Key Insights

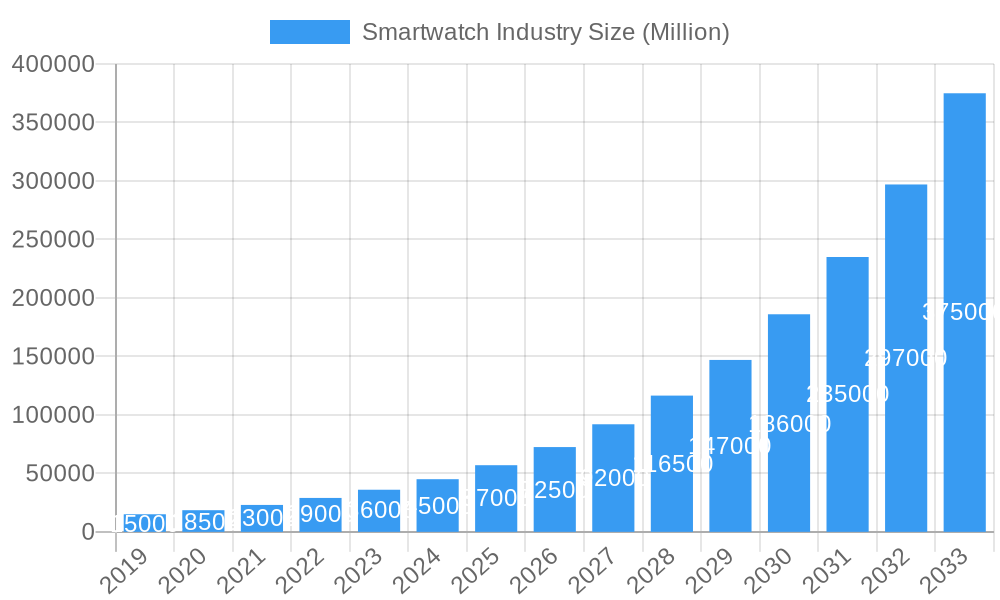

The global smartwatch market is poised for significant expansion, projected to reach $76.17 billion by 2033. Fueled by a robust Compound Annual Growth Rate (CAGR) of 25.78%, this sector's growth is attributed to rising consumer interest in advanced health and fitness monitoring, seamless integration with digital ecosystems, and continuous innovation in wearable technology. Key growth segments include personal assistance and medical applications, as smartwatches increasingly function as comprehensive personal health management tools. The availability of diverse, feature-rich devices across various price points is also driving widespread adoption.

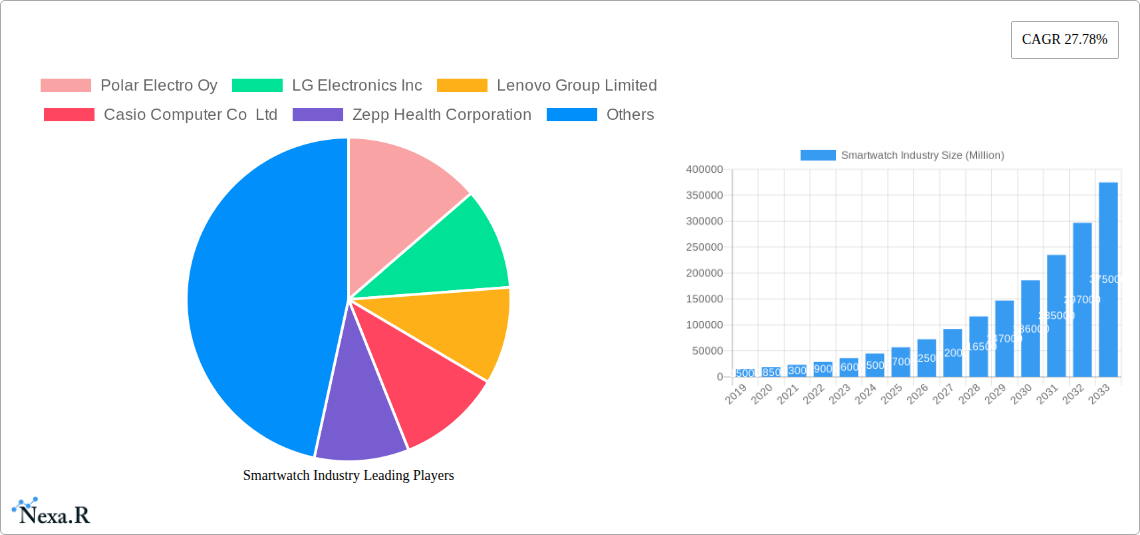

Smartwatch Industry Market Size (In Billion)

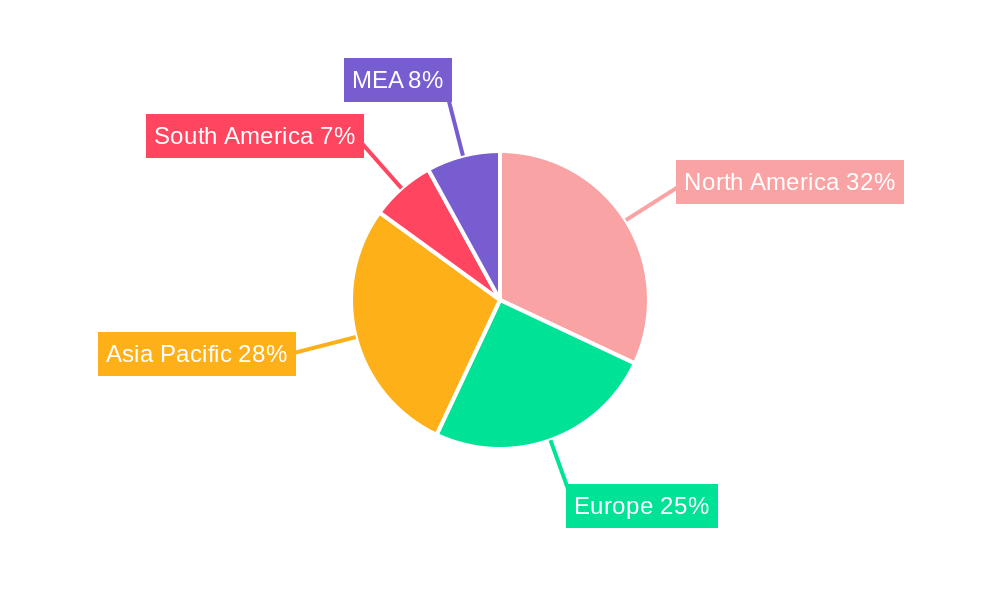

The competitive environment is marked by rapid innovation and strategic collaborations among leading technology firms. Companies are actively developing new features, such as advanced sleep tracking, ECG monitoring, and contactless payments, to enhance market presence. The operating system landscape features established platforms like Watch OS and Wear OS, alongside emerging niche and budget-friendly alternatives. Display technologies like AMOLED and PMOLED are central to advancements, offering superior visual performance and energy efficiency. Geographically, North America and Asia Pacific are expected to lead market growth due to high disposable incomes and technological adoption, with Europe and emerging markets presenting significant future opportunities.

Smartwatch Industry Company Market Share

Unlocking the Future of Wearable Technology: A Comprehensive Smartwatch Industry Report (2019-2033)

This in-depth smartwatch industry report provides a definitive analysis of the global wearable technology market, focusing on the dynamic evolution and future trajectory of smartwatches. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product landscapes, key drivers, emerging opportunities, and the strategic moves of major players. Analyze the parent market and child market segments with detailed data, presented in million units, to understand the intricate ecosystem of this rapidly expanding sector. This report is optimized with high-traffic keywords such as smartwatch market analysis, wearable device trends, consumer electronics, health and fitness trackers, connected devices, and IoT wearables to maximize search engine visibility and cater to industry professionals seeking critical intelligence.

Smartwatch Industry Market Dynamics & Structure

The smartwatch industry is characterized by a dynamic and evolving market structure, driven by relentless technological innovation and shifting consumer demands. Market concentration remains significant, with a few key players holding substantial market share, particularly in the premium segment. However, the proliferation of new entrants and the increasing demand for budget-friendly options are fostering a more competitive landscape. Key drivers of technological innovation include advancements in sensor technology, battery life, miniaturization, and the development of more sophisticated operating systems and software ecosystems. Regulatory frameworks, while still developing, are beginning to address data privacy and security concerns related to health and personal information collected by smartwatches. Competitive product substitutes, such as fitness trackers and advanced wristwatches, pose a constant challenge, necessitating continuous innovation and differentiation. End-user demographics are broadening, with increasing adoption among younger generations and a growing interest from the elderly population for health monitoring features. Mergers and acquisitions (M&A) are a notable trend, as established tech giants seek to consolidate their market positions and smaller innovative companies are acquired to gain access to new technologies and customer bases.

- Market Concentration: Dominated by key players like Apple Inc., Samsung Electronics Co Ltd, and Huawei Technologies Co Ltd.

- Technological Innovation Drivers: Miniaturization of components, enhanced sensor accuracy (e.g., ECG, SpO2), improved battery efficiency, and AI-powered analytics for health and fitness.

- Regulatory Frameworks: Emerging regulations focused on data privacy (e.g., GDPR, CCPA) and health data security standards.

- Competitive Product Substitutes: Advanced fitness trackers, traditional luxury watches, and smartphones with integrated health features.

- End-User Demographics: Expanding to include a wider age range, with specific features catering to athletes, health-conscious individuals, and the elderly.

- M&A Trends: Strategic acquisitions by larger tech companies to enhance their wearable portfolios and ecosystem integration. For instance, Google's acquisition of Fitbit Inc.

Smartwatch Industry Growth Trends & Insights

The global smartwatch market is poised for sustained and robust growth, driven by increasing consumer awareness of health and wellness, the expanding capabilities of wearable technology, and the continuous integration of smartwatches into the broader digital ecosystem. Market size evolution has been consistently upward, with significant year-over-year increases in unit shipments and revenue. Adoption rates are accelerating across both developed and emerging economies, fueled by decreasing price points for entry-level devices and the widespread availability of advanced features. Technological disruptions, such as the integration of advanced health monitoring sensors, contactless payment functionalities, and seamless connectivity with other smart devices, are playing a pivotal role in driving adoption. Consumer behavior shifts are evident, with a growing preference for personalized health insights, proactive wellness management, and the convenience of a connected lifestyle. The parent market for smartwatches, encompassing the broader wearable technology landscape, is expanding rapidly, while the child market segments, such as health-focused smartwatches and sports-specific wearables, are exhibiting specialized growth trajectories.

- Market Size Evolution: Projected to reach significant valuations in the coming years, with substantial growth in unit sales.

- Adoption Rates: High penetration in developed markets and rapidly growing adoption in developing regions, particularly in Asia-Pacific.

- Technological Disruptions: Integration of advanced medical-grade sensors, improved AI for personalized health coaching, and enhanced durability for outdoor activities.

- Consumer Behavior Shifts: Increasing demand for proactive health management, stress monitoring, sleep tracking, and integration with smart home ecosystems.

- CAGR (Compound Annual Growth Rate): Expected to witness a healthy CAGR of approximately XX% during the forecast period.

- Market Penetration: Smartwatches are transitioning from niche products to mainstream consumer electronics, further increasing market penetration.

Dominant Regions, Countries, or Segments in Smartwatch Industry

North America, particularly the United States, continues to be a dominant region in the smartwatch industry, driven by high disposable incomes, strong consumer appetite for innovative technology, and established tech giants like Apple and Samsung. Asia-Pacific, led by China, is emerging as a significant growth engine, propelled by a burgeoning middle class, increasing urbanization, and a strong manufacturing base.

In terms of operating systems, Watch OS commands a substantial market share due to the immense popularity of the Apple Watch. However, Wear OS is steadily gaining traction, benefiting from wider device compatibility and ongoing development efforts by Google and its partners, including Samsung Electronics Co Ltd and Fossil Group Inc. Other Operating Systems, often proprietary to specific manufacturers like Huawei Technologies Co Ltd, also hold a niche but important presence, catering to specific market segments.

The AMOLED display type is increasingly favored for its superior contrast ratios, vibrant colors, and energy efficiency, contributing to enhanced user experience and battery life. This is a key factor in the success of premium smartwatch offerings. TFT LCD displays, while more cost-effective, are typically found in lower-tier or specialized smartwatches.

From an application perspective, Personal Assistance remains a core function, with features like notifications, calls, and messaging being essential. However, the Medical application segment is experiencing explosive growth, driven by advanced health monitoring capabilities like ECG, blood oxygen saturation (SpO2) tracking, and fall detection. The Sports application segment continues to be a strong driver, with dedicated features for a wide array of athletic activities, performance tracking, and training guidance.

- Dominant Region: North America (USA) and Asia-Pacific (China) leading market penetration and sales volume.

- Key Operating System Drivers: Apple's ecosystem dominance with Watch OS, and Google's strategic push with Wear OS and partnerships.

- Leading Display Technology: AMOLED displays favored for premium user experience and power efficiency.

- High-Growth Application Segments: Medical and health monitoring features are driving significant adoption and innovation.

- Market Share within Segments:

- Operating System: Watch OS (XX%), Wear OS (XX%), Other Operating Systems (XX%)

- Display Type: AMOLED (XX%), PMOLED (XX%), TFT LCD (XX%)

- Application: Personal Assistance (XX%), Medical (XX%), Sports (XX%), Other Applications (XX%)

Smartwatch Industry Product Landscape

The smartwatch product landscape is characterized by a relentless pursuit of innovation, with manufacturers continually pushing the boundaries of functionality, design, and user experience. Key product developments revolve around integrating advanced health sensors for comprehensive wellness tracking, enhancing battery life to address user concerns, and improving connectivity options for seamless integration with the digital world. Unique selling propositions often lie in specialized features such as advanced sleep tracking, stress management tools, or robust sports metrics for specific athletic disciplines. Technological advancements include the development of more power-efficient processors, sophisticated AI algorithms for data analysis, and the incorporation of new materials for improved durability and aesthetics.

- Product Innovations: Integration of advanced health sensors (e.g., continuous glucose monitoring prototypes, blood pressure monitoring), AI-driven personalized coaching, and enhanced on-device AI capabilities.

- Applications: Beyond fitness and notifications, smartwatches are evolving into personal health hubs, communication tools, and payment devices.

- Performance Metrics: Focus on accuracy of biometric data, battery longevity (often exceeding 24-48 hours for premium devices), and responsiveness of the user interface.

Key Drivers, Barriers & Challenges in Smartwatch Industry

The smartwatch industry is propelled by several key drivers. The growing global emphasis on health and wellness, coupled with an increasing aging population seeking proactive health management solutions, is a significant catalyst. Technological advancements in miniaturization, sensor accuracy, and battery technology are enabling more sophisticated and desirable devices. The expanding adoption of smartphones and the pervasive nature of the digital lifestyle are creating a natural synergy for wearable technology. Furthermore, the increasing affordability of smartwatches across various price points is making them accessible to a broader consumer base.

However, the industry also faces notable barriers and challenges. Battery life remains a persistent concern for many consumers, despite continuous improvements. Data privacy and security concerns associated with the collection of sensitive personal health information pose regulatory and trust-related hurdles. Intense competition among numerous brands, including established tech giants and emerging players, can lead to price wars and margin pressures. Additionally, the perceived necessity of smartwatches versus optional accessories can impact adoption rates in certain demographics.

- Key Drivers:

- Growing health and wellness consciousness

- Advancements in sensor technology and battery efficiency

- Ubiquity of smartphones and digital connectivity

- Increasing affordability and wider product range

- Barriers & Challenges:

- Battery life limitations

- Data privacy and security concerns

- Intense market competition and price sensitivity

- Consumer perception of necessity versus optionality

Emerging Opportunities in Smartwatch Industry

Emerging opportunities in the smartwatch industry are plentiful, particularly in the burgeoning area of personalized health and remote patient monitoring. The integration of advanced medical-grade sensors and AI-powered diagnostics holds immense potential for proactive disease management and early detection. Untapped markets in developing economies, where smartphone penetration is rising, represent significant growth potential. Innovative applications in areas like mental wellness tracking, stress management, and sleep optimization are gaining traction. Furthermore, the evolution of smartwatches as standalone devices, capable of performing a wider range of functions without constant reliance on a smartphone, is an area ripe for development and consumer adoption.

- Untapped Markets: Expansion into rural areas and emerging economies with increasing digital literacy.

- Innovative Applications: Mental health tracking, advanced sleep analytics, and personalized nutrition guidance.

- Evolving Consumer Preferences: Demand for stylish and customizable designs alongside functional features.

Growth Accelerators in the Smartwatch Industry Industry

Several key growth accelerators are expected to shape the future of the smartwatch industry. Technological breakthroughs in battery technology, such as solid-state batteries, will significantly address current limitations and enhance user experience. Strategic partnerships between smartwatch manufacturers and healthcare providers, insurance companies, and fitness platforms will unlock new revenue streams and broaden the scope of wearable applications. Market expansion strategies, including a focus on emerging markets and niche consumer segments, will drive unit sales and revenue growth. The increasing development of open platforms and robust app ecosystems will foster greater innovation and user engagement.

- Technological Breakthroughs: Advancements in miniaturized processors, more efficient displays, and novel sensor technologies.

- Strategic Partnerships: Collaborations with healthcare institutions for medical-grade features and data integration.

- Market Expansion Strategies: Focused product development for specific demographics like children and seniors, and expansion into underserved geographical regions.

Key Players Shaping the Smartwatch Industry Market

- Apple Inc.

- Samsung Electronics Co Ltd

- Huawei Technologies Co Ltd

- Garmin Ltd

- Fitbit Inc

- Xiaomi Corporation

- Sony Corporation

- Fossil Group Inc.

- LG Electronics Inc

- Lenovo Group Limited

- Casio Computer Co Ltd

- Zepp Health Corporation

- Polar Electro Oy

Notable Milestones in Smartwatch Industry Sector

- June 2022: Apple previewed watch OS 9, enhancing user experience with more watch faces, richer complications, and advanced workout metrics inspired by high-performing athletes.

- January 2022: Fossil and Razer partnered to launch the limited-edition Razer X Fossil Gen 6 Smartwatch, integrating Razer's branding and exclusive watch faces onto Fossil's platform.

In-Depth Smartwatch Industry Market Outlook

The smartwatch industry market outlook is exceptionally positive, with sustained growth projected through the forecast period. Key growth accelerators, including ongoing technological advancements in health monitoring and battery efficiency, coupled with increasing consumer demand for connected health solutions, will continue to fuel market expansion. Strategic partnerships between technology companies and healthcare providers are set to unlock new frontiers in preventative care and remote patient monitoring. Furthermore, the development of more sophisticated AI-driven personalized insights and the increasing integration of smartwatches into the broader IoT ecosystem will solidify their position as indispensable consumer electronics. The parent market for wearables will continue to expand, with smartwatches playing a central role in this growth trajectory, offering a wealth of opportunities for innovation and market penetration.

Smartwatch Industry Segmentation

-

1. Operating System

- 1.1. Watch OS

- 1.2. Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

Smartwatch Industry Segmentation By Geography

- 1. North America: United States Canada Mexico

- 2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 3. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 4. South America : Brazil, Argentina, Rest of South America

- 5. MEA: Middle East, Africa

Smartwatch Industry Regional Market Share

Geographic Coverage of Smartwatch Industry

Smartwatch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increasing Health Awareness among the Consumers

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices

- 3.3.2 Limited Use of Features

- 3.3.3 and Security Risks

- 3.4. Market Trends

- 3.4.1. Sports Segment to Account for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Watch OS

- 5.1.2. Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America: United States Canada Mexico

- 5.4.2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 5.4.3. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 5.4.4. South America : Brazil, Argentina, Rest of South America

- 5.4.5. MEA: Middle East, Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. North America: United States Canada Mexico Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 6.1.1. Watch OS

- 6.1.2. Wear OS

- 6.1.3. Other Operating Systems

- 6.2. Market Analysis, Insights and Forecast - by Display Type

- 6.2.1. AMOLED

- 6.2.2. PMOLED

- 6.2.3. TFT LCD

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal Assistance

- 6.3.2. Medical

- 6.3.3. Sports

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 7. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 7.1.1. Watch OS

- 7.1.2. Wear OS

- 7.1.3. Other Operating Systems

- 7.2. Market Analysis, Insights and Forecast - by Display Type

- 7.2.1. AMOLED

- 7.2.2. PMOLED

- 7.2.3. TFT LCD

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal Assistance

- 7.3.2. Medical

- 7.3.3. Sports

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 8. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 8.1.1. Watch OS

- 8.1.2. Wear OS

- 8.1.3. Other Operating Systems

- 8.2. Market Analysis, Insights and Forecast - by Display Type

- 8.2.1. AMOLED

- 8.2.2. PMOLED

- 8.2.3. TFT LCD

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal Assistance

- 8.3.2. Medical

- 8.3.3. Sports

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 9. South America : Brazil, Argentina, Rest of South America Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 9.1.1. Watch OS

- 9.1.2. Wear OS

- 9.1.3. Other Operating Systems

- 9.2. Market Analysis, Insights and Forecast - by Display Type

- 9.2.1. AMOLED

- 9.2.2. PMOLED

- 9.2.3. TFT LCD

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal Assistance

- 9.3.2. Medical

- 9.3.3. Sports

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 10. MEA: Middle East, Africa Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 10.1.1. Watch OS

- 10.1.2. Wear OS

- 10.1.3. Other Operating Systems

- 10.2. Market Analysis, Insights and Forecast - by Display Type

- 10.2.1. AMOLED

- 10.2.2. PMOLED

- 10.2.3. TFT LCD

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal Assistance

- 10.3.2. Medical

- 10.3.3. Sports

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Polar Electro Oy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Electronics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lenovo Group Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Casio Computer Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zepp Health Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Samsung Electronics Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Garmin Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fitbit Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huawei Technologies Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fossil Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sony Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Polar Electro Oy

List of Figures

- Figure 1: Global Smartwatch Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Smartwatch Industry Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America: United States Canada Mexico Smartwatch Industry Revenue (billion), by Operating System 2025 & 2033

- Figure 4: North America: United States Canada Mexico Smartwatch Industry Volume (Million), by Operating System 2025 & 2033

- Figure 5: North America: United States Canada Mexico Smartwatch Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 6: North America: United States Canada Mexico Smartwatch Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 7: North America: United States Canada Mexico Smartwatch Industry Revenue (billion), by Display Type 2025 & 2033

- Figure 8: North America: United States Canada Mexico Smartwatch Industry Volume (Million), by Display Type 2025 & 2033

- Figure 9: North America: United States Canada Mexico Smartwatch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 10: North America: United States Canada Mexico Smartwatch Industry Volume Share (%), by Display Type 2025 & 2033

- Figure 11: North America: United States Canada Mexico Smartwatch Industry Revenue (billion), by Application 2025 & 2033

- Figure 12: North America: United States Canada Mexico Smartwatch Industry Volume (Million), by Application 2025 & 2033

- Figure 13: North America: United States Canada Mexico Smartwatch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America: United States Canada Mexico Smartwatch Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: North America: United States Canada Mexico Smartwatch Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America: United States Canada Mexico Smartwatch Industry Volume (Million), by Country 2025 & 2033

- Figure 17: North America: United States Canada Mexico Smartwatch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America: United States Canada Mexico Smartwatch Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue (billion), by Operating System 2025 & 2033

- Figure 20: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume (Million), by Operating System 2025 & 2033

- Figure 21: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 22: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 23: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue (billion), by Display Type 2025 & 2033

- Figure 24: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume (Million), by Display Type 2025 & 2033

- Figure 25: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 26: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume Share (%), by Display Type 2025 & 2033

- Figure 27: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue (billion), by Application 2025 & 2033

- Figure 28: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume (Million), by Application 2025 & 2033

- Figure 29: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume (Million), by Country 2025 & 2033

- Figure 33: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Smartwatch Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue (billion), by Operating System 2025 & 2033

- Figure 36: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume (Million), by Operating System 2025 & 2033

- Figure 37: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 38: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 39: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue (billion), by Display Type 2025 & 2033

- Figure 40: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume (Million), by Display Type 2025 & 2033

- Figure 41: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 42: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume Share (%), by Display Type 2025 & 2033

- Figure 43: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume (Million), by Application 2025 & 2033

- Figure 45: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume (Million), by Country 2025 & 2033

- Figure 49: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Smartwatch Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue (billion), by Operating System 2025 & 2033

- Figure 52: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume (Million), by Operating System 2025 & 2033

- Figure 53: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 54: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 55: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue (billion), by Display Type 2025 & 2033

- Figure 56: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume (Million), by Display Type 2025 & 2033

- Figure 57: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 58: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume Share (%), by Display Type 2025 & 2033

- Figure 59: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue (billion), by Application 2025 & 2033

- Figure 60: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume (Million), by Application 2025 & 2033

- Figure 61: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 62: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume Share (%), by Application 2025 & 2033

- Figure 63: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume (Million), by Country 2025 & 2033

- Figure 65: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America : Brazil, Argentina, Rest of South America Smartwatch Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: MEA: Middle East, Africa Smartwatch Industry Revenue (billion), by Operating System 2025 & 2033

- Figure 68: MEA: Middle East, Africa Smartwatch Industry Volume (Million), by Operating System 2025 & 2033

- Figure 69: MEA: Middle East, Africa Smartwatch Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 70: MEA: Middle East, Africa Smartwatch Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 71: MEA: Middle East, Africa Smartwatch Industry Revenue (billion), by Display Type 2025 & 2033

- Figure 72: MEA: Middle East, Africa Smartwatch Industry Volume (Million), by Display Type 2025 & 2033

- Figure 73: MEA: Middle East, Africa Smartwatch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 74: MEA: Middle East, Africa Smartwatch Industry Volume Share (%), by Display Type 2025 & 2033

- Figure 75: MEA: Middle East, Africa Smartwatch Industry Revenue (billion), by Application 2025 & 2033

- Figure 76: MEA: Middle East, Africa Smartwatch Industry Volume (Million), by Application 2025 & 2033

- Figure 77: MEA: Middle East, Africa Smartwatch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 78: MEA: Middle East, Africa Smartwatch Industry Volume Share (%), by Application 2025 & 2033

- Figure 79: MEA: Middle East, Africa Smartwatch Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: MEA: Middle East, Africa Smartwatch Industry Volume (Million), by Country 2025 & 2033

- Figure 81: MEA: Middle East, Africa Smartwatch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: MEA: Middle East, Africa Smartwatch Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smartwatch Industry Revenue billion Forecast, by Operating System 2020 & 2033

- Table 2: Global Smartwatch Industry Volume Million Forecast, by Operating System 2020 & 2033

- Table 3: Global Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 4: Global Smartwatch Industry Volume Million Forecast, by Display Type 2020 & 2033

- Table 5: Global Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Smartwatch Industry Volume Million Forecast, by Application 2020 & 2033

- Table 7: Global Smartwatch Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Smartwatch Industry Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global Smartwatch Industry Revenue billion Forecast, by Operating System 2020 & 2033

- Table 10: Global Smartwatch Industry Volume Million Forecast, by Operating System 2020 & 2033

- Table 11: Global Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 12: Global Smartwatch Industry Volume Million Forecast, by Display Type 2020 & 2033

- Table 13: Global Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Smartwatch Industry Volume Million Forecast, by Application 2020 & 2033

- Table 15: Global Smartwatch Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Smartwatch Industry Volume Million Forecast, by Country 2020 & 2033

- Table 17: Global Smartwatch Industry Revenue billion Forecast, by Operating System 2020 & 2033

- Table 18: Global Smartwatch Industry Volume Million Forecast, by Operating System 2020 & 2033

- Table 19: Global Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 20: Global Smartwatch Industry Volume Million Forecast, by Display Type 2020 & 2033

- Table 21: Global Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Smartwatch Industry Volume Million Forecast, by Application 2020 & 2033

- Table 23: Global Smartwatch Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Smartwatch Industry Volume Million Forecast, by Country 2020 & 2033

- Table 25: Global Smartwatch Industry Revenue billion Forecast, by Operating System 2020 & 2033

- Table 26: Global Smartwatch Industry Volume Million Forecast, by Operating System 2020 & 2033

- Table 27: Global Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 28: Global Smartwatch Industry Volume Million Forecast, by Display Type 2020 & 2033

- Table 29: Global Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Smartwatch Industry Volume Million Forecast, by Application 2020 & 2033

- Table 31: Global Smartwatch Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Smartwatch Industry Volume Million Forecast, by Country 2020 & 2033

- Table 33: Global Smartwatch Industry Revenue billion Forecast, by Operating System 2020 & 2033

- Table 34: Global Smartwatch Industry Volume Million Forecast, by Operating System 2020 & 2033

- Table 35: Global Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 36: Global Smartwatch Industry Volume Million Forecast, by Display Type 2020 & 2033

- Table 37: Global Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Smartwatch Industry Volume Million Forecast, by Application 2020 & 2033

- Table 39: Global Smartwatch Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Smartwatch Industry Volume Million Forecast, by Country 2020 & 2033

- Table 41: Global Smartwatch Industry Revenue billion Forecast, by Operating System 2020 & 2033

- Table 42: Global Smartwatch Industry Volume Million Forecast, by Operating System 2020 & 2033

- Table 43: Global Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 44: Global Smartwatch Industry Volume Million Forecast, by Display Type 2020 & 2033

- Table 45: Global Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 46: Global Smartwatch Industry Volume Million Forecast, by Application 2020 & 2033

- Table 47: Global Smartwatch Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Smartwatch Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smartwatch Industry?

The projected CAGR is approximately 25.78%.

2. Which companies are prominent players in the Smartwatch Industry?

Key companies in the market include Polar Electro Oy, LG Electronics Inc, Lenovo Group Limited, Casio Computer Co Ltd, Zepp Health Corporation, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Sony Corporation.

3. What are the main segments of the Smartwatch Industry?

The market segments include Operating System, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increasing Health Awareness among the Consumers.

6. What are the notable trends driving market growth?

Sports Segment to Account for Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices. Limited Use of Features. and Security Risks.

8. Can you provide examples of recent developments in the market?

June 2022 - Apple previewed watch OS 9, which brings the latest features and improved experiences to the wearable operating system. Apple Watch users can now have more watch faces to choose from, with richer complications that offer more information and opportunity for personalization. In the updated Workout app, advanced metrics, views, and training experiences inspired by high-performing athletes help users take their workouts to the next level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smartwatch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smartwatch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smartwatch Industry?

To stay informed about further developments, trends, and reports in the Smartwatch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence