Key Insights

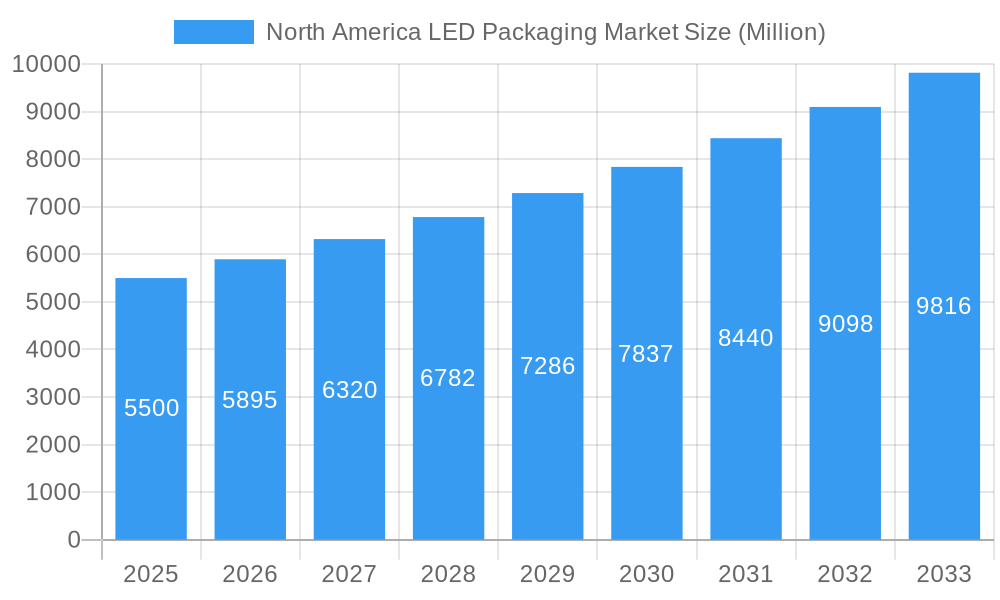

The North America LED Packaging Market is projected for substantial growth, with an estimated market size of USD 2.17 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 16% from 2025 to 2033. Key growth drivers include rising demand for energy-efficient lighting in residential and commercial sectors, supportive government regulations, and continuous technological advancements in LED packaging. The adoption of Chip-on-Board (COB) and Surface-Mount Device (SMD) technologies is increasing due to their superior performance and versatility. Smart city initiatives and the integration of LEDs in automotive lighting, displays, and horticultural applications are also propelling market expansion. The United States and Canada are leading this growth, driven by early technology adoption and a focus on sustainability.

North America LED Packaging Market Market Size (In Billion)

While the outlook is positive, market restraints include the initial high cost of advanced LED packaging solutions and complex manufacturing processes requiring specialized expertise. However, ongoing innovation in materials and manufacturing is expected to improve cost-competitiveness and accessibility. Trends like miniaturization, enhanced thermal management, and the development of high-power LEDs will shape the market. Leading companies are investing in research and development, fostering product innovation and expanding the North American LED packaging ecosystem.

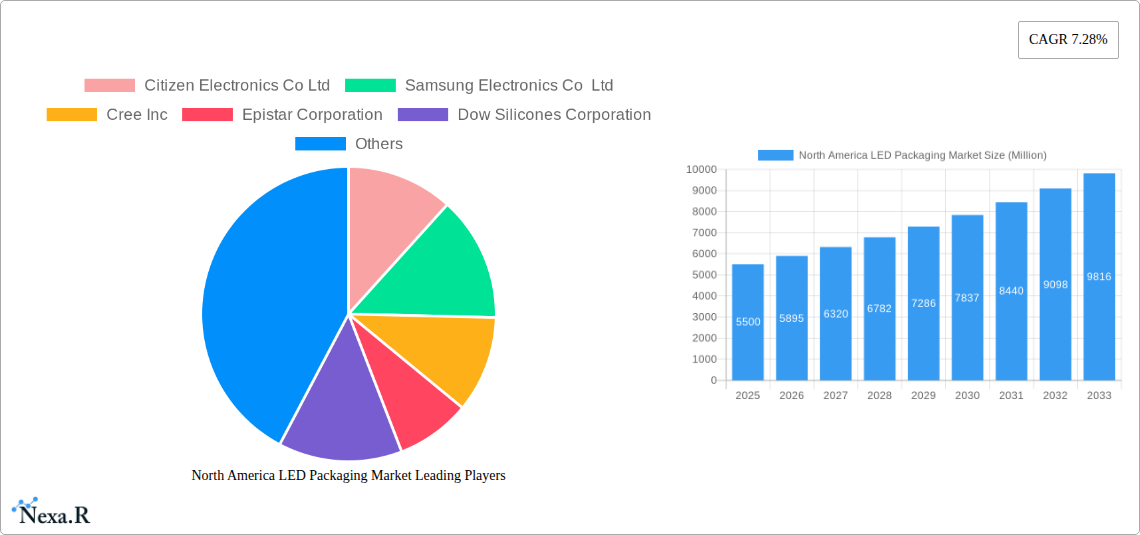

North America LED Packaging Market Company Market Share

This report provides a comprehensive analysis of the North America LED Packaging Market from 2025 to 2033, with 2025 as the base year. It examines market dynamics, growth trends, product types (Chip-on-board (COB), Surface-mount Device (SMD), Chip Scale Package (CSP)), and end-user verticals (Residential, Commercial, Others), with a focus on the United States and Canada. This resource offers valuable quantitative and qualitative insights into the factors influencing the North America LED packaging industry.

North America LED Packaging Market Market Dynamics & Structure

The North America LED Packaging Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demographics. Market concentration is moderately fragmented, with several key players vying for market share, fostering an environment ripe for technological advancements. Drivers of innovation are primarily fueled by the relentless pursuit of higher efficacy, improved color rendering index (CRI), and enhanced thermal management in LED packages. Regulatory frameworks, particularly those related to energy efficiency standards and environmental impact, play a crucial role in shaping product development and market adoption. Competitive product substitutes, such as traditional lighting technologies, are steadily being displaced by the superior performance and energy savings offered by advanced LED solutions. End-user demographics are shifting towards a greater demand for smart lighting solutions and human-centric lighting, influencing the features and functionalities of LED packages. Mergers and acquisitions (M&A) trends, while not exhaustive, indicate strategic consolidation and vertical integration efforts by leading companies to expand their product portfolios and market reach.

- Market Concentration: Moderately fragmented with key players and emerging innovators.

- Technological Innovation Drivers: Higher efficacy (lm/W), improved CRI, enhanced thermal management, miniaturization, and smart lighting integration.

- Regulatory Frameworks: Stringent energy efficiency standards (e.g., Energy Star), environmental regulations, and safety certifications driving adoption of compliant products.

- Competitive Product Substitutes: Incandescent, fluorescent, and halogen lamps are being increasingly replaced by LED technology.

- End-User Demographics: Growing demand from residential and commercial sectors for energy-efficient, customizable, and smart lighting solutions.

- M&A Trends: Strategic acquisitions aimed at expanding technological capabilities and market presence.

North America LED Packaging Market Growth Trends & Insights

The North America LED Packaging Market is poised for significant expansion, driven by a confluence of technological advancements, increasing adoption rates across various verticals, and evolving consumer preferences for sustainable and efficient lighting solutions. The market size is projected to witness a substantial Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth is underpinned by the continuous innovation in LED packaging technologies, leading to higher lumen outputs, improved energy efficiency, and enhanced durability. Adoption rates are accelerating across diverse end-user segments, including smart home technologies, automotive lighting, industrial illumination, and public infrastructure, all of which benefit from the versatility and performance of advanced LED packages. Technological disruptions, such as the development of new materials for improved heat dissipation and novel packaging techniques for enhanced light extraction, are further propelling the market forward. Consumer behavior shifts towards a greater awareness of energy conservation and the desire for optimized lighting environments are also contributing to the escalating demand for sophisticated LED packaging solutions. The market penetration of LED lighting is expected to reach new heights as the cost-benefit analysis becomes increasingly favorable for businesses and households alike, solidifying LED packaging’s indispensable role in modern illumination.

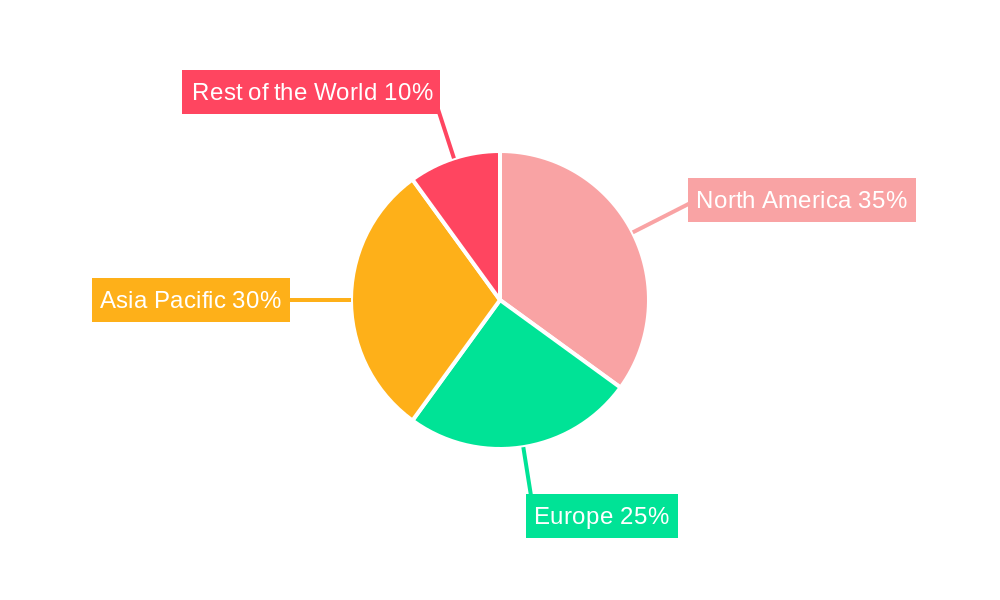

Dominant Regions, Countries, or Segments in North America LED Packaging Market

Within the North America LED Packaging Market, the United States stands as the dominant country, driven by its robust economic infrastructure, significant investments in research and development, and a strong consumer base embracing technological advancements. The commercial end-user vertical exhibits the most significant market share, fueled by widespread adoption in office buildings, retail spaces, healthcare facilities, and industrial settings, all prioritizing energy savings, improved productivity, and enhanced aesthetics. Among the types of LED packaging, Surface-mount Device (SMD) LEDs continue to command a substantial portion of the market due to their versatility, cost-effectiveness, and suitability for a wide range of applications, from general lighting to specialized displays. However, Chip Scale Package (CSP) LEDs are experiencing rapid growth due to their compact size, high efficiency, and superior performance characteristics, making them increasingly popular for high-density lighting applications and portable electronic devices. The residential sector is also a key growth driver, with the increasing demand for smart home integration and energy-efficient lighting solutions. The Canadian market, while smaller, also contributes to regional growth, with a growing emphasis on sustainable building practices and energy-efficient technologies.

- Dominant Country: United States, due to strong economic growth, R&D investments, and high consumer adoption.

- Dominant End-User Vertical: Commercial sector, driven by energy efficiency mandates, operational cost savings, and demand for advanced lighting solutions in workplaces and public spaces.

- Leading LED Packaging Type: Surface-mount Device (SMD) LEDs maintain dominance due to their widespread applicability and cost-effectiveness.

- Fastest Growing LED Packaging Type: Chip Scale Package (CSP) LEDs, owing to their miniaturization, high performance, and suitability for next-generation devices.

- Key Growth Drivers: Government incentives for energy efficiency, technological advancements, increasing demand for smart lighting, and retrofitting of existing infrastructure.

North America LED Packaging Market Product Landscape

The North America LED Packaging Market is characterized by a dynamic product landscape featuring continuous innovation in terms of performance, efficiency, and functionality. Manufacturers are actively developing advanced LED packages with higher lumen outputs per watt, superior color rendering capabilities for true-to-life illumination, and enhanced thermal management systems to ensure longevity and reliability. Emerging trends include the development of specialized LED packages for niche applications such as horticultural lighting, automotive headlamps, and advanced display technologies. Miniaturization and integration are key themes, with Chip Scale Packages (CSPs) gaining traction for their compact form factor and high light density. The integration of smart capabilities, such as dimming and color tuning, directly within the LED package is also a significant area of development, catering to the growing demand for intelligent lighting systems.

Key Drivers, Barriers & Challenges in North America LED Packaging Market

Key Drivers: The North America LED Packaging Market is primarily propelled by the unwavering demand for energy-efficient lighting solutions, driven by escalating energy costs and stringent government regulations mandating reduced energy consumption. Technological advancements, leading to higher efficacy, better color quality, and increased lifespan of LED packages, are crucial growth enablers. The expanding applications of LEDs across diverse sectors, including automotive, healthcare, and horticulture, further bolster market growth. Furthermore, the increasing adoption of smart lighting systems, offering enhanced control and customization, is a significant catalyst.

Barriers & Challenges: Despite the robust growth, the market faces certain challenges. The initial higher upfront cost of LED lighting systems compared to traditional alternatives can be a barrier for some consumers and businesses. Supply chain disruptions, particularly concerning raw material availability and manufacturing capacity, can impact production timelines and costs. Intense market competition can lead to price pressures, affecting profit margins for manufacturers. Evolving technological standards and the need for continuous R&D investment to stay competitive also present significant challenges.

Emerging Opportunities in North America LED Packaging Market

Emerging opportunities in the North America LED Packaging Market lie in the expanding applications for specialized LED packages, such as those designed for UV-C disinfection, horticultural lighting to optimize plant growth, and advanced automotive lighting systems. The growing trend towards the Internet of Things (IoT) is creating a significant demand for smart LED packages that can seamlessly integrate with connected devices, offering advanced control and data-gathering capabilities. Furthermore, the increasing focus on human-centric lighting, which aims to mimic natural light patterns to improve well-being and productivity, presents a substantial opportunity for innovative LED packaging solutions that offer tunable color temperatures and dynamic lighting profiles. The development of more sustainable and eco-friendly packaging materials also represents an untapped market segment.

Growth Accelerators in the North America LED Packaging Market Industry

Growth accelerators for the North America LED Packaging Market are firmly rooted in continuous technological breakthroughs, such as the development of quantum dot enhanced LEDs for superior color quality and increased efficiency, and advancements in micro-LED technology promising unprecedented display resolutions and brightness. Strategic partnerships between LED manufacturers and luminaire designers, as well as collaborations with smart home technology providers, are crucial for developing integrated and user-friendly lighting solutions. Market expansion strategies, including penetration into underserved segments and the development of customized LED packages for specific industrial applications, will also drive sustained growth. The increasing global push towards sustainability and circular economy principles will further accelerate the adoption of energy-efficient LED technologies.

Key Players Shaping the North America LED Packaging Market Market

- Citizen Electronics Co Ltd

- Samsung Electronics Co Ltd

- Cree Inc

- Epistar Corporation

- Dow Silicones Corporation

- LG Corporation (LG Innotek)

- OSRAM Licht AG

- Everlight Electronics Co Ltd

- Lumileds Holding B V

- Nichia Corporation

Notable Milestones in North America LED Packaging Market Sector

- May 2021: Samsung Electronics introduced the LM301B EVO, a new mid-power LED package boasting increased light efficacy of 235 lumens per watt (lm/W) due to a novel reflective substance, aiming to bolster its presence in the lighting LED market.

- December 2020: Everlight Electronics significantly expanded its monthly packaging capacity for IR and UV-C LED devices by 200 million chips, reaching a total of over one billion chips in 2020.

- November 2020: BIOS, a Human Centric Lighting developer, and Lumileds partnered to launch the SkyBlue LED, a new mid-power 3030 LED that doubles the performance of previous chips, lowering cost barriers for luminaire manufacturers and advancing healthier lighting solutions.

In-Depth North America LED Packaging Market Market Outlook

The future outlook for the North America LED Packaging Market is exceptionally promising, driven by sustained innovation and expanding application horizons. The continuous pursuit of higher energy efficiency, superior color quality, and enhanced product longevity will remain central to market development. Emerging opportunities in smart lighting integration, human-centric lighting solutions, and specialized applications like UV-C disinfection and horticulture will unlock new avenues for growth. Strategic collaborations between technology providers, luminaire manufacturers, and smart home ecosystem players will be critical in shaping the market's trajectory. Furthermore, the increasing global emphasis on sustainability and the circular economy will favor the adoption of advanced LED technologies, solidifying their position as the dominant lighting solution for years to come.

North America LED Packaging Market Segmentation

-

1. Type

- 1.1. Chip-on-board (COB)

- 1.2. Surface-mount Device (SMD)

- 1.3. Chip Scale Package (CSP)

-

2. End-User Vertical

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other End-User Verticals

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

-

3.1. North America

North America LED Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America LED Packaging Market Regional Market Share

Geographic Coverage of North America LED Packaging Market

North America LED Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For High-Speed Network; Increasing Demand for Energy-efficient

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness and Higher Capital Investment Required

- 3.4. Market Trends

- 3.4.1. Growing Commercial Segment Demand is Expected to Boost the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America LED Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chip-on-board (COB)

- 5.1.2. Surface-mount Device (SMD)

- 5.1.3. Chip Scale Package (CSP)

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other End-User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Citizen Electronics Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cree Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Epistar Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dow Silicones Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Corporation (LG Innotek)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OSRAM Licht AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Everlight Electronics Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lumileds Holding B V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nichia Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Citizen Electronics Co Ltd

List of Figures

- Figure 1: North America LED Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America LED Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America LED Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America LED Packaging Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 3: North America LED Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America LED Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America LED Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America LED Packaging Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 7: North America LED Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America LED Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America LED Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America LED Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America LED Packaging Market?

The projected CAGR is approximately 16%.

2. Which companies are prominent players in the North America LED Packaging Market?

Key companies in the market include Citizen Electronics Co Ltd, Samsung Electronics Co Ltd, Cree Inc, Epistar Corporation, Dow Silicones Corporation, LG Corporation (LG Innotek), OSRAM Licht AG, Everlight Electronics Co Ltd, Lumileds Holding B V, Nichia Corporation*List Not Exhaustive.

3. What are the main segments of the North America LED Packaging Market?

The market segments include Type, End-User Vertical, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For High-Speed Network; Increasing Demand for Energy-efficient.

6. What are the notable trends driving market growth?

Growing Commercial Segment Demand is Expected to Boost the Studied Market.

7. Are there any restraints impacting market growth?

Lack of Awareness and Higher Capital Investment Required.

8. Can you provide examples of recent developments in the market?

May 2021 - Samsung Electronics introduced a new mid-power LED package with increased light efficacy and color quality, as the South Korean company seeks to expand its influence in the lighting LED market. According to Samsung, the LM301B EVO has a 235 lumens per watt (lm/W) efficacy due to a novel reflective substance inside the packaging mold.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America LED Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America LED Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America LED Packaging Market?

To stay informed about further developments, trends, and reports in the North America LED Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence