Key Insights

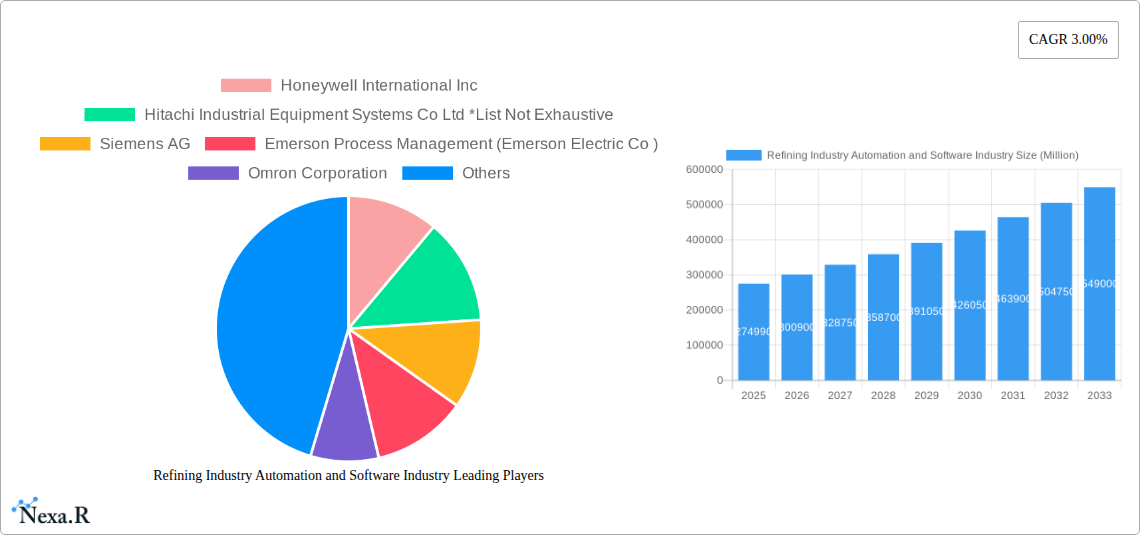

The Refining Industry Automation and Software market is poised for significant expansion, projected to reach an estimated USD 274.99 billion by 2025. This robust growth is underpinned by a compelling compound annual growth rate (CAGR) of 9.5% throughout the forecast period of 2025-2033. A primary driver of this expansion is the increasing demand for enhanced operational efficiency and safety within refining facilities. Modern refineries are increasingly adopting sophisticated automation solutions to optimize complex processes, minimize human error, and ensure compliance with stringent environmental regulations. This includes the widespread implementation of Programmable Logic Controllers (PLCs) for discrete control tasks, Distributed Control Systems (DCS) for integrated process management, and Human Machine Interfaces (HMIs) for intuitive operator interaction. Furthermore, the adoption of Product Lifecycle Management (PLM) software is gaining traction, enabling refineries to streamline product development, manage assets effectively, and improve overall plant lifecycle performance.

Refining Industry Automation and Software Industry Market Size (In Billion)

The market's upward trajectory is further fueled by several critical trends. The integration of advanced technologies such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning (ML) is revolutionizing refining operations, enabling predictive maintenance, real-time performance monitoring, and data-driven decision-making. This digital transformation allows refineries to achieve higher yields, reduce energy consumption, and enhance their competitive edge. Key players like Honeywell International Inc., Siemens AG, Emerson Process Management, and ABB Limited are at the forefront of this innovation, offering comprehensive automation and software solutions tailored to the unique challenges of the refining sector. While the market benefits from these advancements, certain restraints may influence the pace of adoption, including the significant capital investment required for upgrading existing infrastructure and the need for skilled personnel to manage and maintain these complex systems. However, the long-term benefits of increased productivity, reduced operational costs, and improved safety are expected to outweigh these challenges, driving sustained market growth across key regions like North America, Europe, and Asia Pacific.

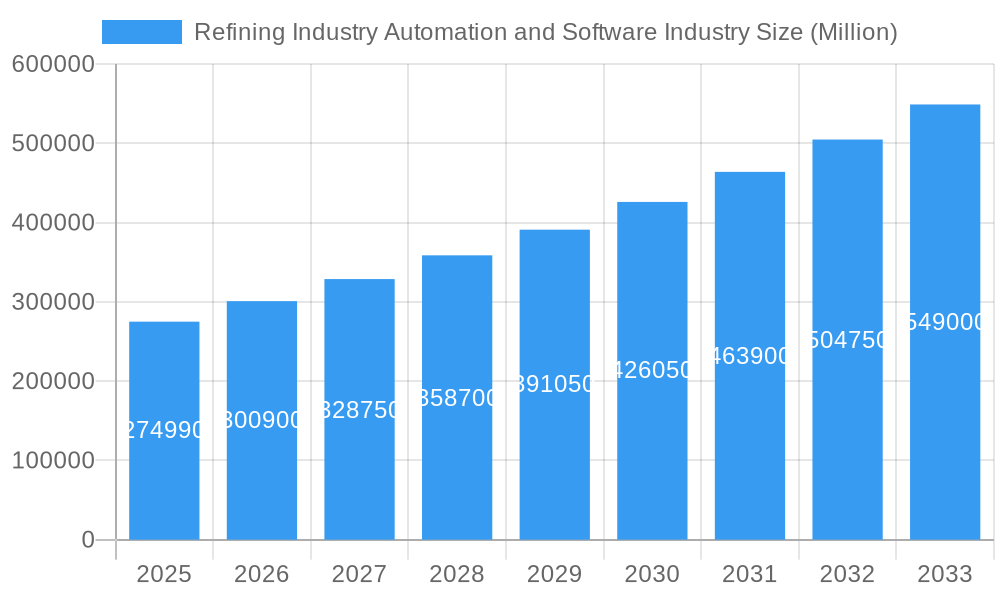

Refining Industry Automation and Software Industry Company Market Share

Unlocking Efficiency: A Deep Dive into the Refining Industry Automation and Software Market (2019-2033)

This comprehensive report provides an unparalleled analysis of the global Refining Industry Automation and Software market, forecasting significant growth and intricate market dynamics from 2019 to 2033. Delve into the evolving landscape of process control, data management, and operational excellence within the refining sector. Understand the critical role of automation and software in driving efficiency, safety, and profitability in a competitive global market. With a base year of 2025, this report offers crucial insights for stakeholders seeking to capitalize on emerging trends and navigate future challenges.

Refining Industry Automation and Software Industry Market Dynamics & Structure

The global Refining Industry Automation and Software market is characterized by a moderately concentrated competitive landscape, with key players like Honeywell International Inc., Siemens AG, and Emerson Process Management (Emerson Electric Co.) holding significant market shares. Technological innovation remains a primary driver, fueled by the relentless pursuit of operational efficiency, enhanced safety protocols, and reduced environmental impact. Advancements in Artificial Intelligence (AI), Machine Learning (ML), and the Industrial Internet of Things (IIoT) are revolutionizing process optimization and predictive maintenance. Regulatory frameworks, particularly those focused on emissions control and process safety, further shape market demand for sophisticated automation solutions. Competitive product substitutes exist within specific solution types, such as advanced PLC systems for basic control and more comprehensive DCS for plant-wide integration. End-user demographics are increasingly sophisticated, demanding integrated solutions that offer real-time data analytics and seamless interoperability. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to expand their product portfolios, geographical reach, and technological capabilities. For instance, the historical period (2019-2024) saw several strategic acquisitions aimed at bolstering offerings in areas like cybersecurity and advanced analytics.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: AI, ML, IIoT, cybersecurity, predictive analytics.

- Regulatory Frameworks: Environmental compliance (e.g., emissions), process safety standards.

- Competitive Product Substitutes: Advanced PLCs vs. DCS, specialized software solutions.

- End-User Demographics: Growing demand for integrated, data-driven solutions.

- M&A Trends: Strategic consolidation for portfolio expansion and technological enhancement.

Refining Industry Automation and Software Industry Growth Trends & Insights

The Refining Industry Automation and Software market is poised for substantial expansion, driven by the imperative for enhanced operational efficiency and stringent regulatory compliance. The global market size for refining industry automation and software is projected to reach an estimated $XX billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% expected between 2025 and 2033. This growth is underpinned by increasing adoption rates of advanced control systems and data analytics platforms across both new and existing refinery infrastructure. Technological disruptions, such as the integration of AI for real-time process optimization and predictive maintenance, are significantly impacting traditional operational paradigms. These advancements enable refineries to minimize downtime, reduce energy consumption, and improve product yield, thereby bolstering profitability. Consumer behavior shifts within the industry are evident in the growing demand for solutions that offer greater transparency, agility, and real-time decision-making capabilities. The emphasis is moving from basic automation to intelligent, interconnected systems that facilitate holistic plant management. Furthermore, the increasing complexity of crude oil feedstocks and the demand for higher-value refined products necessitate more sophisticated automation and software solutions to maintain product quality and operational flexibility. The transition towards digital transformation is a key theme, with refineries investing heavily in software platforms that support digital twins, advanced simulation, and integrated supply chain management. The market penetration of IIoT devices and cloud-based analytics platforms is accelerating, providing unprecedented insights into process performance and enabling proactive intervention strategies. The historical period (2019-2024) laid the groundwork for this accelerated growth, witnessing increased investment in digitalization initiatives and the initial rollout of advanced analytics capabilities.

Dominant Regions, Countries, or Segments in Refining Industry Automation and Software Industry

The Distributed Control System (DCS) segment is emerging as a dominant force in the Refining Industry Automation and Software market, driven by its comprehensive capabilities in managing complex refining processes and ensuring plant-wide integration. The estimated market value for DCS solutions within the refining sector is projected to reach $XX billion by 2025. North America, particularly the United States, stands out as a leading country due to its extensive refining infrastructure, stringent environmental regulations, and significant investments in technological upgrades. Economic policies that encourage refinery modernization and efficiency improvements, coupled with robust industrial infrastructure, further solidify its dominance. Key drivers for the DCS segment’s growth include the increasing complexity of refinery operations, the need for centralized control and monitoring, and the demand for enhanced safety and reliability. The adoption of advanced DCS platforms enables refineries to optimize throughput, minimize energy consumption, and ensure compliance with evolving environmental standards. The market share for DCS within the broader automation solutions for refining is significant and expected to expand further throughout the forecast period.

- Dominant Segment: Distributed Control System (DCS)

- Leading Region: North America (specifically the United States)

- Key Drivers:

- Complex refinery operations requiring integrated control.

- Demand for enhanced safety and reliability.

- Stringent environmental regulations and compliance needs.

- Investments in refinery modernization and upgrades.

- Need for optimized throughput and energy consumption.

- Market Share & Growth Potential: DCS holds a substantial market share and is anticipated to experience strong growth due to its comprehensive functionality and critical role in modern refining.

Refining Industry Automation and Software Industry Product Landscape

The product landscape in the Refining Industry Automation and Software market is characterized by continuous innovation focused on enhancing operational efficiency, safety, and sustainability. Programmable Logic Controllers (PLCs) are evolving with increased processing power and connectivity options for discrete control tasks, while Distributed Control Systems (DCS) offer sophisticated, plant-wide process management with advanced diagnostics and cybersecurity features. Human Machine Interfaces (HMIs) are becoming more intuitive and feature-rich, providing operators with comprehensive real-time data visualization and control capabilities. Product Lifecycle Management (PLM) software is increasingly being integrated to streamline asset management, maintenance scheduling, and operational workflows. Beyond these core solutions, a burgeoning category of "Other Solution Types" encompasses AI-powered predictive analytics, digital twin technology, and specialized cybersecurity platforms, all designed to optimize refinery performance and mitigate risks. These advancements are directly addressing the industry’s need for greater agility, reduced downtime, and improved yield optimization.

Key Drivers, Barriers & Challenges in Refining Industry Automation and Software Industry

Key Drivers:

The refining industry automation and software market is propelled by a confluence of factors. The relentless pursuit of operational efficiency and cost reduction remains a primary driver, with automation solutions promising optimized throughput and reduced energy consumption. Stringent environmental regulations worldwide necessitate the adoption of advanced technologies for emissions monitoring and control, further boosting demand. The imperative for enhanced safety protocols and risk mitigation in inherently hazardous refining environments also fuels investment in sophisticated control and monitoring systems. Furthermore, the digital transformation wave sweeping across industries is compelling refineries to embrace smart technologies like IIoT and AI for predictive maintenance and data-driven decision-making.

Barriers & Challenges:

Despite the growth potential, the market faces several barriers and challenges. The high initial capital investment required for implementing advanced automation and software solutions can be a significant hurdle, particularly for smaller or older refineries. The complex and legacy nature of existing infrastructure often presents integration challenges, requiring substantial retrofitting or replacement. A shortage of skilled personnel with expertise in automation, data analytics, and cybersecurity further constrains adoption and effective implementation. Cybersecurity threats pose a significant risk to interconnected refinery systems, demanding robust protection measures that add to implementation costs. Finally, resistance to change within established operational paradigms and the need for extensive training can slow down the adoption of new technologies. The supply chain disruptions experienced globally can also impact the timely delivery and availability of critical automation components, affecting project timelines and budgets.

Emerging Opportunities in Refining Industry Automation and Software Industry

Emerging opportunities lie in the integration of advanced analytics with existing automation infrastructure to unlock predictive maintenance capabilities, significantly reducing unplanned downtime. The development of AI-driven solutions for real-time process optimization, enabling refineries to adapt swiftly to fluctuating crude oil prices and market demands, presents a substantial growth area. Furthermore, the growing emphasis on sustainability and decarbonization is creating demand for automation solutions that enhance energy efficiency and enable the integration of renewable energy sources into refinery operations. The expansion of cybersecurity solutions tailored for critical infrastructure in the refining sector, addressing evolving threat landscapes, also represents a significant untapped market. The adoption of digital twin technology for simulation, training, and scenario planning is another burgeoning opportunity that offers enhanced operational insights and risk mitigation.

Growth Accelerators in the Refining Industry Automation and Software Industry Industry

Several factors are accelerating the growth of the refining industry automation and software market. Technological breakthroughs in AI, ML, and edge computing are enabling more sophisticated and localized data processing, leading to faster decision-making and improved operational responsiveness. Strategic partnerships between automation vendors and software developers are fostering the creation of integrated, end-to-end solutions that address the multifaceted needs of refineries. Market expansion strategies, including the development of cloud-based solutions and subscription models, are making advanced technologies more accessible to a wider range of refineries. The increasing demand for higher-value refined products and the need to adapt to evolving fuel standards are also compelling refineries to invest in advanced automation for greater flexibility and product quality control. The ongoing digital transformation initiatives across the industrial sector, coupled with government incentives promoting smart manufacturing, are further fueling this growth trajectory.

Key Players Shaping the Refining Industry Automation and Software Industry Market

- Honeywell International Inc.

- Hitachi Industrial Equipment Systems Co Ltd

- Siemens AG

- Emerson Process Management (Emerson Electric Co.)

- Omron Corporation

- Schneider Electric

- Honeywell Process Solutions

- Yokogawa Electric Corporation

- ABB Limited

- HollySys Automation Technologies (Hollysys Group)

Notable Milestones in Refining Industry Automation and Software Industry Sector

- 2019: Launch of advanced AI-powered predictive maintenance platforms for refineries, enhancing asset reliability.

- 2020: Significant advancements in cybersecurity solutions for industrial control systems, addressing growing threat vectors.

- 2021: Introduction of cloud-based DCS solutions, enabling remote monitoring and data analytics for refineries.

- 2022: Increased M&A activity focusing on companies specializing in IIoT integration and digital twin technology.

- 2023: Development of enhanced HMI interfaces with advanced visualization and intuitive control for complex refinery operations.

- 2024: Growing adoption of integrated PLM and automation software for comprehensive asset lifecycle management.

In-Depth Refining Industry Automation and Software Industry Market Outlook

The future of the Refining Industry Automation and Software market is exceptionally promising, driven by the persistent demand for enhanced efficiency, stringent safety standards, and increasing environmental regulations. Growth accelerators such as the proliferation of AI and ML for predictive analytics and process optimization will continue to revolutionize refinery operations. Strategic partnerships and the development of integrated, end-to-end solutions will further empower refineries to achieve greater agility and cost-effectiveness. The ongoing digital transformation, supported by government initiatives, will solidify the adoption of smart manufacturing principles. The market is expected to witness significant opportunities in areas like sustainable operations, advanced cybersecurity, and the widespread implementation of digital twin technologies, collectively shaping a more intelligent, resilient, and profitable refining industry.

Refining Industry Automation and Software Industry Segmentation

-

1. Solution Type

- 1.1. Programmable Logic Controller (PLC)

- 1.2. Distributed Control System (DCS)

- 1.3. Human Machine Interface (HMI)

- 1.4. Product Lifecycle Management (PLM)

- 1.5. Other Solution Types

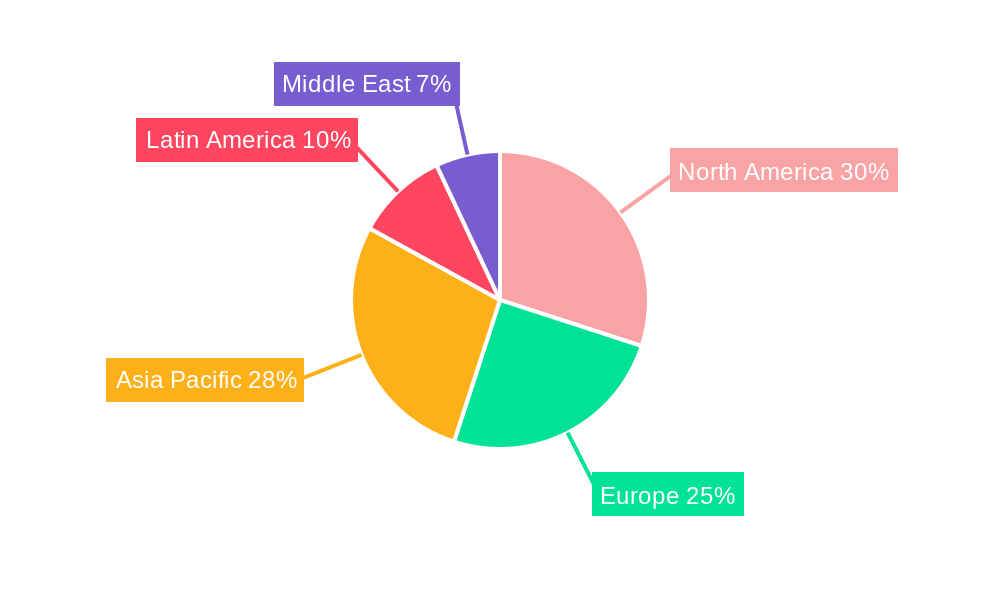

Refining Industry Automation and Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Refining Industry Automation and Software Industry Regional Market Share

Geographic Coverage of Refining Industry Automation and Software Industry

Refining Industry Automation and Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Oil and Energy Sectors is Driving the Market

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment

- 3.4. Market Trends

- 3.4.1. Increase in Drilling Activity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refining Industry Automation and Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Programmable Logic Controller (PLC)

- 5.1.2. Distributed Control System (DCS)

- 5.1.3. Human Machine Interface (HMI)

- 5.1.4. Product Lifecycle Management (PLM)

- 5.1.5. Other Solution Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. North America Refining Industry Automation and Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution Type

- 6.1.1. Programmable Logic Controller (PLC)

- 6.1.2. Distributed Control System (DCS)

- 6.1.3. Human Machine Interface (HMI)

- 6.1.4. Product Lifecycle Management (PLM)

- 6.1.5. Other Solution Types

- 6.1. Market Analysis, Insights and Forecast - by Solution Type

- 7. Europe Refining Industry Automation and Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution Type

- 7.1.1. Programmable Logic Controller (PLC)

- 7.1.2. Distributed Control System (DCS)

- 7.1.3. Human Machine Interface (HMI)

- 7.1.4. Product Lifecycle Management (PLM)

- 7.1.5. Other Solution Types

- 7.1. Market Analysis, Insights and Forecast - by Solution Type

- 8. Asia Pacific Refining Industry Automation and Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution Type

- 8.1.1. Programmable Logic Controller (PLC)

- 8.1.2. Distributed Control System (DCS)

- 8.1.3. Human Machine Interface (HMI)

- 8.1.4. Product Lifecycle Management (PLM)

- 8.1.5. Other Solution Types

- 8.1. Market Analysis, Insights and Forecast - by Solution Type

- 9. Latin America Refining Industry Automation and Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution Type

- 9.1.1. Programmable Logic Controller (PLC)

- 9.1.2. Distributed Control System (DCS)

- 9.1.3. Human Machine Interface (HMI)

- 9.1.4. Product Lifecycle Management (PLM)

- 9.1.5. Other Solution Types

- 9.1. Market Analysis, Insights and Forecast - by Solution Type

- 10. Middle East Refining Industry Automation and Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution Type

- 10.1.1. Programmable Logic Controller (PLC)

- 10.1.2. Distributed Control System (DCS)

- 10.1.3. Human Machine Interface (HMI)

- 10.1.4. Product Lifecycle Management (PLM)

- 10.1.5. Other Solution Types

- 10.1. Market Analysis, Insights and Forecast - by Solution Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi Industrial Equipment Systems Co Ltd *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Emerson Process Management (Emerson Electric Co )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Omron Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell Process Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yokogawa Electric Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABB Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HollySys Automation Technologies (Hollysys Group)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Refining Industry Automation and Software Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Refining Industry Automation and Software Industry Revenue (undefined), by Solution Type 2025 & 2033

- Figure 3: North America Refining Industry Automation and Software Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 4: North America Refining Industry Automation and Software Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Refining Industry Automation and Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Refining Industry Automation and Software Industry Revenue (undefined), by Solution Type 2025 & 2033

- Figure 7: Europe Refining Industry Automation and Software Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 8: Europe Refining Industry Automation and Software Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Refining Industry Automation and Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Refining Industry Automation and Software Industry Revenue (undefined), by Solution Type 2025 & 2033

- Figure 11: Asia Pacific Refining Industry Automation and Software Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 12: Asia Pacific Refining Industry Automation and Software Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Refining Industry Automation and Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Refining Industry Automation and Software Industry Revenue (undefined), by Solution Type 2025 & 2033

- Figure 15: Latin America Refining Industry Automation and Software Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 16: Latin America Refining Industry Automation and Software Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America Refining Industry Automation and Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Refining Industry Automation and Software Industry Revenue (undefined), by Solution Type 2025 & 2033

- Figure 19: Middle East Refining Industry Automation and Software Industry Revenue Share (%), by Solution Type 2025 & 2033

- Figure 20: Middle East Refining Industry Automation and Software Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Refining Industry Automation and Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Solution Type 2020 & 2033

- Table 2: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Solution Type 2020 & 2033

- Table 4: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Solution Type 2020 & 2033

- Table 6: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Solution Type 2020 & 2033

- Table 8: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Solution Type 2020 & 2033

- Table 10: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Solution Type 2020 & 2033

- Table 12: Global Refining Industry Automation and Software Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refining Industry Automation and Software Industry?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the Refining Industry Automation and Software Industry?

Key companies in the market include Honeywell International Inc, Hitachi Industrial Equipment Systems Co Ltd *List Not Exhaustive, Siemens AG, Emerson Process Management (Emerson Electric Co ), Omron Corporation, Schneider Electric, Honeywell Process Solutions, Yokogawa Electric Corporation, ABB Limited, HollySys Automation Technologies (Hollysys Group).

3. What are the main segments of the Refining Industry Automation and Software Industry?

The market segments include Solution Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Oil and Energy Sectors is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Drilling Activity is Driving the Market.

7. Are there any restraints impacting market growth?

; High Initial Investment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refining Industry Automation and Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refining Industry Automation and Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refining Industry Automation and Software Industry?

To stay informed about further developments, trends, and reports in the Refining Industry Automation and Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence