Key Insights

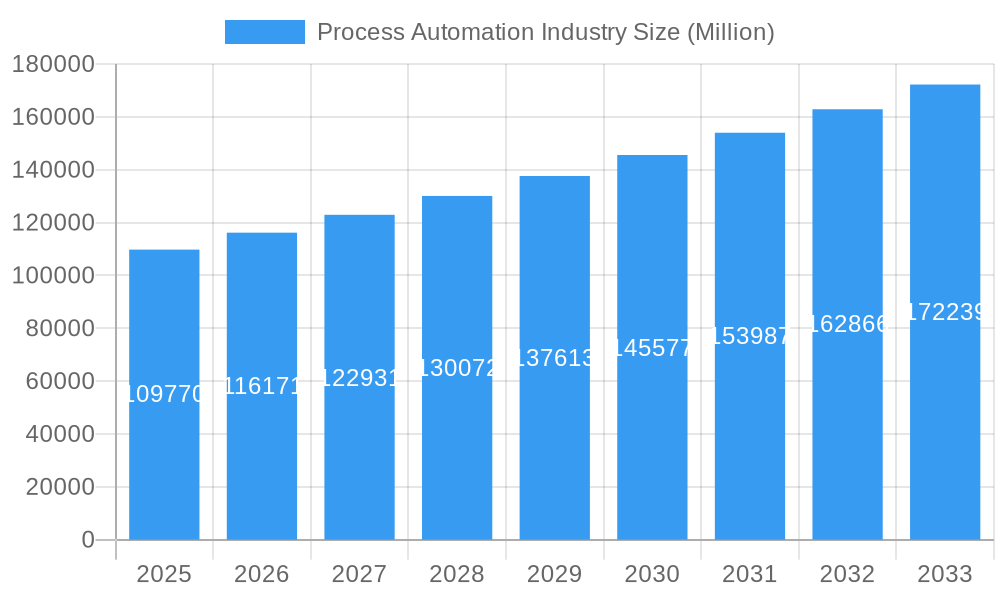

The global Process Automation Industry is poised for significant expansion, with a current market size estimated at USD 109.77 billion in 2025. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 5.82% through 2033, signifying a dynamic and expanding market. The industry's expansion is propelled by an increasing demand for enhanced operational efficiency, stringent regulatory compliance, and the integration of advanced technologies such as the Industrial Internet of Things (IIoT) and Artificial Intelligence (AI). Key drivers include the perpetual need for cost reduction, improved product quality, and the imperative to minimize environmental impact across various manufacturing and processing sectors. The rising adoption of automation in energy-intensive industries like Oil & Gas and Energy & Utilities, alongside the pharmaceutical and food & beverage sectors, is further fueling this growth trajectory.

Process Automation Industry Market Size (In Billion)

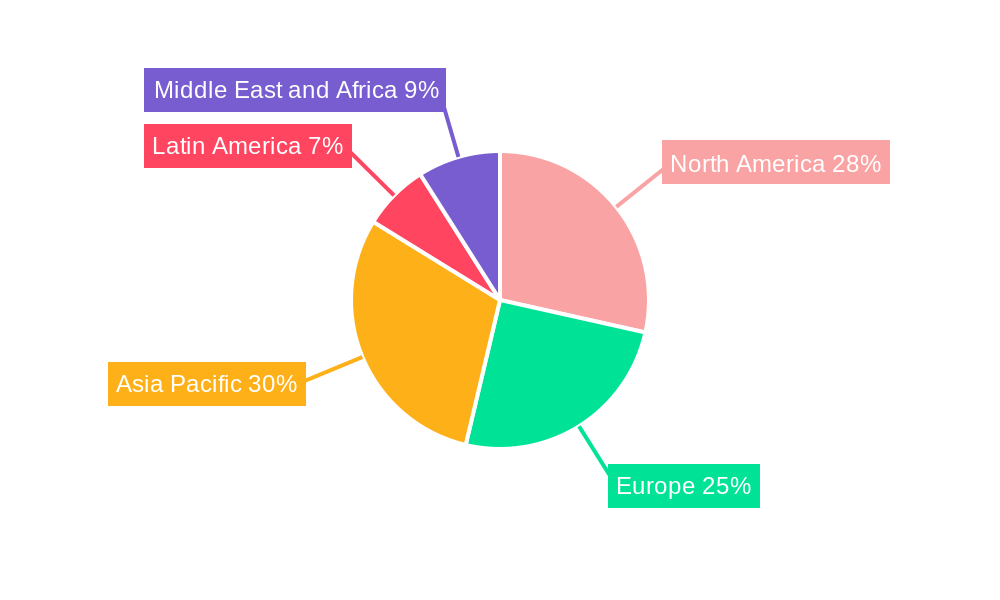

The market is segmented into critical system types, with Supervisory Control and Data Acquisition (SCADA), Programmable Logic Controllers (PLC), and Distributed Control Systems (DCS) forming the foundational pillars of process automation. These are complemented by Machine Execution Systems (MES), Valves and Actuators, Electric Motors, Human Machine Interfaces (HMI), Process Safety Systems, and Sensors and Transmitters, all contributing to a comprehensive automation ecosystem. Communication protocols, encompassing both Wired and Wireless, are vital for seamless data exchange. Geographically, North America and Asia Pacific are expected to lead market growth due to substantial investments in industrial upgrades and the presence of key manufacturing hubs. Key players like Honeywell International Inc., ABB Ltd., Siemens Corporation, and Emerson Electric Co. are at the forefront, innovating and expanding their offerings to cater to the evolving demands of industries such as Chemical and Petrochemical, Water and Wastewater Treatment, and Paper and Pulp.

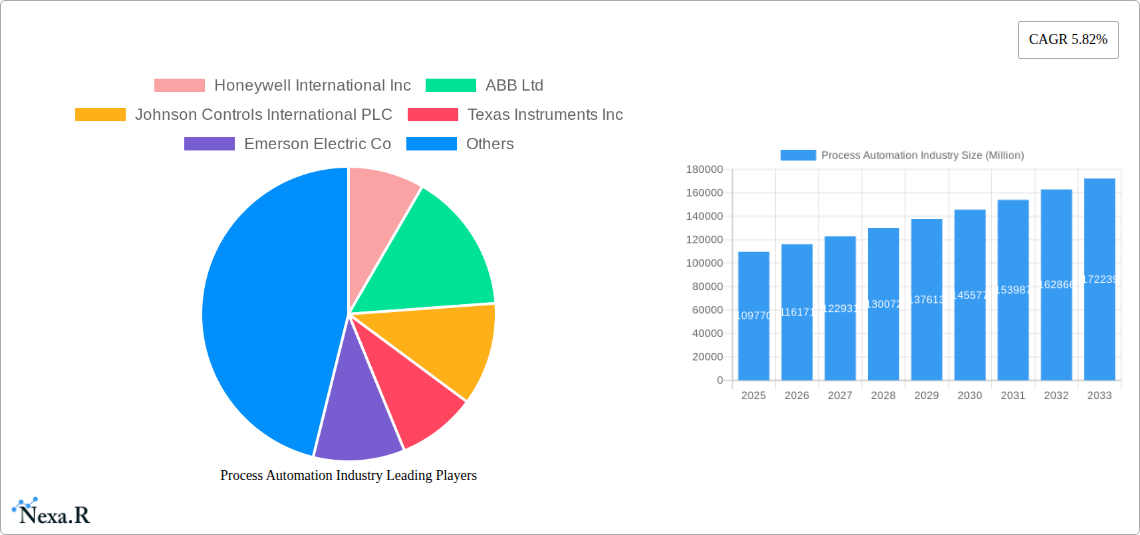

Process Automation Industry Company Market Share

Here is a comprehensive, SEO-optimized report description for the Process Automation Industry, designed for immediate use without modification:

Process Automation Industry Market Dynamics & Structure

The global Process Automation Industry is characterized by a moderately concentrated market structure, with key players like Honeywell International Inc, ABB Ltd, Johnson Controls International PLC, Texas Instruments Inc, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric SE, Eaton Corporation PLC, Siemens Corporation, Rockwell Automation Inc, Bosch Rexroth AG (Robert Bosch GmBH), Dassault Systemes SE, and Yokogawa Electric Corporation holding significant market share. Technological innovation is a primary driver, fueled by advancements in AI, IoT, and cloud computing, enabling more sophisticated control and data analysis. Stringent regulatory frameworks, particularly concerning safety and environmental compliance in industries like Chemical and Petrochemical, Oil and Gas, and Pharmaceutical, are also shaping market dynamics. Competitive product substitutes are emerging, though they often focus on niche applications rather than complete replacements for established Supervisory Control and Data Acquisition (SCADA), Programmable Logic Controller (PLC), and Distributed Control System (DCS) solutions. End-user demographics are shifting towards digital transformation initiatives and a demand for greater operational efficiency and sustainability across sectors such as Energy and Utilities, Water and Wastewater Treatment, and Food and Beverages. Mergers and acquisitions (M&A) trends are active, as larger entities seek to expand their portfolios and technological capabilities, with an estimated XX M&A deal volumes recorded in the historical period. Innovation barriers include the high cost of implementation and integration, as well as the need for specialized expertise.

Process Automation Industry Growth Trends & Insights

The Process Automation Industry is poised for robust growth, projected to reach a market size of approximately $XXX Billion by 2033, expanding from an estimated $XX Billion in 2025. This growth trajectory is driven by an increasing adoption rate of advanced automation solutions across diverse end-user industries. The relentless pace of technological disruption, including the proliferation of Industrial Internet of Things (IIoT) devices, edge computing, and sophisticated analytics, is fundamentally reshaping operational paradigms. Consumer behavior shifts are manifesting as a heightened demand for enhanced product quality, reduced operational costs, and improved sustainability. These factors are compelling businesses to invest in process automation to achieve greater precision, efficiency, and predictive maintenance capabilities. The Compound Annual Growth Rate (CAGR) is estimated to be XX% during the forecast period of 2025–2033, indicating a sustained expansionary phase. Market penetration is deepening, particularly in emerging economies where industrialization is rapidly advancing. The integration of AI-powered algorithms for real-time decision-making and optimization is becoming a standard expectation, further accelerating the adoption of intelligent automation systems. Furthermore, the increasing focus on cybersecurity within industrial environments is driving the demand for integrated process safety systems and secure communication protocols. The evolution from basic automation to more intelligent and connected solutions is a defining trend, promising significant market expansion and value creation for stakeholders.

Dominant Regions, Countries, or Segments in Process Automation Industry

The Energy and Utilities sector stands out as a dominant end-user industry driving growth in the global Process Automation Industry, with an estimated market share of XX% in 2025. This dominance is attributed to the critical need for reliable, efficient, and safe operations in power generation, transmission, and distribution, as well as in water and wastewater management. Leading countries within this segment include the United States, Germany, China, and Japan, where significant investments in upgrading aging infrastructure and adopting smart grid technologies are prevalent. From a system type perspective, Supervisory Control and Data Acquisition (SCADA) and Distributed Control Systems (DCS) are leading the charge, providing the backbone for large-scale industrial operations. The Chemical and Petrochemical industry is also a significant contributor, driven by stringent process control requirements and the demand for optimized production yields.

Key drivers for dominance include:

- Economic Policies: Government initiatives promoting industrial modernization and energy efficiency.

- Infrastructure Development: Extensive investments in building and upgrading power plants, water treatment facilities, and petrochemical complexes.

- Technological Advancements: Early and widespread adoption of advanced sensors and transmitters, programmable logic controllers (PLCs), and human-machine interfaces (HMIs) tailored for complex industrial environments.

- Market Share Growth Potential: The continuous need for process optimization, safety enhancements, and regulatory compliance in these core industries ensures sustained demand. For instance, the Energy and Utilities segment is projected to grow at a CAGR of XX% through 2033.

From a communication protocol standpoint, Wired Protocol continues to be dominant due to its reliability in industrial settings, though Wireless Protocol adoption is rapidly increasing, particularly for remote monitoring and IIoT applications. The Oil and Gas industry, alongside Pharmaceuticals, also represent substantial market segments, each with specific automation needs driven by safety, precision, and regulatory demands.

Process Automation Industry Product Landscape

The Process Automation Industry is witnessing a surge in product innovations focused on enhancing operational efficiency, safety, and connectivity. Advanced Sensors and Transmitters are offering higher precision and real-time data analytics, crucial for optimizing processes in the Chemical and Petrochemical and Pharmaceutical sectors. Programmable Logic Controllers (PLCs) are becoming more powerful and scalable, supporting complex logic and faster processing for demanding applications in Energy and Utilities. Distributed Control Systems (DCS) are increasingly integrated with AI and machine learning capabilities, enabling predictive maintenance and autonomous control. The development of user-friendly Human Machine Interfaces (HMIs) with intuitive graphical displays is improving operator interaction and reducing the potential for human error. Furthermore, the rise of the Industrial Internet of Things (IIoT) is driving the integration of various automation components, creating a more interconnected and intelligent industrial ecosystem.

Key Drivers, Barriers & Challenges in Process Automation Industry

Key Drivers:

- Demand for Operational Efficiency and Cost Reduction: Automation significantly reduces manual labor costs, minimizes errors, and optimizes resource utilization.

- Increasing Focus on Safety and Regulatory Compliance: Stringent industry regulations and a growing emphasis on worker and environmental safety are driving the adoption of advanced process safety systems.

- Technological Advancements (IIoT, AI, Cloud Computing): The integration of these technologies enhances data analysis, predictive capabilities, and remote monitoring, leading to smarter operations.

- Industry 4.0 and Digital Transformation Initiatives: Companies are investing in automation to achieve greater agility, scalability, and data-driven decision-making.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of implementing sophisticated automation systems can be a significant barrier for small and medium-sized enterprises.

- Integration Complexity: Integrating new automation systems with existing legacy infrastructure can be challenging and time-consuming.

- Skill Gap: A shortage of skilled personnel capable of designing, implementing, and maintaining advanced automation systems poses a significant challenge.

- Cybersecurity Concerns: The increasing connectivity of industrial systems raises concerns about cyber threats, requiring robust security measures. Supply chain disruptions for critical components have also impacted project timelines, with an estimated XX% delay in some deployments.

Emerging Opportunities in Process Automation Industry

Emerging opportunities in the Process Automation Industry lie in the burgeoning demand for smart manufacturing solutions and the application of AI in predictive maintenance. The expansion of the Wireless Protocol for IIoT devices presents a significant avenue for growth, enabling more flexible and scalable deployments. Untapped markets in developing economies, particularly in Asia-Pacific and Africa, offer substantial growth potential as these regions industrialize. Innovative applications in the Food and Beverages sector, focusing on traceability and quality control, are creating new product development opportunities. Furthermore, the increasing focus on sustainability and circular economy principles is driving demand for automation solutions that optimize resource usage and minimize waste across industries like Water and Wastewater Treatment. The development of low-code/no-code automation platforms is also democratizing access to automation technologies, opening doors for a wider range of businesses.

Growth Accelerators in the Process Automation Industry Industry

Several factors are acting as significant growth accelerators for the Process Automation Industry. The ongoing digital transformation across all major end-user industries, including Energy and Utilities, Chemical and Petrochemical, and Pharmaceutical, necessitates the adoption of advanced automation to enhance competitiveness and efficiency. Technological breakthroughs in areas like machine learning algorithms for real-time process optimization and the increasing miniaturization and affordability of sensors are driving innovation and adoption. Strategic partnerships between automation providers and software developers are fostering the creation of integrated solutions that offer end-to-end capabilities. Market expansion strategies, particularly in emerging economies, are also fueling growth, as global players establish a stronger presence to cater to local industrial demands. The growing emphasis on predictive maintenance, powered by AI and Big Data analytics, is another key accelerator, promising significant cost savings and operational uptime improvements.

Key Players Shaping the Process Automation Industry Market

- Honeywell International Inc

- ABB Ltd

- Johnson Controls International PLC

- Texas Instruments Inc

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Eaton Corporation PLC

- Siemens Corporation

- Rockwell Automation Inc

- Bosch Rexroth AG (Robert Bosch GmBH)

- Dassault Systemes SE

- Yokogawa Electric Corporation

Notable Milestones in Process Automation Industry Sector

- 2019: Rockwell Automation acquires Kalypso, a digital transformation consultancy, to enhance its smart manufacturing offerings.

- 2020: Siemens launches its new generation of SIMATIC controllers, offering advanced performance and connectivity for industrial automation.

- 2021: Emerson Electric Co. acquires ProMax, a leader in powder processing technology, expanding its portfolio for the pharmaceutical and food industries.

- 2022: ABB announces its acquisition of Codian Robotics, strengthening its robotics portfolio for intricate industrial tasks.

- 2023: Schneider Electric launches its EcoStruxure Automation Expert V2, a new generation of industrial automation software.

- 2024: Honeywell International Inc. introduces new AI-powered analytics for its Experion PKS control system, enhancing operational insights.

- 2025 (Estimated): Increased adoption of edge computing for real-time data processing in remote industrial locations.

- 2026 (Estimated): Significant advancements in cybersecurity solutions specifically designed for OT (Operational Technology) environments.

- 2027 (Estimated): Wider integration of digital twins for process simulation and optimization across diverse industries.

- 2028 (Estimated): Emergence of highly autonomous control systems in select highly regulated industries.

- 2029 (Estimated): Greater emphasis on sustainable automation solutions driving energy efficiency and waste reduction.

- 2030 (Estimated): Broader adoption of wireless communication protocols for real-time data acquisition in challenging environments.

- 2031 (Estimated): Increased use of augmented reality (AR) for remote assistance and operator training.

- 2032 (Estimated): Standardization efforts for inter-operability between different automation platforms.

- 2033 (Estimated): Full realization of Industry 5.0 concepts, emphasizing human-robot collaboration and personalized production.

In-Depth Process Automation Industry Market Outlook

The future of the Process Automation Industry is exceptionally promising, driven by ongoing digital transformation and the relentless pursuit of operational excellence. Growth accelerators such as pervasive IIoT adoption, AI-driven analytics for predictive maintenance, and the increasing demand for sustainable and energy-efficient operations will continue to fuel market expansion. Strategic partnerships and a focus on emerging markets in Asia-Pacific and Africa will unlock new avenues for growth. The industry is set to witness a paradigm shift towards more intelligent, autonomous, and interconnected systems, moving beyond traditional automation to truly smart manufacturing. The integration of advanced technologies will lead to enhanced productivity, reduced operational costs, and improved safety across a multitude of industrial sectors, solidifying process automation as a cornerstone of modern industry.

Process Automation Industry Segmentation

-

1. System Type

- 1.1. Supervisory Control and Data Acquisition (SCADA)

- 1.2. Programmable Logic Controller (PLC)

- 1.3. Distributed Control System (DCS)

- 1.4. Machine Execution System (MES)

- 1.5. Valves and Actuators

- 1.6. Electric Motors

- 1.7. Human Machine Interface (HMI)

- 1.8. Process Safety Systems

- 1.9. Sensors and Transmitters

- 1.10. Other Systems

-

2. Communication Protocol

- 2.1. Wired Protocol

- 2.2. Wireless Protocol

-

3. End-user Industry

- 3.1. Chemical and Petrochemical

- 3.2. Paper and Pulp

- 3.3. Water and Wastewater Treatment

- 3.4. Energy and Utilities

- 3.5. Oil and Gas

- 3.6. Pharmaceutical

- 3.7. Food and Beverages

- 3.8. Other End-user Industries

Process Automation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Process Automation Industry Regional Market Share

Geographic Coverage of Process Automation Industry

Process Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Adoption of Robotics; Growing Emphasis on Energy Efficiency and Cost Reduction; Emergence of IIoT; Demand for Safety Automation Systems

- 3.3. Market Restrains

- 3.3.1. High Up-front Installation Costs and Interoperability Issues; Unavailability for Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Paper and Pulp Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Process Automation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System Type

- 5.1.1. Supervisory Control and Data Acquisition (SCADA)

- 5.1.2. Programmable Logic Controller (PLC)

- 5.1.3. Distributed Control System (DCS)

- 5.1.4. Machine Execution System (MES)

- 5.1.5. Valves and Actuators

- 5.1.6. Electric Motors

- 5.1.7. Human Machine Interface (HMI)

- 5.1.8. Process Safety Systems

- 5.1.9. Sensors and Transmitters

- 5.1.10. Other Systems

- 5.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.2.1. Wired Protocol

- 5.2.2. Wireless Protocol

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Chemical and Petrochemical

- 5.3.2. Paper and Pulp

- 5.3.3. Water and Wastewater Treatment

- 5.3.4. Energy and Utilities

- 5.3.5. Oil and Gas

- 5.3.6. Pharmaceutical

- 5.3.7. Food and Beverages

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by System Type

- 6. North America Process Automation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System Type

- 6.1.1. Supervisory Control and Data Acquisition (SCADA)

- 6.1.2. Programmable Logic Controller (PLC)

- 6.1.3. Distributed Control System (DCS)

- 6.1.4. Machine Execution System (MES)

- 6.1.5. Valves and Actuators

- 6.1.6. Electric Motors

- 6.1.7. Human Machine Interface (HMI)

- 6.1.8. Process Safety Systems

- 6.1.9. Sensors and Transmitters

- 6.1.10. Other Systems

- 6.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 6.2.1. Wired Protocol

- 6.2.2. Wireless Protocol

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Chemical and Petrochemical

- 6.3.2. Paper and Pulp

- 6.3.3. Water and Wastewater Treatment

- 6.3.4. Energy and Utilities

- 6.3.5. Oil and Gas

- 6.3.6. Pharmaceutical

- 6.3.7. Food and Beverages

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by System Type

- 7. Europe Process Automation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System Type

- 7.1.1. Supervisory Control and Data Acquisition (SCADA)

- 7.1.2. Programmable Logic Controller (PLC)

- 7.1.3. Distributed Control System (DCS)

- 7.1.4. Machine Execution System (MES)

- 7.1.5. Valves and Actuators

- 7.1.6. Electric Motors

- 7.1.7. Human Machine Interface (HMI)

- 7.1.8. Process Safety Systems

- 7.1.9. Sensors and Transmitters

- 7.1.10. Other Systems

- 7.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 7.2.1. Wired Protocol

- 7.2.2. Wireless Protocol

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Chemical and Petrochemical

- 7.3.2. Paper and Pulp

- 7.3.3. Water and Wastewater Treatment

- 7.3.4. Energy and Utilities

- 7.3.5. Oil and Gas

- 7.3.6. Pharmaceutical

- 7.3.7. Food and Beverages

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by System Type

- 8. Asia Pacific Process Automation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System Type

- 8.1.1. Supervisory Control and Data Acquisition (SCADA)

- 8.1.2. Programmable Logic Controller (PLC)

- 8.1.3. Distributed Control System (DCS)

- 8.1.4. Machine Execution System (MES)

- 8.1.5. Valves and Actuators

- 8.1.6. Electric Motors

- 8.1.7. Human Machine Interface (HMI)

- 8.1.8. Process Safety Systems

- 8.1.9. Sensors and Transmitters

- 8.1.10. Other Systems

- 8.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 8.2.1. Wired Protocol

- 8.2.2. Wireless Protocol

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Chemical and Petrochemical

- 8.3.2. Paper and Pulp

- 8.3.3. Water and Wastewater Treatment

- 8.3.4. Energy and Utilities

- 8.3.5. Oil and Gas

- 8.3.6. Pharmaceutical

- 8.3.7. Food and Beverages

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by System Type

- 9. Latin America Process Automation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System Type

- 9.1.1. Supervisory Control and Data Acquisition (SCADA)

- 9.1.2. Programmable Logic Controller (PLC)

- 9.1.3. Distributed Control System (DCS)

- 9.1.4. Machine Execution System (MES)

- 9.1.5. Valves and Actuators

- 9.1.6. Electric Motors

- 9.1.7. Human Machine Interface (HMI)

- 9.1.8. Process Safety Systems

- 9.1.9. Sensors and Transmitters

- 9.1.10. Other Systems

- 9.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 9.2.1. Wired Protocol

- 9.2.2. Wireless Protocol

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Chemical and Petrochemical

- 9.3.2. Paper and Pulp

- 9.3.3. Water and Wastewater Treatment

- 9.3.4. Energy and Utilities

- 9.3.5. Oil and Gas

- 9.3.6. Pharmaceutical

- 9.3.7. Food and Beverages

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by System Type

- 10. Middle East and Africa Process Automation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by System Type

- 10.1.1. Supervisory Control and Data Acquisition (SCADA)

- 10.1.2. Programmable Logic Controller (PLC)

- 10.1.3. Distributed Control System (DCS)

- 10.1.4. Machine Execution System (MES)

- 10.1.5. Valves and Actuators

- 10.1.6. Electric Motors

- 10.1.7. Human Machine Interface (HMI)

- 10.1.8. Process Safety Systems

- 10.1.9. Sensors and Transmitters

- 10.1.10. Other Systems

- 10.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 10.2.1. Wired Protocol

- 10.2.2. Wireless Protocol

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Chemical and Petrochemical

- 10.3.2. Paper and Pulp

- 10.3.3. Water and Wastewater Treatment

- 10.3.4. Energy and Utilities

- 10.3.5. Oil and Gas

- 10.3.6. Pharmaceutical

- 10.3.7. Food and Beverages

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by System Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Johnson Controls International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Texas Instruments Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Electric Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eaton Corporation PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockwell Automation Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bosch Rexroth AG (Robert Bosch GmBH)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dassault Systemes SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Yokogawa Electric Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Process Automation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Process Automation Industry Revenue (Million), by System Type 2025 & 2033

- Figure 3: North America Process Automation Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 4: North America Process Automation Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 5: North America Process Automation Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 6: North America Process Automation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Process Automation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Process Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Process Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Process Automation Industry Revenue (Million), by System Type 2025 & 2033

- Figure 11: Europe Process Automation Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 12: Europe Process Automation Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 13: Europe Process Automation Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 14: Europe Process Automation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Process Automation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Process Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Process Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Process Automation Industry Revenue (Million), by System Type 2025 & 2033

- Figure 19: Asia Pacific Process Automation Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 20: Asia Pacific Process Automation Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 21: Asia Pacific Process Automation Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 22: Asia Pacific Process Automation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Process Automation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Process Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Process Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Process Automation Industry Revenue (Million), by System Type 2025 & 2033

- Figure 27: Latin America Process Automation Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 28: Latin America Process Automation Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 29: Latin America Process Automation Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 30: Latin America Process Automation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Process Automation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Process Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Process Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Process Automation Industry Revenue (Million), by System Type 2025 & 2033

- Figure 35: Middle East and Africa Process Automation Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 36: Middle East and Africa Process Automation Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 37: Middle East and Africa Process Automation Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 38: Middle East and Africa Process Automation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Process Automation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Process Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Process Automation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Process Automation Industry Revenue Million Forecast, by System Type 2020 & 2033

- Table 2: Global Process Automation Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 3: Global Process Automation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Process Automation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Process Automation Industry Revenue Million Forecast, by System Type 2020 & 2033

- Table 6: Global Process Automation Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 7: Global Process Automation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Process Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Process Automation Industry Revenue Million Forecast, by System Type 2020 & 2033

- Table 12: Global Process Automation Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 13: Global Process Automation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Process Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Process Automation Industry Revenue Million Forecast, by System Type 2020 & 2033

- Table 20: Global Process Automation Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 21: Global Process Automation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Process Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Process Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Process Automation Industry Revenue Million Forecast, by System Type 2020 & 2033

- Table 28: Global Process Automation Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 29: Global Process Automation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Process Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Process Automation Industry Revenue Million Forecast, by System Type 2020 & 2033

- Table 32: Global Process Automation Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 33: Global Process Automation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Process Automation Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Process Automation Industry?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the Process Automation Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Johnson Controls International PLC, Texas Instruments Inc, Emerson Electric Co, Mitsubishi Electric Corporation, Schneider Electric SE, Eaton Corporation PLC, Siemens Corporation, Rockwell Automation Inc, Bosch Rexroth AG (Robert Bosch GmBH), Dassault Systemes SE, Yokogawa Electric Corporation.

3. What are the main segments of the Process Automation Industry?

The market segments include System Type, Communication Protocol, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.77 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Adoption of Robotics; Growing Emphasis on Energy Efficiency and Cost Reduction; Emergence of IIoT; Demand for Safety Automation Systems.

6. What are the notable trends driving market growth?

Paper and Pulp Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

High Up-front Installation Costs and Interoperability Issues; Unavailability for Skilled Workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Process Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Process Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Process Automation Industry?

To stay informed about further developments, trends, and reports in the Process Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence