Key Insights

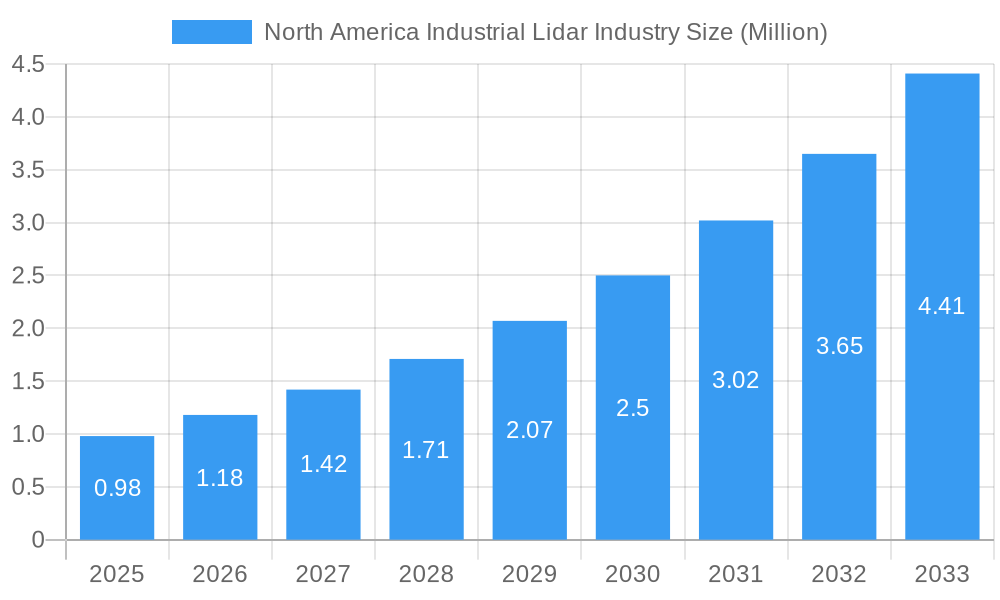

The North American Industrial Lidar market is poised for significant expansion, currently valued at approximately \$0.98 million and projected to grow at an impressive CAGR of 19.50% through 2033. This robust growth is primarily fueled by the escalating adoption of automation across various industrial sectors, including manufacturing, logistics, and construction, where Lidar's precision in 3D mapping, object detection, and navigation is indispensable. The automotive industry's increasing investment in advanced driver-assistance systems (ADAS) and autonomous driving technologies represents a substantial driver, demanding highly accurate spatial awareness solutions. Furthermore, the ongoing digital transformation initiatives and the drive towards Industry 4.0 are propelling the demand for Lidar in applications such as intelligent robotics, automated guided vehicles (AGVs), and high-precision surveying. The market is also experiencing a surge in demand for compact and cost-effective Lidar components, integrated with advanced software for data processing and analysis.

North America Industrial Lidar Industry Market Size (In Million)

The market is segmented across various product types, with Aerial LiDAR and Ground-based LiDAR systems catering to distinct industrial needs, from large-scale aerial mapping to detailed on-site inspections. Key components like GPS, Laser Scanners, and Inertial Measurement Units are crucial enablers of Lidar functionality, with continuous innovation in these areas driving performance improvements. Engineering, Automotive, and Industrial sectors are the dominant end-users, each leveraging Lidar for critical applications that enhance efficiency, safety, and productivity. While the market demonstrates strong growth potential, certain restraints such as the initial high cost of some advanced Lidar systems and the need for skilled personnel for deployment and data interpretation could pose challenges. However, ongoing technological advancements and increasing economies of scale are expected to mitigate these concerns, solidifying North America's position as a leading adopter of industrial Lidar solutions.

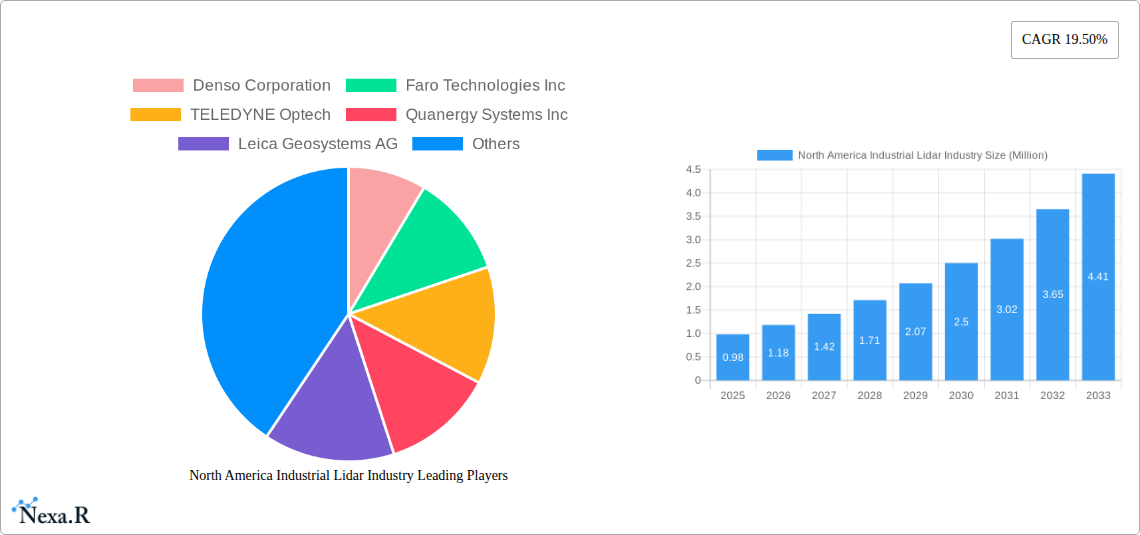

North America Industrial Lidar Industry Company Market Share

North America Industrial Lidar Industry: Comprehensive Market Analysis and Forecast 2019-2033

This in-depth report provides a detailed examination of the North America Industrial Lidar industry, offering critical insights into market dynamics, growth trends, competitive landscape, and future outlook. Leveraging extensive data and analysis, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this sector. We cover both parent and child markets, offering a granular view of the industry's structure and evolution. All values are presented in Million units.

North America Industrial Lidar Industry Market Dynamics & Structure

The North America Industrial Lidar industry is characterized by a moderately concentrated market, with a few key players dominating market share, while a growing number of innovative startups are carving out niches. Technological innovation remains a primary driver, fueled by advancements in laser scanning technology, sensor miniaturization, and data processing capabilities. The increasing demand for automation and precision in various sectors, including automotive, manufacturing, and infrastructure, is pushing the boundaries of Lidar capabilities. Regulatory frameworks are evolving, particularly concerning autonomous vehicle safety standards and data privacy, which will shape market adoption and product development. Competitive product substitutes, such as radar and advanced camera systems, are present, but Lidar’s superior accuracy in 3D mapping and object detection continues to differentiate it. End-user demographics are diversifying, with significant growth anticipated from the industrial automation and engineering sectors alongside the established automotive market. Mergers and acquisitions (M&A) are a notable trend, as larger companies seek to acquire cutting-edge Lidar technologies and expand their market presence.

- Market Concentration: Dominated by a few key players, with increasing fragmentation due to new entrants.

- Technological Innovation Drivers: Advancements in solid-state Lidar, AI integration for data analysis, and miniaturization.

- Regulatory Frameworks: Evolving safety standards for autonomous driving and infrastructure mapping requirements.

- Competitive Product Substitutes: Radar, ultrasonic sensors, and high-resolution cameras.

- End-User Demographics: Diversifying demand from industrial automation, robotics, surveying, and smart city initiatives.

- M&A Trends: Strategic acquisitions aimed at bolstering technological portfolios and market access.

North America Industrial Lidar Industry Growth Trends & Insights

The North America Industrial Lidar industry is poised for substantial growth, driven by an escalating demand for advanced sensing solutions across multiple verticals. The market size is projected to expand significantly, moving from xx Million units in 2019 to an estimated xx Million units by 2025 and further to xx Million units by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of xx%. This expansion is fueled by increasing adoption rates in sectors such as autonomous vehicles, where Lidar is crucial for perception and safety systems, and industrial automation, where it enables precise robotic navigation and quality control. Technological disruptions, including the development of more affordable, higher-resolution, and more durable Lidar sensors, are accelerating this adoption. Consumer behavior shifts towards greater reliance on automated systems and the growing awareness of the benefits of Lidar in infrastructure inspection and mapping are also contributing factors. Market penetration is expected to deepen considerably as Lidar technology becomes more accessible and integrated into a wider array of applications, transforming industries and enhancing operational efficiencies. The continuous pursuit of enhanced safety, productivity, and data accuracy will remain the primary catalysts for sustained market expansion.

Dominant Regions, Countries, or Segments in North America Industrial Lidar Industry

The North America Industrial Lidar industry's dominance is multifaceted, with specific regions, countries, and segments leading the charge. In terms of geography, the United States stands out as the most dominant country, driven by its robust automotive sector, significant investments in autonomous vehicle research and development, and a strong presence of industrial automation companies. Canada also plays a vital role, particularly in specialized areas like resource surveying and robotics.

Within the product segments, Ground-based LiDAR is currently experiencing the most significant growth and market share. This is largely attributable to its widespread application in autonomous driving systems, industrial robotics, construction surveying, and infrastructure monitoring. The increasing deployment of autonomous vehicles on roads and the need for precise mapping of complex industrial environments directly fuel the demand for ground-based LiDAR.

In the components market, Laser Scanners are the core technology and thus represent the largest segment. However, advancements and increasing integration of GPS and Inertial Measurement Units (IMUs) are critical enablers for accurate positioning and navigation, making them vital growth drivers within the components segment.

The end-user market is increasingly driven by the Automotive sector, which is investing heavily in Lidar for advanced driver-assistance systems (ADAS) and fully autonomous driving capabilities. The Industrial sector is also a significant and rapidly growing end-user, utilizing Lidar for automation, quality control, and safety within manufacturing plants and warehouses. The Engineering sector is also a major adopter for surveying, mapping, and design.

- Dominant Country: United States, due to its strong automotive industry and R&D investments.

- Dominant Product Segment: Ground-based LiDAR, driven by autonomous vehicles and industrial automation.

- Dominant Component: Laser Scanners, as the core sensing technology.

- Key End-User Segments: Automotive and Industrial sectors are major growth drivers, with Engineering also being a significant adopter.

- Key Drivers for Dominance:

- Economic Policies: Government initiatives supporting R&D and adoption of advanced technologies.

- Infrastructure Development: Investment in smart city initiatives and infrastructure upgrades requiring precise mapping.

- Technological Advancement: Continuous innovation in sensor accuracy, range, and cost-effectiveness.

- Industry Demand: Growing need for automation, safety, and efficiency across various sectors.

- Market Penetration: Increasing adoption rates as Lidar technology becomes more accessible and integrated.

North America Industrial Lidar Industry Product Landscape

The North America Industrial Lidar industry is witnessing a dynamic product landscape characterized by continuous innovation and diversification. Key product categories include Aerial LiDAR, offering broad-area mapping for topography and environmental monitoring, and Ground-based LiDAR, crucial for high-resolution 3D scanning of immediate surroundings for applications like autonomous navigation and detailed site surveys. Within the components sector, advancements in GPS receivers, sophisticated Laser Scanners with enhanced range and resolution, and miniaturized Inertial Measurement Units (IMUs) are enabling more compact, accurate, and cost-effective Lidar systems. The integration of these components is leading to unique selling propositions such as real-time data acquisition, improved object recognition, and enhanced environmental resilience for the deployed Lidar solutions. Technological advancements are focused on increasing scan rates, expanding detection ranges, reducing power consumption, and improving performance in adverse weather conditions.

Key Drivers, Barriers & Challenges in North America Industrial Lidar Industry

Key Drivers

The North America Industrial Lidar industry is propelled by several significant drivers. The relentless pursuit of enhanced safety and efficiency in autonomous vehicle development stands as a primary catalyst. The increasing adoption of automation in manufacturing and logistics, demanding precise spatial understanding, further fuels growth. Government initiatives promoting smart city development and infrastructure modernization, requiring detailed 3D mapping, also contribute significantly. Furthermore, technological advancements leading to more affordable, compact, and higher-performance Lidar sensors are democratizing access and expanding application possibilities.

Barriers & Challenges

Despite the robust growth, the industry faces several barriers and challenges. High initial costs for advanced Lidar systems, particularly for smaller enterprises, can be a significant restraint. The complexity of data processing and the need for specialized expertise to interpret Lidar data can also pose a challenge. Regulatory uncertainties surrounding autonomous vehicle deployment and data privacy concerns may slow down widespread adoption. Supply chain disruptions for critical components can impact production volumes and timelines. Lastly, intense competition from alternative sensing technologies, such as radar and advanced camera systems, necessitates continuous innovation and cost optimization.

Emerging Opportunities in North America Industrial Lidar Industry

Emerging opportunities within the North America Industrial Lidar industry are diverse and promising. The burgeoning smart city initiatives present a significant avenue, with Lidar enabling detailed urban planning, traffic management, and infrastructure monitoring. The expansion of the robotics sector, from industrial automation to logistics and even consumer applications, will require increasingly sophisticated Lidar for navigation and interaction. Furthermore, the application of Lidar in drone-based surveying and inspection for agriculture, construction, and utilities offers untapped market potential. The development of software and AI solutions for Lidar data analysis represents another lucrative area, transforming raw point cloud data into actionable insights.

Growth Accelerators in the North America Industrial Lidar Industry Industry

Several factors are acting as significant growth accelerators for the North America Industrial Lidar industry. The continuous technological breakthroughs in solid-state Lidar and MEMS-based systems are driving down costs and improving reliability, making Lidar more accessible. Strategic partnerships between Lidar manufacturers, automotive OEMs, and technology integrators are accelerating product development and market penetration. The expanding use of Lidar in diverse industrial applications beyond automotive, such as mining, forestry, and advanced manufacturing, is opening up new revenue streams. Moreover, the increasing demand for high-definition mapping and 3D data for various applications, from digital twins to virtual reality, is creating sustained market momentum.

Key Players Shaping the North America Industrial Lidar Industry Market

- Denso Corporation

- Faro Technologies Inc

- TELEDYNE Optech

- Quanergy Systems Inc

- Leica Geosystems AG

- Velodyne Lidar Inc

- Sick AG

- Trimble Inc

- Phantom Intelligence INC

- Topcon Corporation

- Neptec Technologies Corp

Notable Milestones in North America Industrial Lidar Industry Sector

- April 2023: Aeva and Plus announced the unveiling of a design for the next-generation PlusDrive, a highly automated driving solution integrated with the company's Aeries II 4D LiDAR sensor.

- February 2023: Mercedes-Benz announced the addition of lidar sensors to a range of its vehicles by the middle of the decade. The laser sensors will help power the company's driver-assist system, which allows for autonomous driving on certain highways. The lidar will be supplied by Luminar, a Florida-based company in which Mercedes owns a small investment stake.

In-Depth North America Industrial Lidar Industry Market Outlook

The North America Industrial Lidar industry is poised for a future characterized by rapid innovation and expanding applications. Growth accelerators such as the ongoing advancements in solid-state Lidar technology, leading to more cost-effective and integrated solutions, will be crucial. Strategic collaborations between Lidar providers and key industry players, particularly in the automotive and industrial automation sectors, will further expedite market penetration. The increasing demand for sophisticated 3D data for digital twin creation, urban planning, and enhanced robotics will create sustained market momentum. The future market potential lies in unlocking new use cases within smart cities, advanced manufacturing, and specialized surveying applications, solidifying Lidar's role as an indispensable sensing technology.

North America Industrial Lidar Industry Segmentation

-

1. Product

- 1.1. Aerial LiDAR

- 1.2. Ground-based LiDAR

-

2. Components

- 2.1. GPS

- 2.2. Laser Scanners

- 2.3. Inertial Measurement Unit

- 2.4. Other Components

-

3. End-User

- 3.1. Engineering

- 3.2. Automotive

- 3.3. Industrial

- 3.4. Aerospace & Defense

North America Industrial Lidar Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

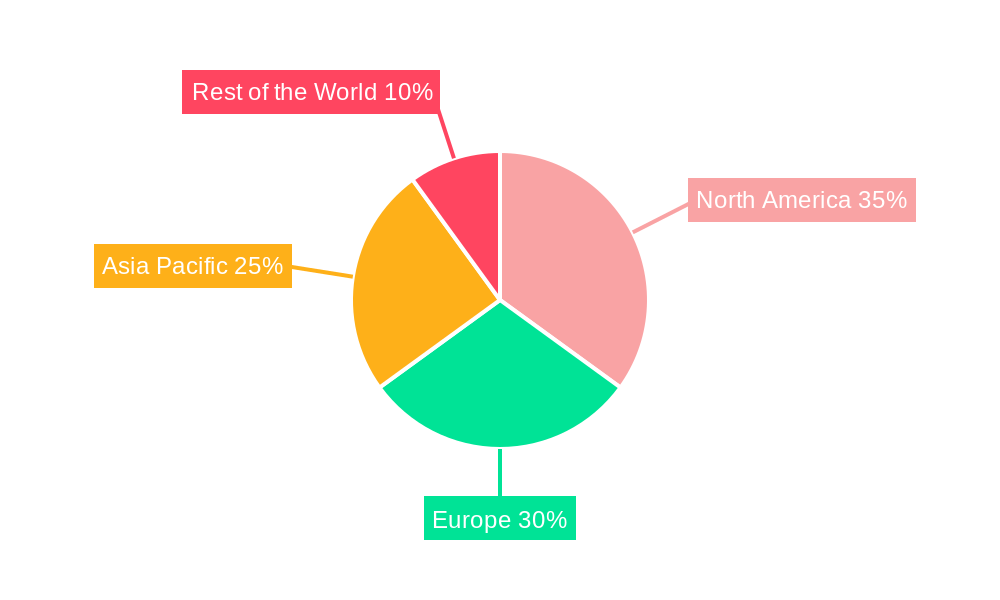

North America Industrial Lidar Industry Regional Market Share

Geographic Coverage of North America Industrial Lidar Industry

North America Industrial Lidar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Paced Developments And Increasing Applications Of Drones; Growing Applications In Government Sector; Increasing Adoption In Automotive Industry

- 3.3. Market Restrains

- 3.3.1. High Cost of The LiDAR Systems

- 3.4. Market Trends

- 3.4.1. The Demand for Advanced Global Positioning System (GPS) will Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Lidar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Aerial LiDAR

- 5.1.2. Ground-based LiDAR

- 5.2. Market Analysis, Insights and Forecast - by Components

- 5.2.1. GPS

- 5.2.2. Laser Scanners

- 5.2.3. Inertial Measurement Unit

- 5.2.4. Other Components

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Engineering

- 5.3.2. Automotive

- 5.3.3. Industrial

- 5.3.4. Aerospace & Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Faro Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TELEDYNE Optech

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Quanergy Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Leica Geosystems AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Velodyne Lidar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sick AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trimble Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Phantom Intelligence INC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Topcon Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Neptec Technologies Corp

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: North America Industrial Lidar Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Industrial Lidar Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Lidar Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Industrial Lidar Industry Revenue Million Forecast, by Components 2020 & 2033

- Table 3: North America Industrial Lidar Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: North America Industrial Lidar Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Industrial Lidar Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: North America Industrial Lidar Industry Revenue Million Forecast, by Components 2020 & 2033

- Table 7: North America Industrial Lidar Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: North America Industrial Lidar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Industrial Lidar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Industrial Lidar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Industrial Lidar Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Lidar Industry?

The projected CAGR is approximately 19.50%.

2. Which companies are prominent players in the North America Industrial Lidar Industry?

Key companies in the market include Denso Corporation, Faro Technologies Inc, TELEDYNE Optech, Quanergy Systems Inc, Leica Geosystems AG, Velodyne Lidar Inc, Sick AG, Trimble Inc, Phantom Intelligence INC, Topcon Corporation, Neptec Technologies Corp.

3. What are the main segments of the North America Industrial Lidar Industry?

The market segments include Product, Components, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Fast Paced Developments And Increasing Applications Of Drones; Growing Applications In Government Sector; Increasing Adoption In Automotive Industry.

6. What are the notable trends driving market growth?

The Demand for Advanced Global Positioning System (GPS) will Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

High Cost of The LiDAR Systems.

8. Can you provide examples of recent developments in the market?

April 2023: Aeva and Plus announced the unveiling of a design for the next-generation PlusDrive, a highly automated driving solution integrated with the company's Aeries II 4D LiDAR sensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Lidar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Lidar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Lidar Industry?

To stay informed about further developments, trends, and reports in the North America Industrial Lidar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence