Key Insights

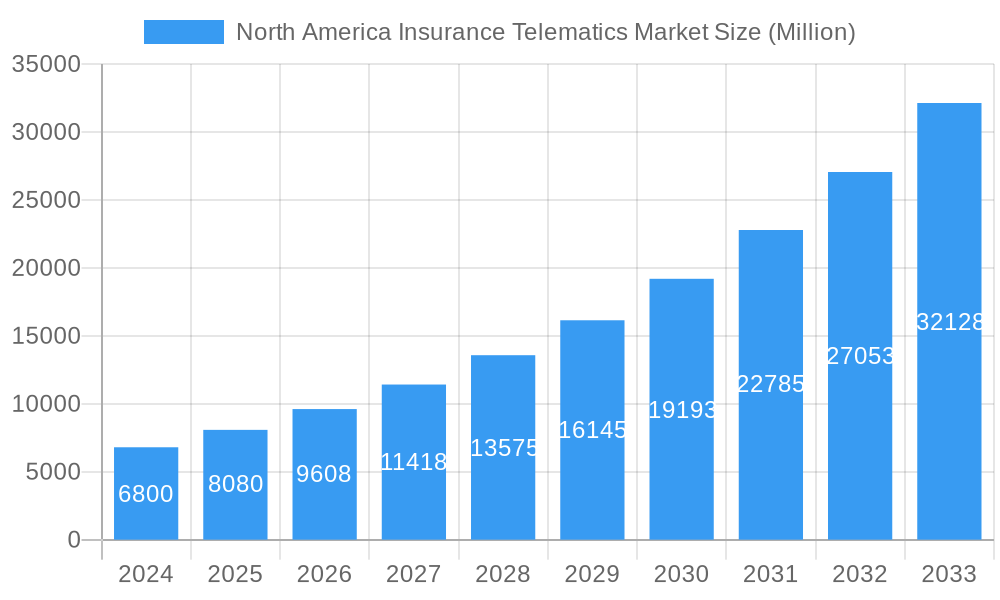

The North American Insurance Telematics market is experiencing robust expansion, projected to reach a significant USD 6.8 billion in 2024. This growth is fueled by a compelling CAGR of 18.9%, indicating a dynamic and rapidly evolving landscape. The primary drivers behind this surge include increasing consumer adoption of connected car technologies, growing insurer interest in usage-based insurance (UBI) programs to mitigate risks and personalize premiums, and advancements in telematics hardware and software capabilities. Furthermore, a heightened awareness of road safety and a desire for potential cost savings on insurance policies are empowering drivers to embrace telematics solutions. The market is also benefiting from supportive regulatory frameworks in certain regions that encourage the adoption of UBI. This confluence of technological innovation, evolving consumer preferences, and strategic insurer initiatives is shaping a highly promising future for the North American Insurance Telematics sector.

North America Insurance Telematics Market Market Size (In Billion)

The market's trajectory is further influenced by distinct trends such as the rise of smartphone-based telematics solutions, offering a more accessible entry point for consumers, and the integration of advanced analytics for deeper insights into driver behavior. The proliferation of IoT devices and the ongoing development of 5G infrastructure are creating new avenues for real-time data transmission and analysis, enhancing the accuracy and utility of telematics. While the market is characterized by strong growth, certain restraints, such as data privacy concerns and the initial cost of implementation for some fleet operators, warrant strategic attention. However, the overwhelming potential for improved risk management, enhanced customer engagement, and the development of innovative insurance products continues to drive significant investment and market penetration across North America, including key markets like the United States, Canada, and Mexico.

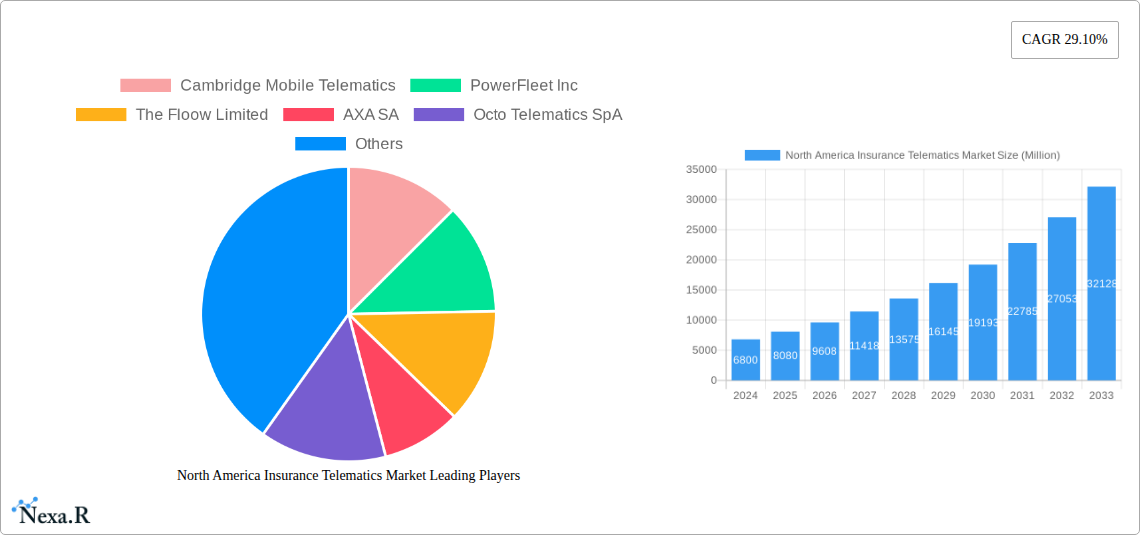

North America Insurance Telematics Market Company Market Share

North America Insurance Telematics Market: Unlocking Data-Driven Driving Insights and Usage-Based Insurance Growth (2019–2033)

This comprehensive report provides an in-depth analysis of the North America Insurance Telematics Market, a rapidly evolving sector driven by the convergence of automotive technology, data analytics, and evolving consumer demands for personalized insurance solutions. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report offers critical insights into market dynamics, growth trends, dominant regions, product landscapes, key drivers, challenges, opportunities, and leading players. The North America Insurance Telematics Market is projected to witness robust growth, fueled by the increasing adoption of connected car technologies, the demand for fairer insurance pricing through Usage-Based Insurance (UBI) programs, and advancements in data analytics and artificial intelligence. The market is segmented into distinct parent and child markets, offering a granular view of its intricate structure. Expected to reach $XX billion by 2033, the market is poised for significant expansion.

North America Insurance Telematics Market Market Dynamics & Structure

The North America Insurance Telematics Market exhibits a dynamic and evolving structure, characterized by a moderate to high degree of market concentration in certain segments, driven by a few dominant players. Technological innovation is the primary engine of growth, with continuous advancements in sensor technology, data processing capabilities, and mobile application development enhancing the precision and scope of telematics solutions. Regulatory frameworks, particularly those pertaining to data privacy and the use of telematics data for underwriting, play a crucial role in shaping market adoption and competitive strategies. The availability of competitive product substitutes, such as traditional underwriting methods and black box devices, presents a constant challenge, though telematics offers superior data granularity. End-user demographics are increasingly shifting towards tech-savvy younger generations who are more receptive to data-driven insurance models. Mergers and acquisitions (M&A) are prevalent, as larger insurance providers and technology companies seek to acquire innovative telematics solutions and expand their market reach. For instance, the acquisition of telematics startups by established insurers highlights a trend towards consolidation and strategic integration.

- Market Concentration: Moderate to high in key technology providers and data analytics firms.

- Technological Innovation Drivers: Advancements in IoT, AI, machine learning for risk assessment, and smartphone capabilities.

- Regulatory Frameworks: Evolving data privacy laws (e.g., CCPA, GDPR equivalents) and insurance regulations impact data utilization.

- Competitive Product Substitutes: Traditional underwriting, driver behavior observation, and early forms of telematics.

- End-User Demographics: Growing acceptance among younger, digitally connected demographics.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market penetration.

North America Insurance Telematics Market Growth Trends & Insights

The North America Insurance Telematics Market is experiencing a transformative growth trajectory, driven by a confluence of factors that are reshaping the automotive insurance landscape. Market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) estimated at XX% over the forecast period. Adoption rates for telematics-based insurance programs are steadily increasing, particularly in the United States and Canada, as consumers become more aware of the potential for cost savings and personalized coverage. Technological disruptions, including the widespread integration of Advanced Driver-Assistance Systems (ADAS) and the increasing prevalence of smartphones, are acting as powerful catalysts for telematics adoption. These technologies provide a rich source of real-time driving data, enabling insurers to develop more accurate risk profiles and offer tailored pricing. Consumer behavior shifts are also playing a pivotal role. Drivers are increasingly valuing transparency and fairness in their insurance premiums, and Usage-Based Insurance (UBI) models, powered by telematics, offer precisely that by aligning premiums with actual driving behavior rather than broad demographic assumptions. The shift towards a data-driven economy further encourages the collection and analysis of driving data for various applications beyond just insurance, creating a fertile ground for telematics innovation. The market penetration of telematics solutions, while still having substantial room for growth, is accelerating, especially in the younger driver demographic and among fleet operators. Furthermore, the development of sophisticated analytics platforms is enabling insurers to extract deeper insights from telematics data, leading to more effective fraud detection, claims management, and driver coaching programs, all contributing to enhanced customer engagement and loyalty. The growing emphasis on road safety and the reduction of traffic accidents is another significant driver, as telematics data can be used to identify risky driving patterns and provide interventions. The overall trend indicates a move towards a more proactive and personalized approach to automotive insurance, with telematics at its core. The market size for North America Insurance Telematics Market is expected to reach $XX billion by 2033.

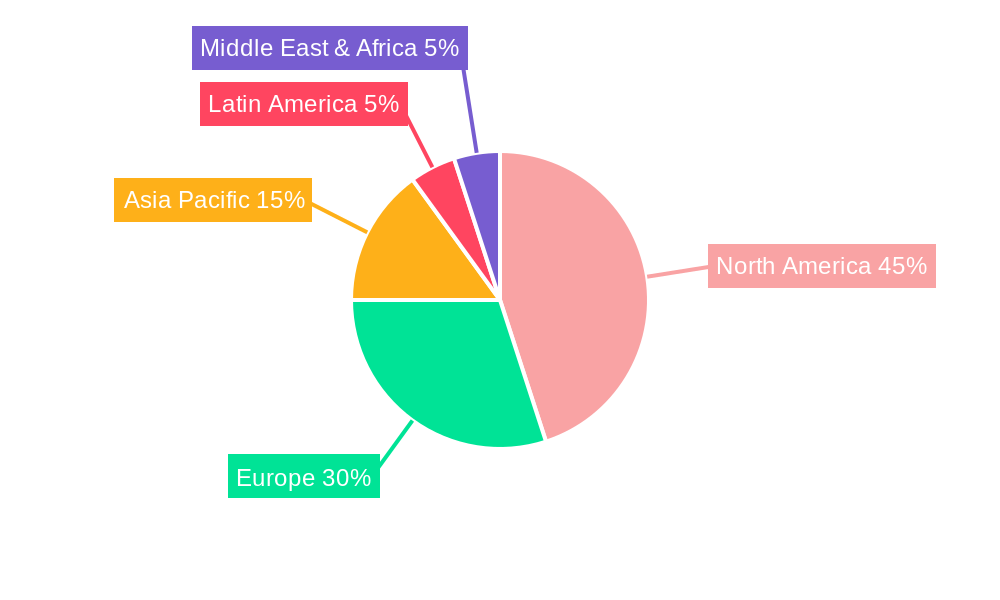

Dominant Regions, Countries, or Segments in North America Insurance Telematics Market

The North America Insurance Telematics Market is characterized by distinct regional and country-level dominance, driven by a combination of economic factors, regulatory environments, and consumer adoption patterns. The United States stands out as the most dominant region in terms of both Production Analysis and Consumption Analysis of insurance telematics solutions. This leadership is attributed to a mature insurance market, a high penetration of connected vehicles, and a robust ecosystem of technology providers and insurance companies actively developing and deploying telematics programs. The U.S. market benefits from a competitive landscape that encourages innovation and diverse product offerings, including Pay-As-You-Drive (PAYD) and Manage-How-You-Drive (MHYD) models.

- Production Analysis: The United States leads in the development and manufacturing of telematics hardware and software solutions, supported by a strong technological infrastructure and R&D investment. Canada also shows growing capabilities in this segment.

- Consumption Analysis: The U.S. exhibits the highest consumption of insurance telematics solutions, driven by a large insured vehicle population and a high propensity for adopting UBI programs. Canada follows, with a rapidly growing interest in usage-based insurance.

- Import Market Analysis (Value & Volume): While North America has strong domestic production, there are imports of specialized hardware components and advanced software modules from global technology hubs. The value of imports is estimated at $XX billion in 2025, with an estimated volume of XX million units.

- Export Market Analysis (Value & Volume): North American companies are significant exporters of telematics technology and services to other regions, particularly Latin America and parts of Europe. Exports are projected to reach $XX billion in value and XX million units in volume by 2025.

- Price Trend Analysis: Prices for telematics devices and associated software services are gradually decreasing due to economies of scale and technological advancements, making them more accessible to a broader consumer base.

Key Drivers of Dominance in the U.S.:

- Economic Policies: Favorable market conditions and investment in technological infrastructure.

- Infrastructure: Widespread cellular network coverage and advanced internet connectivity.

- Consumer Behavior: High acceptance of data-driven services and a desire for personalized insurance.

- Insurance Market Maturity: A large, competitive insurance market incentivizing innovation in underwriting and customer engagement.

Canada's Growing Influence: Canada is emerging as a significant growth market, with insurers actively piloting and launching UBI programs. The country's progressive approach to consumer data and increasing interest in telematics for safety and cost-saving purposes are key growth factors.

North America Insurance Telematics Market Product Landscape

The product landscape of the North America Insurance Telematics Market is characterized by continuous innovation, focusing on enhanced data capture, advanced analytics, and seamless user experience. Leading products include sophisticated telematics devices (e.g., OBD-II dongles, smartphone apps, embedded OEM solutions) that accurately record driving behavior such as speed, acceleration, braking, cornering, and mileage. These devices feed data into cloud-based platforms that leverage AI and machine learning algorithms to assess risk profiles, detect driving patterns associated with accidents, and provide personalized feedback to drivers. Unique selling propositions often revolve around the precision of data collection, the interpretability of driving insights, and the integration capabilities with existing insurance IT systems. Technological advancements are pushing towards real-time data analysis for immediate feedback and interventions, as well as predictive analytics for proactive risk management.

Key Drivers, Barriers & Challenges in North America Insurance Telematics Market

Key Drivers:

- Demand for Usage-Based Insurance (UBI): Consumers seek fairer premiums based on actual driving.

- Technological Advancements: Improved accuracy and affordability of telematics devices and data analytics.

- Focus on Road Safety: Insurers and governments promoting safer driving habits.

- Fleet Management Efficiency: Businesses leveraging telematics for cost savings and operational improvements.

- Data Monetization Opportunities: Insurers exploring new revenue streams from telematics data.

Key Barriers & Challenges:

- Data Privacy Concerns: Consumer apprehension about sharing personal driving data.

- Regulatory Hurdles: Varying data privacy laws and insurance regulations across jurisdictions.

- Implementation Costs: Initial investment for insurers in technology infrastructure and program rollout.

- Consumer Adoption Inertia: Resistance to change and lack of awareness about telematics benefits.

- Data Accuracy and Standardization: Ensuring consistent and reliable data across different devices and platforms.

- Cybersecurity Risks: Protecting sensitive driving data from breaches.

Emerging Opportunities in North America Insurance Telematics Market

Emerging opportunities in the North America Insurance Telematics Market lie in the expansion of UBI programs to a wider consumer base, including commercial fleets and specialized vehicle segments. The development of more sophisticated driver coaching and behavioral modification tools, leveraging gamification and personalized feedback, presents a significant opportunity to improve road safety and reduce claims costs. Integration with smart city initiatives and the Internet of Things (IoT) ecosystem offers potential for new data streams and value-added services, such as proactive vehicle maintenance alerts and enhanced emergency response. Furthermore, exploring partnerships with automotive manufacturers for deeper OEM integration of telematics solutions into new vehicles is a key growth avenue.

Growth Accelerators in the North America Insurance Telematics Market Industry

Several catalysts are accelerating long-term growth in the North America Insurance Telematics Market. Technological breakthroughs in artificial intelligence and machine learning are enabling more accurate and nuanced risk assessments, thereby enhancing the value proposition of UBI. Strategic partnerships between telematics providers, insurance companies, and automotive manufacturers are crucial for expanding market reach and creating integrated ecosystems. The increasing demand for data-driven insights for fraud detection, claims management, and personalized customer engagement further fuels market expansion. As regulatory frameworks evolve to better accommodate the use of telematics data, market adoption is expected to accelerate, creating a virtuous cycle of innovation and growth.

Key Players Shaping the North America Insurance Telematics Market Market

- Cambridge Mobile Telematics

- PowerFleet Inc

- The Floow Limited

- AXA SA

- Octo Telematics SpA

- IMERTIK Global Inc

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- GEICO (Berkshire Hathaway Inc)

- LexisNexis Risk Solutions (RELX Group)

Notable Milestones in North America Insurance Telematics Market Sector

- September 2023 - OCTO announced the launch of the Digital Driver, Try Before You Buy solution, available through an App dedicated to drivers and designed to encourage a more objective risk assessment based on driving style. The exclusive monitoring features of Try Before You Buy allow the insurance company to accurately define customer pricing through a more transparent relationship based on actual driving behavior data that goes far beyond the traditional use of demographic factors.

- September 2023 - The Floow Limited partnered with Definity and Munich Re, a provider of reinsurance solutions, to bring a new, innovative, usage-based auto insurance product to Canada. Definity’s new Sonnet Shift is the first ever UBI product in Canada to offer quarterly price adjustments based on recent driving scores. Powered by The Floow advanced telematics and Munich Re, Sonnet Shift uses individual driving behaviors and preferences as the main factors for pricing, including time of day, fatigue, smooth driving, speed, mobile distraction, and road risk.

In-Depth North America Insurance Telematics Market Market Outlook

The future outlook for the North America Insurance Telematics Market is exceptionally promising, driven by an unwavering commitment to data-driven innovation and personalized insurance. The market is poised to witness sustained growth, fueled by an increasing consumer appetite for UBI programs that offer transparency and cost savings. The ongoing evolution of connected car technology, coupled with advancements in AI and analytics, will unlock new levels of predictive risk management and driver behavior insights. Strategic collaborations and the seamless integration of telematics into the automotive value chain will be pivotal for expanding market reach and enhancing customer engagement. As regulatory landscapes continue to adapt, further opportunities for data utilization and innovative product development will emerge, solidifying telematics as an indispensable component of the modern automotive insurance industry.

North America Insurance Telematics Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Insurance Telematics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Insurance Telematics Market Regional Market Share

Geographic Coverage of North America Insurance Telematics Market

North America Insurance Telematics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Usage-based Insurance by Insurance Companies; Increase in Innovation in the Automotive Industry Across the Region to Witness the Growth

- 3.3. Market Restrains

- 3.3.1. Installation Complexities

- 3.4. Market Trends

- 3.4.1. Increase in Innovation in the Automotive Industry Across the Region to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Insurance Telematics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cambridge Mobile Telematics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PowerFleet Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Floow Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AXA SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Octo Telematics SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IMERTIK Global Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nationwide Mutual Insurance Compan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 State Farm Mutual Automobile Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEICO (Berkshire Hathaway Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LexisNexis Risks Solutions (RELX Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cambridge Mobile Telematics

List of Figures

- Figure 1: North America Insurance Telematics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Insurance Telematics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Insurance Telematics Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Insurance Telematics Market Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 3: North America Insurance Telematics Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 4: North America Insurance Telematics Market Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 5: North America Insurance Telematics Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: North America Insurance Telematics Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: North America Insurance Telematics Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: North America Insurance Telematics Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: North America Insurance Telematics Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: North America Insurance Telematics Market Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: North America Insurance Telematics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: North America Insurance Telematics Market Volume Million Forecast, by Region 2020 & 2033

- Table 13: North America Insurance Telematics Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: North America Insurance Telematics Market Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 15: North America Insurance Telematics Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 16: North America Insurance Telematics Market Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: North America Insurance Telematics Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: North America Insurance Telematics Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: North America Insurance Telematics Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: North America Insurance Telematics Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: North America Insurance Telematics Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: North America Insurance Telematics Market Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: North America Insurance Telematics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: North America Insurance Telematics Market Volume Million Forecast, by Country 2020 & 2033

- Table 25: United States North America Insurance Telematics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United States North America Insurance Telematics Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Canada North America Insurance Telematics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Canada North America Insurance Telematics Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico North America Insurance Telematics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Mexico North America Insurance Telematics Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Insurance Telematics Market?

The projected CAGR is approximately 18.9%.

2. Which companies are prominent players in the North America Insurance Telematics Market?

Key companies in the market include Cambridge Mobile Telematics, PowerFleet Inc, The Floow Limited, AXA SA, Octo Telematics SpA, IMERTIK Global Inc, Nationwide Mutual Insurance Compan, State Farm Mutual Automobile Insurance Company, GEICO (Berkshire Hathaway Inc ), LexisNexis Risks Solutions (RELX Group).

3. What are the main segments of the North America Insurance Telematics Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Usage-based Insurance by Insurance Companies; Increase in Innovation in the Automotive Industry Across the Region to Witness the Growth.

6. What are the notable trends driving market growth?

Increase in Innovation in the Automotive Industry Across the Region to Witness Growth.

7. Are there any restraints impacting market growth?

Installation Complexities.

8. Can you provide examples of recent developments in the market?

September 2023 - OCTO announced the launch of the Digital Driver, Try Before You Buy solution, available through an App dedicated to drivers and designed to encourage a more objective risk assessment based on driving style. The exclusive monitoring features of Try Before You Buy allow the insurance company to accurately define customer pricing through a more transparent relationship based on actual driving behavior data that goes far beyond the traditional use of demographic factors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Insurance Telematics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Insurance Telematics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Insurance Telematics Market?

To stay informed about further developments, trends, and reports in the North America Insurance Telematics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence