Key Insights

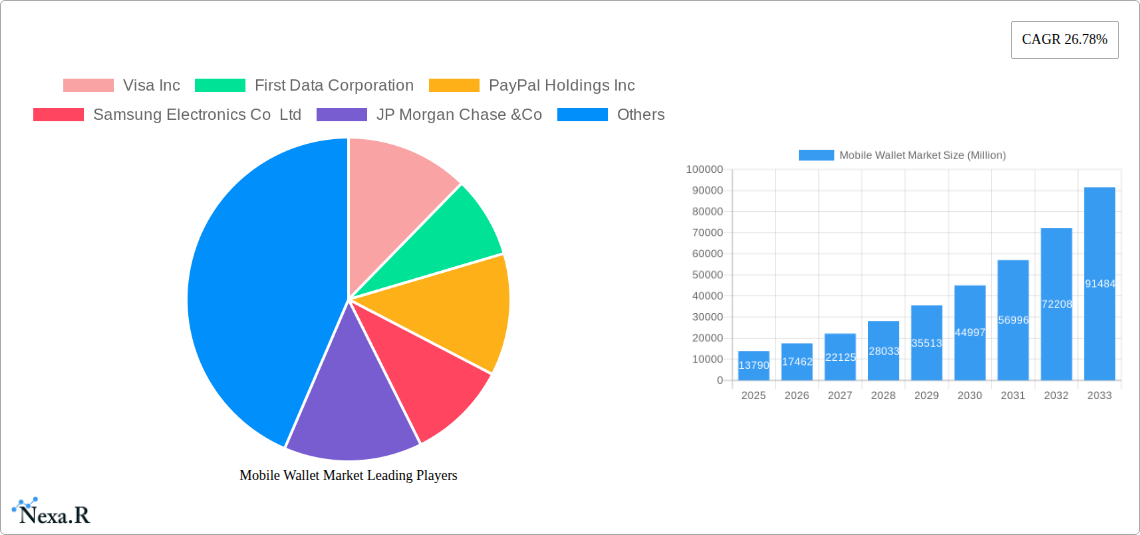

The global Mobile Wallet Market is poised for explosive growth, projected to reach a substantial $13.79 billion by 2025, driven by an exceptional 26.78% CAGR. This rapid expansion is fueled by the increasing adoption of smartphones, a growing comfort level with digital transactions, and the inherent convenience mobile wallets offer across diverse applications. Key drivers include the proliferation of e-commerce, the demand for seamless money transfers, the efficiency of micropayments for small transactions, and the integration of mobile wallets into daily life, from retail purchases and restaurant dining to public transport. The market is segmented by payment mode, with Proximity payments and Remote payments both contributing significantly to its evolution. Companies like Visa Inc., PayPal Holdings Inc., Samsung Electronics Co. Ltd., and tech giants such as Apple Inc. and Google Inc. are at the forefront, innovating and expanding their offerings to capture this burgeoning market. The shift towards a cashless society further cements the mobile wallet's indispensability.

Mobile Wallet Market Market Size (In Billion)

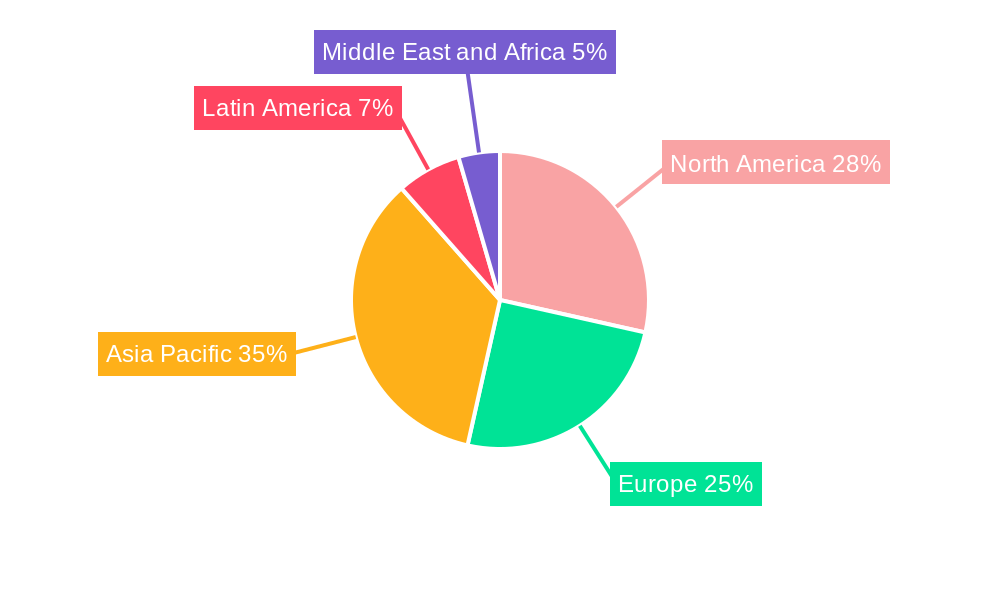

Looking ahead, the forecast period (2025-2033) anticipates sustained high growth, indicating a transformative impact on consumer behavior and financial ecosystems. Asia Pacific, led by China, Japan, and India, is expected to be a dominant region, owing to its large, tech-savvy population and rapid digital infrastructure development. North America and Europe will also witness significant adoption, propelled by advanced payment technologies and supportive regulatory frameworks. While the market enjoys strong growth, it's crucial to acknowledge potential restraints such as data security concerns and varying levels of consumer trust in different regions. However, continuous advancements in security protocols and user-friendly interfaces are mitigating these challenges, ensuring a robust future for mobile wallets as a primary mode of transaction globally. The market's dynamic nature, characterized by constant innovation and strategic partnerships, underscores its potential to reshape the future of commerce.

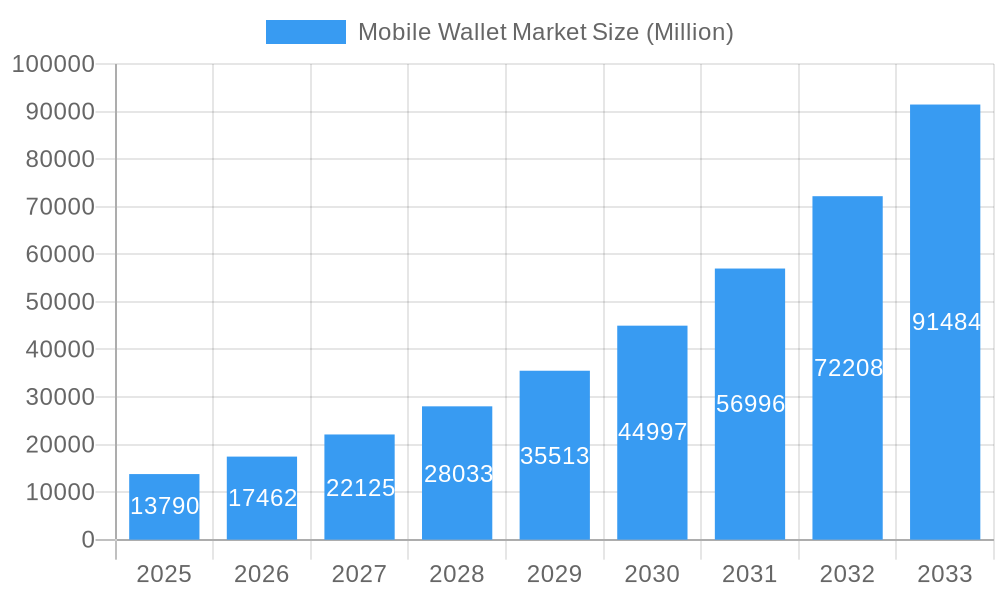

Mobile Wallet Market Company Market Share

Mobile Wallet Market: Comprehensive Industry Analysis & Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global mobile wallet market, encompassing its market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, and challenges, emerging opportunities, growth accelerators, and leading players. Covering the study period from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period from 2025 to 2033, this report leverages extensive data from the historical period of 2019-2024 to offer unparalleled insights for industry professionals. We delve into parent and child market segments, exploring the intricate evolution of mobile payment solutions, digital payments, fintech innovation, and the burgeoning cashless economy.

Mobile Wallet Market Market Dynamics & Structure

The mobile wallet market is characterized by a dynamic and evolving competitive landscape. Market concentration is moderately high, with a few key global players holding significant market share, alongside a growing number of regional and niche providers. Technological innovation is a primary driver, fueled by advancements in NFC, QR codes, biometrics, and secure element technologies. Regulatory frameworks, while varying by region, are increasingly focusing on data privacy, security standards, and consumer protection, shaping market entry and operational strategies. Competitive product substitutes, such as physical cards and traditional payment methods, are gradually being eroded by the convenience and functionality offered by mobile wallets. End-user demographics are expanding rapidly, encompassing younger, tech-savvy populations as well as an increasing adoption among older demographics seeking ease of use. Mergers and acquisitions (M&A) are a constant feature, with larger financial institutions and tech giants acquiring innovative startups to expand their mobile payment offerings and market reach.

- Market Concentration: Dominated by global tech and financial service providers, with increasing fragmentation in emerging markets.

- Technological Innovation Drivers: NFC, QR codes, biometrics, tokenization, AI for personalization, and blockchain for enhanced security.

- Regulatory Frameworks: GDPR, PCI DSS, PSD2, and local central bank regulations influencing security protocols and data handling.

- Competitive Product Substitutes: Credit/debit cards, cash, and other digital payment platforms.

- End-User Demographics: Broadening appeal across age groups, income levels, and geographies, with a strong uptake among millennials and Gen Z.

- M&A Trends: Strategic acquisitions by banks, payment processors, and tech companies to bolster their digital payment ecosystems. Recent M&A deal volumes are estimated to be in the hundreds of millions of units annually.

Mobile Wallet Market Growth Trends & Insights

The global mobile wallet market is poised for significant expansion, driven by accelerating digital transformation and evolving consumer preferences for seamless, secure, and convenient payment solutions. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 25-30% during the forecast period, expanding from an estimated market size of XX million units in 2025 to over XXX million units by 2033. Adoption rates are surging globally, propelled by increasing smartphone penetration and the growing acceptance of mobile payments across various sectors. Technological disruptions, such as the integration of AI for personalized offers, advanced biometrics for enhanced security, and the exploration of blockchain for decentralized finance, are continuously redefining the user experience. Consumer behavior shifts are clearly indicative of a preference for contactless and card-less transactions, with mobile wallets becoming an indispensable tool for everyday purchases, from retail shopping and dining to public transportation and peer-to-peer money transfers. The convenience of storing multiple payment methods, loyalty cards, and even tickets within a single device significantly contributes to this sustained growth trajectory. The increasing integration of mobile wallets into broader digital ecosystems, including e-commerce platforms, ride-sharing services, and digital identity solutions, further solidifies their market presence and future potential.

Dominant Regions, Countries, or Segments in Mobile Wallet Market

The Asia Pacific region is emerging as a dominant force in the global mobile wallet market, largely driven by rapid digitalization, a massive unbanked and underbanked population embracing mobile-first financial solutions, and significant government initiatives promoting cashless economies. Within this region, countries like China, India, and South Korea are leading the charge. China's advanced mobile payment ecosystem, dominated by giants like Alipay and WeChat Pay, sets a global benchmark for adoption and innovation. India, with its massive population and the success of initiatives like UPI, is experiencing an unprecedented surge in mobile wallet usage for everything from retail transactions to bill payments. South Korea's high smartphone penetration and technologically savvy populace further contribute to its significant market share.

The Mode of Payment segment of Proximit (e.g., NFC, QR code-based payments) and Remote P (online payments) are both witnessing substantial growth. Proximit payments are particularly popular for in-store transactions due to their speed and convenience, while Remote P is crucial for the booming e-commerce and online service industries.

In terms of Application, Mobile Commerce and Money Transfer are the leading segments. The convenience of making purchases directly from mobile devices, coupled with the ease of sending money to friends and family, are primary growth drivers. The Retail and Restaurant sectors are also significant contributors, with businesses increasingly integrating mobile payment options to cater to consumer demand for faster and more touchless transactions. The Public Transport segment is also gaining traction, with many cities implementing mobile ticketing solutions.

- Leading Region: Asia Pacific

- Key Countries: China, India, South Korea

- Dominance Factors: High smartphone penetration, large unbanked population, government support for digital payments, robust e-commerce growth, and a culture of early technology adoption.

- Market Share: Asia Pacific accounts for an estimated 45-50% of the global mobile wallet market.

- Dominant Modes of Payment:

- Proximit: Rapid adoption driven by contactless convenience in physical retail.

- Remote P: Essential for the expanding e-commerce and digital service landscape.

- Dominant Applications:

- Mobile Commerce: Fueling online retail and in-app purchases.

- Money Transfer: Facilitating peer-to-peer and cross-border remittances.

- Retail & Restaurant: Driven by the demand for quick, contactless payment options.

- Public Transport: Growing adoption of mobile ticketing and fare payments.

Mobile Wallet Market Product Landscape

The mobile wallet market product landscape is characterized by continuous innovation, offering a rich array of functionalities beyond simple payment processing. Modern mobile wallets integrate features such as loyalty program management, digital coupons, event tickets, boarding passes, and even secure digital identification. Companies are investing heavily in enhancing user experience through intuitive interfaces, personalized offers, and seamless integration with other digital services. Performance metrics are largely focused on transaction speed, security protocols, and compatibility across various devices and operating systems. Unique selling propositions often lie in advanced security features like tokenization and biometric authentication, as well as the ability to aggregate diverse digital assets. Technological advancements in areas like augmented reality for in-store navigation and payment, and the potential integration with wearables, are shaping the future of mobile wallet products.

Key Drivers, Barriers & Challenges in Mobile Wallet Market

Key Drivers:

- Technological Advancements: The ongoing evolution of NFC, QR codes, and biometric authentication enhances security and convenience.

- Growing Smartphone Penetration: Widespread smartphone ownership is the fundamental enabler of mobile wallet adoption.

- Government Initiatives: Supportive policies and promotion of digital payments in various countries are accelerating market growth.

- E-commerce Boom: The surge in online shopping necessitates convenient and secure digital payment methods.

- Consumer Demand for Convenience: Users increasingly prefer contactless and card-less transactions.

Key Barriers & Challenges:

- Security Concerns and Data Privacy: User apprehension regarding the security of sensitive financial information remains a significant hurdle.

- Regulatory Hurdles: Fragmented and evolving regulations across different geographies can create compliance challenges.

- Interoperability Issues: Lack of seamless interoperability between different mobile wallet platforms and legacy systems.

- Infrastructure Limitations: In some emerging markets, inconsistent internet connectivity and lack of point-of-sale (POS) terminal adoption.

- Consumer Inertia: Resistance to change and reliance on traditional payment methods in certain demographics. The global market faces challenges from an estimated 15-20% of consumers still preferring cash for routine transactions.

Emerging Opportunities in Mobile Wallet Market

Emerging opportunities in the mobile wallet market lie in the expansion of functionalities beyond basic payments. The integration of decentralized finance (DeFi) protocols could unlock new avenues for investment and lending directly within wallets. The growing demand for embedded finance solutions presents an opportunity to offer micro-insurance, buy-now-pay-later (BNPL) options, and other financial services directly through mobile wallets. Furthermore, the development of secure digital identity solutions linked to mobile wallets can streamline online verification processes and enhance user trust. Untapped markets in developing economies, where mobile-first financial services are crucial, offer significant growth potential. The increasing use of mobile wallets for loyalty programs and personalized shopping experiences also represents a substantial opportunity for increased customer engagement and revenue generation.

Growth Accelerators in the Mobile Wallet Market Industry

Several catalysts are driving the long-term growth of the mobile wallet market. Technological breakthroughs in areas such as wearable payment devices and the metaverse will create new payment touchpoints and use cases. Strategic partnerships between financial institutions, telecommunication companies, and technology providers are expanding service reach and enhancing user experience. Market expansion strategies focused on developing economies, where the potential for mobile-first financial inclusion is immense, will be critical. The continuous development of APIs and open banking frameworks facilitates greater integration and innovation, allowing for a more interconnected and user-centric financial ecosystem. The increasing focus on sustainability and digital sustainability further encourages the shift away from paper-based transactions.

Key Players Shaping the Mobile Wallet Market Market

- Visa Inc

- First Data Corporation

- PayPal Holdings Inc

- Samsung Electronics Co Ltd

- JP Morgan Chase &Co

- Ant Financial Services Group

- Tencent Holdings Ltd

- Paytm

- Mobikwik

- MasterCard Incorporated

- The American Express Company

- Google Inc

- Apple Inc

Notable Milestones in Mobile Wallet Market Sector

- October 2022: i2c Inc. launched SHAREPay, partnering with Majid Al Futtaim to integrate their loyalty program, SHARE, for a seamless "pay, earn, and redeem" experience in the Middle East, Africa, and Asia.

- September 2022: Leading Asian mobile payment providers integrated Alipay+ cross-border digital payment solutions in South Korea to promote cashless travel, enabling Southeast Asian and Hong Kong-based companies to extend their services in South Korea via Alipay for the first time.

In-Depth Mobile Wallet Market Market Outlook

The future outlook for the mobile wallet market is exceptionally strong, driven by a confluence of accelerating growth accelerators. The continued push towards a cashless society, coupled with an ever-increasing reliance on digital channels for commerce and daily life, paints a promising picture. Strategic partnerships, particularly those that bridge traditional finance with emerging fintech innovations, will be instrumental in unlocking new revenue streams and expanding market reach. The potential for mobile wallets to become a central hub for a user's digital life, encompassing not just payments but also identity management, loyalty programs, and access to a wider range of financial services, presents a significant long-term opportunity. As technology continues to evolve and consumer adoption deepens, the mobile wallet market is set to redefine the future of financial transactions and digital engagement.

Mobile Wallet Market Segmentation

-

1. Mode of Payment

- 1.1. Proximit

- 1.2. Remote P

-

2. Application

- 2.1. Mobile Commerce

- 2.2. Money Transfer

- 2.3. Micropayment

- 2.4. Retail

- 2.5. Restaurant

- 2.6. Public Transport

Mobile Wallet Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Mobile Wallet Market Regional Market Share

Geographic Coverage of Mobile Wallet Market

Mobile Wallet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of smartphone and proximity payment; Government initiative towards digital transformation; Growth of e-commerce platforms

- 3.3. Market Restrains

- 3.3.1. Data Privacy concerns by end-users

- 3.4. Market Trends

- 3.4.1. Proximity Payments to Witness the Fastest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Wallet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Proximit

- 5.1.2. Remote P

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Mobile Commerce

- 5.2.2. Money Transfer

- 5.2.3. Micropayment

- 5.2.4. Retail

- 5.2.5. Restaurant

- 5.2.6. Public Transport

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America Mobile Wallet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Proximit

- 6.1.2. Remote P

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Mobile Commerce

- 6.2.2. Money Transfer

- 6.2.3. Micropayment

- 6.2.4. Retail

- 6.2.5. Restaurant

- 6.2.6. Public Transport

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. Europe Mobile Wallet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Proximit

- 7.1.2. Remote P

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Mobile Commerce

- 7.2.2. Money Transfer

- 7.2.3. Micropayment

- 7.2.4. Retail

- 7.2.5. Restaurant

- 7.2.6. Public Transport

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Asia Pacific Mobile Wallet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Proximit

- 8.1.2. Remote P

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Mobile Commerce

- 8.2.2. Money Transfer

- 8.2.3. Micropayment

- 8.2.4. Retail

- 8.2.5. Restaurant

- 8.2.6. Public Transport

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Latin America Mobile Wallet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Proximit

- 9.1.2. Remote P

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Mobile Commerce

- 9.2.2. Money Transfer

- 9.2.3. Micropayment

- 9.2.4. Retail

- 9.2.5. Restaurant

- 9.2.6. Public Transport

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Middle East and Africa Mobile Wallet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Proximit

- 10.1.2. Remote P

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Mobile Commerce

- 10.2.2. Money Transfer

- 10.2.3. Micropayment

- 10.2.4. Retail

- 10.2.5. Restaurant

- 10.2.6. Public Transport

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Visa Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 First Data Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PayPal Holdings Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung Electronics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JP Morgan Chase &Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ant Financial Services Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tencent Holdings Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Paytm

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mobikwik

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MasterCard Incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The American Express Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Google Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Apple Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Visa Inc

List of Figures

- Figure 1: Global Mobile Wallet Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mobile Wallet Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 3: North America Mobile Wallet Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 4: North America Mobile Wallet Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Mobile Wallet Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Mobile Wallet Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Mobile Wallet Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mobile Wallet Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 9: Europe Mobile Wallet Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 10: Europe Mobile Wallet Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Mobile Wallet Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Mobile Wallet Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Mobile Wallet Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Mobile Wallet Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 15: Asia Pacific Mobile Wallet Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 16: Asia Pacific Mobile Wallet Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Mobile Wallet Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Mobile Wallet Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Mobile Wallet Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Mobile Wallet Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 21: Latin America Mobile Wallet Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 22: Latin America Mobile Wallet Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Mobile Wallet Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Mobile Wallet Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Mobile Wallet Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Mobile Wallet Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 27: Middle East and Africa Mobile Wallet Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 28: Middle East and Africa Mobile Wallet Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Mobile Wallet Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Mobile Wallet Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Mobile Wallet Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Wallet Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Global Mobile Wallet Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Mobile Wallet Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Mobile Wallet Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 5: Global Mobile Wallet Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Mobile Wallet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Mobile Wallet Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 10: Global Mobile Wallet Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Mobile Wallet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: UK Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Mobile Wallet Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 18: Global Mobile Wallet Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Mobile Wallet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Australia Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Mobile Wallet Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 26: Global Mobile Wallet Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Mobile Wallet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Mobile Wallet Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 33: Global Mobile Wallet Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Mobile Wallet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: UAE Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Mobile Wallet Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Wallet Market?

The projected CAGR is approximately 26.78%.

2. Which companies are prominent players in the Mobile Wallet Market?

Key companies in the market include Visa Inc, First Data Corporation, PayPal Holdings Inc, Samsung Electronics Co Ltd, JP Morgan Chase &Co, Ant Financial Services Group, Tencent Holdings Ltd, Paytm, Mobikwik, MasterCard Incorporated, The American Express Company, Google Inc, Apple Inc.

3. What are the main segments of the Mobile Wallet Market?

The market segments include Mode of Payment, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of smartphone and proximity payment; Government initiative towards digital transformation; Growth of e-commerce platforms.

6. What are the notable trends driving market growth?

Proximity Payments to Witness the Fastest Market Growth.

7. Are there any restraints impacting market growth?

Data Privacy concerns by end-users.

8. Can you provide examples of recent developments in the market?

October 2022: A digital payment and banking technology developer, i2c Inc., recently announced the introduction of SHAREPay and its cooperation with Majid Al Futtaim, a leader in shopping centers, communities, retail, and leisure in the Middle East, Africa, and Asia. A component of this solution is the region's top loyalty program, SHARE by Majid Al Futtaim, which enables users to "pay, earn, and redeem" points with only one tap.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Wallet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Wallet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Wallet Market?

To stay informed about further developments, trends, and reports in the Mobile Wallet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence