Key Insights

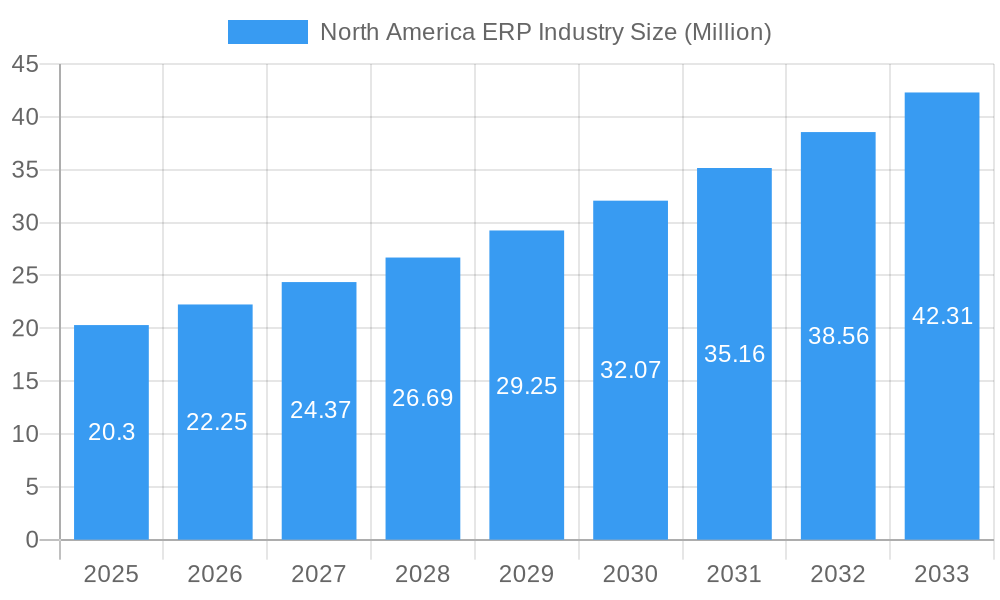

The North America ERP industry is poised for robust expansion, projected to reach a market size of $20.30 Million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 9.51% through 2033. This sustained growth is fueled by several key drivers. The increasing adoption of cloud-based ERP solutions is a significant catalyst, offering scalability, flexibility, and reduced IT overhead for businesses of all sizes, from SMBs to large enterprises. The escalating demand for real-time data analytics and enhanced business intelligence within applications further propels market penetration. Furthermore, the imperative for streamlined operations and improved decision-making across diverse sectors such as Retail, Manufacturing, BFSI, and Government necessitates sophisticated ERP functionalities. The ongoing digital transformation initiatives across North American businesses, coupled with the need for greater operational efficiency and competitive advantage, are fundamental to this market's upward trajectory. Emerging trends like the integration of AI and machine learning into ERP systems for predictive analytics and automation are also shaping the market landscape, promising to unlock new levels of productivity and innovation.

North America ERP Industry Market Size (In Million)

Despite this strong growth trajectory, certain restraints could influence the pace of adoption. The initial cost of implementation and ongoing maintenance, particularly for large-scale, on-premise solutions, can be a barrier for some organizations. Moreover, concerns surrounding data security and privacy associated with cloud deployments, although diminishing, remain a factor. The complexity of integrating ERP systems with existing legacy infrastructure can also present challenges. However, the market is actively addressing these through advancements in hybrid cloud models and robust security protocols. The increasing focus on specialized ERP solutions tailored to specific industry needs, such as those for the unique requirements of Transport & Logistics or Education & Research, highlights the industry's adaptability. As businesses continue to prioritize digital agility and operational excellence, the North America ERP market is well-positioned to capitalize on these dynamics, with cloud and hybrid deployments expected to dominate the landscape and drive significant value creation for the foreseeable future.

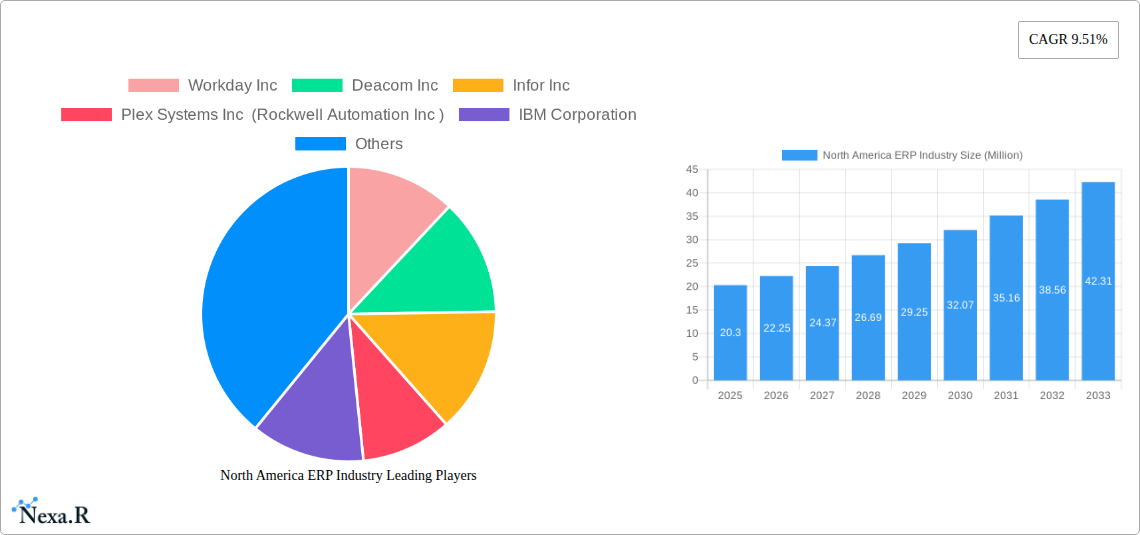

North America ERP Industry Company Market Share

North America ERP Industry: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report delivers a meticulously researched analysis of the North American Enterprise Resource Planning (ERP) industry, providing critical insights into market dynamics, growth trajectories, and future opportunities. Designed for industry professionals, solution providers, investors, and strategists, this report covers a comprehensive study period from 2019 to 2033, with a base year of 2025. We dissect the market by deployment models (On-premise, Cloud, Hybrid), business sizes (SMBs, Large Enterprises), technology types (Mobile, Cloud, Social, Two-Tier), and a diverse range of end-user industries including Retail, Manufacturing, BFSI, Government, Telecom, Military and Defense, Education & Research, Transport & Logistics, and Others. Leveraging high-traffic SEO keywords, this report ensures maximum visibility and engagement for those seeking to understand the evolving North American ERP landscape.

North America ERP Industry Market Dynamics & Structure

The North American ERP industry is characterized by a dynamic interplay of intense competition and rapid technological evolution, with a notable presence of both global giants and specialized niche players. Market concentration is moderately high, with major vendors like Oracle Corporation, Microsoft Corporation, SAP SE, and Workday Inc. holding significant shares, particularly in the large enterprise segment. However, the rise of cloud-based solutions has fostered opportunities for agile, specialized providers such as Deacom Inc., Plex Systems Inc. (Rockwell Automation Inc.), and FinancialForce.com Inc., who cater to specific industry needs and SMB requirements. Technological innovation remains a primary driver, fueled by advancements in Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and predictive analytics, all aiming to enhance automation, data-driven decision-making, and user experience. Regulatory frameworks, particularly around data privacy (e.g., GDPR, CCPA) and industry-specific compliance, influence product development and implementation strategies. Competitive product substitutes are emerging, including specialized business management software and low-code/no-code platforms that can address specific functional gaps, posing a challenge to traditional, monolithic ERP systems. End-user demographics are shifting, with a growing demand for intuitive, mobile-first, and integrated solutions across all business sizes. Mergers and acquisitions (M&A) are a constant feature, driven by the pursuit of market expansion, technological consolidation, and the acquisition of specialized expertise. For instance, Rockwell Automation's acquisition of Plex Systems underscores the trend of integrating ERP with broader operational technology (OT) strategies.

- Market Concentration: Dominated by a few large players, but with increasing fragmentation due to cloud adoption and niche solutions.

- Technological Innovation Drivers: AI, ML, IoT, Big Data analytics, cloud-native architectures, and low-code/no-code platforms.

- Regulatory Frameworks: Data privacy regulations (GDPR, CCPA), industry-specific compliance mandates.

- Competitive Product Substitutes: Specialized CRM, SCM, WMS, and Business Intelligence (BI) tools; low-code platforms.

- End-User Demographics: Growing demand for user-friendly, mobile-enabled, cloud-based, and integrated solutions.

- M&A Trends: Strategic acquisitions to expand technology portfolios, market reach, and acquire specialized talent.

- Innovation Barriers: High implementation costs, data migration complexities, resistance to change, and the need for skilled IT professionals.

North America ERP Industry Growth Trends & Insights

The North American ERP industry is poised for robust growth, driven by the imperative for digital transformation and operational efficiency across all business sectors. The market size is projected to expand significantly, with cloud ERP adoption continuing its meteoric rise, offering scalability, flexibility, and cost-effectiveness. This shift is dismantling traditional barriers to entry for SMBs, who are increasingly leveraging cloud ERP solutions to compete with larger enterprises. Technological disruptions, including the integration of AI for intelligent automation, predictive analytics for forecasting, and advanced reporting capabilities, are reshaping how businesses manage their core operations. Consumer behavior shifts towards real-time data access and personalized user experiences are compelling ERP vendors to develop more intuitive and mobile-friendly interfaces. The market penetration of cloud ERP is expected to reach xx% by 2025, with hybrid deployments also gaining traction as organizations seek to balance the benefits of cloud with existing on-premise investments. The CAGR for the forecast period (2025-2033) is estimated at xx%, a testament to the sustained demand for sophisticated business management software. The growing emphasis on supply chain resilience, driven by recent global disruptions, is further propelling the adoption of integrated ERP systems that offer end-to-end visibility and control. Furthermore, the need for real-time financial management and compliance reporting in sectors like BFSI and Government is a constant growth catalyst. The adoption of ERP systems is no longer limited to core functions; it's extending to encompass customer engagement, human capital management, and advanced analytics, reflecting a holistic approach to business operations. The ongoing digital transformation initiatives across manufacturing, retail, and logistics industries are creating a fertile ground for ERP solutions that can streamline complex processes and improve decision-making. The increasing demand for integrated solutions that can connect various departments and data sources is a key trend shaping the market. This demand is further amplified by the need for greater agility and responsiveness in today's volatile business environment. The development of industry-specific ERP modules and tailored solutions is also contributing to market growth, as businesses seek systems that directly address their unique challenges and operational requirements. The market is witnessing a trend towards modular ERP systems, allowing businesses to choose and implement only the functionalities they need, thereby reducing costs and complexity. The increasing adoption of IoT devices in industries like manufacturing and logistics is creating new opportunities for ERP systems to integrate with real-time operational data, enabling more informed and proactive decision-making. The focus on data security and privacy is also driving the demand for robust ERP solutions that can ensure compliance with evolving regulations and protect sensitive business information. The market is also seeing a rise in demand for ERP solutions that can support remote workforces and distributed business operations, offering greater flexibility and accessibility.

Dominant Regions, Countries, or Segments in North America ERP Industry

The North American ERP industry's dominance is clearly established in the United States, driven by its vast market size, advanced technological infrastructure, and a highly competitive business environment that necessitates robust operational management. The Cloud deployment segment stands out as the primary growth engine and dominant category, reflecting a widespread shift away from on-premise solutions due to its inherent advantages in scalability, accessibility, and reduced upfront costs. This segment is experiencing rapid adoption across all business sizes, but particularly within SMBs, who find cloud ERP solutions to be a more accessible and cost-effective pathway to advanced business capabilities. The Manufacturing sector is another significant area of dominance, with ERP systems playing a crucial role in managing complex production processes, supply chains, and inventory. This sector's adoption is further boosted by the integration of IoT and AI for smart manufacturing initiatives.

- Dominant Country: United States, leading in terms of market size, adoption rates, and technological innovation.

- Dominant Deployment: Cloud ERP, offering superior flexibility, scalability, and cost-efficiency compared to on-premise solutions.

- Dominant Business Size: SMBs, increasingly leveraging cloud ERP to level the playing field and access advanced functionalities.

- Dominant Segment: Manufacturing, due to the critical need for streamlined production, supply chain management, and operational efficiency.

- Key Drivers for Cloud Dominance:

- Reduced IT infrastructure and maintenance costs.

- Enhanced accessibility and remote work enablement.

- Faster deployment and easier updates.

- Scalability to meet fluctuating business needs.

- Key Drivers for SMB Adoption:

- Affordable subscription-based pricing models.

- Access to enterprise-grade functionalities.

- Reduced reliance on in-house IT expertise.

- Competitive advantage through digital transformation.

- Key Drivers for Manufacturing Sector Growth:

- Demand for Industry 4.0 integration (IoT, AI, automation).

- Need for real-time production monitoring and control.

- Streamlined supply chain management and inventory optimization.

- Compliance with stringent industry regulations and quality standards.

- Market Share & Growth Potential: The Cloud segment is expected to capture over xx% of the total North American ERP market by 2025, with SMBs showing the highest year-over-year growth rate in ERP adoption. Manufacturing alone accounts for approximately xx% of the total ERP market revenue in North America.

- Supporting Factors: Favorable economic policies promoting technological adoption, a robust digital infrastructure, and a strong culture of innovation in the United States significantly contribute to the dominance of these segments. The increasing availability of specialized ERP solutions tailored to the unique needs of the manufacturing sector further fuels its growth. The shift towards hybrid cloud models also presents significant growth potential for organizations seeking a balanced approach.

North America ERP Industry Product Landscape

The North American ERP product landscape is characterized by continuous innovation, focusing on delivering integrated, intelligent, and user-centric solutions. Vendors are actively enhancing their offerings with AI-powered automation, predictive analytics, and robust data visualization tools. Mobile ERP applications are becoming increasingly sophisticated, providing real-time access to critical business information and functionalities on the go. Cloud-native architectures are standard, enabling greater agility and faster deployment cycles. Product differentiation often lies in industry-specific functionalities, such as advanced shop floor control for manufacturers, sophisticated compliance tools for BFSI, or optimized logistics management for transport. The emphasis is on creating a seamless user experience, reducing the complexity often associated with traditional ERP systems.

Key Drivers, Barriers & Challenges in North America ERP Industry

Key Drivers:

- Digital Transformation Imperative: Businesses across all sectors are compelled to adopt digital solutions to remain competitive, enhance efficiency, and improve customer experiences.

- Demand for Operational Efficiency: Streamlining business processes, optimizing resource allocation, and reducing operational costs are primary motivators for ERP adoption.

- Technological Advancements: The integration of AI, ML, IoT, and cloud computing is creating more powerful and intelligent ERP solutions.

- Data-Driven Decision Making: Growing emphasis on leveraging real-time data for strategic planning and improved business insights.

- Scalability and Flexibility: Cloud ERP solutions offer the agility businesses need to adapt to changing market conditions.

Barriers & Challenges:

- High Implementation Costs and Time: Initial investment and deployment time can be significant, particularly for large enterprises.

- Data Migration Complexities: Transferring existing data to a new ERP system can be challenging and prone to errors.

- Resistance to Change: Employee adoption and organizational change management are critical hurdles for successful ERP implementation.

- Integration with Legacy Systems: Ensuring seamless integration with existing IT infrastructure can be complex and costly.

- Skilled IT Workforce Shortage: A lack of qualified professionals to implement, manage, and maintain ERP systems.

- Cybersecurity Concerns: Protecting sensitive business data in cloud environments remains a paramount concern for many organizations, impacting cloud ERP adoption rates.

- Vendor Lock-in: Concerns about being tied to a specific vendor's ecosystem, limiting future flexibility and increasing long-term costs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of hardware components and skilled implementation resources, indirectly affecting ERP project timelines and costs.

Emerging Opportunities in North America ERP Industry

Emerging opportunities in the North American ERP industry lie in the further integration of AI and ML for predictive capabilities, automating complex decision-making processes and enhancing user productivity. The burgeoning Internet of Things (IoT) ecosystem presents a significant avenue, with ERP systems poised to integrate real-time data from connected devices, particularly in manufacturing and logistics, enabling proactive maintenance and optimized operations. The increasing demand for specialized, industry-specific ERP solutions, catering to niche markets within sectors like healthcare, professional services, and sustainable industries, offers substantial growth potential. Furthermore, the development of low-code/no-code ERP platforms empowers businesses to customize and extend their ERP functionalities without extensive programming knowledge, democratizing access to tailored solutions. The growing focus on sustainability and ESG (Environmental, Social, and Governance) reporting is also creating a demand for ERP modules that can track and manage environmental impact and social responsibility metrics.

Growth Accelerators in the North America ERP Industry Industry

Several key growth accelerators are propelling the North American ERP industry forward. The relentless pursuit of digital transformation by businesses of all sizes is a primary catalyst, driving the adoption of modern ERP systems to enhance agility and competitiveness. Technological breakthroughs, including advancements in AI for intelligent automation, predictive analytics, and machine learning for enhanced forecasting and decision-making, are making ERP solutions more powerful and indispensable. Strategic partnerships between ERP vendors and cloud service providers are expanding market reach and offering more integrated, scalable solutions. The increasing demand for industry-specific ERP solutions, tailored to the unique needs of sectors like manufacturing, retail, and BFSI, is creating specialized growth pockets. Furthermore, the growing adoption of hybrid cloud models is providing businesses with flexible options to leverage both cloud and on-premise resources, catering to diverse security and operational requirements.

Key Players Shaping the North America ERP Industry Market

- Workday Inc

- Deacom Inc

- Infor Inc

- Plex Systems Inc (Rockwell Automation Inc)

- IBM Corporation

- Epicor Software Corporation

- FinancialForce com Inc

- Microsoft Corporation

- Oracle Corporation

- The Sage Group PLC

- Deltek Inc

- SAP SE

- Unit4 NV

Notable Milestones in North America ERP Industry Sector

- October 2022: The city of Lancaster, California, and Tyler Technologies, Inc. have agreed to use Tyler's Enterprise ERP solution suite, powered by Munis. The management of the city's finances, personnel, income and expenditures, enterprise assets, content management, and controlled detection and reaction will all be handled by Tyler's solutions for the city. This highlights the ongoing adoption of comprehensive ERP solutions in government sectors.

- July 2022: Meridian has chosen Oracle NetSuite to assist with updating and optimizing its business procedures to serve its members better. Meridian is the second-largest credit union in Canada and the biggest in Ontario. Meridian will benefit from an effective integrated finance system with NetSuite to support its expansion and digital transformation. This demonstrates the strategic importance of integrated finance systems for financial institutions' growth and digital advancement.

In-Depth North America ERP Industry Market Outlook

The North American ERP industry is set for a period of sustained and dynamic growth, fueled by ongoing digital transformation initiatives and the imperative for operational excellence. Future market potential is significant, driven by the increasing demand for cloud-native, AI-integrated, and industry-specific ERP solutions. Strategic opportunities abound for vendors who can deliver scalable, flexible, and user-friendly platforms that address the evolving needs of SMBs and large enterprises alike. The continued adoption of mobile and social ERP functionalities will enhance accessibility and collaboration. Furthermore, the integration of IoT data and advanced analytics will unlock new levels of predictive power and efficiency, positioning ERP systems as the central nervous system for modern businesses. The market will continue to witness M&A activities as players seek to consolidate technologies and expand their service offerings to capture market share in this ever-evolving landscape.

North America ERP Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

- 1.3. Hybrid

-

2. Size of Business

- 2.1. SMB's

- 2.2. Large Enterprises

-

3. Type

- 3.1. Mobile

- 3.2. Cloud

- 3.3. Social

- 3.4. Two-Tier

-

4. Application

- 4.1. Retail

- 4.2. Manufacturing

- 4.3. BFSI

- 4.4. Government

- 4.5. Telecom

- 4.6. Military and Defense

- 4.7. Education & Research

- 4.8. Transport & Logistics

- 4.9. Other End-user Industries

North America ERP Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

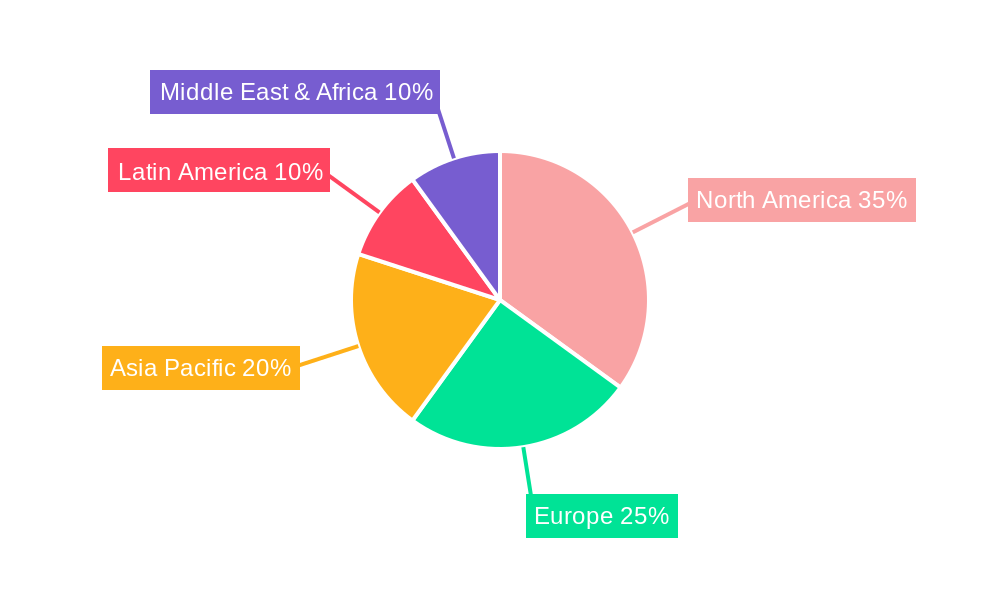

North America ERP Industry Regional Market Share

Geographic Coverage of North America ERP Industry

North America ERP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Real Time Decision Making; Rapid Adoption of Cloud Based ERP Solutions

- 3.3. Market Restrains

- 3.3.1. Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Cloud ERP To Be a Major Market Attraction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ERP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Size of Business

- 5.2.1. SMB's

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Mobile

- 5.3.2. Cloud

- 5.3.3. Social

- 5.3.4. Two-Tier

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Retail

- 5.4.2. Manufacturing

- 5.4.3. BFSI

- 5.4.4. Government

- 5.4.5. Telecom

- 5.4.6. Military and Defense

- 5.4.7. Education & Research

- 5.4.8. Transport & Logistics

- 5.4.9. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Workday Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deacom Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Infor Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plex Systems Inc (Rockwell Automation Inc )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IBM Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Epicor Software Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FinancialForce com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Sage Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deltek Inc *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SAP SE

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Unit4 NV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Workday Inc

List of Figures

- Figure 1: North America ERP Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America ERP Industry Share (%) by Company 2025

List of Tables

- Table 1: North America ERP Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: North America ERP Industry Revenue Million Forecast, by Size of Business 2020 & 2033

- Table 3: North America ERP Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: North America ERP Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: North America ERP Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America ERP Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: North America ERP Industry Revenue Million Forecast, by Size of Business 2020 & 2033

- Table 8: North America ERP Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: North America ERP Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America ERP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States North America ERP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America ERP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America ERP Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ERP Industry?

The projected CAGR is approximately 9.51%.

2. Which companies are prominent players in the North America ERP Industry?

Key companies in the market include Workday Inc, Deacom Inc, Infor Inc, Plex Systems Inc (Rockwell Automation Inc ), IBM Corporation, Epicor Software Corporation, FinancialForce com Inc, Microsoft Corporation, Oracle Corporation, The Sage Group PLC, Deltek Inc *List Not Exhaustive, SAP SE, Unit4 NV.

3. What are the main segments of the North America ERP Industry?

The market segments include Deployment, Size of Business, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Real Time Decision Making; Rapid Adoption of Cloud Based ERP Solutions.

6. What are the notable trends driving market growth?

Cloud ERP To Be a Major Market Attraction.

7. Are there any restraints impacting market growth?

Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

October 2022: The city of Lancaster, California, and Tyler Technologies, Inc. have agreed to use Tyler's Enterprise ERP solution suite, powered by Munis. The management of the city's finances, personnel, income and expenditures, enterprise assets, content management, and controlled detection and reaction will all be handled by Tyler's solutions for the city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ERP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ERP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ERP Industry?

To stay informed about further developments, trends, and reports in the North America ERP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence