Key Insights

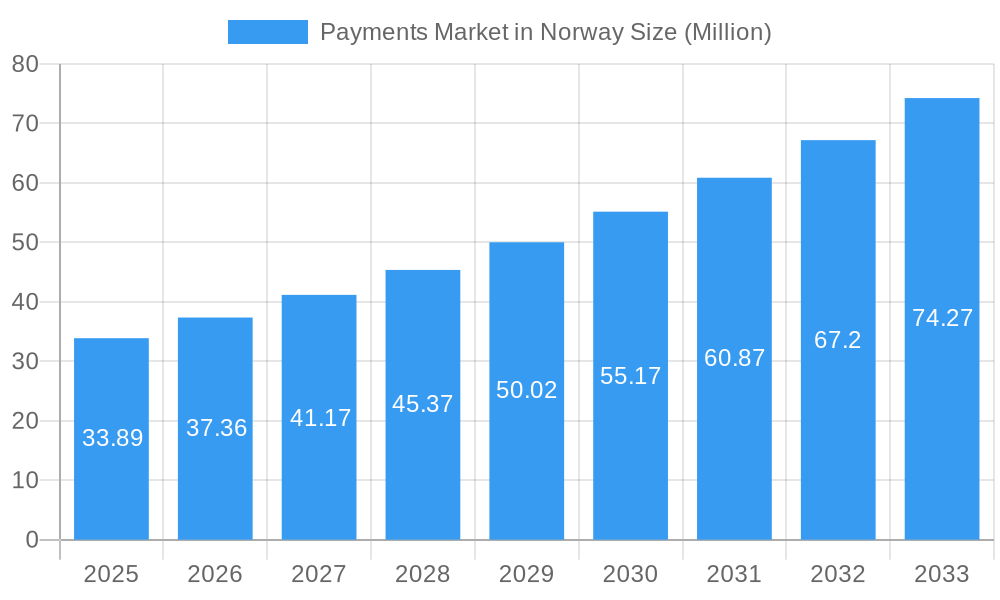

The Norwegian payments market is poised for robust expansion, projected to reach USD 33.89 million in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 10.31% through 2033. This sustained growth is primarily fueled by the escalating adoption of digital payment methods, spurred by increasing consumer comfort with online transactions and the proliferation of mobile wallets. Government initiatives aimed at promoting digital inclusion and a sophisticated financial infrastructure further bolster this trend. Furthermore, the convenience and security offered by various electronic payment solutions, coupled with a strong e-commerce ecosystem, are compelling consumers and businesses alike to shift away from traditional cash-based transactions. The market's dynamism is also influenced by intense competition among established players and innovative fintech startups, all striving to offer seamless and secure payment experiences.

Payments Market in Norway Market Size (In Million)

The market's evolution is further shaped by evolving consumer preferences towards faster, more integrated payment solutions. Trends such as the rise of Buy Now, Pay Later (BNPL) services and the increasing integration of payments into non-financial platforms are expected to play a significant role. While the overall outlook is highly positive, potential restraints could emerge from stricter regulatory frameworks concerning data privacy and cybersecurity, as well as the need for continuous investment in infrastructure to support the growing volume of digital transactions. However, the inherent adaptability of the Norwegian financial sector and the proactive stance of key companies like Visa Inc., Mastercard Inc., and PayPal Holdings Inc. are well-positioned to navigate these challenges, ensuring continued innovation and market growth. The diverse payment landscape, encompassing both Point of Sale (POS) and online sales, offers ample opportunities for various payment modes, including card payments, digital wallets, and innovative POS solutions, catering to a broad spectrum of user needs.

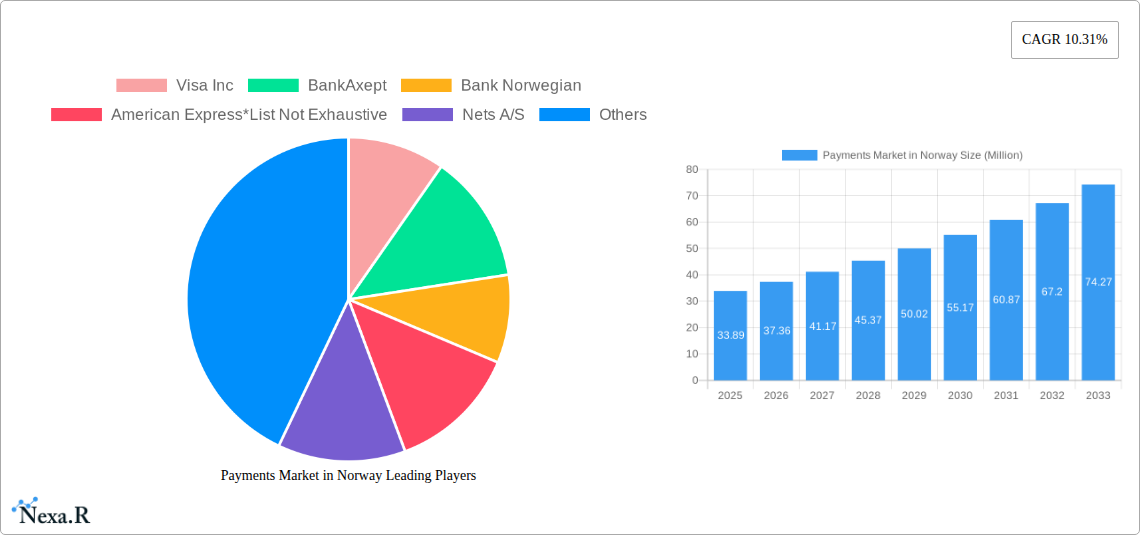

Payments Market in Norway Company Market Share

Norway Payments Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a detailed analysis of the Norway payments market, encompassing its current dynamics, growth trends, and future trajectory. Covering the study period of 2019–2033, with 2025 as the base year and estimated year, and a forecast period from 2025–2033, this report offers critical insights for industry stakeholders. Historical data from 2019–2024 sets the foundation for a thorough understanding of market evolution. We delve into parent and child markets, analyzing key segments like Point of Sale (Card Pay, Digital Wallet, Cash) and Online Sales, providing a holistic view of the digital payments Norway landscape.

Payments Market in Norway Market Dynamics & Structure

The Norway payments market is characterized by a dynamic interplay of technological innovation, robust regulatory frameworks, and evolving consumer preferences. Market concentration is moderate, with a few dominant players holding significant shares, yet the landscape is fostering innovation through strategic partnerships and increasing adoption of digital solutions. Technological drivers include the proliferation of smartphones, advancements in NFC technology, and the growing demand for seamless, secure transactions. Regulatory bodies actively promote competition and consumer protection, ensuring a stable and trustworthy environment for payment services. Competitive product substitutes are abundant, ranging from traditional card payments to an increasing array of digital wallets and mobile payment solutions, forcing incumbents to constantly innovate. End-user demographics show a strong inclination towards digital-first solutions, particularly among younger generations, driving the demand for convenient and accessible payment methods. Mergers and acquisitions (M&A) trends indicate a consolidation drive among smaller fintech players seeking to scale and a strategic interest from larger entities in acquiring innovative technologies and customer bases.

- Market Concentration: Moderate to high in card payments, with increasing fragmentation in the digital wallet and online payment segments.

- Technological Innovation Drivers: Rise of contactless payments, secure biometric authentication, open banking initiatives, and the adoption of AI for fraud detection.

- Regulatory Frameworks: Governed by stringent PSD2 directives and national regulations ensuring data security and consumer protection.

- Competitive Product Substitutes: Digital wallets (Vipps, Apple Pay, Google Pay), Buy Now Pay Later (BNPL) solutions, and direct bank transfers are increasingly challenging traditional payment methods.

- End-User Demographics: High digital literacy and a preference for convenience drive adoption of mobile and online payment solutions.

- M&A Trends: Focus on acquiring innovative fintech solutions and expanding market reach within the online payments Norway sector.

Payments Market in Norway Growth Trends & Insights

The Norway payments market is poised for significant growth, driven by a confluence of factors including increasing digitalization, favorable government initiatives, and a robust financial ecosystem. The market size is projected to expand at a healthy Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated value of over 50,000 million units by the end of the forecast period. This growth is underpinned by escalating adoption rates of digital payment methods, a trend accelerated by the convenience and security they offer. Technological disruptions, such as the widespread implementation of faster payment systems and the integration of AI in fraud prevention, are further enhancing the user experience and driving market penetration. Consumer behavior has demonstrably shifted towards a preference for contactless and mobile payments, with a notable decrease in cash usage for everyday transactions. The expanding e-commerce sector in Norway also acts as a powerful catalyst, demanding more sophisticated and integrated online payment solutions. Furthermore, the government's commitment to fostering a digital economy, coupled with the increasing sophistication of financial technology providers, creates a fertile ground for sustained market expansion. The penetration of digital wallets and mobile payment solutions is expected to soar, becoming the preferred mode of payment for a significant portion of the Norwegian population. The rise of innovative payment solutions tailored to specific consumer needs, such as BNPL options offered by companies like Klarna Bank AB, will also contribute to the overall market growth.

Dominant Regions, Countries, or Segments in Payments Market in Norway

Within the Norway payments market, the Digital Wallet (includes Mobile Wallets) segment is emerging as the dominant force, driving significant growth and innovation. This ascendance is propelled by a combination of factors, including widespread smartphone penetration, user-friendly interfaces, and the increasing integration of these wallets into everyday consumer activities, from online shopping to peer-to-peer transfers. Vipps AS, a leading mobile payment solution, has cemented its position as a national favorite, demonstrating the immense potential of well-executed digital wallet services. The convenience of making instant payments without the need for physical cards or cash has resonated deeply with the tech-savvy Norwegian population.

Furthermore, the growing adoption of Card Pay at Point of Sale (POS) terminals continues to be a strong contributor to the overall market. Major players like Visa Inc and Mastercard Inc, alongside the national BankAxept, ensure a robust infrastructure for card transactions, facilitating seamless payments across various retail environments. The continued investment in secure and advanced POS technology by merchants further solidifies this segment's importance.

The Online Sale segment, encompassing various online payment modes, is also experiencing substantial growth, fueled by the robust expansion of e-commerce in Norway. Consumers are increasingly comfortable making purchases online, demanding secure and efficient payment gateways. This trend is supported by the availability of diverse online payment options, including those offered by international players like PayPal Holdings Inc and local entities.

Digital Wallet (includes Mobile Wallets):

- Key Drivers: High smartphone adoption, user-friendly interfaces, seamless integration with various services (e.g., e-commerce, bill payments, P2P transfers).

- Market Share: Experiencing rapid growth and projected to capture a dominant share in the coming years.

- Growth Potential: Significant, driven by continuous innovation and increasing consumer preference for convenience.

- Dominance Factors: The ubiquity and ease of use of solutions like Vipps AS have created strong network effects.

Card Pay (Point of Sale):

- Key Drivers: Extensive POS infrastructure, consumer trust in established card networks (Visa Inc, Mastercard Inc, BankAxept), secure transaction technologies.

- Market Share: Remains substantial, especially for in-person transactions.

- Growth Potential: Steady growth, influenced by the adoption of newer card technologies and contactless payments.

- Dominance Factors: Long-standing presence and widespread acceptance by merchants.

Online Sale (Others):

- Key Drivers: Growth of e-commerce, demand for secure online payment gateways, availability of diverse online payment options (e.g., BNPL, international payment providers).

- Market Share: Growing rapidly with the expansion of online retail.

- Growth Potential: High, especially with the integration of advanced payment technologies and cross-border e-commerce.

- Dominance Factors: Increasing consumer comfort with online transactions and the availability of various secure payment methods.

Payments Market in Norway Product Landscape

The Norway payments market product landscape is characterized by innovation and diversification, with a strong emphasis on security, convenience, and user experience. Digital wallets, such as Vipps AS, continue to evolve, offering enhanced functionalities beyond simple P2P transfers, including loyalty programs and integrated merchant services. Mobile payment solutions are increasingly leveraging biometric authentication (face or fingerprint recognition) to bolster security and streamline transactions. Contactless payment technologies, embedded in both cards and mobile devices, have become the norm, significantly reducing transaction times. Buy Now Pay Later (BNPL) solutions, spearheaded by players like Klarna Bank AB, are gaining traction, providing consumers with flexible payment options for online purchases. Furthermore, the integration of AI and machine learning is enhancing fraud detection capabilities, offering a more secure payment environment.

Key Drivers, Barriers & Challenges in Payments Market in Norway

The Norway payments market is propelled by several key drivers. The increasing digital literacy and tech-savviness of the Norwegian population significantly fuels the adoption of digital payment solutions. Government initiatives promoting a digital economy and open banking frameworks create a conducive environment for innovation and competition. The robust e-commerce sector continues to demand more sophisticated and secure online payment options.

However, the market also faces challenges. Maintaining robust cybersecurity to combat evolving threats remains a paramount concern, necessitating continuous investment in advanced fraud prevention technologies. Regulatory compliance, while fostering trust, can also present hurdles for smaller players. Furthermore, ensuring universal access to digital payment infrastructure across all demographics and geographical regions is crucial to avoid digital exclusion.

Key Drivers:

- High smartphone penetration and digital adoption.

- Government support for digital transformation and open banking.

- Thriving e-commerce sector demanding innovative payment solutions.

- Consumer preference for convenience and speed in transactions.

Barriers & Challenges:

- Cybersecurity threats and the need for continuous fraud prevention.

- Regulatory complexities and compliance costs.

- Ensuring digital inclusion for all segments of the population.

- Competition from established players and emerging fintechs.

Emerging Opportunities in Payments Market in Norway

Emerging opportunities in the Norway payments market lie in further leveraging the potential of open banking to foster innovative financial services and personalized payment experiences. The growing demand for embedded finance solutions, where payment functionalities are seamlessly integrated into non-financial applications and platforms, presents a significant avenue for growth. Furthermore, the development of more sophisticated loyalty and rewards programs integrated within digital wallets can enhance customer engagement and retention. The increasing interest in sustainable finance also opens doors for payment solutions that support eco-friendly transactions and carbon footprint tracking.

Growth Accelerators in the Payments Market in Norway Industry

The Norway payments market industry is experiencing growth acceleration through strategic technological advancements and evolving consumer behaviors. The ongoing expansion of contactless payment infrastructure and the increasing adoption of mobile wallets are significant catalysts. Furthermore, the integration of AI and machine learning into payment platforms enhances security and personalization, driving user adoption. Strategic partnerships between traditional financial institutions and innovative fintech companies are also accelerating the development and deployment of new payment solutions. The government's continued support for digitalization and open banking principles further fuels this growth trajectory.

Key Players Shaping the Payments Market in Norway Market

- Visa Inc

- BankAxept

- Bank Norwegian

- American Express

- Nets A/S

- PayPal Holdings Inc

- Vipps AS

- Klarna Bank AB

- Mastercard Inc

Notable Milestones in Payments Market in Norway Sector

- September 2023: Tata Consultancy Services (TSC) has partnered with BankID BankAxept AS, Norway’s national payment and electronic identity systems provider. This alliance aims to establish and manage an operations command center, enhancing security and operational efficiency in the payment ecosystem.

- June 2022: Bulder Bank, a Norwegian financial services provider, launched new enriched data transaction services for its retail banking customers. This innovation transforms unorganized payment data into clear merchant names, logos, and categories, improving user experience and transaction clarity.

- May 2022: The government of Norway announced its plan to replace the digital ID authentication platform BankID with new apps requiring face or fingerprint biometrics and passwords or PINs, enhancing security and accessibility for online banking services.

- April 2022: The anti-fraud and identity verification platform Sphonic, based in the UK, was bought by Norwegian digital ID company Signicat. This acquisition aims to bolster Signicat's identity platform with KYC, KYB, and AML solutions, strengthening the defense against financial crime for financial institutions.

In-Depth Payments Market in Norway Market Outlook

The Norway payments market is set for continued robust growth, driven by a persistent shift towards digital and mobile-first payment solutions. Future market potential is immense, fueled by ongoing innovation in areas like instant payments, biometric authentication, and the further development of open banking ecosystems. Strategic opportunities abound for companies that can offer seamless, secure, and personalized payment experiences. The increasing integration of payment functionalities into various aspects of daily life, from smart home devices to autonomous vehicles, will further expand the market's reach. Companies that can adapt to evolving consumer preferences and leverage emerging technologies will be well-positioned for success in this dynamic and rapidly expanding market.

Payments Market in Norway Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Other POS Payment Modes

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

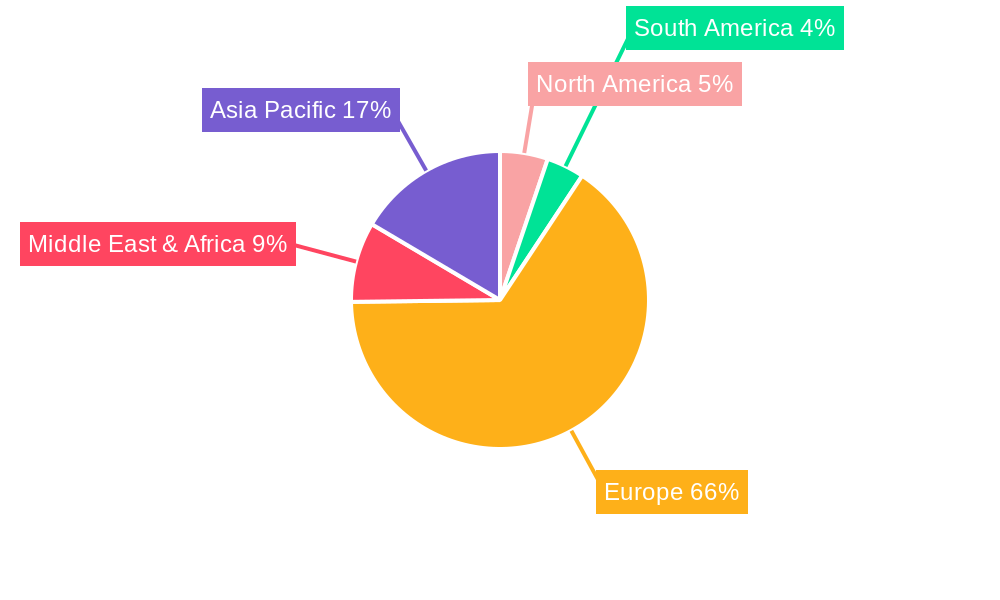

Payments Market in Norway Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Payments Market in Norway Regional Market Share

Geographic Coverage of Payments Market in Norway

Payments Market in Norway REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives; Adoption of online mode of Payments

- 3.3. Market Restrains

- 3.3.1. Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network

- 3.4. Market Trends

- 3.4.1. Adoption of Online Mode of Payments Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Payments Market in Norway Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Other POS Payment Modes

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America Payments Market in Norway Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Point of Sale

- 6.1.1.1. Card Pay

- 6.1.1.2. Digital Wallet (includes Mobile Wallets)

- 6.1.1.3. Cash

- 6.1.1.4. Other POS Payment Modes

- 6.1.2. Online Sale

- 6.1.2.1. Others (

- 6.1.1. Point of Sale

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. South America Payments Market in Norway Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Point of Sale

- 7.1.1.1. Card Pay

- 7.1.1.2. Digital Wallet (includes Mobile Wallets)

- 7.1.1.3. Cash

- 7.1.1.4. Other POS Payment Modes

- 7.1.2. Online Sale

- 7.1.2.1. Others (

- 7.1.1. Point of Sale

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Europe Payments Market in Norway Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Point of Sale

- 8.1.1.1. Card Pay

- 8.1.1.2. Digital Wallet (includes Mobile Wallets)

- 8.1.1.3. Cash

- 8.1.1.4. Other POS Payment Modes

- 8.1.2. Online Sale

- 8.1.2.1. Others (

- 8.1.1. Point of Sale

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Middle East & Africa Payments Market in Norway Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Point of Sale

- 9.1.1.1. Card Pay

- 9.1.1.2. Digital Wallet (includes Mobile Wallets)

- 9.1.1.3. Cash

- 9.1.1.4. Other POS Payment Modes

- 9.1.2. Online Sale

- 9.1.2.1. Others (

- 9.1.1. Point of Sale

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Asia Pacific Payments Market in Norway Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Point of Sale

- 10.1.1.1. Card Pay

- 10.1.1.2. Digital Wallet (includes Mobile Wallets)

- 10.1.1.3. Cash

- 10.1.1.4. Other POS Payment Modes

- 10.1.2. Online Sale

- 10.1.2.1. Others (

- 10.1.1. Point of Sale

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Visa Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BankAxept

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bank Norwegian

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Express*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nets A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PayPal Holdings Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vipps AS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Klarna Bank AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mastercard Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Visa Inc

List of Figures

- Figure 1: Global Payments Market in Norway Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Payments Market in Norway Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 3: North America Payments Market in Norway Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 4: North America Payments Market in Norway Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Payments Market in Norway Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Payments Market in Norway Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 7: South America Payments Market in Norway Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 8: South America Payments Market in Norway Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Payments Market in Norway Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Payments Market in Norway Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 11: Europe Payments Market in Norway Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 12: Europe Payments Market in Norway Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Payments Market in Norway Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Payments Market in Norway Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 15: Middle East & Africa Payments Market in Norway Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 16: Middle East & Africa Payments Market in Norway Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Payments Market in Norway Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Payments Market in Norway Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 19: Asia Pacific Payments Market in Norway Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 20: Asia Pacific Payments Market in Norway Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Payments Market in Norway Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Global Payments Market in Norway Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 4: Global Payments Market in Norway Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 9: Global Payments Market in Norway Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 14: Global Payments Market in Norway Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 25: Global Payments Market in Norway Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 33: Global Payments Market in Norway Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Payments Market in Norway Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Payments Market in Norway?

The projected CAGR is approximately 10.31%.

2. Which companies are prominent players in the Payments Market in Norway?

Key companies in the market include Visa Inc, BankAxept, Bank Norwegian, American Express*List Not Exhaustive, Nets A/S, PayPal Holdings Inc, Vipps AS, Klarna Bank AB, Mastercard Inc.

3. What are the main segments of the Payments Market in Norway?

The market segments include Mode of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives; Adoption of online mode of Payments.

6. What are the notable trends driving market growth?

Adoption of Online Mode of Payments Drives the Market Growth.

7. Are there any restraints impacting market growth?

Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network.

8. Can you provide examples of recent developments in the market?

September 2023 : Tata Consultancy Services (TSC) has partnered with BankID BankAxept AS, Norway’s national payment and electronic identity systems provider. This alliance aims to establish and manage an operations command center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Payments Market in Norway," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Payments Market in Norway report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Payments Market in Norway?

To stay informed about further developments, trends, and reports in the Payments Market in Norway, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence