Key Insights

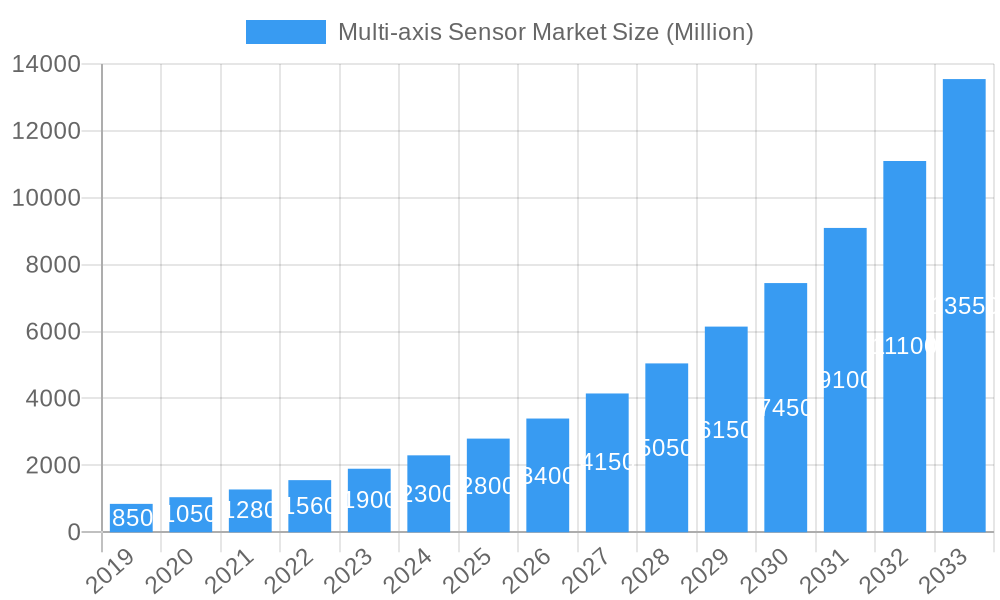

The global Multi-axis Sensor market is poised for significant expansion, driven by a projected Compound Annual Growth Rate (CAGR) of 13.7%. The market size is estimated at $5.86 billion in the base year 2025, with a forecast period from 2025 to 2033. This robust growth is propelled by escalating demand for precise motion tracking and orientation detection in consumer electronics and the automotive sector, particularly for Advanced Driver-Assistance Systems (ADAS). Integration in industrial automation for precision control and in medical devices for enhanced diagnostics also contributes significantly. Key trends include miniaturization, increased accuracy, and reduced power consumption in MEMS gyroscopes and accelerometers. Motion sensor combos are gaining traction for their cost-effectiveness and comprehensive motion analysis capabilities.

Multi-axis Sensor Market Market Size (In Billion)

Challenges such as the initial high cost of specialized sensor solutions and integration complexities may temper growth. Supply chain volatility, though recently stabilizing, can still impact availability. However, continuous technological innovation, the pursuit of superior user experiences, and operational efficiencies will drive market advancement. Emerging applications in robotics, virtual and augmented reality, and drone technology offer substantial growth opportunities, cementing the multi-axis sensor's role in modern technological progress. Leading companies like Honeywell International Inc., Trimble Navigation Ltd., and STMicroelectronics are investing in R&D to meet evolving market demands.

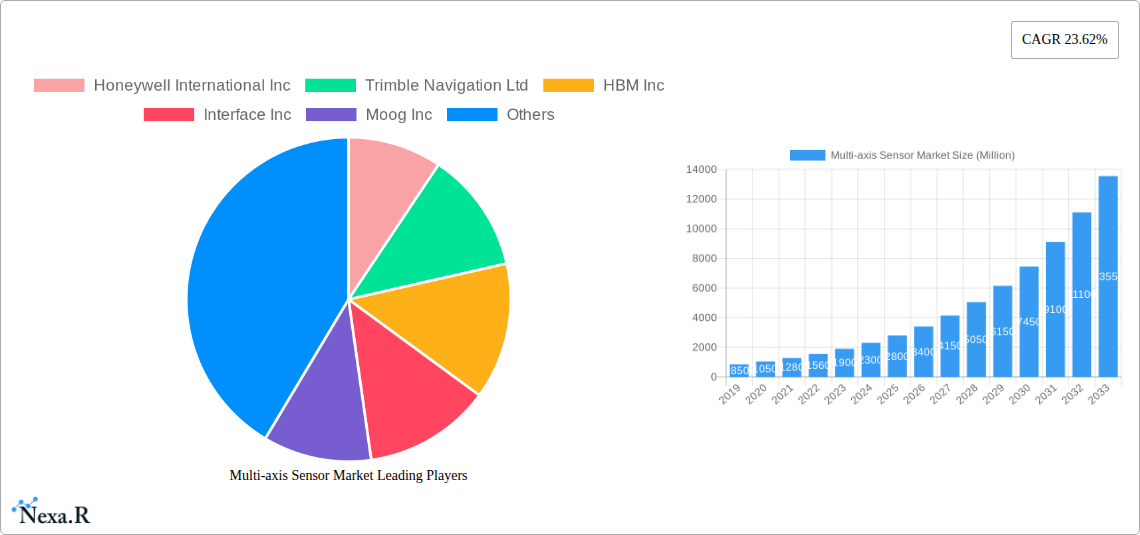

Multi-axis Sensor Market Company Market Share

This comprehensive report analyzes the global Multi-axis Sensor market dynamics, growth trends, segmentation, competitive landscape, and future projections. Utilizing extensive historical data and advanced forecasting models, the research offers actionable insights for navigating this dynamic industry. The study covers the period from 2019 to 2033, with 2025 as the base year.

Multi-axis Sensor Market Market Dynamics & Structure

The Multi-axis Sensor market is characterized by moderate to high concentration, driven by a select group of established players and emerging innovators. Technological innovation is a primary driver, with continuous advancements in MEMS (Micro-Electro-Mechanical Systems) technology leading to smaller, more accurate, and energy-efficient sensors. Key innovation drivers include miniaturization, increased sensitivity, enhanced robustness, and lower power consumption for mobile and IoT applications. Regulatory frameworks, particularly concerning data privacy and safety standards in automotive and medical devices, indirectly influence sensor design and adoption. Competitive product substitutes, while present in specific niche applications, are largely being superseded by the versatility and integration capabilities of multi-axis sensors. End-user demographics are diverse, ranging from tech-savvy consumers demanding advanced features in their devices to industrial operators seeking improved automation and safety. Merger and acquisition (M&A) trends are indicative of market consolidation and strategic partnerships aimed at expanding product portfolios and market reach. For instance, the last two years (2023-2024) have seen an estimated 15-20 M&A deals, with average deal values ranging from $50 million to $200 million, as larger companies acquire innovative startups to bolster their sensor capabilities. Barriers to innovation include high research and development costs, long product development cycles, and the need for stringent testing and certification.

- Market Concentration: Moderately concentrated, with a few key players holding significant market share.

- Technological Innovation Drivers: Miniaturization, enhanced accuracy, power efficiency, integration capabilities.

- Regulatory Frameworks: Focus on safety, data privacy, and industry-specific standards.

- Competitive Product Substitutes: Limited in broad applications, but present in specific niche areas.

- End-User Demographics: Diverse, spanning consumer, industrial, automotive, and healthcare sectors.

- M&A Trends: Active consolidation and strategic partnerships observed in recent years.

- Innovation Barriers: High R&D costs, lengthy development cycles, stringent certification requirements.

Multi-axis Sensor Market Growth Trends & Insights

The global Multi-axis Sensor market is poised for significant growth, propelled by an escalating demand for intelligent and connected devices across various industries. The market size is projected to expand from an estimated $5,000 million units in 2025 to an impressive $12,000 million units by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 12.5%. This robust expansion is fueled by the increasing integration of multi-axis sensors into consumer electronics, such as smartphones, wearables, and gaming consoles, where they enable features like gesture recognition, orientation sensing, and advanced motion tracking. The automotive sector is another major growth engine, with the rising adoption of Advanced Driver-Assistance Systems (ADAS), autonomous driving technologies, and in-car infotainment systems necessitating sophisticated sensing solutions for precise motion and position monitoring. The aerospace and defense industry continues to be a stable demand generator, utilizing these sensors for navigation, stabilization, and control systems.

Technological disruptions are at the forefront of this market's evolution. The continuous miniaturization of MEMS accelerometers and gyroscopes, coupled with advancements in sensor fusion algorithms, allows for more complex and precise data acquisition. This enables applications that were previously unfeasible, such as advanced robotics, industrial automation with enhanced precision, and sophisticated medical monitoring devices. Consumer behavior shifts towards seeking richer, more interactive experiences in their devices are directly translating into higher demand for multi-axis sensor functionalities. The growing awareness and adoption of IoT devices in smart homes, smart cities, and industrial settings further amplify the need for reliable and cost-effective multi-axis sensing solutions. For instance, the penetration rate of motion sensor combos in smartphones has already surpassed 95%, highlighting the mainstream adoption within the consumer electronics segment. The forecast anticipates continued innovation in areas like magnetic sensors and inertial measurement units (IMUs), leading to even more integrated and intelligent sensing capabilities that will further accelerate market penetration.

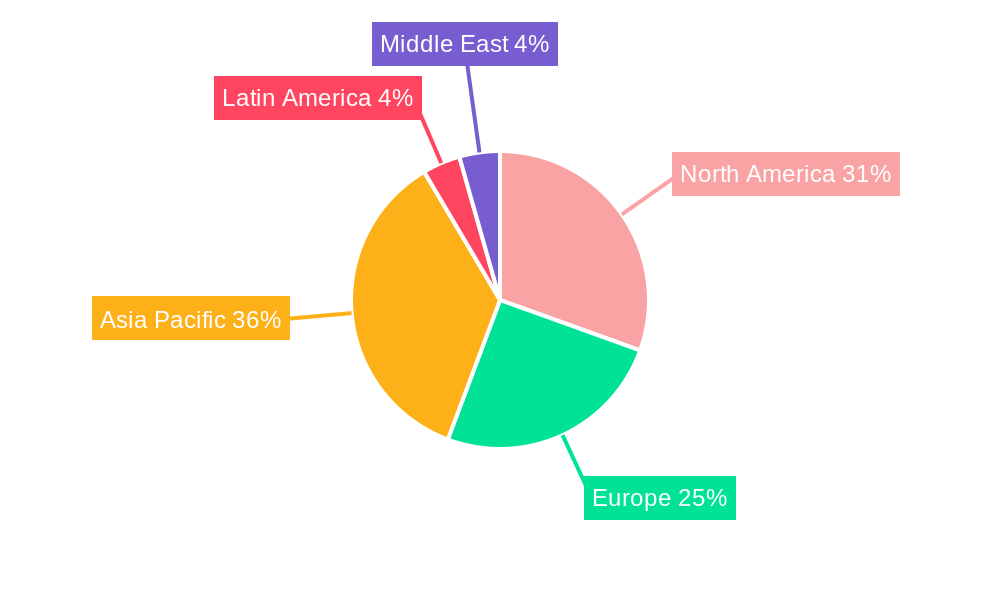

Dominant Regions, Countries, or Segments in Multi-axis Sensor Market

The Consumer Electronics segment, particularly within the Asia Pacific region, is currently the dominant force driving the global Multi-axis Sensor market. This dominance is fueled by several interconnected factors, including a massive consumer base, robust manufacturing capabilities, and rapid technological adoption. The sheer volume of smartphones, tablets, wearables, and gaming consoles produced and consumed in countries like China, South Korea, and Japan creates an insatiable demand for multi-axis sensors, especially MEMS Accelerometers and Motion Sensor Combos. These sensors are integral to user interface functionalities, motion-based gaming, fitness tracking, and image stabilization, making them indispensable components.

Within the Asia Pacific region, China stands out as a pivotal market, contributing significantly to both production and consumption. Its vast manufacturing ecosystem, coupled with a growing middle class with increasing disposable income, supports the high demand for consumer electronics incorporating advanced sensor technology. Government initiatives promoting technological innovation and smart manufacturing further bolster the region's leadership.

While Consumer Electronics takes the lead, the Automotive sector is a rapidly growing segment and a significant contributor to market value, particularly in regions with strong automotive manufacturing bases like North America and Europe. The increasing integration of ADAS and the pursuit of autonomous driving are driving substantial demand for sophisticated multi-axis sensors, including gyroscopes and accelerometers, for applications such as electronic stability control, adaptive cruise control, and parking assistance.

- Dominant Segment: Consumer Electronics, driven by smartphones, wearables, and gaming consoles.

- Dominant Region: Asia Pacific, led by China, due to manufacturing prowess and consumer demand.

- Key Drivers in Asia Pacific: Large consumer base, advanced manufacturing, government support for technology.

- Key Drivers in Automotive Segment: ADAS integration, autonomous driving development, in-car electronics.

- Growth Potential: Significant growth anticipated in Automotive and Industrial applications in North America and Europe.

- Emerging Segments: Medical and Healthcare applications showing promising growth due to remote patient monitoring and advanced diagnostics.

Multi-axis Sensor Market Product Landscape

The Multi-axis Sensor market is characterized by a dynamic product landscape focused on enhanced performance, integration, and cost-effectiveness. MEMS accelerometers and gyroscopes continue to dominate due to their miniaturization and affordability, finding widespread use in smartphones, wearables, and automotive systems for motion and orientation detection. Motion Sensor Combos, integrating accelerometers, gyroscopes, and digital compasses, offer comprehensive motion tracking solutions, simplifying system design and reducing power consumption. Digital compasses provide accurate heading information, crucial for navigation applications. Emerging trends include the development of highly sensitive inertial measurement units (IMUs) with improved noise performance for critical applications in aerospace and industrial automation, as well as advancements in low-power sensors for extended battery life in IoT devices. Novel materials and fabrication techniques are enabling smaller footprints and improved resistance to environmental factors like temperature and vibration.

Key Drivers, Barriers & Challenges in Multi-axis Sensor Market

Key Drivers: The Multi-axis Sensor market is propelled by several key factors. The escalating demand for smart and connected devices across consumer electronics, automotive, and industrial sectors is a primary driver. Technological advancements in MEMS, leading to smaller, more accurate, and power-efficient sensors, further fuel adoption. The increasing implementation of ADAS and autonomous driving technologies in vehicles significantly boosts demand for high-performance inertial sensors. Furthermore, the growth of the Industrial Internet of Things (IIoT) for automation, predictive maintenance, and robotics creates substantial opportunities.

Key Barriers & Challenges: Despite the positive growth trajectory, the market faces several challenges. High research and development costs and the need for specialized expertise can pose barriers to entry for new players. Supply chain disruptions, as witnessed in recent years, can impact component availability and lead times, affecting production schedules. Intense competition among established players and emerging manufacturers can lead to price pressures, affecting profit margins. Stringent regulatory requirements, especially in the automotive and medical sectors, necessitate extensive testing and certification, adding to development time and costs. Moreover, ensuring data accuracy and reliability in diverse and often harsh operating environments remains a persistent technical challenge.

Emerging Opportunities in Multi-axis Sensor Market

Emerging opportunities within the Multi-axis Sensor market are abundant, driven by innovation and evolving consumer and industrial needs. The rapidly expanding IoT ecosystem presents a vast landscape for low-power, integrated multi-axis sensors in smart home devices, wearables for health monitoring, and industrial asset tracking. The burgeoning field of augmented reality (AR) and virtual reality (VR) demands highly precise and responsive motion tracking capabilities, creating a significant growth avenue. In the medical sector, the development of advanced prosthetics, robotic surgery systems, and sophisticated diagnostic tools will necessitate highly accurate and reliable multi-axis sensing. Furthermore, the increasing focus on smart agriculture and environmental monitoring applications offers a niche yet growing market for ruggedized and energy-efficient sensor solutions.

Growth Accelerators in the Multi-axis Sensor Market Industry

Several factors are acting as significant growth accelerators for the Multi-axis Sensor market. Continuous technological breakthroughs in MEMS fabrication, leading to enhanced performance characteristics such as higher sensitivity, lower drift, and improved shock resistance, are key enablers. Strategic partnerships and collaborations between sensor manufacturers and end-product developers, particularly in the automotive and consumer electronics sectors, are accelerating the integration and adoption of multi-axis sensors. Market expansion strategies, including geographical diversification into emerging economies and the development of specialized sensor solutions for niche applications, are further driving growth. The increasing trend towards sensor fusion and the development of sophisticated algorithms that leverage data from multiple sensors to provide richer insights are also critical growth accelerators, unlocking new application possibilities.

Key Players Shaping the Multi-axis Sensor Market Market

- Honeywell International Inc

- Trimble Navigation Ltd

- HBM Inc

- Interface Inc

- Moog Inc

- L3 Communications

- Parker Hannifin

- Jewell Instruments LLC

- Aeron Systems

- STMicroelectronics

Notable Milestones in Multi-axis Sensor Market Sector

- 2023: Introduction of next-generation MEMS accelerometers with significantly reduced power consumption for extended IoT device battery life.

- 2023: Launch of advanced IMUs with enhanced vibration immunity, targeting demanding industrial automation and robotics applications.

- 2024: Strategic acquisition of a specialized sensor fusion software company by a leading multi-axis sensor manufacturer to offer integrated solutions.

- 2024: Significant advancements in solid-state gyroscopes demonstrating improved accuracy and reduced susceptibility to temperature variations.

- 2024: Increased adoption of multi-axis sensors in entry-level automotive models for basic ADAS functionalities, expanding market reach.

In-Depth Multi-axis Sensor Market Market Outlook

The future outlook for the Multi-axis Sensor market is exceptionally bright, characterized by sustained robust growth and transformative innovation. Key growth accelerators, including ongoing advancements in MEMS technology, the pervasive expansion of the IoT, and the relentless pursuit of intelligent automation across industries, will continue to fuel market expansion. Strategic collaborations and the development of highly integrated sensor modules will streamline adoption and unlock novel applications. The increasing demand for sophisticated sensing capabilities in emerging fields such as AR/VR, advanced healthcare solutions, and smart infrastructure will create significant untapped market potential. Stakeholders can expect continued investment in research and development, leading to even more compact, precise, and energy-efficient multi-axis sensors, solidifying their indispensable role in the future of technology and industry.

Multi-axis Sensor Market Segmentation

-

1. Type

- 1.1. MEMS Gyroscopes

- 1.2. MEMS Accelerometers

- 1.3. Digital Compass

- 1.4. Motion Sensor Combos

- 1.5. Other Types

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Aerospace and Defense

- 2.4. Medical and Healthcare

- 2.5. Industrial

- 2.6. Other Applications

Multi-axis Sensor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Multi-axis Sensor Market Regional Market Share

Geographic Coverage of Multi-axis Sensor Market

Multi-axis Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancements Giving Rise to Innovative Products; Increasing Applications Based on Motion Sensing

- 3.3. Market Restrains

- 3.3.1. ; Complex Nature of Integration in Existing Systems and Need for Ancillary Components

- 3.4. Market Trends

- 3.4.1. Incorporation of MEMS Sensors in Consumer Electronics Segment to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Multi-axis Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. MEMS Gyroscopes

- 5.1.2. MEMS Accelerometers

- 5.1.3. Digital Compass

- 5.1.4. Motion Sensor Combos

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Aerospace and Defense

- 5.2.4. Medical and Healthcare

- 5.2.5. Industrial

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Multi-axis Sensor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. MEMS Gyroscopes

- 6.1.2. MEMS Accelerometers

- 6.1.3. Digital Compass

- 6.1.4. Motion Sensor Combos

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Aerospace and Defense

- 6.2.4. Medical and Healthcare

- 6.2.5. Industrial

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Multi-axis Sensor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. MEMS Gyroscopes

- 7.1.2. MEMS Accelerometers

- 7.1.3. Digital Compass

- 7.1.4. Motion Sensor Combos

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Aerospace and Defense

- 7.2.4. Medical and Healthcare

- 7.2.5. Industrial

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Multi-axis Sensor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. MEMS Gyroscopes

- 8.1.2. MEMS Accelerometers

- 8.1.3. Digital Compass

- 8.1.4. Motion Sensor Combos

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Aerospace and Defense

- 8.2.4. Medical and Healthcare

- 8.2.5. Industrial

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Multi-axis Sensor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. MEMS Gyroscopes

- 9.1.2. MEMS Accelerometers

- 9.1.3. Digital Compass

- 9.1.4. Motion Sensor Combos

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Aerospace and Defense

- 9.2.4. Medical and Healthcare

- 9.2.5. Industrial

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Multi-axis Sensor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. MEMS Gyroscopes

- 10.1.2. MEMS Accelerometers

- 10.1.3. Digital Compass

- 10.1.4. Motion Sensor Combos

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Consumer Electronics

- 10.2.2. Automotive

- 10.2.3. Aerospace and Defense

- 10.2.4. Medical and Healthcare

- 10.2.5. Industrial

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trimble Navigation Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HBM Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Interface Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Moog Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L3 Communications

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Parker Hannifin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jewell Instruments LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aeron Systems*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 STMicroelectronic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Multi-axis Sensor Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Multi-axis Sensor Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Multi-axis Sensor Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Multi-axis Sensor Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Multi-axis Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Multi-axis Sensor Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Multi-axis Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Multi-axis Sensor Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Multi-axis Sensor Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Multi-axis Sensor Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Multi-axis Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Multi-axis Sensor Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Multi-axis Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Multi-axis Sensor Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Multi-axis Sensor Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Multi-axis Sensor Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Multi-axis Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Multi-axis Sensor Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Multi-axis Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Multi-axis Sensor Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Multi-axis Sensor Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Multi-axis Sensor Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Multi-axis Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Multi-axis Sensor Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Multi-axis Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Multi-axis Sensor Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Multi-axis Sensor Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Multi-axis Sensor Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Multi-axis Sensor Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Multi-axis Sensor Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Multi-axis Sensor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Multi-axis Sensor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Multi-axis Sensor Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Multi-axis Sensor Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Multi-axis Sensor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Multi-axis Sensor Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Multi-axis Sensor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Multi-axis Sensor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Multi-axis Sensor Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Multi-axis Sensor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Multi-axis Sensor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Multi-axis Sensor Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Multi-axis Sensor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Multi-axis Sensor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Multi-axis Sensor Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Multi-axis Sensor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Multi-axis Sensor Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Multi-axis Sensor Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Multi-axis Sensor Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Multi-axis Sensor Market?

The projected CAGR is approximately 13.7%.

2. Which companies are prominent players in the Multi-axis Sensor Market?

Key companies in the market include Honeywell International Inc, Trimble Navigation Ltd, HBM Inc, Interface Inc, Moog Inc, L3 Communications, Parker Hannifin, Jewell Instruments LLC, Aeron Systems*List Not Exhaustive, STMicroelectronic.

3. What are the main segments of the Multi-axis Sensor Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.86 billion as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancements Giving Rise to Innovative Products; Increasing Applications Based on Motion Sensing.

6. What are the notable trends driving market growth?

Incorporation of MEMS Sensors in Consumer Electronics Segment to Drive the Market.

7. Are there any restraints impacting market growth?

; Complex Nature of Integration in Existing Systems and Need for Ancillary Components.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Multi-axis Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Multi-axis Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Multi-axis Sensor Market?

To stay informed about further developments, trends, and reports in the Multi-axis Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence