Key Insights

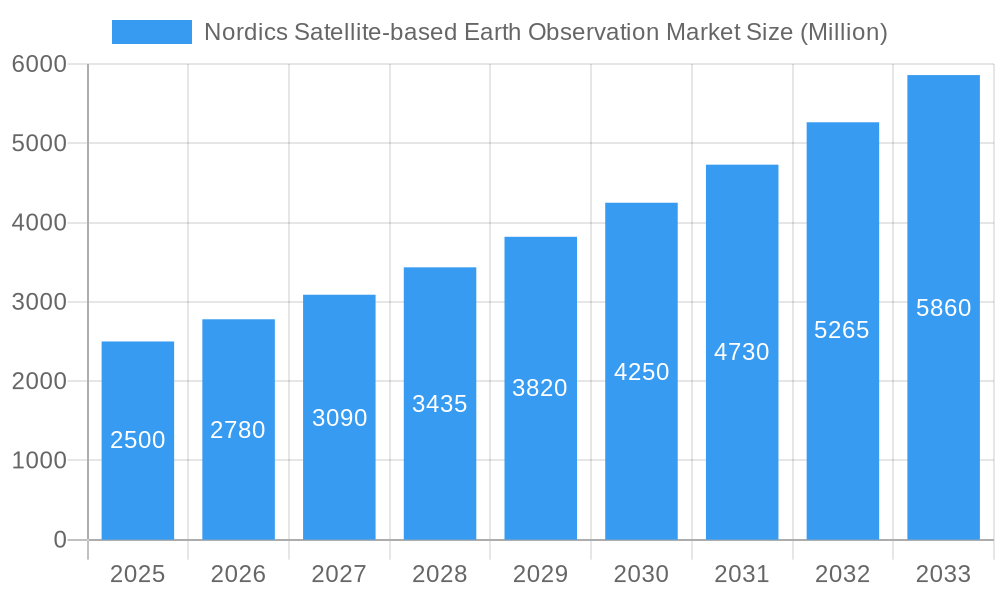

The Nordic satellite-based Earth Observation (EO) market is set for substantial growth, driven by technological innovation and heightened demand for precise environmental and geographical intelligence. Projected to reach $2.64 billion by 2025, the market is expected to experience a Compound Annual Growth Rate (CAGR) of 15.9%, culminating in an estimated size of $X.XX billion by 2033. Key growth drivers include the increasing demand for climate services and urban development initiatives across the Nordic region. The proliferation of Low Earth Orbit (LEO) satellites is enhancing image resolution and revisit frequency, benefiting applications in precision agriculture, infrastructure monitoring, and disaster response. Furthermore, value-added services that transform raw satellite data into actionable insights are becoming critical for informed decision-making in resource management and urban planning.

Nordics Satellite-based Earth Observation Market Market Size (In Billion)

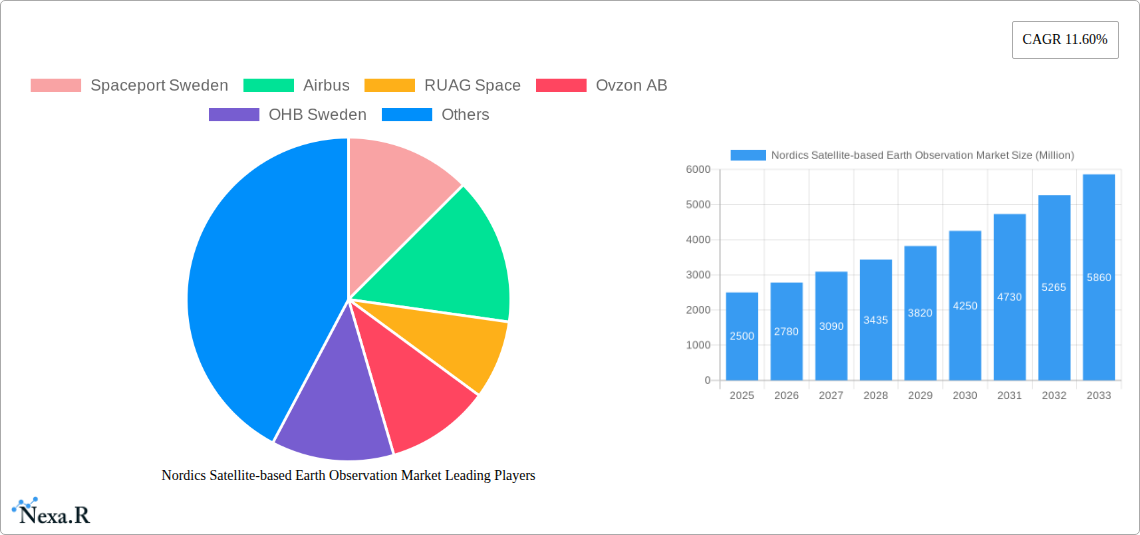

The competitive arena comprises established aerospace leaders and agile regional innovators competing for market share. Prominent companies such as Airbus and Thales, alongside Nordic firms like RUAG Space and OHB Sweden, are actively advancing satellite technologies and data processing solutions. Emerging trends include the integration of AI and machine learning for automated, efficient, and accurate data analysis. Market challenges include significant upfront investment costs for satellite development and launch, along with regulatory complexities in data acquisition and usage. Nevertheless, the strong regional focus on sustainable development, precision agriculture, and comprehensive climate monitoring solidifies a dynamic and promising outlook for the Nordic satellite-based EO market.

Nordics Satellite-based Earth Observation Market Company Market Share

Nordics Satellite-based Earth Observation Market: Comprehensive Growth Analysis & Forecast (2019-2033)

This report offers an in-depth analysis of the Nordics Satellite-based Earth Observation Market, providing critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019 to 2024 and forecasting to 2033, with a base year of 2025, this study delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, barriers, emerging opportunities, and major players. Discover how advancements in Earth Observation Data, Value Added Services, and satellite technologies are reshaping industries like Agriculture, Climate Services, and Urban Development. With a focus on Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO) satellites, this report equips you with the data to capitalize on the evolving Nordics space economy.

Nordics Satellite-based Earth Observation Market Market Dynamics & Structure

The Nordics Satellite-based Earth Observation Market is characterized by a moderately consolidated structure, with key players investing heavily in technological innovation. The increasing demand for precise Earth Observation Data and sophisticated Value Added Services is a significant driver. Regulatory frameworks are evolving to support space-based activities, fostering a conducive environment for growth. While direct competitive product substitutes are limited, the market faces indirect competition from terrestrial and aerial surveying methods. End-user demographics are shifting towards a greater reliance on data-driven decision-making across various sectors, including Agriculture, Climate Services, and Infrastructure. Mergers and acquisitions (M&A) are observed as companies seek to expand their capabilities and market reach.

- Market Concentration: Moderate concentration with a few prominent players holding significant market share.

- Technological Innovation: Driven by advancements in sensor technology, AI-powered data analysis, and miniaturized satellite platforms.

- Regulatory Frameworks: Supportive national space strategies and EU initiatives are fostering market expansion.

- End-User Demographics: Growing adoption by governmental agencies, private enterprises, and research institutions.

- M&A Trends: Strategic acquisitions aimed at integrating upstream and downstream capabilities.

Nordics Satellite-based Earth Observation Market Growth Trends & Insights

The Nordics Satellite-based Earth Observation Market is poised for substantial growth, projected to reach a market size of approximately $1,250 Million by 2033, with a compound annual growth rate (CAGR) of around 8.5% from 2025 to 2033. This expansion is fueled by an increasing adoption rate of satellite-derived insights across diverse industries, including precision Agriculture, advanced Climate Services, and critical Infrastructure monitoring. Technological disruptions, such as the development of hyperspectral imaging and real-time data processing, are enhancing the precision and utility of Earth Observation Data. Consumer behavior is shifting towards a greater appreciation for the value of actionable intelligence derived from space-based assets. The base year (2025) is estimated to see market revenues of around $600 Million, indicating a robust trajectory.

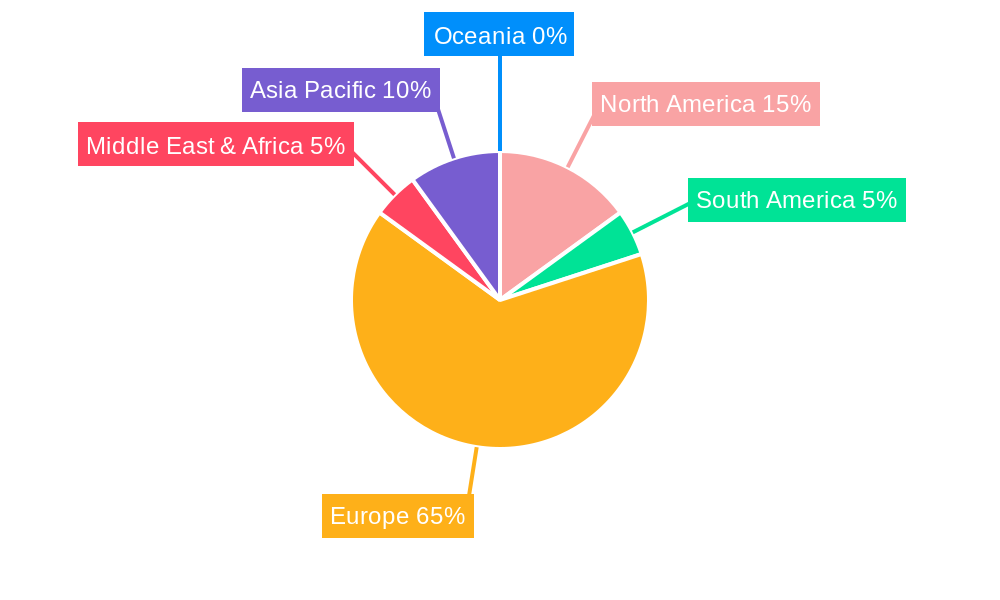

Dominant Regions, Countries, or Segments in Nordics Satellite-based Earth Observation Market

Within the Nordics Satellite-based Earth Observation Market, Earth Observation Data as a segment is demonstrating exceptional dominance, driven by its foundational role in all subsequent Value Added Services. Norway, with its significant investments in space infrastructure and research, is emerging as a leading country. The country's commitment to climate monitoring and its strategic geographical location for satellite operations are key factors. Furthermore, the Low Earth Orbit (LEO) satellite segment is experiencing the most rapid growth due to the increasing deployment of constellations for higher temporal resolution data acquisition. The Climate Services and Agriculture end-use segments are major contributors, as these sectors increasingly rely on accurate, up-to-date satellite imagery for resource management and environmental monitoring.

- Dominant Segment (Type): Earth Observation Data, providing the raw material for all other applications.

- Leading Country: Norway, supported by government initiatives and a growing aerospace sector.

- Dominant Orbit: Low Earth Orbit (LEO), enabling frequent revisits and detailed imagery.

- Key End-Use Segments:

- Climate Services: Critical for understanding climate change impacts and developing mitigation strategies.

- Agriculture: Driving precision farming, yield prediction, and sustainable land management.

- Market Share & Growth Potential: Earth Observation Data holds an estimated 65% market share, with LEO contributing to over 50% of new satellite deployments. Climate Services and Agriculture are projected to exhibit CAGRs exceeding 9% during the forecast period.

Nordics Satellite-based Earth Observation Market Product Landscape

The product landscape in the Nordics Satellite-based Earth Observation Market is characterized by a rapid evolution of advanced imaging sensors and sophisticated data processing platforms. Innovations include high-resolution optical imaging, synthetic aperture radar (SAR) for all-weather capabilities, and hyperspectral sensors for detailed material identification. Applications range from precise crop monitoring and soil health assessment in Agriculture to real-time tracking of environmental changes for Climate Services, and detailed urban planning and infrastructure monitoring for Urban Development. Performance metrics are continually improving, with advancements in spatial resolution, temporal resolution, and spectral accuracy, enabling more nuanced and actionable insights.

Key Drivers, Barriers & Challenges in Nordics Satellite-based Earth Observation Market

Key Drivers:

- Technological Advancements: Miniaturization of satellites, improved sensor resolution, and AI-driven data analytics are expanding capabilities.

- Growing Demand for Data: Increasing need for precise environmental monitoring, resource management, and climate change adaptation.

- Governmental Support & Funding: National space agencies and EU initiatives are providing significant investment and regulatory support.

- Environmental Concerns: Heightened awareness of climate change and its impacts is driving demand for Earth observation solutions.

Barriers & Challenges:

- High Initial Investment: The cost of developing, launching, and operating satellites remains substantial.

- Data Processing & Interpretation: The sheer volume of data requires advanced infrastructure and skilled personnel for effective analysis.

- Regulatory Hurdles: Navigating international and national regulations for satellite operation and data sharing can be complex.

- Competition from Alternative Technologies: While specialized, Earth observation competes with aerial and ground-based data collection methods.

- Supply Chain Volatility: Potential disruptions in the manufacturing and launch services sector can impact project timelines. The estimated market value for 2023 was $500 Million, with supply chain challenges impacting growth by an estimated 5%.

Emerging Opportunities in Nordics Satellite-based Earth Observation Market

Emerging opportunities in the Nordics Satellite-based Earth Observation Market lie in the development of integrated Value Added Services that combine data from multiple satellite constellations and ground sensors. The increasing focus on sustainable practices in Agriculture and Energy and Raw Materials presents a significant untapped market for precision management solutions. Furthermore, the growing need for real-time environmental risk assessment and disaster response is creating demand for rapid-updating data streams and advanced analytics. The development of specialized payloads for specific industrial applications, such as maritime surveillance and forestry management, also represents a significant growth avenue. The market for AI-powered predictive analytics is expected to grow by an estimated 15% annually.

Growth Accelerators in the Nordics Satellite-based Earth Observation Market Industry

Growth in the Nordics Satellite-based Earth Observation Market is being significantly accelerated by breakthroughs in AI and machine learning, enabling more sophisticated analysis and interpretation of satellite data. Strategic partnerships between satellite operators, data providers, and end-users are fostering the development of tailored solutions for specific industry needs. Market expansion strategies, including the development of cloud-based platforms for easier data access and utilization, are democratizing the use of Earth observation insights. The increasing focus on the Green Transition and sustainability goals across the Nordics is a powerful catalyst, driving demand for accurate environmental monitoring and climate impact assessment.

Key Players Shaping the Nordics Satellite-based Earth Observation Market Market

- Spaceport Sweden

- Airbus

- RUAG Space

- Ovzon AB

- OHB Sweden

- Thales

- Satlentis

- Spacemetric

- TerraNIS

- AndoyaSpace

Notable Milestones in Nordics Satellite-based Earth Observation Market Sector

- May 2023: The inaugural "Global Space Conference on Climate Change" (GLOC 2023) was held in Norway, highlighting the region's commitment to space-based climate solutions. OHB SE showcased its significant contributions to Copernicus missions (CO2M, CHIME, CIMR), Meteosat Third Generation (MTG) satellites, and the EnMAP environmental satellite, underscoring the advanced capabilities of European space initiatives.

- April 2023: AndoyaSpace, a Norwegian aerospace business, established a new satellite launch station in Andoya, Norway. This development positions Norway as one of the few nations globally with its own spaceport, significantly enhancing its capacity for launching and supporting space missions, thereby boosting the domestic satellite-based Earth observation sector.

In-Depth Nordics Satellite-based Earth Observation Market Market Outlook

The future outlook for the Nordics Satellite-based Earth Observation Market is exceptionally promising, driven by continuous technological innovation and an escalating demand for data-driven solutions. Growth accelerators include the ongoing advancements in AI for data analytics, fostering the creation of more insightful and predictive applications. Strategic collaborations among industry players are crucial for developing integrated service offerings that address complex challenges in sectors like Climate Services and sustainable Agriculture. The market's trajectory is further bolstered by governmental initiatives supporting space exploration and the global push towards sustainability, creating a fertile ground for market expansion and the emergence of new, impactful applications of satellite technology.

Nordics Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-Use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Other End-Use

Nordics Satellite-based Earth Observation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nordics Satellite-based Earth Observation Market Regional Market Share

Geographic Coverage of Nordics Satellite-based Earth Observation Market

Nordics Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Requirement of Satellite Based Earth Observation in Agriculture; Increasing Demand of High-resolution Imaging Services

- 3.3. Market Restrains

- 3.3.1. Utilisation of Alternative Earth Observation Technologies is Growing

- 3.4. Market Trends

- 3.4.1. Growing Requirement of Satellite Based Earth Observation in Agriculture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nordics Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-Use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Other End-Use

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Nordics Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Earth Observation Data

- 6.1.2. Value Added Services

- 6.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 6.2.1. Low Earth Orbit

- 6.2.2. Medium Earth Orbit

- 6.2.3. Geostationary Orbit

- 6.3. Market Analysis, Insights and Forecast - by End-Use

- 6.3.1. Urban Development and Cultural Heritage

- 6.3.2. Agriculture

- 6.3.3. Climate Services

- 6.3.4. Energy and Raw Materials

- 6.3.5. Infrastructure

- 6.3.6. Other End-Use

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Nordics Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Earth Observation Data

- 7.1.2. Value Added Services

- 7.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 7.2.1. Low Earth Orbit

- 7.2.2. Medium Earth Orbit

- 7.2.3. Geostationary Orbit

- 7.3. Market Analysis, Insights and Forecast - by End-Use

- 7.3.1. Urban Development and Cultural Heritage

- 7.3.2. Agriculture

- 7.3.3. Climate Services

- 7.3.4. Energy and Raw Materials

- 7.3.5. Infrastructure

- 7.3.6. Other End-Use

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Nordics Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Earth Observation Data

- 8.1.2. Value Added Services

- 8.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 8.2.1. Low Earth Orbit

- 8.2.2. Medium Earth Orbit

- 8.2.3. Geostationary Orbit

- 8.3. Market Analysis, Insights and Forecast - by End-Use

- 8.3.1. Urban Development and Cultural Heritage

- 8.3.2. Agriculture

- 8.3.3. Climate Services

- 8.3.4. Energy and Raw Materials

- 8.3.5. Infrastructure

- 8.3.6. Other End-Use

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Nordics Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Earth Observation Data

- 9.1.2. Value Added Services

- 9.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 9.2.1. Low Earth Orbit

- 9.2.2. Medium Earth Orbit

- 9.2.3. Geostationary Orbit

- 9.3. Market Analysis, Insights and Forecast - by End-Use

- 9.3.1. Urban Development and Cultural Heritage

- 9.3.2. Agriculture

- 9.3.3. Climate Services

- 9.3.4. Energy and Raw Materials

- 9.3.5. Infrastructure

- 9.3.6. Other End-Use

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Nordics Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Earth Observation Data

- 10.1.2. Value Added Services

- 10.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 10.2.1. Low Earth Orbit

- 10.2.2. Medium Earth Orbit

- 10.2.3. Geostationary Orbit

- 10.3. Market Analysis, Insights and Forecast - by End-Use

- 10.3.1. Urban Development and Cultural Heritage

- 10.3.2. Agriculture

- 10.3.3. Climate Services

- 10.3.4. Energy and Raw Materials

- 10.3.5. Infrastructure

- 10.3.6. Other End-Use

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Spaceport Sweden

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Airbus

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RUAG Space

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ovzon AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OHB Sweden

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thales

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Satlentis

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spacemetric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TerraNIS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AndoyaSpace*List Not Exhaustive 7 2 *List Not Exhaustiv

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Spaceport Sweden

List of Figures

- Figure 1: Global Nordics Satellite-based Earth Observation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Nordics Satellite-based Earth Observation Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Nordics Satellite-based Earth Observation Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Nordics Satellite-based Earth Observation Market Revenue (billion), by Satellite Orbit 2025 & 2033

- Figure 5: North America Nordics Satellite-based Earth Observation Market Revenue Share (%), by Satellite Orbit 2025 & 2033

- Figure 6: North America Nordics Satellite-based Earth Observation Market Revenue (billion), by End-Use 2025 & 2033

- Figure 7: North America Nordics Satellite-based Earth Observation Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 8: North America Nordics Satellite-based Earth Observation Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Nordics Satellite-based Earth Observation Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Nordics Satellite-based Earth Observation Market Revenue (billion), by Type 2025 & 2033

- Figure 11: South America Nordics Satellite-based Earth Observation Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Nordics Satellite-based Earth Observation Market Revenue (billion), by Satellite Orbit 2025 & 2033

- Figure 13: South America Nordics Satellite-based Earth Observation Market Revenue Share (%), by Satellite Orbit 2025 & 2033

- Figure 14: South America Nordics Satellite-based Earth Observation Market Revenue (billion), by End-Use 2025 & 2033

- Figure 15: South America Nordics Satellite-based Earth Observation Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 16: South America Nordics Satellite-based Earth Observation Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Nordics Satellite-based Earth Observation Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Nordics Satellite-based Earth Observation Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe Nordics Satellite-based Earth Observation Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Nordics Satellite-based Earth Observation Market Revenue (billion), by Satellite Orbit 2025 & 2033

- Figure 21: Europe Nordics Satellite-based Earth Observation Market Revenue Share (%), by Satellite Orbit 2025 & 2033

- Figure 22: Europe Nordics Satellite-based Earth Observation Market Revenue (billion), by End-Use 2025 & 2033

- Figure 23: Europe Nordics Satellite-based Earth Observation Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 24: Europe Nordics Satellite-based Earth Observation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Nordics Satellite-based Earth Observation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue (billion), by Satellite Orbit 2025 & 2033

- Figure 29: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue Share (%), by Satellite Orbit 2025 & 2033

- Figure 30: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue (billion), by End-Use 2025 & 2033

- Figure 31: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 32: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue (billion), by Satellite Orbit 2025 & 2033

- Figure 37: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue Share (%), by Satellite Orbit 2025 & 2033

- Figure 38: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue (billion), by End-Use 2025 & 2033

- Figure 39: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue Share (%), by End-Use 2025 & 2033

- Figure 40: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Nordics Satellite-based Earth Observation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 3: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 4: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 7: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 8: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 14: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 15: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 21: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 22: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 34: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 35: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 43: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 44: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by End-Use 2020 & 2033

- Table 45: Global Nordics Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Nordics Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordics Satellite-based Earth Observation Market?

The projected CAGR is approximately 15.9%.

2. Which companies are prominent players in the Nordics Satellite-based Earth Observation Market?

Key companies in the market include Spaceport Sweden, Airbus, RUAG Space, Ovzon AB, OHB Sweden, Thales, Satlentis, Spacemetric, TerraNIS, AndoyaSpace*List Not Exhaustive 7 2 *List Not Exhaustiv.

3. What are the main segments of the Nordics Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Requirement of Satellite Based Earth Observation in Agriculture; Increasing Demand of High-resolution Imaging Services.

6. What are the notable trends driving market growth?

Growing Requirement of Satellite Based Earth Observation in Agriculture.

7. Are there any restraints impacting market growth?

Utilisation of Alternative Earth Observation Technologies is Growing.

8. Can you provide examples of recent developments in the market?

May 2023: The inaugural "Global Space Conference on Climate Change" (GLOC 2023) was held in Norway. OHB SE highlighted its contributions to the Copernicus missions Copernicus Anthropogenic Carbon Dioxide Monitoring (CO2M), Copernicus Hyperspectral Imaging Mission for the Environment (CHIME), and Copernicus Imaging Microwave Radiometer (CIMR), as well as the Meteosat Third Generation (MTG) weather satellites and the German environmental satellite EnMAP, during this conference.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordics Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordics Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordics Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the Nordics Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence