Key Insights

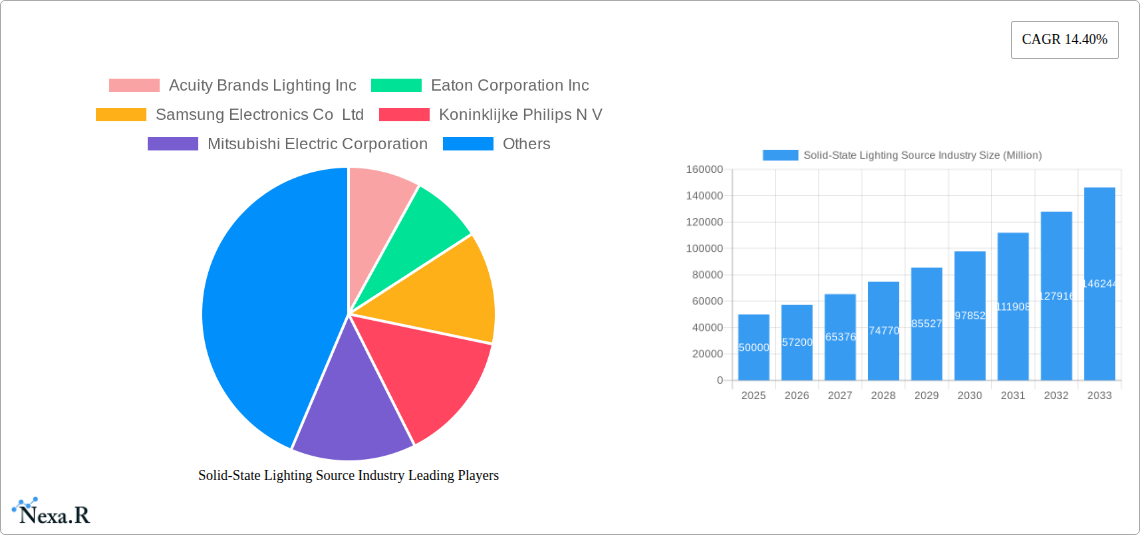

The Solid-State Lighting (SSL) Source Industry is poised for remarkable expansion, projected to reach a substantial market size of approximately $XX million by 2033. This growth is propelled by a compelling Compound Annual Growth Rate (CAGR) of 14.40%, indicating a dynamic and rapidly evolving sector. The primary drivers behind this surge are the increasing adoption of energy-efficient lighting solutions, stringent government regulations promoting sustainability, and continuous technological advancements in LED, OLED, and PLED technologies. These innovations are not only enhancing performance characteristics like brightness and color rendition but also driving down costs, making SSL sources a more accessible and attractive alternative to traditional lighting. The transition towards smart cities, the burgeoning demand for sophisticated display technologies in consumer electronics, and the critical role of specialized lighting in medical and automotive applications are further fueling this market's ascent.

Solid-State Lighting Source Industry Market Size (In Billion)

The market is strategically segmented by technology, with Light Emitting Diodes (LEDs) currently dominating due to their widespread application and maturity, but Organic Light Emitting Diodes (OLED) and Polymer Light Emitting Diodes (PLED) are gaining significant traction, especially in high-end displays and flexible lighting applications. The end-user landscape is equally diverse, encompassing residential, commercial, automotive, medical, and consumer electronics sectors, each contributing uniquely to market demand. While robust growth is anticipated across all regions, the Asia Pacific is expected to lead due to rapid industrialization, smart city initiatives, and a substantial manufacturing base. Restraints, such as the initial high cost of some advanced SSL technologies and the complexity of integration in legacy systems, are being progressively overcome by innovation and economies of scale. The competitive landscape features key players like Acuity Brands Lighting, Eaton Corporation, Samsung Electronics, and Koninklijke Philips, who are investing heavily in R&D to maintain their market leadership and capitalize on emerging opportunities.

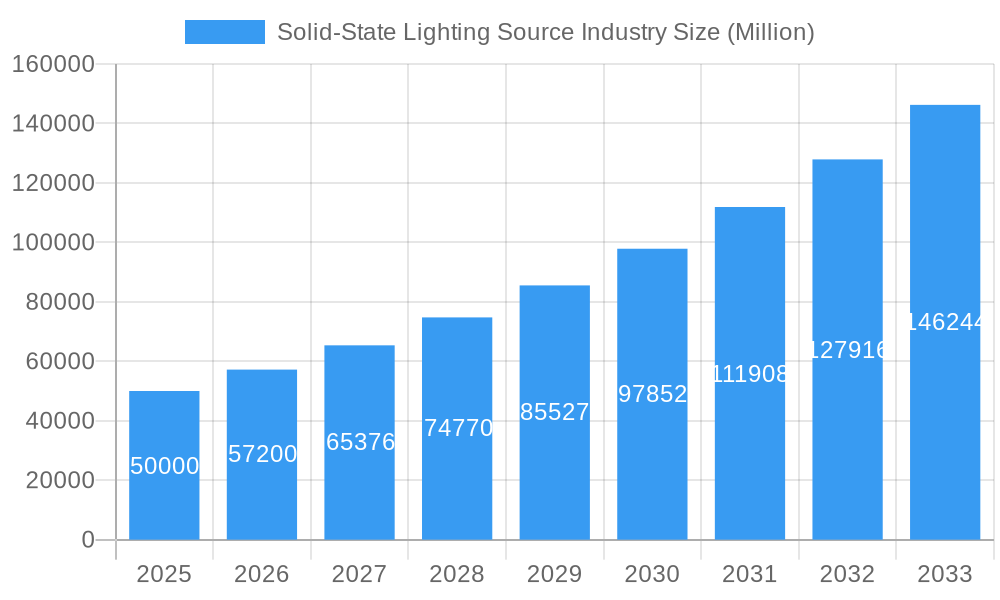

Solid-State Lighting Source Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Solid-State Lighting (SSL) Source Industry, a critical and rapidly evolving sector driven by advancements in LED, OLED, and PLED technologies. The market is characterized by dynamic shifts in end-user adoption across Residential, Commercial, Automotive, Medical, and Consumer Electronics segments. This report leverages extensive data from the Historical Period (2019-2024), Base Year (2025), and Forecast Period (2025-2033) to offer actionable insights into market size, growth drivers, competitive landscape, and future potential.

Solid-State Lighting Source Industry Market Dynamics & Structure

The Solid-State Lighting Source Industry is experiencing a significant shift towards consolidation, with leading players like Samsung Electronics Co Ltd, Koninklijke Philips N V, and GE Lighting spearheading innovation and market share acquisition. The market concentration is moderately high, driven by substantial R&D investments in Light Emitting Diodes (LEDs), which continue to dominate due to their energy efficiency and cost-effectiveness. Technological innovation is primarily fueled by the pursuit of higher luminous efficacy, improved color rendering index (CRI), and novel form factors. Regulatory frameworks promoting energy efficiency standards globally act as a strong tailwind. Competitive product substitutes, though diminishing, still include traditional lighting technologies like fluorescent and incandescent lamps, but their market share is steadily eroding. End-user demographics reveal a growing demand for smart lighting solutions in Residential and Commercial applications, influencing product development towards integrated control systems and IoT connectivity. Mergers & Acquisitions (M&A) trends indicate strategic moves to gain technological expertise and expand market reach, with approximately 15-20 M&A deals observed annually in the historical period. Barriers to innovation primarily stem from high initial development costs for next-generation SSL technologies and the need for robust intellectual property protection.

- Market Concentration: Moderately high, with top 5 players holding approximately 45-50% market share.

- Technological Innovation Drivers: Higher efficacy, improved CRI, smart lighting integration, miniaturization.

- Regulatory Frameworks: Energy efficiency mandates (e.g., Energy Star, European Ecodesign), building codes.

- Competitive Product Substitutes: Fluorescent lamps, halogen lamps (declining share).

- End-User Demographics: Increasing demand for energy savings, smart home integration, and design flexibility.

- M&A Trends: Focus on acquiring advanced LED packaging, OLED materials, and smart lighting control companies.

Solid-State Lighting Source Industry Growth Trends & Insights

The Solid-State Lighting Source Industry is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately 12-15% from 2025 to 2033. The market size, estimated at $85,000 Million units in the base year 2025, is anticipated to reach $180,000 Million units by the end of the forecast period. This remarkable growth is underpinned by the widespread adoption of LEDs across virtually every end-user segment. Declining manufacturing costs for LED chips, coupled with escalating energy prices, continue to fuel an accelerated adoption rate, pushing traditional lighting technologies into obsolescence. Technological disruptions are predominantly observed in the development of advanced LED architectures, such as Chip-Scale Packaging (CSP) LEDs and high-power LEDs for specialized applications. Furthermore, the emergence of OLEDs and Polymer Light Emitting Diodes (PLEDs), while currently niche, is set to disrupt the premium lighting and display markets with their unique properties like flexibility and transparency. Consumer behavior shifts are characterized by an increasing preference for lighting solutions that offer enhanced controllability, tunable white light, and integration with smart home ecosystems. This demand is driving innovation in intelligent lighting controls and connected lighting systems, further solidifying the growth trajectory of the SSL market. The penetration of SSL sources in the overall lighting market is expected to surpass 90% by 2033, a testament to their superior performance and economic advantages.

Dominant Regions, Countries, or Segments in Solid-State Lighting Source Industry

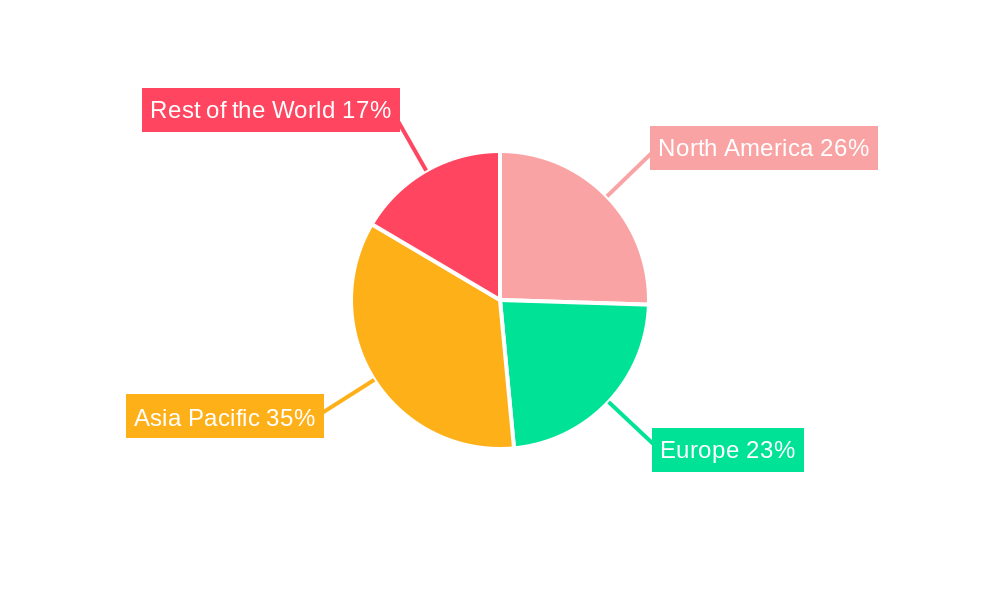

The Asia-Pacific region is the undisputed leader in the Solid-State Lighting Source Industry, driven by a confluence of factors including robust manufacturing capabilities, significant government support for technology development, and a massive domestic market. Countries like China and South Korea are at the forefront of LED chip production and innovation, contributing significantly to the global supply chain. Within the technology segments, Light Emitting Diodes (LEDs) continue to dominate, accounting for an estimated 85-90% market share of the overall SSL source market in 2025. This dominance is attributed to their maturity, cost-effectiveness, and widespread application across all end-user segments. The Commercial end-user segment is a major growth engine, propelled by retrofitting initiatives in office buildings, retail spaces, and industrial facilities to achieve substantial energy savings. Automotive lighting, with its increasing demand for advanced headlamps, taillights, and interior illumination, represents another high-growth segment, projected to witness a CAGR of over 18% during the forecast period. Economic policies promoting energy efficiency and smart city development in countries like Japan and Singapore are further bolstering the SSL market. Infrastructure development, particularly in emerging economies, also plays a crucial role by creating new demand for lighting solutions. While OLEDs are gaining traction in specific applications like premium displays and automotive lighting, their market share remains significantly smaller than LEDs but is expected to grow at a faster pace.

- Dominant Region: Asia-Pacific (estimated 45-50% market share).

- Leading Technology Segment: Light Emitting Diodes (LEDs) (estimated 85-90% market share).

- Key End-User Segments: Commercial, Automotive, Residential.

- Dominance Factors in Asia-Pacific: Manufacturing prowess, government incentives, large consumer base, R&D investment.

- Growth Drivers in Commercial Segment: Energy efficiency mandates, cost savings, smart building integration.

- Growth Drivers in Automotive Segment: Demand for advanced safety features, aesthetic customization, and energy efficiency.

Solid-State Lighting Source Industry Product Landscape

The product landscape of the Solid-State Lighting Source Industry is characterized by continuous innovation in chip design, packaging, and material science. Advanced LEDs now offer exceptional luminous efficacy exceeding 200 lumens per watt, enabling significant energy savings. Innovations in phosphor technology are enhancing color rendering, with CRI values approaching 95 for high-fidelity applications. OLED panels are gaining prominence for their thin, flexible form factors and superior contrast ratios, finding applications in premium displays and architectural lighting. The development of UV and IR LEDs is opening up new avenues in sterilization, medical treatments, and horticultural lighting. Unique selling propositions include ultra-low power consumption, long operational lifetimes (exceeding 50,000 hours), and precise controllability, facilitating dynamic lighting effects and smart integration.

Key Drivers, Barriers & Challenges in Solid-State Lighting Source Industry

The Solid-State Lighting Source Industry is propelled by several key drivers. Technological advancements in LED efficacy and color quality, coupled with decreasing manufacturing costs, make SSL the most economically viable lighting solution. Government regulations and energy efficiency standards worldwide are mandating the adoption of SSL. The growing consumer awareness of energy conservation and environmental impact further fuels demand. Smart city initiatives and the increasing adoption of IoT in homes and buildings are creating a burgeoning market for connected SSL systems.

However, the industry faces significant challenges. High initial R&D investment for next-generation SSL technologies like quantum dots and micro-LEDs can be a barrier. Supply chain disruptions, particularly for critical raw materials and components, can impact production and pricing. Evolving regulatory landscapes and the need for adherence to diverse international standards create compliance challenges. Intense competition among a large number of players leads to price pressures and necessitates continuous innovation to maintain market share.

Emerging Opportunities in Solid-State Lighting Source Industry

Emerging opportunities in the Solid-State Lighting Source Industry are vast and diverse. The burgeoning market for horticultural lighting, driven by the growth of indoor farming, presents a significant untapped potential for specialized LED solutions. The integration of SSL with sensors for occupancy detection, daylight harvesting, and air quality monitoring opens doors for truly intelligent and adaptive lighting systems. The increasing demand for personalized and tunable lighting in healthcare and wellness applications, such as circadian rhythm lighting, offers a premium market segment. Furthermore, the development of visible light communication (VLC) using SSL sources for data transmission represents a revolutionary future application.

Growth Accelerators in the Solid-State Lighting Source Industry Industry

Several catalysts are accelerating the growth of the Solid-State Lighting Source Industry. Continuous breakthroughs in material science are leading to more efficient and durable SSL components. Strategic partnerships between LED manufacturers, luminaire companies, and smart home technology providers are fostering integrated solutions and expanding market reach. The growing emphasis on sustainability and circular economy principles is driving innovation in recyclable SSL materials and extended product lifecycles. Market expansion into developing economies, where energy efficiency is becoming a paramount concern, is also a significant growth accelerator.

Key Players Shaping the Solid-State Lighting Source Industry Market

- Acuity Brands Lighting Inc

- Eaton Corporation Inc

- Samsung Electronics Co Ltd

- Koninklijke Philips N V

- Mitsubishi Electric Corporation

- GE Lighting

- OsRam Licht AG

- Toshiba Lighting

- Bridgelux Inc

- Nichia Corporation

Notable Milestones in Solid-State Lighting Source Industry Sector

- 2019: Significant advancements in high-efficacy LED chips with luminous efficacy exceeding 200 lm/W reported by multiple manufacturers.

- 2020: Increased adoption of OLED lighting panels in high-end architectural and automotive interior applications.

- 2021: Growth in the UV-C LED market for disinfection and sterilization applications due to global health concerns.

- 2022: Emergence of Micro-LED technology gaining traction for display and large-format lighting applications, though still in early stages of commercialization.

- 2023: Increased focus on smart lighting systems, with enhanced integration of IoT platforms and advanced control capabilities.

- 2024: Continued improvements in cost-effectiveness of LED lighting solutions, driving broader adoption in emerging markets.

In-Depth Solid-State Lighting Source Industry Market Outlook

The future outlook for the Solid-State Lighting Source Industry is exceptionally bright, driven by ongoing technological innovation and a global push for energy efficiency. Growth accelerators include the relentless pursuit of higher performance metrics like luminous efficacy and color accuracy, coupled with the development of novel SSL applications in areas like agriculture and healthcare. Strategic collaborations between industry leaders and technology developers will continue to foster integrated solutions and open new market frontiers. The increasing affordability of SSL sources, particularly LEDs, will facilitate their adoption in price-sensitive markets, ensuring sustained global demand. The market's trajectory indicates a continued dominance of LEDs, with OLEDs and PLEDs carving out significant niches in premium and specialized applications, collectively shaping a more sustainable and intelligent lighting future.

Solid-State Lighting Source Industry Segmentation

-

1. Technology

- 1.1. Light Emitting Diodes (LEDs)

- 1.2. Organic Light Emitting Diodes (OLED)

- 1.3. Polymer Light Emitting Diodes (PLED)

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Automotive

- 2.4. Medical

- 2.5. Consumer Electronics

- 2.6. Other End-Users

Solid-State Lighting Source Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Solid-State Lighting Source Industry Regional Market Share

Geographic Coverage of Solid-State Lighting Source Industry

Solid-State Lighting Source Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Greater Energy Savings Compared to Other Forms of Lighting; Growing Adoption of LEDs in the Automotive Industry

- 3.3. Market Restrains

- 3.3.1. ; High Implementation and Equipment Cost

- 3.4. Market Trends

- 3.4.1. LED Technology to Occupy the Maximum Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Light Emitting Diodes (LEDs)

- 5.1.2. Organic Light Emitting Diodes (OLED)

- 5.1.3. Polymer Light Emitting Diodes (PLED)

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Automotive

- 5.2.4. Medical

- 5.2.5. Consumer Electronics

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Light Emitting Diodes (LEDs)

- 6.1.2. Organic Light Emitting Diodes (OLED)

- 6.1.3. Polymer Light Emitting Diodes (PLED)

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Automotive

- 6.2.4. Medical

- 6.2.5. Consumer Electronics

- 6.2.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Light Emitting Diodes (LEDs)

- 7.1.2. Organic Light Emitting Diodes (OLED)

- 7.1.3. Polymer Light Emitting Diodes (PLED)

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Automotive

- 7.2.4. Medical

- 7.2.5. Consumer Electronics

- 7.2.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Light Emitting Diodes (LEDs)

- 8.1.2. Organic Light Emitting Diodes (OLED)

- 8.1.3. Polymer Light Emitting Diodes (PLED)

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Automotive

- 8.2.4. Medical

- 8.2.5. Consumer Electronics

- 8.2.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Light Emitting Diodes (LEDs)

- 9.1.2. Organic Light Emitting Diodes (OLED)

- 9.1.3. Polymer Light Emitting Diodes (PLED)

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Automotive

- 9.2.4. Medical

- 9.2.5. Consumer Electronics

- 9.2.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Acuity Brands Lighting Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eaton Corporation Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GE Lighting

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OsRam Licht AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toshiba Lighting

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bridgelux Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nichia Corporation*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Acuity Brands Lighting Inc

List of Figures

- Figure 1: Global Solid-State Lighting Source Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 17: Asia Pacific Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest of the World Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest of the World Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Rest of the World Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Rest of the World Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 9: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solid-State Lighting Source Industry?

The projected CAGR is approximately 14.40%.

2. Which companies are prominent players in the Solid-State Lighting Source Industry?

Key companies in the market include Acuity Brands Lighting Inc, Eaton Corporation Inc, Samsung Electronics Co Ltd, Koninklijke Philips N V, Mitsubishi Electric Corporation, GE Lighting, OsRam Licht AG, Toshiba Lighting, Bridgelux Inc, Nichia Corporation*List Not Exhaustive.

3. What are the main segments of the Solid-State Lighting Source Industry?

The market segments include Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Greater Energy Savings Compared to Other Forms of Lighting; Growing Adoption of LEDs in the Automotive Industry.

6. What are the notable trends driving market growth?

LED Technology to Occupy the Maximum Share.

7. Are there any restraints impacting market growth?

; High Implementation and Equipment Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solid-State Lighting Source Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solid-State Lighting Source Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solid-State Lighting Source Industry?

To stay informed about further developments, trends, and reports in the Solid-State Lighting Source Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence