Key Insights

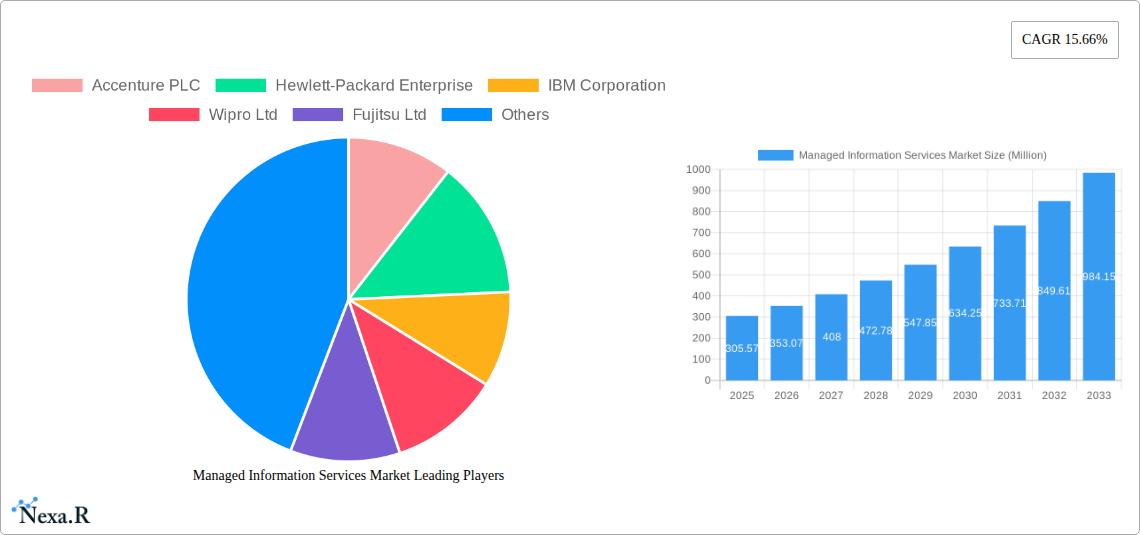

The Managed Information Services Market is poised for significant expansion, with a current market size estimated at USD 305.57 million. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 15.66% during the forecast period of 2025-2033. This remarkable growth is fueled by an increasing demand for specialized IT expertise to manage complex digital infrastructures and a growing need for robust data backup and recovery solutions. Companies are increasingly recognizing the strategic advantage of outsourcing these critical functions to specialized providers, allowing them to focus on core business objectives and innovation. The surge in cloud adoption further underpins this market's trajectory, as businesses seek flexible and scalable managed services that can adapt to their evolving digital landscapes. This market expansion is also driven by the imperative to enhance network security and operational efficiency in an increasingly interconnected world.

Managed Information Services Market Market Size (In Million)

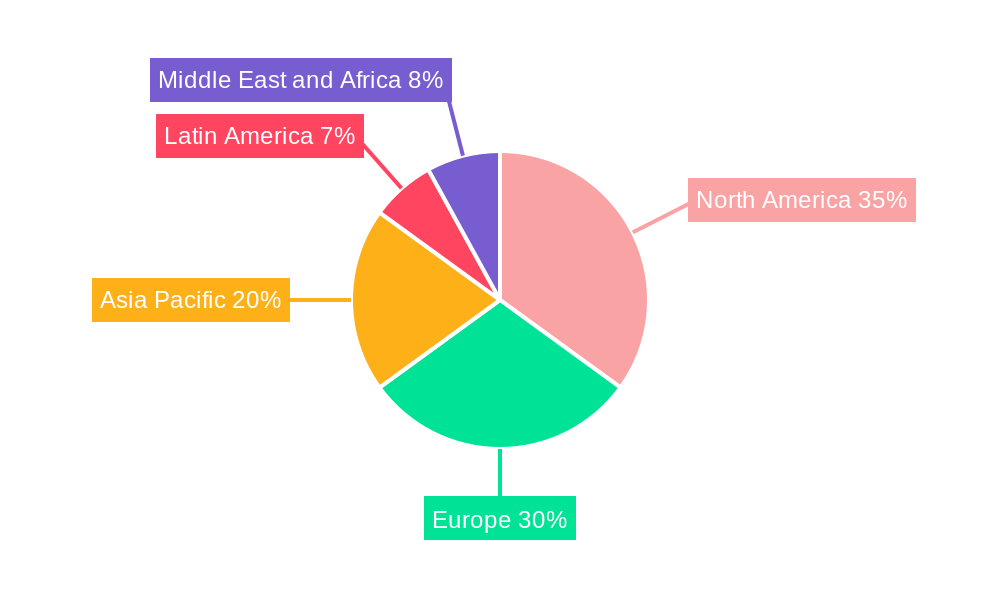

Key segments contributing to this market's dynamism include Data Backup and Recovery, Network Monitoring and Security, Human Resource management, and System Management functions. Deployment modes are shifting towards cloud-based solutions, offering greater agility and cost-effectiveness. The Telecommunication and IT, BFSI, and Retail sectors are anticipated to be major end-user verticals, owing to their extensive reliance on sophisticated IT infrastructure and data-intensive operations. Geographically, North America and Europe are expected to dominate the market, driven by early adoption of advanced technologies and a mature business environment. However, the Asia Pacific region is projected to witness the fastest growth, propelled by rapid digital transformation initiatives and increasing investments in IT infrastructure by emerging economies.

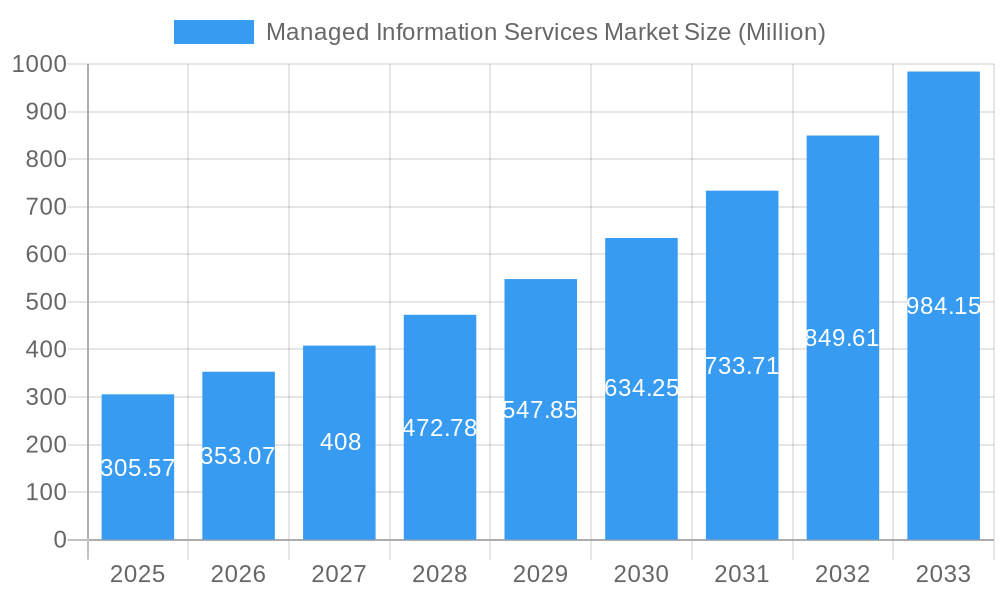

Managed Information Services Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Managed Information Services Market, exploring its dynamics, growth trajectory, and future potential. With a focus on high-traffic keywords like "managed IT services," "outsourced IT support," "cloud managed services," and "network security services," this report is designed to maximize search engine visibility and provide actionable insights for industry professionals. We delve into parent and child market segments, offering a nuanced understanding of market segmentation and competitive landscapes. All monetary values are presented in Million USD.

Managed Information Services Market Market Dynamics & Structure

The Managed Information Services Market exhibits a moderately concentrated structure, with key players like Accenture PLC, Hewlett-Packard Enterprise, and IBM Corporation holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for cloud adoption, cybersecurity solutions, and digital transformation initiatives. Regulatory frameworks, particularly those pertaining to data privacy and security (e.g., GDPR, CCPA), are shaping service offerings and compliance strategies. Competitive product substitutes include in-house IT departments and fragmented point solutions, but the comprehensive and cost-effective nature of managed services often presents a superior value proposition. End-user demographics are increasingly leaning towards small and medium-sized enterprises (SMEs) seeking sophisticated IT support without substantial capital investment. Merger and acquisition (M&A) trends are active as larger players consolidate to expand service portfolios and geographical reach, aiming to capture a greater share of the growing managed IT services market. Innovation barriers include the high cost of developing cutting-edge security and AI-driven managed services, as well as the challenge of integrating diverse client IT infrastructures.

- Market Concentration: Moderately concentrated, dominated by a few large global providers.

- Technological Innovation Drivers: Cloud computing, AI, IoT, cybersecurity advancements.

- Regulatory Frameworks: Data privacy laws (GDPR, CCPA), industry-specific compliance standards.

- Competitive Substitutes: In-house IT teams, freelance IT professionals, niche software solutions.

- End-User Demographics: Growing adoption by SMEs across all verticals.

- M&A Trends: Active consolidation for service portfolio expansion and market penetration.

Managed Information Services Market Growth Trends & Insights

The Managed Information Services Market has witnessed robust growth, driven by the escalating complexity of IT infrastructures and the critical need for specialized expertise. The market size evolution is projected to continue its upward trajectory, fueled by the increasing reliance on digital technologies across all business sectors. Adoption rates for managed IT services are accelerating as organizations recognize the benefits of cost optimization, enhanced security, and improved operational efficiency. Technological disruptions, such as the widespread adoption of cloud computing and the integration of Artificial Intelligence (AI) for predictive maintenance and enhanced customer support, are profoundly reshaping the market landscape. Consumer behavior shifts are evident in the growing preference for subscription-based IT services and a greater emphasis on proactive rather than reactive IT management. The global managed services market is expected to experience a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period. Market penetration is expanding rapidly, particularly within the Telecommunication and IT, and BFSI sectors, which are increasingly outsourcing their IT operations to specialized providers.

Dominant Regions, Countries, or Segments in Managed Information Services Market

North America currently dominates the Managed Information Services Market, driven by its technologically advanced infrastructure, strong presence of major IT service providers, and a high degree of digital adoption across various industries. The United States, in particular, is a key market, with significant investments in cloud-based managed services and advanced cybersecurity solutions.

- Leading Region: North America

- Key Country: United States

Within Deployment Mode, the Cloud segment is experiencing the most significant growth. This is attributed to the inherent scalability, flexibility, and cost-effectiveness of cloud-based managed solutions. Organizations are increasingly migrating their IT operations to the cloud to leverage these benefits.

- Dominant Deployment Mode: Cloud

- Key Drivers: Scalability, flexibility, cost-efficiency, pay-as-you-go models.

In terms of End-user Verticals, the Telecommunication and IT sector leads the market, closely followed by the BFSI (Banking, Financial Services, and Insurance) sector. These industries are characterized by their heavy reliance on complex IT systems, stringent security requirements, and the constant need for innovation and agility, making them prime candidates for managed IT services.

- Leading End-user Vertical: Telecommunication and IT

- Secondary Leading Vertical: BFSI

- Drivers in Telecommunication and IT: Network management, data center services, cybersecurity, digital transformation initiatives.

- Drivers in BFSI: Regulatory compliance, data security, fraud detection, customer experience enhancement.

The Function segment of Network Monitoring and Security is a critical area of growth, reflecting the escalating cybersecurity threats and the imperative for robust network infrastructure management.

- Dominant Function: Network Monitoring and Security

- Drivers: Rising cyber threats, need for 24/7 network uptime, compliance mandates.

Managed Information Services Market Product Landscape

The Managed Information Services Market product landscape is characterized by continuous innovation, with a focus on delivering integrated and intelligent solutions. Cloud-based platforms are central to product development, offering enhanced flexibility and scalability. Unique selling propositions often revolve around advanced security features, proactive threat detection using AI and machine learning, and customized service level agreements (SLAs) tailored to specific client needs. Performance metrics are increasingly measured by uptime guarantees, response times, and the quantifiable impact of managed services on business productivity and cost savings.

Key Drivers, Barriers & Challenges in Managed Information Services Market

Key Drivers:

- Digital Transformation: The imperative for businesses to modernize IT infrastructure and embrace digital technologies.

- Cybersecurity Threats: Escalating and sophisticated cyberattacks necessitate robust managed security services.

- Cost Optimization: Outsourcing IT functions to managed service providers (MSPs) offers significant cost savings compared to in-house management.

- Skilled IT Labor Shortage: Difficulty in recruiting and retaining skilled IT professionals drives demand for MSPs.

- Cloud Adoption: The widespread migration to cloud environments necessitates specialized cloud management services.

Barriers & Challenges:

- Security Concerns: Residual concerns among some organizations regarding data security and privacy when outsourcing.

- Vendor Lock-in: The risk of becoming overly dependent on a single MSP, limiting flexibility.

- Integration Complexity: Challenges in integrating MSP services with existing on-premise IT infrastructure.

- Regulatory Compliance: Navigating diverse and evolving regulatory landscapes across different industries and geographies.

- Economic Downturns: Potential reduction in IT spending during economic slowdowns can impact demand.

Emerging Opportunities in Managed Information Services Market

Emerging opportunities lie in the growing demand for specialized managed services such as AI-driven IT operations (AIOps), Internet of Things (IoT) management, and advanced analytics. The expansion of managed services for remote work environments and the increasing adoption of hybrid cloud strategies present significant untapped markets. Furthermore, the focus on providing industry-specific managed solutions, such as tailored cybersecurity for healthcare or compliance management for financial institutions, represents a key growth avenue.

Growth Accelerators in the Managed Information Services Market Industry

Catalysts driving long-term growth in the Managed Information Services Market include technological breakthroughs in automation and AI, enabling more efficient and proactive service delivery. Strategic partnerships between MSPs and technology vendors are crucial for expanding service offerings and market reach. The increasing maturity of the cloud ecosystem and the development of standardized managed service frameworks are further accelerating adoption. Moreover, the ongoing trend of digital transformation across global enterprises will continue to fuel the demand for comprehensive IT outsourcing solutions.

Key Players Shaping the Managed Information Services Market Market

- Accenture PLC

- Hewlett-Packard Enterprise

- IBM Corporation

- Wipro Ltd

- Fujitsu Ltd

- Cisco Systems Inc

- Microsoft Corporation

- Nokia Solutions and Networks

- Deutsche Telekom AG

- Tata Consultancy Services Limited

- Dell Technologies Inc

- Rackspace Inc

Notable Milestones in Managed Information Services Market Sector

- January 2023: Hughes Network Systems introduced programs for small and medium-sized enterprises (SMEs), offering network security and enterprise-grade protections through its newly launched Managed Detection and Response (MDR) service. This development enhances proactive intervention and real-time incident response capabilities.

- December 2022: Slovak University of Technology (STU) signed a scientific research contract with IBM, fostering collaboration in joint education, training, and support for students within specific professional subjects.

- November 2022: TCS introduced Managed Services for Security with SAP, designed to secure SAP environments on Microsoft Azure by covering identity and access management, network security, cloud infrastructure security, and cloud SecOps, ensuring data protection and zero-trust policies.

In-Depth Managed Information Services Market Market Outlook

The Managed Information Services Market is poised for sustained growth, driven by the ongoing digital transformation imperatives and the escalating complexity of IT landscapes. Future potential is significant, with an increasing demand for specialized services like AIOps and IoT management. Strategic opportunities abound in expanding into emerging economies, developing niche vertical-specific solutions, and further leveraging AI and automation to enhance service delivery. The market's evolution will be shaped by continued innovation in cybersecurity, cloud management, and data analytics, making it a dynamic and rewarding sector for both providers and clients.

Managed Information Services Market Segmentation

-

1. Function

- 1.1. Data Backup and Recovery

- 1.2. Network Monitoring and Security

- 1.3. Human Resource

- 1.4. System Management

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Vertical

- 3.1. Telecommunication and IT

- 3.2. BFSI

- 3.3. Retail

Managed Information Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. Australia and New Zealand

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Managed Information Services Market Regional Market Share

Geographic Coverage of Managed Information Services Market

Managed Information Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Limited IT Budget of SMEs Leads to Outsourcing of IT Infrastructure

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Data Backup and Recovery to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Managed Information Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Data Backup and Recovery

- 5.1.2. Network Monitoring and Security

- 5.1.3. Human Resource

- 5.1.4. System Management

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Telecommunication and IT

- 5.3.2. BFSI

- 5.3.3. Retail

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Managed Information Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Data Backup and Recovery

- 6.1.2. Network Monitoring and Security

- 6.1.3. Human Resource

- 6.1.4. System Management

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Telecommunication and IT

- 6.3.2. BFSI

- 6.3.3. Retail

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. Europe Managed Information Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Data Backup and Recovery

- 7.1.2. Network Monitoring and Security

- 7.1.3. Human Resource

- 7.1.4. System Management

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Telecommunication and IT

- 7.3.2. BFSI

- 7.3.3. Retail

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Asia Managed Information Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Data Backup and Recovery

- 8.1.2. Network Monitoring and Security

- 8.1.3. Human Resource

- 8.1.4. System Management

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Telecommunication and IT

- 8.3.2. BFSI

- 8.3.3. Retail

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Latin America Managed Information Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Data Backup and Recovery

- 9.1.2. Network Monitoring and Security

- 9.1.3. Human Resource

- 9.1.4. System Management

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Telecommunication and IT

- 9.3.2. BFSI

- 9.3.3. Retail

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Middle East and Africa Managed Information Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Data Backup and Recovery

- 10.1.2. Network Monitoring and Security

- 10.1.3. Human Resource

- 10.1.4. System Management

- 10.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Telecommunication and IT

- 10.3.2. BFSI

- 10.3.3. Retail

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hewlett-Packard Enterprise

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wipro Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nokia Solutions and Networks

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deutsche Telekom AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tata Consultancy Services Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dell Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rackspace Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global Managed Information Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Managed Information Services Market Revenue (Million), by Function 2025 & 2033

- Figure 3: North America Managed Information Services Market Revenue Share (%), by Function 2025 & 2033

- Figure 4: North America Managed Information Services Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 5: North America Managed Information Services Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 6: North America Managed Information Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Managed Information Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Managed Information Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Managed Information Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Managed Information Services Market Revenue (Million), by Function 2025 & 2033

- Figure 11: Europe Managed Information Services Market Revenue Share (%), by Function 2025 & 2033

- Figure 12: Europe Managed Information Services Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 13: Europe Managed Information Services Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 14: Europe Managed Information Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Managed Information Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Managed Information Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Managed Information Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Managed Information Services Market Revenue (Million), by Function 2025 & 2033

- Figure 19: Asia Managed Information Services Market Revenue Share (%), by Function 2025 & 2033

- Figure 20: Asia Managed Information Services Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 21: Asia Managed Information Services Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 22: Asia Managed Information Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Managed Information Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Managed Information Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Managed Information Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Managed Information Services Market Revenue (Million), by Function 2025 & 2033

- Figure 27: Latin America Managed Information Services Market Revenue Share (%), by Function 2025 & 2033

- Figure 28: Latin America Managed Information Services Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 29: Latin America Managed Information Services Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 30: Latin America Managed Information Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Managed Information Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Managed Information Services Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Managed Information Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Managed Information Services Market Revenue (Million), by Function 2025 & 2033

- Figure 35: Middle East and Africa Managed Information Services Market Revenue Share (%), by Function 2025 & 2033

- Figure 36: Middle East and Africa Managed Information Services Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 37: Middle East and Africa Managed Information Services Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 38: Middle East and Africa Managed Information Services Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Managed Information Services Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Managed Information Services Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Managed Information Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Managed Information Services Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Global Managed Information Services Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 3: Global Managed Information Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Managed Information Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Managed Information Services Market Revenue Million Forecast, by Function 2020 & 2033

- Table 6: Global Managed Information Services Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 7: Global Managed Information Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Managed Information Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Managed Information Services Market Revenue Million Forecast, by Function 2020 & 2033

- Table 12: Global Managed Information Services Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 13: Global Managed Information Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Managed Information Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Managed Information Services Market Revenue Million Forecast, by Function 2020 & 2033

- Table 19: Global Managed Information Services Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 20: Global Managed Information Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Managed Information Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia and New Zealand Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Managed Information Services Market Revenue Million Forecast, by Function 2020 & 2033

- Table 26: Global Managed Information Services Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 27: Global Managed Information Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Managed Information Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Mexico Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Brazil Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Managed Information Services Market Revenue Million Forecast, by Function 2020 & 2033

- Table 32: Global Managed Information Services Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 33: Global Managed Information Services Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 34: Global Managed Information Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Managed Information Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Managed Information Services Market?

The projected CAGR is approximately 15.66%.

2. Which companies are prominent players in the Managed Information Services Market?

Key companies in the market include Accenture PLC, Hewlett-Packard Enterprise, IBM Corporation, Wipro Ltd, Fujitsu Ltd, Cisco Systems Inc, Microsoft Corporation, Nokia Solutions and Networks, Deutsche Telekom AG, Tata Consultancy Services Limited, Dell Technologies Inc, Rackspace Inc.

3. What are the main segments of the Managed Information Services Market?

The market segments include Function, Deployment Mode, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 305.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Limited IT Budget of SMEs Leads to Outsourcing of IT Infrastructure.

6. What are the notable trends driving market growth?

Data Backup and Recovery to Dominate the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

January 2023: Hughes Network Systems introduced programs for small and medium-sized enterprises (SMEs). This will offer the organization network security and the benefits of in-house, enterprise-grade protections. The newly launched Managed Detection and Response (MDR) service protects enterprises from cyber criminals with proactive intervention, real-time incident response, and active threat containment through automation and trained security professionals' attention.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Managed Information Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Managed Information Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Managed Information Services Market?

To stay informed about further developments, trends, and reports in the Managed Information Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence