Key Insights

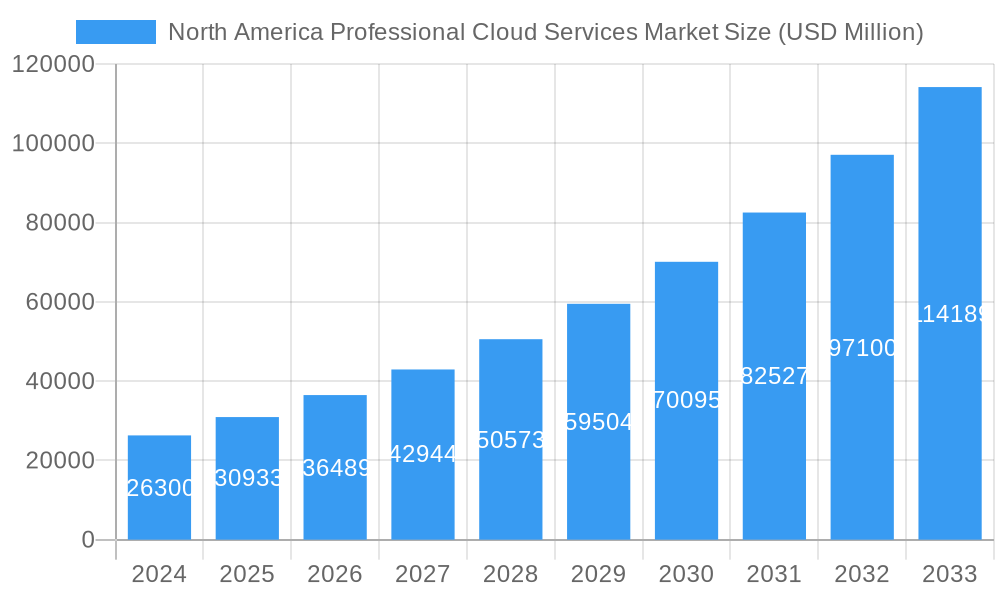

The North American Professional Cloud Services Market is experiencing robust expansion, projected to reach an estimated $26.3 billion in 2024 and sustain a compelling CAGR of 17.5% through 2033. This impressive growth is propelled by the escalating adoption of cloud technologies across diverse industries, driven by the inherent benefits of scalability, cost-efficiency, and enhanced agility. Key market drivers include the increasing demand for digital transformation initiatives, the burgeoning need for data analytics and AI capabilities, and the continuous evolution of IT infrastructure towards cloud-native solutions. Furthermore, the ongoing shift towards remote work models has further accelerated the reliance on cloud-based services for seamless collaboration and productivity.

North America Professional Cloud Services Market Market Size (In Billion)

The market is segmented across various deployment types, including Public, Private, and Hybrid clouds, with a significant preference for flexible and scalable solutions. Service models such as Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS), and Infrastructure-as-a-Service (IaaS) are witnessing substantial uptake. Key end-user industries like Healthcare, Retail, Entertainment and Media, Government, BFSI, and Information and Communication Technology are heavily investing in professional cloud services to optimize operations, enhance customer experiences, and gain a competitive edge. Major industry players, including Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, and Oracle, are at the forefront, offering a comprehensive suite of services that cater to the evolving needs of businesses in North America. The market's trajectory is further supported by strategic partnerships and continuous innovation in cloud security and management solutions.

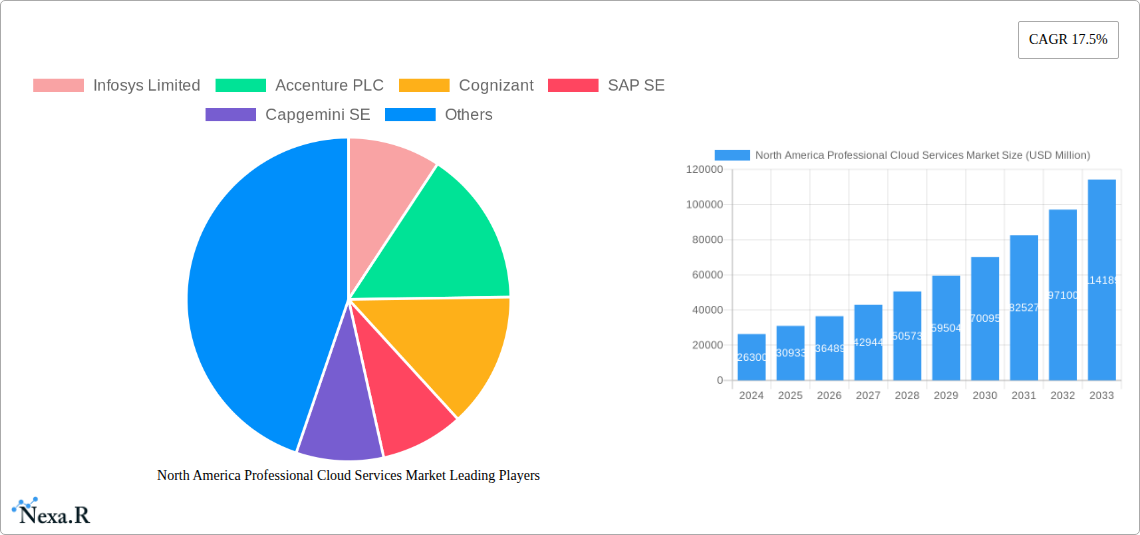

North America Professional Cloud Services Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the North America Professional Cloud Services Market:

This in-depth report provides an unparalleled analysis of the North America Professional Cloud Services Market, offering critical insights into its dynamics, growth trajectories, and future potential. Covering the extensive study period from 2019 to 2033, with a detailed focus on the base and estimated year of 2025 and a robust forecast period from 2025 to 2033, this research is essential for stakeholders seeking to understand and capitalize on this rapidly evolving sector. We delve into market size, adoption rates, technological innovations, and evolving consumer behavior, presenting all values in billion units for clarity and impact.

North America Professional Cloud Services Market Market Dynamics & Structure

The North America Professional Cloud Services Market is characterized by a dynamic interplay of competitive forces, technological advancements, and evolving regulatory landscapes. Market concentration remains significant, with major players continuously innovating to capture market share. Technological innovation is a primary driver, fueled by the demand for scalable, secure, and cost-effective cloud solutions across diverse industries. Regulatory frameworks, while varied across the region, are increasingly focused on data privacy, security, and compliance, influencing service provider strategies. Competitive product substitutes, though present in niche areas, are largely outpaced by the comprehensive offerings of established cloud service providers. End-user demographics are shifting, with a growing emphasis on digital transformation and a proactive adoption of cloud technologies by businesses of all sizes. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger entities acquiring smaller innovators to expand their service portfolios and geographical reach. For instance, the market has witnessed an average of 30-40 M&A deals annually in recent years, with deal values ranging from $50 million to over $2 billion, reflecting strategic moves to enhance capabilities and market presence. The drive for enhanced data analytics, artificial intelligence (AI), and machine learning (ML) integration within cloud platforms is a key area of competitive differentiation.

- Market Concentration: Dominated by a few large players, but with increasing niche specialization.

- Technological Innovation Drivers: AI/ML integration, edge computing, serverless architectures, and advanced cybersecurity solutions.

- Regulatory Frameworks: Emphasis on data sovereignty, privacy (e.g., GDPR, CCPA influences), and industry-specific compliance standards.

- Competitive Product Substitutes: Primarily traditional on-premise solutions and niche managed IT services, often facing challenges in scalability and agility.

- End-User Demographics: Growing adoption by SMBs alongside large enterprises, with a strong demand from digitally native companies.

- M&A Trends: Strategic acquisitions to expand service offerings, acquire talent, and gain market share, averaging 30-40 deals per year.

North America Professional Cloud Services Market Growth Trends & Insights

The North America Professional Cloud Services Market is poised for substantial growth, driven by the pervasive digital transformation initiatives across all sectors. The market size is projected to expand from approximately $180.5 billion in 2024 to an estimated $550.7 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period (2025–2033). This robust growth is underpinned by an increasing adoption rate of cloud services by enterprises seeking agility, scalability, and cost efficiencies. Technological disruptions, such as the widespread adoption of AI and ML, the expansion of 5G networks, and the rise of the Internet of Things (IoT), are creating new avenues for cloud service utilization. Consumer behavior shifts, characterized by a greater demand for seamless digital experiences and data-driven decision-making, further propel the market forward.

- Market Size Evolution: Anticipated to grow from $180.5 billion in 2024 to $550.7 billion by 2033.

- Adoption Rates: Accelerating adoption across SMBs and large enterprises, with over 85% of businesses utilizing at least one cloud service.

- Technological Disruptions: AI/ML, IoT, 5G, and edge computing are creating new demand for cloud infrastructure and services.

- Consumer Behavior Shifts: Increased reliance on digital platforms, demand for personalized services, and greater data utilization for business insights.

- Market Penetration: High penetration in the IT and BFSI sectors, with significant growth potential in healthcare, manufacturing, and retail.

- Key Growth Metrics: A projected CAGR of 12.5% from 2025 to 2033.

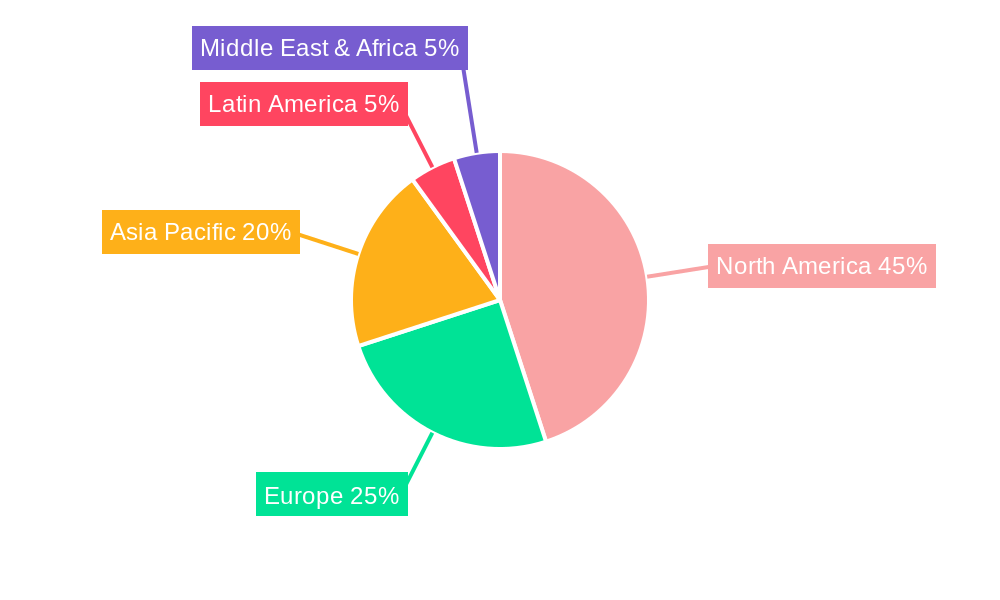

Dominant Regions, Countries, or Segments in North America Professional Cloud Services Market

Within the North America Professional Cloud Services Market, the United States stands as the dominant country, driven by its advanced technological infrastructure, high concentration of Fortune 500 companies, and a vibrant startup ecosystem. The Information and Communication Technology (ICT) end-user industry exhibits the highest market share, consistently leveraging cloud services for data storage, processing, application hosting, and innovation. This segment's dominance is a direct reflection of its core business operations being intrinsically linked to digital technologies.

Dominant Country: United States.

- Key Drivers: Robust technological innovation, significant investment in R&D, presence of major cloud providers and tech giants, and strong demand for advanced digital solutions.

- Market Share: Accounts for over 70% of the total North American cloud services market.

- Growth Potential: Continued leadership due to ongoing digital transformation and adoption of emerging technologies.

Dominant End-User Industry: Information and Communication Technology (ICT).

- Key Drivers: Need for scalable infrastructure for software development, data analytics, network management, and global service delivery.

- Market Share: Represents approximately 25% of the total market revenue.

- Growth Potential: Steadily growing as ICT companies continue to expand their digital offerings and rely heavily on cloud for operational efficiency.

Dominant Type of Service Model: Infrastructure-as-a-Service (IaaS).

- Key Drivers: Fundamental need for scalable computing resources, storage, and networking for businesses of all sizes. Its flexibility and cost-effectiveness make it a foundational element of cloud adoption.

- Market Share: Estimated at around 35-40% of the service model segment.

- Growth Potential: Strong continued growth as more organizations migrate their core IT infrastructure to the cloud.

Dominant Type of Deployment: Public Cloud.

- Key Drivers: Cost-effectiveness, scalability, ease of deployment, and accessibility for a wide range of applications and workloads. The inherent benefits of shared resources and pay-as-you-go models make it highly attractive.

- Market Share: Holds a majority share, estimated at over 50% of the deployment model segment.

- Growth Potential: Continues to be the leading deployment model due to its widespread applicability and continuous innovation by providers.

North America Professional Cloud Services Market Product Landscape

The North America Professional Cloud Services Market is witnessing a surge in product innovations focused on enhanced automation, AI-driven analytics, and specialized industry solutions. Companies are introducing advanced Platform-as-a-Service (PaaS) offerings that simplify application development and deployment, while Software-as-a-Service (SaaS) solutions are becoming more sophisticated, addressing complex business processes in areas like customer relationship management (CRM) and enterprise resource planning (ERP). Infrastructure-as-a-Service (IaaS) providers are continuously enhancing their offerings with greater compute power, advanced networking capabilities, and robust security features, ensuring high performance and reliability for critical workloads. Unique selling propositions often revolve around seamless integration, superior security postures, and comprehensive managed services.

Key Drivers, Barriers & Challenges in North America Professional Cloud Services Market

Key Drivers: The North America Professional Cloud Services Market is propelled by the escalating demand for digital transformation, the need for cost optimization and operational efficiency, and the increasing adoption of advanced technologies like AI, ML, and IoT. Favorable government initiatives promoting digital infrastructure development and the growing emphasis on data analytics for informed decision-making also act as significant growth accelerators. The inherent scalability and flexibility of cloud services allow businesses to adapt quickly to market changes and fluctuating demands.

Barriers & Challenges: Despite its robust growth, the market faces challenges such as data security and privacy concerns, leading to stringent compliance requirements. The complexity of migrating legacy systems to the cloud and the shortage of skilled cloud professionals represent significant hurdles. Interoperability issues between different cloud platforms and vendor lock-in are also concerns for enterprises. Additionally, the high initial investment for certain cloud solutions and the potential for unexpected cost escalations in pay-as-you-go models can act as restraints. Supply chain disruptions, though less impactful on digital services, can indirectly affect hardware and infrastructure deployment timelines.

Emerging Opportunities in North America Professional Cloud Services Market

Emerging opportunities in the North America Professional Cloud Services Market are abundant, driven by the burgeoning demand for specialized cloud solutions. The expansion of edge computing, enabling data processing closer to the source, presents a significant growth area, particularly for IoT applications. The increasing adoption of hybrid and multi-cloud strategies by enterprises opens up avenues for enhanced management and orchestration services. Furthermore, the growing focus on sustainable cloud practices and green IT solutions offers a niche but rapidly expanding market. The development of industry-specific cloud solutions tailored for sectors like biotechnology, advanced manufacturing, and autonomous vehicles is also poised for substantial growth, catering to unique operational and regulatory needs.

Growth Accelerators in the North America Professional Cloud Services Market Industry

Catalysts driving long-term growth in the North America Professional Cloud Services Market include continuous technological breakthroughs, such as advancements in serverless computing, quantum computing exploration, and more sophisticated AI models. Strategic partnerships between cloud providers, software vendors, and system integrators are expanding service portfolios and market reach. Market expansion strategies, including geographical diversification within North America and the development of specialized cloud offerings for emerging industries, are also critical growth accelerators. The increasing maturity of cloud security and compliance solutions is building greater enterprise confidence, further fueling adoption.

Key Players Shaping the North America Professional Cloud Services Market Market

- Infosys Limited

- Accenture PLC

- Cognizant

- SAP SE

- Capgemini SE

- Hewlett Packard Enterprise Company

- Dell EMC

- Cisco Systems Inc

- Microsoft Corporation

- Fujitsu Limited

- Atos SE

- NTT Data

- Oracle Corporation

- Nippon Data Systems Ltd

- HCL Technologies Limited

Notable Milestones in North America Professional Cloud Services Market Sector

- June 2022: Splunk rolled out enhancements to its Splunk Cloud Platform and announced the general availability of its Splunk Enterprise 9.0 software targeted at helping enterprise customers manage their data in the cloud and hybrid-cloud environments.

- April 2022: Fujitsu announced the launch of its new service portfolio, Fujitsu Computing as a Service (CaaS), to accelerate digital transformation (DX) by offering access to some of the advanced computing technologies via the cloud for commercial use.

In-Depth North America Professional Cloud Services Market Market Outlook

The future outlook for the North America Professional Cloud Services Market is exceptionally bright, fueled by sustained demand for digital transformation and the relentless pace of technological innovation. Growth accelerators such as the widespread adoption of AI, the evolution of edge computing, and the increasing embrace of hybrid and multi-cloud architectures will continue to shape the market landscape. Strategic partnerships and the development of highly specialized, industry-specific cloud solutions will unlock new revenue streams and cater to niche market demands. The ongoing focus on enhanced security, compliance, and sustainability within cloud offerings will build greater enterprise confidence, solidifying cloud services as an indispensable component of modern business operations and driving significant future market potential.

North America Professional Cloud Services Market Segmentation

-

1. Type of Deployment

- 1.1. Public

- 1.2. Private

- 1.3. Hybrid

-

2. Type of Service Model

- 2.1. Platform-as-a-Service

- 2.2. Software-as-a-Service

- 2.3. Infrastructure-as-a-Service

-

3. End-user Industry

- 3.1. Healthcare

- 3.2. Retail

- 3.3. Entertainment and Media

- 3.4. Government and Public Sector

- 3.5. BFSI

- 3.6. Information and Communication Technology

- 3.7. Others End-user Industries

North America Professional Cloud Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Professional Cloud Services Market Regional Market Share

Geographic Coverage of North America Professional Cloud Services Market

North America Professional Cloud Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Delivering Strengthen Buyer Experiences; Focus on Business Productivity

- 3.3. Market Restrains

- 3.3.1. Increasing Incidents of Cyber-attacks

- 3.4. Market Trends

- 3.4.1. Hybrid Cloud is Expected to Have High Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Professional Cloud Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 5.1.1. Public

- 5.1.2. Private

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Type of Service Model

- 5.2.1. Platform-as-a-Service

- 5.2.2. Software-as-a-Service

- 5.2.3. Infrastructure-as-a-Service

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Healthcare

- 5.3.2. Retail

- 5.3.3. Entertainment and Media

- 5.3.4. Government and Public Sector

- 5.3.5. BFSI

- 5.3.6. Information and Communication Technology

- 5.3.7. Others End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infosys Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Accenture PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cognizant

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAP SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Capgemini SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell EMC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Microsoft Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujitsu Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Atos SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 NTT Data

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Oracle Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Nippon Data Systems Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 HCL Technologies Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Infosys Limited

List of Figures

- Figure 1: North America Professional Cloud Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Professional Cloud Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Professional Cloud Services Market Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 2: North America Professional Cloud Services Market Revenue undefined Forecast, by Type of Service Model 2020 & 2033

- Table 3: North America Professional Cloud Services Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Professional Cloud Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Professional Cloud Services Market Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 6: North America Professional Cloud Services Market Revenue undefined Forecast, by Type of Service Model 2020 & 2033

- Table 7: North America Professional Cloud Services Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Professional Cloud Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States North America Professional Cloud Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Professional Cloud Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Professional Cloud Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Professional Cloud Services Market?

The projected CAGR is approximately 17.5%.

2. Which companies are prominent players in the North America Professional Cloud Services Market?

Key companies in the market include Infosys Limited, Accenture PLC, Cognizant, SAP SE, Capgemini SE, Hewlett Packard Enterprise Company, Dell EMC, Cisco Systems Inc, Microsoft Corporation, Fujitsu Limited, Atos SE, NTT Data, Oracle Corporation, Nippon Data Systems Ltd, HCL Technologies Limited.

3. What are the main segments of the North America Professional Cloud Services Market?

The market segments include Type of Deployment, Type of Service Model, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Need for Delivering Strengthen Buyer Experiences; Focus on Business Productivity.

6. What are the notable trends driving market growth?

Hybrid Cloud is Expected to Have High Growth in the Market.

7. Are there any restraints impacting market growth?

Increasing Incidents of Cyber-attacks.

8. Can you provide examples of recent developments in the market?

June 2022: Splunk rolled out enhancements to its Splunk Cloud Platform and announced the general availability of its Splunk Enterprise 9.0 software targeted at helping enterprise customers manage their data in the cloud and hybrid-cloud environments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Professional Cloud Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Professional Cloud Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Professional Cloud Services Market?

To stay informed about further developments, trends, and reports in the North America Professional Cloud Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence