Key Insights

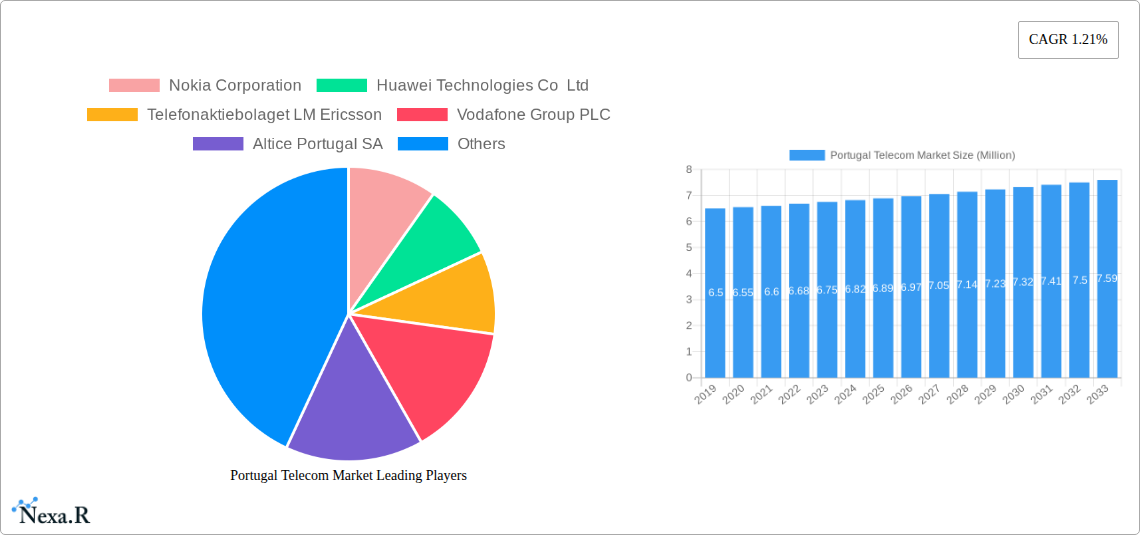

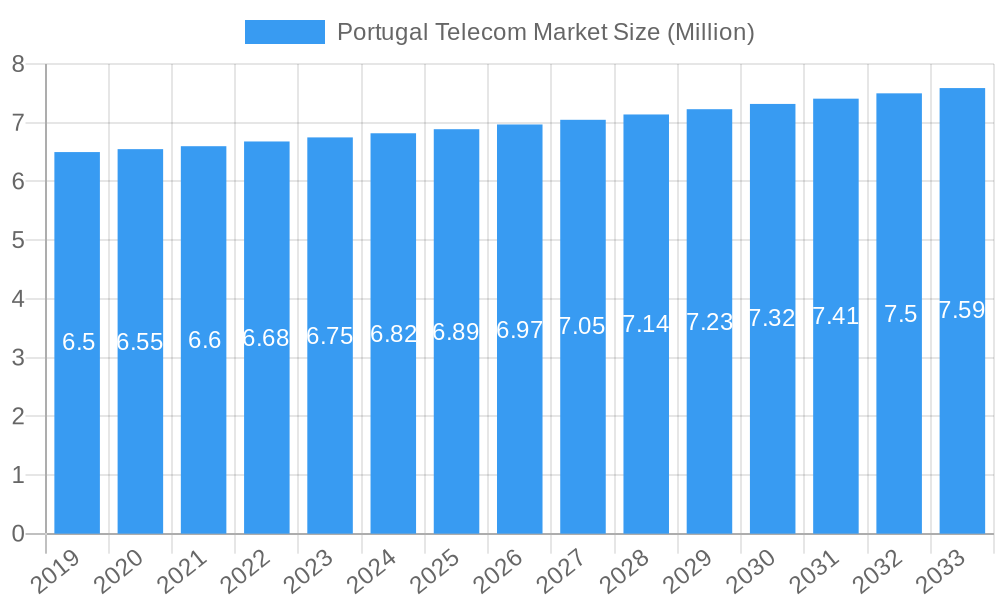

The Portugal Telecom Market is projected to reach 6.89 Million in value by 2025, exhibiting a compound annual growth rate (CAGR) of 1.21% from 2019 to 2033. This steady but modest expansion is underpinned by consistent demand for core telecommunications services and evolving consumer preferences. Key drivers fueling this growth include the ongoing digital transformation across various industries, increasing penetration of smartphones and connected devices, and the continuous need for reliable broadband internet access for both personal and professional use. Furthermore, the burgeoning demand for high-definition content and interactive digital experiences is stimulating growth in the Over-The-Top (OTT) and Pay-TV segments, pushing operators to enhance their network infrastructure and service offerings.

Portugal Telecom Market Market Size (In Million)

Despite the overall positive trajectory, the market faces certain restraints, primarily stemming from intense competition among established players, including telecommunication giants and emerging service providers. This competitive landscape necessitates significant investments in network upgrades, particularly in fiber optic expansion and 5G deployment, which can strain profitability margins. Additionally, regulatory complexities and the need for substantial capital expenditure for infrastructure development represent ongoing challenges. However, the market is actively adapting through strategic alliances, service diversification, and a focus on customer experience, particularly within the Voice Services (Wired and Wireless), Data, and OTT/Pay-TV segments, to navigate these obstacles and capitalize on emerging opportunities.

Portugal Telecom Market Company Market Share

This in-depth report provides a holistic analysis of the dynamic Portugal telecom market. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report delves into market dynamics, growth trends, dominant segments, product landscapes, key drivers, barriers, emerging opportunities, and the strategic moves of key players. It offers quantitative insights, including market share percentages and M&A deal volumes (where applicable), alongside qualitative factors, to equip industry professionals with actionable intelligence for strategic decision-making. All values are presented in millions.

Portugal Telecom Market Market Dynamics & Structure

The Portugal telecom market exhibits a moderately concentrated structure, characterized by the presence of established giants and agile new entrants. Technological innovation remains a primary driver, with significant investments in 5G infrastructure and fiber optic networks reshaping service delivery and consumer expectations. Regulatory frameworks, while supportive of infrastructure development, also influence competitive dynamics and pricing strategies. The market grapples with the challenge of competitive product substitutes, primarily from Over-the-Top (OTT) services, which necessitate continuous innovation in core telecom offerings. End-user demographics are evolving, with increasing demand for high-speed data, seamless connectivity, and integrated entertainment packages. Merger and acquisition (M&A) trends are present, albeit less pronounced, often focusing on consolidation of services or expansion into niche markets.

- Market Concentration: Dominated by a few major players, with increasing competition from new entrants focusing on specific services or price points.

- Technological Innovation Drivers: Pervasive adoption of 5G, expansion of fiber optic networks, and integration of Artificial Intelligence (AI) for network management and customer service.

- Regulatory Frameworks: Favorable policies for 5G spectrum allocation and infrastructure deployment, balanced with consumer protection regulations.

- Competitive Product Substitutes: Growing threat from OTT communication and entertainment platforms, pushing traditional operators to bundle services and enhance value propositions.

- End-User Demographics: Shifting consumer preferences towards mobile-first, high-bandwidth data consumption, and bundled digital services.

- M&A Trends: Targeted acquisitions for service diversification or market penetration, with limited large-scale consolidation.

Portugal Telecom Market Growth Trends & Insights

The Portugal telecom market is poised for robust growth, driven by an increasing demand for high-speed connectivity and a robust digital transformation across industries. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) from xx Million in the historical period to an estimated xx Million by 2033. Adoption rates for advanced services like 5G and fiber optic broadband are accelerating, fueled by government initiatives promoting digital inclusion and by telecom operators' proactive infrastructure rollouts. Technological disruptions, such as the widespread implementation of standalone 5G and the continued evolution of cloud-based services, are fundamentally altering the service landscape. Consumer behavior is shifting significantly, with an increasing reliance on digital platforms for communication, entertainment, and essential services. This necessitates operators to focus on customer experience, personalized offerings, and flexible service plans. The increasing penetration of smartphones and the proliferation of connected devices further contribute to the surge in data consumption, creating new revenue streams from data services and value-added applications. Moreover, the growing adoption of Internet of Things (IoT) solutions across various sectors, from smart cities to industrial automation, presents a significant growth avenue for telecom providers. The ongoing evolution of the digital economy in Portugal, supported by favorable economic conditions and a skilled workforce, acts as a critical enabler for sustained market expansion. As the country continues to embrace digital transformation, the demand for reliable, high-performance telecommunication services will only intensify, solidifying its position as a key growth market in Europe.

Dominant Regions, Countries, or Segments in Portugal Telecom Market

The Data and OTT and PayTV Services segment stands out as the dominant force driving growth within the Portugal telecom market. This supremacy is underpinned by a confluence of factors, including evolving consumer lifestyles, advancements in digital content delivery, and the increasing integration of telecommunications with entertainment and information platforms. As the digital economy flourishes, the demand for seamless, high-speed data connectivity has become paramount. This fuels the adoption of advanced mobile and fixed broadband services, which are the bedrock for accessing a vast array of online content and services.

- Market Share Dominance: The Data and OTT and PayTV Services segment is estimated to hold a substantial market share, projected to reach xx Million by 2033, demonstrating a consistent upward trajectory throughout the forecast period. This segment's growth is significantly outperforming traditional voice services.

- Key Drivers of Dominance:

- Ubiquitous Smartphone Penetration: The high adoption of smartphones in Portugal acts as a primary catalyst, enabling widespread access to mobile data services and a multitude of online applications.

- Growing Demand for Streaming Content: The increasing popularity of Over-the-Top (OTT) platforms for video streaming, music, and gaming has created an insatiable appetite for robust data infrastructure. This directly benefits telecom operators offering competitive data plans and high-speed connectivity.

- Fiber Optic Network Expansion: Significant investments in fiber optic infrastructure, particularly in urban and suburban areas, are providing the high bandwidth necessary for delivering premium data and PayTV experiences, further solidifying the segment's growth.

- Bundled Service Offerings: Telecom operators are increasingly bundling data services with PayTV packages and other digital content, creating attractive propositions for consumers and enhancing customer loyalty within this segment.

- Digital Transformation in Businesses: The ongoing digital transformation across various industries in Portugal necessitates enhanced data capabilities, driving demand for business-grade data solutions and cloud-based services.

- Technological Advancements in Content Delivery: Innovations in video compression, high-definition streaming (4K, 8K), and immersive technologies are pushing the boundaries of content consumption, requiring more sophisticated data infrastructure and driving segment growth.

- Economic Policies Favoring Digitalization: Government initiatives and economic policies aimed at fostering a digital economy indirectly support the growth of data-intensive services by encouraging infrastructure development and digital literacy.

The sustained growth and adoption rates within this segment indicate its central role in the future of the Portuguese telecommunications landscape.

Portugal Telecom Market Product Landscape

The Portugal telecom market's product landscape is characterized by a strong emphasis on high-speed connectivity solutions and integrated digital service packages. Leading innovations include the widespread deployment of 5G standalone networks, offering significantly enhanced speeds, lower latency, and greater capacity, enabling advanced applications such as enhanced mobile broadband, mission-critical communications, and massive IoT deployments. Fiber optic broadband services continue to expand, providing symmetrical download and upload speeds crucial for demanding applications like high-definition video conferencing, cloud gaming, and professional content creation. Furthermore, telecom operators are actively developing and offering bundled packages that integrate voice, data, OTT entertainment services, and PayTV, providing a comprehensive digital lifestyle solution for consumers. Performance metrics for these services are continuously improving, with average mobile download speeds exceeding xx Mbps and fixed broadband speeds reaching xx Gbps in deployed areas.

Key Drivers, Barriers & Challenges in Portugal Telecom Market

Key Drivers:

- Technological Advancements: The ongoing rollout and optimization of 5G technology and the expansion of fiber optic infrastructure are fundamental drivers, enabling higher speeds, lower latency, and new service possibilities.

- Increasing Data Consumption: A growing demand for video streaming, online gaming, and digital services fuels the need for more robust and accessible data plans.

- Digital Transformation Initiatives: Government and private sector efforts to digitize the economy and improve digital inclusion create a favorable environment for telecom service adoption.

- Competitive Landscape: Intense competition among operators spurs innovation and leads to more attractive pricing and service bundles for consumers.

Barriers & Challenges:

- High Infrastructure Investment Costs: The significant capital expenditure required for deploying advanced network technologies like 5G and widespread fiber optics presents a substantial financial barrier.

- Regulatory Hurdles and Spectrum Allocation: Navigating complex regulatory frameworks and securing adequate spectrum can slow down deployment and increase operational costs.

- Cybersecurity Threats: The increasing reliance on digital services heightens vulnerability to cyberattacks, requiring continuous investment in security measures.

- Price Sensitivity and Market Saturation: In certain segments, market saturation and price sensitivity among consumers can limit revenue growth and profit margins.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of essential network equipment.

Emerging Opportunities in Portugal Telecom Market

Emerging opportunities in the Portugal telecom market lie in the expansion of Internet of Things (IoT) solutions across various sectors, including smart cities, agriculture, and healthcare, creating demand for specialized connectivity and data management services. The growing adoption of edge computing and network function virtualization (NFV) presents avenues for service providers to offer enhanced performance and lower latency for business-critical applications. Furthermore, the continued evolution of Over-the-Top (OTT) services, coupled with a desire for integrated entertainment and communication experiences, opens doors for telcos to develop more sophisticated content partnerships and bundled offerings. The untapped potential in rural areas for high-speed broadband access also represents a significant opportunity for market expansion and digital inclusion initiatives.

Growth Accelerators in the Portugal Telecom Market Industry

Catalysts driving long-term growth in the Portugal telecom market include the continued aggressive expansion of 5G standalone networks, which will unlock new revenue streams through enhanced mobile broadband and low-latency applications. Strategic partnerships between telecom operators, content providers, and technology enablers are crucial for developing innovative bundled services and immersive experiences. Furthermore, a focused approach on expanding high-speed fiber optic coverage into underserved regions will not only drive market penetration but also contribute to the nation's digital divide reduction. The increasing adoption of cloud-based solutions and the development of edge computing capabilities will also be instrumental in supporting the evolving needs of businesses and consumers alike.

Key Players Shaping the Portugal Telecom Market Market

- Nokia Corporation

- Huawei Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- Vodafone Group PLC

- Altice Portugal SA

- Verizon Communications Inc

- NOWO

- Teleperformance SE

- MEO

- Foundever

Notable Milestones in Portugal Telecom Market Sector

- March 2024: Telecoms company Digi, a company of Romanian origins, announced plans to launch its first telecommunications offer in Portugal. The telecoms operator has also revealed that it intends to provide fixed and mobile services, namely 5G Fibre Optic.

- November 2023: NOS, in partnership with Nokia, launched its 5G standalone network in Portugal. The operator reports having more than 4,200 5G base stations, covering over 93% of the Portuguese population.

In-Depth Portugal Telecom Market Market Outlook

The Portugal telecom market is projected for sustained growth, propelled by ongoing investments in cutting-edge infrastructure such as 5G and fiber optics. Future market potential is significantly enhanced by the increasing demand for data-intensive services, including high-definition streaming and cloud-based applications. Strategic opportunities are abundant in the development of IoT solutions for smart cities and industries, alongside the provision of enhanced cybersecurity and edge computing capabilities. The continued integration of telecommunications with entertainment and essential digital services will further solidify the market's expansion, positioning Portugal as a leading digital economy in Europe.

Portugal Telecom Market Segmentation

-

1. Servi

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Portugal Telecom Market Segmentation By Geography

- 1. Portugal

Portugal Telecom Market Regional Market Share

Geographic Coverage of Portugal Telecom Market

Portugal Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G Network across the Nation; Agile digital Transformation across Industries

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G Network across the Nation; Agile digital Transformation across Industries

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fixed Broadband Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Servi

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by Servi

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nokia Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Huawei Technologies Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telefonaktiebolaget LM Ericsson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vodafone Group PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Altice Portugal SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verizon Communications Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NOWO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teleperformance SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MEO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Foundever*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nokia Corporation

List of Figures

- Figure 1: Portugal Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Portugal Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Portugal Telecom Market Revenue Million Forecast, by Servi 2020 & 2033

- Table 2: Portugal Telecom Market Volume Billion Forecast, by Servi 2020 & 2033

- Table 3: Portugal Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Portugal Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Portugal Telecom Market Revenue Million Forecast, by Servi 2020 & 2033

- Table 6: Portugal Telecom Market Volume Billion Forecast, by Servi 2020 & 2033

- Table 7: Portugal Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Portugal Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal Telecom Market?

The projected CAGR is approximately 1.21%.

2. Which companies are prominent players in the Portugal Telecom Market?

Key companies in the market include Nokia Corporation, Huawei Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Vodafone Group PLC, Altice Portugal SA, Verizon Communications Inc, NOWO, Teleperformance SE, MEO, Foundever*List Not Exhaustive.

3. What are the main segments of the Portugal Telecom Market?

The market segments include Servi.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G Network across the Nation; Agile digital Transformation across Industries.

6. What are the notable trends driving market growth?

Rising Demand for Fixed Broadband Services.

7. Are there any restraints impacting market growth?

Rising Demand for 5G Network across the Nation; Agile digital Transformation across Industries.

8. Can you provide examples of recent developments in the market?

March 2024: Telecoms company Digi, a company of Romanian origins, announced plans to launch its first telecommunications offer in Portugal. The telecoms operator has also revealed that it intends to provide fixed and mobile services, namely 5G Fibre Optic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal Telecom Market?

To stay informed about further developments, trends, and reports in the Portugal Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence