Key Insights

The global Optical Coordinate Measuring Machine (OCMM) market is projected to reach $6.57 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.87% through 2033. This expansion is driven by the increasing demand for high-precision measurement solutions across advanced industries like Aerospace & Defense and Automotive, where stringent quality control and complex component manufacturing necessitate OCMM technology. The non-contact measurement, speed, and accuracy of OCMMs are vital for validating intricate designs and ensuring product reliability. The Industry 4.0 initiative, focused on automation and data-driven manufacturing, further propels the adoption of advanced metrology for enhanced process efficiency and digital traceability. Innovations in multi-sensor OCMMs are also broadening their application scope.

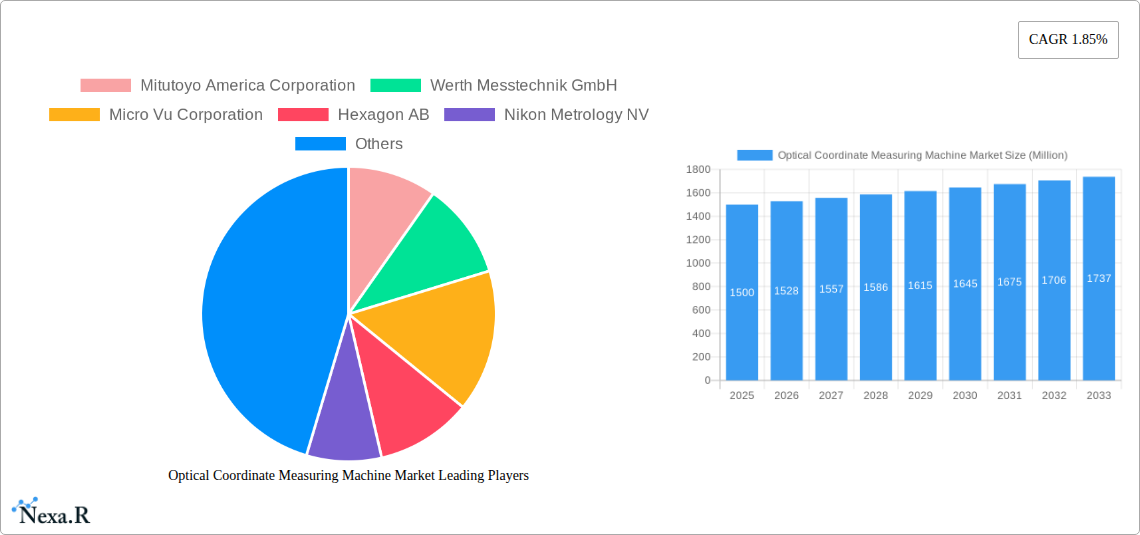

Optical Coordinate Measuring Machine Market Market Size (In Billion)

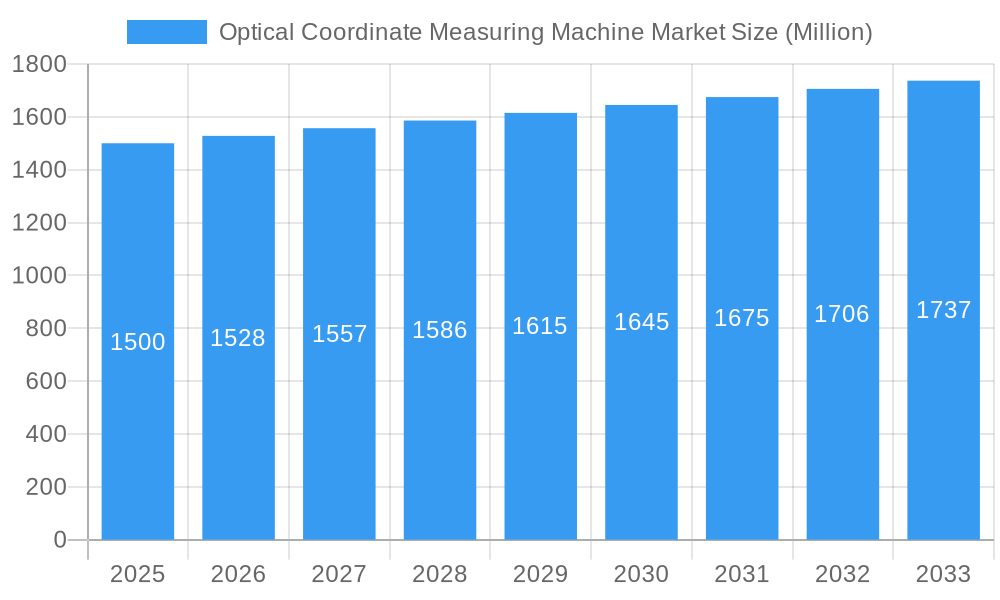

The competitive landscape includes established players such as Hexagon AB, Mitutoyo America Corporation, and Carl Zeiss AG, who continually innovate their product portfolios. Potential restraints include the high initial investment for sophisticated OCMM systems, particularly for small and medium-sized enterprises (SMEs), and the need for skilled operators. However, the trend towards miniaturization in electronics and the increasing complexity of manufactured parts in sectors like Heavy Machinery and Metal Fabrication are expected to sustain market growth. The forecast period will likely see advancements in machine vision algorithms, AI integration for automated defect detection, and the development of portable OCMM solutions for on-site inspection.

Optical Coordinate Measuring Machine Market Company Market Share

This comprehensive report provides an in-depth analysis of the Optical Coordinate Measuring Machine (OCMM) market, offering critical insights for industry professionals. Covering the historical period (2019-2024), base year (2025), and forecast period through 2033, the report details market dynamics, growth drivers, regional trends, product segmentation, challenges, and the competitive environment. Quantitative data is presented in millions of dollars, offering actionable intelligence for strategic decision-making.

Optical Coordinate Measuring Machine Market Market Dynamics & Structure

The Optical Coordinate Measuring Machine market is characterized by a moderate level of concentration, with key players investing heavily in technological innovation to maintain a competitive edge. Driven by increasing demands for precision measurement across various industries, advancements in optics, sensor technology, and automation are paramount. Regulatory frameworks, particularly those related to quality control and international standards, play a significant role in shaping market entry and product development. The availability of competitive product substitutes, such as traditional CMMs and advanced metrology software, necessitates continuous innovation and differentiation in OCMM offerings. End-user demographics are evolving, with a growing emphasis on automated inspection solutions in high-tech manufacturing sectors. Mergers and acquisitions (M&A) are a notable trend, consolidating market share and expanding technological capabilities.

- Market Concentration: Moderate, with significant influence from established global players.

- Technological Innovation Drivers: Miniaturization of sensors, AI-powered defect detection, enhanced software for data analysis, and integration with Industry 4.0 platforms.

- Regulatory Frameworks: Adherence to ISO standards (e.g., ISO 10360 series), industry-specific quality certifications, and data security regulations.

- Competitive Product Substitutes: Traditional CMMs with touch probes, laser scanners, and non-contact metrology solutions.

- End-User Demographics: Increasing adoption by automotive OEMs, aerospace manufacturers, electronics producers, and medical device companies seeking enhanced process control.

- M&A Trends: Strategic acquisitions by larger players to gain access to new technologies, customer bases, and market segments.

Optical Coordinate Measuring Machine Market Growth Trends & Insights

The global Optical Coordinate Measuring Machine (OCMM) market is poised for robust expansion, driven by an escalating demand for high-precision metrology solutions across a spectrum of industries. From 2019 to 2024, the market witnessed steady growth, a trend expected to accelerate significantly through 2033. The base year, 2025, sets the stage for an estimated market size of approximately $1,850 million units. The forecast period, 2025-2033, is projected to see a compound annual growth rate (CAGR) of around 7.5%, pushing the market value to an estimated $3,280 million units by 2033. This growth is underpinned by several critical factors. Firstly, the relentless pursuit of higher quality standards and reduced defect rates in manufacturing necessitates sophisticated inspection tools like OCMMs. Industries such as aerospace and automotive, where part tolerances are exceptionally tight, are primary beneficiaries and drivers of this demand. Secondly, rapid advancements in sensor technology, including high-resolution optical sensors and advanced imaging techniques, are enhancing the capabilities of OCMMs, enabling faster and more accurate measurements of complex geometries. This technological evolution is also making OCMMs more accessible and user-friendly, broadening their adoption beyond specialized metrology labs into production floor environments.

The shift towards Industry 4.0 and smart manufacturing further fuels OCMM adoption. These machines are increasingly integrated into automated production lines, providing real-time quality feedback and enabling closed-loop manufacturing processes. The ability of OCMMs to perform non-contact measurements also addresses concerns related to delicate surfaces and contamination, making them ideal for inspecting sensitive components in industries like electronics and medical devices. Consumer behavior is also subtly influencing this market; as end-products become more complex and require higher levels of finish and functionality, so too does the demand for the precision measurement equipment that guarantees their quality. Furthermore, a growing awareness among manufacturers regarding the total cost of ownership, where the upfront investment in an OCMM is offset by reduced scrap rates, rework, and improved product reliability, is contributing to higher adoption rates. The market penetration of OCMMs, particularly in emerging economies, is still in its nascent stages, presenting significant untapped potential and further opportunities for market expansion. As these economies industrialize and focus on export quality, the demand for advanced metrology solutions will undoubtedly surge.

Dominant Regions, Countries, or Segments in Optical Coordinate Measuring Machine Market

The Automotive end-user industry segment is currently the most dominant force driving growth in the Optical Coordinate Measuring Machine (OCMM) market, projected to account for an estimated 30% of the market share in 2025, valued at approximately $555 million units. This dominance stems from the automotive sector's unyielding commitment to stringent quality control, the increasing complexity of vehicle components, and the widespread adoption of advanced manufacturing techniques.

- Automotive Sector Dominance:

- High-Volume Production: The sheer scale of automotive manufacturing necessitates efficient and accurate inspection methods to maintain production flow and minimize defects.

- Complex Geometries: Modern automotive parts, from engine components to interior trim, often feature intricate designs and tight tolerances, requiring the precision of OCMMs.

- Electrification and ADAS: The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) introduces new, high-precision components requiring sophisticated metrology for their development and production.

- Supplier Network Requirements: Automotive OEMs mandate strict quality standards for their vast supplier networks, driving OCMM adoption throughout the value chain.

- Growth Potential: Continued innovation in automotive design and manufacturing technologies will ensure sustained demand.

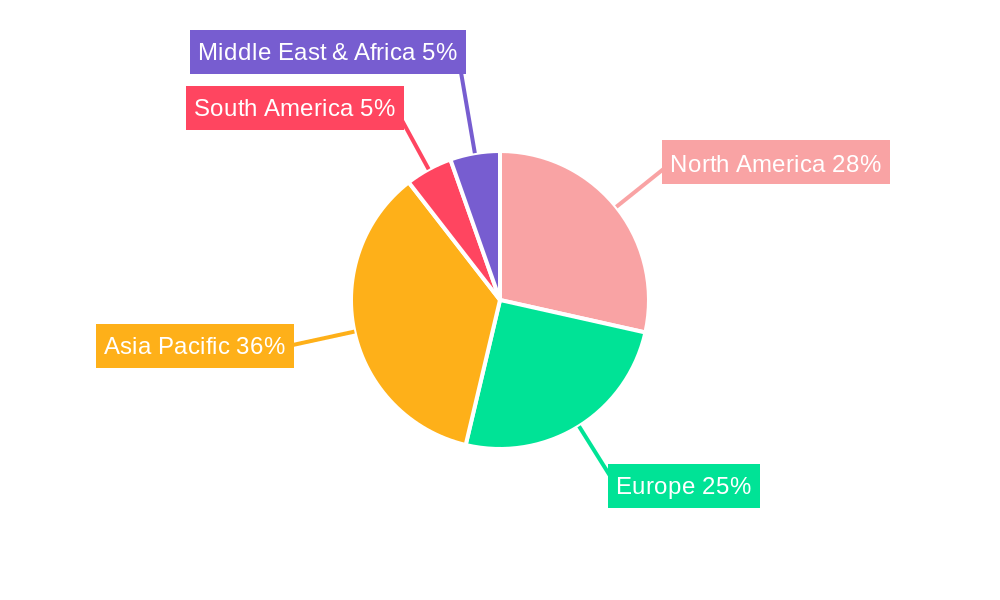

Regionally, North America is expected to lead the OCMM market in 2025, holding an estimated market share of 28%, valued at approximately $518 million units. This leadership is propelled by a robust manufacturing base, significant investments in R&D, and a strong emphasis on technological advancement in key sectors.

- North America's Leadership:

- Aerospace & Defense Hub: The presence of major aerospace and defense manufacturers, characterized by extremely high precision requirements, significantly boosts OCMM demand.

- Automotive Manufacturing: A strong domestic automotive industry, including advanced manufacturing facilities, contributes substantially to OCMM adoption.

- Technological Innovation: Leading research institutions and technology companies in the region drive the development and adoption of cutting-edge metrology solutions.

- Government Initiatives: Support for advanced manufacturing and technological upgrades through grants and policy frameworks encourages investment in OCMMs.

- High Adoption Rate: Industries in North America have historically been early adopters of advanced technologies, including sophisticated measurement equipment.

Within product types, 3D Vision Measurement Machines are anticipated to command the largest market share in 2025, estimated at 45%, valued at approximately $833 million units. Their ability to capture comprehensive geometric data makes them indispensable for complex part inspection.

- 3D Vision Measurement Machines' Ascendancy:

- Comprehensive Data Capture: Ability to measure complex 3D features, surfaces, and form & vị trí tolerances, crucial for intricate parts.

- Non-Contact Measurement: Ideal for delicate or easily deformable components, preventing damage during inspection.

- Advanced Software Integration: Seamless integration with CAD models for rapid comparison and analysis, improving efficiency.

- Growing Applications: Increasing use in reverse engineering, quality control of additive manufactured parts, and complex assembly verification.

- Technological Advancements: Continuous improvements in resolution, speed, and scanning capabilities enhance their value proposition.

Optical Coordinate Measuring Machine Market Product Landscape

The OCMM product landscape is characterized by continuous innovation, focusing on enhancing speed, accuracy, and user-friendliness. 3D Vision Measurement Machines are at the forefront, leveraging advanced optical sensors and sophisticated algorithms to capture intricate 3D geometries with sub-micron precision. Applications span from detailed inspection of aerospace components and automotive engine parts to the verification of micro-electronics and medical implants. Multi-sensor OCMMs are also gaining traction, integrating various measurement technologies, such as interferometry, laser scanning, and tactile probing, to offer comprehensive inspection capabilities within a single platform. This versatility allows for the measurement of a wider range of material properties and surface finishes. The performance metrics of these machines are continually being pushed, with advancements in scan speeds, point cloud density, and automated data processing, significantly reducing inspection cycle times and improving overall manufacturing efficiency.

Key Drivers, Barriers & Challenges in Optical Coordinate Measuring Machine Market

Key Drivers: The OCMM market is primarily driven by the escalating demand for superior product quality and precision across diverse manufacturing sectors. Advancements in sensor technology, leading to faster and more accurate measurements, are a significant catalyst. The global push towards Industry 4.0 and smart manufacturing necessitates automated, data-rich inspection solutions, for which OCMMs are ideally suited. The increasing complexity of manufactured components, particularly in aerospace, automotive, and electronics, further fuels the need for sophisticated metrology. Economic growth in emerging markets, coupled with government initiatives promoting technological adoption in manufacturing, also acts as a strong growth driver.

Key Barriers & Challenges: Despite the strong growth trajectory, the OCMM market faces several challenges. The high upfront cost of advanced OCMM systems can be a barrier to entry for small and medium-sized enterprises (SMEs). The need for highly skilled operators and specialized training can also limit adoption. Supply chain disruptions for critical components can impact production and lead times. Furthermore, intense competition from established players and emerging technologies requires continuous investment in R&D to maintain market share. The integration of OCMMs into existing manufacturing workflows can also present technical and logistical hurdles.

Emerging Opportunities in Optical Coordinate Measuring Machine Market

Emerging opportunities in the OCMM market lie in the expansion of non-contact metrology for advanced additive manufacturing, enabling the precise inspection of 3D printed parts with complex internal structures. The integration of AI and machine learning for automated defect detection and predictive maintenance of OCMMs presents a significant avenue for enhancement. Furthermore, the growing demand for miniaturized and portable OCMM solutions for on-site inspection in fields like construction and infrastructure maintenance offers untapped potential. The increasing adoption of OCMMs in the healthcare sector for inspecting intricate medical devices and implants also represents a rapidly growing niche. The development of cloud-based OCMM platforms for remote monitoring, data analysis, and collaborative inspection workflows is another promising area.

Growth Accelerators in the Optical Coordinate Measuring Machine Market Industry

The long-term growth of the Optical Coordinate Measuring Machine market is being significantly accelerated by several key factors. Continuous technological breakthroughs in optics, sensor resolution, and processing power are enabling OCMMs to achieve unprecedented levels of accuracy and speed, making them indispensable for cutting-edge manufacturing. Strategic partnerships between OCMM manufacturers and software developers are fostering the creation of more integrated and intelligent metrology solutions, enhancing user experience and data analysis capabilities. Market expansion strategies, including the development of more affordable entry-level models and the provision of comprehensive service and support packages, are broadening the accessibility of OCMM technology to a wider range of industries and company sizes. The increasing focus on sustainable manufacturing and product lifecycle management also highlights the role of accurate measurement in reducing waste and optimizing resource utilization, further bolstering OCMM adoption.

Key Players Shaping the Optical Coordinate Measuring Machine Market Market

- Mitutoyo America Corporation

- Werth Messtechnik GmbH

- Micro Vu Corporation

- Hexagon AB

- Nikon Metrology NV

- OGP (Quality Vision International Inc)

- Carl Zeiss AG

Notable Milestones in Optical Coordinate Measuring Machine Market Sector

- August 2022: Hexagon's Manufacturing Intelligence division introduced the TEMPO robotic part loading system for CMMs, enhancing automated inspection throughput without operator intervention, compatible with new and existing CMMs.

- February 2022: Made to Measure launched the AccuFLEX series of coordinate measuring machines (CMMs), including bridge, shop floor, horizontal, and gantry variants, built in the United States to cater to diverse industries and applications.

In-Depth Optical Coordinate Measuring Machine Market Market Outlook

The future of the Optical Coordinate Measuring Machine market is exceptionally promising, driven by a confluence of technological advancements and evolving industry demands. The estimated market value of $3,280 million units by 2033 underscores substantial growth potential. Key accelerators, such as ongoing innovations in high-resolution imaging, AI integration for intelligent data analysis, and the expansion of non-contact metrology solutions, will continue to propel market expansion. Strategic collaborations and the development of more accessible, integrated OCMM systems are expected to broaden adoption across industries, including the rapidly growing sectors of electronics and medical devices. The increasing emphasis on Industry 4.0 and smart manufacturing will further solidify the role of OCMMs as critical components of automated, data-driven production environments, creating significant opportunities for market players to innovate and capture share.

Optical Coordinate Measuring Machine Market Segmentation

-

1. Product Type

- 1.1. Multi-sensor

- 1.2. 2D Vision Measurement Machine

- 1.3. 3D Vision Measurement Machine

-

2. End User Industry

- 2.1. Aerospace & Defense

- 2.2. Automotive

- 2.3. Heavy Machinery and Metal Fabrication

- 2.4. Other End-user Industries

-

3. Machine Type

- 3.1. Articulated

- 3.2. Bridge

- 3.3. Other Types

Optical Coordinate Measuring Machine Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Optical Coordinate Measuring Machine Market Regional Market Share

Geographic Coverage of Optical Coordinate Measuring Machine Market

Optical Coordinate Measuring Machine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Changing product designs and growing investments in industry 4.; Adoption of in-line solutions and Technological advancements

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data

- 3.4. Market Trends

- 3.4.1. Automotive Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Coordinate Measuring Machine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Multi-sensor

- 5.1.2. 2D Vision Measurement Machine

- 5.1.3. 3D Vision Measurement Machine

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Aerospace & Defense

- 5.2.2. Automotive

- 5.2.3. Heavy Machinery and Metal Fabrication

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Machine Type

- 5.3.1. Articulated

- 5.3.2. Bridge

- 5.3.3. Other Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Optical Coordinate Measuring Machine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Multi-sensor

- 6.1.2. 2D Vision Measurement Machine

- 6.1.3. 3D Vision Measurement Machine

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Aerospace & Defense

- 6.2.2. Automotive

- 6.2.3. Heavy Machinery and Metal Fabrication

- 6.2.4. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Machine Type

- 6.3.1. Articulated

- 6.3.2. Bridge

- 6.3.3. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Optical Coordinate Measuring Machine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Multi-sensor

- 7.1.2. 2D Vision Measurement Machine

- 7.1.3. 3D Vision Measurement Machine

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Aerospace & Defense

- 7.2.2. Automotive

- 7.2.3. Heavy Machinery and Metal Fabrication

- 7.2.4. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Machine Type

- 7.3.1. Articulated

- 7.3.2. Bridge

- 7.3.3. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Optical Coordinate Measuring Machine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Multi-sensor

- 8.1.2. 2D Vision Measurement Machine

- 8.1.3. 3D Vision Measurement Machine

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Aerospace & Defense

- 8.2.2. Automotive

- 8.2.3. Heavy Machinery and Metal Fabrication

- 8.2.4. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Machine Type

- 8.3.1. Articulated

- 8.3.2. Bridge

- 8.3.3. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Optical Coordinate Measuring Machine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Multi-sensor

- 9.1.2. 2D Vision Measurement Machine

- 9.1.3. 3D Vision Measurement Machine

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Aerospace & Defense

- 9.2.2. Automotive

- 9.2.3. Heavy Machinery and Metal Fabrication

- 9.2.4. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Machine Type

- 9.3.1. Articulated

- 9.3.2. Bridge

- 9.3.3. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Optical Coordinate Measuring Machine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Multi-sensor

- 10.1.2. 2D Vision Measurement Machine

- 10.1.3. 3D Vision Measurement Machine

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Aerospace & Defense

- 10.2.2. Automotive

- 10.2.3. Heavy Machinery and Metal Fabrication

- 10.2.4. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Machine Type

- 10.3.1. Articulated

- 10.3.2. Bridge

- 10.3.3. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mitutoyo America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Werth Messtechnik GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Micro Vu Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hexagon AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nikon Metrology NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OGP (Quality Vision International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carl Zeiss AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Mitutoyo America Corporation

List of Figures

- Figure 1: Global Optical Coordinate Measuring Machine Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Optical Coordinate Measuring Machine Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Optical Coordinate Measuring Machine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Optical Coordinate Measuring Machine Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 5: North America Optical Coordinate Measuring Machine Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: North America Optical Coordinate Measuring Machine Market Revenue (billion), by Machine Type 2025 & 2033

- Figure 7: North America Optical Coordinate Measuring Machine Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 8: North America Optical Coordinate Measuring Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Optical Coordinate Measuring Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Optical Coordinate Measuring Machine Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Optical Coordinate Measuring Machine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Optical Coordinate Measuring Machine Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 13: South America Optical Coordinate Measuring Machine Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: South America Optical Coordinate Measuring Machine Market Revenue (billion), by Machine Type 2025 & 2033

- Figure 15: South America Optical Coordinate Measuring Machine Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 16: South America Optical Coordinate Measuring Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Optical Coordinate Measuring Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Optical Coordinate Measuring Machine Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe Optical Coordinate Measuring Machine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Optical Coordinate Measuring Machine Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 21: Europe Optical Coordinate Measuring Machine Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Europe Optical Coordinate Measuring Machine Market Revenue (billion), by Machine Type 2025 & 2033

- Figure 23: Europe Optical Coordinate Measuring Machine Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 24: Europe Optical Coordinate Measuring Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Optical Coordinate Measuring Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 29: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 30: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue (billion), by Machine Type 2025 & 2033

- Figure 31: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 32: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Optical Coordinate Measuring Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Optical Coordinate Measuring Machine Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Optical Coordinate Measuring Machine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Optical Coordinate Measuring Machine Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 37: Asia Pacific Optical Coordinate Measuring Machine Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 38: Asia Pacific Optical Coordinate Measuring Machine Market Revenue (billion), by Machine Type 2025 & 2033

- Figure 39: Asia Pacific Optical Coordinate Measuring Machine Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 40: Asia Pacific Optical Coordinate Measuring Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Optical Coordinate Measuring Machine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 3: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 4: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 15: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 21: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 22: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 34: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 35: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 44: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 45: Global Optical Coordinate Measuring Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Optical Coordinate Measuring Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Coordinate Measuring Machine Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the Optical Coordinate Measuring Machine Market?

Key companies in the market include Mitutoyo America Corporation, Werth Messtechnik GmbH, Micro Vu Corporation, Hexagon AB, Nikon Metrology NV, OGP (Quality Vision International Inc, Carl Zeiss AG.

3. What are the main segments of the Optical Coordinate Measuring Machine Market?

The market segments include Product Type, End User Industry, Machine Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.57 billion as of 2022.

5. What are some drivers contributing to market growth?

Changing product designs and growing investments in industry 4.; Adoption of in-line solutions and Technological advancements.

6. What are the notable trends driving market growth?

Automotive Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data.

8. Can you provide examples of recent developments in the market?

August 2022 - Hexagon's Manufacturing Intelligence division has introduced the TEMPO robotic part loading system for CMMs, allowing manufacturers to maintain inspection throughput without operator intervention. TEMPO is compatible with new and existing CMMs for automated part loading, queuing, and unloading. The system can be configured to perform measurements while operators are away from the CMM on other tasks, thereby driving workflow efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Coordinate Measuring Machine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Coordinate Measuring Machine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Coordinate Measuring Machine Market?

To stay informed about further developments, trends, and reports in the Optical Coordinate Measuring Machine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence