Key Insights

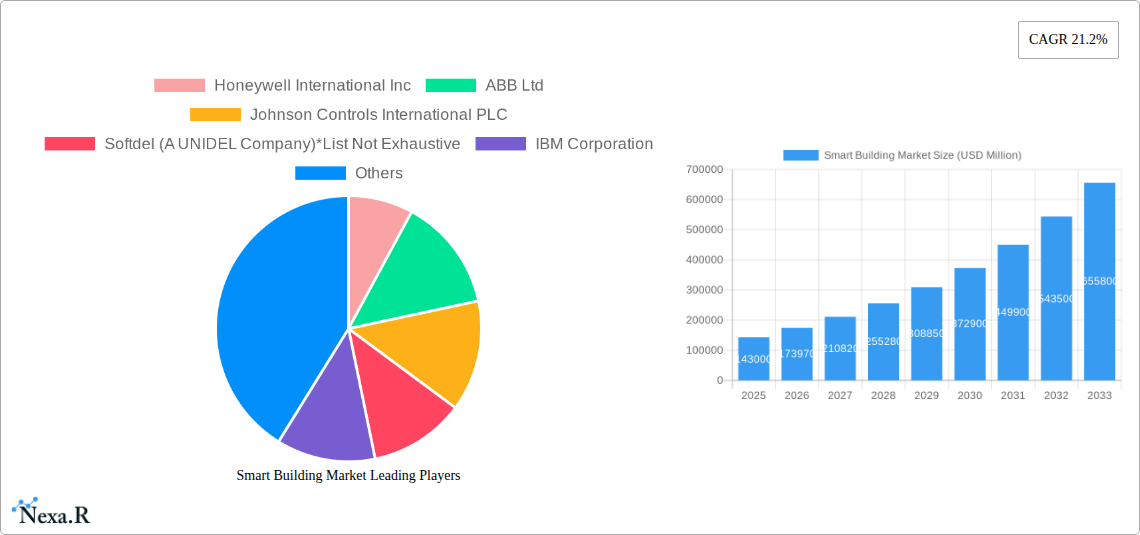

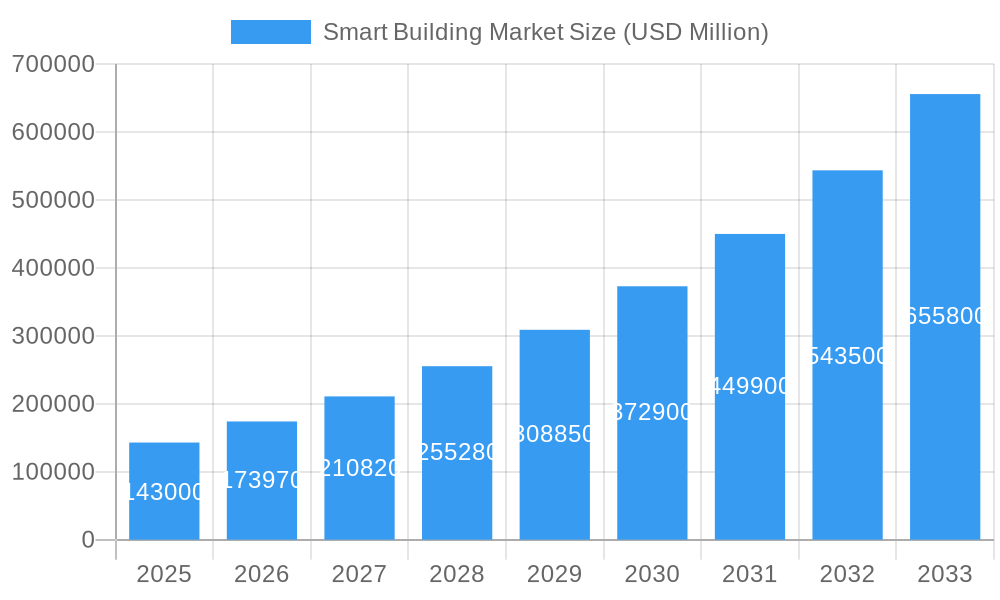

The global Smart Building Market is poised for substantial expansion, with a projected market size of USD 143 billion in 2025. This rapid growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 21.2% anticipated over the forecast period from 2025 to 2033. Key drivers behind this surge include the increasing demand for energy efficiency and sustainability in buildings, driven by stringent environmental regulations and rising energy costs. The integration of advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and machine learning is revolutionizing building management, enhancing operational efficiency, occupant comfort, and security. Furthermore, the growing adoption of smart home devices and the need for intelligent infrastructure management systems are significantly contributing to market momentum. The market is segmented into Components, offering Solutions such as Building Energy Management Systems, Infrastructure Management Systems, and Intelligent Security Systems, alongside vital Services. Applications span across both Residential and Commercial sectors, reflecting the pervasive nature of smart building technologies.

Smart Building Market Market Size (In Billion)

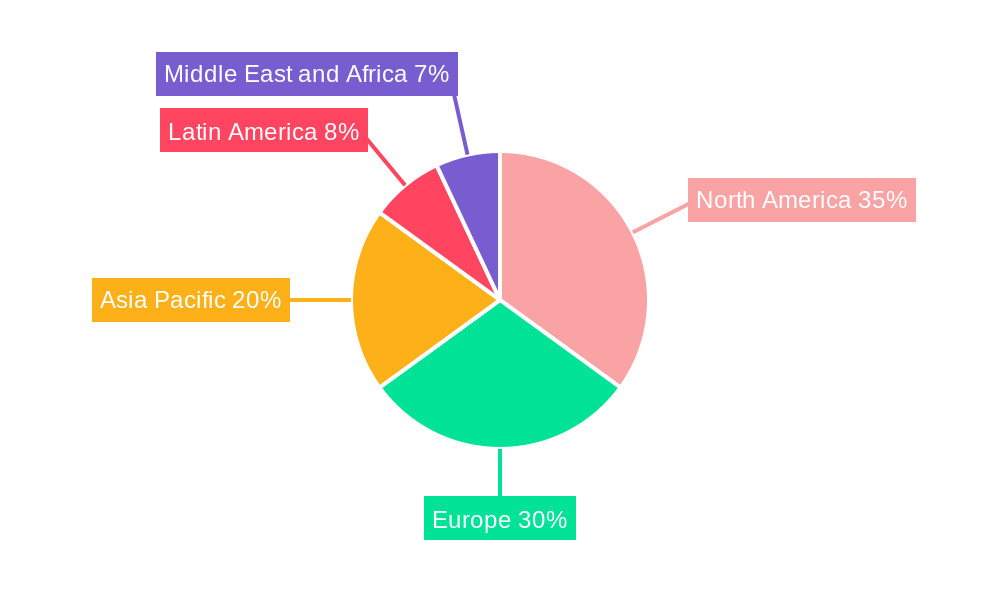

Leading companies such as Honeywell International Inc., ABB Ltd, Johnson Controls International PLC, Siemens AG, and Schneider Electric SE are at the forefront of innovation, investing heavily in research and development to offer comprehensive smart building solutions. While the market is experiencing robust growth, certain restraints like high initial investment costs and concerns regarding data privacy and cybersecurity need to be addressed to ensure widespread adoption. Emerging trends include the rise of predictive maintenance, smart grid integration, and the development of more sophisticated AI-driven building automation systems. Geographically, North America and Europe are currently dominant markets, driven by early adoption and supportive government policies. However, the Asia Pacific region is expected to witness the fastest growth due to rapid urbanization, increasing disposable incomes, and a growing emphasis on smart city initiatives.

Smart Building Market Company Market Share

This in-depth report offers a panoramic view of the global smart building market, detailing its intricate dynamics, growth trajectories, and future potential. With a comprehensive study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this analysis delves into market size, segmentation, key players, and influential developments. It leverages high-traffic keywords such as "smart building solutions," "IoT in buildings," "building automation systems," "energy-efficient buildings," and "intelligent security systems" to maximize SEO visibility and attract industry professionals. The report meticulously examines parent and child market segments, providing a granular understanding of this rapidly evolving industry.

Smart Building Market Market Dynamics & Structure

The smart building market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demographics. Market concentration is moderate, with established giants like Honeywell International Inc., ABB Ltd., Johnson Controls International PLC, Siemens AG, and Schneider Electric SE holding significant sway, alongside emerging innovators such as Softdel (A UNIDEL Company). Technological advancements, particularly in Internet of Things (IoT), artificial intelligence (AI), and cloud computing, are pivotal drivers, enabling enhanced building performance and energy efficiency. Regulatory frameworks promoting sustainability and energy conservation further bolster market growth.

- Technological Innovation Drivers: Increased adoption of AI and machine learning for predictive maintenance and optimized resource allocation, advancements in wireless connectivity (5G, Wi-Fi 6) for seamless data exchange, and the proliferation of integrated IoT platforms.

- Regulatory Frameworks: Government mandates for energy efficiency standards, incentives for green building certifications (e.g., LEED, BREEAM), and evolving data privacy regulations influencing security system design.

- Competitive Product Substitutes: While fully integrated smart building systems offer a comprehensive solution, standalone energy management systems and individual smart device installations represent potential substitutes, albeit with limited holistic functionality.

- End-User Demographics: Growing demand from commercial real estate for operational cost reduction and enhanced occupant experience, increasing interest in smart home technologies from residential consumers, and specific needs within industrial applications for process optimization and safety.

- M&A Trends: Strategic acquisitions and partnerships are prevalent as larger players seek to expand their portfolios and market reach, integrate new technologies, and gain a competitive edge. For example, acquisitions of specialized IoT providers or cybersecurity firms are common.

Smart Building Market Growth Trends & Insights

The smart building market is poised for substantial growth, driven by an escalating demand for energy efficiency, enhanced occupant comfort, and robust security. The global market size for smart buildings is projected to reach an estimated $250.5 billion by 2025, with significant expansion expected throughout the forecast period. This growth is fueled by increasing awareness of climate change, stricter energy regulations, and the tangible operational cost savings that smart building technologies offer. The adoption rates of building energy management systems (BEMS) and intelligent security systems are particularly high, reflecting their immediate impact on operational expenses and safety.

Technological disruptions continue to reshape the market. The integration of AI and machine learning is enabling buildings to learn and adapt to occupancy patterns, weather conditions, and energy prices, leading to unprecedented levels of optimization. Cloud-based platforms are democratizing access to sophisticated building management tools, allowing even smaller enterprises to benefit from smart technologies. Consumer behavior is also shifting, with a greater emphasis on wellness and occupant experience. Features such as advanced air quality monitoring, personalized climate control, and intuitive user interfaces are becoming key differentiators. The rise of smart home automation is a direct reflection of this trend in the residential sector. Furthermore, the increasing penetration of the Internet of Things (IoT) is creating interconnected ecosystems within buildings, facilitating data-driven decision-making and proactive maintenance. This pervasive connectivity allows for real-time monitoring and control of various building functions, from lighting and HVAC to security and waste management. The compound annual growth rate (CAGR) is estimated to be around 12.5% during the forecast period, underscoring the market's robust expansion.

Dominant Regions, Countries, or Segments in Smart Building Market

The smart building market is experiencing robust growth across various regions and segments, with distinct drivers contributing to dominance. North America and Europe currently lead the market, owing to well-established regulatory frameworks promoting energy efficiency and a high concentration of technologically advanced infrastructure. However, the Asia Pacific region is emerging as a rapidly growing hub, fueled by significant investments in smart city initiatives and large-scale construction projects.

Within the Component segment, Solutions are driving market growth, with Building Energy Management Systems (BEMS) and Intelligent Security Systems holding substantial market share.

- Building Energy Management Systems (BEMS): These systems are critical for optimizing energy consumption, reducing operational costs, and meeting stringent environmental regulations. Their market dominance is further amplified by the increasing global focus on sustainability and carbon footprint reduction.

- Intelligent Security Systems: The escalating concerns over safety and security in both commercial and residential spaces have propelled the growth of advanced security solutions, including AI-powered surveillance, access control, and integrated threat detection.

- Infrastructure Management Systems: This segment is crucial for the seamless operation and maintenance of smart building components, ensuring reliability and efficiency across the entire building ecosystem.

The Application segment sees Commercial buildings as the dominant force.

- Commercial: Office buildings, retail spaces, hospitality venues, and healthcare facilities are actively adopting smart building technologies to enhance operational efficiency, improve occupant experience, and reduce energy expenditures. The business case for smart buildings in the commercial sector is particularly strong, offering clear ROI through cost savings and increased productivity.

- Residential: While still growing, the residential sector is increasingly embracing smart home technologies, driven by convenience, security, and energy-saving features. The increasing affordability and accessibility of smart home devices are accelerating this adoption.

- Industry: Industrial applications leverage smart building technologies for process automation, safety monitoring, and predictive maintenance, contributing to improved operational efficiency and reduced downtime.

Smart Building Market Product Landscape

The smart building market's product landscape is characterized by continuous innovation in integrated solutions and advanced technologies. Key product innovations focus on interoperability and data analytics, enabling a holistic approach to building management. Building Energy Management Systems (BEMS) are evolving with AI-powered predictive capabilities, while Intelligent Security Systems are incorporating advanced facial recognition and anomaly detection. The integration of IoT sensors and actuators is creating a more responsive and adaptive building environment. Performance metrics such as energy savings of up to 30%, reduced maintenance costs, and improved occupant comfort are becoming standard benchmarks for these products. Unique selling propositions often lie in the seamless integration of diverse systems and the ability to provide actionable insights from collected data.

Key Drivers, Barriers & Challenges in Smart Building Market

Key Drivers:

- Growing demand for energy efficiency and sustainability: Stringent government regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing for reduced energy consumption and carbon emissions.

- Technological advancements: The proliferation of IoT, AI, and cloud computing enables more sophisticated and integrated smart building solutions.

- Cost savings and operational efficiency: Smart building technologies offer significant reductions in operational costs through optimized energy usage, predictive maintenance, and streamlined management.

- Enhanced occupant comfort and productivity: Smart buildings can create more pleasant and productive environments through personalized climate control, improved air quality, and optimized lighting.

Barriers & Challenges:

- High initial investment costs: The upfront cost of implementing comprehensive smart building systems can be a significant barrier for some organizations.

- Interoperability and standardization issues: The lack of universal standards can lead to compatibility challenges between different vendor solutions, hindering seamless integration.

- Cybersecurity concerns: The increased connectivity of smart buildings creates vulnerabilities to cyber threats, requiring robust security measures.

- Data privacy and regulatory compliance: Managing the vast amounts of data generated by smart buildings requires adherence to complex data privacy regulations.

- Lack of skilled personnel: A shortage of trained professionals capable of installing, managing, and maintaining complex smart building systems can impede adoption.

Emerging Opportunities in Smart Building Market

Emerging opportunities in the smart building market are driven by the growing demand for hyper-personalized experiences and advanced sustainability solutions. The rise of edge computing within buildings allows for real-time data processing and faster response times, enhancing automation capabilities. The integration of smart buildings with smart grids presents a significant opportunity for energy demand response and grid stabilization. Furthermore, the increasing focus on occupant wellness and health is driving demand for solutions that monitor and improve indoor air quality, lighting, and acoustics. Untapped markets in developing economies, particularly in regions with rapid urbanization, represent substantial growth potential. The development of flexible, modular smart building solutions catering to the needs of smaller enterprises and retrofitting existing structures also presents a key avenue for expansion.

Growth Accelerators in the Smart Building Market Industry

Several catalysts are accelerating long-term growth in the smart building industry. Technological breakthroughs in areas like 5G connectivity, advanced AI algorithms for predictive analytics, and more efficient energy storage solutions are creating more powerful and cost-effective smart building systems. Strategic partnerships between technology providers, construction firms, and real estate developers are crucial for integrating smart technologies from the design phase onwards. Market expansion strategies focused on targeting specific verticals with tailored solutions, such as healthcare facilities or educational institutions, are also driving growth. The increasing emphasis on the circular economy and sustainable construction practices will further incentivize the adoption of smart building technologies that optimize resource utilization and minimize waste.

Key Players Shaping the Smart Building Market Market

- Honeywell International Inc

- ABB Ltd

- Johnson Controls International PLC

- Softdel (A UNIDEL Company)

- IBM Corporation

- Legrand SA

- Hitachi Ltd

- Cisco Systems Inc

- Siemens AG

- Schneider Electric SE

- Avnet Inc

- Huawei Technologies Co Ltd

Notable Milestones in Smart Building Market Sector

- March 2023: Siemens Smart Infrastructure introduced Connect Box, an open and easy-to-use IoT solution for small- to medium-sized buildings. This addition to the Siemens Xcelerator portfolio aims to simplify building performance monitoring, potentially optimizing energy efficiency by up to around 30% and substantially improving indoor air quality in structures like schools, retail shops, apartments, and small offices.

- May 2023: Delta, a global provider of power and thermal management solutions, announced its "Intelligent Sustainable Connecting Hub," a smart community hub powered by its IoT-based Smart Green Solutions. This hub features an intelligent Operation Center with a multi-functional management platform for critical operations, including carbon emissions inventory and renewable power matching. The integration of VORTEX, a cloud-based video surveillance as a service (VSaaS), smart microgrid-supported EV charging infrastructure, and energy-efficient data center solutions showcases Delta's commitment to sustainable development across various sectors.

In-Depth Smart Building Market Market Outlook

The future outlook for the smart building market is exceptionally promising, driven by an accelerating convergence of technological innovation, environmental imperatives, and evolving occupant expectations. Growth accelerators such as the increasing affordability and accessibility of IoT devices, coupled with advancements in AI and machine learning, are creating more intelligent, responsive, and energy-efficient buildings. Strategic partnerships and the development of open, interoperable platforms will further streamline adoption and integration. The market is expected to witness significant expansion in emerging economies and a deeper penetration into the residential sector. The continued focus on sustainability, occupant wellness, and operational cost reduction will ensure that smart building technologies remain a critical component of modern infrastructure development, paving the way for a more sustainable and intelligent built environment.

Smart Building Market Segmentation

-

1. Component

-

1.1. Solutions

- 1.1.1. Building Energy Management Systems

- 1.1.2. Infrastructure Management Systems

- 1.1.3. Intelligent Security Systems

- 1.1.4. Other Solutions

- 1.2. Services

-

1.1. Solutions

-

2. Application

- 2.1. Residential

- 2.2. Commercial

Smart Building Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Smart Building Market Regional Market Share

Geographic Coverage of Smart Building Market

Smart Building Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concerns about the Energy Consumption Leading to Adopt Smart Solutions; Government Initiatives on Smart Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. Cost Implications In Line With Retrofits; European Macroeconomic and Geopolitical Factors

- 3.4. Market Trends

- 3.4.1. Intelligent Security Systems to be the Fastest Growing Solution Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Building Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.1.1. Building Energy Management Systems

- 5.1.1.2. Infrastructure Management Systems

- 5.1.1.3. Intelligent Security Systems

- 5.1.1.4. Other Solutions

- 5.1.2. Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Smart Building Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.1.1. Building Energy Management Systems

- 6.1.1.2. Infrastructure Management Systems

- 6.1.1.3. Intelligent Security Systems

- 6.1.1.4. Other Solutions

- 6.1.2. Services

- 6.1.1. Solutions

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Smart Building Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.1.1. Building Energy Management Systems

- 7.1.1.2. Infrastructure Management Systems

- 7.1.1.3. Intelligent Security Systems

- 7.1.1.4. Other Solutions

- 7.1.2. Services

- 7.1.1. Solutions

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Smart Building Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.1.1. Building Energy Management Systems

- 8.1.1.2. Infrastructure Management Systems

- 8.1.1.3. Intelligent Security Systems

- 8.1.1.4. Other Solutions

- 8.1.2. Services

- 8.1.1. Solutions

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Smart Building Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.1.1. Building Energy Management Systems

- 9.1.1.2. Infrastructure Management Systems

- 9.1.1.3. Intelligent Security Systems

- 9.1.1.4. Other Solutions

- 9.1.2. Services

- 9.1.1. Solutions

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Smart Building Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.1.1. Building Energy Management Systems

- 10.1.1.2. Infrastructure Management Systems

- 10.1.1.3. Intelligent Security Systems

- 10.1.1.4. Other Solutions

- 10.1.2. Services

- 10.1.1. Solutions

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Johnson Controls International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Softdel (A UNIDEL Company)*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Legrand SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hitachi Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cisco Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schneider Electric SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avnet Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huawei Technologies Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Smart Building Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Smart Building Market Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Smart Building Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Smart Building Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Smart Building Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Smart Building Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Smart Building Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Building Market Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe Smart Building Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Smart Building Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Smart Building Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Smart Building Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Smart Building Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Building Market Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific Smart Building Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Smart Building Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Smart Building Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Smart Building Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Building Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Building Market Revenue (undefined), by Component 2025 & 2033

- Figure 21: Latin America Smart Building Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Smart Building Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Latin America Smart Building Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Smart Building Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Smart Building Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Building Market Revenue (undefined), by Component 2025 & 2033

- Figure 27: Middle East and Africa Smart Building Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Smart Building Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Smart Building Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Smart Building Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Building Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Building Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Smart Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Smart Building Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Smart Building Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global Smart Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Smart Building Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Smart Building Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Global Smart Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Smart Building Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Smart Building Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 11: Global Smart Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Smart Building Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Smart Building Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 14: Global Smart Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Smart Building Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Smart Building Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 17: Global Smart Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Smart Building Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Building Market?

The projected CAGR is approximately 21.2%.

2. Which companies are prominent players in the Smart Building Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Johnson Controls International PLC, Softdel (A UNIDEL Company)*List Not Exhaustive, IBM Corporation, Legrand SA, Hitachi Ltd, Cisco Systems Inc, Siemens AG, Schneider Electric SE, Avnet Inc, Huawei Technologies Co Ltd.

3. What are the main segments of the Smart Building Market?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Concerns about the Energy Consumption Leading to Adopt Smart Solutions; Government Initiatives on Smart Infrastructure Projects.

6. What are the notable trends driving market growth?

Intelligent Security Systems to be the Fastest Growing Solution Segment.

7. Are there any restraints impacting market growth?

Cost Implications In Line With Retrofits; European Macroeconomic and Geopolitical Factors.

8. Can you provide examples of recent developments in the market?

In March 2023, Siemens Smart Infrastructure introduced Connect Box, an open and easy-to-use IoT solution for small- to medium-sized buildings. The addition to the Siemens Xcelerator portfolio, Connect Box, is mainly a user-friendly approach for monitoring building performance, with the potential to optimize energy efficiency by up to around 30% and to substantially improve the overall indoor air quality in small to medium-sized buildings such as schools, retail shops, apartments, or small offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Building Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Building Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Building Market?

To stay informed about further developments, trends, and reports in the Smart Building Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence