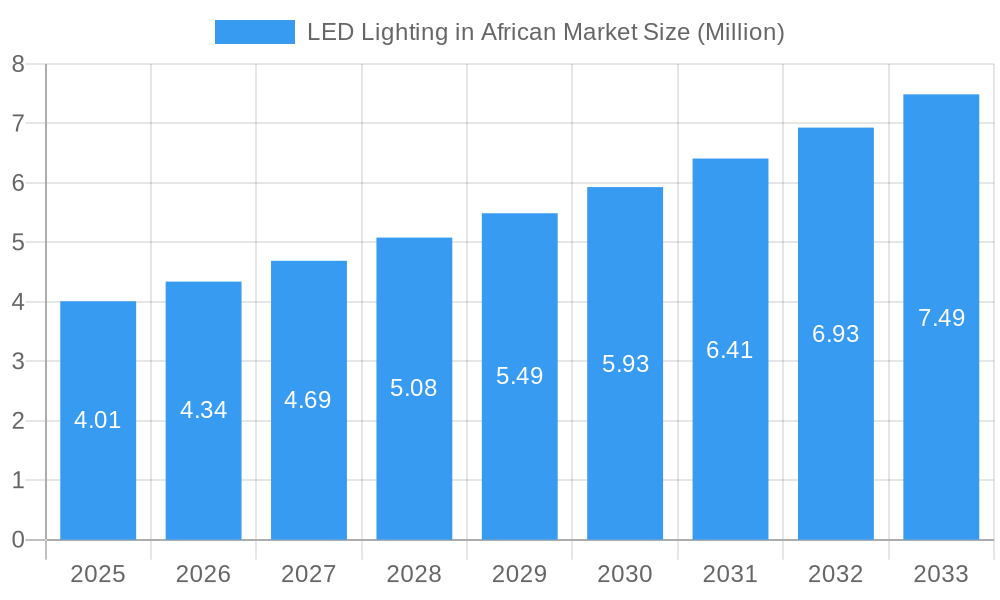

The African LED lighting market is poised for significant expansion, projecting a substantial market size of $4.01 million in 2025, with an impressive CAGR of 8.17% anticipated to drive growth through 2033. This robust expansion is fueled by a confluence of factors, most notably the increasing demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors. Growing urbanization and infrastructure development initiatives across the continent are creating a fertile ground for the adoption of advanced LED technologies. Furthermore, government regulations and incentives promoting energy conservation and reducing carbon footprints are acting as powerful catalysts. The declining cost of LED technology, coupled with enhanced performance and longevity compared to traditional lighting, makes it an increasingly attractive investment for businesses and consumers alike. Key market drivers include the rising disposable incomes, a growing awareness of the environmental and economic benefits of LEDs, and the continuous innovation in smart lighting solutions that offer advanced control and customization. The market is witnessing a dynamic shift, with a clear trend towards more sophisticated and connected lighting systems, integrating IoT capabilities for enhanced efficiency and user experience.

LED Lighting in African Market Market Size (In Million)

The African LED lighting market is segmented across various light types, applications, and distribution channels, offering diverse opportunities for market players. In terms of light type, the Lamp/Bulb segment is expected to dominate, catering to widespread replacement needs, while Luminaire/Fixture segments are gaining traction with new installations and upgrades. The Residential/Consumer segment is a significant contributor, driven by individual consumer demand for cost savings and improved lighting ambiance. Simultaneously, Commercial/Architecture and Industrial applications are experiencing substantial growth due to large-scale projects and a focus on operational efficiency. The Outdoor segment is also expanding, supported by smart city initiatives and improved public spaces. Distribution channels are evolving, with a blend of Direct Sales for large projects, Wholesale Retail for broader accessibility, and the increasing influence of Architects/Consultants in specifying LED solutions. Major players like Signify Holding, Opple Lighting Co, and Dialight PLC are actively expanding their presence, indicating a competitive landscape focused on innovation and market penetration across key African regions such as South Africa and Nigeria.

LED Lighting in African Market Company Market Share

Comprehensive Report: LED Lighting in the African Market (2019–2033)

This in-depth report delivers a definitive analysis of the LED lighting sector across the African continent, providing critical insights for industry stakeholders. Examining market dynamics, growth trends, regional dominance, product landscapes, and competitive strategies, this report is an indispensable resource for navigating the burgeoning opportunities within the African LED lighting market. With a forecast period extending to 2033, it offers a strategic roadmap for investment and business development. The report focuses on presenting all values in Million units for standardized understanding.

LED Lighting in African Market Market Dynamics & Structure

The African LED lighting market is characterized by a moderately concentrated structure, with a significant presence of both established global players and emerging regional manufacturers. Technological innovation remains a key driver, propelled by advancements in energy efficiency, smart lighting solutions, and cost reductions in LED chip manufacturing. Regulatory frameworks are gradually evolving across different African nations, with some countries implementing energy efficiency standards and promoting the adoption of LED technology to reduce electricity consumption and carbon footprints. Competitive product substitutes, primarily traditional lighting technologies like incandescent and fluorescent lamps, are steadily being phased out due to their lower efficiency and higher operating costs. End-user demographics are increasingly favoring LED adoption due to growing awareness of energy savings and government initiatives. Merger and acquisition (M&A) trends are anticipated to gain momentum as larger players seek to expand their market reach and portfolio, while smaller companies may be acquired to leverage their local expertise and distribution networks. For instance, a projected M&A deal volume of 5 to 7 deals is expected within the historical period (2019-2024), indicating early consolidation. Innovation barriers, such as the initial capital investment required for advanced manufacturing and the need for specialized technical expertise, are being addressed through partnerships and technology transfer agreements. The market concentration is estimated to be around 40-50% held by the top 5-7 players in the base year of 2025.

- Market Concentration: Moderate, with increasing competition from global and local players.

- Technological Innovation Drivers: Energy efficiency improvements, smart lighting integration, cost reduction in LED production.

- Regulatory Frameworks: Developing, with a focus on energy efficiency standards and sustainability goals.

- Competitive Product Substitutes: Declining dominance of traditional lighting technologies.

- End-User Demographics: Growing awareness of cost savings and environmental benefits.

- M&A Trends: Expected to increase for market expansion and consolidation.

- Innovation Barriers: High initial investment, need for skilled labor.

LED Lighting in African Market Growth Trends & Insights

The African LED lighting market is poised for substantial growth, driven by a confluence of economic, environmental, and technological factors. Market size is projected to expand from an estimated $1,500 Million in 2019 to reach $6,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 10.5% during the forecast period (2025–2033). Adoption rates are accelerating as governments across the continent prioritize energy efficiency initiatives and smart city development. This shift is significantly influenced by the increasing cost-effectiveness of LED technology compared to conventional lighting, leading to a reduction in electricity bills for both residential and commercial consumers. Technological disruptions are playing a pivotal role, with the integration of smart features such as dimming, color control, and IoT connectivity becoming increasingly prevalent, enhancing functionality and user experience. Consumer behavior is evolving, with a growing demand for sustainable and long-lasting lighting solutions that offer both cost savings and improved ambient conditions. Market penetration of LED lighting, which stood at an estimated 35% in 2019, is projected to surge past 75% by 2033. The substantial decrease in the cost of LED components, alongside improved manufacturing processes, has made LED lighting more accessible to a wider consumer base. Furthermore, increasing urbanization and the subsequent expansion of infrastructure, including commercial buildings, residential complexes, and public spaces, are creating significant demand for new lighting installations. The growing awareness of the environmental impact of traditional lighting and the push towards renewable energy sources further bolster the appeal of energy-efficient LED solutions. Challenges such as the initial investment cost for some advanced LED systems and the need for skilled installation and maintenance personnel are being addressed through ongoing technological advancements and the development of local training programs. The widespread availability of various LED lighting types, from basic bulbs to sophisticated luminaire fixtures, caters to diverse application needs across residential, commercial, industrial, and outdoor segments. The Base Year (2025) market size is estimated at $2,800 Million. The Estimated Year (2025) is the same as the Base Year.

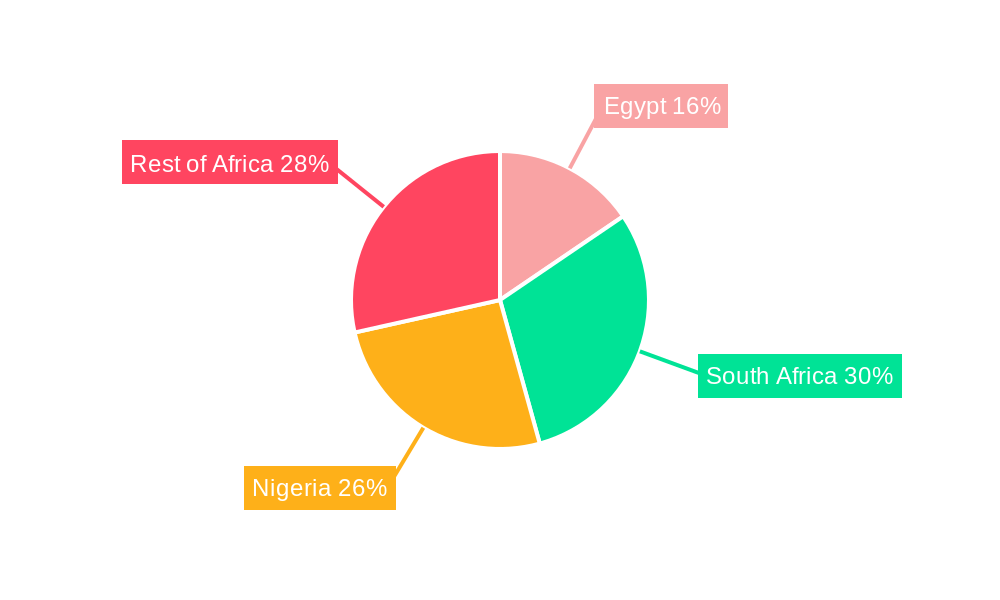

Dominant Regions, Countries, or Segments in LED Lighting in African Market

The growth trajectory of the LED lighting market in Africa is being significantly shaped by specific regions, countries, and application segments. South Africa currently stands as a dominant country, driven by its relatively developed economy, established infrastructure, and proactive government policies promoting energy efficiency and renewable energy adoption. Nigeria and Egypt are also emerging as key markets due to their large populations, rapid urbanization, and increasing investment in infrastructure development, particularly in the commercial and industrial sectors.

Within the Application segment, Commercial/Architecture is exhibiting the strongest growth momentum. This dominance is fueled by the rapid expansion of commercial real estate, including office buildings, retail spaces, hotels, and public institutions, all of which are increasingly adopting LED lighting for its energy savings, reduced maintenance costs, and aesthetic versatility. Governments and private developers are prioritizing sustainable building practices, making LED integration a standard requirement.

The Luminaire/Fixture Light Type is also a significant growth driver. As the market matures, there is a clear shift from simple lamp replacements to integrated lighting solutions. Modern luminaires offer advanced features, improved design aesthetics, and enhanced performance, catering to specific architectural and functional needs.

The Wholesale Retail/Architects/Consultants Distribution Channel plays a crucial role in market penetration. This channel effectively reaches a broad spectrum of end-users, from large-scale commercial projects managed by architects and consultants to smaller retail purchases, ensuring widespread availability and adoption of LED products.

- Dominant Country: South Africa, followed by Nigeria and Egypt, due to economic development, population, and infrastructure investment.

- Dominant Application: Commercial/Architecture, driven by new construction and retrofitting in office buildings, retail, and hospitality.

- Dominant Light Type: Luminaire/Fixture, reflecting a move towards integrated and advanced lighting solutions.

- Dominant Distribution Channel: Wholesale Retail/Architects/Consultants, enabling broad market reach and project specification.

- Key Drivers for Dominance: Energy efficiency mandates, urbanization, infrastructure development, growing environmental consciousness, and the desire for modern aesthetics.

- Market Share Insights: The Commercial/Architecture segment is estimated to hold approximately 30-35% of the market share in the Base Year (2025).

- Growth Potential: The Industrial and Outdoor segments also present significant growth potential, particularly with the development of industrial zones and smart city initiatives.

LED Lighting in African Market Product Landscape

The African LED lighting product landscape is evolving rapidly, characterized by a focus on enhanced energy efficiency, extended lifespan, and intelligent functionality. Manufacturers are introducing a diverse range of products, from cost-effective LED lamps and bulbs designed for mass adoption in residential settings to sophisticated LED luminaires and fixtures for commercial, industrial, and architectural applications. Innovations include high-efficacy LED chips, improved thermal management systems for longer product life, and the integration of smart technologies like dimming controls, occupancy sensors, and daylight harvesting capabilities. The trend towards tunable white LEDs, allowing for adjustment of color temperature to mimic natural daylight, is also gaining traction, particularly in office and healthcare environments. Performance metrics are increasingly emphasized, with a growing demand for products that offer superior lumen output per watt and exceptional color rendering index (CRI) for improved visual comfort and accuracy.

Key Drivers, Barriers & Challenges in LED Lighting in African Market

The African LED lighting market is propelled by several key drivers, primarily centered around significant energy savings, reduced operational costs, and a growing environmental consciousness. Government initiatives promoting energy efficiency and sustainability, coupled with the falling prices of LED technology, are making it an increasingly attractive alternative to traditional lighting. The long lifespan of LED products also contributes to lower maintenance and replacement costs, appealing to both consumers and businesses.

However, the market faces several barriers and challenges. The initial upfront cost of LED lighting, although decreasing, can still be a deterrent for some consumers and small businesses, especially in lower-income regions. The availability of counterfeit or low-quality LED products poses a risk to market integrity and consumer trust. Furthermore, the lack of standardized quality control and installation expertise in some areas can lead to suboptimal performance and premature product failure. Supply chain complexities and import duties in certain countries can also impact product availability and pricing.

- Key Drivers:

- Significant energy savings and reduced electricity bills.

- Lower operational and maintenance costs due to long lifespan.

- Government policies promoting energy efficiency and sustainability.

- Decreasing cost of LED technology.

- Growing environmental awareness.

- Barriers & Challenges:

- Initial upfront cost, especially for advanced solutions.

- Prevalence of counterfeit and low-quality products.

- Lack of standardized quality control and installation expertise.

- Supply chain inefficiencies and import-related hurdles.

- Limited access to financing for larger projects in some regions.

Emerging Opportunities in LED Lighting in African Market

Emerging opportunities in the African LED lighting market lie in the burgeoning demand for smart city solutions, particularly in areas like smart street lighting for enhanced safety and energy management. The growth of renewable energy integration, such as solar-powered LED streetlights, presents a significant untapped market, especially in off-grid or remote areas. Furthermore, there is a growing niche for specialized LED lighting applications in sectors like agriculture (e.g., vertical farming), healthcare (e.g., germicidal LEDs), and industrial automation, offering significant potential for innovation and market penetration. The increasing focus on sustainable building designs and retrofitting older infrastructure with energy-efficient LED solutions also presents a substantial growth avenue.

Growth Accelerators in the LED Lighting in the African Market Industry

The long-term growth of the LED lighting industry in Africa will be significantly accelerated by several key factors. Continued technological breakthroughs leading to further cost reductions and performance enhancements in LED components will make the technology even more accessible and desirable. Strategic partnerships between international LED manufacturers and local African distributors and integrators will be crucial for expanding market reach, improving distribution networks, and providing localized technical support. Government-led initiatives, such as national energy efficiency programs and the phasing out of less efficient lighting technologies, will act as powerful catalysts. The increasing adoption of smart grid technologies and the development of smart cities will create a sustained demand for connected and intelligent LED lighting systems, further driving innovation and market expansion.

Key Players Shaping the LED Lighting in African Market Market

- LEDWISE LIGHTING (PTY) LTD

- SHANGHAI YAMING LIGHTING CO

- SIGNIFY HOLDING

- LED LIGHTING SA

- NVC SA LIGHTING

- NORDLAND LIGHTING

- GL LIGHTING

- SAVANT SYSTEMS INC

- OPPLE LIGHTING CO

- DIALIGHT PLC

- HELIOSPECTRA AB

- AFRISON LED

Notable Milestones in LED Lighting in African Market Sector

- 2019: Increased government investment in renewable energy projects, boosting demand for solar-powered LED solutions in countries like Kenya and South Africa.

- 2020: Launch of several energy efficiency standards by African nations, accelerating the transition away from traditional lighting.

- 2021: Significant price drops in LED chips globally, making LED products more affordable for the African market.

- 2022: Growing adoption of smart street lighting pilot projects in major cities like Johannesburg and Nairobi.

- 2023: Expansion of local manufacturing and assembly operations by some international players to cater to African demand and reduce import costs.

- 2024: Increased focus on sustainable building certifications across African real estate development, driving demand for architectural LED lighting.

In-Depth LED Lighting in African Market Market Outlook

The outlook for the LED lighting market in Africa is exceptionally robust, driven by a confluence of factors that are creating a fertile ground for sustained growth. The ongoing digital transformation and the push towards smart city infrastructure will continue to fuel demand for intelligent and connected LED lighting solutions. Furthermore, the increasing awareness of climate change and the global shift towards sustainable energy practices will further solidify LED technology's position as the preferred lighting solution. Strategic investments in local manufacturing and distribution networks, coupled with supportive government policies, will be crucial in unlocking the full potential of this dynamic market. The integration of AI and IoT in lighting systems will open new avenues for enhanced efficiency, predictive maintenance, and personalized user experiences, positioning the African LED lighting market for a bright and progressive future.

LED Lighting in African Market Segmentation

-

1. Light Type

- 1.1. Lamp/Bulb

- 1.2. Luminaire/Fixture

-

2. Application

- 2.1. Residential/Consumer

- 2.2. Commercial/Architecture

- 2.3. Industrial

- 2.4. Outdoor

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Wholesale Retail/Architects/Consultants & Others

LED Lighting in African Market Segmentation By Geography

- 1. Egypt

- 2. South Africa

- 3. Nigeria

- 4. Rest of Africa

LED Lighting in African Market Regional Market Share

Geographic Coverage of LED Lighting in African Market

LED Lighting in African Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Cost of LED Lighting; High Energy and Long Lifespan

- 3.3. Market Restrains

- 3.3.1. Expensive Light Products Compared to Traditional Light

- 3.4. Market Trends

- 3.4.1. Government Initiatives and Growing Infrastructure Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. LED Lighting in African Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Light Type

- 5.1.1. Lamp/Bulb

- 5.1.2. Luminaire/Fixture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential/Consumer

- 5.2.2. Commercial/Architecture

- 5.2.3. Industrial

- 5.2.4. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Wholesale Retail/Architects/Consultants & Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.4.2. South Africa

- 5.4.3. Nigeria

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Light Type

- 6. Egypt LED Lighting in African Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Light Type

- 6.1.1. Lamp/Bulb

- 6.1.2. Luminaire/Fixture

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential/Consumer

- 6.2.2. Commercial/Architecture

- 6.2.3. Industrial

- 6.2.4. Outdoor

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Wholesale Retail/Architects/Consultants & Others

- 6.1. Market Analysis, Insights and Forecast - by Light Type

- 7. South Africa LED Lighting in African Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Light Type

- 7.1.1. Lamp/Bulb

- 7.1.2. Luminaire/Fixture

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential/Consumer

- 7.2.2. Commercial/Architecture

- 7.2.3. Industrial

- 7.2.4. Outdoor

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Wholesale Retail/Architects/Consultants & Others

- 7.1. Market Analysis, Insights and Forecast - by Light Type

- 8. Nigeria LED Lighting in African Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Light Type

- 8.1.1. Lamp/Bulb

- 8.1.2. Luminaire/Fixture

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential/Consumer

- 8.2.2. Commercial/Architecture

- 8.2.3. Industrial

- 8.2.4. Outdoor

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Wholesale Retail/Architects/Consultants & Others

- 8.1. Market Analysis, Insights and Forecast - by Light Type

- 9. Rest of Africa LED Lighting in African Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Light Type

- 9.1.1. Lamp/Bulb

- 9.1.2. Luminaire/Fixture

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential/Consumer

- 9.2.2. Commercial/Architecture

- 9.2.3. Industrial

- 9.2.4. Outdoor

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Wholesale Retail/Architects/Consultants & Others

- 9.1. Market Analysis, Insights and Forecast - by Light Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LEDWISE LIGHTING (PTY) LTD

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SHANGHAI YAMING LIGHTING CO

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SIGNIFY HOLDING

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LED LIGHTING SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NVC SA LIGHTING

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NORDLAND LIGHTING

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GL LIGHTING

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAVANT SYSTEMS INC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 OPPLE LIGHTING CO

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 DIALIGHT PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 HELIOSPECTRA AB

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 AFRISON LED

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 LEDWISE LIGHTING (PTY) LTD

List of Figures

- Figure 1: LED Lighting in African Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: LED Lighting in African Market Share (%) by Company 2025

List of Tables

- Table 1: LED Lighting in African Market Revenue Million Forecast, by Light Type 2020 & 2033

- Table 2: LED Lighting in African Market Volume K Unit Forecast, by Light Type 2020 & 2033

- Table 3: LED Lighting in African Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: LED Lighting in African Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: LED Lighting in African Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: LED Lighting in African Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: LED Lighting in African Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: LED Lighting in African Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: LED Lighting in African Market Revenue Million Forecast, by Light Type 2020 & 2033

- Table 10: LED Lighting in African Market Volume K Unit Forecast, by Light Type 2020 & 2033

- Table 11: LED Lighting in African Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: LED Lighting in African Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: LED Lighting in African Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: LED Lighting in African Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: LED Lighting in African Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: LED Lighting in African Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: LED Lighting in African Market Revenue Million Forecast, by Light Type 2020 & 2033

- Table 18: LED Lighting in African Market Volume K Unit Forecast, by Light Type 2020 & 2033

- Table 19: LED Lighting in African Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: LED Lighting in African Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: LED Lighting in African Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: LED Lighting in African Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: LED Lighting in African Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: LED Lighting in African Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: LED Lighting in African Market Revenue Million Forecast, by Light Type 2020 & 2033

- Table 26: LED Lighting in African Market Volume K Unit Forecast, by Light Type 2020 & 2033

- Table 27: LED Lighting in African Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: LED Lighting in African Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: LED Lighting in African Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: LED Lighting in African Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 31: LED Lighting in African Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: LED Lighting in African Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: LED Lighting in African Market Revenue Million Forecast, by Light Type 2020 & 2033

- Table 34: LED Lighting in African Market Volume K Unit Forecast, by Light Type 2020 & 2033

- Table 35: LED Lighting in African Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: LED Lighting in African Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: LED Lighting in African Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 38: LED Lighting in African Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 39: LED Lighting in African Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: LED Lighting in African Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Lighting in African Market?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the LED Lighting in African Market?

Key companies in the market include LEDWISE LIGHTING (PTY) LTD , SHANGHAI YAMING LIGHTING CO, SIGNIFY HOLDING, LED LIGHTING SA, NVC SA LIGHTING, NORDLAND LIGHTING, GL LIGHTING, SAVANT SYSTEMS INC, OPPLE LIGHTING CO, DIALIGHT PLC, HELIOSPECTRA AB, AFRISON LED.

3. What are the main segments of the LED Lighting in African Market?

The market segments include Light Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Declining Cost of LED Lighting; High Energy and Long Lifespan.

6. What are the notable trends driving market growth?

Government Initiatives and Growing Infrastructure Driving the Market.

7. Are there any restraints impacting market growth?

Expensive Light Products Compared to Traditional Light.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Lighting in African Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Lighting in African Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Lighting in African Market?

To stay informed about further developments, trends, and reports in the LED Lighting in African Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence