Key Insights

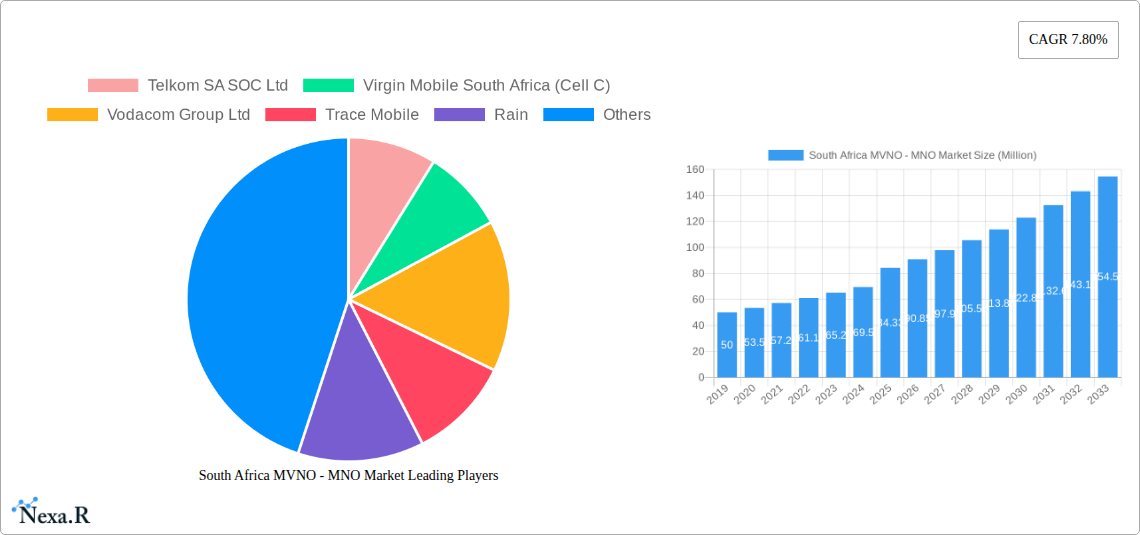

The South African Mobile Virtual Network Operator (MVNO) market is poised for significant expansion, projected to reach an estimated $84.33 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.80% expected through 2033. This upward trajectory is primarily fueled by increasing mobile penetration across both enterprise and consumer segments, coupled with a growing demand for specialized and affordable mobile services. The competitive landscape is dynamic, featuring established Mobile Network Operators (MNOs) like Vodacom, MTN, and Telkom, alongside an increasing number of MVNOs such as Virgin Mobile, Trace Mobile, and Rain, all vying for market share. The proliferation of affordable data plans and value-added services, including entertainment, financial services (as indicated by the presence of First National Bank and MRP Mobile), and niche consumer offerings, are key drivers attracting subscribers. Furthermore, the burgeoning digital economy and the increasing reliance on mobile connectivity for business operations are bolstering the enterprise segment.

South Africa MVNO - MNO Market Market Size (In Million)

However, certain factors could temper this growth. Intense price competition among both MNOs and MVNOs may lead to thinning profit margins. The high cost of spectrum acquisition and infrastructure development for MNOs, which can indirectly impact MVNO operating costs, remains a significant challenge. Regulatory hurdles and the need for robust network quality and customer service to retain subscribers in a crowded market will also be critical determinants of success. Despite these restraints, the inherent demand for flexible, cost-effective mobile solutions, particularly from younger demographics and SMEs, provides a strong foundation for continued MVNO market development in South Africa. The focus on innovative service bundles and strategic partnerships will be crucial for players to differentiate themselves and capture a larger share of this expanding market.

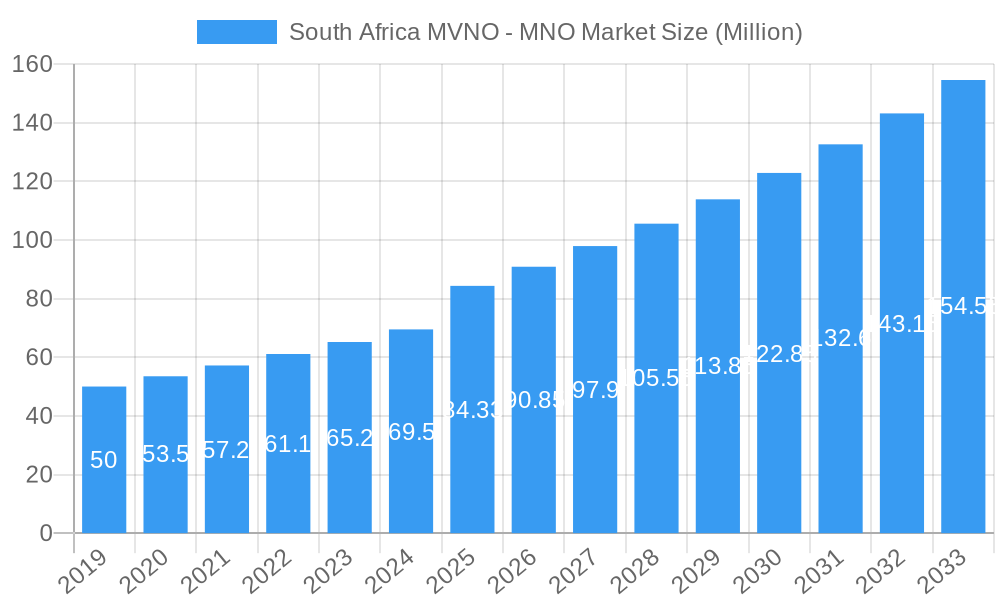

South Africa MVNO - MNO Market Company Market Share

South Africa MVNO - MNO Market Analysis: Unlocking Growth in a Dynamic Telecom Landscape

This comprehensive report delves into the intricacies of the South African Mobile Virtual Network Operator (MVNO) and Mobile Network Operator (MNO) market, providing deep insights and actionable intelligence for industry stakeholders. Explore market dynamics, growth trajectories, competitive landscapes, and future opportunities within this rapidly evolving telecommunications sector. The study encompasses a detailed analysis from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033.

South Africa MVNO - MNO Market Market Dynamics & Structure

The South African MVNO and MNO market is characterized by a dynamic interplay of market concentration, rapid technological innovation, and evolving regulatory frameworks. While Vodacom Group Ltd and MTN Group Ltd historically hold significant market share, the emergence of MVNOs like Virgin Mobile South Africa (Cell C), Trace Mobile, and Rain, alongside corporate MVNOs such as First National Bank (Cell C) and MRP Mobile (Pty) Limited, has intensified competition. Technological drivers, particularly the ongoing rollout of 4G and 5G connectivity, are paramount, spurred by the successful radio frequency spectrum auction in March 2022. Regulatory bodies are balancing market liberalization with infrastructure development, creating both opportunities and challenges. Competitive product substitutes are numerous, ranging from traditional MNO services to innovative digital offerings by new entrants. End-user demographics are diverse, with a growing demand for affordable data, enhanced mobile broadband, and specialized enterprise solutions. Mergers and acquisitions (M&A) activity, exemplified by the planned acquisition of Telkom SA SOC Ltd by MTN Group Ltd, signifies a consolidation trend aimed at strengthening competitive positions and expanding network reach.

- Market Concentration: Dominated by major players, with increasing influence from MVNOs.

- Technological Innovation: Driven by 4G/5G deployment, spectrum availability, and digital service innovation.

- Regulatory Frameworks: Focus on fair competition, spectrum allocation, and consumer protection.

- Competitive Substitutes: Wide array of MNO and MVNO offerings, digital services.

- End-User Demographics: Diverse, with strong demand for data and specialized solutions.

- M&A Trends: Consolidation aimed at market share expansion and enhanced capabilities.

South Africa MVNO - MNO Market Growth Trends & Insights

The South African MVNO and MNO market is poised for substantial growth, driven by increasing mobile penetration, a burgeoning digital economy, and evolving consumer preferences. The market size has seen consistent expansion, fueled by the demand for affordable data plans, enhanced mobile broadband services, and specialized enterprise solutions. Adoption rates for mobile services, particularly among the youth and in underserved rural areas, continue to climb. Technological disruptions, including the widespread adoption of 5G technology, are reshaping the competitive landscape, enabling faster speeds, lower latency, and new service possibilities. Consumer behavior shifts towards increased data consumption for entertainment, communication, and productivity are a key market driver. The integration of innovative technologies and the expansion of network infrastructure are critical for sustaining this growth trajectory.

- Market Size Evolution: Steady increase driven by mobile adoption and data demand.

- Adoption Rates: High and growing, with focus on expanding coverage and affordability.

- Technological Disruptions: 5G rollout, IoT integration, and AI-powered services are transforming offerings.

- Consumer Behavior Shifts: Increased reliance on mobile for data-intensive activities, demand for flexible plans.

- Key Market Penetration: XX% penetration in the consumer segment, XX% in the enterprise segment, expected to grow.

- CAGR Projection: The market is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Dominant Regions, Countries, or Segments in South Africa MVNO - MNO Market

Within the South African MVNO and MNO market, the Consumer segment stands out as the dominant force driving market growth. This segment's expansive reach and consistent demand for mobile services, data, and communication tools underpin the market's overall expansion. Key drivers for the Consumer segment's dominance include the large and youthful population, increasing disposable incomes in certain demographics, and the growing reliance on mobile devices for daily activities, entertainment, and social interaction. Furthermore, the proliferation of affordable smartphones and the strategic offerings by both MNOs and MVNOs tailored to consumer needs have significantly boosted adoption rates. Economic policies that encourage digital inclusion and infrastructure development, particularly in expanding mobile network coverage to previously underserved areas, further solidify the Consumer segment's leading position.

The Enterprise segment, while not as large in subscriber numbers, represents a significant area of growth and value, particularly for specialized MVNO services and advanced MNO offerings. The increasing digitalization of businesses across South Africa, from small and medium enterprises (SMEs) to large corporations, fuels the demand for robust mobile connectivity, secure data solutions, and integrated communication platforms. The ability of MNOs and MVNOs to offer customized enterprise solutions, including dedicated network slices for IoT, private 5G networks, and advanced cybersecurity measures, positions them to capture substantial market share in this segment. Strategic partnerships between telecommunication providers and technology firms are also emerging to cater to the sophisticated needs of the enterprise sector.

- Dominant Segment: Consumer segment, accounting for approximately XX% of total subscribers.

- Key Consumer Drivers:

- Large and growing population base.

- Increasing smartphone affordability and penetration.

- High demand for data, social media, and entertainment.

- Competitive pricing strategies by MNOs and MVNOs.

- Enterprise Segment Growth Factors:

- Digital transformation of businesses.

- Demand for IoT and M2M solutions.

- Need for secure and reliable enterprise connectivity.

- Tailored mobile solutions for specific industry verticals.

- Market Share (Consumer): XX% attributed to the Consumer segment.

- Growth Potential (Enterprise): Expected to grow at a CAGR of XX% due to increasing business digitalization.

South Africa MVNO - MNO Market Product Landscape

The product landscape within the South African MVNO and MNO market is characterized by a diverse and innovative array of offerings designed to meet varied consumer and enterprise needs. Mobile Network Operators (MNOs) continue to enhance their core services with broader 4G and nascent 5G network coverage, offering competitive voice and data bundles. Mobile Virtual Network Operators (MVNOs) are differentiating themselves through specialized plans, often targeting specific demographics or niche market segments. Examples include data-only plans, youth-focused offerings, and bundled entertainment services. Corporate MVNOs are emerging to provide tailored solutions for businesses, integrating mobile services with existing enterprise platforms. The focus is on delivering value through affordability, flexibility, and enhanced digital experiences, with unique selling propositions often revolving around data value, customer service, and specialized feature sets. Technological advancements are enabling the integration of AI for personalized customer support and the development of richer digital services.

Key Drivers, Barriers & Challenges in South Africa MVNO - MNO Market

Key Drivers: The South African MVNO and MNO market is propelled by several key drivers. The increasing demand for affordable mobile data, driven by the widespread use of smartphones for internet access and digital services, is a primary catalyst. Technological advancements, particularly the ongoing deployment of 4G and the foundational rollout of 5G, are expanding network capabilities and enabling new service possibilities. Government initiatives promoting digital inclusion and broadband penetration also play a crucial role. Furthermore, a growing digitally-savvy youth population and the increasing adoption of digital services by businesses are significant growth accelerators.

Barriers & Challenges: Despite the growth drivers, the market faces significant barriers and challenges. Intense price competition among MNOs and MVNOs can squeeze profit margins and hinder investment in infrastructure. Regulatory hurdles and the complexity of spectrum allocation can slow down technological advancements and market expansion. Infrastructure development, especially in rural and remote areas, remains a significant capital investment challenge. Supply chain issues impacting device availability and component sourcing can also pose challenges. The threat of disruptive technologies and the need to constantly innovate to retain subscriber loyalty present ongoing competitive pressures. The impact of economic downturns on consumer spending power can also create a restraint.

Emerging Opportunities in South Africa MVNO - MNO Market

Emerging opportunities in the South African MVNO and MNO market lie in several key areas. The continued expansion of 5G infrastructure presents a significant opportunity for MNOs and MVNOs to offer enhanced mobile broadband, low-latency applications, and new services like enhanced mobile gaming and AR/VR experiences. The growing demand for Internet of Things (IoT) solutions across various industries, including agriculture, logistics, and smart cities, opens avenues for specialized connectivity and data management services. Furthermore, the untapped potential in underserved rural and peri-urban areas offers a significant growth opportunity for affordable mobile data and voice services. Innovative digital services, such as mobile financial services, telemedicine, and e-learning platforms, powered by robust mobile connectivity, are also poised for rapid growth.

Growth Accelerators in the South Africa MVNO - MNO Market Industry

Several catalysts are accelerating growth within the South African MVNO and MNO industry. The ongoing digital transformation across all sectors of the economy is creating an insatiable demand for reliable and high-speed mobile connectivity. Strategic partnerships between MNOs, MVNOs, and technology providers are crucial for co-creating innovative solutions and expanding market reach. For instance, collaborations for IoT deployments or bundled digital service offerings can significantly boost adoption. Market expansion strategies, including targeted campaigns for specific demographics and geographic regions, along with the development of flexible and competitive pricing models, are further fueling growth. The continuous evolution of network technology, from 4G enhancements to the broader deployment of 5G, is a fundamental growth accelerator, enabling a new generation of mobile services.

Key Players Shaping the South Africa MVNO - MNO Market Market

- Telkom SA SOC Ltd

- Virgin Mobile South Africa (Cell C)

- Vodacom Group Ltd

- Trace Mobile

- Rain

- MTN Group Ltd

- First National Bank (Cell C)

- Me & You

- MRP Mobile (Pty) Limited

- Cell C Pty Ltd

Notable Milestones in South Africa MVNO - MNO Market Sector

- July 2022: MTN Group Ltd announced plans to acquire Telkom SA SOC Ltd for over USD 1 million, indicating significant consolidation and competition-strengthening moves within the MNO space.

- July 2022: Following the MTN-Telkom acquisition announcement, Telkom's shares saw a surge of nearly 30%, while MTN's shares increased by approximately 5%, reflecting market confidence in the potential deal.

- March 2022: South Africa successfully completed a crucial radio frequency spectrum auction, a vital step for the widespread rollout and adoption of 5G technology across the country.

In-Depth South Africa MVNO - MNO Market Market Outlook

The future outlook for the South African MVNO and MNO market is exceptionally promising, driven by sustained demand for mobile connectivity and digital services. Growth accelerators, including the expansive 5G rollout, burgeoning IoT adoption, and continued digitalization of businesses, will pave the way for innovative service offerings and enhanced revenue streams. Strategic partnerships and the expansion of network infrastructure into previously underserved regions will unlock significant market potential. The ability of operators to cater to evolving consumer preferences for data-rich experiences and personalized services, coupled with tailored enterprise solutions, will be key to capitalizing on these opportunities. The market is set for a period of dynamic evolution, marked by technological advancements and strategic competitive maneuvers.

South Africa MVNO - MNO Market Segmentation

-

1. Subscriber

- 1.1. Enterprise

- 1.2. Consumer

South Africa MVNO - MNO Market Segmentation By Geography

- 1. South Africa

South Africa MVNO - MNO Market Regional Market Share

Geographic Coverage of South Africa MVNO - MNO Market

South Africa MVNO - MNO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Digital Banking Solutions

- 3.4. Market Trends

- 3.4.1. The Full MVNO Segment is Expected to Hold a Significant Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Subscriber

- 5.1.1. Enterprise

- 5.1.2. Consumer

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Subscriber

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telkom SA SOC Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Virgin Mobile South Africa (Cell C)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vodacom Group Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trace Mobile

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MTN Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 First National Bank (Cell C)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Me & You

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MRP Mobile (Pty) Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cell C Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Telkom SA SOC Ltd

List of Figures

- Figure 1: South Africa MVNO - MNO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa MVNO - MNO Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa MVNO - MNO Market Revenue Million Forecast, by Subscriber 2020 & 2033

- Table 2: South Africa MVNO - MNO Market Volume K Unit Forecast, by Subscriber 2020 & 2033

- Table 3: South Africa MVNO - MNO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Africa MVNO - MNO Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: South Africa MVNO - MNO Market Revenue Million Forecast, by Subscriber 2020 & 2033

- Table 6: South Africa MVNO - MNO Market Volume K Unit Forecast, by Subscriber 2020 & 2033

- Table 7: South Africa MVNO - MNO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: South Africa MVNO - MNO Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa MVNO - MNO Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the South Africa MVNO - MNO Market?

Key companies in the market include Telkom SA SOC Ltd, Virgin Mobile South Africa (Cell C), Vodacom Group Ltd, Trace Mobile, Rain, MTN Group Ltd, First National Bank (Cell C), Me & You, MRP Mobile (Pty) Limited, Cell C Pty Ltd.

3. What are the main segments of the South Africa MVNO - MNO Market?

The market segments include Subscriber.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

The Full MVNO Segment is Expected to Hold a Significant Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Adoption of Digital Banking Solutions.

8. Can you provide examples of recent developments in the market?

July 2022 - The South African mobile operator MTN Group Ltd planned to buy its smaller domestic rival, Telkom, for more than USD 1 million in stock or a cash-and-stock deal. Telkom's shares increased by nearly 30% following the announcement, while MTN's shares were up by nearly 5%. The deal between MTN and Telkom may help MTN strengthen its competition against Vodacom Group as both the carriers aim to expand 4G and 5G connectivity to more parts of the country. South Africa completed a radio frequency spectrum auction in March 2022, which was needed to roll out 5G.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa MVNO - MNO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa MVNO - MNO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa MVNO - MNO Market?

To stay informed about further developments, trends, and reports in the South Africa MVNO - MNO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence