Key Insights

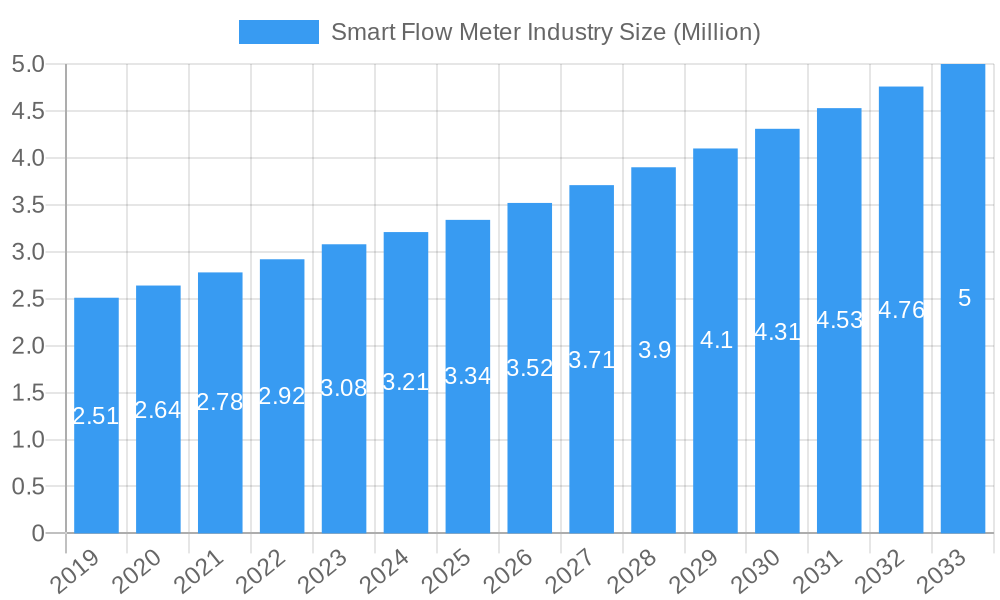

The global Smart Flow Meter market is poised for significant expansion, projected to reach $3.34 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.59%. This growth is fueled by increasing adoption of advanced industrial automation, stringent regulatory compliance across various sectors, and the escalating demand for precise and efficient resource management. Key drivers include the need for real-time data acquisition for process optimization, the integration of IoT technologies enabling remote monitoring and control, and the inherent benefits of smart meters in reducing operational costs and minimizing environmental impact. The market is segmented across diverse technologies, with Coriolis and Magnetic flow meters leading in adoption due to their superior accuracy and reliability. Furthermore, the rising prevalence of Industry 4.0 initiatives is a significant catalyst, pushing industries to invest in connected devices for enhanced operational intelligence.

Smart Flow Meter Industry Market Size (In Million)

The Smart Flow Meter market is characterized by a dynamic interplay of technological advancements and evolving industry needs. While the market is experiencing strong growth, certain restraints, such as high initial investment costs for certain advanced technologies and the need for skilled personnel for installation and maintenance, need to be addressed. However, the overarching trend towards digitalization and the increasing emphasis on sustainability and efficiency across sectors like Oil and Gas, Pharmaceuticals, and Water and Wastewater are expected to outweigh these challenges. The proliferation of communication protocols such as Profibus, Modbus, and Hart further enhances the interoperability and integration capabilities of smart flow meters, contributing to their widespread adoption. Leading companies are actively involved in research and development, focusing on enhancing meter accuracy, expanding connectivity options, and developing solutions tailored to specific industry requirements, thereby driving market innovation and expansion.

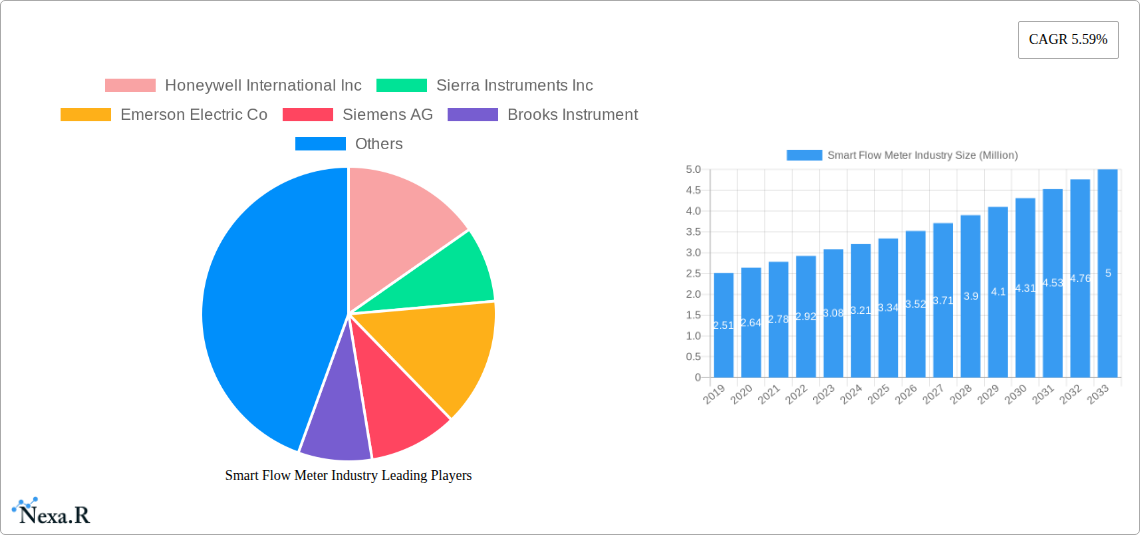

Smart Flow Meter Industry Company Market Share

Smart Flow Meter Industry Report: Market Analysis, Trends, and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the global Smart Flow Meter industry, meticulously examining market dynamics, growth trends, regional dominance, product innovation, key players, and future opportunities. Leveraging advanced analytical tools and extensive research, this report offers critical insights for industry stakeholders, investors, and decision-makers navigating the evolving landscape of intelligent flow measurement technologies. Our analysis covers the Historical Period (2019–2024), Base Year (2025), and Forecast Period (2025–2033), providing a robust outlook for the smart flow meter market.

Smart Flow Meter Industry Market Dynamics & Structure

The Smart Flow Meter industry is characterized by a moderately concentrated market structure, driven by technological innovation and stringent regulatory requirements across various end-user sectors. Key drivers of innovation include the increasing demand for process optimization, accurate data acquisition for industrial IoT (IIoT) integration, and the need for predictive maintenance in critical infrastructure. Regulatory frameworks, particularly in the Water and Wastewater and Oil and Gas sectors, mandate the use of accurate and reliable flow measurement, fueling the adoption of smart technologies. Competitive product substitutes, such as traditional mechanical flow meters, are gradually being replaced by smart alternatives offering enhanced digital capabilities. End-user demographics are shifting towards industries prioritizing operational efficiency and sustainability, with significant growth observed in Power Generation and Pharmaceuticals. Mergers and Acquisitions (M&A) trends indicate a strategic consolidation among key players to expand product portfolios and geographical reach, aiming to capture a larger share of the US$ XX Billion global smart flow meter market by 2025.

- Market Concentration: Moderate, with a few leading players holding significant market share.

- Technological Innovation Drivers: IIoT integration, Industry 4.0 adoption, demand for real-time data, energy efficiency mandates.

- Regulatory Frameworks: Strict regulations in water management, environmental monitoring, and process industries.

- Competitive Product Substitutes: Gradual displacement of mechanical flow meters by smart digital alternatives.

- End-User Demographics: Shifting towards process-intensive industries seeking automation and data-driven decision-making.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market presence.

- Projected Market Size (2025): US$ XX Billion.

Smart Flow Meter Industry Growth Trends & Insights

The global Smart Flow Meter market is poised for significant expansion, driven by escalating industrial automation and the ubiquitous integration of the Internet of Things (IoT). The market size is projected to grow from approximately US$ XX Million in 2019 to an estimated US$ XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. This robust growth is underpinned by increasing adoption rates in key sectors like Oil and Gas, Water and Wastewater, and Pharmaceuticals, where accurate flow measurement is paramount for operational efficiency, safety, and compliance. Technological disruptions, including advancements in sensor technology, data analytics, and wireless communication protocols, are transforming the capabilities of smart flow meters. These include the development of Multiphase flow meters capable of simultaneously measuring multiple fluid phases, and the integration of AI for predictive analytics and anomaly detection.

Consumer behavior is also shifting, with a greater emphasis on real-time data accessibility, remote monitoring, and cost-effectiveness. Manufacturers are responding by developing more user-friendly interfaces and offering integrated solutions that combine hardware, software, and cloud-based services. The penetration of smart flow meters in emerging economies is on the rise, spurred by government initiatives promoting industrial modernization and smart city development. The transition from basic flow metering to intelligent, data-driven solutions is a defining trend, enabling businesses to optimize resource allocation, reduce waste, and enhance overall productivity. The development of new communication protocols like advanced Hart and proprietary IIoT standards further facilitates seamless integration into existing industrial networks, driving market penetration and adoption.

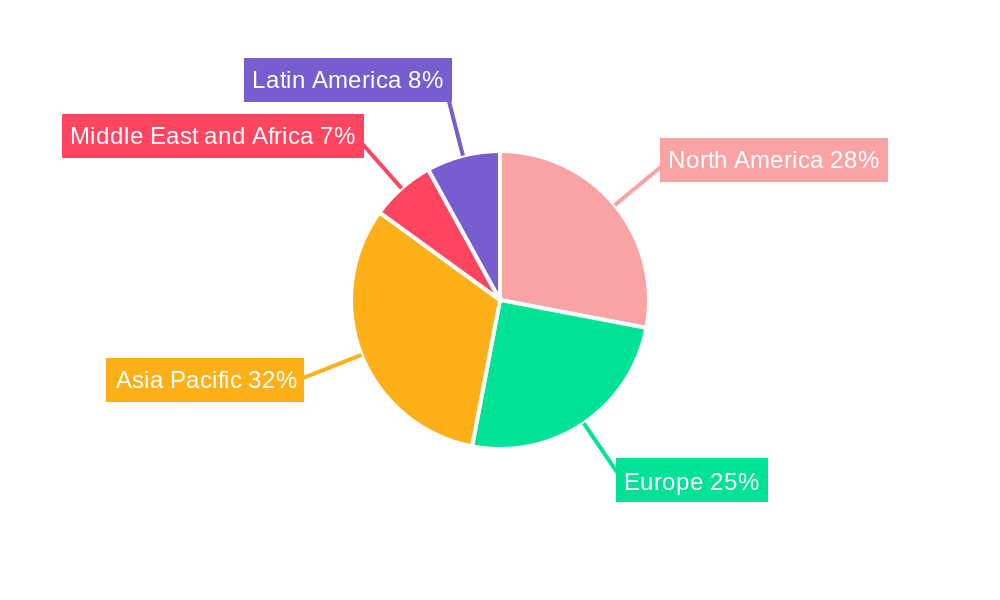

Dominant Regions, Countries, or Segments in Smart Flow Meter Industry

The Smart Flow Meter industry's dominance is multifaceted, with significant contributions from various regions, countries, and specific market segments. North America currently leads the market, driven by its mature industrial base, substantial investments in oil and gas exploration and production, and stringent environmental regulations in the water and wastewater sector. The United States, in particular, is a major consumer of advanced flow measurement technologies, supported by its strong manufacturing sector and commitment to digitalization.

Among the Type segments, Coriolis and Ultrasonic flow meters are exhibiting particularly strong growth. Coriolis meters are favored for their high accuracy and ability to measure mass flow directly, making them indispensable in applications demanding precision, such as in the pharmaceutical and chemical industries. Ultrasonic meters, on the other hand, are gaining traction due to their non-intrusive nature and suitability for measuring liquids and gases in large-diameter pipes, especially in the water and wastewater and oil and gas sectors. The adoption of Magnetic flow meters remains robust, particularly in the water and wastewater industry, due to their reliability and cost-effectiveness for conductive liquids.

In terms of Communication Protocol, Modbus continues to be a widely adopted standard due to its simplicity and widespread compatibility. However, there is a growing trend towards more advanced protocols like Profibus and Hart in complex industrial automation systems requiring higher data integrity and diagnostic capabilities. The increasing adoption of IIoT platforms is also driving the demand for protocols that support cloud connectivity and remote data access.

The End-User Industry landscape shows Oil and Gas as a dominant segment, owing to the critical need for accurate flow measurement in exploration, production, refining, and transportation. The stringent safety and environmental regulations in this sector necessitate reliable and intelligent flow metering solutions. The Water and Wastewater sector is another significant growth driver, propelled by increasing global water scarcity, aging infrastructure, and the need for efficient water management and conservation.

- Dominant Region: North America, driven by technological adoption and industrial demand.

- Leading Countries: United States, Germany, China.

- Dominant Types: Coriolis flow meters (accuracy-driven applications) and Ultrasonic flow meters (non-intrusive, large-diameter applications).

- Key Communication Protocols: Modbus (widespread compatibility), Profibus and Hart (advanced automation).

- Dominant End-User Industries: Oil and Gas (critical process control), Water and Wastewater (resource management and compliance).

- Market Share (Leading Type Segment): XX.X%

- CAGR (Leading End-User Industry): XX.X%

Smart Flow Meter Industry Product Landscape

The Smart Flow Meter industry is witnessing continuous product innovation, focusing on enhanced accuracy, digital connectivity, and specialized applications. Key advancements include the development of Multiphase flow meters capable of simultaneously measuring oil, gas, and water in real-time, crucial for the upstream oil and gas sector. Coriolis meters are being refined for higher precision and wider operational ranges, while Ultrasonic meters are incorporating advanced signal processing for improved performance in challenging fluid conditions. Integration with IIoT platforms allows for remote diagnostics, predictive maintenance, and seamless data integration into plant-wide control systems. The development of compact and energy-efficient designs is also a notable trend, enabling deployment in a wider array of industrial settings. For instance, the release of the OpreXVortex Flowmeter VY Series by Yokogawa Electric Corporation emphasizes remote maintenance and condition-based monitoring capabilities, a testament to the industry's focus on lifecycle efficiency.

Key Drivers, Barriers & Challenges in Smart Flow Meter Industry

The Smart Flow Meter industry is propelled by several key drivers, including the pervasive adoption of Industry 4.0 and the Industrial Internet of Things (IIoT), demanding precise, real-time data for process automation and optimization. Government mandates for environmental protection and resource management, particularly in water and wastewater treatment, further fuel demand. Technological advancements in sensor technology and digital communication protocols enhance accuracy and connectivity, making smart meters a preferred choice for critical applications.

However, the industry faces significant barriers and challenges. The high initial cost of advanced smart flow meters compared to traditional mechanical counterparts can be a restraint, especially for small and medium-sized enterprises. Supply chain disruptions and the complexity of integrating new smart meters into legacy industrial systems can pose implementation hurdles. Intense competition among global players and the threat of commoditization in certain segments also present challenges to sustained profitability. Cybersecurity concerns related to connected devices are also a growing area of focus, requiring robust security measures.

- Key Drivers: IIoT and Industry 4.0 adoption, environmental regulations, technological advancements.

- Barriers & Challenges: High initial investment, integration complexity with legacy systems, supply chain volatility, cybersecurity risks, intense competition.

Emerging Opportunities in Smart Flow Meter Industry

Emerging opportunities in the Smart Flow Meter industry lie in the expansion of smart metering solutions into underserved markets and the development of specialized applications. The growing focus on sustainability and circular economy principles is driving demand for accurate flow measurement in applications like carbon capture and utilization, and advanced waste management systems. The integration of artificial intelligence (AI) and machine learning (ML) into smart flow meters for advanced analytics, predictive maintenance, and process optimization presents a significant growth avenue. Furthermore, the development of flow meters for microfluidics in the pharmaceutical and biotechnology sectors, and for highly corrosive or abrasive media in specialized industrial processes, offers untapped market potential. The increasing digitalization of utilities globally, particularly in emerging economies, also presents substantial opportunities for market penetration.

Growth Accelerators in the Smart Flow Meter Industry Industry

The long-term growth of the Smart Flow Meter industry is significantly accelerated by groundbreaking technological breakthroughs and strategic market expansion initiatives. The continuous refinement of sensor technologies, leading to increased accuracy, wider measurement ranges, and enhanced durability, is a primary accelerator. The development of cost-effective and robust wireless communication solutions, such as 5G and LoRaWAN, is facilitating the deployment of smart meters in remote and challenging environments, expanding market reach. Strategic partnerships between flow meter manufacturers and IIoT platform providers are creating integrated ecosystems that offer end-to-end solutions, enhancing value proposition for customers. Furthermore, the ongoing digitalization efforts by governments and industries worldwide, coupled with a growing awareness of the benefits of data-driven decision-making, are creating a conducive environment for sustained market expansion.

Key Players Shaping the Smart Flow Meter Industry Market

- Honeywell International Inc

- Sierra Instruments Inc

- Emerson Electric Co

- Siemens AG

- Brooks Instrument

- KROHNE Messtechnik GmbH

- Fuji Electric

- ABB Ltd

- Azbil Corporation

- Yokogawa Electric Corporation

- Endress + Hauser AG

- General Electric Company

- Teledyne Isco Inc

Notable Milestones in Smart Flow Meter Industry Sector

- April 2022: Yokogawa Electric Corporation released OpreXVortex Flowmeter VY Series, targeting Southeast Asia, Oceania, India, the Middle East, and South America (excluding Brazil), with enhanced remote maintenance and condition-based maintenance functions.

- November 2021: Brooks Instrument showcased its new GP200 Series pressure-based mass flow controller (P-MFC) at SEMICON Europa. This P-MFC is designed for advanced semiconductor manufacturing processes, offering industry-first pressure insensitivity for etch and CVD applications.

In-Depth Smart Flow Meter Industry Market Outlook

The future of the Smart Flow Meter industry appears exceptionally promising, driven by an amalgamation of accelerating growth factors and strategic market initiatives. The ongoing technological evolution, particularly in areas like AI-powered analytics, predictive diagnostics, and the seamless integration of flow meters into comprehensive IIoT ecosystems, will unlock new levels of operational efficiency for industries worldwide. The global push towards sustainable practices and stricter environmental regulations will continue to be a significant catalyst, driving demand for precise measurement in sectors ranging from renewable energy to advanced water resource management. Furthermore, the increasing digitalization across all industrial sectors, especially in emerging economies, presents a vast untapped market potential, paving the way for widespread adoption of smart flow metering solutions and fostering substantial long-term growth opportunities.

Smart Flow Meter Industry Segmentation

-

1. Type

- 1.1. Coriolis

- 1.2. Magnetic

- 1.3. Ultrasonic

- 1.4. Multiphase

- 1.5. Vortex

- 1.6. Variable Area

- 1.7. Differential pressure

- 1.8. Thermal

- 1.9. Turbine

-

2. Communication Protocol

- 2.1. Profibus

- 2.2. Modbus

- 2.3. Hart

- 2.4. Others

-

3. End-User Industry

- 3.1. Oil and Gas

- 3.2. Pharmaceuticals

- 3.3. Water and Wastewater

- 3.4. Paper and Pulp

- 3.5. Power Generation

- 3.6. Food and Beverages

- 3.7. Other End-User Industries

Smart Flow Meter Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Smart Flow Meter Industry Regional Market Share

Geographic Coverage of Smart Flow Meter Industry

Smart Flow Meter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Penetration of Advanced Flow Meters in the Oil and Gas Sector and Water & Wastewater Management; Penetration of IoT in Flow Rate Measurement Solutions

- 3.3. Market Restrains

- 3.3.1. Higher Cost of Intelligent Flow Meters Compared to Traditional Flow Meters; High Initial Cost for Coriolis and Magnetic Flow Meters

- 3.4. Market Trends

- 3.4.1. Food and Beverages Industry to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Flow Meter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Coriolis

- 5.1.2. Magnetic

- 5.1.3. Ultrasonic

- 5.1.4. Multiphase

- 5.1.5. Vortex

- 5.1.6. Variable Area

- 5.1.7. Differential pressure

- 5.1.8. Thermal

- 5.1.9. Turbine

- 5.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.2.1. Profibus

- 5.2.2. Modbus

- 5.2.3. Hart

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil and Gas

- 5.3.2. Pharmaceuticals

- 5.3.3. Water and Wastewater

- 5.3.4. Paper and Pulp

- 5.3.5. Power Generation

- 5.3.6. Food and Beverages

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.4.3. Europe

- 5.4.4. Asia Pacific

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Smart Flow Meter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Coriolis

- 6.1.2. Magnetic

- 6.1.3. Ultrasonic

- 6.1.4. Multiphase

- 6.1.5. Vortex

- 6.1.6. Variable Area

- 6.1.7. Differential pressure

- 6.1.8. Thermal

- 6.1.9. Turbine

- 6.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 6.2.1. Profibus

- 6.2.2. Modbus

- 6.2.3. Hart

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Oil and Gas

- 6.3.2. Pharmaceuticals

- 6.3.3. Water and Wastewater

- 6.3.4. Paper and Pulp

- 6.3.5. Power Generation

- 6.3.6. Food and Beverages

- 6.3.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Latin America Smart Flow Meter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Coriolis

- 7.1.2. Magnetic

- 7.1.3. Ultrasonic

- 7.1.4. Multiphase

- 7.1.5. Vortex

- 7.1.6. Variable Area

- 7.1.7. Differential pressure

- 7.1.8. Thermal

- 7.1.9. Turbine

- 7.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 7.2.1. Profibus

- 7.2.2. Modbus

- 7.2.3. Hart

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Oil and Gas

- 7.3.2. Pharmaceuticals

- 7.3.3. Water and Wastewater

- 7.3.4. Paper and Pulp

- 7.3.5. Power Generation

- 7.3.6. Food and Beverages

- 7.3.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Smart Flow Meter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Coriolis

- 8.1.2. Magnetic

- 8.1.3. Ultrasonic

- 8.1.4. Multiphase

- 8.1.5. Vortex

- 8.1.6. Variable Area

- 8.1.7. Differential pressure

- 8.1.8. Thermal

- 8.1.9. Turbine

- 8.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 8.2.1. Profibus

- 8.2.2. Modbus

- 8.2.3. Hart

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Oil and Gas

- 8.3.2. Pharmaceuticals

- 8.3.3. Water and Wastewater

- 8.3.4. Paper and Pulp

- 8.3.5. Power Generation

- 8.3.6. Food and Beverages

- 8.3.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Smart Flow Meter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Coriolis

- 9.1.2. Magnetic

- 9.1.3. Ultrasonic

- 9.1.4. Multiphase

- 9.1.5. Vortex

- 9.1.6. Variable Area

- 9.1.7. Differential pressure

- 9.1.8. Thermal

- 9.1.9. Turbine

- 9.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 9.2.1. Profibus

- 9.2.2. Modbus

- 9.2.3. Hart

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Oil and Gas

- 9.3.2. Pharmaceuticals

- 9.3.3. Water and Wastewater

- 9.3.4. Paper and Pulp

- 9.3.5. Power Generation

- 9.3.6. Food and Beverages

- 9.3.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Smart Flow Meter Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Coriolis

- 10.1.2. Magnetic

- 10.1.3. Ultrasonic

- 10.1.4. Multiphase

- 10.1.5. Vortex

- 10.1.6. Variable Area

- 10.1.7. Differential pressure

- 10.1.8. Thermal

- 10.1.9. Turbine

- 10.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 10.2.1. Profibus

- 10.2.2. Modbus

- 10.2.3. Hart

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Oil and Gas

- 10.3.2. Pharmaceuticals

- 10.3.3. Water and Wastewater

- 10.3.4. Paper and Pulp

- 10.3.5. Power Generation

- 10.3.6. Food and Beverages

- 10.3.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sierra Instruments Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emerson Electric Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brooks Instrument

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KROHNE Messtechnik GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fuji Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ABB Ltd *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Azbil Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yokogawa Electric Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Endress + Hauser AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 General Electric Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Teledyne Isco Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Smart Flow Meter Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Flow Meter Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Smart Flow Meter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Smart Flow Meter Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 5: North America Smart Flow Meter Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 6: North America Smart Flow Meter Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: North America Smart Flow Meter Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Smart Flow Meter Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Smart Flow Meter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Smart Flow Meter Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Latin America Smart Flow Meter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Latin America Smart Flow Meter Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 13: Latin America Smart Flow Meter Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 14: Latin America Smart Flow Meter Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: Latin America Smart Flow Meter Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Latin America Smart Flow Meter Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Smart Flow Meter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Smart Flow Meter Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Smart Flow Meter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Smart Flow Meter Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 21: Europe Smart Flow Meter Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 22: Europe Smart Flow Meter Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Europe Smart Flow Meter Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe Smart Flow Meter Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Smart Flow Meter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Smart Flow Meter Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Smart Flow Meter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Smart Flow Meter Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 29: Asia Pacific Smart Flow Meter Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 30: Asia Pacific Smart Flow Meter Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 31: Asia Pacific Smart Flow Meter Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Asia Pacific Smart Flow Meter Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Asia Pacific Smart Flow Meter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Smart Flow Meter Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Smart Flow Meter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Smart Flow Meter Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 37: Middle East and Africa Smart Flow Meter Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 38: Middle East and Africa Smart Flow Meter Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Smart Flow Meter Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Smart Flow Meter Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Smart Flow Meter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Flow Meter Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Smart Flow Meter Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 3: Global Smart Flow Meter Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Smart Flow Meter Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Smart Flow Meter Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Smart Flow Meter Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 7: Global Smart Flow Meter Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Smart Flow Meter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Smart Flow Meter Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Smart Flow Meter Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 11: Global Smart Flow Meter Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Smart Flow Meter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Smart Flow Meter Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Smart Flow Meter Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 15: Global Smart Flow Meter Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Smart Flow Meter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Smart Flow Meter Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Smart Flow Meter Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 19: Global Smart Flow Meter Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Smart Flow Meter Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Smart Flow Meter Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Smart Flow Meter Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 23: Global Smart Flow Meter Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Smart Flow Meter Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Flow Meter Industry?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the Smart Flow Meter Industry?

Key companies in the market include Honeywell International Inc, Sierra Instruments Inc, Emerson Electric Co, Siemens AG, Brooks Instrument, KROHNE Messtechnik GmbH, Fuji Electric, ABB Ltd *List Not Exhaustive, Azbil Corporation, Yokogawa Electric Corporation, Endress + Hauser AG, General Electric Company, Teledyne Isco Inc.

3. What are the main segments of the Smart Flow Meter Industry?

The market segments include Type, Communication Protocol, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Penetration of Advanced Flow Meters in the Oil and Gas Sector and Water & Wastewater Management; Penetration of IoT in Flow Rate Measurement Solutions.

6. What are the notable trends driving market growth?

Food and Beverages Industry to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

Higher Cost of Intelligent Flow Meters Compared to Traditional Flow Meters; High Initial Cost for Coriolis and Magnetic Flow Meters.

8. Can you provide examples of recent developments in the market?

April 2022 - Yokogawa Electric Corporation released OpreXVortex Flowmeter VY Series. The new series will be released in Southeast Asia, Oceania, India, the Middle East, and South America, excluding Brazil. The product will support remote maintenance functions that allow condition-based maintenance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Flow Meter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Flow Meter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Flow Meter Industry?

To stay informed about further developments, trends, and reports in the Smart Flow Meter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence