Key Insights

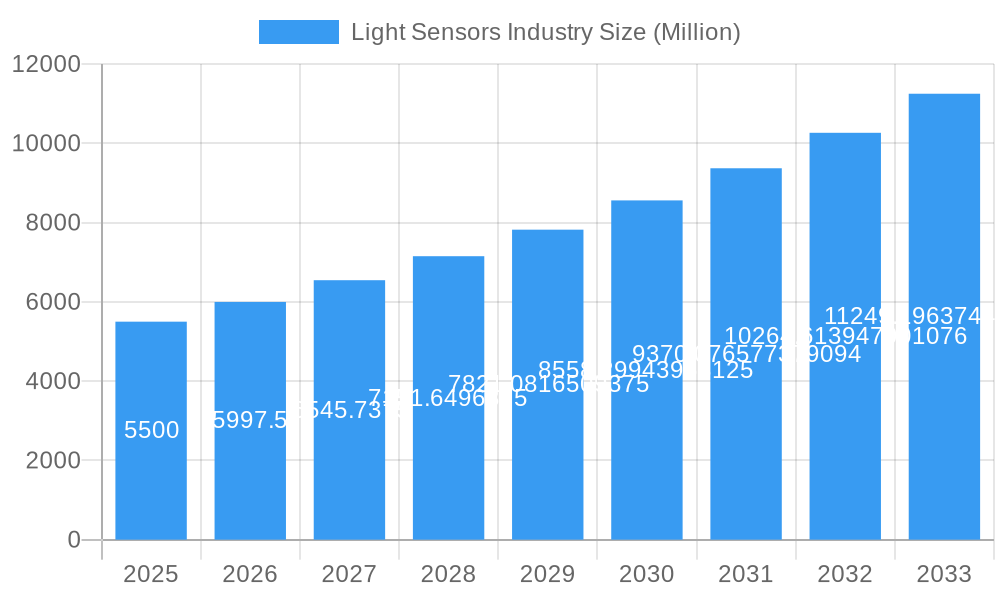

The global light sensors market is poised for significant expansion, projected to reach a substantial market size of [Estimate based on CAGR and Base Year] Million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 9.10% throughout the forecast period of 2025-2033. This impressive growth is fueled by the escalating demand for enhanced user experiences and sophisticated functionalities across a diverse range of end-user industries. Key market drivers include the rapid integration of light sensors in consumer electronics for automated display adjustments, improved photography, and immersive augmented reality applications. The automotive sector is a significant contributor, with light sensors enabling advanced driver-assistance systems (ADAS) such as automatic headlights, rain sensors, and ambient lighting control, thereby enhancing safety and comfort. Industrial automation also benefits from these sensors, facilitating sophisticated control systems, machine vision, and environmental monitoring. Emerging trends like the miniaturization of sensors, increased power efficiency, and the development of multispectral sensing capabilities are further propelling market adoption. The proliferation of smart home devices and the growing emphasis on energy-efficient lighting solutions also represent substantial growth avenues for the light sensor industry.

Light Sensors Industry Market Size (In Billion)

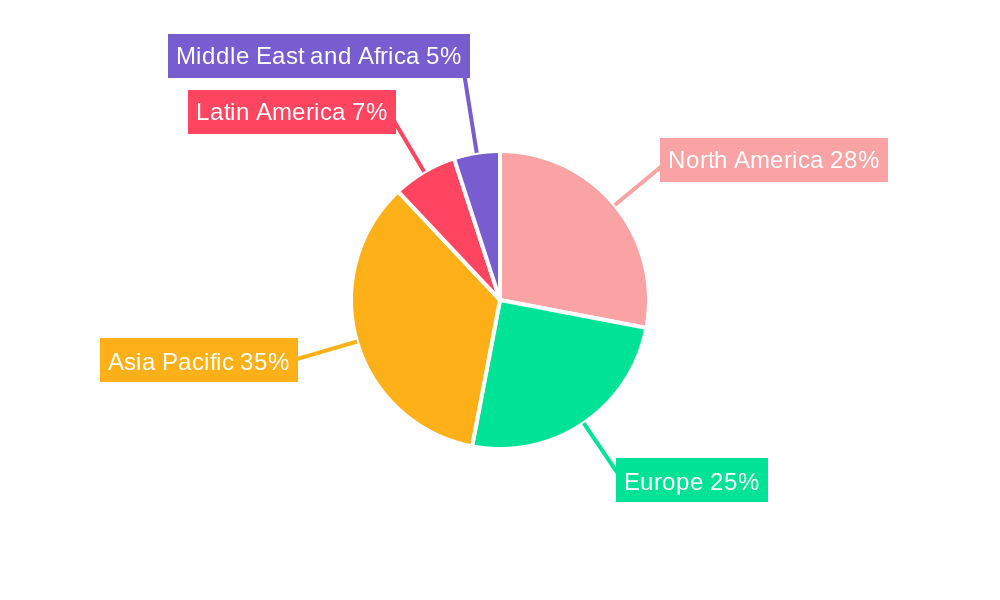

The market segmentation reveals a dynamic landscape with Ambient Light Sensing dominating by volume and value, followed by Proximity Detectors, crucial for device interaction and power saving. RGB Color Sensing is gaining traction for its applications in color matching and quality control, while Gesture Recognition is emerging as a key differentiator for intuitive human-machine interfaces. UV/Infrared (IR) Detection sensors are critical in safety and environmental monitoring applications. Both Analog and Digital output sensors cater to specific application requirements, with digital outputs increasingly favored for their precision and ease of integration with modern microcontrollers. Geographically, the Asia Pacific region is expected to lead the market due to its strong manufacturing base for consumer electronics and rapid adoption of new technologies. North America and Europe are also significant markets, driven by advancements in automotive and industrial sectors, alongside a strong consumer demand for smart devices. While the market presents immense opportunities, potential restraints such as the high cost of advanced sensor technologies in some niche applications and the need for stringent calibration for precise readings could pose challenges.

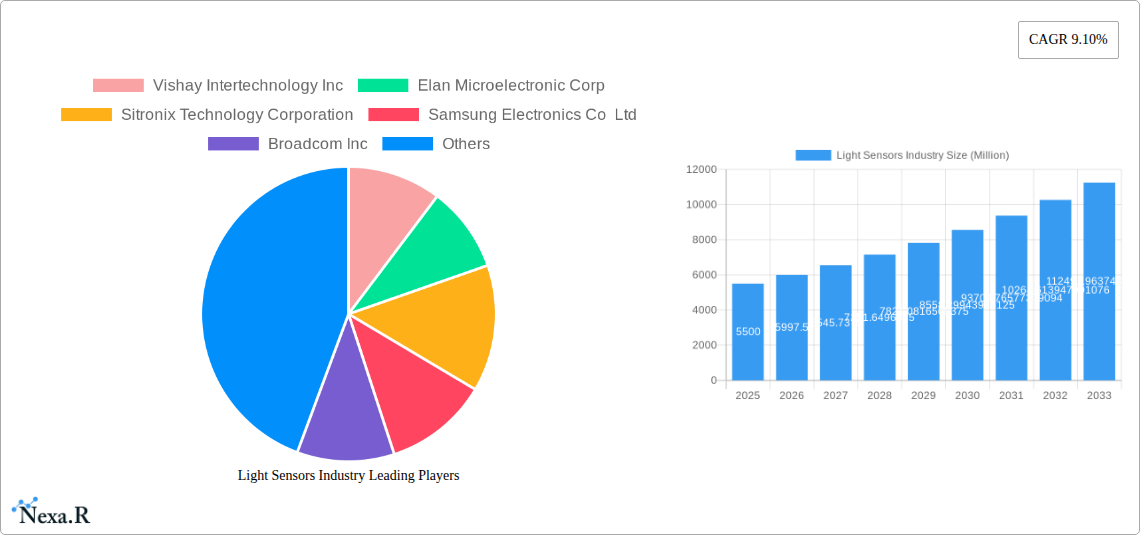

Light Sensors Industry Company Market Share

This comprehensive report delves into the global Light Sensors Industry, providing an in-depth analysis of market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this study offers invaluable insights for industry professionals seeking to understand the evolving market for ambient light sensors, proximity detectors, RGB color sensors, gesture recognition sensors, and UV/infrared (IR) light detection sensors. We explore the adoption of analog and digital output sensors across critical end-user industries including consumer electronics, automotive, and industrial applications. The report quantifies market size in million units, offering precise data for strategic decision-making.

Light Sensors Industry Market Dynamics & Structure

The Light Sensors Industry exhibits a moderately fragmented market structure, characterized by the presence of established global players and emerging innovators. Technological innovation remains a primary driver, fueled by advancements in miniaturization, power efficiency, and enhanced sensing capabilities. The increasing demand for smart devices, advanced driver-assistance systems (ADAS), and sophisticated industrial automation systems significantly influences market dynamics. Regulatory frameworks, particularly concerning data privacy and product safety, are evolving and may impact sensor development and deployment. Competitive product substitutes, such as basic photodiodes and more complex vision systems, present a constant challenge, pushing manufacturers to differentiate through specialized features and superior performance. End-user demographics are shifting towards a greater demand for integrated, intelligent sensing solutions, particularly within the rapidly growing consumer electronics and automotive sectors. Mergers and acquisition (M&A) trends are observed as larger companies seek to expand their product portfolios and technological expertise, consolidating market share.

- Market Concentration: Moderately fragmented, with key players holding significant market share but also space for niche innovators.

- Technological Innovation Drivers: Miniaturization, power efficiency, enhanced accuracy in diverse lighting conditions, integration of multiple sensing functions.

- Regulatory Frameworks: Growing emphasis on data privacy and device security; evolving standards for automotive safety and industrial automation.

- Competitive Product Substitutes: Basic photodiodes, image sensors, and alternative sensing technologies like ultrasonic or radar.

- End-User Demographics: Increasing demand for smart features in consumer goods, autonomous driving capabilities in vehicles, and IoT integration in industrial settings.

- M&A Trends: Strategic acquisitions aimed at gaining access to new technologies, expanding market reach, and consolidating market positions.

Light Sensors Industry Growth Trends & Insights

The global Light Sensors Industry is poised for robust growth, driven by the pervasive integration of these components across a multitude of applications. The market size, estimated at XX million units in the base year 2025, is projected to expand significantly through the forecast period of 2025–2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.XX%. This expansion is underpinned by escalating adoption rates in consumer electronics, where ambient light sensors optimize display brightness and power consumption in smartphones, tablets, and wearables. The automotive sector is witnessing a surge in demand for proximity detectors for parking assist systems, interior lighting control, and advanced driver-assistance systems (ADAS) that rely on light-based sensing for object detection. RGB color sensors are becoming indispensable for applications requiring accurate color reproduction and adaptive lighting. Technological disruptions, such as the development of smaller, more power-efficient, and highly accurate sensors, continue to fuel market expansion. Consumer behavior shifts towards a preference for smarter, more intuitive, and energy-efficient devices further accelerate the adoption of light sensor technology. The market penetration of light sensors in emerging economies is also expected to witness substantial growth as disposable incomes rise and the demand for advanced electronic devices increases.

Dominant Regions, Countries, or Segments in Light Sensors Industry

The Consumer Electronics end-user industry is a dominant force propelling the global Light Sensors Industry, showcasing remarkable growth and extensive adoption. This segment is expected to account for a substantial market share, driven by the insatiable demand for smartphones, smart home devices, wearables, and advanced computing peripherals. Key drivers within this segment include the continuous innovation in mobile device features, the proliferation of the Internet of Things (IoT), and the increasing consumer appetite for immersive and interactive technological experiences. Furthermore, the automotive sector is rapidly emerging as a significant growth engine. The integration of light sensors in vehicles for ADAS, interior and exterior lighting control, and driver monitoring systems is expanding exponentially. Stringent safety regulations and the pursuit of enhanced driving comfort and fuel efficiency are accelerating the adoption of sophisticated light sensing solutions. Geographically, Asia-Pacific is a leading region, owing to its robust manufacturing capabilities, the presence of major consumer electronics giants like Samsung Electronics Co Ltd and Apple Inc, and the rapidly growing domestic demand for technologically advanced products. North America and Europe also represent significant markets, driven by early adoption of advanced technologies and strong automotive manufacturing bases. Within the Type segment, Ambient Light Sensing and Proximity Detector are the largest contributors due to their widespread use in mobile devices and automotive safety features, respectively. However, Gesture Recognition and UV/Infrared Light (IR) Detection are emerging as high-growth areas, fueled by advancements in human-computer interaction and health monitoring applications.

- Dominant End-User Industry: Consumer Electronics

- Key Drivers: Smartphone proliferation, smart home adoption, wearable technology growth, IoT integration.

- Market Share Potential: Significant and expanding due to continuous product innovation and consumer demand.

- Emerging Growth End-User Industry: Automotive

- Key Drivers: ADAS expansion, safety regulations, improved driver experience, autonomous driving development.

- Growth Potential: High, driven by increasing sensor integration and technological advancements.

- Dominant Region: Asia-Pacific

- Key Drivers: Strong manufacturing base, major consumer electronics companies, large domestic market, increasing disposable income.

- Market Share: Leading due to production volume and end-user demand.

- Dominant Segment (Type): Ambient Light Sensing & Proximity Detector

- Drivers: Widespread integration in mobile devices and automotive safety systems.

- Growth Potential: Steady and significant.

- High-Growth Segment (Type): Gesture Recognition & UV/Infrared Light (IR) Detection

- Drivers: Advancements in HCI, health monitoring, and specialized industrial applications.

- Growth Potential: Rapid, driven by emerging technologies and novel applications.

Light Sensors Industry Product Landscape

The product landscape of the Light Sensors Industry is characterized by continuous innovation, focusing on enhanced performance, reduced form factors, and increased functionality. Key product innovations include the development of highly sensitive ambient light sensors capable of accurate color temperature detection, multi-zone proximity sensors for advanced gesture recognition and presence detection, and miniaturized UV/IR sensors for health monitoring and specialized industrial applications. Applications span from automatic display adjustment in smartphones and tablets to sophisticated driver monitoring systems in automobiles, gesture-controlled interfaces in smart appliances, and environmental monitoring in industrial settings. Performance metrics such as sensitivity, response time, spectral response, and power consumption are critical differentiators. For instance, STMicroelectronics' FlightSense Time-of-Flight (ToF) multi-zone sensor offers superior accuracy for gesture recognition and user detection, while ams OSRAM's UV-A detecting ambient light sensor caters to health and safety applications.

Key Drivers, Barriers & Challenges in Light Sensors Industry

Key Drivers:

The Light Sensors Industry is primarily propelled by the relentless demand for enhanced user experience and advanced functionalities in electronic devices. The burgeoning consumer electronics market, with its constant drive for smarter features, is a major catalyst. In the automotive sector, the increasing adoption of ADAS and the pursuit of enhanced safety and comfort features necessitate sophisticated light sensing solutions. Technological advancements in sensor design, including miniaturization, improved accuracy, and lower power consumption, are also critical drivers. The growing adoption of IoT devices across various sectors, from smart homes to industrial automation, further expands the application base for light sensors.

Barriers & Challenges:

Despite the positive growth trajectory, the industry faces several challenges. Intense price competition, particularly in high-volume consumer electronics applications, can compress profit margins. Supply chain disruptions, exacerbated by global geopolitical events and semiconductor shortages, can impact production and lead times. The rapid pace of technological evolution requires continuous investment in R&D, posing a significant barrier for smaller players. Furthermore, the development of highly specialized sensors for niche applications can be complex and costly. Regulatory compliance, particularly concerning data privacy and product safety standards, adds another layer of complexity.

Emerging Opportunities in Light Sensors Industry

Emerging opportunities within the Light Sensors Industry are abundant and diverse. The expanding market for augmented reality (AR) and virtual reality (VR) devices presents a significant avenue for advanced gesture recognition and depth-sensing proximity detectors. The healthcare sector offers considerable potential for UV/IR light sensors used in wearable health trackers for monitoring vital signs and environmental exposure. The automotive industry's drive towards autonomous driving will further necessitate sophisticated light sensing for object detection, environmental perception, and advanced interior sensing. The smart city initiatives and the growth of industrial IoT are creating demand for specialized light sensors for environmental monitoring, smart lighting control, and process automation.

Growth Accelerators in the Light Sensors Industry Industry

Several factors are accelerating the long-term growth of the Light Sensors Industry. Continued technological breakthroughs in photonics and semiconductor manufacturing are enabling the development of smaller, more powerful, and energy-efficient sensors. Strategic partnerships between sensor manufacturers and device OEMs are crucial for co-developing integrated solutions and ensuring market adoption. The expansion of the light sensor market into developing economies, driven by increasing disposable incomes and the desire for advanced consumer electronics, represents a significant growth accelerator. Furthermore, the increasing focus on sustainability and energy efficiency across industries will drive demand for light sensors that optimize power consumption in electronic devices.

Key Players Shaping the Light Sensors Industry Market

- Vishay Intertechnology Inc

- Elan Microelectronic Corp

- Sitronix Technology Corporation

- Samsung Electronics Co Ltd

- Broadcom Inc

- STMicroelectronics NV

- ROHM Co Ltd

- Sharp Corporation

- Maxim Integrated Products Inc

- Everlight Electronics Co Ltd

- Apple Inc

- AMS AG

Notable Milestones in Light Sensors Industry Sector

- July 2022: STMicroelectronics unveiled its latest FlightSense Time-of-Flight (ToF) multi-zone sensor, a turnkey solution for user detection, gesture recognition, and intruder alert, primarily for the PC market.

- October 2021: ams OSRAM launched an ambient light sensor with proprietary UV-A light detection, enabling warnings for excessive UV-A radiation and suitable for space-constrained wearable and mobile applications.

In-Depth Light Sensors Industry Market Outlook

The in-depth market outlook for the Light Sensors Industry is exceptionally promising, driven by a confluence of technological innovation and expanding market applications. The continued evolution of AI and machine learning further enhances the capabilities of light sensors, enabling more sophisticated data analysis and intelligent decision-making within devices. The push towards greater connectivity and the proliferation of smart devices across consumer, automotive, and industrial sectors will ensure a sustained demand for diverse types of light sensors. Strategic collaborations between semiconductor manufacturers and end-product developers will be pivotal in unlocking new application frontiers and accelerating market penetration. Emerging markets represent a significant growth frontier, with increasing adoption of advanced electronics. The industry's ability to adapt to evolving consumer preferences for intuitive, responsive, and energy-efficient technology will be crucial in capitalizing on future market potential.

Light Sensors Industry Segmentation

-

1. Type

- 1.1. Ambient Light Sensing

- 1.2. Proximity Detector

- 1.3. RGB Color Sensing

- 1.4. Gesture Recognition

- 1.5. UV/Infrared Light (IR) Detection

-

2. Output

- 2.1. Analog

- 2.2. Digital

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. Industrial

- 3.4. Other End-user Industries

Light Sensors Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Light Sensors Industry Regional Market Share

Geographic Coverage of Light Sensors Industry

Light Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in the Automotive Sector Fuel the Market; Growing Implementation of Light Sensors in Smartphones and PC Tablets

- 3.3. Market Restrains

- 3.3.1. Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality

- 3.4. Market Trends

- 3.4.1. Consumer Electronics is Expected to Hold a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Light Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ambient Light Sensing

- 5.1.2. Proximity Detector

- 5.1.3. RGB Color Sensing

- 5.1.4. Gesture Recognition

- 5.1.5. UV/Infrared Light (IR) Detection

- 5.2. Market Analysis, Insights and Forecast - by Output

- 5.2.1. Analog

- 5.2.2. Digital

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. Industrial

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Light Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ambient Light Sensing

- 6.1.2. Proximity Detector

- 6.1.3. RGB Color Sensing

- 6.1.4. Gesture Recognition

- 6.1.5. UV/Infrared Light (IR) Detection

- 6.2. Market Analysis, Insights and Forecast - by Output

- 6.2.1. Analog

- 6.2.2. Digital

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Consumer Electronics

- 6.3.2. Automotive

- 6.3.3. Industrial

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Light Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ambient Light Sensing

- 7.1.2. Proximity Detector

- 7.1.3. RGB Color Sensing

- 7.1.4. Gesture Recognition

- 7.1.5. UV/Infrared Light (IR) Detection

- 7.2. Market Analysis, Insights and Forecast - by Output

- 7.2.1. Analog

- 7.2.2. Digital

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Consumer Electronics

- 7.3.2. Automotive

- 7.3.3. Industrial

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Light Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ambient Light Sensing

- 8.1.2. Proximity Detector

- 8.1.3. RGB Color Sensing

- 8.1.4. Gesture Recognition

- 8.1.5. UV/Infrared Light (IR) Detection

- 8.2. Market Analysis, Insights and Forecast - by Output

- 8.2.1. Analog

- 8.2.2. Digital

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Consumer Electronics

- 8.3.2. Automotive

- 8.3.3. Industrial

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Light Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ambient Light Sensing

- 9.1.2. Proximity Detector

- 9.1.3. RGB Color Sensing

- 9.1.4. Gesture Recognition

- 9.1.5. UV/Infrared Light (IR) Detection

- 9.2. Market Analysis, Insights and Forecast - by Output

- 9.2.1. Analog

- 9.2.2. Digital

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Consumer Electronics

- 9.3.2. Automotive

- 9.3.3. Industrial

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Light Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ambient Light Sensing

- 10.1.2. Proximity Detector

- 10.1.3. RGB Color Sensing

- 10.1.4. Gesture Recognition

- 10.1.5. UV/Infrared Light (IR) Detection

- 10.2. Market Analysis, Insights and Forecast - by Output

- 10.2.1. Analog

- 10.2.2. Digital

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Consumer Electronics

- 10.3.2. Automotive

- 10.3.3. Industrial

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vishay Intertechnology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elan Microelectronic Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sitronix Technology Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung Electronics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Broadcom Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STMicroelectronics NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ROHM Co Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sharp Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maxim Integrated Products Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Everlight Electronics Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AMS AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Light Sensors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Light Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Light Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Light Sensors Industry Revenue (Million), by Output 2025 & 2033

- Figure 5: North America Light Sensors Industry Revenue Share (%), by Output 2025 & 2033

- Figure 6: North America Light Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Light Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Light Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Light Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Light Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Light Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Light Sensors Industry Revenue (Million), by Output 2025 & 2033

- Figure 13: Europe Light Sensors Industry Revenue Share (%), by Output 2025 & 2033

- Figure 14: Europe Light Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Light Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Light Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Light Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Light Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Light Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Light Sensors Industry Revenue (Million), by Output 2025 & 2033

- Figure 21: Asia Pacific Light Sensors Industry Revenue Share (%), by Output 2025 & 2033

- Figure 22: Asia Pacific Light Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Light Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Light Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Light Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Light Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Light Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Light Sensors Industry Revenue (Million), by Output 2025 & 2033

- Figure 29: Latin America Light Sensors Industry Revenue Share (%), by Output 2025 & 2033

- Figure 30: Latin America Light Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Light Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Light Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Light Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Light Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Light Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Light Sensors Industry Revenue (Million), by Output 2025 & 2033

- Figure 37: Middle East and Africa Light Sensors Industry Revenue Share (%), by Output 2025 & 2033

- Figure 38: Middle East and Africa Light Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Light Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Light Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Light Sensors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Light Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Light Sensors Industry Revenue Million Forecast, by Output 2020 & 2033

- Table 3: Global Light Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Light Sensors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Light Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Light Sensors Industry Revenue Million Forecast, by Output 2020 & 2033

- Table 7: Global Light Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Light Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Light Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Light Sensors Industry Revenue Million Forecast, by Output 2020 & 2033

- Table 11: Global Light Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Light Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Light Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Light Sensors Industry Revenue Million Forecast, by Output 2020 & 2033

- Table 15: Global Light Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Light Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Light Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Light Sensors Industry Revenue Million Forecast, by Output 2020 & 2033

- Table 19: Global Light Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Light Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Light Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Light Sensors Industry Revenue Million Forecast, by Output 2020 & 2033

- Table 23: Global Light Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Light Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Light Sensors Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the Light Sensors Industry?

Key companies in the market include Vishay Intertechnology Inc, Elan Microelectronic Corp, Sitronix Technology Corporation, Samsung Electronics Co Ltd, Broadcom Inc, STMicroelectronics NV, ROHM Co Ltd*List Not Exhaustive, Sharp Corporation, Maxim Integrated Products Inc, Everlight Electronics Co Ltd, Apple Inc, AMS AG.

3. What are the main segments of the Light Sensors Industry?

The market segments include Type, Output, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in the Automotive Sector Fuel the Market; Growing Implementation of Light Sensors in Smartphones and PC Tablets.

6. What are the notable trends driving market growth?

Consumer Electronics is Expected to Hold a Major Share.

7. Are there any restraints impacting market growth?

Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality.

8. Can you provide examples of recent developments in the market?

July 2022 - STMicroelectronics, a global semiconductor company serving customers across the spectrum of electronics applications, unveiled its latest FlightSense Time-of-Flight (ToF) multi-zone sensor. Delivered together with a suite of valuable software algorithms, the combination offers a turnkey solution for user detection, gesture recognition, and intruder alert, specially developed for the PC market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Light Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Light Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Light Sensors Industry?

To stay informed about further developments, trends, and reports in the Light Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence