Key Insights

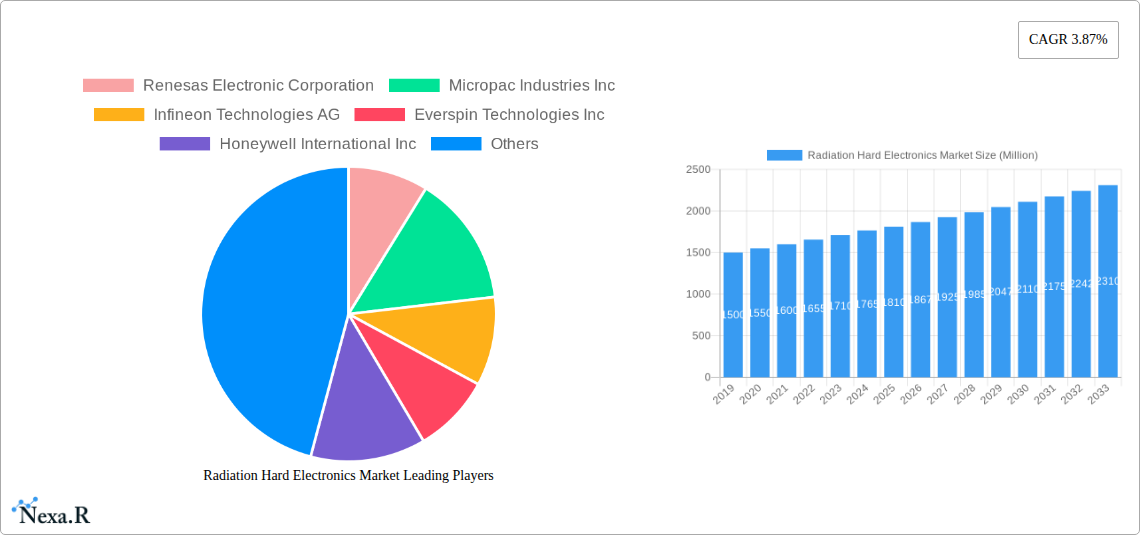

The global Radiation Hard Electronics market is poised for substantial expansion, projected to reach $1.81 Billion by 2025, exhibiting a compound annual growth rate (CAGR) of 3.87% through 2033. This growth is fundamentally driven by the escalating demand for reliable electronic components in environments characterized by high radiation levels. Key sectors fueling this market include the space industry, where satellites and deep-space probes require robust electronics to withstand cosmic radiation, and the aerospace and defense sector, necessitating radiation-hardened components for aircraft, missiles, and ground-based systems operating in challenging electromagnetic and radiation environments. The growing adoption of nuclear power plants for clean energy generation also contributes significantly, demanding specialized electronics resistant to ionizing radiation. Emerging trends such as the increasing complexity of space missions, the development of next-generation defense systems, and the expansion of space-based communication networks will further accelerate market adoption.

Radiation Hard Electronics Market Market Size (In Billion)

While the market demonstrates strong upward momentum, certain factors present challenges. The high cost associated with research, development, and manufacturing of radiation-hardened components can be a restraint, alongside the stringent qualification and testing processes required to ensure reliability. However, advancements in materials science and manufacturing techniques are gradually mitigating these cost pressures. The market segmentation reveals significant opportunities across various component types, including discrete components, sensors, integrated circuits, microcontrollers, microprocessors, and memory. These segments are crucial for building resilient electronic systems across diverse applications, from critical defense infrastructure to advanced scientific instruments for space exploration. Leading companies are actively investing in innovation to capture market share and address the evolving needs of these high-stakes industries.

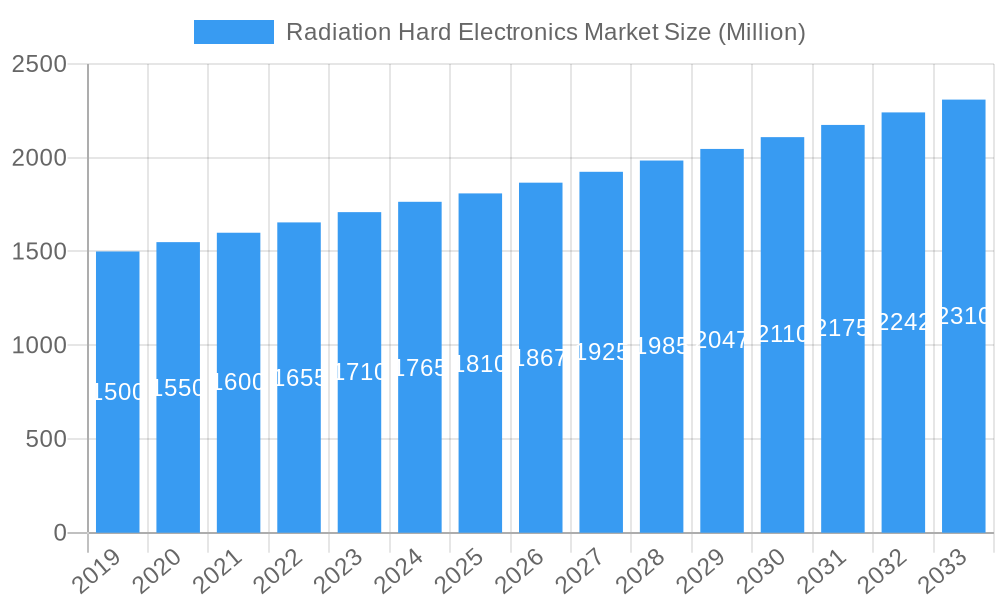

Radiation Hard Electronics Market Company Market Share

This comprehensive report offers an in-depth analysis of the Radiation Hard Electronics Market, a critical sector driven by the stringent demands of space exploration, aerospace and defense applications, and nuclear power plants. Explore the evolving landscape of radiation-hardened components, including discrete semiconductors, advanced sensors, integrated circuits (ICs), microcontrollers, microprocessors, and memory solutions. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period of 2025–2033, this report provides actionable insights into market dynamics, growth trends, and key players.

Keywords: Radiation Hard Electronics, Rad-Hard Electronics, Radiation Tolerant Electronics, Space Electronics, Aerospace Electronics, Defense Electronics, Nuclear Electronics, Microcontrollers, Integrated Circuits, Sensors, Memory, Discrete Semiconductors, High-Reliability Electronics, Space Grade Components, Radiation Hardened ICs, Microelectronics, Nanotechnology, Electronics Market.

Radiation Hard Electronics Market Market Dynamics & Structure

The Radiation Hard Electronics Market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Technological innovation remains the primary driver, fueled by the relentless pursuit of enhanced reliability and performance in extreme radiation environments. Key innovation drivers include the development of novel semiconductor materials and advanced packaging techniques to withstand ionizing radiation. Regulatory frameworks, particularly in the aerospace and defense sectors, mandate rigorous testing and qualification of radiation-hardened components, influencing product design and adoption. Competitive product substitutes, while limited in true radiation-hardened capabilities, often manifest in higher-cost, lower-radiation tolerance alternatives that might be considered for less critical applications. End-user demographics are heavily skewed towards government-funded programs in space, aerospace, and defense, with a growing presence in the nuclear power industry. Mergers and acquisitions (M&A) trends are driven by a desire to consolidate expertise, expand product portfolios, and secure critical supply chains. For instance, a notable M&A in recent years involved a leading aerospace company acquiring a specialized radiation-hardened component manufacturer to bolster its in-house capabilities, representing a significant market consolidation strategy.

- Market Concentration: Moderate to High, with key players dominating specific niches.

- Technological Innovation Drivers: Novel materials, advanced packaging, fault-tolerant architectures, miniaturization.

- Regulatory Frameworks: Stringent qualification standards (e.g., MIL-STD, JEDEC) across end-user segments.

- Competitive Product Substitutes: Higher-cost, non-radiation-hardened components for less demanding applications.

- End-User Demographics: Predominantly government agencies and contractors in space, defense, and nuclear sectors.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market reach.

Radiation Hard Electronics Market Growth Trends & Insights

The Radiation Hard Electronics Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is underpinned by increasing investments in space exploration initiatives, the modernization of defense systems, and the continued reliance on nuclear energy. The market size for radiation-hardened electronics, valued at USD XX Million in 2025, is anticipated to reach USD XX Million by 2033. Adoption rates for radiation-hardened components are accelerating across all key end-user segments as mission durations extend and operational environments become more challenging. Technological disruptions, such as the advent of novel semiconductor manufacturing processes and the integration of artificial intelligence for radiation effect prediction, are shaping the market. Consumer behavior shifts are less pronounced in this B2B market, but there's an increasing demand for higher performance, lower power consumption, and reduced form factors in radiation-hardened solutions. The market penetration of radiation-hardened electronics is steadily increasing as awareness of their criticality in preventing mission failures and ensuring personnel safety grows. For example, the development of advanced System-on-Chips (SoCs) specifically designed for space applications, offering integrated processing and memory capabilities with built-in radiation tolerance, is a significant trend. Furthermore, the increasing number of small satellite constellations is driving demand for cost-effective, yet reliable, radiation-hardened solutions. The total addressable market for radiation-hardened components is substantial, with ongoing research and development efforts continually pushing the boundaries of what is achievable in terms of radiation tolerance and operational lifespan.

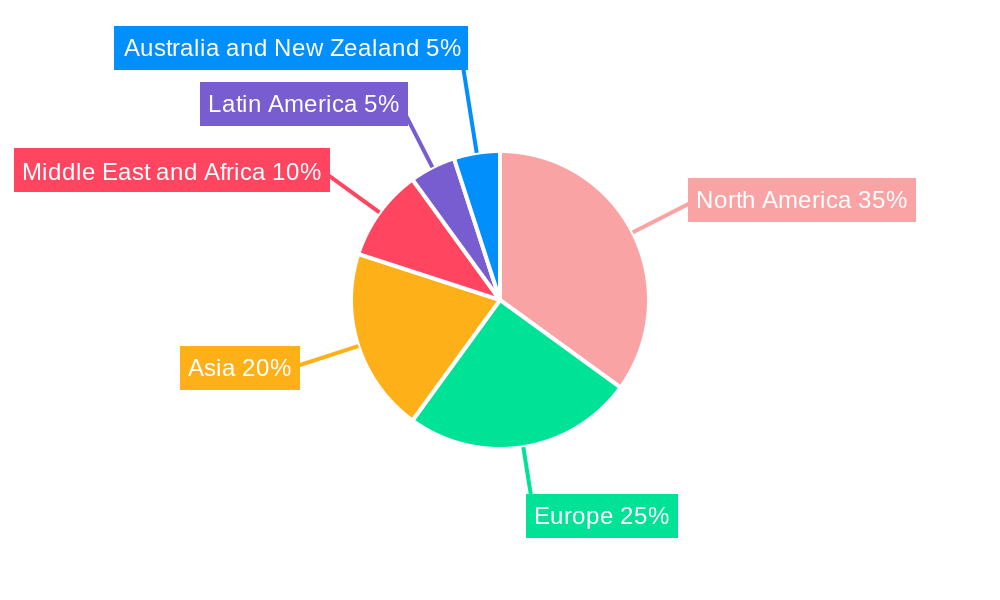

Dominant Regions, Countries, or Segments in Radiation Hard Electronics Market

The Space end-user segment is a dominant force driving growth in the Radiation Hard Electronics Market, exhibiting a significant market share of approximately XX% in 2025. This dominance stems from the inherently harsh radiation environments encountered in space, necessitating the use of highly reliable and radiation-hardened electronic components for satellites, spacecraft, and deep-space probes. Countries leading in space exploration, such as the United States and China, are major consumers and developers of these advanced electronics. Economic policies that foster investment in space programs and robust infrastructure for research and development contribute to this segment's leadership.

Within the Component segment, Integrated Circuits (ICs) are expected to hold the largest market share, estimated at XX% in 2025. This is due to the increasing complexity of electronic systems in space and defense applications, where integrated circuits perform critical functions ranging from computation and signal processing to data storage and communication. The miniaturization trend also favors ICs, allowing for smaller, lighter, and more power-efficient electronic payloads.

Dominant End-User Segment: Space

- Key Drivers: Extensive satellite deployment, deep-space missions, increasing reliance on space-based services, government funding for space exploration and national security.

- Market Share (2025): Approximately XX%

- Growth Potential: High, driven by megaconstellations and lunar/Martian exploration.

Dominant Component Segment: Integrated Circuits (ICs)

- Key Drivers: Demand for complex processing power, miniaturization, integration of multiple functions, advancements in semiconductor technology.

- Market Share (2025): Approximately XX%

- Growth Potential: High, with increasing sophistication of electronic warfare and communication systems.

Leading Region: North America, particularly the United States, due to its significant government investment in space, defense, and advanced technology research.

Radiation Hard Electronics Market Product Landscape

The Radiation Hard Electronics Market is witnessing continuous product innovation aimed at enhancing performance, reliability, and cost-effectiveness in high-radiation environments. Key advancements include the development of ultra-low power microcontrollers designed for long-duration missions and the introduction of novel memory solutions offering higher data retention in the face of radiation-induced bit flips. Radiation-hardened sensors are also seeing significant evolution, with improved sensitivity and accuracy under extreme conditions. Unique selling propositions often revolve around guaranteed radiation tolerance levels (e.g., up to 1000 Mrad), extended operational lifespans, and compliance with stringent industry standards. Technological advancements are focused on smaller process nodes, advanced packaging techniques like wafer-level chip-scale packaging, and the implementation of built-in error detection and correction mechanisms.

Key Drivers, Barriers & Challenges in Radiation Hard Electronics Market

Key Drivers:

- Increasing Space Exploration & Commercialization: Growing number of satellite launches for communication, Earth observation, and scientific research.

- Modernization of Defense Systems: Demand for resilient electronics in advanced weaponry, surveillance, and communication platforms.

- Nuclear Power Plant Safety & Longevity: Requirement for reliable components in harsh reactor environments.

- Technological Advancements: Continuous innovation in semiconductor materials and design for improved radiation tolerance.

Key Barriers & Challenges:

- High Development & Manufacturing Costs: Radiation hardening processes are complex and expensive, leading to premium pricing.

- Long Qualification & Certification Cycles: Rigorous testing and validation processes can significantly delay product deployment.

- Supply Chain Vulnerabilities: Limited number of specialized manufacturers and potential disruptions in raw material availability.

- Technological Obsolescence: Rapid pace of technological change requires continuous investment in R&D to remain competitive.

- Competition from Traditional Components (in less critical applications): For applications with lower radiation exposure, standard commercial-grade components might be considered, creating a price-sensitive competitive pressure.

Emerging Opportunities in Radiation Hard Electronics Market

Emerging opportunities in the Radiation Hard Electronics Market are driven by several key trends. The burgeoning small satellite and CubeSat market presents a significant opportunity for cost-effective, yet radiation-tolerant, electronic solutions. Furthermore, the growing interest in deep space exploration missions, including lunar bases and Mars colonization efforts, will demand highly robust and long-lasting electronics. Innovations in neuromorphic computing for radiation-hardened applications, enabling AI and machine learning capabilities in extreme environments, represent a future growth area. The development of hybrid solutions combining radiation-hardened and radiation-tolerant components for optimized performance and cost is also an emerging trend.

Growth Accelerators in the Radiation Hard Electronics Market Industry

Long-term growth in the Radiation Hard Electronics Market is being accelerated by several critical factors. Continued government funding for national security and space programs globally is a primary catalyst. Technological breakthroughs in novel materials, such as Gallium Nitride (GaN) and Silicon Carbide (SiC), for enhanced radiation tolerance and performance are opening new avenues. Strategic partnerships and collaborations between semiconductor manufacturers, system integrators, and end-users are fostering innovation and accelerating time-to-market for new products. Furthermore, the expansion of commercial space activities, including satellite constellations for internet connectivity and remote sensing, is creating sustained demand for radiation-hardened electronics.

Key Players Shaping the Radiation Hard Electronics Market Market

- Renesas Electronic Corporation

- Micropac Industries Inc

- Infineon Technologies AG

- Everspin Technologies Inc

- Honeywell International Inc

- Microchip Technology Inc

- Texas Instruments

- Data Device Corporation

- Frontgrade Technologies

- BAE Systems PLC

- Vorago Technologie

- Solid State Devices Inc

- Advanced Micro Devices Inc

- STMicroelectronics International NV

Notable Milestones in Radiation Hard Electronics Market Sector

- October 2023: An Indian University (IU) announced securing and planning to invest approximately USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university also allocated USD 10 million to establish a new Center for Reliable and Trusted Electronics, focusing on modeling and simulation of radiation effects and the design of radiation-hardened technologies.

- June 2023: Texas Instruments (TI) announced an expansion of its manufacturing operations in Malaysia by building two new assembly and test factories in Kuala Lumpur and Melaka, aiming to enhance cost advantage and supply chain control.

In-Depth Radiation Hard Electronics Market Market Outlook

The future outlook for the Radiation Hard Electronics Market is exceptionally positive, driven by a convergence of strategic imperatives and technological advancements. Growth accelerators, including substantial government investments in space and defense, coupled with the rapid expansion of the commercial space industry, are creating a sustained demand for high-reliability electronic components. Emerging opportunities in deep space exploration and the development of AI-enabled radiation-hardened systems further bolster the market's potential. Strategic partnerships and continuous innovation in materials science and semiconductor design will be crucial in addressing the evolving challenges of radiation tolerance and performance. The market is set to witness increasing adoption of advanced integrated circuits and specialized components, solidifying its critical role in enabling future technological frontiers.

Radiation Hard Electronics Market Segmentation

-

1. End-user

- 1.1. Space

- 1.2. Aerospace and Defense

- 1.3. Nuclear Power Plants

-

2. Component

- 2.1. Discrete

- 2.2. Sensors

- 2.3. Integrated Circuit

- 2.4. Microcontrollers and Microprocessors

- 2.5. Memory

Radiation Hard Electronics Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Radiation Hard Electronics Market Regional Market Share

Geographic Coverage of Radiation Hard Electronics Market

Radiation Hard Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment

- 3.3. Market Restrains

- 3.3.1. High Designing and Development Cost

- 3.4. Market Trends

- 3.4.1. Nuclear Power Plants to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Space

- 5.1.2. Aerospace and Defense

- 5.1.3. Nuclear Power Plants

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Discrete

- 5.2.2. Sensors

- 5.2.3. Integrated Circuit

- 5.2.4. Microcontrollers and Microprocessors

- 5.2.5. Memory

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Americas Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. Space

- 6.1.2. Aerospace and Defense

- 6.1.3. Nuclear Power Plants

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Discrete

- 6.2.2. Sensors

- 6.2.3. Integrated Circuit

- 6.2.4. Microcontrollers and Microprocessors

- 6.2.5. Memory

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. Space

- 7.1.2. Aerospace and Defense

- 7.1.3. Nuclear Power Plants

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Discrete

- 7.2.2. Sensors

- 7.2.3. Integrated Circuit

- 7.2.4. Microcontrollers and Microprocessors

- 7.2.5. Memory

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. Space

- 8.1.2. Aerospace and Defense

- 8.1.3. Nuclear Power Plants

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Discrete

- 8.2.2. Sensors

- 8.2.3. Integrated Circuit

- 8.2.4. Microcontrollers and Microprocessors

- 8.2.5. Memory

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. Australia and New Zealand Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. Space

- 9.1.2. Aerospace and Defense

- 9.1.3. Nuclear Power Plants

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Discrete

- 9.2.2. Sensors

- 9.2.3. Integrated Circuit

- 9.2.4. Microcontrollers and Microprocessors

- 9.2.5. Memory

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Latin America Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. Space

- 10.1.2. Aerospace and Defense

- 10.1.3. Nuclear Power Plants

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Discrete

- 10.2.2. Sensors

- 10.2.3. Integrated Circuit

- 10.2.4. Microcontrollers and Microprocessors

- 10.2.5. Memory

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Middle East and Africa Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 11.1.1. Space

- 11.1.2. Aerospace and Defense

- 11.1.3. Nuclear Power Plants

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Discrete

- 11.2.2. Sensors

- 11.2.3. Integrated Circuit

- 11.2.4. Microcontrollers and Microprocessors

- 11.2.5. Memory

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renesas Electronic Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Micropac Industries Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infineon Technologies AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Everspin Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Honeywell International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microchip Technology Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Texas Instruments

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Data Device Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Frontgrade Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BAE Systems PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Vorago Technologie

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Solid State Devices Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Advanced Micro Devices Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 STMicroelectronics International NV

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global Radiation Hard Electronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 3: Americas Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: Americas Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 5: Americas Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: Americas Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Americas Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 9: Europe Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Europe Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 15: Asia Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Asia Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 21: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 27: Latin America Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 28: Latin America Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 29: Latin America Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Latin America Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 33: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Radiation Hard Electronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 5: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 9: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 11: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 14: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 15: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 17: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Hard Electronics Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the Radiation Hard Electronics Market?

Key companies in the market include Renesas Electronic Corporation, Micropac Industries Inc, Infineon Technologies AG, Everspin Technologies Inc, Honeywell International Inc, Microchip Technology Inc, Texas Instruments, Data Device Corporation, Frontgrade Technologies, BAE Systems PLC, Vorago Technologie, Solid State Devices Inc, Advanced Micro Devices Inc, STMicroelectronics International NV.

3. What are the main segments of the Radiation Hard Electronics Market?

The market segments include End-user, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment.

6. What are the notable trends driving market growth?

Nuclear Power Plants to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Designing and Development Cost.

8. Can you provide examples of recent developments in the market?

October 2023: Indian University (IU) announced that it had secured and would invest about USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university has also made a provision of USD 10 million to launch the new Center for Reliable and Trusted Electronics, which aims to take forward research activities focused primarily on the modeling and simulation of radiation effects and the design of radiation-hardened technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Hard Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Hard Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Hard Electronics Market?

To stay informed about further developments, trends, and reports in the Radiation Hard Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence