Key Insights

The North American Nano Sensors Market is projected for significant expansion, expected to reach USD 213.14 million by 2025, with a Compound Annual Growth Rate (CAGR) of 10.24% through 2033. This growth is driven by increasing demand for compact, high-performance sensing solutions across key industries. Consumer electronics are integrating nano sensors for advanced features in smartphones, wearables, and smart home devices. The automotive sector utilizes these sensors for enhanced safety, autonomous driving, and cabin monitoring. Aerospace and defense sectors benefit from their lightweight and high-sensitivity properties for surveillance, navigation, and structural health monitoring. Healthcare is also experiencing a rise in nano sensor applications for diagnostics, drug delivery, and medical imaging, supporting personalized patient care.

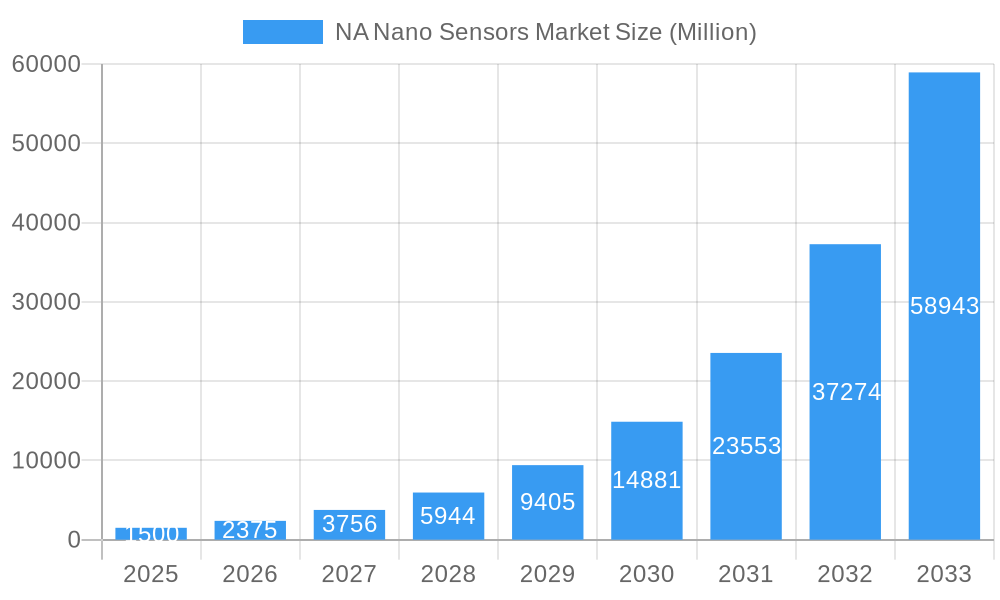

NA Nano Sensors Market Market Size (In Million)

Technological advancements and robust R&D in North America are further propelling market growth. Innovations in sensor types, including optical, electrochemical, and electromechanical sensors, are broadening their applications. Industrial automation is a major contributor, with nano sensors enabling predictive maintenance, process optimization, and quality control in manufacturing. Challenges such as high R&D costs and stringent regulatory approvals require strategic consideration. However, nano sensors' inherent advantages—superior sensitivity, accuracy, and molecular-level detection—position them as essential components for future technological advancements and sustainable industrial development in North America.

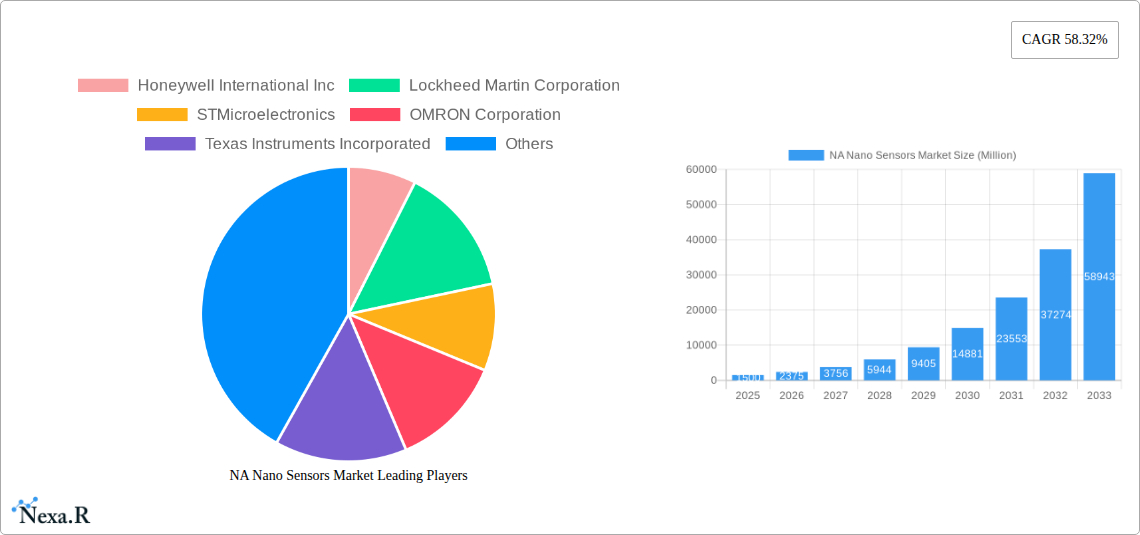

NA Nano Sensors Market Company Market Share

NA Nano Sensors Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

Report Description:

Dive deep into the dynamic North America (NA) Nano Sensors Market, a critical segment poised for exponential growth. This in-depth report provides a comprehensive 600-word analysis of market dynamics, growth trends, and future opportunities. Leveraging advanced analytical frameworks and high-traffic keywords, this report targets industry professionals seeking actionable insights into optical sensors, electrochemical sensors, and electromechanical sensors. Explore the burgeoning applications in consumer electronics, automotive, aerospace and defense, and healthcare, alongside critical industry developments and key players like Honeywell International Inc., Lockheed Martin Corporation, STMicroelectronics, OMRON Corporation, Texas Instruments Incorporated, Agilent Technologies, Analog Devices Inc, Teledyne Technologies, and Samsung Electronics co Limited. With a detailed forecast period from 2025 to 2033, this report is your definitive guide to understanding and capitalizing on the future of nano sensor technology in North America.

NA Nano Sensors Market Market Dynamics & Structure

The North America (NA) nano sensors market is characterized by a moderate to high level of concentration, with a few key players dominating innovation and market share. Technological innovation is the primary driver, fueled by relentless R&D in areas like miniaturization, enhanced sensitivity, and novel material science for sensing applications. Regulatory frameworks, while evolving to ensure safety and efficacy, are largely supportive of technological advancements, particularly in sectors like healthcare and environmental monitoring. Competitive product substitutes exist, especially in traditional sensor categories, but nano sensors offer distinct advantages in performance and size. End-user demographics are broadening, with increasing demand from the consumer electronics sector for smart devices, the automotive industry for advanced driver-assistance systems (ADAS), and healthcare for point-of-care diagnostics. Mergers & Acquisitions (M&A) trends are active, as larger companies seek to acquire innovative nano sensor startups and expand their technological portfolios.

- Market Concentration: Dominated by a mix of established corporations and specialized R&D-focused firms.

- Technological Innovation Drivers: Miniaturization, improved sensitivity, power efficiency, new material applications (e.g., graphene, quantum dots).

- Regulatory Frameworks: Growing emphasis on data security, interoperability, and specific application standards (e.g., FDA for medical devices).

- Competitive Product Substitutes: Traditional sensors (e.g., MEMS, bulk sensors) where cost or legacy systems are prioritized.

- End-User Demographics: Proliferation in smart homes, wearable technology, advanced medical devices, industrial IoT, and autonomous systems.

- M&A Trends: Strategic acquisitions to gain access to cutting-edge intellectual property and market segments.

- Innovation Barriers: High R&D costs, complex manufacturing processes, and the need for extensive validation and certification.

NA Nano Sensors Market Growth Trends & Insights

The NA Nano Sensors Market is experiencing robust growth, projected to witness significant expansion driven by increasing adoption across diverse industries. The market size evolution is being shaped by the relentless pursuit of miniaturization, enhanced precision, and cost-effectiveness in sensor technology. Adoption rates are particularly high in sectors demanding real-time data and sophisticated analytical capabilities. Technological disruptions, such as the development of novel nanomaterials and advanced fabrication techniques, are continually redefining the possibilities of nano sensor applications. Consumer behavior shifts towards smart, connected devices are creating unprecedented demand for integrated nano sensors in everyday products. The forecast period (2025–2033) is expected to see a Compound Annual Growth Rate (CAGR) of approximately 18-22%, reflecting this strong upward trajectory. Market penetration is rapidly increasing, moving beyond niche applications to become integral components in mainstream technologies. The base year (2025) is a crucial benchmark, with estimates suggesting a market valuation of around $15.5 billion units, growing to an estimated $45 billion units by the end of the forecast period in 2033. The historical period (2019–2024) has laid the groundwork for this accelerated growth, marked by increasing investments in research and development and the successful commercialization of early-stage nano sensor technologies. The integration of AI and machine learning with nano sensor data is further enhancing their value proposition, enabling predictive maintenance, personalized healthcare, and more efficient industrial processes. The ongoing miniaturization trend is also crucial, allowing for the deployment of sensors in previously inaccessible locations and enabling the development of more discreet and less intrusive devices. The demand for energy-efficient sensors, crucial for battery-powered devices and IoT networks, is also a significant growth driver. Furthermore, the increasing focus on environmental monitoring and public health is spurring the development and adoption of highly sensitive nano sensors for detecting pollutants, pathogens, and other critical indicators. The automotive sector's drive towards autonomous driving and enhanced safety features is a major contributor, with nano sensors playing a pivotal role in perception, navigation, and control systems.

Dominant Regions, Countries, or Segments in NA Nano Sensors Market

Within the North American (NA) Nano Sensors Market, the Automotive end-user industry stands out as a dominant growth driver, propelled by the transformative shift towards electrification, autonomy, and enhanced safety features. This segment's dominance is underpinned by the critical role nano sensors play in advanced driver-assistance systems (ADAS), autonomous driving capabilities, and sophisticated in-cabin monitoring. The inherent need for high precision, reliability, and miniaturization in automotive applications aligns perfectly with the strengths of nano sensor technology. Market share within this sector is substantial and projected to grow significantly over the forecast period.

- Dominant End-User Industry: Automotive

- Key Drivers:

- ADAS and Autonomous Driving: Nano sensors are crucial for object detection, lane keeping, adaptive cruise control, and parking assistance. Examples include LiDAR, radar, and optical sensors utilizing nanomaterials for improved performance and reduced size.

- Electrification: Battery management systems, thermal monitoring, and power electronics in electric vehicles (EVs) increasingly rely on advanced nano sensors for efficiency and safety.

- In-Cabin Monitoring: Sensors for driver alertness, passenger safety, and environmental control are becoming more sophisticated, leveraging nano sensor capabilities.

- Regulatory Push: Increasing safety regulations and mandates for ADAS features worldwide are accelerating adoption.

- Consumer Demand: Growing consumer preference for advanced automotive features and safety technologies.

- Market Share & Growth Potential: The automotive segment is estimated to hold over 30% of the NA nano sensors market share in 2025, with a projected CAGR of 20-25% from 2025-2033.

- Technological Advancements: Innovations in MEMS-based nano sensors, quantum dot-enhanced optical sensors, and novel electrochemical sensors for exhaust gas monitoring are key contributors.

- Key Drivers:

While automotive leads, the Industrial segment is also a significant contributor, driven by the Internet of Things (IoT) adoption for predictive maintenance, process optimization, and smart manufacturing. Consumer Electronics remains a strong segment due to wearable technology and smart home devices. In terms of sensor types, Optical Sensors are experiencing rapid growth due to their versatility and applications in imaging, spectroscopy, and optical communication, with their adoption in automotive LiDAR and advanced medical imaging devices bolstering their dominance.

NA Nano Sensors Market Product Landscape

The NA Nano Sensors Market is defined by an array of innovative products featuring enhanced performance metrics and novel applications. Optical nano sensors, for instance, are revolutionizing imaging with quantum dot-based sensors offering superior color fidelity and sensitivity, crucial for advanced camera systems in consumer electronics and automotive applications. Electrochemical nano sensors are enabling highly sensitive and rapid detection of gases and biomolecules, finding critical use in industrial safety monitoring, environmental analysis, and point-of-care diagnostics in healthcare. Electromechanical nano sensors, often based on micro-electromechanical systems (MEMS) incorporating nanoscale components, are delivering unprecedented accuracy in pressure, acceleration, and vibration sensing for applications ranging from consumer wearables to aerospace and defense systems. Unique selling propositions include miniaturization enabling integration into compact devices, increased energy efficiency for battery-powered applications, and higher sensitivity for detecting minute changes in physical or chemical environments. Technological advancements are focused on improving durability, expanding the operational temperature range, and developing multi-functional sensor arrays capable of detecting multiple parameters simultaneously.

Key Drivers, Barriers & Challenges in NA Nano Sensors Market

Key Drivers:

- Technological Advancements: Continuous innovation in nanomaterials and fabrication techniques leading to smaller, more sensitive, and power-efficient sensors.

- Growing Demand in Key Sectors: Proliferation of IoT, smart devices, autonomous vehicles, and advanced healthcare diagnostics.

- Miniaturization Trend: The insatiable demand for smaller electronic components across all industries.

- Increasing Investments in R&D: Significant funding from both private and public sectors to advance nano sensor technology.

- Government Initiatives: Supportive policies and funding for advanced manufacturing and technology development.

Barriers & Challenges:

- High Manufacturing Costs: Scalable and cost-effective mass production of nano sensors remains a challenge.

- Regulatory Hurdles: Obtaining certifications and approvals for new sensor technologies, especially in healthcare and automotive sectors, can be a lengthy process.

- Integration Complexity: Seamless integration of nano sensors into existing systems and infrastructure can be complex.

- Supply Chain Volatility: Dependence on specialized raw materials and complex supply chains can lead to disruptions.

- Performance Degradation: Long-term reliability and performance degradation in harsh environments can be a concern for certain applications.

- Competitive Pressures: Intense competition from established sensor manufacturers and alternative technologies.

Emerging Opportunities in NA Nano Sensors Market

Emerging opportunities in the NA Nano Sensors Market are abundant, driven by untapped potential in novel applications and evolving consumer preferences. The burgeoning field of personalized medicine presents significant avenues for highly sensitive diagnostic nano sensors capable of early disease detection and real-time health monitoring. The expansion of smart cities infrastructure creates a demand for distributed nano sensor networks for environmental monitoring, traffic management, and public safety. Furthermore, advancements in quantum sensing technology are opening doors for ultra-precise measurements in scientific research and metrology. The development of biodegradable nano sensors for environmental remediation and sustainable agriculture also represents a promising, albeit nascent, area of growth. The increasing need for cybersecurity solutions is also driving innovation in tamper-evident and secure sensing technologies.

Growth Accelerators in the NA Nano Sensors Market Industry

Several catalysts are accelerating the long-term growth of the NA Nano Sensors Market. Technological breakthroughs in areas like flexible nano electronics and self-powered sensors are paving the way for entirely new product categories and applications. Strategic partnerships between sensor manufacturers, research institutions, and end-user industries are crucial for bridging the gap between innovation and commercialization, fostering collaborative development and accelerating market adoption. Market expansion strategies, including the penetration of underserved regions and the development of customized sensor solutions for emerging markets, will also play a pivotal role. The increasing demand for data analytics and artificial intelligence integration with sensor outputs further enhances the value proposition and drives demand for more sophisticated sensing solutions.

Key Players Shaping the NA Nano Sensors Market Market

- Honeywell International Inc.

- Lockheed Martin Corporation

- STMicroelectronics

- OMRON Corporation

- Texas Instruments Incorporated

- Agilent Technologies

- Analog Devices Inc

- Teledyne Technologies

- Samsung Electronics co Limited

Notable Milestones in NA Nano Sensors Market Sector

- September 2021: Honeywell introduces new robotic technology to help warehouses increase productivity and reduce the number of injuries. The company's innovative robotics technology aims to automate the manual pallet unloading process, which reduces the operational risk of potential injury.

In-Depth NA Nano Sensors Market Market Outlook

The NA Nano Sensors Market is poised for sustained and significant growth, driven by a confluence of accelerating factors. The continued evolution of nanomaterials, coupled with advancements in manufacturing processes, will unlock new levels of performance and cost-effectiveness, making nano sensors accessible for a broader range of applications. The deepening integration of nano sensors into the Internet of Things (IoT) ecosystem across industrial, consumer, and healthcare sectors will be a primary growth engine. Strategic collaborations and partnerships will be crucial for translating cutting-edge research into market-ready solutions. Furthermore, the increasing emphasis on sustainability and efficiency in various industries will necessitate the adoption of advanced nano sensor technologies for precise monitoring and control. The market is expected to witness further consolidation and specialization as key players focus on specific application niches and technological competencies.

NA Nano Sensors Market Segmentation

-

1. Type

- 1.1. Optical Sensor

- 1.2. Electrochemical Sensor

- 1.3. Electromechanical Sensor

-

2. End-User Industry

- 2.1. Consumer Electronics

- 2.2. Power Generation

- 2.3. Automotive

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. Industrial

- 2.7. Other End-User Industries

NA Nano Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

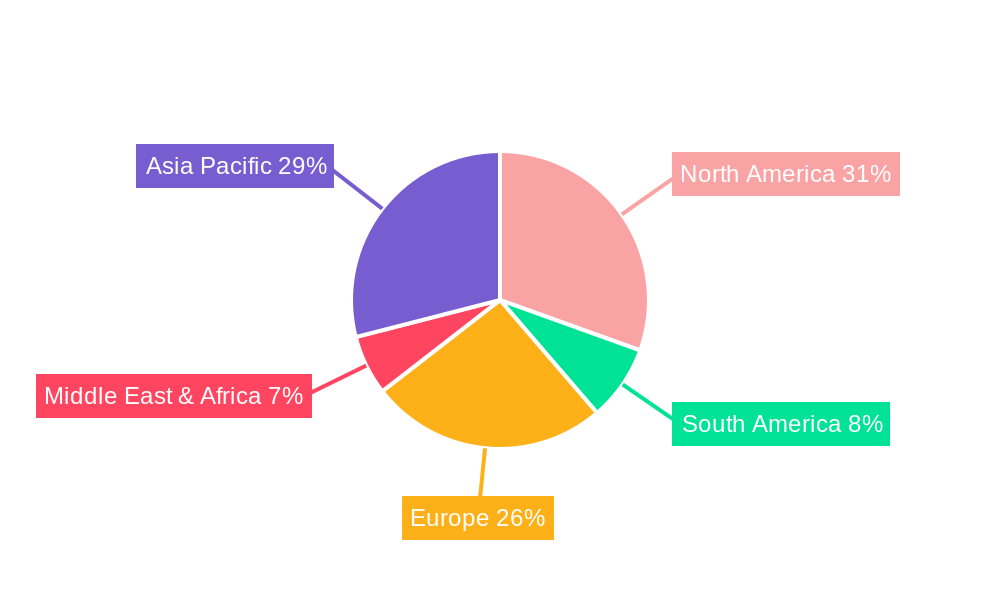

NA Nano Sensors Market Regional Market Share

Geographic Coverage of NA Nano Sensors Market

NA Nano Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing research and development in innovative materials; Increasing Trend of Miniaturization and Use of Miniaturized Products Across Various Industries

- 3.3. Market Restrains

- 3.3.1. Complexity in Manufacturing Nanosensors

- 3.4. Market Trends

- 3.4.1. The electrochemical segment is expected to command prominent share over the forecasted period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Nano Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Optical Sensor

- 5.1.2. Electrochemical Sensor

- 5.1.3. Electromechanical Sensor

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Power Generation

- 5.2.3. Automotive

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. Industrial

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NA Nano Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Optical Sensor

- 6.1.2. Electrochemical Sensor

- 6.1.3. Electromechanical Sensor

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Power Generation

- 6.2.3. Automotive

- 6.2.4. Aerospace and Defense

- 6.2.5. Healthcare

- 6.2.6. Industrial

- 6.2.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America NA Nano Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Optical Sensor

- 7.1.2. Electrochemical Sensor

- 7.1.3. Electromechanical Sensor

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Power Generation

- 7.2.3. Automotive

- 7.2.4. Aerospace and Defense

- 7.2.5. Healthcare

- 7.2.6. Industrial

- 7.2.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe NA Nano Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Optical Sensor

- 8.1.2. Electrochemical Sensor

- 8.1.3. Electromechanical Sensor

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Power Generation

- 8.2.3. Automotive

- 8.2.4. Aerospace and Defense

- 8.2.5. Healthcare

- 8.2.6. Industrial

- 8.2.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa NA Nano Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Optical Sensor

- 9.1.2. Electrochemical Sensor

- 9.1.3. Electromechanical Sensor

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Power Generation

- 9.2.3. Automotive

- 9.2.4. Aerospace and Defense

- 9.2.5. Healthcare

- 9.2.6. Industrial

- 9.2.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific NA Nano Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Optical Sensor

- 10.1.2. Electrochemical Sensor

- 10.1.3. Electromechanical Sensor

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Consumer Electronics

- 10.2.2. Power Generation

- 10.2.3. Automotive

- 10.2.4. Aerospace and Defense

- 10.2.5. Healthcare

- 10.2.6. Industrial

- 10.2.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STMicroelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OMRON Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agilent Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Analog Devices Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Teledyne Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung Electronics co Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global NA Nano Sensors Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America NA Nano Sensors Market Revenue (million), by Type 2025 & 2033

- Figure 3: North America NA Nano Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America NA Nano Sensors Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 5: North America NA Nano Sensors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America NA Nano Sensors Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America NA Nano Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America NA Nano Sensors Market Revenue (million), by Type 2025 & 2033

- Figure 9: South America NA Nano Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America NA Nano Sensors Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 11: South America NA Nano Sensors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: South America NA Nano Sensors Market Revenue (million), by Country 2025 & 2033

- Figure 13: South America NA Nano Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe NA Nano Sensors Market Revenue (million), by Type 2025 & 2033

- Figure 15: Europe NA Nano Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe NA Nano Sensors Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 17: Europe NA Nano Sensors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Europe NA Nano Sensors Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe NA Nano Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa NA Nano Sensors Market Revenue (million), by Type 2025 & 2033

- Figure 21: Middle East & Africa NA Nano Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa NA Nano Sensors Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 23: Middle East & Africa NA Nano Sensors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Middle East & Africa NA Nano Sensors Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa NA Nano Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific NA Nano Sensors Market Revenue (million), by Type 2025 & 2033

- Figure 27: Asia Pacific NA Nano Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific NA Nano Sensors Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 29: Asia Pacific NA Nano Sensors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Asia Pacific NA Nano Sensors Market Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific NA Nano Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Nano Sensors Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global NA Nano Sensors Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global NA Nano Sensors Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global NA Nano Sensors Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global NA Nano Sensors Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global NA Nano Sensors Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global NA Nano Sensors Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: Global NA Nano Sensors Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global NA Nano Sensors Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global NA Nano Sensors Market Revenue million Forecast, by Type 2020 & 2033

- Table 17: Global NA Nano Sensors Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global NA Nano Sensors Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global NA Nano Sensors Market Revenue million Forecast, by Type 2020 & 2033

- Table 29: Global NA Nano Sensors Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 30: Global NA Nano Sensors Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global NA Nano Sensors Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global NA Nano Sensors Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 39: Global NA Nano Sensors Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: China NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific NA Nano Sensors Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Nano Sensors Market?

The projected CAGR is approximately 10.24%.

2. Which companies are prominent players in the NA Nano Sensors Market?

Key companies in the market include Honeywell International Inc, Lockheed Martin Corporation, STMicroelectronics, OMRON Corporation, Texas Instruments Incorporated, Agilent Technologies, Analog Devices Inc, Teledyne Technologies, Samsung Electronics co Limited.

3. What are the main segments of the NA Nano Sensors Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.14 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing research and development in innovative materials; Increasing Trend of Miniaturization and Use of Miniaturized Products Across Various Industries.

6. What are the notable trends driving market growth?

The electrochemical segment is expected to command prominent share over the forecasted period.

7. Are there any restraints impacting market growth?

Complexity in Manufacturing Nanosensors.

8. Can you provide examples of recent developments in the market?

Sept 2021 - Honeywell introduces new robotic technology to help warehouses increase productivity and reduce the number of injuries. The company's innovative robotics technology aims to automate the manual pallet unloading process, which reduces the operational risk of potential injury.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Nano Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Nano Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Nano Sensors Market?

To stay informed about further developments, trends, and reports in the NA Nano Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence