Key Insights

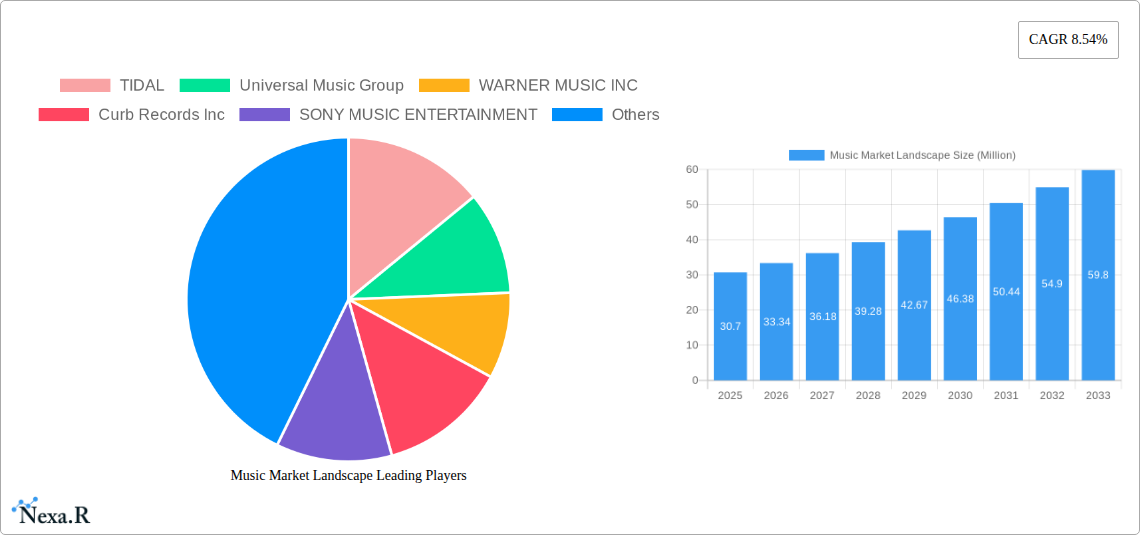

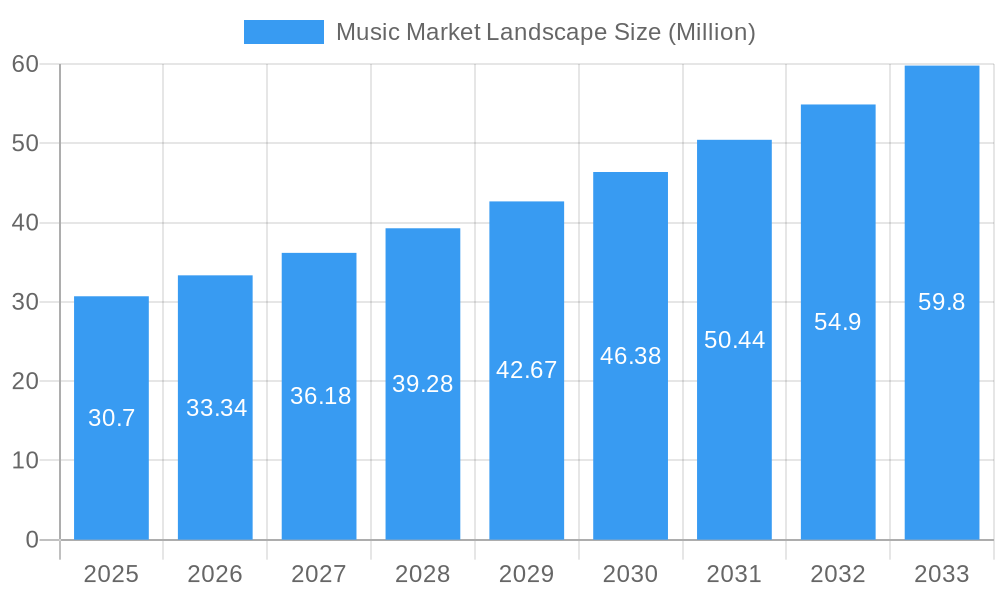

The global music market is experiencing robust growth, projected to reach $30.70 million by 2025, fueled by a CAGR of 8.54% through 2033. This expansion is primarily driven by the escalating adoption of digital music streaming services, which have revolutionized music consumption and revenue generation. The ease of access, vast libraries, and personalized experiences offered by platforms like Spotify, Apple Music, and Deezer have cemented their position as dominant forces. Furthermore, the increasing ubiquity of smartphones and affordable internet connectivity, especially in emerging economies, is unlocking new consumer bases and driving subscription growth. The digital segment, encompassing downloads and streaming, continues to outperform traditional physical media, although vinyl sales have seen a niche resurgence. Performance rights, licensing for media, and burgeoning digital product sales also contribute significantly to the market's overall health, indicating a diversified revenue stream for artists and rights holders.

Music Market Landscape Market Size (In Million)

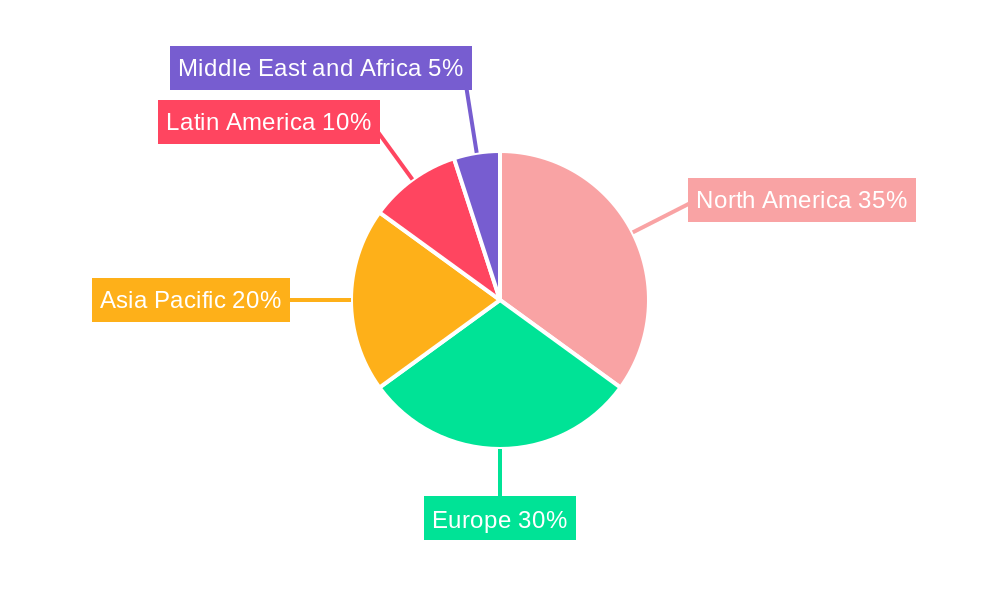

While the digital transformation propels the market forward, certain factors necessitate careful consideration. Intense competition among streaming giants, coupled with the challenge of fair artist compensation models, presents an ongoing dynamic. Piracy, although diminished by convenient legal alternatives, remains a subtle restraint. However, the industry's ability to innovate, explore new revenue streams like NFTs and virtual concerts, and the growing influence of social media in music discovery and promotion, suggest a resilient and adaptive market. Geographically, North America and Europe continue to lead in terms of market value, but the Asia Pacific region, particularly China and India, shows immense potential for accelerated growth due to a rapidly expanding middle class and increasing digital penetration. This dynamic landscape promises continued evolution and exciting opportunities for all stakeholders involved.

Music Market Landscape Company Market Share

Music Market Landscape: Comprehensive Analysis and Future Outlook (2019–2033)

Gain unparalleled insight into the dynamic global music market landscape. This comprehensive report, spanning the historical period (2019–2024) and extending to the forecast period (2025–2033) with a base year and estimated year of 2025, delivers an in-depth analysis of market trends, growth drivers, and competitive strategies. We provide actionable intelligence for industry professionals navigating the evolving world of music revenue generation formats including streaming, digital, physical products, and performance rights. With a focus on both the parent market and crucial child markets, this report equips you with the data and analysis needed to thrive.

Music Market Landscape Market Dynamics & Structure

The music market landscape is characterized by a dynamic interplay of technological innovation, evolving consumer preferences, and strategic corporate maneuvers. Market concentration, while significant within major labels like Universal Music Group, WARNER MUSIC INC, and SONY MUSIC ENTERTAINMENT, is increasingly influenced by agile independent players such as Kobalt Music Group Ltd and BMG Rights Management GmbH, alongside direct-to-fan platforms. Technological advancements, particularly in streaming technologies and AI-driven music creation and discovery, serve as primary drivers, continuously reshaping distribution and consumption patterns. Regulatory frameworks, though evolving, are crucial in safeguarding intellectual property and ensuring fair compensation for artists and rights holders. Competitive product substitutes, ranging from other forms of entertainment to emerging audio experiences, necessitate continuous innovation and strategic differentiation. End-user demographics are increasingly segmented, with a growing Gen Z and Alpha audience driving demand for interactive and personalized music experiences. Merger and acquisition (M&A) trends, exemplified by strategic alliances within the parent market and child markets, indicate a consolidation of power and a pursuit of synergistic growth opportunities. The music market landscape is a complex ecosystem where innovation and adaptation are paramount for sustained success.

- Market Concentration: Dominated by major labels but with growing influence of independent entities and tech giants.

- Technological Innovation: Streaming, AI in music production, and personalized discovery platforms are key drivers.

- Regulatory Frameworks: Essential for IP protection, artist royalties, and fair market practices.

- Competitive Substitutes: Competition from other entertainment forms and evolving audio experiences.

- End-User Demographics: Younger audiences demanding personalized and interactive content.

- M&A Trends: Strategic acquisitions and partnerships driving consolidation and synergy.

Music Market Landscape Growth Trends & Insights

The music market landscape is poised for robust growth, fueled by the escalating adoption of digital technologies and shifting consumer behaviors. The streaming segment, a critical child market within the broader music market landscape, continues to be the primary growth engine, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2019 to 2033. This surge is driven by increased internet penetration, the proliferation of affordable smart devices, and the convenience offered by platforms like Spotify, Apple Music, and TIDAL. The global market size, valued at over $60,000 Million units in 2019, is projected to reach an estimated $130,000 Million units by 2025 and surpass $220,000 Million units by 2033. Adoption rates for paid streaming subscriptions remain high, indicating a strong willingness among consumers to pay for curated and on-demand music access. Technological disruptions, including advancements in audio codecs, AI-powered recommendation engines, and the nascent but promising metaverse music experiences, are continuously enhancing user engagement and creating new avenues for revenue. Consumer behavior has fundamentally shifted towards access over ownership, with streaming services fulfilling this demand seamlessly. The digital segment, encompassing downloads and ringtones, while mature, still contributes a significant portion to overall revenue, albeit with a slower growth trajectory compared to streaming. Understanding these evolving trends and the intricate dynamics of the parent market and its child markets is crucial for strategic planning.

- Market Size Evolution: Projected to grow from over $60,000 Million units in 2019 to over $220,000 Million units by 2033.

- CAGR: Estimated at 9.5% from 2019 to 2033, primarily driven by streaming.

- Adoption Rates: High adoption for paid streaming subscriptions signifies consumer preference for access models.

- Technological Disruptions: AI, metaverse music, and enhanced audio quality driving innovation.

- Consumer Behavior Shifts: Movement from ownership to access, with a demand for personalized experiences.

- Digital Segment Contribution: Still relevant but with a slower growth rate compared to streaming.

Dominant Regions, Countries, or Segments in Music Market Landscape

The music market landscape is demonstrably dominated by the streaming segment, a pivotal child market of the parent market, accounting for over 65% of global music revenues. This dominance is propelled by widespread internet accessibility, the ubiquitous presence of smartphones, and the increasing preference for subscription-based entertainment models. North America and Europe currently lead in streaming revenue, with the United States and the United Kingdom exhibiting particularly strong market penetration and high Average Revenue Per User (ARPU). However, Asia-Pacific is rapidly emerging as a significant growth frontier, driven by large populations, expanding middle classes, and the increasing adoption of affordable streaming services. Economic policies that support digital infrastructure development and intellectual property protection are crucial for nurturing growth in these regions.

- Streaming Segment Dominance: Accounts for over 65% of global music revenues, a key child market.

- Key Drivers: Internet accessibility, smartphone penetration, subscription model appeal.

- Market Share: Leading share in North America and Europe, with rapid growth in Asia-Pacific.

- Growth Potential: High, especially in emerging economies with increasing digital access.

- Digital Segment: While still significant, its growth is plateauing compared to streaming.

- Market Share: Contributes a substantial but decreasing percentage of overall revenue.

- Key Drivers: Legacy adoption, niche markets for high-fidelity downloads.

- Physical Products: Experiencing a niche resurgence, particularly in vinyl.

- Market Share: A smaller but stable segment, appealing to collectors and enthusiasts.

- Key Drivers: Nostalgia, perceived value, collectible appeal.

- Performance Rights: A vital revenue stream, influenced by licensing and public performance.

- Market Share: Consistent contributor, directly impacted by broadcast and live event activity.

- Key Drivers: Radio airplay, live performances, synchronization licenses.

Music Market Landscape Product Landscape

The music market landscape is continuously enriched by innovative products and applications designed to enhance music creation, distribution, and consumption. Streaming platforms like TIDAL and Deezer are at the forefront, offering high-fidelity audio options and curated artist content, differentiating themselves within a competitive child market. Digital distribution services and artist services from companies such as Sont ATV and Kobalt Music Group Ltd empower independent artists, offering them greater control over their repertoire and revenue streams. The integration of AI in music production and recommendation algorithms by tech giants like Apple Inc. is revolutionizing how music is discovered and consumed. Furthermore, the development of immersive audio technologies and virtual concert experiences within the metaverse signifies a new frontier for product innovation in the music market landscape.

Key Drivers, Barriers & Challenges in Music Market Landscape

The music market landscape is propelled by several key drivers. Technological advancements, particularly in streaming and digital distribution, are paramount. The increasing global connectivity and smartphone penetration enable wider access to music. Furthermore, the growing demand for diverse genres and independent artists fuels market expansion.

Key barriers and challenges include content piracy and the ongoing struggle to ensure fair compensation for artists and creators, especially in the streaming child market. Regulatory hurdles related to copyright and digital rights management can also impede growth. Intense competition among streaming platforms and the rising costs associated with talent acquisition and marketing present significant competitive pressures. Supply chain issues can impact the production and distribution of physical products, while evolving consumer preferences demand constant adaptation from all players in the parent market.

Emerging Opportunities in Music Market Landscape

Emerging opportunities within the music market landscape are abundant, particularly in underserved geographic regions and through innovative monetization models. The burgeoning live-streaming and virtual concert market presents significant potential for artist engagement and revenue generation, directly impacting child markets. The integration of music into gaming and the metaverse offers new avenues for brand partnerships and unique fan experiences. Furthermore, the increasing demand for niche genres and curated playlists creates opportunities for specialized streaming services and independent labels. The growth of AI-powered music creation tools also opens doors for new creative workflows and licensing models.

Growth Accelerators in the Music Market Landscape Industry

Several catalysts are accelerating growth in the music market landscape industry. Strategic partnerships between major labels, independent artists, and technology companies, such as the collaboration between Big Bang Music and Sony Music Publishing (SMP), are vital for expanding reach and optimizing royalty collection. Technological breakthroughs in audio quality and immersive experiences continue to drive consumer engagement. The ongoing expansion of streaming services into emerging markets, coupled with the rise of social media as a discovery and promotion tool, further fuels adoption rates. The evolving landscape of music licensing for digital content and synchronized media also represents a significant growth accelerator.

Key Players Shaping the Music Market Landscape Market

- TIDAL

- Universal Music Group

- WARNER MUSIC INC

- Curb Records Inc

- SONY MUSIC ENTERTAINMENT

- Kobalt Music Group Ltd

- BMG Rights Management GmbH

- Deezer

- Sont ATV

- Apple Inc

Notable Milestones in Music Market Landscape Sector

- August 2023: Big Bang Music entered into a strategic agreement with Sony Music Publishing (SMP). This collaboration entails SMP taking charge of the worldwide administration and promotion of Big Bang Music’s repertoire, aiming to amplify the exposure of their music across the global landscape. The partnership is anticipated to boost the publishing and royalty earnings of artists and songwriters while attaining a more extensive global audience via sync opportunities and global songwriter collaborations. The agreement covers administration, synchronization, and catalog promotion of the Indie music label’s repertoire.

- April 2023: Sony Music Entertainment UK announced the relaunch of the legendary record label Epic Records UK. Epic Records UK will likely relaunch as a frontline label, operating alongside other iconic Sony Music labels, including RCA, Columbia, and Ministry of Sound, with the ambition to champion global music and British culture. The announcement coincides with Epic Records's anniversary, which will celebrate 70 years of recorded music in 2023.

In-Depth Music Market Landscape Market Outlook

The future outlook for the music market landscape is exceptionally promising, driven by sustained innovation and evolving consumer engagement. The continued dominance of streaming as a child market within the parent market, coupled with expansion into emerging economies, will be a primary growth engine. Strategic alliances and the adoption of AI in content creation and personalization will further enhance market dynamics. Opportunities in the metaverse and other immersive technologies present exciting new frontiers for revenue generation and fan interaction. The report projects continued growth driven by these growth accelerators, indicating a dynamic and expanding global music market landscape for years to come.

Music Market Landscape Segmentation

-

1. Revenue Generation Format

- 1.1. Streaming

- 1.2. Digital

- 1.3. Physical Products

- 1.4. Performance Rights

Music Market Landscape Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East and Africa

Music Market Landscape Regional Market Share

Geographic Coverage of Music Market Landscape

Music Market Landscape REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment by the Record Companies; Increasing the travel and tourism industry will fuel market expansion.; Increased use of online music streaming to boost the market.

- 3.3. Market Restrains

- 3.3.1. Data Security and Privacy

- 3.4. Market Trends

- 3.4.1. Music Streaming to Witness the Largest Revenue Generation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Market Landscape Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 5.1.1. Streaming

- 5.1.2. Digital

- 5.1.3. Physical Products

- 5.1.4. Performance Rights

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 6. North America Music Market Landscape Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 6.1.1. Streaming

- 6.1.2. Digital

- 6.1.3. Physical Products

- 6.1.4. Performance Rights

- 6.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 7. Europe Music Market Landscape Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 7.1.1. Streaming

- 7.1.2. Digital

- 7.1.3. Physical Products

- 7.1.4. Performance Rights

- 7.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 8. Asia Pacific Music Market Landscape Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 8.1.1. Streaming

- 8.1.2. Digital

- 8.1.3. Physical Products

- 8.1.4. Performance Rights

- 8.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 9. Latin America Music Market Landscape Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 9.1.1. Streaming

- 9.1.2. Digital

- 9.1.3. Physical Products

- 9.1.4. Performance Rights

- 9.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 10. Middle East and Africa Music Market Landscape Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 10.1.1. Streaming

- 10.1.2. Digital

- 10.1.3. Physical Products

- 10.1.4. Performance Rights

- 10.1. Market Analysis, Insights and Forecast - by Revenue Generation Format

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TIDAL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Universal Music Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WARNER MUSIC INC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Curb Records Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SONY MUSIC ENTERTAINMENT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kobalt Music Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BMG Rights Management GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deezer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sont ATV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 TIDAL

List of Figures

- Figure 1: Global Music Market Landscape Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Music Market Landscape Revenue (Million), by Revenue Generation Format 2025 & 2033

- Figure 3: North America Music Market Landscape Revenue Share (%), by Revenue Generation Format 2025 & 2033

- Figure 4: North America Music Market Landscape Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Music Market Landscape Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Music Market Landscape Revenue (Million), by Revenue Generation Format 2025 & 2033

- Figure 7: Europe Music Market Landscape Revenue Share (%), by Revenue Generation Format 2025 & 2033

- Figure 8: Europe Music Market Landscape Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Music Market Landscape Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Music Market Landscape Revenue (Million), by Revenue Generation Format 2025 & 2033

- Figure 11: Asia Pacific Music Market Landscape Revenue Share (%), by Revenue Generation Format 2025 & 2033

- Figure 12: Asia Pacific Music Market Landscape Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Music Market Landscape Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Music Market Landscape Revenue (Million), by Revenue Generation Format 2025 & 2033

- Figure 15: Latin America Music Market Landscape Revenue Share (%), by Revenue Generation Format 2025 & 2033

- Figure 16: Latin America Music Market Landscape Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Music Market Landscape Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Music Market Landscape Revenue (Million), by Revenue Generation Format 2025 & 2033

- Figure 19: Middle East and Africa Music Market Landscape Revenue Share (%), by Revenue Generation Format 2025 & 2033

- Figure 20: Middle East and Africa Music Market Landscape Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Music Market Landscape Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Music Market Landscape Revenue Million Forecast, by Revenue Generation Format 2020 & 2033

- Table 2: Global Music Market Landscape Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Music Market Landscape Revenue Million Forecast, by Revenue Generation Format 2020 & 2033

- Table 4: Global Music Market Landscape Revenue Million Forecast, by Country 2020 & 2033

- Table 5: US Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Music Market Landscape Revenue Million Forecast, by Revenue Generation Format 2020 & 2033

- Table 8: Global Music Market Landscape Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: UK Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Music Market Landscape Revenue Million Forecast, by Revenue Generation Format 2020 & 2033

- Table 15: Global Music Market Landscape Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Music Market Landscape Revenue Million Forecast, by Revenue Generation Format 2020 & 2033

- Table 22: Global Music Market Landscape Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Latin America Music Market Landscape Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Music Market Landscape Revenue Million Forecast, by Revenue Generation Format 2020 & 2033

- Table 27: Global Music Market Landscape Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Market Landscape?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the Music Market Landscape?

Key companies in the market include TIDAL, Universal Music Group, WARNER MUSIC INC, Curb Records Inc, SONY MUSIC ENTERTAINMENT, Kobalt Music Group Ltd, BMG Rights Management GmbH, Deezer, Sont ATV, Apple Inc.

3. What are the main segments of the Music Market Landscape?

The market segments include Revenue Generation Format.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment by the Record Companies; Increasing the travel and tourism industry will fuel market expansion.; Increased use of online music streaming to boost the market..

6. What are the notable trends driving market growth?

Music Streaming to Witness the Largest Revenue Generation.

7. Are there any restraints impacting market growth?

Data Security and Privacy.

8. Can you provide examples of recent developments in the market?

August 2023 : Big Bang Music has entered into a strategic agreement with Sony Music Publishing (SMP). This collaboration entails SMP taking charge of the worldwide administration and promotion of Big Bang Music’s repertoire, aiming to amplify the exposure of their music across the global landscape. The partnership is anticipated to boost the publishing and royalty earnings of artists and songwriters while attaining a more extensive global audience via sync opportunities and global songwriter collaborations. The agreement covers administration, synchronization, and catalog promotion of the Indie music label’s repertoire.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Market Landscape," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Market Landscape report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Market Landscape?

To stay informed about further developments, trends, and reports in the Music Market Landscape, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence