Key Insights

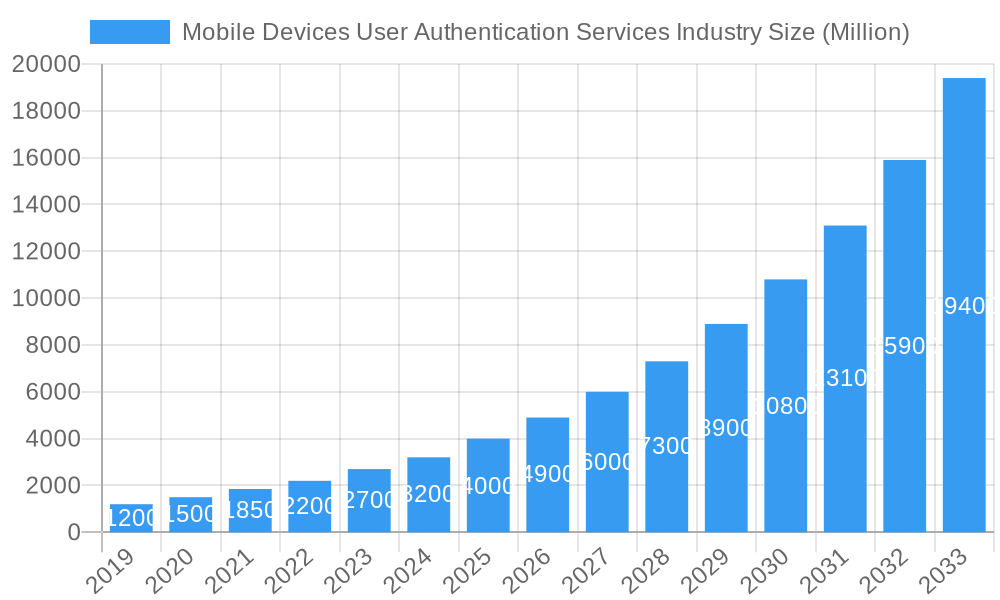

The Mobile Devices User Authentication Services market is projected for substantial growth, expected to reach $4.44 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 19.5% from a 2025 base year. This expansion is fueled by the increasing demand for robust mobile security amidst sophisticated cyber threats and the widespread use of mobile devices for sensitive transactions. Key growth factors include the rise of mobile banking, e-commerce, and enterprise BYOD policies, all necessitating secure and seamless authentication. The market is shifting towards multi-factor authentication (MFA), incorporating biometrics (fingerprint, facial recognition), two-factor authentication (2FA), and a move away from password-only systems, influenced by regulatory compliance and heightened consumer awareness of data privacy.

Mobile Devices User Authentication Services Industry Market Size (In Billion)

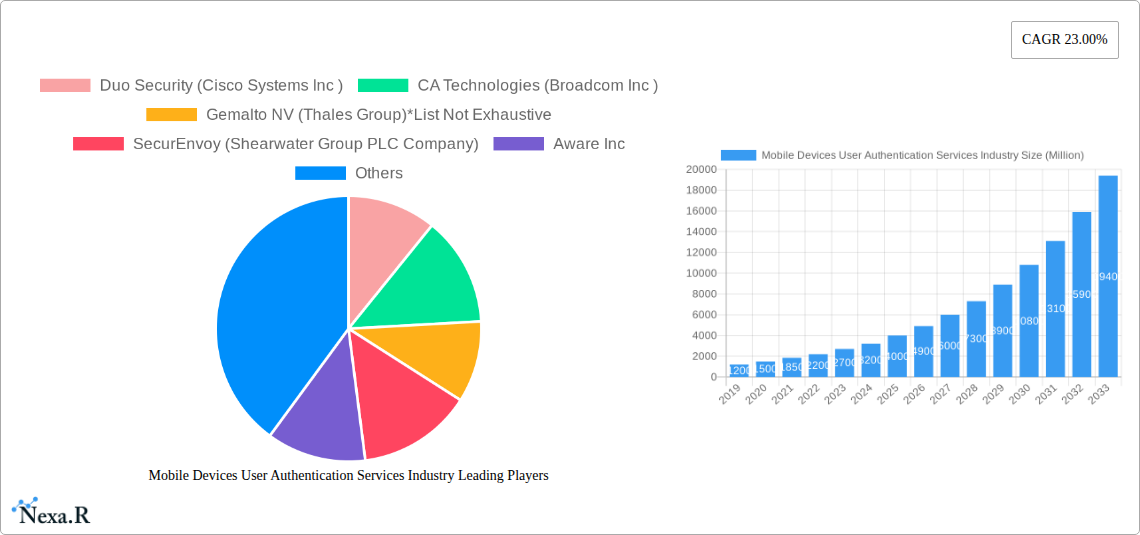

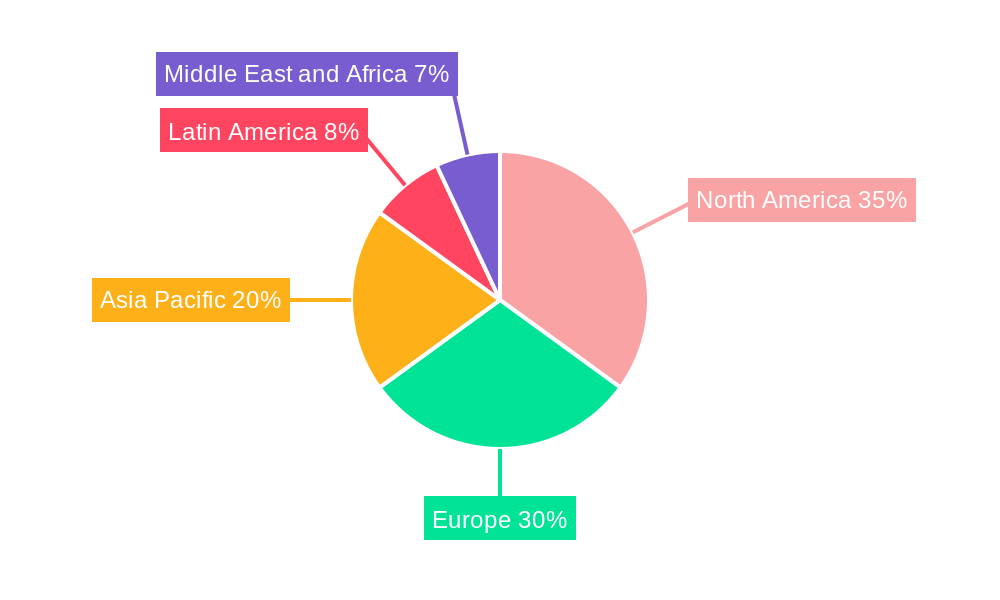

Leading market players include Duo Security (Cisco Systems Inc.), CA Technologies (Broadcom Inc.), and Gemalto NV (Thales Group), alongside notable companies such as Aware Inc. and OneSpan Inc., signifying a competitive and innovation-rich environment. While advanced authentication methods are primary growth drivers, implementation costs and user adoption challenges, particularly with legacy systems or specific user demographics, pose potential restraints. Geographically, North America and Europe currently dominate due to mature digital ecosystems and strong regulatory frameworks. However, the Asia Pacific region is poised for the fastest growth, driven by increasing smartphone penetration, a rapidly expanding digital economy, and escalating cybersecurity concerns. Market segmentation by authentication type (biometrics, MFA), enterprise size (SMEs to large enterprises), and end-user verticals (BFSI, Healthcare, Government) underscores the broad applicability and adaptability of mobile device user authentication services.

Mobile Devices User Authentication Services Industry Company Market Share

This comprehensive analysis of the Mobile Devices User Authentication Services Industry provides critical insights for stakeholders. Covering historical data from 2019-2024, with a 2025 base year and forecasts through 2033, this report examines market dynamics, growth trajectories, regional leadership, product innovation, key drivers, challenges, opportunities, and competitive landscapes. Emphasizing quantitative data and actionable intelligence, this report is an essential resource for understanding current market conditions and future trends in mobile device security. The study offers a holistic view of the ecosystem, including parent and child markets.

Mobile Devices User Authentication Services Industry Market Dynamics & Structure

The Mobile Devices User Authentication Services Industry is characterized by a moderate to high market concentration, with a few prominent players holding significant market share. Technological innovation remains a primary driver, fueled by the escalating demand for enhanced mobile security solutions. Emerging technologies like AI-powered behavioral biometrics and passwordless authentication are reshaping the competitive landscape. Regulatory frameworks, such as GDPR and CCPA, are increasingly influencing authentication service providers to adopt robust data protection and privacy measures. Competitive product substitutes are diverse, ranging from traditional password managers to advanced hardware security keys, each vying for end-user adoption. End-user demographics are shifting towards a more tech-savvy population, demanding seamless yet secure access to mobile applications and services. Mergers and acquisitions (M&A) activity is a key trend, with larger entities acquiring innovative startups to expand their service portfolios and market reach.

- Market Concentration: Dominated by a blend of established cybersecurity giants and specialized authentication providers.

- Technological Innovation Drivers: Rise of advanced biometrics, AI in anomaly detection, and the push for passwordless authentication.

- Regulatory Frameworks: Increasing compliance demands from data privacy regulations worldwide.

- Competitive Product Substitutes: Evolution from simple PINs to multi-factor authentication (MFA) solutions, hardware tokens, and biometrics.

- End-user Demographics: Growing adoption by individuals across all age groups and increasing demand from enterprises for secure remote access.

- M&A Trends: Strategic acquisitions aimed at integrating cutting-edge authentication technologies and expanding customer bases.

Mobile Devices User Authentication Services Industry Growth Trends & Insights

The Mobile Devices User Authentication Services Industry is projected to experience robust growth over the forecast period, driven by a confluence of escalating cybersecurity threats and the pervasive adoption of mobile devices across all facets of personal and professional life. The market size is expected to expand significantly from an estimated XXX million units in 2025 to a projected XXX million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of XX%. This growth trajectory is underpinned by increasing consumer awareness of data breaches and the subsequent demand for more secure authentication methods beyond traditional passwords. Adoption rates for advanced solutions like two-factor authentication (2FA) and multi-factor authentication (MFA) are rapidly rising across various end-user verticals. Technological disruptions, including the widespread integration of facial recognition, fingerprint scanning, and voice authentication into everyday mobile devices, are further accelerating this trend. Consumer behavior is shifting towards prioritizing security and convenience equally, leading to a preference for authentication services that offer a frictionless user experience without compromising on protection. The increasing sophistication of cyberattacks, such as phishing and credential stuffing, is compelling organizations of all sizes to invest more heavily in robust authentication measures to safeguard sensitive data and maintain customer trust. The rise of the Internet of Things (IoT) and the expanding attack surface it presents also necessitates advanced authentication protocols for device and data security. Furthermore, the growing remote workforce and the need for secure access to corporate networks and cloud-based applications are significant catalysts for the adoption of mobile device user authentication services. The evolving regulatory landscape, which mandates stricter data protection and access control, also plays a crucial role in driving market expansion.

Dominant Regions, Countries, or Segments in Mobile Devices User Authentication Services Industry

The Biometrics / Multi-Factor Authentication segment is poised to be the dominant force within the Mobile Devices User Authentication Services Industry, exhibiting exceptional growth potential and widespread adoption across various regions and verticals. This dominance stems from the inherent security advantages offered by biometrics, such as fingerprint, facial, and iris recognition, which are increasingly integrated into modern smartphones and other mobile devices. Multi-factor authentication, encompassing a combination of these biometrics with other authentication methods like PINs or soft tokens, provides a superior layer of security against unauthorized access, making it indispensable for protecting sensitive data.

North America, particularly the United States, is anticipated to lead in market share, driven by a mature technology infrastructure, a high concentration of large enterprises across BFSI, Telecommunication, and Healthcare sectors, and a strong emphasis on cybersecurity innovation. The region's proactive regulatory environment, coupled with a high adoption rate of advanced mobile technologies, further solidifies its leading position.

- Leading Authentication Type: Biometrics / Multi-Factor Authentication, driven by inherent security and user convenience.

- Dominant Region: North America, fueled by technological advancement and strong enterprise adoption.

- Key Country: United States, with its robust cybersecurity market and high disposable income for premium security solutions.

- Dominant Enterprise Size: Large Enterprises, due to their critical need to protect vast amounts of sensitive data and comply with stringent regulations.

- Key End-user Verticals:

- BFSI: Highest demand for robust authentication to prevent financial fraud and secure customer accounts.

- Telecommunication: Essential for securing subscriber data and preventing account takeovers.

- Government: Critical for safeguarding national security and sensitive citizen information.

- Growth Drivers in Dominant Segments:

- Increasing sophistication of cyber threats necessitating advanced security.

- Ubiquitous integration of biometric sensors in smartphones.

- Strict data privacy regulations pushing for stronger authentication.

- Growth of remote work and cloud-based services requiring secure access.

- Consumer demand for seamless yet secure login experiences.

Mobile Devices User Authentication Services Industry Product Landscape

The product landscape of mobile devices user authentication services is rapidly evolving, marked by continuous innovation aimed at enhancing security, user experience, and device compatibility. Providers are developing sophisticated solutions that integrate multiple authentication factors, including advanced biometrics like continuous authentication and behavioral biometrics, alongside traditional methods. Key innovations include passwordless authentication solutions that leverage secure enclaves and device-bound credentials, offering both enhanced security and unparalleled convenience. Performance metrics are increasingly focused on reducing authentication latency, minimizing false positives/negatives in biometric matching, and ensuring seamless integration with diverse mobile operating systems and application programming interfaces (APIs). Unique selling propositions often revolve around the breadth of authentication options, the intelligence of fraud detection capabilities, and the ease of deployment and management for enterprises.

Key Drivers, Barriers & Challenges in Mobile Devices User Authentication Services Industry

The Mobile Devices User Authentication Services Industry is propelled by several key drivers. The escalating sophistication and frequency of cyber threats, including phishing, ransomware, and identity theft, necessitate robust authentication solutions. The pervasive use of mobile devices for sensitive transactions and data access across personal and professional spheres creates a constant demand for secure access. Furthermore, stringent regulatory mandates for data protection and privacy, such as GDPR and CCPA, compel organizations to implement advanced authentication protocols. The growing adoption of remote work models further amplifies the need for secure mobile access to corporate resources.

However, the industry faces significant barriers and challenges. The high cost of implementing and managing advanced authentication systems can be a deterrent, particularly for Small and Medium-sized Enterprises (SMEs). User resistance to adopting new authentication methods, especially those perceived as cumbersome, can hinder widespread adoption. Ensuring compatibility and seamless integration across a diverse range of mobile devices, operating systems, and applications presents a complex technical challenge. Moreover, the evolving nature of cyber threats requires continuous updates and adaptations of authentication technologies, leading to ongoing research and development costs. The threat of sophisticated social engineering attacks and the potential for sophisticated spoofing of biometric data also pose ongoing challenges.

Emerging Opportunities in Mobile Devices User Authentication Services Industry

Emerging opportunities within the Mobile Devices User Authentication Services Industry are abundant and varied. The burgeoning Internet of Things (IoT) ecosystem presents a vast untapped market for secure device authentication, from smart home devices to industrial sensors. The increasing adoption of decentralized identity solutions and blockchain-based authentication methods offers a pathway to enhanced privacy and user control. The demand for adaptive and risk-based authentication, which dynamically adjusts security measures based on context and user behavior, is another significant growth area. Furthermore, specialized authentication solutions tailored for emerging technologies like augmented reality (AR) and virtual reality (VR) are expected to gain traction as these platforms mature. The focus on frictionless authentication, enabling seamless access without compromising security, continues to drive innovation and create new market niches.

Growth Accelerators in the Mobile Devices User Authentication Services Industry Industry

Several factors are acting as significant growth accelerators for the Mobile Devices User Authentication Services Industry. The ongoing digital transformation across all sectors is fundamentally increasing the reliance on digital identities and secure access, driving demand for advanced authentication. Technological breakthroughs in artificial intelligence and machine learning are enabling more intelligent and adaptive authentication systems, improving accuracy and reducing friction. Strategic partnerships between cybersecurity firms, mobile device manufacturers, and software developers are fostering greater integration and wider adoption of authentication solutions. The expanding global smartphone penetration, especially in emerging economies, opens up new customer bases for authentication services. Furthermore, proactive government initiatives and the establishment of cybersecurity standards are creating a more favorable ecosystem for the growth of this industry.

Key Players Shaping the Mobile Devices User Authentication Services Industry Market

- Duo Security (Cisco Systems Inc)

- CA Technologies (Broadcom Inc)

- Gemalto NV (Thales Group)

- SecurEnvoy (Shearwater Group PLC Company)

- Aware Inc

- OneSpan Inc

- Symantec Corporation

- RSA Security LLC (Dell Technologies)

- Nexus Group

- Entrust Datacard Corporation

Notable Milestones in Mobile Devices User Authentication Services Industry Sector

- 2019: Increased adoption of FIDO2 standards for passwordless authentication gains momentum.

- 2020: Widespread shift to remote work accelerates demand for secure mobile access and MFA solutions.

- 2021: Advancements in behavioral biometrics demonstrate higher accuracy in continuous authentication.

- 2022: Growing prevalence of SIM-swap fraud leads to renewed focus on more resilient authentication methods beyond SMS OTPs.

- 2023: Increased investment in AI-powered anomaly detection for proactive threat identification in authentication processes.

- 2024: Growing regulatory pressure for stronger identity verification and data protection measures globally.

In-Depth Mobile Devices User Authentication Services Industry Market Outlook

The Mobile Devices User Authentication Services Industry is poised for substantial and sustained growth, driven by an escalating global demand for secure digital interactions. Key growth accelerators include the continued proliferation of mobile devices, the increasing threat landscape, and the relentless push for regulatory compliance. Future market potential lies in the seamless integration of advanced biometrics, the widespread adoption of passwordless authentication, and the development of adaptive, context-aware security solutions. Strategic opportunities for stakeholders include expanding into emerging markets, developing specialized authentication services for the burgeoning IoT sector, and forging partnerships to enhance interoperability and user experience. The industry is set to witness significant innovation, with a strong emphasis on creating a balance between robust security and frictionless access for end-users.

Mobile Devices User Authentication Services Industry Segmentation

-

1. Authentication Type

- 1.1. Two-Factor Authentication

- 1.2. Biometrics / Multi-Factor Authentication

- 1.3. Passwords

- 1.4. Soft Tokens

- 1.5. Other Types

-

2. Enterprise Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Consumer Electronics

- 3.3. Government

- 3.4. Telecommunication

- 3.5. Healthcare

- 3.6. Manufacturing

- 3.7. Other End-user Verticals

Mobile Devices User Authentication Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Mobile Devices User Authentication Services Industry Regional Market Share

Geographic Coverage of Mobile Devices User Authentication Services Industry

Mobile Devices User Authentication Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing adoption of Bring Your Own Device (BYOD) Solutions; Growing Demand for Internet of Things (IoT)

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Related to Authentication and Security of the Devices

- 3.4. Market Trends

- 3.4.1. Biometrics / Multi-Factor Authentication is Expected to Have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Devices User Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 5.1.1. Two-Factor Authentication

- 5.1.2. Biometrics / Multi-Factor Authentication

- 5.1.3. Passwords

- 5.1.4. Soft Tokens

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Consumer Electronics

- 5.3.3. Government

- 5.3.4. Telecommunication

- 5.3.5. Healthcare

- 5.3.6. Manufacturing

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6. North America Mobile Devices User Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6.1.1. Two-Factor Authentication

- 6.1.2. Biometrics / Multi-Factor Authentication

- 6.1.3. Passwords

- 6.1.4. Soft Tokens

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.2.1. SMEs

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Consumer Electronics

- 6.3.3. Government

- 6.3.4. Telecommunication

- 6.3.5. Healthcare

- 6.3.6. Manufacturing

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Authentication Type

- 7. Europe Mobile Devices User Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Authentication Type

- 7.1.1. Two-Factor Authentication

- 7.1.2. Biometrics / Multi-Factor Authentication

- 7.1.3. Passwords

- 7.1.4. Soft Tokens

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.2.1. SMEs

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Consumer Electronics

- 7.3.3. Government

- 7.3.4. Telecommunication

- 7.3.5. Healthcare

- 7.3.6. Manufacturing

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Authentication Type

- 8. Asia Pacific Mobile Devices User Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Authentication Type

- 8.1.1. Two-Factor Authentication

- 8.1.2. Biometrics / Multi-Factor Authentication

- 8.1.3. Passwords

- 8.1.4. Soft Tokens

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.2.1. SMEs

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Consumer Electronics

- 8.3.3. Government

- 8.3.4. Telecommunication

- 8.3.5. Healthcare

- 8.3.6. Manufacturing

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Authentication Type

- 9. Latin America Mobile Devices User Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Authentication Type

- 9.1.1. Two-Factor Authentication

- 9.1.2. Biometrics / Multi-Factor Authentication

- 9.1.3. Passwords

- 9.1.4. Soft Tokens

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.2.1. SMEs

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Consumer Electronics

- 9.3.3. Government

- 9.3.4. Telecommunication

- 9.3.5. Healthcare

- 9.3.6. Manufacturing

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Authentication Type

- 10. Middle East and Africa Mobile Devices User Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Authentication Type

- 10.1.1. Two-Factor Authentication

- 10.1.2. Biometrics / Multi-Factor Authentication

- 10.1.3. Passwords

- 10.1.4. Soft Tokens

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.2.1. SMEs

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. BFSI

- 10.3.2. Consumer Electronics

- 10.3.3. Government

- 10.3.4. Telecommunication

- 10.3.5. Healthcare

- 10.3.6. Manufacturing

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Authentication Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Duo Security (Cisco Systems Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CA Technologies (Broadcom Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gemalto NV (Thales Group)*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SecurEnvoy (Shearwater Group PLC Company)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aware Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OneSpan Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Symantec Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RSA Security LLC (Dell Technologies)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nexus Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Entrust Datacard Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Duo Security (Cisco Systems Inc )

List of Figures

- Figure 1: Global Mobile Devices User Authentication Services Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Mobile Devices User Authentication Services Industry Revenue (billion), by Authentication Type 2025 & 2033

- Figure 3: North America Mobile Devices User Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 4: North America Mobile Devices User Authentication Services Industry Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 5: North America Mobile Devices User Authentication Services Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 6: North America Mobile Devices User Authentication Services Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 7: North America Mobile Devices User Authentication Services Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Mobile Devices User Authentication Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Mobile Devices User Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Mobile Devices User Authentication Services Industry Revenue (billion), by Authentication Type 2025 & 2033

- Figure 11: Europe Mobile Devices User Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 12: Europe Mobile Devices User Authentication Services Industry Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 13: Europe Mobile Devices User Authentication Services Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 14: Europe Mobile Devices User Authentication Services Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 15: Europe Mobile Devices User Authentication Services Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Mobile Devices User Authentication Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Mobile Devices User Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Mobile Devices User Authentication Services Industry Revenue (billion), by Authentication Type 2025 & 2033

- Figure 19: Asia Pacific Mobile Devices User Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 20: Asia Pacific Mobile Devices User Authentication Services Industry Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 21: Asia Pacific Mobile Devices User Authentication Services Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 22: Asia Pacific Mobile Devices User Authentication Services Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Mobile Devices User Authentication Services Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Mobile Devices User Authentication Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Mobile Devices User Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Mobile Devices User Authentication Services Industry Revenue (billion), by Authentication Type 2025 & 2033

- Figure 27: Latin America Mobile Devices User Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 28: Latin America Mobile Devices User Authentication Services Industry Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 29: Latin America Mobile Devices User Authentication Services Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 30: Latin America Mobile Devices User Authentication Services Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Mobile Devices User Authentication Services Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Mobile Devices User Authentication Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Mobile Devices User Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue (billion), by Authentication Type 2025 & 2033

- Figure 35: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 36: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 37: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 38: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Mobile Devices User Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Authentication Type 2020 & 2033

- Table 2: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 3: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Authentication Type 2020 & 2033

- Table 6: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 7: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Authentication Type 2020 & 2033

- Table 10: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 11: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Authentication Type 2020 & 2033

- Table 14: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 15: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Authentication Type 2020 & 2033

- Table 18: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 19: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Authentication Type 2020 & 2033

- Table 22: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 23: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Mobile Devices User Authentication Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Devices User Authentication Services Industry?

The projected CAGR is approximately 19.5%.

2. Which companies are prominent players in the Mobile Devices User Authentication Services Industry?

Key companies in the market include Duo Security (Cisco Systems Inc ), CA Technologies (Broadcom Inc ), Gemalto NV (Thales Group)*List Not Exhaustive, SecurEnvoy (Shearwater Group PLC Company), Aware Inc, OneSpan Inc, Symantec Corporation, RSA Security LLC (Dell Technologies), Nexus Group, Entrust Datacard Corporation.

3. What are the main segments of the Mobile Devices User Authentication Services Industry?

The market segments include Authentication Type, Enterprise Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.44 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing adoption of Bring Your Own Device (BYOD) Solutions; Growing Demand for Internet of Things (IoT).

6. What are the notable trends driving market growth?

Biometrics / Multi-Factor Authentication is Expected to Have Significant Share.

7. Are there any restraints impacting market growth?

; Lack of Awareness Related to Authentication and Security of the Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Devices User Authentication Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Devices User Authentication Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Devices User Authentication Services Industry?

To stay informed about further developments, trends, and reports in the Mobile Devices User Authentication Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence