Key Insights

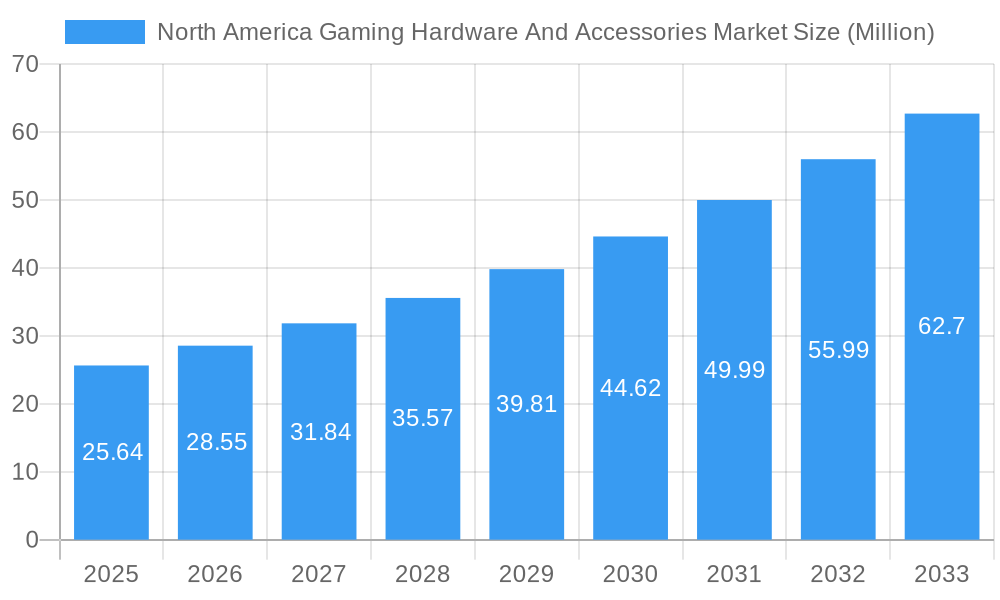

The North America Gaming Hardware and Accessories Market is poised for significant expansion, with a current market size estimated at $25.64 million. This growth is fueled by a robust compound annual growth rate (CAGR) of 11.47%, projecting a dynamic trajectory throughout the forecast period of 2025-2033. The increasing adoption of high-performance gaming PCs and sophisticated gaming consoles, coupled with the rising popularity of esports and competitive gaming, are primary drivers. Furthermore, the surge in demand for immersive experiences, driven by virtual reality (VR) devices and advanced peripherals like specialized gaming headsets, keyboards, and mice, is propelling market expansion. The proliferation of both casual and professional gamers across the United States, Canada, and Mexico underscores the broad appeal and diverse consumer base within this sector.

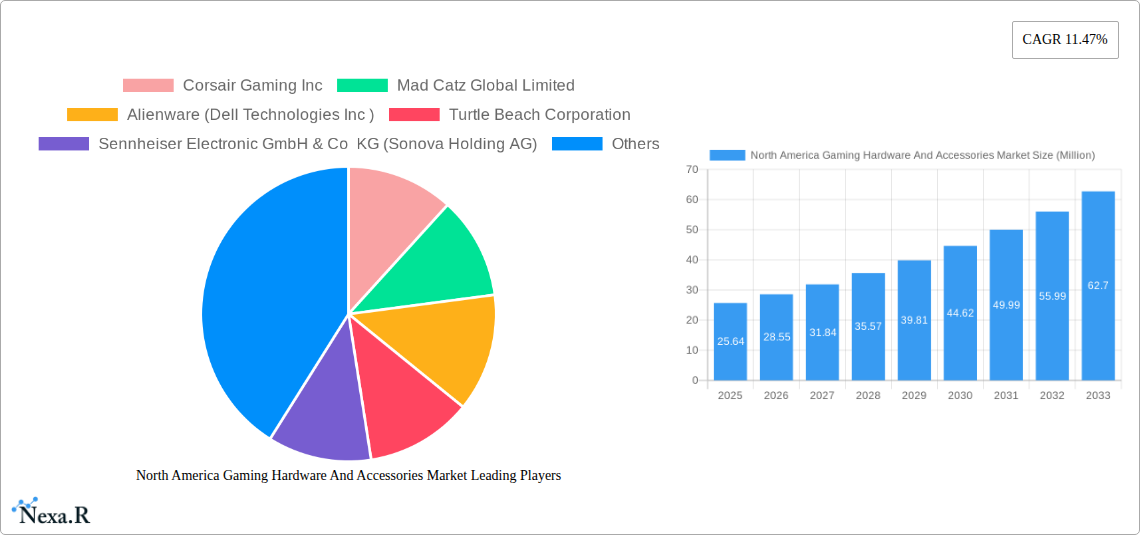

North America Gaming Hardware And Accessories Market Market Size (In Million)

The market's robust growth is further supported by ongoing innovation in gaming technology and a growing ecosystem of content creators and streamers who influence consumer purchasing decisions. While the market experiences strong tailwinds, potential restraints may emerge from the high cost of premium gaming hardware and accessories, which could pose a barrier for some segments of the casual gaming audience. However, the consistent release of new gaming titles, the increasing accessibility of cloud gaming services, and the continuous evolution of hardware capabilities are expected to outweigh these limitations. Key players like Corsair Gaming Inc., Razer Inc., Sony Group Corporation, and Nvidia Corporation are actively investing in product development and market penetration strategies, further stimulating competition and innovation within the North America gaming hardware and accessories landscape.

North America Gaming Hardware And Accessories Market Company Market Share

Dive deep into the booming North America Gaming Hardware and Accessories Market with our comprehensive report. This essential resource provides unparalleled insights into market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033, with a detailed analysis of the base year 2025 and a robust forecast period. Explore the intricate parent and child market segments driving innovation and consumer engagement, from high-performance Gaming PCs and next-generation Gaming Consoles to immersive Virtual Reality Devices and essential Gaming Accessories like Gaming Headsets, Gaming Keyboards, Gaming Mice, and Gaming Controllers/Joysticks/Gamepads.

This SEO-optimized report is meticulously crafted for industry professionals, including manufacturers, distributors, investors, and market analysts, seeking to capitalize on the surging demand for cutting-edge gaming technology. Discover key trends influencing the United States, Canada, and Mexico, and understand the distinct preferences of Casual Gamers, Professional Gamers, and Esports Athletes. With quantitative data presented in millions of units and qualitative analyses, this report is your definitive guide to navigating and thriving in this dynamic and rapidly evolving market.

North America Gaming Hardware And Accessories Market Market Dynamics & Structure

The North America Gaming Hardware and Accessories Market exhibits a dynamic and evolving structure characterized by a moderate to high market concentration, heavily influenced by technological innovation and intense competition. Major players like Sony Group Corporation, Nintendo Co Ltd, and Nvidia Corporation dominate segments such as Gaming Consoles and high-performance Gaming PCs, leveraging their strong brand equity and extensive R&D investments. The market is a fertile ground for technological innovation, driven by advancements in graphics processing, virtual reality, and artificial intelligence, pushing the boundaries of immersive gaming experiences. Regulatory frameworks, primarily focused on consumer safety and intellectual property rights, play a role but generally foster a competitive environment. Competitive product substitutes are abundant, particularly in the accessories segment, where brands like Corsair Gaming Inc, Razer Inc, and Logitech International SA vie for market share with feature-rich offerings. End-user demographics are increasingly diverse, with a growing segment of casual gamers alongside the established professional and esports athlete communities, each with specific hardware demands. Mergers and acquisitions (M&A) are strategic maneuvers for market consolidation and technological integration; for instance, the acquisition of HyperX by HP Inc. has reshaped the peripherals landscape. Innovation barriers exist, including the high cost of R&D for cutting-edge technologies like advanced VR and the need for continuous product updates to meet rapidly evolving consumer expectations.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Technological Innovation Drivers: Advancements in GPU technology, VR/AR, cloud gaming, and AI integration.

- Regulatory Frameworks: Focus on consumer protection, data privacy, and IP rights.

- Competitive Product Substitutes: High availability across all accessory categories, driving feature differentiation.

- End-User Demographics: Expanding beyond core gamers to include a broader casual audience and mobile gamers.

- M&A Trends: Strategic acquisitions to expand product portfolios and market reach.

- Innovation Barriers: High R&D costs, rapid product obsolescence, and the need for seamless integration across devices.

North America Gaming Hardware And Accessories Market Growth Trends & Insights

The North America Gaming Hardware and Accessories Market has witnessed a remarkable upward trajectory, fueled by increasing disposable incomes, the proliferation of high-speed internet, and the growing cultural acceptance of gaming as a mainstream entertainment and competitive activity. The market size evolution is a testament to this robust growth, with a projected compound annual growth rate (CAGR) that reflects sustained expansion across all key segments. Adoption rates for advanced gaming hardware, particularly Gaming PCs and Gaming Consoles, continue to climb as consumers seek more immersive and high-fidelity experiences. Technological disruptions, such as the rise of cloud gaming platforms and the refinement of Virtual Reality Devices, are not only expanding the market but also reshaping consumer behavior shifts towards more accessible and flexible gaming options. The transition from traditional console gaming to hybrid models and the increasing demand for cross-platform compatibility are significant trends.

Furthermore, the booming esports industry has created a dedicated segment of Professional Gamers and Esports Athletes who demand top-tier, performance-oriented hardware, driving innovation in Gaming Headsets, Gaming Keyboards, and Gaming Mice. Casual gamers, representing a vast consumer base, are increasingly investing in accessories that enhance their gaming sessions, leading to a surge in demand for ergonomic and feature-rich controllers and other gaming peripherals. The integration of smart technologies, such as customizable RGB lighting and advanced haptic feedback, has become a key differentiator, appealing to a generation of gamers who view their hardware as an extension of their personal style and competitive edge. The COVID-19 pandemic acted as an unexpected accelerator, as lockdowns and increased home-based entertainment led to a significant surge in gaming hardware sales, solidifying its position as a primary leisure activity. Looking ahead, the continued development of more affordable and accessible VR technologies, alongside advancements in mobile gaming hardware like the Razer Kishi Ultra, are poised to unlock new market segments and further propel growth. The market penetration of specialized gaming accessories continues to deepen, driven by a desire for enhanced performance, comfort, and personalized gaming environments.

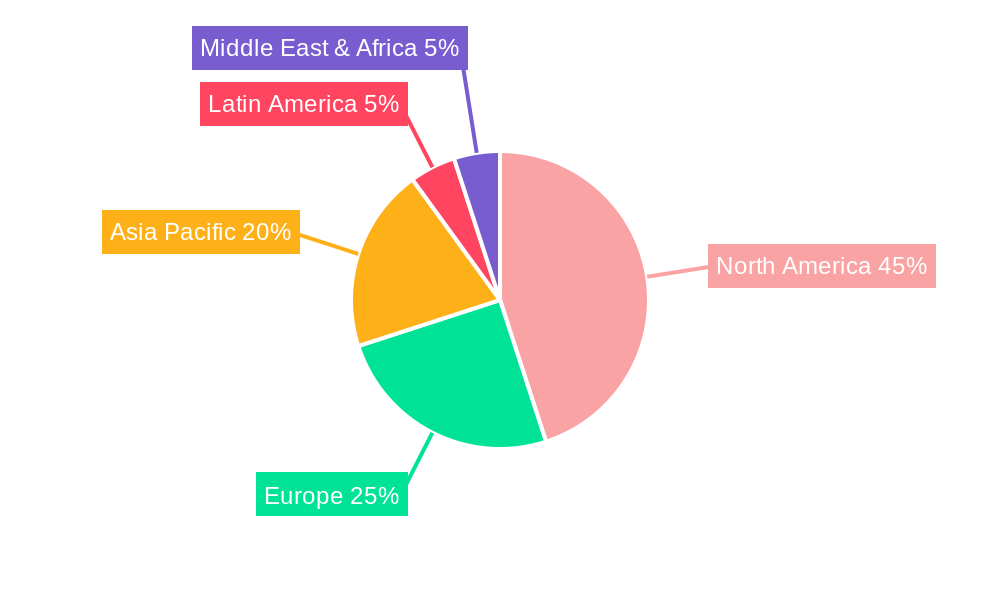

Dominant Regions, Countries, or Segments in North America Gaming Hardware And Accessories Market

The North America Gaming Hardware and Accessories Market is largely dominated by the United States, which consistently leads in terms of market size, consumer spending, and adoption of new gaming technologies. Its dominance is a confluence of several factors, including a large, affluent population with high disposable incomes, a well-established gaming culture, and a significant presence of esports leagues and professional gamers. The US market demonstrates high penetration rates for all major product segments, from high-end Gaming PCs and Gaming Consoles to a vast array of Gaming Accessories.

Within product types, Gaming Consoles and Gaming PCs represent the foundational pillars of the North American market, consistently driving significant revenue and unit sales. The intense competition between Sony Group Corporation and Nintendo Co Ltd for console market share, coupled with the demand for powerful Gaming PCs driven by Nvidia Corporation's GPUs, underscores their importance. Gaming Headsets and Gaming Keyboards are also critical segments, with substantial growth fueled by the esports phenomenon and the demand for superior audio and tactile feedback. Companies like Steelseries (GN Store Nord A/S) and Corsair Gaming Inc. are at the forefront of innovation in these areas, offering products tailored for competitive play.

The United States' market share in gaming hardware and accessories is estimated to be over 70% of the North American total. This is attributed to:

- Economic Policies: Favorable economic conditions and consumer spending power.

- Infrastructure: Widespread availability of high-speed internet essential for online gaming and streaming.

- Cultural Influence: A deeply ingrained gaming culture that influences entertainment choices.

- Esports Ecosystem: A mature and rapidly growing esports infrastructure, including leagues, tournaments, and professional teams, that drives demand for high-performance gear.

- Technological Adoption: Early and widespread adoption of new gaming technologies, from next-gen consoles to advanced VR.

While Canada and Mexico are significant markets in their own right, they represent a smaller share of the overall North American gaming hardware and accessories landscape. Canada benefits from similar technological adoption trends and a strong gaming community, while Mexico is a rapidly growing market with increasing disposable incomes and a burgeoning youth population eager to engage with gaming. However, the sheer scale of the US consumer base and its economic might solidify its position as the undisputed leader in driving market growth and shaping trends across the entire North American region.

North America Gaming Hardware And Accessories Market Product Landscape

The product landscape within the North America Gaming Hardware and Accessories Market is characterized by relentless innovation and a focus on delivering enhanced performance, immersion, and user experience. High-performance Gaming PCs, featuring advanced graphics cards from Nvidia Corporation and powerful processors, continue to be a cornerstone, catering to demanding gamers. The latest generation of Gaming Consoles from Sony Group Corporation and Nintendo Co Ltd offers unparalleled gaming experiences, pushing graphical boundaries. In the accessories realm, innovations abound: Gaming Headsets are increasingly incorporating spatial audio technologies for superior directional awareness, as exemplified by the recent launch of Steelseries' Arctis Nova Pro. Gaming Keyboards are evolving with faster actuation switches and customizable RGB lighting, while Gaming Mice offer advanced sensor technology and ergonomic designs for precision control. Virtual Reality Devices are becoming more accessible and sophisticated, promising deeper immersion. Notable advancements include the Razer Kishi Ultra, a USB-C gaming controller that brings console-grade control to mobile devices, highlighting a significant trend in expanding the gaming ecosystem.

Key Drivers, Barriers & Challenges in North America Gaming Hardware And Accessories Market

Key Drivers:

- Technological Advancements: Continuous innovation in GPU technology, AI, VR, and cloud gaming enhances performance and immersive experiences, driving demand for upgraded hardware.

- Growth of Esports and Streaming: The burgeoning esports scene and the popularity of game streaming platforms create a strong demand for high-performance peripherals among professional gamers and content creators.

- Increasing Disposable Income and Leisure Time: Growing consumer spending power and a greater emphasis on home entertainment fuel investment in gaming hardware and accessories.

- Growing Gaming Population: The expansion of the gaming demographic to include a wider age range and more casual players broadens the market base for various gaming products.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events and component shortages can impact manufacturing and lead to increased costs and limited availability of key components, affecting production volumes (e.g., impact on GPU availability in recent years).

- High Cost of Advanced Technology: The premium pricing of cutting-edge hardware, particularly for high-end PCs and VR devices, can be a barrier for budget-conscious consumers.

- Rapid Product Obsolescence: The fast pace of technological evolution means that products can quickly become outdated, requiring continuous investment from consumers and manufacturers.

- Intense Market Competition: The crowded market space, especially in accessories, leads to price pressures and the need for constant differentiation and marketing efforts.

- Evolving Consumer Preferences: Keeping pace with rapidly shifting trends and consumer demands requires agile product development and marketing strategies.

Emerging Opportunities in North America Gaming Hardware And Accessories Market

Emerging opportunities within the North America Gaming Hardware and Accessories Market lie in the continued expansion of mobile gaming, the advancement of cloud gaming accessibility, and the growing integration of AI. The increasing sophistication of mobile gaming hardware, as demonstrated by devices like the Razer Kishi Ultra, opens up new revenue streams and attracts a broader user base seeking console-like experiences on their smartphones. Cloud gaming platforms present an opportunity to lower hardware entry barriers, allowing more consumers to access high-fidelity games without expensive consoles or PCs, thereby driving demand for compatible controllers and accessories. The integration of AI in gaming hardware for personalized performance optimization and enhanced user experiences represents a future growth frontier. Furthermore, the expansion of the esports ecosystem into niche genres and decentralized competitive structures presents opportunities for specialized hardware tailored to specific game types.

Growth Accelerators in the North America Gaming Hardware And Accessories Market Industry

Several key catalysts are accelerating the long-term growth of the North America Gaming Hardware and Accessories Market. The relentless pursuit of technological breakthroughs, such as more powerful and energy-efficient GPUs from Nvidia Corporation and advancements in haptic feedback technology, continuously pushes the boundaries of what's possible in gaming. Strategic partnerships between hardware manufacturers, game developers, and platform holders are crucial for creating cohesive gaming ecosystems and ensuring seamless hardware-software integration. For instance, console manufacturers' exclusive partnerships with game studios drive hardware sales. Market expansion strategies, including the targeting of new demographic segments like older adults or the development of more affordable entry-level gaming options, are broadening the consumer base. The increasing investment in esports infrastructure and the professionalization of the industry also act as significant growth accelerators, encouraging hardware upgrades and specialized product development.

Key Players Shaping the North America Gaming Hardware And Accessories Market Market

- Corsair Gaming Inc

- Mad Catz Global Limited

- Alienware (Dell Technologies Inc)

- Turtle Beach Corporation

- Sennheiser Electronic GmbH & Co KG (Sonova Holding AG)

- Steelseries (GN Store Nord A/S)

- Redragon (Eastern Times Technology Co Ltd)

- Nintendo Co Ltd

- Anker Innovations Technology Co Ltd

- Sony Group Corporation

- Razer Inc

- Cooler Master Co Ltd

- Logitech International SA

- Nvidia Corporation

- HyperX (HP Inc)

Notable Milestones in North America Gaming Hardware And Accessories Market Sector

- April 2024 - Razer released the Razer Kishi Ultra, a USB C gaming controller designed to elevate the mobile gaming experience by offering console-grade control and immersive haptics for Android, iPhone 15 series, and iPad Mini devices.

- April 2024 - SteelSeries launched an all-new white version of its Arctis Nova Pro headphones, inspired by audiophile listening rooms and providing comprehensive audio control for an enhanced acoustic experience.

In-Depth North America Gaming Hardware And Accessories Market Market Outlook

The North America Gaming Hardware and Accessories Market is poised for sustained and significant growth, driven by a confluence of technological innovation, expanding consumer engagement, and the thriving esports ecosystem. Future market potential is amplified by the ongoing development of more immersive VR/AR technologies and the increasing accessibility of cloud gaming, which democratizes high-end gaming experiences. Strategic opportunities lie in further tailoring products to the diverse needs of casual, professional, and mobile gamers, alongside a growing demand for sustainable and feature-rich accessories. The market's outlook is exceptionally bright, with a projected expansion that will solidify its position as a dominant force in global entertainment and technology sectors.

North America Gaming Hardware And Accessories Market Segmentation

-

1. Product Type

- 1.1. Gaming PCs

- 1.2. Gaming Consoles

- 1.3. Gaming Headsets

- 1.4. Gaming Keyboards

- 1.5. Gaming Mice

- 1.6. Gaming Controllers/Joysticks/Gamepads

- 1.7. Virtual Reality Devices

- 1.8. Other Gaming Accessories

-

2. Region

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. End User

- 3.1. Casual Gamers

- 3.2. Professional Gamers

- 3.3. Esports Athletes

North America Gaming Hardware And Accessories Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Gaming Hardware And Accessories Market Regional Market Share

Geographic Coverage of North America Gaming Hardware And Accessories Market

North America Gaming Hardware And Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment; New Console and Computer GPU Unit Launch to Present an Increase in the Demand for Accessories

- 3.3. Market Restrains

- 3.3.1. Fluctuation in the Production of Silicon Chips is Leading to a Shortage in the Demand for Gaming Accessories

- 3.4. Market Trends

- 3.4.1. Gaming PCs to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gaming Hardware And Accessories Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Gaming PCs

- 5.1.2. Gaming Consoles

- 5.1.3. Gaming Headsets

- 5.1.4. Gaming Keyboards

- 5.1.5. Gaming Mice

- 5.1.6. Gaming Controllers/Joysticks/Gamepads

- 5.1.7. Virtual Reality Devices

- 5.1.8. Other Gaming Accessories

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Casual Gamers

- 5.3.2. Professional Gamers

- 5.3.3. Esports Athletes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Corsair Gaming Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mad Catz Global Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alienware (Dell Technologies Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turtle Beach Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sennheiser Electronic GmbH & Co KG (Sonova Holding AG)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Steelseries (GN Store Nord A/S)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Redragon (Eastern Times Technology Co Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nintendo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Anker Innovations Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Group Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Razer Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cooler Master Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Logitech International SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Nvidia Corporation7 2 Market Positioning Analysi

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 HyperX (HP Inc )

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Corsair Gaming Inc

List of Figures

- Figure 1: North America Gaming Hardware And Accessories Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Gaming Hardware And Accessories Market Share (%) by Company 2025

List of Tables

- Table 1: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: North America Gaming Hardware And Accessories Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Gaming Hardware And Accessories Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Gaming Hardware And Accessories Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Gaming Hardware And Accessories Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gaming Hardware And Accessories Market?

The projected CAGR is approximately 11.47%.

2. Which companies are prominent players in the North America Gaming Hardware And Accessories Market?

Key companies in the market include Corsair Gaming Inc, Mad Catz Global Limited, Alienware (Dell Technologies Inc ), Turtle Beach Corporation, Sennheiser Electronic GmbH & Co KG (Sonova Holding AG), Steelseries (GN Store Nord A/S), Redragon (Eastern Times Technology Co Ltd), Nintendo Co Ltd, Anker Innovations Technology Co Ltd, Sony Group Corporation, Razer Inc, Cooler Master Co Ltd, Logitech International SA, Nvidia Corporation7 2 Market Positioning Analysi, HyperX (HP Inc ).

3. What are the main segments of the North America Gaming Hardware And Accessories Market?

The market segments include Product Type, Region, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment; New Console and Computer GPU Unit Launch to Present an Increase in the Demand for Accessories.

6. What are the notable trends driving market growth?

Gaming PCs to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Fluctuation in the Production of Silicon Chips is Leading to a Shortage in the Demand for Gaming Accessories.

8. Can you provide examples of recent developments in the market?

April 2024 - Razer, a global lifestyle brand for gamers, released the Razer Kishi Ultra, an addition to the mobile gaming world. The Kishi Ultra, a USB C gaming controller compatible with Android, iPhone 15 series, and iPad Mini, marks a paradigm shift in mobile gaming by providing gamers console-grade control with immersive haptics. Built with attention to detail, the Kishi Ultra is a full-size console-class controller featuring high-quality ergonomics, haptics, and Razer Chroma RGB to provide a true console gaming experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gaming Hardware And Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gaming Hardware And Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gaming Hardware And Accessories Market?

To stay informed about further developments, trends, and reports in the North America Gaming Hardware And Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence