Key Insights

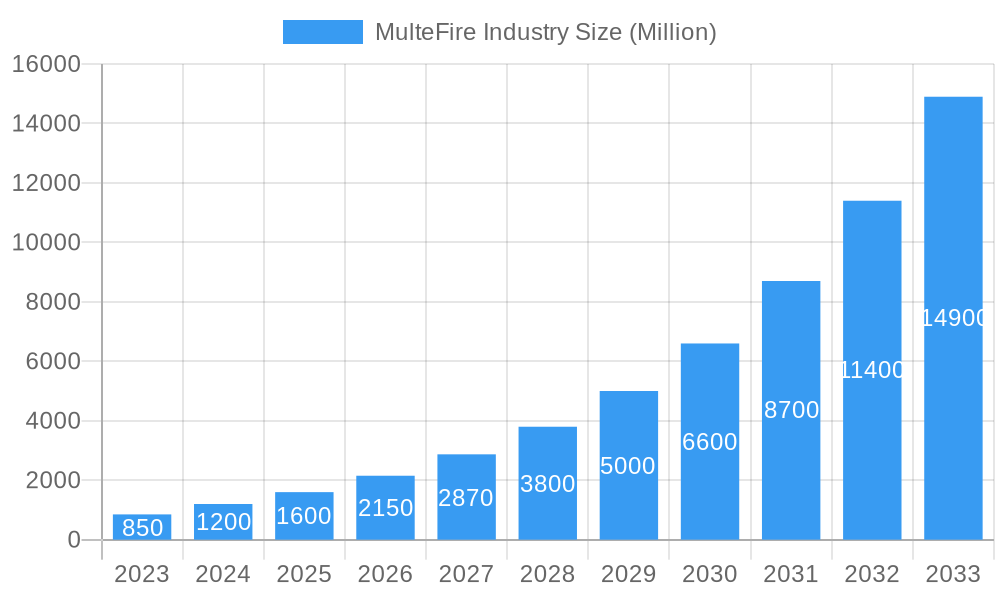

The MulteFire industry is experiencing exceptional growth, with a projected market size of 1.60 Billion by 2025, propelled by a remarkable Compound Annual Growth Rate (CAGR) of 31.04% through 2033. This rapid expansion is fueled by the increasing demand for high-speed, low-latency wireless connectivity across a diverse range of applications, particularly in enterprise environments. Key drivers include the widespread adoption of private networks, the growing need for robust indoor and outdoor coverage, and the continuous evolution of wireless technologies. The inherent flexibility and cost-effectiveness of MulteFire solutions, which operate in unlicensed spectrum, make them an attractive alternative to traditional licensed spectrum deployments. This technological advantage allows for rapid deployment and scalability, catering to the evolving connectivity demands of businesses seeking enhanced operational efficiency and enhanced user experiences. The market's trajectory indicates a significant shift towards more agile and specialized wireless infrastructure.

MulteFire Industry Market Size (In Million)

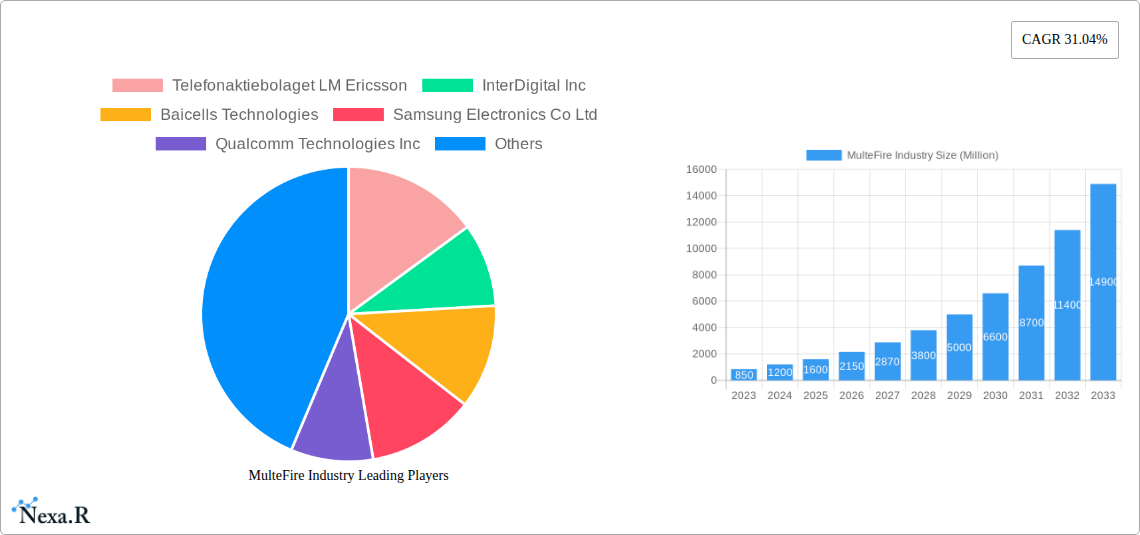

The MulteFire market is segmented across various equipment types, with Small Cells, Switches, and Controllers forming the core technological backbone. The end-user vertical landscape is broad, encompassing Commercial & Institutional Buildings, Supply Chain and Distribution, Retail, Hospitality, Public Venues, and Healthcare, each contributing significantly to market penetration. Notable companies such as Telefonaktiebolaget LM Ericsson, InterDigital Inc., Baicells Technologies, Samsung Electronics Co Ltd., Qualcomm Technologies Inc., Huawei Technologies Co Ltd., Nokia Corporation, and Intel Corporation are actively innovating and competing within this dynamic space. Geographically, North America and Asia Pacific are anticipated to lead market adoption, with significant contributions also expected from Europe. The forecast period of 2025-2033 is poised to witness substantial advancements in MulteFire technology, further solidifying its position as a crucial enabler of next-generation wireless networks, particularly for private and neutral host deployments demanding high performance and dedicated connectivity.

MulteFire Industry Company Market Share

Here is a comprehensive, SEO-optimized report description for the MulteFire Industry, designed for maximum visibility and engagement with industry professionals.

MulteFire Industry Market Dynamics & Structure

The MulteFire industry exhibits a dynamic market structure characterized by increasing concentration around key technology providers and a growing emphasis on specialized solutions. Technological innovation drivers, particularly advancements in spectrum utilization and device miniaturization, are pivotal in expanding MulteFire's reach. Robust regulatory frameworks are evolving to support unlicensed spectrum deployments, fostering wider adoption. Competitive product substitutes, while present in the form of Wi-Fi and other wireless technologies, are increasingly differentiated by MulteFire's unique ability to offer licensed-like performance and predictable QoS. End-user demographics are shifting towards enterprises and venue operators seeking dedicated, high-performance wireless networks. Mergers and acquisitions (M&A) trends indicate consolidation among key players aiming to capture market share and develop integrated solutions.

- Market Concentration: Dominated by a few key technology developers and chipset manufacturers.

- Technological Innovation Drivers: Advancements in spectrum sharing, efficient antenna design, and integrated access and backhaul (IAB).

- Regulatory Frameworks: Evolving policies supporting unlicensed spectrum and neutral host models.

- Competitive Product Substitutes: Wi-Fi 6/6E, private LTE/5G solutions.

- End-User Demographics: Enterprise, industrial, public venue, and smart city applications.

- M&A Trends: Strategic acquisitions focused on expanding product portfolios and geographical reach.

MulteFire Industry Growth Trends & Insights

The MulteFire industry is poised for significant expansion, driven by the increasing demand for reliable, high-capacity wireless connectivity in diverse environments. The market size is projected to witness a substantial CAGR of xx% over the forecast period (2025-2033), evolving from an estimated xx Million units in 2025 to xx Million units by 2033. Adoption rates are accelerating as businesses and public entities recognize the benefits of dedicated, unlicensed spectrum solutions for private networks, IoT deployments, and enhanced mobile broadband. Technological disruptions, such as the integration of AI for network management and the development of more energy-efficient small cell architectures, are further fueling this growth. Consumer behavior shifts towards a preference for seamless, high-speed connectivity across all touchpoints are creating a strong pull for MulteFire's capabilities. The report leverages extensive market research to provide granular insights into these evolving dynamics.

- Market Size Evolution: Projected to grow from xx Million units in 2025 to xx Million units by 2033.

- CAGR: Estimated at xx% during the forecast period.

- Adoption Rates: Increasing across enterprise, industrial, and public venue sectors.

- Technological Disruptions: AI-driven network optimization, advanced beamforming, and modular small cell designs.

- Consumer Behavior Shifts: Demand for ubiquitous, high-performance wireless access influencing enterprise deployment strategies.

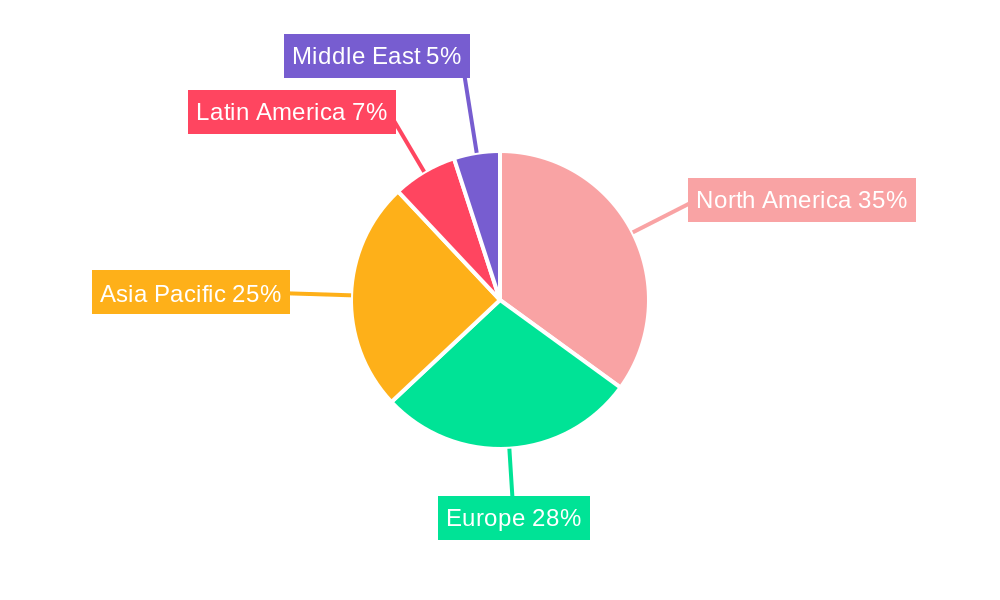

Dominant Regions, Countries, or Segments in MulteFire Industry

North America currently leads the MulteFire industry, driven by its robust technological innovation ecosystem, significant enterprise investment in private wireless networks, and supportive regulatory environment for spectrum utilization. The United States, in particular, is a key market, with a high concentration of technology pioneers and early adopters across various verticals. Within the equipment type segment, Small Cells are the dominant category, accounting for a substantial xx% of the market share in 2025. These compact and versatile devices are crucial for densifying wireless networks and providing localized coverage. For end-user verticals, Commercial & Institutional Buildings represent the largest segment, comprising approximately xx% of the market in 2025. This dominance stems from the growing need for reliable and secure connectivity in office spaces, educational institutions, and research facilities, where existing infrastructure may be insufficient or outdated.

- Dominant Region: North America, with the United States as the leading country.

- Dominant Equipment Type: Small Cells, capturing xx% market share in 2025.

- Key drivers: Need for localized coverage, capacity expansion, and private network deployments.

- Dominant End User Vertical: Commercial & Institutional Buildings, representing xx% of the market in 2025.

- Key drivers: Enterprise demand for private wireless, IoT integration, and enhanced employee/visitor experience.

- Sub-segments include office buildings, universities, and government facilities.

MulteFire Industry Product Landscape

The MulteFire industry's product landscape is characterized by an array of innovative small cell solutions, sophisticated switches, and intelligent controllers designed to deliver robust private wireless networks. Product innovations focus on enhancing spectrum efficiency, reducing latency, and simplifying deployment and management. Applications span enterprise Wi-Fi offload, industrial IoT, public safety networks, and venue connectivity. Performance metrics are increasingly evaluated on their ability to provide licensed-like Quality of Service (QoS) and predictable throughput, distinguishing them from traditional unlicensed spectrum solutions. Unique selling propositions often revolve around cost-effectiveness, flexibility, and the ability to integrate seamlessly with existing IT infrastructure.

Key Drivers, Barriers & Challenges in MulteFire Industry

Key Drivers:

- Growing Demand for Private Wireless Networks: Enterprises are increasingly seeking dedicated, secure, and high-performance wireless solutions for enhanced productivity and operational efficiency.

- Spectrum Availability: Leveraging unlicensed spectrum (e.g., 3.5 GHz CBRS) offers a cost-effective alternative to licensed spectrum.

- IoT Proliferation: The exponential growth of IoT devices necessitates robust and scalable wireless connectivity solutions.

- Technological Advancements: Miniaturization of hardware, improved power efficiency, and advanced antenna technologies are making MulteFire solutions more viable and affordable.

- Neutral Host Deployments: MulteFire's architecture is well-suited for neutral host models, enabling shared infrastructure for multiple tenants or operators.

Barriers & Challenges:

- Spectrum Congestion and Interference: While unlicensed spectrum offers advantages, it can be susceptible to interference from other devices, impacting performance predictability.

- Regulatory Hurdles: Navigating the evolving regulatory landscape for unlicensed and shared spectrum can be complex.

- Interoperability Concerns: Ensuring seamless interoperability between different MulteFire vendors and existing network infrastructure remains a challenge.

- Limited Ecosystem Maturity: Compared to established technologies like Wi-Fi and licensed LTE/5G, the MulteFire ecosystem is still maturing.

- Security Perceptions: Building trust and ensuring robust security protocols are crucial for widespread enterprise adoption.

Emerging Opportunities in MulteFire Industry

Emerging opportunities within the MulteFire industry lie in the untapped potential of smart cities, expanding industrial automation, and the growing demand for enhanced connectivity in transportation hubs. The integration of MulteFire with edge computing offers new avenues for real-time data processing and localized intelligence. Furthermore, the development of specialized MulteFire solutions for critical infrastructure and remote area connectivity presents significant untapped markets. Evolving consumer preferences for seamless, high-bandwidth experiences in public spaces will also drive adoption.

Growth Accelerators in the MulteFire Industry Industry

Catalysts driving long-term growth in the MulteFire industry include ongoing technological breakthroughs in spectrum management and small cell efficiency, strategic partnerships between infrastructure providers and enterprises, and aggressive market expansion strategies by key players. The development of integrated access and backhaul (IAB) solutions will further streamline deployments. Investments in research and development focused on enabling 5G capabilities over unlicensed spectrum will also act as significant growth accelerators.

Key Players Shaping the MulteFire Industry Market

- Telefonaktiebolaget LM Ericsson

- InterDigital Inc

- Baicells Technologies

- Samsung Electronics Co Ltd

- Qualcomm Technologies Inc

- DEKRA India Private Limited

- Huawei Technologies Co Ltd

- Nokia Corporation

- Intel Corporation

- Sony Corporation

Notable Milestones in MulteFire Industry Sector

- February 2023: Verana Networks, a mmWave small cells startup, published parameters of a new trial with Verizon, making Verizon a strategic investor. Verana's mmWave small cells, designed for Integrated Access and Backhaul, will undergo field testing.

In-Depth MulteFire Industry Market Outlook

The future market outlook for the MulteFire industry is exceptionally promising, fueled by continuous technological advancements, a burgeoning demand for private wireless networks, and expanding application areas. Growth accelerators such as AI-driven network optimization, the maturation of the CBRS ecosystem in North America, and the increasing need for robust IoT connectivity will propel market expansion. Strategic partnerships, innovative product development focusing on enhanced performance and ease of deployment, and the exploration of new geographical markets present significant opportunities for sustained growth and market penetration. The industry is well-positioned to capitalize on the global shift towards ubiquitous, high-performance wireless connectivity.

MulteFire Industry Segmentation

-

1. Equipment Type

- 1.1. Small Cells

- 1.2. Switches

- 1.3. Controllers

-

2. End User Vertical

- 2.1. Commercial & Institutional Buildings

- 2.2. Supply Chain and Distribution

- 2.3. Retail

- 2.4. Hospitality

- 2.5. Public Venues

- 2.6. Healthcare

- 2.7. Others

MulteFire Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

MulteFire Industry Regional Market Share

Geographic Coverage of MulteFire Industry

MulteFire Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Shared and Unlicensed Spectrum Bands; Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications; Low Cost of Deployment that doesn't Require Spectrum License

- 3.3. Market Restrains

- 3.3.1. Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel; Delay in Decision-Making Regarding Use of Shared Spectrum

- 3.4. Market Trends

- 3.4.1. Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Small Cells

- 5.1.2. Switches

- 5.1.3. Controllers

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Commercial & Institutional Buildings

- 5.2.2. Supply Chain and Distribution

- 5.2.3. Retail

- 5.2.4. Hospitality

- 5.2.5. Public Venues

- 5.2.6. Healthcare

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Small Cells

- 6.1.2. Switches

- 6.1.3. Controllers

- 6.2. Market Analysis, Insights and Forecast - by End User Vertical

- 6.2.1. Commercial & Institutional Buildings

- 6.2.2. Supply Chain and Distribution

- 6.2.3. Retail

- 6.2.4. Hospitality

- 6.2.5. Public Venues

- 6.2.6. Healthcare

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Small Cells

- 7.1.2. Switches

- 7.1.3. Controllers

- 7.2. Market Analysis, Insights and Forecast - by End User Vertical

- 7.2.1. Commercial & Institutional Buildings

- 7.2.2. Supply Chain and Distribution

- 7.2.3. Retail

- 7.2.4. Hospitality

- 7.2.5. Public Venues

- 7.2.6. Healthcare

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Small Cells

- 8.1.2. Switches

- 8.1.3. Controllers

- 8.2. Market Analysis, Insights and Forecast - by End User Vertical

- 8.2.1. Commercial & Institutional Buildings

- 8.2.2. Supply Chain and Distribution

- 8.2.3. Retail

- 8.2.4. Hospitality

- 8.2.5. Public Venues

- 8.2.6. Healthcare

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Latin America MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Small Cells

- 9.1.2. Switches

- 9.1.3. Controllers

- 9.2. Market Analysis, Insights and Forecast - by End User Vertical

- 9.2.1. Commercial & Institutional Buildings

- 9.2.2. Supply Chain and Distribution

- 9.2.3. Retail

- 9.2.4. Hospitality

- 9.2.5. Public Venues

- 9.2.6. Healthcare

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Middle East MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10.1.1. Small Cells

- 10.1.2. Switches

- 10.1.3. Controllers

- 10.2. Market Analysis, Insights and Forecast - by End User Vertical

- 10.2.1. Commercial & Institutional Buildings

- 10.2.2. Supply Chain and Distribution

- 10.2.3. Retail

- 10.2.4. Hospitality

- 10.2.5. Public Venues

- 10.2.6. Healthcare

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11. United Arab Emirates MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11.1.1. Small Cells

- 11.1.2. Switches

- 11.1.3. Controllers

- 11.2. Market Analysis, Insights and Forecast - by End User Vertical

- 11.2.1. Commercial & Institutional Buildings

- 11.2.2. Supply Chain and Distribution

- 11.2.3. Retail

- 11.2.4. Hospitality

- 11.2.5. Public Venues

- 11.2.6. Healthcare

- 11.2.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Telefonaktiebolaget LM Ericsson

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 InterDigital Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baicells Technologies

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Samsung Electronics Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Qualcomm Technologies Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DEKRA India Private Limited*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huawei Technologies Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nokia Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intel Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Telefonaktiebolaget LM Ericsson

List of Figures

- Figure 1: Global MulteFire Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 3: North America MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: North America MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 5: North America MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 6: North America MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 9: Europe MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 10: Europe MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 11: Europe MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 12: Europe MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 15: Asia Pacific MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Asia Pacific MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 17: Asia Pacific MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 18: Asia Pacific MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 21: Latin America MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Latin America MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 23: Latin America MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 24: Latin America MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 27: Middle East MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 28: Middle East MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 29: Middle East MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 30: Middle East MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 33: United Arab Emirates MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 34: United Arab Emirates MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 35: United Arab Emirates MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 36: United Arab Emirates MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: United Arab Emirates MulteFire Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 3: Global MulteFire Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 6: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 10: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 11: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 17: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 18: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: India MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 24: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 25: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Brazil MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Argentina MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 30: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 31: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 33: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 34: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MulteFire Industry?

The projected CAGR is approximately 31.04%.

2. Which companies are prominent players in the MulteFire Industry?

Key companies in the market include Telefonaktiebolaget LM Ericsson, InterDigital Inc, Baicells Technologies, Samsung Electronics Co Ltd, Qualcomm Technologies Inc, DEKRA India Private Limited*List Not Exhaustive, Huawei Technologies Co Ltd, Nokia Corporation, Intel Corporation, Sony Corporation.

3. What are the main segments of the MulteFire Industry?

The market segments include Equipment Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Shared and Unlicensed Spectrum Bands; Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications; Low Cost of Deployment that doesn't Require Spectrum License.

6. What are the notable trends driving market growth?

Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications.

7. Are there any restraints impacting market growth?

Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel; Delay in Decision-Making Regarding Use of Shared Spectrum.

8. Can you provide examples of recent developments in the market?

February 2023 - Verana Networks, a mmWave small cells startup that The Mobile Network (TMN) profiled last year, has published parameters of a new trial with Verizon and made Verizon a strategic investor in the startup public for the initial time. Verana's mmWave small cells, installed to enable Integrated Access and Backhaul, will be put through field tests.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MulteFire Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MulteFire Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MulteFire Industry?

To stay informed about further developments, trends, and reports in the MulteFire Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence