Key Insights

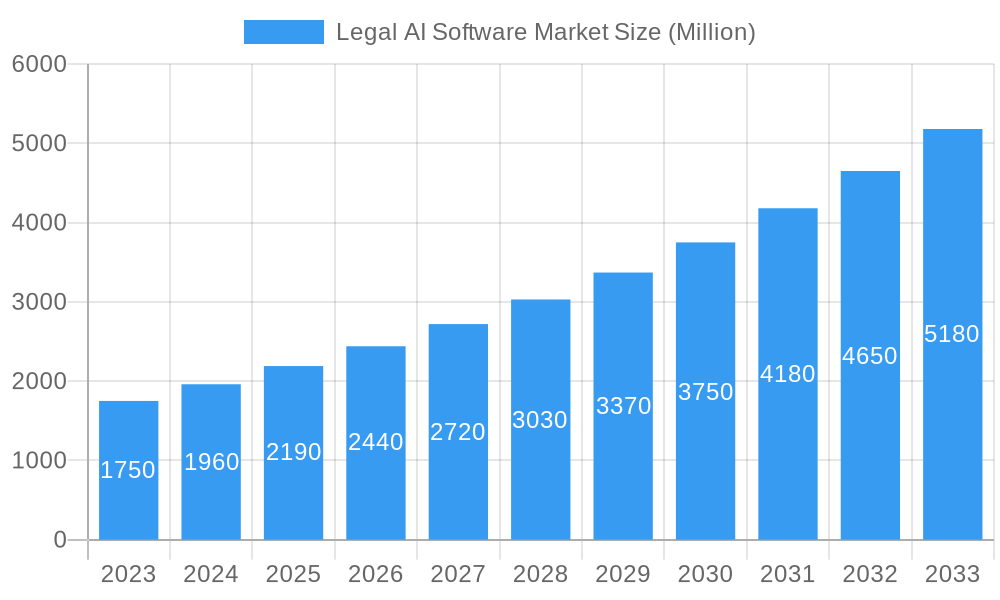

The global Legal AI Software Market is poised for substantial growth, projected to reach approximately $2.19 million by 2025. Driven by an impressive Compound Annual Growth Rate (CAGR) of 10.70% from 2019 to 2033, this market signifies a critical technological evolution within the legal sector. The increasing demand for enhanced efficiency, accuracy, and cost-effectiveness in legal processes is a primary catalyst. AI-powered solutions are revolutionizing tasks such as legal research, contract review and management, e-billing, and e-discovery, allowing legal professionals to focus on higher-value strategic work. The integration of AI is particularly crucial for compliance management and the emerging field of case prediction, offering predictive analytics to inform legal strategies. As law firms and corporate legal departments increasingly recognize the transformative potential of these technologies, adoption rates are expected to accelerate, making legal AI software an indispensable tool for modern legal practice.

Legal AI Software Market Market Size (In Billion)

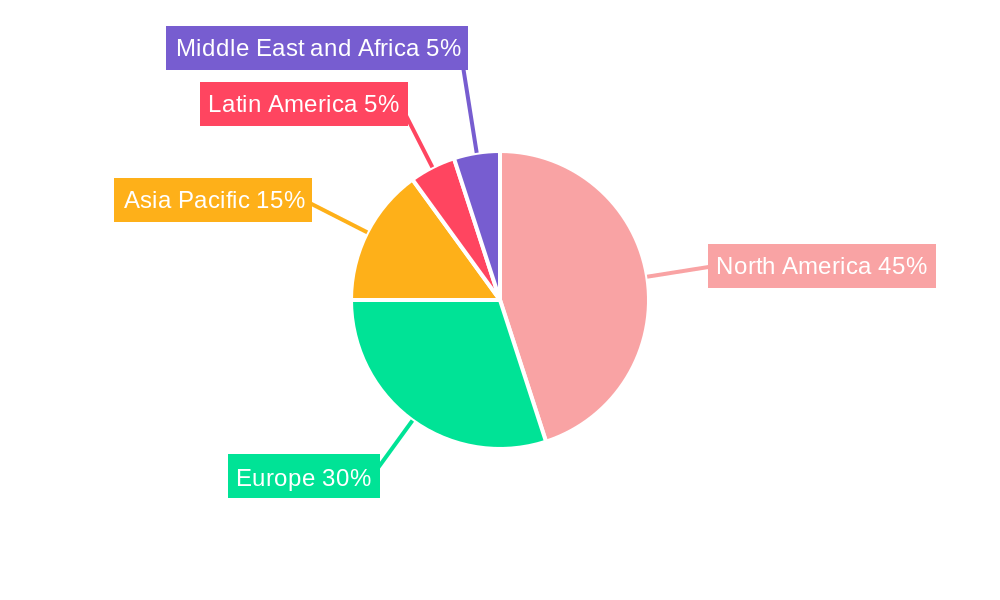

The market's expansion is further bolstered by advancements in natural language processing (NLP) and machine learning, enabling sophisticated analysis of vast legal documents and data. Key trends include the growing adoption of cloud-based deployment models, which offer scalability and accessibility, and the development of specialized AI solutions tailored for specific legal applications. While the benefits are clear, potential restraints may include the initial investment costs, the need for specialized training, and concerns regarding data privacy and security within the legal domain. However, the overwhelming advantages in terms of speed, precision, and the ability to handle complex legal workflows are expected to outweigh these challenges. Geographically, North America is anticipated to lead the market, owing to early adoption and a mature legal tech ecosystem, with Europe and the Asia Pacific region showing significant growth potential as they embrace digital transformation in their legal industries.

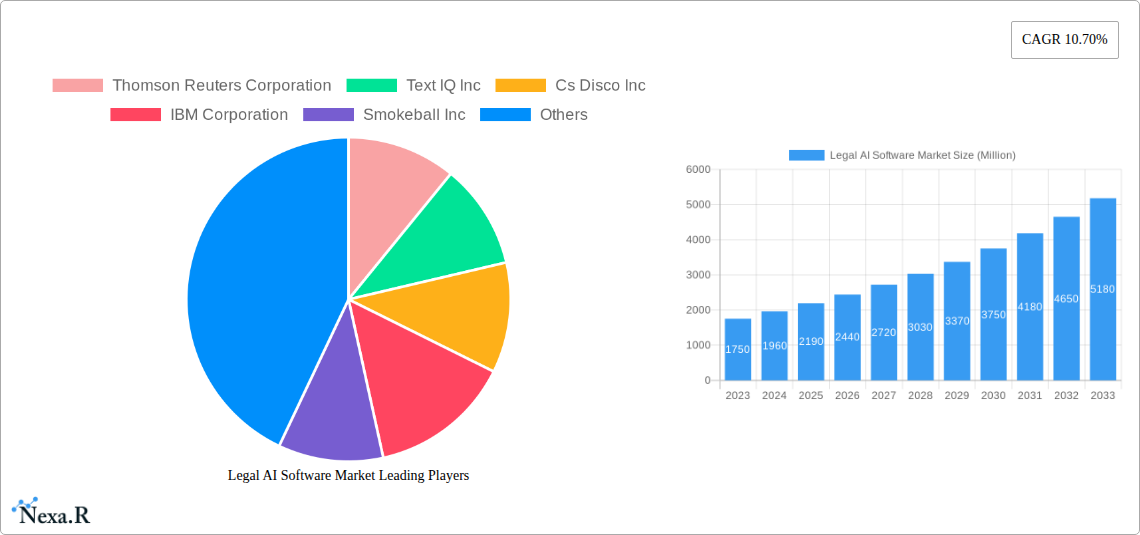

Legal AI Software Market Company Market Share

Unlock the future of legal technology with our comprehensive Legal AI Software Market report. This in-depth analysis provides strategic insights into the burgeoning legal AI market, covering its market dynamics, growth trends, regional dominance, product landscape, and key players. Designed for legal professionals, technology providers, and investors, this report offers critical data and actionable intelligence to navigate the evolving legal technology landscape. Explore the parent market of Legal Technology and its child market of Legal AI Software, with detailed segmentation across Components (Solution, Services), Deployment (On-premise, Cloud), Applications (Legal Research, Contract Review and Management, E-billing, E-discovery, Compliance, Case Prediction, Other Applications), and End-Users (Law Firms, Corporate Legal Departments, Other End-users).

This report utilizes data from the Historical Period (2019-2024), with the Base Year and Estimated Year at 2025, and projects future trends through the Forecast Period (2025-2033). All quantitative values are presented in Million Units.

Legal AI Software Market Market Dynamics & Structure

The legal AI software market is characterized by a dynamic interplay of innovation, consolidation, and increasing adoption. Market concentration is observed to be moderate, with a significant presence of both established legal technology giants and agile AI startups. Technological innovation serves as a primary driver, with continuous advancements in Natural Language Processing (NLP), Machine Learning (ML), and predictive analytics enhancing the capabilities of AI solutions. Regulatory frameworks are still evolving, presenting both opportunities and challenges for market players. Competitive product substitutes, while present in the form of traditional legal software and manual processes, are increasingly being supplanted by AI-powered alternatives. End-user demographics are shifting, with a growing demand for efficiency and cost-effectiveness from law firms and corporate legal departments. Merger and acquisition (M&A) trends are prominent, indicating a drive towards market consolidation and the integration of specialized AI capabilities.

- Market Concentration: Moderate, with key players establishing significant market share through strategic acquisitions and organic growth.

- Technological Innovation Drivers: Advancements in NLP, ML, and predictive analytics are enabling more sophisticated legal AI solutions.

- Regulatory Frameworks: Evolving regulations surrounding data privacy and AI ethics influence development and adoption.

- Competitive Product Substitutes: Traditional legal software and manual processes are facing increasing pressure from AI solutions.

- End-User Demographics: Growing demand from law firms and corporate legal departments for enhanced efficiency and cost savings.

- M&A Trends: Active M&A landscape indicating a trend towards market consolidation and synergistic acquisitions.

Legal AI Software Market Growth Trends & Insights

The legal AI software market is experiencing robust growth, propelled by an escalating need for automation, enhanced accuracy, and accelerated legal processes across various applications. The market size is projected to witness a significant evolution from XX Million units in 2025 to an estimated XX Million units by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates are rapidly increasing as legal professionals recognize the transformative potential of AI in streamlining workflows, reducing manual effort, and improving decision-making. Technological disruptions, such as the advent of generative AI models specifically trained on legal data, are further accelerating this trend, enabling more advanced functionalities like automated document drafting and nuanced legal analysis.

Consumer behavior shifts are also playing a crucial role. Clients are increasingly demanding faster turnaround times and more cost-effective legal services, compelling law firms and corporate legal departments to invest in AI solutions to meet these expectations. The penetration of legal AI software is expanding beyond large enterprises to smaller firms and solo practitioners, driven by the availability of scalable and affordable solutions. The integration of AI into core legal functions, from contract review and management to e-discovery and compliance, is becoming standard practice. This widespread adoption is fostering a competitive environment where continuous innovation and value-added features are paramount. The market's trajectory is indicative of a fundamental shift in how legal services are delivered and consumed, with AI becoming an indispensable tool for modern legal practice.

Dominant Regions, Countries, or Segments in Legal AI Software Market

The legal AI software market is currently experiencing significant growth and dominance driven by North America, particularly the United States. This region's leadership is underpinned by a confluence of factors, including a highly developed legal technology ecosystem, substantial investment in AI research and development, and a strong demand for innovative legal solutions from a large concentration of law firms and corporate legal departments. The Component segment of Solution is a primary driver, encompassing advanced AI-powered platforms for legal research, contract review and management, e-discovery, and compliance.

Within the Deployment segment, Cloud-based solutions are increasingly dominating due to their scalability, accessibility, and cost-effectiveness, facilitating wider adoption across firms of all sizes. The Application segment is seeing substantial traction in Contract Review and Management and E-discovery, areas where AI excels in automating tedious and time-consuming tasks, significantly improving efficiency and accuracy. Legal Research also remains a cornerstone application, with AI tools providing faster and more comprehensive access to case law and statutes.

In terms of End-User, Law Firms are at the forefront of adopting legal AI software, driven by the need to enhance client service, manage case loads effectively, and gain a competitive edge. Corporate Legal Departments are also major adopters, focusing on risk mitigation, cost control, and ensuring regulatory compliance.

- Dominant Region: North America, with the United States leading market penetration and innovation.

- Key Drivers in North America: Robust legal tech infrastructure, significant R&D investment, and high demand from legal professionals.

- Dominant Component: Solution, encompassing a wide array of AI-powered platforms.

- Dominant Deployment: Cloud, offering scalability and accessibility.

- Dominant Applications: Contract Review and Management, E-discovery, and Legal Research are key growth areas.

- Dominant End-Users: Law Firms and Corporate Legal Departments are the primary adopters.

- Market Share & Growth Potential: North America holds the largest market share, with substantial growth potential driven by continued technological advancements and increasing digital transformation in the legal sector.

Legal AI Software Market Product Landscape

The legal AI software market is characterized by a rapidly evolving product landscape featuring sophisticated AI-powered solutions. Innovations are focused on enhancing accuracy, speed, and efficiency in legal tasks. Key product advancements include AI-driven legal research platforms that provide more nuanced analysis of case law, intelligent contract review tools that can identify risks and anomalies with high precision, and automated e-discovery solutions that significantly reduce processing time and costs. Performance metrics are consistently improving, with AI algorithms demonstrating superior capabilities in tasks such as sentiment analysis, predictive coding, and factual extraction. Unique selling propositions often revolve around the ability of these tools to learn from vast datasets, adapt to specific legal contexts, and integrate seamlessly into existing legal workflows.

Key Drivers, Barriers & Challenges in Legal AI Software Market

The legal AI software market is propelled by several key drivers. Technologically, advancements in machine learning and natural language processing are enabling more powerful and accurate AI applications. Economically, the demand for cost reduction and increased efficiency in legal services is a significant impetus. Policy-driven factors, such as the increasing complexity of regulations, also necessitate AI-driven compliance solutions.

- Key Drivers:

- Technological advancements in AI (ML, NLP).

- Demand for cost optimization and efficiency gains.

- Increasing regulatory complexity.

- Need for enhanced data analysis and insights.

However, the market faces notable barriers and challenges. Regulatory hurdles, particularly concerning data privacy and ethical AI usage, can slow down adoption. The initial cost of implementation and the need for specialized training can be significant for smaller firms. Furthermore, concerns about job displacement and the inherent complexity of legal reasoning present philosophical and practical challenges.

- Key Barriers & Challenges:

- Data privacy and security concerns.

- High initial investment and implementation costs.

- Need for specialized training and talent.

- Ethical considerations and potential for bias.

- Resistance to change within traditional legal practices.

Emerging Opportunities in Legal AI Software Market

Emerging opportunities in the legal AI software market are abundant, driven by evolving client expectations and technological advancements. Untapped markets include the development of AI solutions tailored for specialized legal niches, such as intellectual property law or environmental law. Innovative applications are emerging in areas like case prediction, where AI can analyze historical data to forecast litigation outcomes, and AI-powered tools for pro bono services, increasing access to justice. Evolving consumer preferences towards more accessible and transparent legal services create opportunities for AI-driven client portals and automated legal guidance platforms. The integration of AI with blockchain technology for enhanced contract security and smart contract execution also presents a significant future avenue.

Growth Accelerators in the Legal AI Software Market Industry

Several growth accelerators are fueling the long-term expansion of the legal AI software market. Technological breakthroughs, particularly in explainable AI (XAI), are increasing trust and adoption by making AI decision-making processes more transparent. Strategic partnerships between AI developers and established legal publishers or service providers are crucial for market penetration and wider distribution. Market expansion strategies, such as offering tiered subscription models and developing user-friendly interfaces, are making AI solutions accessible to a broader range of legal professionals. The increasing volume of digital legal data also serves as a catalyst, providing the necessary fuel for AI algorithms to become more sophisticated and accurate.

Key Players Shaping the Legal AI Software Market Market

- Thomson Reuters Corporation

- Text IQ Inc

- Cs Disco Inc

- IBM Corporation

- Smokeball Inc

- Neota Logic Inc

- Opentext Corporation

- Veritone Inc

- Casetext Inc

- Lexisnexis Group Inc (RELX Group Plc)

- Kira Inc

- Brainspace Corporation

- Luminance Technologies Ltd

- Ross Intelligence Inc

Notable Milestones in Legal AI Software Market Sector

- May 2023 - LexisNexis Group Inc launched its highly-demanded API for state court Legal Analytics, enabling customers to access Lex Machina's state court analytics and data directly. This allows for greater incorporation of Lex Machina's superior Legal Analytics into existing workflows and enables users to combine internal data with Lex Machina's superior Legal Analytics for both state and federal courts.

- April 2023 - Luminance Technologies Ltd partnered with alternative service legal provider, Nexa, to embed Luminance's next-generation AI into the NexaConnex legal service offering. This partnership aims to drive efficiencies into day-to-day work for NexaConnex's clients, allowing them to dedicate more time to high-value client activities.

In-Depth Legal AI Software Market Market Outlook

The Legal AI Software Market is poised for sustained and accelerated growth, driven by a confluence of technological advancements and increasing demand for digital transformation within the legal industry. Future market potential is significant, with continuous innovation in AI capabilities expected to unlock new use cases and enhance existing functionalities. Strategic opportunities lie in the development of more specialized AI tools for niche legal areas, the expansion of AI-powered predictive analytics, and the integration of AI with other emerging technologies like blockchain. The ongoing digital transformation of legal services, coupled with a growing emphasis on efficiency and cost-effectiveness, will continue to propel the adoption of Legal AI software, solidifying its position as an indispensable component of modern legal practice.

Legal AI Software Market Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Services

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. Application

- 3.1. Legal Research

- 3.2. Contract Review and Management

- 3.3. E-billing

- 3.4. E-discovery

- 3.5. Compliance

- 3.6. Case Prediction

- 3.7. Other Applications

-

4. End-User

- 4.1. Law Firms

- 4.2. Corporate Legal Departments

- 4.3. Other End-users

Legal AI Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Legal AI Software Market Regional Market Share

Geographic Coverage of Legal AI Software Market

Legal AI Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For Automation And Increasing Number Of Litigations In The Legal Industry; Growth In The Utilization Of AI By Legal Companies To Complete Legal Cases

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns Of The Confidential And Legal Data

- 3.4. Market Trends

- 3.4.1. Cloud is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Legal AI Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Legal Research

- 5.3.2. Contract Review and Management

- 5.3.3. E-billing

- 5.3.4. E-discovery

- 5.3.5. Compliance

- 5.3.6. Case Prediction

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Law Firms

- 5.4.2. Corporate Legal Departments

- 5.4.3. Other End-users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Legal AI Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Legal Research

- 6.3.2. Contract Review and Management

- 6.3.3. E-billing

- 6.3.4. E-discovery

- 6.3.5. Compliance

- 6.3.6. Case Prediction

- 6.3.7. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Law Firms

- 6.4.2. Corporate Legal Departments

- 6.4.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Legal AI Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Legal Research

- 7.3.2. Contract Review and Management

- 7.3.3. E-billing

- 7.3.4. E-discovery

- 7.3.5. Compliance

- 7.3.6. Case Prediction

- 7.3.7. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Law Firms

- 7.4.2. Corporate Legal Departments

- 7.4.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Legal AI Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Legal Research

- 8.3.2. Contract Review and Management

- 8.3.3. E-billing

- 8.3.4. E-discovery

- 8.3.5. Compliance

- 8.3.6. Case Prediction

- 8.3.7. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Law Firms

- 8.4.2. Corporate Legal Departments

- 8.4.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Legal AI Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Legal Research

- 9.3.2. Contract Review and Management

- 9.3.3. E-billing

- 9.3.4. E-discovery

- 9.3.5. Compliance

- 9.3.6. Case Prediction

- 9.3.7. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Law Firms

- 9.4.2. Corporate Legal Departments

- 9.4.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Legal AI Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solution

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Legal Research

- 10.3.2. Contract Review and Management

- 10.3.3. E-billing

- 10.3.4. E-discovery

- 10.3.5. Compliance

- 10.3.6. Case Prediction

- 10.3.7. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Law Firms

- 10.4.2. Corporate Legal Departments

- 10.4.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thomson Reuters Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Text IQ Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cs Disco Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smokeball Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Neota Logic Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Opentext Corporation*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veritone Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Casetext Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lexisnexis Group Inc (RELX Group Plc)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kira Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Brainspace Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Luminance Technologies Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ross Intelligence Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Thomson Reuters Corporation

List of Figures

- Figure 1: Global Legal AI Software Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Legal AI Software Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Legal AI Software Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Legal AI Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Legal AI Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Legal AI Software Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Legal AI Software Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Legal AI Software Market Revenue (Million), by End-User 2025 & 2033

- Figure 9: North America Legal AI Software Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Legal AI Software Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Legal AI Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Legal AI Software Market Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Legal AI Software Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Legal AI Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Legal AI Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Legal AI Software Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Legal AI Software Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Legal AI Software Market Revenue (Million), by End-User 2025 & 2033

- Figure 19: Europe Legal AI Software Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Europe Legal AI Software Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Legal AI Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Legal AI Software Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Pacific Legal AI Software Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Legal AI Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Asia Pacific Legal AI Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Pacific Legal AI Software Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Asia Pacific Legal AI Software Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Legal AI Software Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific Legal AI Software Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Legal AI Software Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Legal AI Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Legal AI Software Market Revenue (Million), by Component 2025 & 2033

- Figure 33: Latin America Legal AI Software Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Latin America Legal AI Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Latin America Legal AI Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Latin America Legal AI Software Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Latin America Legal AI Software Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Latin America Legal AI Software Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Latin America Legal AI Software Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Latin America Legal AI Software Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Legal AI Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Legal AI Software Market Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East and Africa Legal AI Software Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East and Africa Legal AI Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 45: Middle East and Africa Legal AI Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 46: Middle East and Africa Legal AI Software Market Revenue (Million), by Application 2025 & 2033

- Figure 47: Middle East and Africa Legal AI Software Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Middle East and Africa Legal AI Software Market Revenue (Million), by End-User 2025 & 2033

- Figure 49: Middle East and Africa Legal AI Software Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Middle East and Africa Legal AI Software Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Legal AI Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Legal AI Software Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Legal AI Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Legal AI Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Legal AI Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Global Legal AI Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Legal AI Software Market Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Legal AI Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Legal AI Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Legal AI Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Legal AI Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Legal AI Software Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Legal AI Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global Legal AI Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Legal AI Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Legal AI Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Legal AI Software Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Legal AI Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Legal AI Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Legal AI Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Legal AI Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Legal AI Software Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Legal AI Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global Legal AI Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Legal AI Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 25: Global Legal AI Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Legal AI Software Market Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Legal AI Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Legal AI Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Legal AI Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global Legal AI Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Legal AI Software Market?

The projected CAGR is approximately 10.70%.

2. Which companies are prominent players in the Legal AI Software Market?

Key companies in the market include Thomson Reuters Corporation, Text IQ Inc, Cs Disco Inc, IBM Corporation, Smokeball Inc, Neota Logic Inc, Opentext Corporation*List Not Exhaustive, Veritone Inc, Casetext Inc, Lexisnexis Group Inc (RELX Group Plc), Kira Inc, Brainspace Corporation, Luminance Technologies Ltd, Ross Intelligence Inc.

3. What are the main segments of the Legal AI Software Market?

The market segments include Component, Deployment, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For Automation And Increasing Number Of Litigations In The Legal Industry; Growth In The Utilization Of AI By Legal Companies To Complete Legal Cases.

6. What are the notable trends driving market growth?

Cloud is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Data Privacy Concerns Of The Confidential And Legal Data.

8. Can you provide examples of recent developments in the market?

May 2023 - LexisNexis Group Inc has launched its highly-demanded API for state court Legal Analytics. where the customers can access Lex Machina's state court analytics and data directly through its API, enabling greater incorporation of Lex Machina's superior Legal Analytics directly into one seamless, existing workflow and with Lex Machina's new API for state courts, users can combine their internal data with Lex Machina's superior Legal Analytics for state courts as well as federal courts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Legal AI Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Legal AI Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Legal AI Software Market?

To stay informed about further developments, trends, and reports in the Legal AI Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence