Key Insights

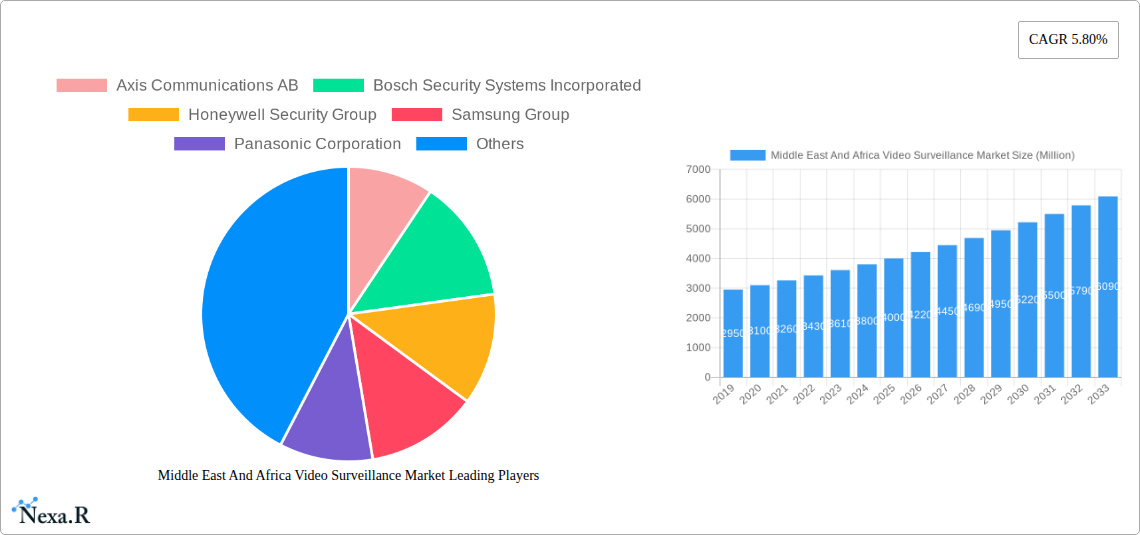

The Middle East and Africa (MEA) video surveillance market is poised for robust growth, projected to reach a significant valuation by 2025. This expansion is fueled by an increasing emphasis on security and safety across diverse sectors, driven by rising urbanization, infrastructure development, and a growing awareness of the benefits of advanced surveillance technologies. The market's upward trajectory is further supported by a projected Compound Annual Growth Rate (CAGR) of 5.80%, indicating sustained and dynamic expansion throughout the forecast period. This growth is underpinned by the increasing adoption of both hardware and software solutions, with IP cameras and advanced video analytics playing pivotal roles in enhancing threat detection and operational efficiency. The demand for sophisticated Video Surveillance as a Service (VSaaS) is also on the rise, offering scalable and cost-effective solutions for businesses of all sizes.

Middle East And Africa Video Surveillance Market Market Size (In Billion)

The MEA region, with its unique security challenges and opportunities, presents a fertile ground for video surveillance advancements. Key drivers for this market include governmental initiatives to bolster public safety, the need for enhanced security in commercial and industrial complexes, and the growing adoption in institutional and residential sectors. While the market benefits from these strong growth factors, it also navigates certain restraints, such as the initial investment cost of high-end solutions and evolving data privacy regulations. However, the continuous innovation in AI-powered video analytics, cloud-based storage, and the integration of surveillance systems with other smart building technologies are expected to overcome these challenges, paving the way for a more secure and interconnected future across the MEA.

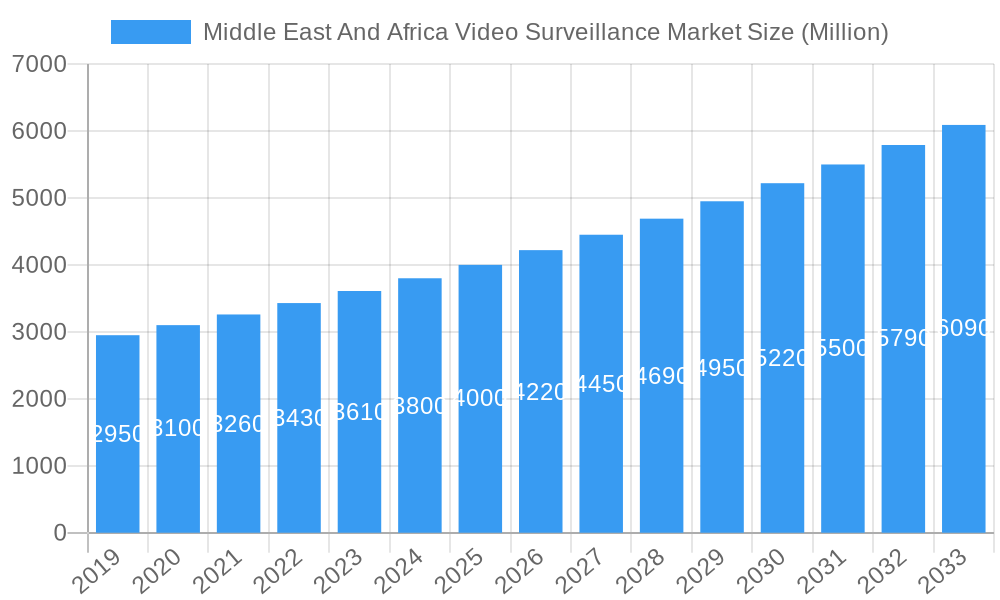

Middle East And Africa Video Surveillance Market Company Market Share

Middle East And Africa Video Surveillance Market: Comprehensive Market Analysis and Growth Forecast (2019–2033)

This comprehensive report delivers an in-depth analysis of the Middle East and Africa (MEA) Video Surveillance Market, encompassing hardware, software, and services. It provides a detailed outlook on market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and the strategies of leading players. With a study period spanning from 2019 to 2033, this report offers critical insights for stakeholders navigating this rapidly evolving sector. The MEA Video Surveillance market is projected to reach $8,250.5 million units in 2025, with substantial growth anticipated throughout the forecast period.

Middle East And Africa Video Surveillance Market Market Dynamics & Structure

The MEA Video Surveillance market is characterized by a moderately concentrated competitive landscape, with key players like Axis Communications AB, Bosch Security Systems Incorporated, Honeywell Security Group, and Dahua Technology India Pvt Ltd vying for market share. Technological innovation is a primary driver, fueled by advancements in AI-powered video analytics, cloud-based solutions, and the increasing adoption of IP cameras. Regulatory frameworks are gradually evolving across the region, with a growing emphasis on data privacy and security standards, impacting the deployment of surveillance systems. Competitive product substitutes, ranging from basic analog cameras to sophisticated AI-driven platforms, offer a wide spectrum of choices for end-users. End-user demographics are diverse, with significant demand stemming from commercial establishments, infrastructure projects, and institutional facilities, increasingly supplemented by residential and industrial applications. Mergers and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of smaller specialized firms by larger corporations aims to integrate advanced analytics and cloud services.

- Market Concentration: Moderate, with a few dominant global players and a growing number of regional and specialized vendors.

- Technological Innovation Drivers: AI for facial recognition and anomaly detection, IoT integration, 4K resolution cameras, cybersecurity for surveillance systems.

- Regulatory Frameworks: Emerging data protection laws and security compliance standards across GCC and African nations.

- Competitive Product Substitutes: Analog cameras vs. IP cameras, on-premise VMS vs. VSaaS, basic recording vs. intelligent video analytics.

- End-User Demographics: Shift towards smart city initiatives, retail analytics, and critical infrastructure protection.

- M&A Trends: Strategic acquisitions for cloud integration, AI capabilities, and market entry into high-growth sub-regions.

Middle East And Africa Video Surveillance Market Growth Trends & Insights

The MEA Video Surveillance Market is experiencing robust growth, driven by escalating security concerns, government initiatives for smart city development, and the increasing adoption of advanced surveillance technologies. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. Adoption rates for IP cameras and Video Analytics software are significantly outpacing traditional analog systems. Technological disruptions, such as the integration of Artificial Intelligence (AI) for real-time threat detection and predictive analysis, are reshaping the industry. Consumer behavior shifts are evident, with an increasing demand for user-friendly, cloud-connected, and data-driven surveillance solutions. The rise of the Internet of Things (IoT) is further accelerating the integration of video surveillance into broader smart building and city ecosystems. For example, the penetration of AI-enabled video analytics in retail for customer behavior analysis and loss prevention is a key growth indicator. The convenience offered by Video Surveillance as a Service (VSaaS) is also a significant factor driving market penetration, particularly among small and medium-sized enterprises (SMEs). The escalating need for perimeter security in large-scale infrastructure projects and industrial complexes further propels market expansion.

Dominant Regions, Countries, or Segments in Middle East And Africa Video Surveillance Market

Within the Middle East and Africa Video Surveillance Market, the Commercial end-user vertical is currently the dominant segment, driven by a persistent demand for enhanced security in retail environments, hospitality, and corporate offices. Countries within the Gulf Cooperation Council (GCC), particularly the UAE and Saudi Arabia, are leading the market due to substantial investments in smart city projects, tourism infrastructure, and large-scale event security. The IP Camera segment within the Hardware category is the fastest-growing product segment, exhibiting a higher adoption rate than Analog or Hybrid cameras due to its superior image quality, scalability, and advanced features. The increasing deployment of Video Analytics and Video Management Software (VMS) is also a significant growth driver, enabling intelligent monitoring and data-driven insights.

- Dominant End-User Vertical: Commercial sector, encompassing retail, hospitality, BFSI, and corporate offices.

- Key Drivers: Need for loss prevention, customer analytics, access control integration, and enhanced operational efficiency.

- Market Share (Estimated): Approximately 35% of the total market revenue in 2025.

- Dominant Geographic Focus: GCC countries (UAE, Saudi Arabia, Qatar), driven by infrastructure development and smart city initiatives.

- Key Drivers: Government investments in public safety, large-scale construction projects, and hosting of international events.

- Market Share (Estimated): Dominating over 50% of the MEA market revenue in 2025.

- Dominant Product Segment (Hardware): IP Cameras.

- Key Drivers: Superior resolution, remote accessibility, integration with AI analytics, and cost-effectiveness over the long term compared to analog systems.

- Market Share (Estimated): Contributing 60% to the hardware segment revenue in 2025.

- Dominant Product Segment (Software): Video Analytics.

- Key Drivers: Demand for real-time threat detection, facial recognition, object tracking, and business intelligence.

- Market Share (Estimated): Experiencing a CAGR of over 15% in the forecast period.

Middle East And Africa Video Surveillance Market Product Landscape

The MEA Video Surveillance market is witnessing a surge in innovative product offerings. Advanced IP cameras with AI capabilities, such as object detection and facial recognition, are becoming standard. The introduction of specialized cameras, like the FUJINON SX1600 for long-range surveillance, highlights the focus on niche applications. Cloud-based Video Management Software (VMS) and Video Surveillance as a Service (VSaaS) are gaining traction, offering scalability, remote access, and reduced infrastructure costs for businesses. Hybrid systems are also evolving to bridge the gap between legacy analog infrastructure and modern IP networks. These products are designed for enhanced performance, cybersecurity, and seamless integration with other smart building technologies.

Key Drivers, Barriers & Challenges in Middle East And Africa Video Surveillance Market

Key Drivers:

- Rising Security Concerns: Increasing incidence of crime and terrorism necessitates robust surveillance solutions.

- Government Initiatives: Smart city projects and national security programs are driving significant demand for video surveillance infrastructure.

- Technological Advancements: AI, IoT integration, and higher resolution cameras enhance surveillance capabilities.

- Cost-Effectiveness of IP Cameras: Long-term operational benefits and scalability of IP systems over analog.

- Growth in Key Verticals: Expansion of commercial, infrastructure, and industrial sectors in the region.

Barriers & Challenges:

- High Initial Investment Costs: For advanced systems, particularly for SMEs, can be a significant barrier.

- Data Privacy and Regulatory Hurdles: Varying and evolving data protection laws across different countries can complicate deployment.

- Cybersecurity Threats: Vulnerability of networked surveillance systems to cyber-attacks requires robust security measures.

- Skilled Workforce Shortage: Lack of trained professionals for installation, maintenance, and operation of advanced systems.

- Interoperability Issues: Challenges in integrating systems from different manufacturers.

- Power and Internet Connectivity: In some parts of the region, unreliable power and internet infrastructure can hinder deployment of certain solutions.

Emerging Opportunities in Middle East And Africa Video Surveillance Market

Emerging opportunities in the MEA Video Surveillance Market lie in the increasing adoption of AI-powered analytics for predictive policing and public safety, especially in rapidly urbanizing areas. The growing demand for integrated security solutions that combine video surveillance with access control, intrusion detection, and fire alarms presents a significant opportunity. The expansion of VSaaS models tailored for SMEs is a key area for growth, offering affordable and scalable surveillance solutions. Furthermore, the development of specialized surveillance systems for niche applications like border control, remote asset monitoring, and smart agriculture will unlock new revenue streams. The trend towards smart homes and the integration of video doorbells and residential security cameras also presents a burgeoning market segment.

Growth Accelerators in the Middle East And Africa Video Surveillance Market Industry

Growth accelerators in the MEA Video Surveillance Market industry include strategic partnerships and collaborations between technology providers and local system integrators to enhance market penetration and provide localized support. The increasing government focus on enhancing public safety and security through smart city initiatives is a major catalyst. Furthermore, technological breakthroughs in areas like edge computing for on-device video analytics and the development of more energy-efficient cameras are contributing to market expansion. The growing adoption of 5G networks is expected to enable higher bandwidth and lower latency for real-time video transmission and analysis, further accelerating growth. The demand for sophisticated analytics for business intelligence in retail and smart building management also acts as a significant growth driver.

Key Players Shaping the Middle East And Africa Video Surveillance Market Market

- Axis Communications AB

- Bosch Security Systems Incorporated

- Honeywell Security Group

- Samsung Group

- Panasonic Corporation

- FLIR Systems Inc

- Schneider Electric SE

- Fujifilm Corporation

- Eagle Eye Networks

- Johnson Controls

- Dahua Technology India Pvt Ltd

- Motorola Solutions Inc

- Veesion

- Ava Security

- Mobotix

Notable Milestones in Middle East And Africa Video Surveillance Market Sector

- March 2024: Hikvision announced a technology partnership with Can'nX, enabling Hikvision technologies to be integrated with the KNX protocol, the global standard for home and building automation. This collaboration enhances building automation solutions by integrating Hikvision AI-enabled devices, improving building management efficiency and overall security.

- October 2023: FUJIFILM introduced the FUJINON SX1600 camera system for long-range surveillance applications at the Milipol homeland security and safety show. This state-of-the-art system features a 40x-zoom FUJINON lens and a newly developed image stabilization system for clear and instantaneous capture of distant subjects.

In-Depth Middle East And Africa Video Surveillance Market Market Outlook

The MEA Video Surveillance Market is poised for substantial growth, driven by a confluence of factors including escalating security needs, proactive government investments in smart infrastructure, and the relentless pace of technological innovation. Future market potential will be significantly shaped by the increasing adoption of AI-driven video analytics, enabling predictive capabilities and proactive threat mitigation. Strategic opportunities abound in developing integrated security solutions that encompass video, access control, and IoT devices. The expansion of cloud-based VSaaS models will democratize access to advanced surveillance for a broader range of businesses. As connectivity improves with 5G deployment, real-time, high-definition video streaming and analysis will become more prevalent, further solidifying the market's trajectory. The growing emphasis on cybersecurity will also drive demand for robust, secure surveillance platforms.

Middle East And Africa Video Surveillance Market Segmentation

-

1. Type

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Camera

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Services (VSaaS)

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Defense

- 2.6. Residential

Middle East And Africa Video Surveillance Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Video Surveillance Market Regional Market Share

Geographic Coverage of Middle East And Africa Video Surveillance Market

Middle East And Africa Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.3. Market Restrains

- 3.3.1. Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.4. Market Trends

- 3.4.1. Rising Geopolitical Unrest in the Region Driving the Importance of Proper Surveillance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Camera

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Services (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Defense

- 5.2.6. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security Systems Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell Security Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FLIR Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fujifilm Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eagle Eye Networks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Johnson Controls

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology India Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Motorola Solutions Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Veesion

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ava Security

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mobotix*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: Middle East And Africa Video Surveillance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Video Surveillance Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Video Surveillance Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Middle East And Africa Video Surveillance Market?

Key companies in the market include Axis Communications AB, Bosch Security Systems Incorporated, Honeywell Security Group, Samsung Group, Panasonic Corporation, FLIR Systems Inc, Schneider Electric SE, Fujifilm Corporation, Eagle Eye Networks, Johnson Controls, Dahua Technology India Pvt Ltd, Motorola Solutions Inc, Veesion, Ava Security, Mobotix*List Not Exhaustive.

3. What are the main segments of the Middle East And Africa Video Surveillance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

6. What are the notable trends driving market growth?

Rising Geopolitical Unrest in the Region Driving the Importance of Proper Surveillance.

7. Are there any restraints impacting market growth?

Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

8. Can you provide examples of recent developments in the market?

March 2024: Hikvision announced a technology partnership with Can'nX, enabling Hikvision technologies to be integrated with the KNX protocol, the global standard for home and building automation. Owing to the collaboration, integrators can enhance their building automation solutions by integrating Hikvision AI-enabled devices, such as cameras, into building systems, surging the efficiency of building management and improving overall security.October 2023: FUJIFILM introduced the FUJINON SX1600 camera system for long-range surveillance applications for the first time in a European show at the Milipol homeland security and safety show held in ParisNord Villepinte from November 14 to 17, 2023, at booth 4F055. The SX1600 is a state-of-the-art long-range camera system incorporating a 40x-zoom FUJINON lens that covers a focal length range from the wide-angle 40 mm to 1600 mm telephoto and has been further equipped with a newly developed image stabilization system and fast and accurate autofocus to capture a distant subject clearly and instantaneously.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Video Surveillance Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence