Key Insights

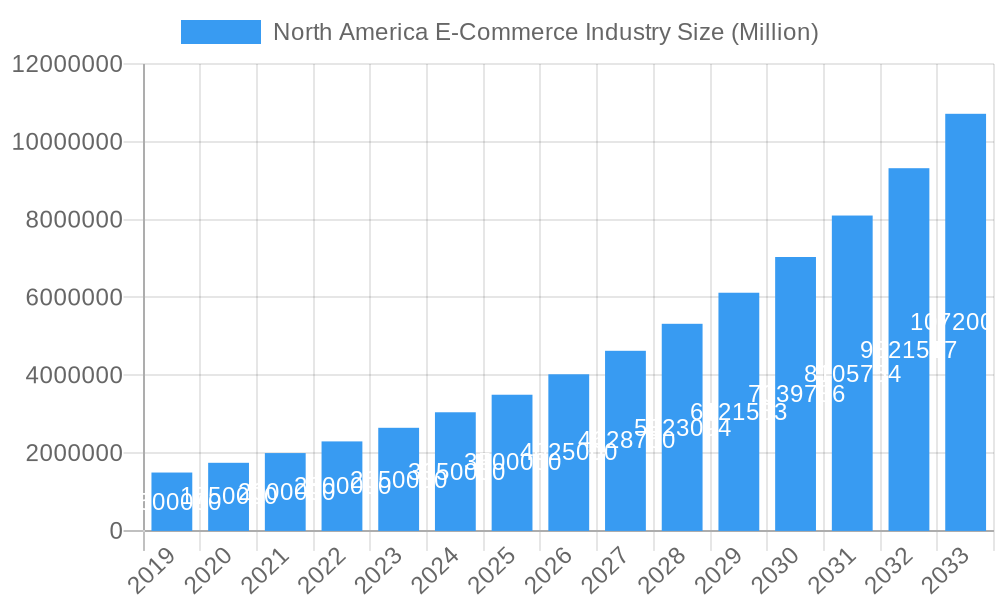

The North American E-commerce industry is projected for significant growth, with an estimated market size of $3333.8 million in 2024. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 18.1% anticipated from 2024 through 2033. Factors fueling this growth include increasing digital payment adoption, rising internet and smartphone penetration across the United States, Canada, and Mexico. Consumers increasingly value convenience and extensive product selection, readily available through e-commerce platforms. The ongoing digital transformation among businesses, including SMBs, is also accelerating B2B e-commerce adoption, optimizing procurement and expanding market reach. Key sectors such as Fashion & Apparel, Consumer Electronics, and Beauty & Personal Care are at the forefront, leveraging advanced online marketing and personalized customer experiences.

North America E-Commerce Industry Market Size (In Billion)

This evolving market is shaped by shifting consumer demands and technological innovation. Social commerce, live streaming sales, and augmented reality (AR) are redefining the online shopping experience. Leading companies are investing in logistics and supply chain enhancements to improve delivery speed and customer satisfaction. Nevertheless, the industry faces challenges including heightened competition, escalating customer acquisition costs, and the imperative to address data privacy and cybersecurity concerns. Despite these obstacles, the core advantages of convenience, accessibility, and diverse product offerings ensure continued strong growth for the North American E-commerce sector. A notable trend is the increasing consumer preference for sustainable e-commerce practices and environmentally conscious brands.

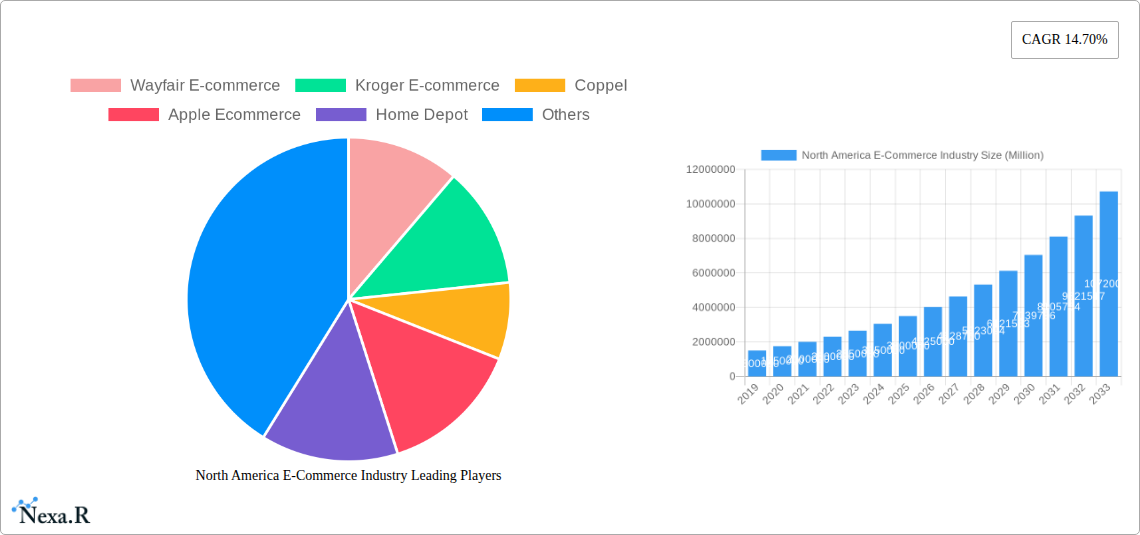

North America E-Commerce Industry Company Market Share

North America E-Commerce Industry: Market Dynamics, Growth, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic North American E-commerce industry, providing an in-depth analysis of its market structure, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this study offers critical insights for industry professionals, investors, and stakeholders seeking to navigate this rapidly evolving digital marketplace. We examine parent and child markets, with all values presented in Million Units for clarity.

North America E-Commerce Industry Market Dynamics & Structure

The North American E-commerce industry is characterized by a moderately concentrated market, with major players like Amazon com Inc. and Walmart Inc. holding significant market share. Technological innovation is a primary driver, fueled by advancements in AI-powered personalization, AR/VR for enhanced shopping experiences, and sophisticated logistics and fulfillment technologies. Regulatory frameworks are evolving, focusing on data privacy (e.g., CCPA), antitrust concerns, and consumer protection, influencing operational strategies for companies such as Apple Ecommerce and Best Buy. Competitive product substitutes are abundant, ranging from traditional retail to subscription boxes and social commerce. End-user demographics are increasingly diverse, with a growing digital native population and an aging demographic adopting online shopping habits. Mergers and acquisition (M&A) trends are active, as larger players acquire innovative startups to expand their technological capabilities or market reach. For instance, the past decade has seen substantial M&A activity, with an estimated xx million deals focused on expanding last-mile delivery or enhancing AI capabilities.

- Market Concentration: Dominated by a few large players, but with a vibrant ecosystem of niche and emerging brands.

- Technological Innovation Drivers: AI, Machine Learning for personalization, AR/VR for immersive experiences, blockchain for supply chain transparency.

- Regulatory Frameworks: Data privacy laws, antitrust regulations, evolving consumer protection standards.

- Competitive Product Substitutes: Physical retail, direct-to-consumer (DTC) brands, subscription services, social commerce platforms.

- End-User Demographics: Young, tech-savvy consumers, increasingly mobile-first shoppers, and a growing senior population.

- M&A Trends: Strategic acquisitions to enhance technology, expand market share, and secure supply chain advantages.

North America E-Commerce Industry Growth Trends & Insights

The North American E-commerce industry is poised for sustained and robust growth over the forecast period. The market size is projected to expand significantly, driven by increasing internet penetration, widespread smartphone adoption, and a shift in consumer purchasing habits towards convenience and digital accessibility. The CAGR for the E-commerce market in North America is estimated to be a healthy xx% during the forecast period (2025-2033). Adoption rates for online shopping continue to climb across all age groups, with younger generations leading the charge and older demographics increasingly comfortable with digital transactions. Technological disruptions are a constant, with innovations in payment gateways, secure online transactions, and personalized customer journeys playing a crucial role. Consumer behavior shifts are marked by a demand for faster delivery times, seamless omnichannel experiences, and a greater emphasis on sustainability and ethical sourcing. The penetration of e-commerce in total retail sales is expected to reach xx% by 2033, a substantial increase from xx% in 2019. This growth is not uniform, with certain segments and parent markets experiencing more rapid expansion. For example, the parent market of online retail is outpacing traditional retail significantly.

- Market Size Evolution: Steady and significant growth projected, driven by digital transformation.

- Adoption Rates: Increasing across all demographics, with a strong emphasis on mobile commerce.

- Technological Disruptions: Innovations in AI, blockchain, and logistics are reshaping the customer experience.

- Consumer Behavior Shifts: Demand for personalization, speed, sustainability, and seamless omnichannel journeys.

- CAGR (2025-2033): Estimated at xx%.

- Market Penetration: Projected to reach xx% by 2033.

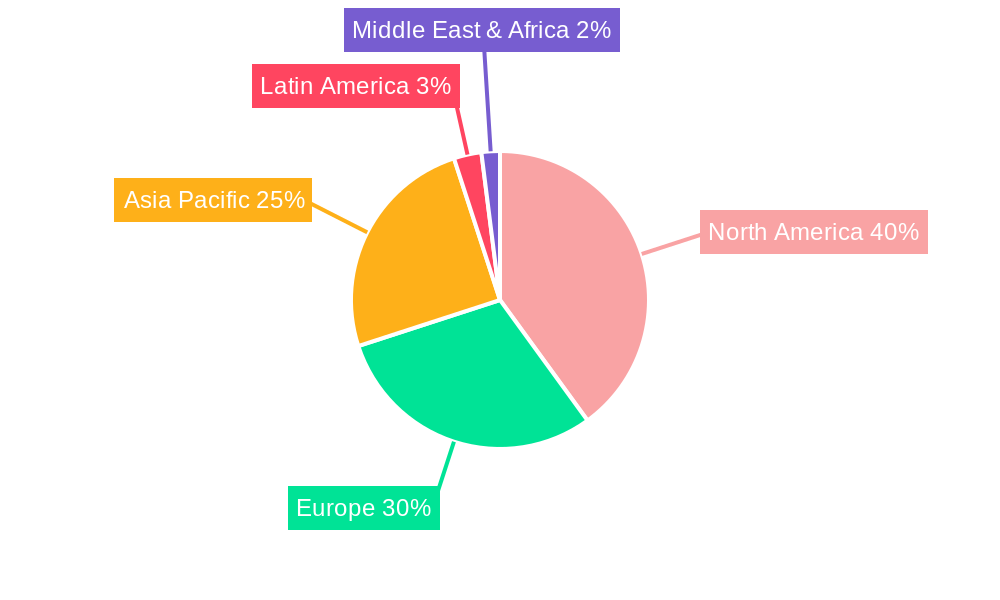

Dominant Regions, Countries, or Segments in North America E-Commerce Industry

Within the North American E-commerce landscape, B2C E-commerce stands as the dominant segment, consistently outperforming its B2B counterpart in terms of sheer transaction volume and market share. This dominance is further amplified by the robust growth in specific industry verticals. The Consumer Electronics and Fashion & Apparel sectors, powered by global giants like Amazon com Inc. and emerging fast-fashion players such as Shein, are leading the charge. The Furniture & Home vertical, with significant contributions from Wayfair E-commerce and Home Depot, is also witnessing accelerated growth due to evolving consumer preferences for home improvement and decor.

The United States remains the most dominant country, accounting for the largest share of the North American e-commerce market, driven by its large consumer base, advanced digital infrastructure, and high disposable income. Canada follows, with a steadily growing e-commerce sector influenced by increasing internet penetration and evolving consumer habits. Key drivers of this dominance include:

- Economic Policies: Favorable business environments and government support for digital infrastructure development.

- Infrastructure: Extensive logistics networks, reliable internet connectivity, and widespread adoption of digital payment systems.

- Consumer Spending Power: High disposable incomes and a propensity for online purchasing.

- Technological Adoption: Early and widespread adoption of smartphones and e-commerce platforms.

- Market Share: B2C E-commerce holds approximately xx% of the total North American e-commerce market.

- Leading Verticals: Consumer Electronics (xx% market share), Fashion & Apparel (xx% market share), Furniture & Home (xx% market share).

- Dominant Country: United States, contributing an estimated xx% to regional e-commerce sales.

North America E-Commerce Industry Product Landscape

The North American E-commerce product landscape is defined by continuous innovation and a widening array of offerings. Companies are increasingly leveraging advanced technologies to enhance product presentation and customer engagement. Augmented Reality (AR) is being integrated to allow consumers to visualize furniture in their homes or virtually try on clothing, improving purchase confidence and reducing returns. AI-powered recommendation engines are becoming more sophisticated, personalizing product suggestions based on individual browsing history, purchase patterns, and stated preferences. The performance metrics are increasingly focused on user experience, conversion rates, and customer lifetime value. Unique selling propositions are shifting towards curated selections, sustainable product sourcing, and personalized bundles, exemplified by initiatives from brands like Target and COSTCO.

Key Drivers, Barriers & Challenges in North America E-Commerce Industry

Several key drivers are propelling the North American E-commerce industry forward.

- Technological Advancements: The continuous evolution of AI, machine learning, and mobile technology provides new avenues for customer engagement and operational efficiency.

- Convenience and Accessibility: The ability to shop anytime, anywhere, and from any device is a primary draw for consumers.

- Personalization: Tailored product recommendations and marketing campaigns enhance customer satisfaction and drive sales.

- Expanding Product Offerings: Online retailers are continuously broadening their product assortments, catering to diverse consumer needs.

However, the industry also faces significant barriers and challenges.

- Supply Chain Disruptions: Global events and logistical complexities can lead to delays and increased costs for companies like Kroger E-commerce.

- Intense Competition: The market is highly competitive, with established giants and agile startups vying for market share, impacting profit margins for all players.

- Regulatory Hurdles: Evolving data privacy laws and potential antitrust scrutiny require constant adaptation and compliance.

- Cybersecurity Threats: Protecting sensitive customer data from breaches remains a critical and ongoing challenge for all online businesses.

Emerging Opportunities in North America E-Commerce Industry

Emerging opportunities in the North American E-commerce industry are ripe for exploration. The rapid growth of the online grocery sector, driven by convenience and expanding delivery networks, presents a significant untapped market. The increasing demand for sustainable and ethically sourced products offers a niche for brands to build loyalty and cater to conscious consumers. The integration of social commerce through platforms like Instagram and TikTok is creating new avenues for product discovery and direct sales. Furthermore, the expansion of cross-border e-commerce within North America, facilitated by improved logistics and payment solutions, opens up new customer bases for businesses.

Growth Accelerators in the North America E-Commerce Industry Industry

Several key catalysts are accelerating the long-term growth of the North American E-commerce industry. Continued investment in logistics and fulfillment infrastructure by major players like Amazon com Inc. and Walmart Inc. is reducing delivery times and costs, enhancing customer satisfaction. Technological breakthroughs in artificial intelligence and machine learning are enabling hyper-personalization and more efficient inventory management. Strategic partnerships between e-commerce platforms and payment providers are streamlining the checkout process, reducing cart abandonment rates. Furthermore, the expanding reach of mobile commerce and the increasing adoption of digital wallets are making online shopping more accessible than ever before.

Key Players Shaping the North America E-Commerce Industry Market

- Amazon com Inc.

- Walmart Inc.

- Apple Ecommerce

- COSTCO

- Target

- Best Buy

- Home Depot

- Wayfair E-commerce

- Kroger E-commerce

- Shein

- Coppel

Notable Milestones in North America E-Commerce Industry Sector

- 2020: Significant surge in online grocery adoption, accelerated by the global pandemic.

- 2021: Increased investment in AI and personalization technologies by leading e-commerce platforms.

- 2022: Growing emphasis on sustainable packaging and ethical sourcing from major retailers.

- 2023: Expansion of same-day and same-hour delivery services in major metropolitan areas.

- 2024: Growing influence of social commerce and shoppable content across various platforms.

In-Depth North America E-Commerce Industry Market Outlook

The future market potential of the North American E-commerce industry is exceptionally strong, driven by ongoing technological innovation and evolving consumer expectations. Growth accelerators such as the continued optimization of last-mile delivery, the pervasive integration of AI for personalized customer experiences, and the expansion of seamless omnichannel strategies will fuel sustained expansion. Strategic opportunities lie in further penetrating underserved markets, developing innovative sustainable e-commerce solutions, and leveraging data analytics to anticipate and meet consumer needs. The industry is poised for continued disruption and growth, making it a critical sector for businesses and investors alike.

North America E-Commerce Industry Segmentation

-

1. Type

- 1.1. B2C E-commerce

- 1.2. B2B E-commerce

-

2. Industry vertical

- 2.1. Beauty & Personal Care

- 2.2. Consumer Electronics

- 2.3. Fashion & Apparel

- 2.4. Food & Beverage

- 2.5. Furniture & Home

North America E-Commerce Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America E-Commerce Industry Regional Market Share

Geographic Coverage of North America E-Commerce Industry

North America E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions

- 3.3. Market Restrains

- 3.3.1. Privacy and Copyright Issues among E-sellers and Book Writers

- 3.4. Market Trends

- 3.4.1. Consumer Interest in Convenient Shopping Solutions is driving the E-Commerce market to grow.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2C E-commerce

- 5.1.2. B2B E-commerce

- 5.2. Market Analysis, Insights and Forecast - by Industry vertical

- 5.2.1. Beauty & Personal Care

- 5.2.2. Consumer Electronics

- 5.2.3. Fashion & Apparel

- 5.2.4. Food & Beverage

- 5.2.5. Furniture & Home

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wayfair E-commerce

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kroger E-commerce

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coppel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apple Ecommerce

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Home Depot

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Best Buy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 COSTCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon com Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Target

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Walmart Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shien

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Wayfair E-commerce

List of Figures

- Figure 1: North America E-Commerce Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: North America E-Commerce Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America E-Commerce Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America E-Commerce Industry Revenue million Forecast, by Industry vertical 2020 & 2033

- Table 4: North America E-Commerce Industry Volume K Unit Forecast, by Industry vertical 2020 & 2033

- Table 5: North America E-Commerce Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: North America E-Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America E-Commerce Industry Revenue million Forecast, by Type 2020 & 2033

- Table 8: North America E-Commerce Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: North America E-Commerce Industry Revenue million Forecast, by Industry vertical 2020 & 2033

- Table 10: North America E-Commerce Industry Volume K Unit Forecast, by Industry vertical 2020 & 2033

- Table 11: North America E-Commerce Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: North America E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America E-Commerce Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States North America E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America E-Commerce Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America E-Commerce Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America E-Commerce Industry?

The projected CAGR is approximately 18.1%.

2. Which companies are prominent players in the North America E-Commerce Industry?

Key companies in the market include Wayfair E-commerce, Kroger E-commerce, Coppel, Apple Ecommerce, Home Depot, Best Buy, COSTCO, Amazon com Inc, Target, Walmart Inc, Shien.

3. What are the main segments of the North America E-Commerce Industry?

The market segments include Type , Industry vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3333.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions.

6. What are the notable trends driving market growth?

Consumer Interest in Convenient Shopping Solutions is driving the E-Commerce market to grow..

7. Are there any restraints impacting market growth?

Privacy and Copyright Issues among E-sellers and Book Writers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America E-Commerce Industry?

To stay informed about further developments, trends, and reports in the North America E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence