Key Insights

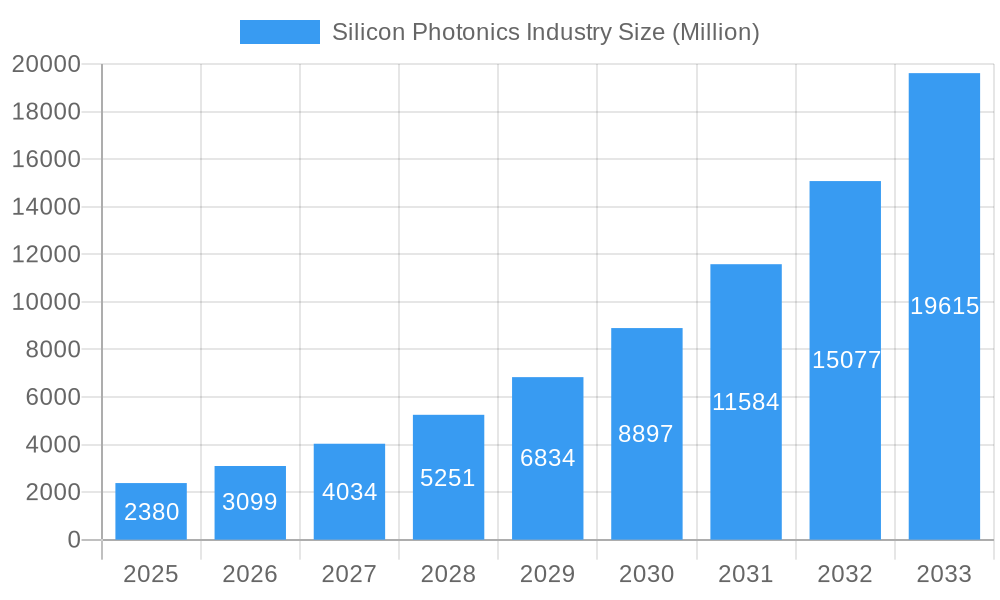

The global Silicon Photonics market is poised for explosive growth, projected to reach an estimated $2.38 billion by 2025. This rapid expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 30.50%, indicating a robust and dynamic industry landscape. The primary drivers behind this surge are the increasing demand for higher bandwidth and faster data transfer speeds across various sectors. Data centers and high-performance computing are at the forefront, requiring sophisticated optical interconnects to manage the ever-growing volumes of data. The telecommunications industry is another significant contributor, with the ongoing deployment of 5G networks and the expansion of fiber optic infrastructure necessitating advanced silicon photonics solutions for efficient signal transmission. Furthermore, the automotive sector's embrace of advanced driver-assistance systems (ADAS) and autonomous driving technologies, which rely heavily on light detection and ranging (LiDAR) and other optical sensors, is creating new avenues for market penetration.

Silicon Photonics Industry Market Size (In Billion)

The trajectory of the Silicon Photonics market is also shaped by evolving trends such as the miniaturization of optical components, the integration of optical and electronic functionalities onto a single chip, and the increasing adoption of co-packaged optics for enhanced performance and reduced power consumption. These advancements are enabling smaller, more efficient, and cost-effective solutions. While the market demonstrates immense potential, certain restraints could influence its pace. The high initial investment required for research, development, and manufacturing infrastructure, along with the need for specialized expertise, presents a challenge. Supply chain complexities for critical raw materials and components, as well as the ongoing efforts to ensure interoperability and standardization across different platforms, are also factors that market players need to carefully navigate. Despite these hurdles, the compelling advantages of silicon photonics, including its scalability, cost-effectiveness, and compatibility with existing CMOS manufacturing processes, strongly position it for continued dominance in advanced optical communication and sensing applications.

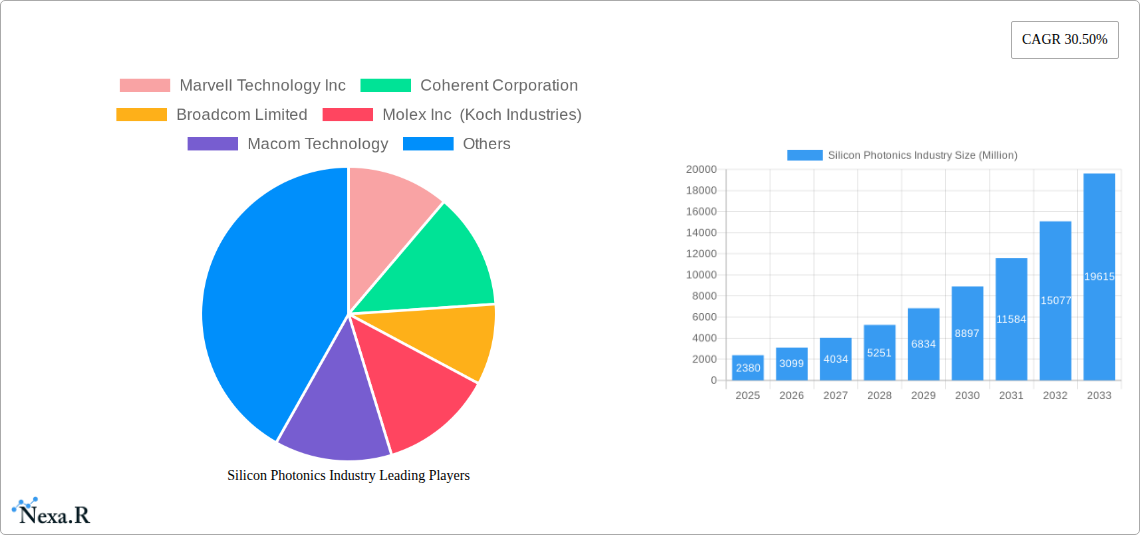

Silicon Photonics Industry Company Market Share

Unlock the Future of Connectivity: Comprehensive Silicon Photonics Industry Report (2019-2033)

This in-depth report provides a strategic analysis of the global silicon photonics industry, offering unparalleled insights into market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. We dissect the intricate interplay of technological advancements, evolving end-user demands, and regulatory influences that are shaping this transformative sector. With a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for industry professionals, investors, and strategists seeking to capitalize on the burgeoning opportunities within data centers, high-performance computing, telecommunications, automotive, and beyond. Discover the pivotal role of silicon photonics in enabling faster, more efficient, and scalable data transfer, driving the next generation of digital infrastructure.

Silicon Photonics Industry Market Dynamics & Structure

The silicon photonics industry is characterized by a dynamic and evolving market structure, driven by intense technological innovation and increasing demand for high-bandwidth solutions. Market concentration is moderately fragmented, with key players continually investing in research and development to gain a competitive edge. Technological innovation serves as the primary growth driver, with advancements in electro-optic modulation, integrated photonics, and high-speed transceivers pushing the boundaries of data transmission capabilities. Regulatory frameworks, while still developing, are increasingly focused on enabling interoperability and promoting sustainable manufacturing practices. Competitive product substitutes, though present, are often outpaced by the superior performance and integration advantages offered by silicon photonics. End-user demographics are heavily skewed towards enterprise and hyperscale data centers, followed by telecommunications providers, with emerging traction in automotive and other specialized applications. Mergers and acquisitions (M&A) trends indicate a consolidation phase, as larger companies seek to integrate advanced silicon photonics capabilities into their existing product portfolios and expand their market reach.

- Market Concentration: Moderately fragmented with key players investing heavily in R&D.

- Technological Innovation Drivers: High-speed data transmission, miniaturization, power efficiency, and integration capabilities.

- Regulatory Frameworks: Focus on standardization, interoperability, and sustainability.

- Competitive Product Substitutes: Traditional copper interconnects and other optical solutions.

- End-User Demographics: Dominance of Data Centers & High-Performance Computing, followed by Telecommunications.

- M&A Trends: Strategic acquisitions to secure IP and market access, with recent deals valued in the hundreds of millions of USD.

Silicon Photonics Industry Growth Trends & Insights

The silicon photonics industry is poised for remarkable growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 28.5% over the forecast period. The market size, estimated to be USD 1,500 million in 2025, is expected to surge to over USD 12,000 million by 2033. This expansion is fueled by the insatiable demand for faster data processing and transmission, driven by the proliferation of AI, cloud computing, and 5G/6G telecommunications networks. Adoption rates for silicon photonics components are accelerating across various applications, as their inherent advantages in speed, power efficiency, and miniaturization become increasingly critical for next-generation infrastructure. Technological disruptions, such as advancements in heterogeneous integration and co-packaged optics, are further enhancing the performance and cost-effectiveness of silicon photonics solutions, paving the way for their widespread deployment. Consumer behavior shifts, particularly the growing reliance on data-intensive applications and services, are indirectly contributing to this growth by creating a sustained demand for the underlying connectivity infrastructure. The market penetration of silicon photonics is expected to deepen significantly, moving beyond niche applications to become a mainstream technology in enterprise and data center environments.

Dominant Regions, Countries, or Segments in Silicon Photonics Industry

The Data Centers and High-performance Computing (HPC) segment is unequivocally the dominant force driving growth in the silicon photonics industry. This segment accounts for an estimated 55% of the global market share in 2025 and is projected to maintain its lead throughout the forecast period. The exponential growth in data generation, coupled with the increasing complexity of AI algorithms and the demand for real-time data analytics, necessitates ultra-high bandwidth and low-latency interconnect solutions that silicon photonics uniquely provides. Hyperscale data centers are at the forefront of adopting these advanced optical technologies to enhance server-to-server communication, improve power efficiency, and reduce the overall footprint of their infrastructure.

- Key Drivers in Data Centers & HPC:

- AI and Machine Learning Workloads: Requiring massive data throughput for training and inference.

- Cloud Computing Expansion: Increasing demand for scalable and efficient data center interconnects.

- Big Data Analytics: Driving the need for faster data processing and transfer speeds.

- Energy Efficiency Mandates: Silicon photonics offers significant power savings compared to traditional solutions.

- Miniaturization Requirements: Enabling higher port densities within data center racks.

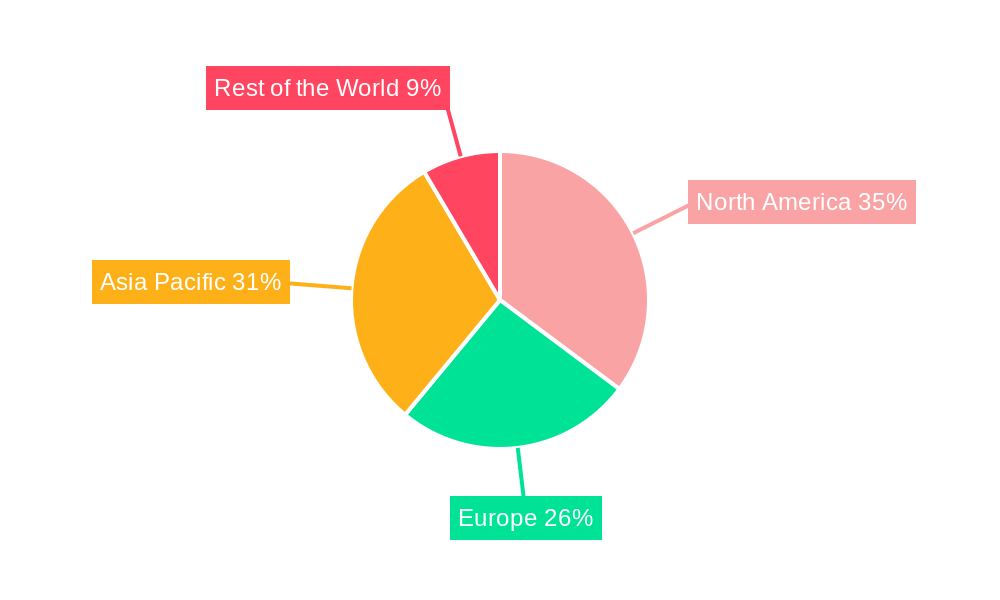

Geographically, North America, particularly the United States, leads the silicon photonics market due to the presence of major cloud providers, leading technology companies, and robust R&D investment in silicon photonics technology. The region's strong ecosystem of semiconductor manufacturers and research institutions fosters continuous innovation and rapid adoption of new technologies. Europe and Asia-Pacific are also significant contributors, with increasing investments in telecommunications infrastructure and data center expansion. The growth potential in these regions is substantial, driven by digital transformation initiatives and the rollout of advanced network technologies.

Silicon Photonics Industry Product Landscape

The silicon photonics product landscape is characterized by a diverse range of high-performance optical components integrated onto silicon chips. This includes silicon photonic transceivers, modulators, photodetectors, and multiplexers, all designed for high-speed data transmission. Innovations focus on increasing data rates per lane, improving power efficiency, and reducing the form factor of these components. Applications range from ultra-high-speed data center interconnects (e.g., 400G, 800G, and 1.6T) to advanced sensing technologies and coherent communication systems. Unique selling propositions include the ability to leverage existing silicon manufacturing infrastructure, enabling cost-effective scaling and mass production, and achieving superior performance metrics such as lower insertion loss and higher bandwidth-density.

Key Drivers, Barriers & Challenges in Silicon Photonics Industry

The silicon photonics industry is propelled by several key drivers: the relentless demand for higher bandwidth and faster data rates in data centers and telecommunications; the increasing adoption of AI and machine learning, which require significant data processing power; the drive for energy efficiency in electronic systems; and the potential for cost reduction through integration and leveraging CMOS manufacturing processes.

Key barriers and challenges include the high initial R&D and manufacturing setup costs; the complexity of integrating optical and electronic components; the need for specialized fabrication processes and expertise; supply chain constraints for certain raw materials and components; and the ongoing competition from other optical interconnect technologies. Regulatory hurdles related to standards harmonization and environmental compliance also pose challenges.

Emerging Opportunities in Silicon Photonics Industry

Emerging opportunities in the silicon photonics industry are abundant. The burgeoning fields of artificial intelligence and machine learning are creating a substantial demand for specialized processors and high-speed interconnects, where silicon photonics can offer significant advantages. The expansion of 5G and future 6G networks will necessitate denser, more efficient optical infrastructure. Furthermore, the automotive sector is exploring silicon photonics for advanced driver-assistance systems (ADAS) and LiDAR applications, offering new avenues for growth. The development of new materials and fabrication techniques continues to unlock possibilities for novel applications in areas such as quantum computing and advanced sensing.

Growth Accelerators in the Silicon Photonics Industry Industry

Several key factors are accelerating the growth of the silicon photonics industry. Technological breakthroughs in areas like optical phased arrays and silicon nitride photonics are expanding the capabilities and application spectrum of these devices. Strategic partnerships between semiconductor manufacturers, equipment providers, and end-users are crucial for driving innovation and accelerating market adoption. The continuous investment in R&D by major technology companies, coupled with growing government initiatives supporting advanced manufacturing and digital infrastructure, provides a strong foundation for sustained growth. Market expansion strategies, including the development of cost-effective solutions and wider interoperability, are further fueling this upward trajectory.

Key Players Shaping the Silicon Photonics Industry Market

- Marvell Technology Inc

- Coherent Corporation

- Broadcom Limited

- Molex Inc (Koch Industries)

- Macom Technology

- Cisco Systems Inc

- Juniper Networks Inc

- Lumentum Operations LLC (Lumentum Holdings Inc )

- Global Foundries Inc

- Sicoya GMBH

- Hamamatsu Photonics K

- Intel Corporation

Notable Milestones in Silicon Photonics Industry Sector

- October 2023: Lumentum and Cloud Light Technology entered into a definitive agreement for Lumentum to acquire Cloud Light for approximately USD 750 million. This acquisition will bolster Lumentum's portfolio of advanced optical modules for automotive sensors and data center interconnect applications.

- October 2023: Marvell Technology successfully demonstrated 200 Gbit/s-per-lane electrical I/O for high-speed copper data center interconnect. This 200G/lane active electrical cable (AEC) technology, driven by PAM4 DSP and 5nm 224G long-reach SerDes technology, is a foundational development for next-generation AI clusters and cloud infrastructure, capable of overcoming significant insertion loss at 224G/lane.

In-Depth Silicon Photonics Industry Market Outlook

The silicon photonics industry is on a trajectory for sustained and robust expansion, driven by foundational technological advancements and a surging global demand for high-speed data connectivity. Growth accelerators include the ongoing integration of silicon photonics into mainstream data center architectures, enabling significant improvements in bandwidth density and power efficiency. Strategic opportunities lie in the continued co-development of photonic and electronic integrated circuits, leading to more sophisticated and compact solutions. The increasing penetration of AI, 5G, and the Internet of Things (IoT) will continue to fuel the need for the core capabilities that silicon photonics offers, solidifying its position as a critical enabler of future digital infrastructure.

Silicon Photonics Industry Segmentation

-

1. Application

- 1.1. Data Centers and High-performance Computing

- 1.2. Telecommunications

- 1.3. Automotive

- 1.4. Other Applications

Silicon Photonics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Silicon Photonics Industry Regional Market Share

Geographic Coverage of Silicon Photonics Industry

Silicon Photonics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers

- 3.3. Market Restrains

- 3.3.1. Risk of Thermal Effect

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Data Centers and High-performance Computing

- 5.1.2. Telecommunications

- 5.1.3. Automotive

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Data Centers and High-performance Computing

- 6.1.2. Telecommunications

- 6.1.3. Automotive

- 6.1.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Data Centers and High-performance Computing

- 7.1.2. Telecommunications

- 7.1.3. Automotive

- 7.1.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Data Centers and High-performance Computing

- 8.1.2. Telecommunications

- 8.1.3. Automotive

- 8.1.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Data Centers and High-performance Computing

- 9.1.2. Telecommunications

- 9.1.3. Automotive

- 9.1.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Marvell Technology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Coherent Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Broadcom Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Molex Inc (Koch Industries)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Macom Technology

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Juniper Networks Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lumentum Operations LLC (Lumentum Holdings Inc )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Global Foundries Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sicoya GMBH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hamamatsu Photonics K

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Marvell Technology Inc

List of Figures

- Figure 1: Global Silicon Photonics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Silicon Photonics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicon Photonics Industry?

The projected CAGR is approximately 30.50%.

2. Which companies are prominent players in the Silicon Photonics Industry?

Key companies in the market include Marvell Technology Inc, Coherent Corporation, Broadcom Limited, Molex Inc (Koch Industries), Macom Technology, Cisco Systems Inc, Juniper Networks Inc, Lumentum Operations LLC (Lumentum Holdings Inc ), Global Foundries Inc, Sicoya GMBH, Hamamatsu Photonics K, Intel Corporation.

3. What are the main segments of the Silicon Photonics Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers.

6. What are the notable trends driving market growth?

Automotive Segment to Witness Major Growth.

7. Are there any restraints impacting market growth?

Risk of Thermal Effect.

8. Can you provide examples of recent developments in the market?

In October 2023, Lumentum and Cloud Light Technology entered into a definitive agreement under which Lumentum would acquire Cloud Light in a deal valued at approximately USD 750 million. Cloud Light designs, markets, and manufactures advanced optical modules for automotive sensors and data center interconnect applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silicon Photonics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silicon Photonics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silicon Photonics Industry?

To stay informed about further developments, trends, and reports in the Silicon Photonics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence