Key Insights

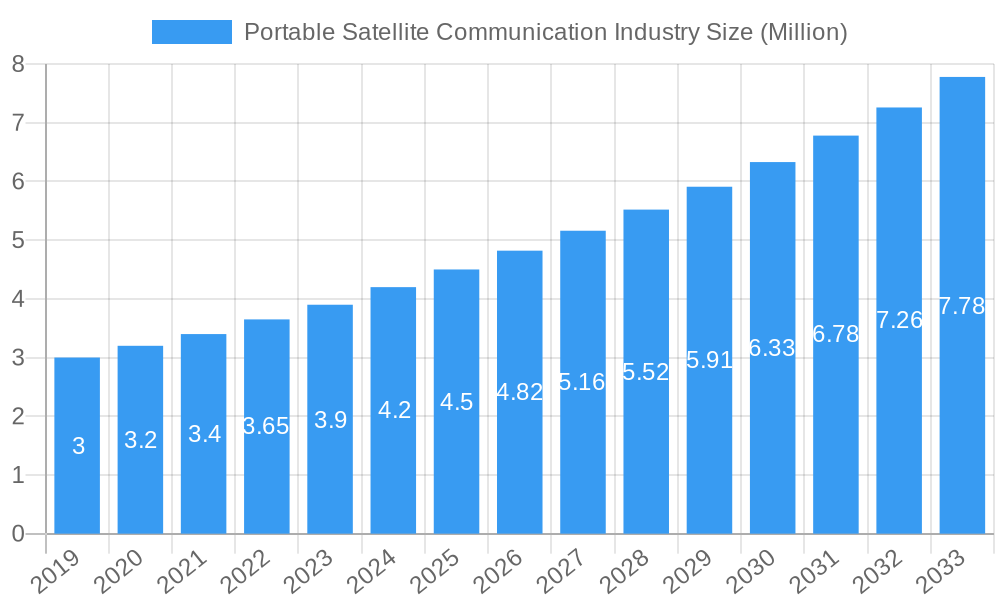

The global Portable Satellite Communication market is poised for robust growth, projected to reach a substantial size of approximately $4.94 billion. This expansion is driven by a compelling compound annual growth rate (CAGR) of 7.11%, indicating sustained and significant market momentum over the forecast period of 2025-2033. The primary catalysts for this upward trajectory include the increasing demand for reliable connectivity in remote and underserved regions, the burgeoning adoption of satellite communication services by maritime, enterprise, and aviation sectors, and the continuous advancements in satellite technology enabling more compact, powerful, and affordable portable devices. Furthermore, the growing geopolitical emphasis on secure and resilient communication infrastructure, particularly for government and defense applications, is a critical driver fueling market expansion. Emerging trends such as the integration of AI and IoT capabilities into satellite communication terminals, the development of Low Earth Orbit (LEO) satellite constellations offering lower latency and higher bandwidth, and the increasing focus on hybrid connectivity solutions are expected to further shape the market landscape.

Portable Satellite Communication Industry Market Size (In Million)

However, the market also faces certain restraints that could temper its growth. These include the high initial cost of satellite terminals and service subscriptions, the complex regulatory landscape in different regions impacting service deployment, and the competition from terrestrial network providers in areas with existing infrastructure. Despite these challenges, the inherent need for ubiquitous connectivity, especially in environments where terrestrial networks are unavailable or unreliable, ensures a strong underlying demand. The market is segmented by service into Voice and Data, with Data services expected to dominate due to the increasing reliance on data-intensive applications. Key end-user industries such as Maritime, Enterprise, Aviation, and Government are all significant contributors to market demand. Major industry players including ViaSat UK Limited, Iridium Communications Inc., ORBCOMM Europe Holding BV, Intelsat S.A., Inmarsat PLC, Ericsson Inc., Globalstar Inc., Thuraya Telecommunications Company, and EchoStar Mobile Limited are actively innovating and expanding their offerings to capture market share. Regional market dynamics are expected to be influenced by infrastructure development, regulatory frameworks, and the specific needs of key industries in each area.

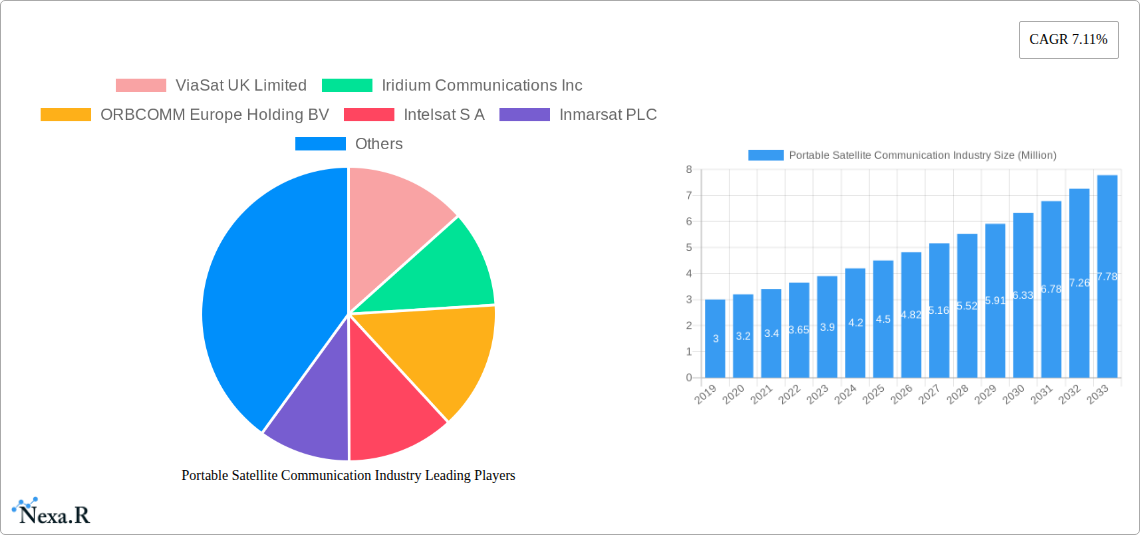

Portable Satellite Communication Industry Company Market Share

Portable Satellite Communication Industry Report: Unlocking Global Connectivity & Growth (2019-2033)

This comprehensive report provides an in-depth analysis of the global Portable Satellite Communication industry, offering critical insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this study delves into market dynamics, growth trends, regional dominance, product landscapes, and key players shaping the future of satellite connectivity. We meticulously analyze parent and child markets, integrating high-traffic keywords such as "satellite communication devices," "mobile satellite service," "VSAT terminals," "satellite data services," "satellite voice solutions," "maritime satellite communication," "enterprise satellite solutions," "aviation satellite connectivity," and "government satellite networks." All values are presented in Million units for clear quantitative understanding.

Portable Satellite Communication Industry Market Dynamics & Structure

The portable satellite communication market is characterized by a moderately concentrated structure, with key players like ViaSat UK Limited, Iridium Communications Inc, and Inmarsat PLC holding significant influence. Technological innovation remains a primary driver, fueled by advancements in miniaturization, increased data speeds, and lower power consumption for portable devices. Regulatory frameworks, particularly those concerning spectrum allocation and international data roaming, play a crucial role in market accessibility and operational efficiency. Competitive product substitutes, while present in terrestrial networks, often fall short in remote or disaster-stricken areas where satellite communication excels. End-user demographics are diversifying, expanding beyond traditional government and military use to encompass enterprise, maritime, and even consumer applications. Mergers and acquisitions (M&A) are a consistent trend, aimed at expanding service portfolios and geographical reach. For instance, the period has seen several strategic acquisitions aimed at consolidating market share and acquiring specialized technologies.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation: Driven by miniaturization, higher bandwidth, and lower power consumption.

- Regulatory Frameworks: Critical for spectrum allocation and international operations.

- Competitive Substitutes: Terrestrial networks are a substitute in covered areas.

- End-User Demographics: Expanding from niche to broader enterprise, maritime, and consumer segments.

- M&A Trends: Ongoing consolidation for market share and technological acquisition.

Portable Satellite Communication Industry Growth Trends & Insights

The portable satellite communication market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This expansion is propelled by increasing demand for reliable connectivity in remote and underserved regions, critical for disaster response, remote operations, and the growing Internet of Things (IoT) ecosystem. The market size, estimated at XX Million units in 2025, is anticipated to reach XX Million units by 2033. Adoption rates are accelerating as satellite technology becomes more affordable and user-friendly. Technological disruptions, such as the proliferation of Low Earth Orbit (LEO) satellite constellations, are significantly enhancing data speeds and reducing latency, making satellite services more competitive with terrestrial alternatives. Consumer behavior shifts, driven by the increasing need for ubiquitous connectivity and the remote work phenomenon, are further fueling adoption across various end-user industries. The penetration of satellite data services, in particular, is witnessing a substantial uptick, driven by applications in remote sensing, asset tracking, and high-bandwidth data transfer. The integration of satellite communication with existing terrestrial networks is also creating hybrid solutions that offer unparalleled reliability and coverage.

Dominant Regions, Countries, or Segments in Portable Satellite Communication Industry

The Government end-user industry segment is a dominant force in the portable satellite communication market, driven by a persistent need for secure, reliable, and globally accessible communication solutions. This segment accounts for an estimated XX% of the total market share in 2025. The inherent requirement for mission-critical communication in defense, emergency services, and diplomatic operations ensures a consistent and substantial demand for portable satellite devices and services. Government initiatives, such as the deployment of satellite communication for national security and disaster preparedness, coupled with significant R&D investments, further bolster this segment's dominance. Economic policies that prioritize robust national infrastructure, including communication resilience, and defense budgets that allocate substantial funds to advanced technologies are key drivers. The growth potential within the government sector remains high due to evolving geopolitical landscapes and the increasing complexity of global operations.

- Key Drivers in Government Sector:

- National security and defense requirements.

- Disaster response and emergency management.

- Diplomatic and international operations.

- Government investments in resilient communication infrastructure.

- Market Share & Growth Potential: Holds a significant market share, with continued growth fueled by evolving security needs and technological advancements.

The Data service segment is experiencing rapid growth, driven by the increasing reliance on real-time information and the expanding capabilities of portable satellite terminals. This segment is projected to capture an estimated XX% of the market by 2033, surpassing traditional voice services in market value. The ability to transmit large volumes of data efficiently and reliably, irrespective of terrestrial infrastructure, makes satellite data services indispensable for industries like maritime (ship tracking, cargo monitoring), enterprise (remote site operations, IoT), and aviation (inflight connectivity, flight data). Technological advancements in satellite technology, enabling higher bandwidth and lower latency, are further accelerating the adoption of data-intensive applications.

- Key Drivers in Data Services:

- Demand for real-time information and analytics.

- Growth of IoT applications in remote environments.

- Advancements in satellite bandwidth and latency reduction.

- Increasing adoption of cloud-based services in remote locations.

Portable Satellite Communication Industry Product Landscape

The product landscape of portable satellite communication is rapidly evolving, marked by increasingly compact, ruggedized, and feature-rich devices. Innovations focus on enhancing data speeds, improving battery life, and integrating multi-band capabilities for greater network flexibility. Applications range from basic voice and messaging for remote workers to sophisticated broadband connectivity for real-time video streaming and complex data transfer in challenging environments. The unique selling proposition lies in their ability to provide connectivity where terrestrial networks fail, ensuring operational continuity and safety. Key technological advancements include the development of smaller, more efficient antennas and integrated satellite modems, alongside user-friendly interfaces that simplify operation for a broader range of users.

Key Drivers, Barriers & Challenges in Portable Satellite Communication Industry

Key Drivers:

- Increasing demand for connectivity in remote and underserved areas: Essential for disaster relief, remote operations, and connecting isolated communities.

- Growth of IoT and M2M applications: Enabling data collection and communication from remote assets.

- Technological advancements: Miniaturization, increased bandwidth, and lower power consumption of satellite devices.

- Government and defense spending: Persistent need for secure and reliable communication solutions.

- Commercial aviation and maritime sector expansion: Driving demand for inflight and at-sea connectivity.

Barriers & Challenges:

- High cost of equipment and service: Still a significant barrier for some smaller enterprises and consumer markets.

- Regulatory complexities and spectrum licensing: Can hinder market entry and operational deployment.

- Competition from improving terrestrial networks: In areas with developing infrastructure, terrestrial options can be more cost-effective.

- Awareness and technical expertise: Limited understanding of satellite capabilities and operation among potential users.

- Supply chain disruptions: Can impact the availability of critical components and devices.

Emerging Opportunities in Portable Satellite Communication Industry

Emerging opportunities lie in the untapped potential of the consumer market for personal satellite communication devices, particularly for adventure enthusiasts and individuals seeking enhanced safety in remote areas. The burgeoning demand for integrated satellite connectivity in vehicles, drones, and other mobile platforms presents a significant growth avenue. Furthermore, the development of specialized satellite communication solutions for burgeoning sectors like precision agriculture, remote healthcare, and smart city initiatives in geographically challenging regions offers substantial untapped markets. The increasing integration of AI and machine learning into satellite communication systems for optimized data routing and predictive maintenance also represents an exciting frontier.

Growth Accelerators in the Portable Satellite Communication Industry Industry

The long-term growth of the portable satellite communication industry is being significantly accelerated by breakthroughs in LEO satellite technology, promising higher speeds and lower latency at more accessible price points. Strategic partnerships between satellite operators, terrestrial network providers, and device manufacturers are creating robust hybrid connectivity solutions that offer unparalleled reliability and seamless user experiences. Market expansion strategies targeting developing economies, where terrestrial infrastructure is still nascent, are opening up vast new customer bases. Furthermore, the growing adoption of satellite communication as a primary connectivity solution for critical infrastructure and emergency services is solidifying its position and driving demand.

Key Players Shaping the Portable Satellite Communication Industry Market

- ViaSat UK Limited

- Iridium Communications Inc

- ORBCOMM Europe Holding BV

- Intelsat S A

- Inmarsat PLC

- Ericsson Inc

- Globalstar Inc

- Thuraya Telecommunications Company

- EchoStar Mobile Limited

Notable Milestones in Portable Satellite Communication Industry Sector

- June 2023: NewSpace India Ltd is establishing mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 coastal states in India to improve maritime communication and monitoring.

- December 2022: Nelco, a Tata Group member, applied for a Global Mobile Personal Communication by Satellite (GMPCS) license in India, highlighting significant growth potential and increased interest in the market.

- August 2022: Vodafone PNG and Kacific partnered to deliver mobile backhaul services via satellite to rural areas in Papua New Guinea, enhancing voice and 3G/4G data network access and supporting digital transformation.

In-Depth Portable Satellite Communication Industry Market Outlook

The future of the portable satellite communication industry is exceptionally bright, fueled by continuous technological innovation and expanding market reach. Growth accelerators such as the advancement of LEO constellations, strategic collaborations, and targeted market expansion into developing regions are set to redefine global connectivity. The increasing integration of satellite solutions into diverse sectors, from consumer electronics to critical infrastructure, underscores its indispensable role. Strategic opportunities abound in developing niche applications, enhancing user experience, and fostering greater accessibility to satellite services. The industry is poised for sustained and significant growth, driven by the fundamental human and industrial need for ubiquitous and reliable communication.

Portable Satellite Communication Industry Segmentation

-

1. Service

- 1.1. Voice

- 1.2. Data

-

2. End-User Industry

- 2.1. Maritime

- 2.2. Enterprise

- 2.3. Aviation

- 2.4. Government

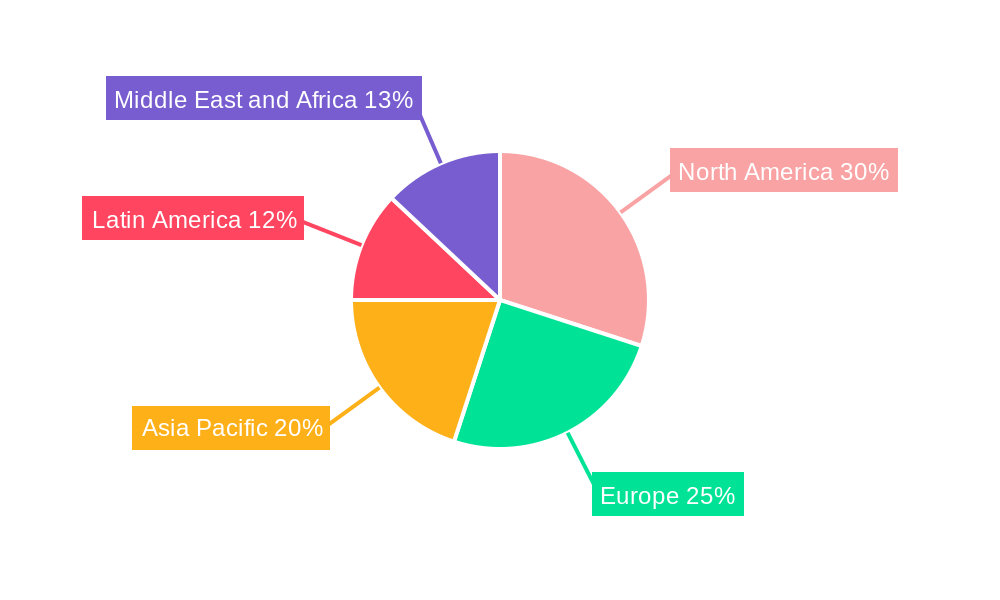

Portable Satellite Communication Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Portable Satellite Communication Industry Regional Market Share

Geographic Coverage of Portable Satellite Communication Industry

Portable Satellite Communication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Integration Demands for Satellite and Terrestrial Mobile Technology; Growing Interest from Government and Military

- 3.3. Market Restrains

- 3.3.1. Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology

- 3.4. Market Trends

- 3.4.1. Voice Service Segment is expected to register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Voice

- 5.1.2. Data

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Maritime

- 5.2.2. Enterprise

- 5.2.3. Aviation

- 5.2.4. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Voice

- 6.1.2. Data

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Maritime

- 6.2.2. Enterprise

- 6.2.3. Aviation

- 6.2.4. Government

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Voice

- 7.1.2. Data

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Maritime

- 7.2.2. Enterprise

- 7.2.3. Aviation

- 7.2.4. Government

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Voice

- 8.1.2. Data

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Maritime

- 8.2.2. Enterprise

- 8.2.3. Aviation

- 8.2.4. Government

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Voice

- 9.1.2. Data

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Maritime

- 9.2.2. Enterprise

- 9.2.3. Aviation

- 9.2.4. Government

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Voice

- 10.1.2. Data

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Maritime

- 10.2.2. Enterprise

- 10.2.3. Aviation

- 10.2.4. Government

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ViaSat UK Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iridium Communications Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ORBCOMM Europe Holding BV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intelsat S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inmarsat PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ericsson Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Globalstar Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thuraya Telecommunications Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EchoStar Mobile Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ViaSat UK Limited

List of Figures

- Figure 1: Global Portable Satellite Communication Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Latin America Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Latin America Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Latin America Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Latin America Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 27: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Portable Satellite Communication Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 9: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Satellite Communication Industry?

The projected CAGR is approximately 7.11%.

2. Which companies are prominent players in the Portable Satellite Communication Industry?

Key companies in the market include ViaSat UK Limited, Iridium Communications Inc, ORBCOMM Europe Holding BV, Intelsat S A, Inmarsat PLC, Ericsson Inc, Globalstar Inc, Thuraya Telecommunications Company, EchoStar Mobile Limited.

3. What are the main segments of the Portable Satellite Communication Industry?

The market segments include Service, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Integration Demands for Satellite and Terrestrial Mobile Technology; Growing Interest from Government and Military.

6. What are the notable trends driving market growth?

Voice Service Segment is expected to register a Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology.

8. Can you provide examples of recent developments in the market?

June 2023: To establish better communication with vessels in the sea and monitor Indian waters more efficiently, NewSpace India Ltd, the commercial arm of the Indian Space Research Organisation (ISRO), is setting up mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 coastal states. In order to set up maritime ship communication and support systems for monitoring, control, and surveillance in marine fishing vessels, NewSpace India has initiated a selection of private contractors that would supply, install, and commission MSS terminals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable Satellite Communication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable Satellite Communication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable Satellite Communication Industry?

To stay informed about further developments, trends, and reports in the Portable Satellite Communication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence