Key Insights

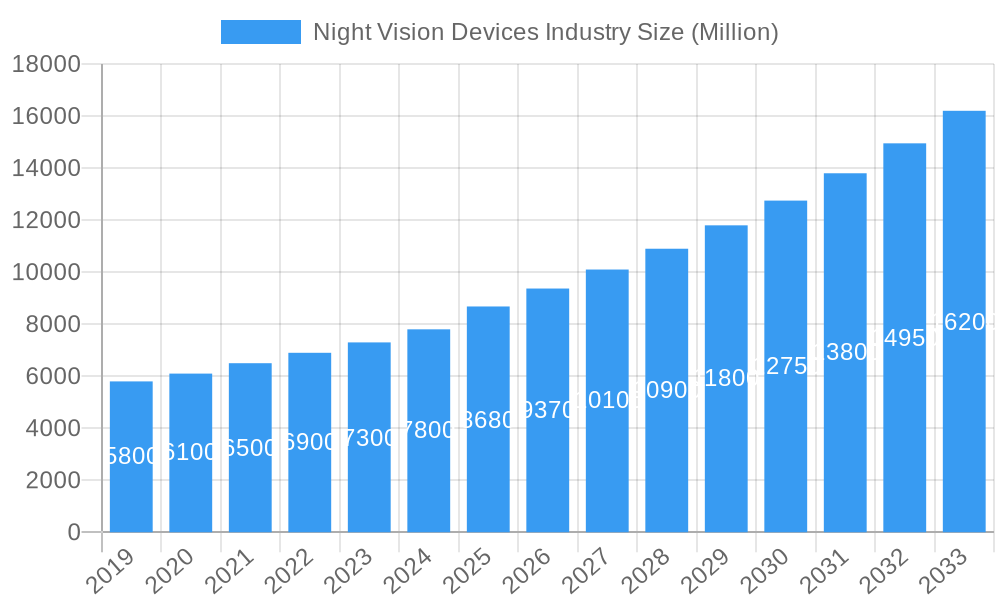

The global Night Vision Devices market is experiencing robust expansion, projected to reach an estimated USD 8.68 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 7.97% through 2033. This dynamic growth is fueled by increasing defense spending globally, a rising demand for advanced surveillance solutions across both governmental and private sectors, and the burgeoning interest in wildlife spotting and conservation efforts. Military and defense applications continue to be the dominant segment, driven by the need for enhanced operational capabilities in low-light conditions and a growing emphasis on border security and tactical advantage. Advancements in thermal imaging and image intensifier technologies are further propelling market penetration, offering superior clarity and detection capabilities that are critical for various applications.

Night Vision Devices Industry Market Size (In Billion)

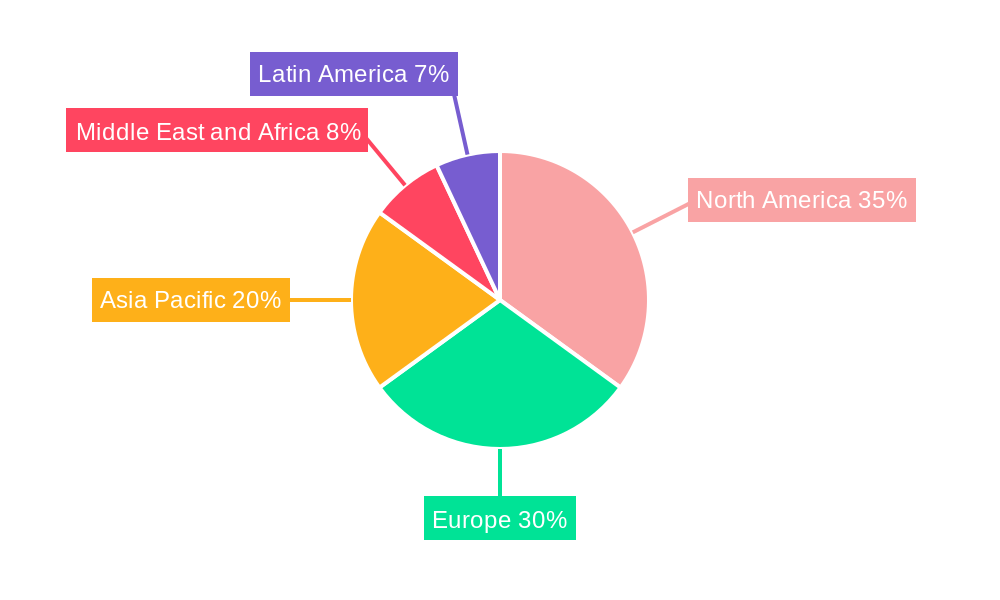

The market is characterized by a diverse range of product types, including versatile cameras, specialized goggles, monoculars and binoculars, and precision rifle scopes, catering to a broad spectrum of user needs. Innovation in image processing, miniaturization of components, and the integration of AI are key trends shaping the industry. While the market is driven by strong demand, certain restraints, such as the high cost of advanced technology and complex regulatory landscapes in some regions, could pose challenges. However, the continuous investment in research and development by leading companies like L3Harris Technologies, Raytheon Technologies, and Teledyne FLIR, coupled with the expanding adoption in civilian applications like security and recreational activities, indicates a promising trajectory for the night vision devices industry. Regional markets, particularly North America and Europe, are expected to lead in terms of market share due to significant defense budgets and advanced technological infrastructure, with Asia Pacific emerging as a rapidly growing segment.

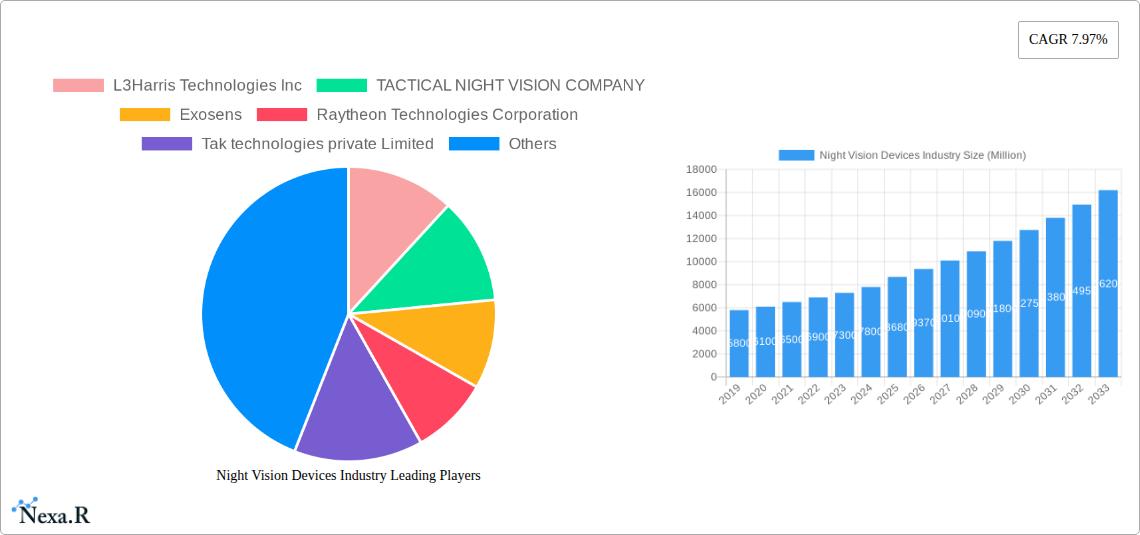

Night Vision Devices Industry Company Market Share

Here's a compelling, SEO-optimized report description for the Night Vision Devices Industry, designed to maximize visibility and engagement:

Report Title: Night Vision Devices Market Size, Share, Growth, Trends & Forecast 2025-2033

Report Description:

Explore the dynamic Night Vision Devices market with our comprehensive report, offering an in-depth analysis of global trends, growth drivers, and future opportunities. This report is an essential resource for industry professionals seeking to understand the evolving landscape of night vision technology, from military applications to wildlife spotting. Our detailed segmentation includes thermal imaging, image intensifier, infrared illumination, night vision cameras, goggles, monoculars, binoculars, and rifle scopes, providing a granular view of the parent market and its child markets.

The Night Vision Devices industry is experiencing robust expansion, driven by increasing defense budgets, advancements in sensor technology, and growing demand for enhanced surveillance capabilities. This report covers the study period 2019–2033, with a detailed base year of 2025 and a forecast period of 2025–2033, presenting a clear outlook for stakeholders. We provide critical insights into the market size, CAGR, and market penetration of key segments.

Discover the key players shaping the future of this sector, including L3Harris Technologies Inc, Teledyne FLIR LLC, BAE Systems PLC, Thales Group SA, and Exosens. Understand the impact of recent industry developments, such as the USD 500 million contract secured by Elbit Systems of America for the US Marine Corps’ SBNVG systems and the launch of Thermoteknix Systems’ Fused Night Vision Goggle with Augmented Reality (FNVG-AR). This report is meticulously crafted to be used without modification, offering actionable intelligence for strategic decision-making.

Night Vision Devices Industry Market Dynamics & Structure

The global Night Vision Devices market is characterized by a moderately concentrated structure, with a few major players holding significant market share. However, the emergence of specialized niche players and rapid technological advancements are fostering a more dynamic competitive environment. Key drivers of technological innovation include the relentless pursuit of enhanced resolution, lower power consumption, improved detection ranges, and the integration of advanced features like augmented reality. Regulatory frameworks, particularly in defense and homeland security, play a crucial role in shaping market access and product development, often demanding adherence to stringent performance and interoperability standards. Competitive product substitutes are emerging, especially in the realm of advanced sensor fusion and AI-powered image processing, challenging traditional image intensification and thermal imaging dominance. End-user demographics are diversifying, extending beyond military and law enforcement to include civilian applications like wildlife observation, search and rescue, and even recreational activities. Mergers and acquisitions (M&A) are a significant trend, with larger companies acquiring innovative startups to expand their technology portfolios and market reach.

- Market Concentration: Moderate to High, with key players dominating specific application segments.

- Technological Innovation Drivers: Miniaturization, AI integration, sensor fusion, cost reduction, enhanced image quality, and extended battery life.

- Regulatory Frameworks: Stringent export controls, defense procurement policies, and evolving standards for civilian use.

- Competitive Product Substitutes: Advanced digital imaging, AI-driven object recognition, and high-sensitivity visible light sensors.

- End-User Demographics: Military, law enforcement, border security, wildlife conservationists, hunters, outdoor enthusiasts, and industrial inspection.

- M&A Trends: Strategic acquisitions to gain access to new technologies and expand product offerings.

Night Vision Devices Industry Growth Trends & Insights

The Night Vision Devices market is poised for substantial growth over the forecast period. The escalating geopolitical tensions and the increasing need for enhanced situational awareness in low-light conditions are significantly boosting demand from military and defense sectors worldwide. This sustained procurement by governmental bodies for advanced surveillance and targeting systems forms the bedrock of the market's expansion. Furthermore, the proliferation of sophisticated technologies like thermal imaging and image intensification is making these devices more accessible and versatile, driving adoption in non-military applications such as wildlife spotting, conservation efforts, and professional surveillance operations. The continuous innovation in sensor technology, leading to smaller, lighter, and more power-efficient devices, is also a major catalyst, expanding their usability and appeal across a broader consumer base. Consumer behavior is shifting towards recognizing the utility of night vision for a variety of outdoor and security-related activities, further fueling market penetration. The integration of AI and machine learning into night vision systems is also a disruptive force, promising to enhance detection capabilities and automate threat identification, thereby accelerating adoption rates. The market size is projected to grow from an estimated XX million units in 2025 to XX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX%. This growth trajectory is supported by increasing research and development investments aimed at overcoming limitations of existing technologies and creating next-generation night vision solutions.

Dominant Regions, Countries, or Segments in Night Vision Devices Industry

The Military and Defense application segment is unequivocally the dominant force driving growth and innovation within the Night Vision Devices industry. This segment accounts for a significant portion of the global market share, estimated at over XX% in the base year 2025, and is projected to maintain this lead throughout the forecast period. The primary drivers behind this dominance are the escalating global security concerns, continuous modernization efforts by armed forces worldwide, and substantial government investments in advanced defense technologies. Countries with large military expenditures and active defense procurement programs, such as the United States, China, and European nations, are key contributors to this segment's growth.

- Leading Segment: Military and Defense Applications

- Market Share (2025): XX%

- Key Drivers: Geopolitical instability, ongoing conflicts, military modernization programs, border security needs, counter-terrorism operations, and increased demand for situational awareness and force protection.

- Dominant Regions/Countries: North America (especially the United States), Europe, and Asia-Pacific (particularly China and India).

- Growth Potential: High, driven by continuous defense budget allocations and the development of next-generation combat capabilities.

Within the Type segmentation, Goggles and Monoculars and Binoculars are leading the market, driven by their widespread use in military operations, surveillance, and outdoor activities.

- Leading Types: Goggles, Monoculars and Binoculars

- Market Share (2025): Combined XX%

- Key Drivers: Portability, ease of use, versatility for various applications, and advancements in design leading to lighter and more comfortable devices.

In terms of Technology, Image Intensifier technology continues to hold a significant market share due to its established performance and reliability, particularly in military applications. However, Thermal Imaging is rapidly gaining traction due to its ability to detect heat signatures regardless of ambient light conditions and its growing affordability.

- Leading Technologies: Image Intensifier, Thermal Imaging

- Market Share (2025): Image Intensifier (XX%), Thermal Imaging (XX%)

- Key Drivers: Image Intensifier's maturity and cost-effectiveness for specific military uses, while Thermal Imaging's capabilities in all-weather, all-light conditions are driving its adoption in defense, security, and industrial sectors.

The United States emerges as the leading country in the Night Vision Devices market, primarily due to its extensive defense spending, advanced technological capabilities, and strong domestic manufacturing base. The nation's military and homeland security requirements consistently drive demand for high-performance night vision systems.

Night Vision Devices Industry Product Landscape

The Night Vision Devices product landscape is characterized by continuous innovation, delivering enhanced performance and new functionalities. Products range from compact monoculars and versatile goggles to advanced rifle scopes and integrated camera systems. Notable advancements include the development of multi-spectrum devices that fuse thermal and image intensification technologies, offering superior situational awareness in diverse conditions. High-resolution sensors, improved battery life, and ergonomic designs are key selling points. The integration of digital technologies allows for image recording, data transmission, and connectivity, expanding application potential.

Key Drivers, Barriers & Challenges in Night Vision Devices Industry

Key Drivers: The primary forces propelling the Night Vision Devices market are the escalating global security concerns, necessitating enhanced surveillance and operational capabilities in low-light conditions. Continuous advancements in sensor technology, leading to more compact, lighter, and higher-performing devices, are significant economic drivers. Government procurement policies and defense modernization programs, especially in major economies, also fuel demand. The growing adoption of thermal imaging for a wider range of applications beyond military use, such as wildlife spotting and industrial inspection, represents a substantial growth accelerator.

Barriers & Challenges: Despite strong growth, the industry faces several challenges. High research and development costs associated with cutting-edge technology can be a barrier to entry for smaller companies. Stringent export control regulations and complex international trade policies can restrict market access for certain advanced night vision systems. Supply chain disruptions, particularly for specialized components, can impact production timelines and costs. Furthermore, the competitive pressure from alternative imaging technologies and the need for continuous innovation to stay ahead of evolving threats pose ongoing challenges. The cost of high-end devices can also be a restraint for some potential civilian users.

Emerging Opportunities in Night Vision Devices Industry

Emerging opportunities in the Night Vision Devices industry lie in the expanding civilian market segments, including professional wildlife photography, search and rescue operations, and outdoor adventure tourism. The integration of AI and machine learning into night vision devices presents a significant avenue for innovation, promising enhanced object recognition and predictive analysis capabilities. The development of more affordable and user-friendly consumer-grade night vision devices is also poised to tap into a wider market. Furthermore, advancements in miniaturization and power efficiency open doors for integration into drones, robotics, and wearable technology, creating new application frontiers.

Growth Accelerators in the Night Vision Devices Industry Industry

The long-term growth of the Night Vision Devices industry is being accelerated by several key catalysts. Breakthroughs in sensor technology, such as the development of uncooled microbolometers with higher resolution and sensitivity, are continuously improving device performance and reducing costs. Strategic partnerships between technology developers and end-users, particularly military and law enforcement agencies, foster innovation tailored to specific operational needs. Market expansion strategies, including diversification into new geographical regions and commercial sectors, are also driving sustained growth. The increasing focus on multi-spectral and fused imaging technologies, offering unparalleled operational advantages, is a significant growth accelerator.

Key Players Shaping the Night Vision Devices Industry Market

- L3Harris Technologies Inc

- TACTICAL NIGHT VISION COMPANY

- Exosens

- Raytheon Technologies Corporation

- Tak technologies private Limited

- Satir

- nivisys LLC

- Excelitas Technologies Corp

- sharp corporation

- Elibit Systems Ltd

- BAE Systems PLC

- EOTECH LLC

- Thales Group SA

- Opgal Optronic Industries Ltd

- Apresys International Inc

- Luna Optics Inc

- Panasonic Holding Corporation

- American Technologies Network Corp

- Bushnell Inc

- Teledyne FLIR LLC

Notable Milestones in Night Vision Devices Industry Sector

- November 2023: Night Vision LLC, a subsidiary of Elbit Systems of America, secured USD 500 million from the US Department of Defense for the supply of Squad Binocular Night Vision Goggle (SBNVG) systems to the US Marine Corps. This contract, expected to conclude by 2028, aims to enhance the Marines' nighttime situational awareness capabilities.

- October 2023: Thermoteknix Systems launched its new Fused Night Vision Goggle with Augmented Reality (FNVG-AR). This advanced, lightweight fused binocular night vision goggle (NVG) integrates latest-generation 16 mm white phosphor night vision tubes with a high-resolution thermal imager and optical sensor fusion.

In-Depth Night Vision Devices Industry Market Outlook

The future outlook for the Night Vision Devices industry is exceptionally bright, driven by sustained demand from the defense sector and the burgeoning opportunities in commercial and civilian applications. Growth accelerators such as ongoing technological advancements in sensor fusion, AI integration, and miniaturization will continue to push the boundaries of performance and expand device utility. Strategic collaborations and government investments are expected to further bolster innovation and market penetration. The increasing awareness and acceptance of night vision technology for diverse purposes, from wildlife conservation to personal security, will unlock new market segments and drive significant revenue growth. The industry is well-positioned to capitalize on these trends, promising a robust and expansive future.

Night Vision Devices Industry Segmentation

-

1. Type

- 1.1. Camera

- 1.2. Goggles

- 1.3. Monoculars and Binoculars

- 1.4. Rifle Scope

- 1.5. Other Types

-

2. Technology

- 2.1. Thermal Imaging

- 2.2. Image Intensifier

- 2.3. Infrared Illumination

- 2.4. Other Technologies

-

3. Application

- 3.1. Military and Defense

- 3.2. Wildlife Spotting and Conservation

- 3.3. Surveillance

- 3.4. Navigation

- 3.5. Other Applications

Night Vision Devices Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Night Vision Devices Industry Regional Market Share

Geographic Coverage of Night Vision Devices Industry

Night Vision Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Military Expenditure; Increasing Adoption from Law Enforcement

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Maintenance

- 3.4. Market Trends

- 3.4.1. Surveillance Applications to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Night Vision Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Camera

- 5.1.2. Goggles

- 5.1.3. Monoculars and Binoculars

- 5.1.4. Rifle Scope

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Thermal Imaging

- 5.2.2. Image Intensifier

- 5.2.3. Infrared Illumination

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Military and Defense

- 5.3.2. Wildlife Spotting and Conservation

- 5.3.3. Surveillance

- 5.3.4. Navigation

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Night Vision Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Camera

- 6.1.2. Goggles

- 6.1.3. Monoculars and Binoculars

- 6.1.4. Rifle Scope

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Thermal Imaging

- 6.2.2. Image Intensifier

- 6.2.3. Infrared Illumination

- 6.2.4. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Military and Defense

- 6.3.2. Wildlife Spotting and Conservation

- 6.3.3. Surveillance

- 6.3.4. Navigation

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Night Vision Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Camera

- 7.1.2. Goggles

- 7.1.3. Monoculars and Binoculars

- 7.1.4. Rifle Scope

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Thermal Imaging

- 7.2.2. Image Intensifier

- 7.2.3. Infrared Illumination

- 7.2.4. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Military and Defense

- 7.3.2. Wildlife Spotting and Conservation

- 7.3.3. Surveillance

- 7.3.4. Navigation

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Night Vision Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Camera

- 8.1.2. Goggles

- 8.1.3. Monoculars and Binoculars

- 8.1.4. Rifle Scope

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Thermal Imaging

- 8.2.2. Image Intensifier

- 8.2.3. Infrared Illumination

- 8.2.4. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Military and Defense

- 8.3.2. Wildlife Spotting and Conservation

- 8.3.3. Surveillance

- 8.3.4. Navigation

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Night Vision Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Camera

- 9.1.2. Goggles

- 9.1.3. Monoculars and Binoculars

- 9.1.4. Rifle Scope

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Thermal Imaging

- 9.2.2. Image Intensifier

- 9.2.3. Infrared Illumination

- 9.2.4. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Military and Defense

- 9.3.2. Wildlife Spotting and Conservation

- 9.3.3. Surveillance

- 9.3.4. Navigation

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Night Vision Devices Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Camera

- 10.1.2. Goggles

- 10.1.3. Monoculars and Binoculars

- 10.1.4. Rifle Scope

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Thermal Imaging

- 10.2.2. Image Intensifier

- 10.2.3. Infrared Illumination

- 10.2.4. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Military and Defense

- 10.3.2. Wildlife Spotting and Conservation

- 10.3.3. Surveillance

- 10.3.4. Navigation

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TACTICAL NIGHT VISION COMPANY

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Exosens

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Raytheon Technologies Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tak technologies private Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Satir

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 nivisys LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Excelitas Technologies Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 sharp Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elibit Systems Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BAE Systems PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 EOTECH LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Thales Group SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Opgal Optronic Industries Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Apresys International Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Luna Optics Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Panasonic Holding Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 American Technologies Network Corp

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Bushnell Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Teledyne FLIR LLC

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Night Vision Devices Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Night Vision Devices Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Night Vision Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Night Vision Devices Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Night Vision Devices Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Night Vision Devices Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Night Vision Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Night Vision Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Night Vision Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Night Vision Devices Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Night Vision Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Night Vision Devices Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Night Vision Devices Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Night Vision Devices Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Night Vision Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Night Vision Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Night Vision Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Night Vision Devices Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Night Vision Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Night Vision Devices Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Night Vision Devices Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Night Vision Devices Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Night Vision Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Night Vision Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Night Vision Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Night Vision Devices Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Night Vision Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Night Vision Devices Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Latin America Night Vision Devices Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Night Vision Devices Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Night Vision Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Night Vision Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Night Vision Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Night Vision Devices Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Night Vision Devices Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Night Vision Devices Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Middle East and Africa Night Vision Devices Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa Night Vision Devices Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Night Vision Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Night Vision Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Night Vision Devices Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Night Vision Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Night Vision Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Night Vision Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Night Vision Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Night Vision Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Night Vision Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Night Vision Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Night Vision Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Night Vision Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Night Vision Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Night Vision Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Night Vision Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Night Vision Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Night Vision Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Night Vision Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Night Vision Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Night Vision Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Night Vision Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Night Vision Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Night Vision Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Night Vision Devices Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Night Vision Devices Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 23: Global Night Vision Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Night Vision Devices Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Night Vision Devices Industry?

The projected CAGR is approximately 7.97%.

2. Which companies are prominent players in the Night Vision Devices Industry?

Key companies in the market include L3Harris Technologies Inc, TACTICAL NIGHT VISION COMPANY, Exosens, Raytheon Technologies Corporation, Tak technologies private Limited, Satir, nivisys LLC, Excelitas Technologies Corp, sharp Corporation, Elibit Systems Ltd, BAE Systems PLC, EOTECH LLC, Thales Group SA, Opgal Optronic Industries Ltd, Apresys International Inc, Luna Optics Inc, Panasonic Holding Corporation, American Technologies Network Corp, Bushnell Inc, Teledyne FLIR LLC.

3. What are the main segments of the Night Vision Devices Industry?

The market segments include Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Military Expenditure; Increasing Adoption from Law Enforcement.

6. What are the notable trends driving market growth?

Surveillance Applications to Hold Significant Share.

7. Are there any restraints impacting market growth?

High Costs Associated with Maintenance.

8. Can you provide examples of recent developments in the market?

November 2023 - Night Vision LLC, a subsidiary of Elbit Systems of America, announced that it secured USD 500 million from the US Department of Defense to enhance the US Marine Corps’ efficiency with the supply of Squad Binocular Night Vision Goggle (SBNVG) systems. The contract is expected to be completed by 2028, aiming to equip the Marines with technology for nighttime situational awareness, with work to be executed in Roanoke, Virginia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Night Vision Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Night Vision Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Night Vision Devices Industry?

To stay informed about further developments, trends, and reports in the Night Vision Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence