Key Insights

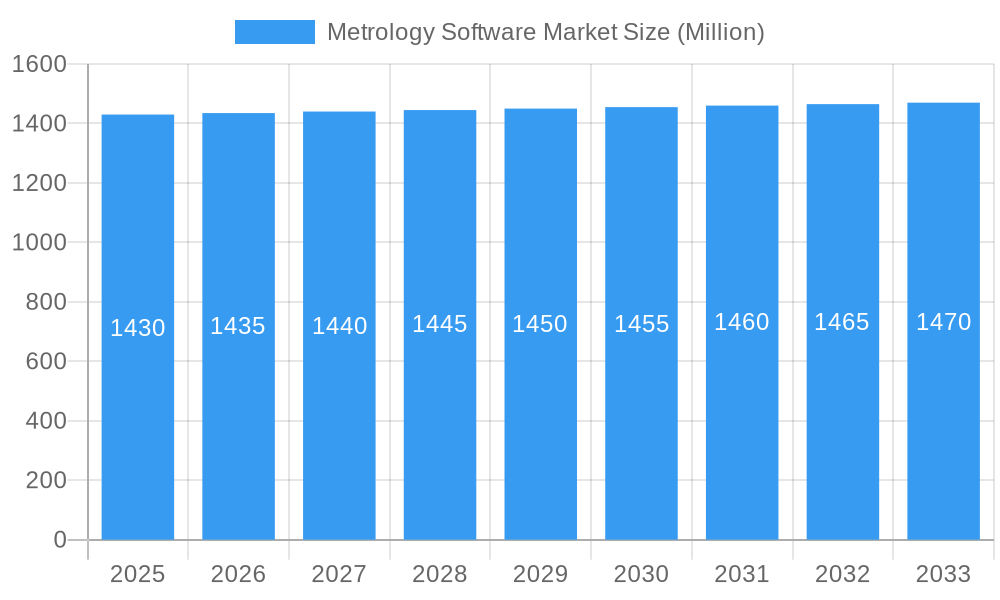

The Metrology Software Market is poised for substantial growth, projected to reach approximately USD 1.43 billion in 2025. This expansion is driven by an estimated Compound Annual Growth Rate (CAGR) of 0.08% through the forecast period of 2025-2033. Key growth accelerators include the increasing adoption of Industry 4.0 technologies, the burgeoning demand for automation and precision in manufacturing processes, and the continuous advancements in 3D scanning and digital twin technologies. The automotive and aerospace sectors are leading the charge, leveraging metrology software for enhanced quality control, product development, and compliance with stringent industry standards. Furthermore, the rapid digitalization within the electronic manufacturing industry, coupled with the need for intricate component inspection, significantly contributes to market expansion. Emerging applications in areas like additive manufacturing and personalized medicine also present promising avenues for growth, indicating a dynamic and evolving market landscape.

Metrology Software Market Market Size (In Billion)

Despite the robust growth trajectory, the market faces certain restraints that warrant strategic consideration. The high initial investment costs associated with advanced metrology software and hardware, coupled with the need for specialized skilled personnel for operation and maintenance, can pose a barrier to adoption, especially for small and medium-sized enterprises (SMEs). Moreover, data security concerns and the integration complexities with existing legacy systems present ongoing challenges. However, the persistent drive for enhanced product quality, reduced scrap rates, and improved operational efficiency, supported by ongoing research and development by leading companies such as Hexagon AB, Renishaw PLC, and Nikon Metrology NV, is expected to counterbalance these restraints. The market's evolution will likely see a greater emphasis on cloud-based solutions, AI-driven analytics, and user-friendly interfaces to address skill gaps and integration hurdles.

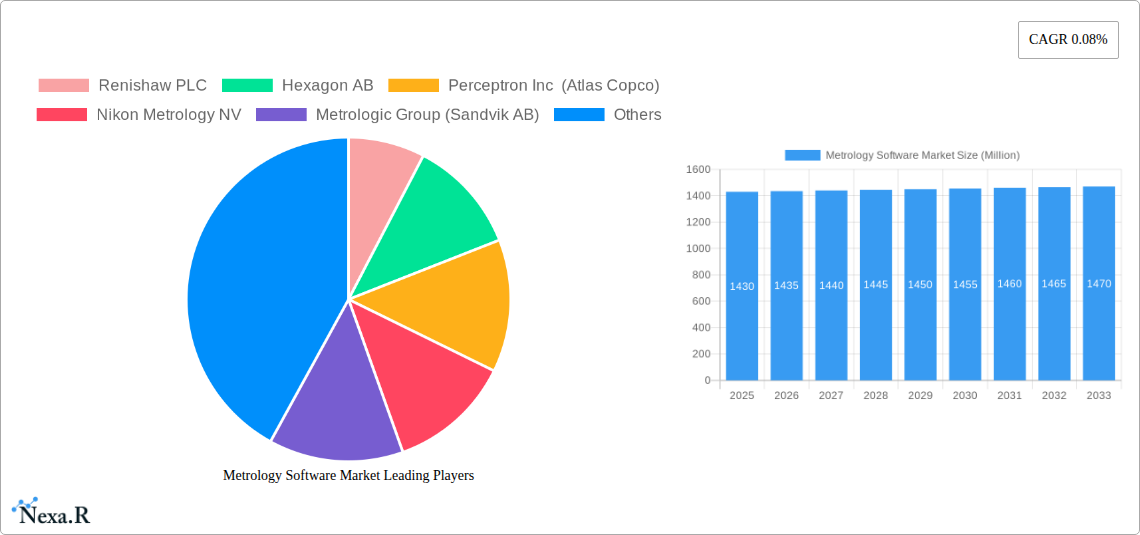

Metrology Software Market Company Market Share

Metrology Software Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report offers an in-depth analysis of the global Metrology Software Market, a critical component of modern manufacturing and quality control. Spanning from 2019 to 2033, with a base year of 2025, this comprehensive study illuminates market dynamics, growth trajectories, and the strategic landscape. We delve into parent and child markets, dissecting the intricate relationships and revenue streams that define this evolving industry. With a focus on high-traffic keywords such as "metrology software," "dimensional measurement software," "inspection software," "quality control software," and "manufacturing analytics," this report is meticulously crafted to enhance search engine visibility and deliver actionable insights for industry professionals, investors, and stakeholders.

Metrology Software Market Market Dynamics & Structure

The Metrology Software Market is characterized by a moderately concentrated structure, with key players like Hexagon AB, Carl Zeiss AG, and Renishaw PLC holding significant market shares. Technological innovation remains the primary driver, fueled by advancements in Artificial Intelligence (AI), Machine Learning (ML), and Augmented Reality (AR) integrated into metrology solutions. These innovations are crucial for automating complex inspection processes, enhancing data analysis, and improving decision-making in manufacturing. Regulatory frameworks, particularly those pertaining to quality standards and data security in industries like automotive and aerospace, play a vital role in shaping market demands. The competitive landscape is further intensified by the availability of advanced computer-aided inspection (CAI) and computer-aided manufacturing (CAM) software, acting as competitive product substitutes in certain applications. End-user demographics are increasingly sophisticated, demanding integrated, cloud-based, and user-friendly metrology software. Merger and Acquisition (M&A) trends are active, with larger entities acquiring specialized software providers to broaden their product portfolios and technological capabilities. For instance, the acquisition of Metrologic Group by Sandvik AB signifies this consolidation trend. Innovation barriers include the high cost of R&D and the need for specialized expertise in both metrology and software development, alongside data interoperability challenges.

- Market Concentration: Moderately concentrated, with a few key players dominating market share.

- Technological Innovation Drivers: AI, ML, AR integration for automation and advanced analytics.

- Regulatory Frameworks: Focus on quality standards (ISO, AS9100) and data integrity.

- Competitive Product Substitutes: Advanced CAI/CAM software, manual inspection methods.

- End-User Demographics: Demand for integrated, cloud-based, and intuitive solutions.

- M&A Trends: Active consolidation for portfolio expansion and technological integration.

- Innovation Barriers: High R&D costs, specialized expertise, data interoperability.

Metrology Software Market Growth Trends & Insights

The Metrology Software Market is poised for robust growth, driven by an escalating demand for precision, efficiency, and automation across various manufacturing sectors. Leveraging advanced analytical frameworks, we project the global market size to witness a substantial expansion in the coming years. The adoption rates of sophisticated metrology software are steadily increasing as manufacturers recognize its crucial role in reducing defects, improving product quality, and optimizing production cycles. Technological disruptions, such as the integration of IoT (Internet of Things) for real-time data collection and analysis, and the burgeoning application of AI for predictive maintenance and anomaly detection, are significantly reshaping the market. Consumer behavior shifts are evident, with a growing preference for end-to-end quality management solutions that offer seamless integration from design to production and inspection.

Specific metrics indicate a promising future: the estimated market size in 2025 stands at xx million units, with an anticipated Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Market penetration is deepening as small and medium-sized enterprises (SMEs) increasingly adopt scalable metrology software solutions to remain competitive. The transition from traditional inspection methods to automated, software-driven metrology is accelerating, particularly in high-volume manufacturing environments. The convergence of hardware and software capabilities, exemplified by smart inspection devices, further fuels this trend. Furthermore, the growing complexity of product designs, especially in the aerospace and automotive industries, necessitates advanced metrology software for accurate and efficient validation. The increasing emphasis on Industry 4.0 principles and smart manufacturing initiatives worldwide provides a fertile ground for the expansion of the metrology software ecosystem. The ability of these software solutions to generate actionable insights from vast amounts of inspection data is a key differentiator, driving their adoption for process optimization and cost reduction.

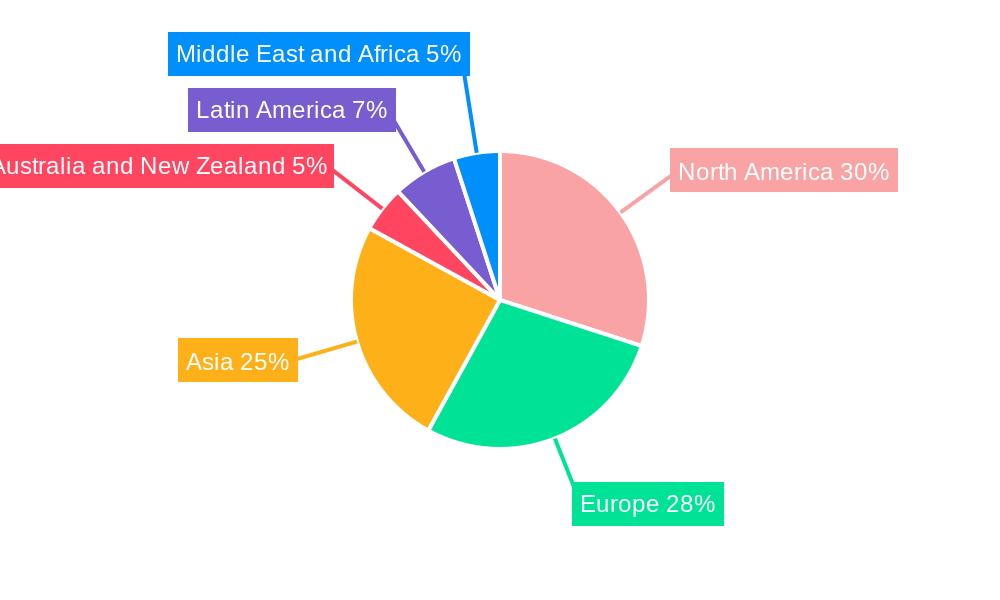

Dominant Regions, Countries, or Segments in Metrology Software Market

The Automotive end-user vertical is currently the dominant force driving growth within the global Metrology Software Market. This segment's leadership is underpinned by several critical factors, including the sheer volume of production, the intricate complexity of vehicle components, and the stringent safety and quality regulations that govern the industry. The automotive sector's relentless pursuit of lighter, stronger, and more efficient vehicles necessitates highly precise manufacturing processes, where metrology software plays an indispensable role in ensuring dimensional accuracy and component integrity.

- Automotive Industry Drivers:

- High Production Volumes: Continuous demand for mass production of vehicles drives the need for efficient and scalable inspection solutions.

- Complex Component Geometries: Modern vehicles feature intricate designs, requiring advanced software for detailed 3D scanning and analysis.

- Stringent Quality and Safety Standards: Regulatory bodies impose rigorous quality control requirements, making metrology software essential for compliance.

- Electric Vehicle (EV) Transition: The shift towards EVs introduces new components and manufacturing processes that require specialized metrology solutions for their validation.

- Cost Optimization: Manufacturers are focused on reducing scrap rates and rework, directly benefiting from the precision and error detection capabilities of metrology software.

- Supplier Quality Management: The complex automotive supply chain relies heavily on metrology software to ensure consistent quality from component suppliers.

The market share held by metrology software solutions in the automotive sector is substantial and continues to expand, estimated at xx% of the total market in 2025. The growth potential in this segment is further amplified by ongoing technological advancements in automotive manufacturing, such as the increasing use of advanced materials and additive manufacturing techniques. Geographically, regions with significant automotive manufacturing hubs, like North America, Europe, and Asia-Pacific (particularly China and Japan), exhibit the highest adoption rates and demand for metrology software. Government initiatives promoting advanced manufacturing and domestic production within these regions also contribute to the dominance of the automotive sector in this market.

Metrology Software Market Product Landscape

The product landscape of the Metrology Software Market is characterized by continuous innovation, offering a diverse range of solutions tailored to specific industrial needs. Key product innovations include the integration of AI and ML for automated defect detection and predictive quality analysis, significantly enhancing inspection efficiency and accuracy. Augmented reality (AR) capabilities are transforming how technicians interpret inspection data, enabling real-time guidance for assembly and quality checks. Applications span across 3D scanning, coordinate measuring machine (CMM) control, surface analysis, geometric dimensioning and tolerancing (GD&T) analysis, and reverse engineering. Performance metrics such as measurement speed, accuracy, repeatability, and ease of data interpretation are crucial selling propositions. Technological advancements are focused on creating more intuitive user interfaces, expanding interoperability with various hardware devices, and enabling cloud-based data management for enhanced collaboration and accessibility.

Key Drivers, Barriers & Challenges in Metrology Software Market

Key Drivers

The Metrology Software Market is propelled by several significant drivers. The relentless pursuit of enhanced product quality and reduced manufacturing defects across industries like automotive and aerospace is a primary motivator. The growing complexity of manufactured parts and assemblies necessitates sophisticated software for accurate dimensional analysis. The widespread adoption of Industry 4.0 principles and smart manufacturing initiatives, emphasizing automation, data analytics, and interconnected systems, further fuels demand. Technological advancements, particularly in AI, ML, and AR, are enabling more intelligent and efficient metrology solutions. Lastly, increasing regulatory compliance requirements for quality and safety standards worldwide also contribute to market growth.

Barriers & Challenges

Despite the strong growth potential, the Metrology Software Market faces certain barriers and challenges. The high initial investment cost for advanced metrology software and associated hardware can be a deterrent for small and medium-sized enterprises (SMEs). A shortage of skilled personnel proficient in operating and interpreting data from advanced metrology systems poses a significant challenge. Data integration and interoperability issues between different software platforms and hardware devices can create inefficiencies. Furthermore, the evolving threat landscape of cybersecurity requires robust measures to protect sensitive inspection data. Competitive pressures from alternative inspection methods and the need for continuous R&D to keep pace with technological advancements also present ongoing challenges.

Emerging Opportunities in Metrology Software Market

Emerging opportunities in the Metrology Software Market lie in the increasing adoption of cloud-based solutions, enabling remote inspection and data access, particularly beneficial for distributed manufacturing operations. The integration of metrology software with additive manufacturing (3D printing) processes presents a significant avenue for growth, ensuring the quality and accuracy of 3D-printed parts. The burgeoning demand for smart factory solutions, where metrology software plays a pivotal role in real-time quality monitoring and process optimization, offers vast untapped potential. Furthermore, the expansion of metrology software applications into niche industries such as medical device manufacturing and renewable energy sector components, driven by their stringent quality requirements, represents a promising frontier.

Growth Accelerators in the Metrology Software Market Industry

Several key factors are accelerating growth in the Metrology Software Market. Technological breakthroughs, such as the development of more sophisticated AI algorithms for automated quality inspection and the advancement of AR/VR technologies for immersive metrology visualization and training, are significant growth accelerators. Strategic partnerships between software developers and hardware manufacturers are crucial, leading to more integrated and seamless metrology solutions. Market expansion strategies, including the penetration into emerging economies with rapidly industrializing manufacturing sectors, are also driving growth. The increasing focus on data-driven decision-making and the ability of metrology software to provide actionable insights for process improvement are further accelerating adoption across various industries.

Key Players Shaping the Metrology Software Market Market

- Renishaw PLC

- Hexagon AB

- Perceptron Inc (Atlas Copco)

- Nikon Metrology NV

- Metrologic Group (Sandvik AB)

- Fluke Corporation

- Autodesk Inc

- 3D Systems Inc

- Carl Zeiss AG

- Innovmetric Software Inc

- Faro Technologies

- LK Metrology Ltd

- Creaform Inc (AMETEK Inc )

Notable Milestones in Metrology Software Market Sector

- August 2022: 3D Infotech announced new releases of its Streamline and Spotlight AR++ software as part of its Universal Metrology Automation (UMA) platform. The new Spotlight AR++ extends 3D Infotech's capability from guided metrology workflows to guided assembly applications, while the new version of Streamline offers extended support with advanced settings for devices from LMI Technologies, Cognex, Universal Robots, and many others. This development enhances the versatility and automation capabilities of metrology workflows.

- March 2022: Nikon Metrology launched AutoMeasure version 13, featuring two new functionalities designed to optimize system performance, thereby reducing operational costs and increasing productivity for manufacturing companies and inspection bureaus. This release highlights continuous efforts to enhance user efficiency and competitive advantage.

In-Depth Metrology Software Market Market Outlook

The future outlook for the Metrology Software Market is exceptionally bright, driven by sustained technological advancements and the increasing integration of metrology solutions into the broader Industry 4.0 ecosystem. Growth accelerators, including the pervasive adoption of AI for intelligent quality control and the expansion of AR/VR applications for intuitive data interaction, will continue to shape the market. Strategic partnerships and the increasing demand for end-to-end quality management systems are fostering innovation and market expansion. The market's trajectory is further bolstered by a growing awareness of the economic benefits derived from precise measurement and early defect detection, such as reduced scrap, improved efficiency, and enhanced product reliability. Future growth will be characterized by the development of more accessible, cloud-enabled, and intelligent metrology software solutions catering to a wider range of industries and business sizes.

Metrology Software Market Segmentation

-

1. End-user Vertical

- 1.1. Automotive

- 1.2. Aerospace

- 1.3. Electronic Manufacturing

- 1.4. Other End-user Verticals

Metrology Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Metrology Software Market Regional Market Share

Geographic Coverage of Metrology Software Market

Metrology Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Drive Toward Automation of Processes in Manufacturing Industry; Demand for High-quality Products from Consumers; Increasing Need for Intelligent and Effective Data Acquisition

- 3.2.2 Analysis

- 3.2.3 and Evaluation and Powerful Data Management and Reporting Tools

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Aerospace Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Automotive

- 5.1.2. Aerospace

- 5.1.3. Electronic Manufacturing

- 5.1.4. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. North America Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. Automotive

- 6.1.2. Aerospace

- 6.1.3. Electronic Manufacturing

- 6.1.4. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Europe Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. Automotive

- 7.1.2. Aerospace

- 7.1.3. Electronic Manufacturing

- 7.1.4. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Asia Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. Automotive

- 8.1.2. Aerospace

- 8.1.3. Electronic Manufacturing

- 8.1.4. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Australia and New Zealand Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. Automotive

- 9.1.2. Aerospace

- 9.1.3. Electronic Manufacturing

- 9.1.4. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Latin America Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.1.1. Automotive

- 10.1.2. Aerospace

- 10.1.3. Electronic Manufacturing

- 10.1.4. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 11. Middle East and Africa Metrology Software Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.1.1. Automotive

- 11.1.2. Aerospace

- 11.1.3. Electronic Manufacturing

- 11.1.4. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renishaw PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hexagon AB

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Perceptron Inc (Atlas Copco)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nikon Metrology NV

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Metrologic Group (Sandvik AB)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fluke Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Autodesk Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 3D Systems Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Carl Zeiss AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Innovmetric Software Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Faro Technologies

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 LK Metrology Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Creaform Inc (AMETEK Inc )

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Renishaw PLC

List of Figures

- Figure 1: Global Metrology Software Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metrology Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 3: North America Metrology Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 4: North America Metrology Software Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Metrology Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Metrology Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: Europe Metrology Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: Europe Metrology Software Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Metrology Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Metrology Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Asia Metrology Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Asia Metrology Software Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Metrology Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Metrology Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Australia and New Zealand Metrology Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Australia and New Zealand Metrology Software Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Metrology Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Metrology Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 19: Latin America Metrology Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 20: Latin America Metrology Software Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Metrology Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Metrology Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Middle East and Africa Metrology Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Middle East and Africa Metrology Software Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Metrology Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 2: Global Metrology Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Metrology Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Metrology Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Metrology Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Metrology Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Metrology Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Metrology Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Metrology Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metrology Software Market?

The projected CAGR is approximately 0.08%.

2. Which companies are prominent players in the Metrology Software Market?

Key companies in the market include Renishaw PLC, Hexagon AB, Perceptron Inc (Atlas Copco), Nikon Metrology NV, Metrologic Group (Sandvik AB), Fluke Corporation, Autodesk Inc, 3D Systems Inc, Carl Zeiss AG, Innovmetric Software Inc, Faro Technologies, LK Metrology Ltd, Creaform Inc (AMETEK Inc ).

3. What are the main segments of the Metrology Software Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Drive Toward Automation of Processes in Manufacturing Industry; Demand for High-quality Products from Consumers; Increasing Need for Intelligent and Effective Data Acquisition. Analysis. and Evaluation and Powerful Data Management and Reporting Tools.

6. What are the notable trends driving market growth?

Aerospace Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: 3D Infotech has announced new releases of its Streamline and Spotlight AR++ software as a part of its Universal Metrology Automation (UMA) platform. The new Spotlight AR++extends 3D Infotech's capability from guided metrology workflows to guided assembly applications, while the new version of Streamline offers extended support with advanced settings for devices from LMI Technologies, Cognex, Universal Robots, and many others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metrology Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metrology Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metrology Software Market?

To stay informed about further developments, trends, and reports in the Metrology Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence