Key Insights

The Taiwan Data Center Rack Market is projected for substantial growth, driven by increasing demand for digital infrastructure across the IT & Telecommunication, BFSI, and Media & Entertainment industries. The market is expected to reach $6.13 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.56%. This expansion is fueled by the ongoing need for advanced data storage and processing, propelled by cloud adoption, big data analytics, and IoT proliferation. Supportive government digital transformation initiatives and significant BFSI investments in data center upgrades further contribute to market penetration. The IT & Telecommunication sector remains a primary driver, with rising data traffic and 5G network deployments demanding scalable and reliable rack solutions.

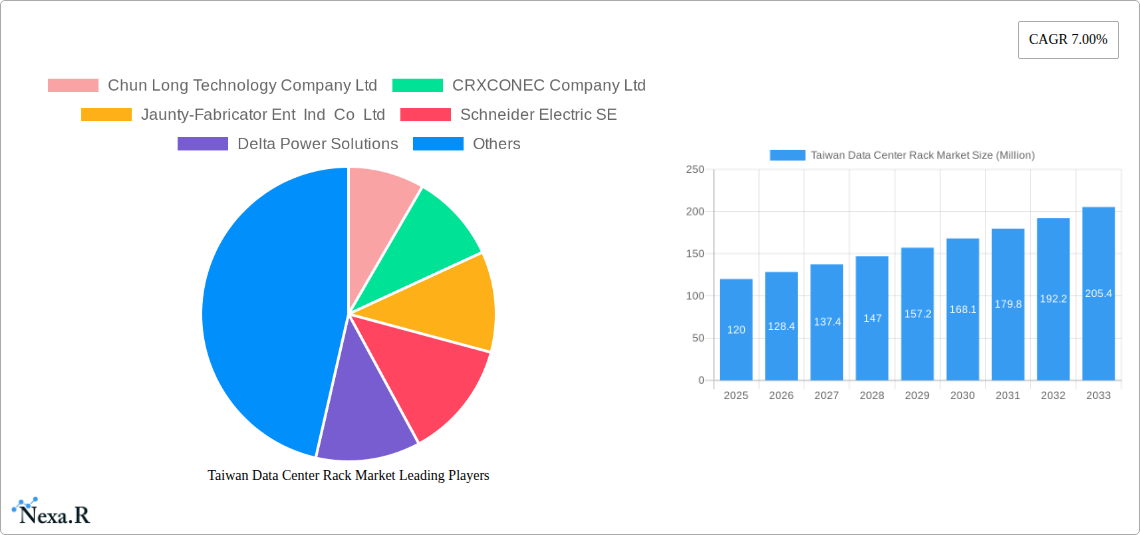

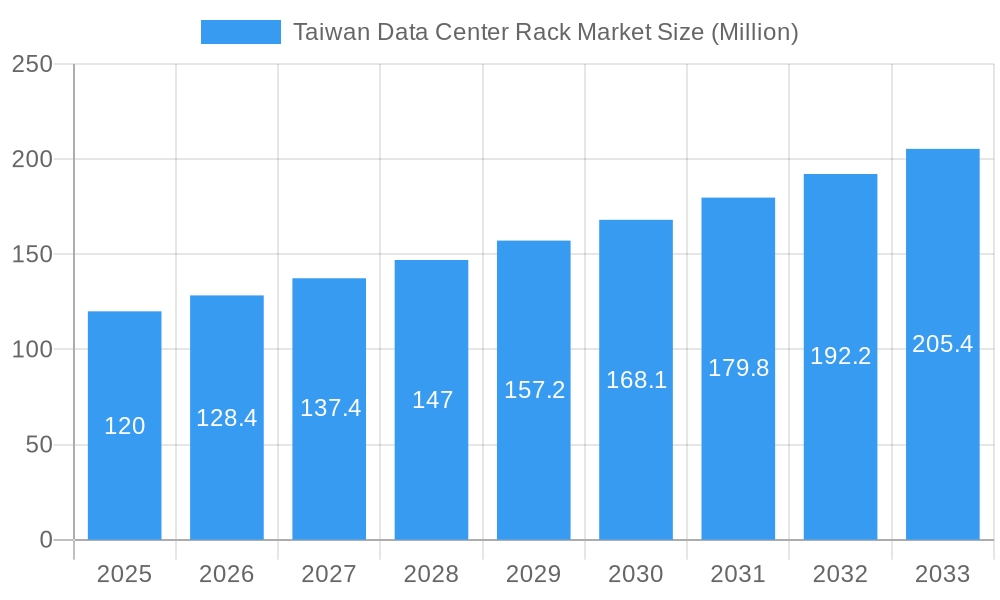

Taiwan Data Center Rack Market Market Size (In Billion)

Market segmentation indicates a strong preference for Half and Full Rack solutions due to evolving density requirements in modern data centers. While Quarter Racks serve smaller deployments and edge computing, the trend favors larger, integrated rack systems. Key challenges such as high initial investment and specialized infrastructure needs are being addressed by technological advancements and energy-efficient designs. Leading companies are actively innovating to meet these demands. Taiwan's position as a technology hub and its favorable regulatory environment solidify its importance in the regional data center rack market.

Taiwan Data Center Rack Market Company Market Share

Gain strategic insights into Taiwan's digital infrastructure evolution with our comprehensive Taiwan Data Center Rack Market report. This analysis provides a detailed understanding of the dynamics, growth drivers, and key players in the critical data center rack sector. It is an essential resource for stakeholders seeking in-depth knowledge of Taiwan data center rack solutions, data center hardware in Taiwan, the server rack market in Taiwan, and enterprise rack solutions for Taiwan. The report offers a holistic view by meticulously analyzing sub-segments within the broader market, highlighting both opportunities and challenges.

This report covers the period from 2019 to 2033, with 2025 as the base year and forecasts extending from 2025 to 2033. Historical data from 2019–2024 is included. All market values are presented in billions of units.

Taiwan Data Center Rack Market Dynamics & Structure

The Taiwan data center rack market is characterized by a moderately concentrated structure, with a few dominant global players and several regional manufacturers vying for market share. Technological innovation remains a key driver, spurred by the increasing demand for high-density computing and advanced cooling solutions. Regulatory frameworks, particularly those focused on data localization and cybersecurity, are subtly influencing rack deployment strategies. Competitive product substitutes, such as prefabricated data center modules, present a nuanced challenge, although traditional racks continue to dominate due to their flexibility and cost-effectiveness. End-user demographics are shifting, with significant growth anticipated from the BFSI and Government sectors, alongside the perpetually expanding IT & Telecommunication industry. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate market presence and enhance their product portfolios. For instance, strategic acquisitions of smaller solution providers by larger entities are aimed at expanding reach and integrating specialized technologies.

- Market Concentration: Moderate, with key global players holding significant market share.

- Technological Innovation: Driven by demand for high-density racks, advanced cooling, and modular solutions.

- Regulatory Influence: Data localization and cybersecurity mandates impacting deployment strategies.

- Competitive Substitutes: Prefabricated modules offer an alternative, but traditional racks remain dominant.

- End-User Evolution: Increasing demand from BFSI and Government, alongside sustained IT & Telecommunication growth.

- M&A Activity: Focus on market consolidation and portfolio enhancement.

Taiwan Data Center Rack Market Growth Trends & Insights

The Taiwan data center rack market is poised for robust growth, propelled by the exponential increase in data generation and consumption. The burgeoning digital economy, fueled by cloud computing adoption, AI development, and the expansion of 5G networks, necessitates continuous investment in data center infrastructure. This surge in demand translates into a steady rise in the adoption of advanced data center rack solutions Taiwan, including high-density and specialized racks designed to accommodate next-generation IT equipment. Technological disruptions, such as the integration of intelligent management systems and enhanced power distribution units, are becoming standard features, optimizing operational efficiency and reducing TCO for data center operators. Consumer behavior shifts are also playing a crucial role; businesses are increasingly prioritizing colocation services and hyperscale data centers, driving the demand for scalable and customizable rack configurations. The increasing prevalence of edge computing further contributes to market expansion, requiring localized data processing capabilities. This multifaceted growth is projected to result in a substantial CAGR over the forecast period, indicating a thriving market for Taiwan data center rack suppliers. The penetration of advanced rack technologies is expected to accelerate as organizations upgrade their existing infrastructure to meet future demands.

Dominant Regions, Countries, or Segments in Taiwan Data Center Rack Market

Within the Taiwan data center rack market, the IT & Telecommunication segment unequivocally dominates, driven by the island's prominent role in global technology supply chains and its advanced communication infrastructure. The rapid deployment of 5G networks, coupled with the relentless growth of cloud services and the expansion of the semiconductor industry, has created an insatiable demand for data center capacity. This surge directly translates into a substantial requirement for various Taiwan data center rack solutions, from standard full racks to specialized configurations.

Key Drivers of Dominance in the IT & Telecommunication Segment:

- Semiconductor Industry Hub: Taiwan's leadership in semiconductor manufacturing necessitates massive data processing and storage capabilities.

- 5G Network Expansion: The nationwide rollout of 5G requires extensive data center build-outs to support low latency and high bandwidth.

- Cloud Computing Growth: The increasing adoption of cloud services by enterprises and consumers fuels demand for hyperscale and enterprise data centers.

- Digital Transformation Initiatives: Government and private sector investments in digital transformation further bolster data center infrastructure.

Beyond IT & Telecommunication, the BFSI sector is emerging as a significant growth driver. Financial institutions are increasingly investing in modernizing their data centers to enhance security, improve transaction speeds, and comply with stringent regulatory requirements. The growing adoption of digital banking and fintech solutions necessitates robust and scalable IT infrastructure.

The Government sector also represents a crucial segment, with initiatives like smart city development and national digital transformation programs requiring dedicated data center facilities for data storage, analysis, and public service delivery. While Media & Entertainment and Other End-Users contribute to the market, their growth is comparatively more moderate than the leading segments.

Market Share and Growth Potential:

The IT & Telecommunication segment is expected to maintain its leading position throughout the forecast period, exhibiting a consistently high growth rate. The BFSI sector is projected to witness the highest CAGR, indicating significant untapped potential. The Government sector will also experience steady growth, driven by ongoing digital infrastructure projects.

Segment Dominance Breakdown:

- Rack Size:

- Full Rack: Dominates due to the need for high-density server deployments in large-scale data centers.

- Half Rack: Significant demand from enterprise data centers and specialized applications.

- Quarter Rack: Niche applications and edge computing deployments.

- End-User:

- IT & Telecommunication: Leading segment, driving significant demand for all rack types.

- BFSI: High growth potential, with increasing investment in modern data centers.

- Government: Steady growth driven by digital initiatives and smart city projects.

- Media & Entertainment: Moderate growth, influenced by content streaming and digital media consumption.

- Other End-Users: Diverse applications with varied growth trajectories.

Taiwan Data Center Rack Market Product Landscape

The Taiwan data center rack market is witnessing a proliferation of innovative products designed to meet the evolving demands of modern data centers. Manufacturers are focusing on high-density solutions that maximize space utilization, crucial for minimizing physical footprints and operational costs. Advanced cooling integration within racks, including passive and active cooling mechanisms, is a key development, addressing the thermal challenges posed by increasingly powerful IT equipment. Intelligent rack features, such as integrated power distribution units (PDUs) with remote monitoring capabilities and environmental sensors, are becoming standard, enhancing manageability and uptime. The product landscape also includes specialized racks for specific applications like network closets, server racks, and colocation racks, each tailored for optimal performance and security. Emphasis is placed on modular designs that allow for scalability and quick deployment, catering to the dynamic needs of businesses.

Key Drivers, Barriers & Challenges in Taiwan Data Center Rack Market

Key Drivers:

The Taiwan data center rack market is propelled by several key drivers. The escalating demand for data storage and processing, fueled by cloud computing, AI, and IoT adoption, is a primary catalyst. Significant investments in digital transformation initiatives by both government and private sectors are creating a continuous need for robust data center infrastructure. Furthermore, Taiwan's strategic position as a global technology manufacturing hub necessitates advanced and scalable data center solutions. The ongoing expansion of 5G networks also contributes significantly, requiring localized data processing capabilities.

Key Barriers & Challenges:

Despite the growth, the market faces certain barriers. High initial capital investment for data center construction and rack procurement can be a restraint for smaller enterprises. Supply chain disruptions and the volatility of raw material prices can impact production costs and lead times for rack manufacturers. Navigating complex regulatory frameworks related to data security and environmental compliance also presents challenges. Intense competition among a growing number of domestic and international Taiwan data center rack suppliers can put pressure on profit margins.

Emerging Opportunities in Taiwan Data Center Rack Market

Emerging opportunities within the Taiwan data center rack market lie in the burgeoning field of edge computing. As businesses push processing closer to data sources, there's a growing demand for compact, robust, and easily deployable rack solutions in decentralized locations. The increasing adoption of AI and machine learning further drives the need for specialized, high-density racks capable of housing powerful GPU servers. Furthermore, the push towards sustainability in the data center industry presents opportunities for manufacturers offering energy-efficient rack designs and integrated cooling solutions that minimize power consumption. The government's ongoing initiatives to promote digital infrastructure development and smart city projects will continue to unlock new deployment avenues for enterprise rack solutions Taiwan.

Growth Accelerators in the Taiwan Data Center Rack Market Industry

Several catalysts are accelerating the long-term growth of the Taiwan data center rack market. Technological breakthroughs in materials science are enabling the development of lighter, stronger, and more cost-effective racks. Strategic partnerships between Taiwan data center rack manufacturers and IT equipment vendors are fostering integrated solutions that offer enhanced performance and interoperability. Market expansion strategies, including the development of tailored solutions for specific industry verticals, are also proving effective. Furthermore, the increasing trend of outsourcing data center operations to colocation providers is creating a sustained demand for rack space and associated infrastructure.

Key Players Shaping the Taiwan Data Center Rack Market Market

- Chun Long Technology Company Ltd

- CRXCONEC Company Ltd

- Jaunty-Fabricator Ent Ind Co Ltd

- Schneider Electric SE

- Delta Power Solutions

- Dell Inc

- Black Box Corporation

- Vertiv Group Corp

- Rittal GMBH & Co KG

- Eaton Corporation

Notable Milestones in Taiwan Data Center Rack Market Sector

- July 2023: The Ministry of Digital Affairs announced that the Telecom Technology Center (TTC) has been selected to lead a project aimed at improving Taiwan's ability to maintain its digital communications network. This initiative is expected to drive demand for robust data center infrastructure and, consequently, data center racks.

- August 2022: Taiwanese telco Chunghwa planned to develop a new data center facility with a floor area of 223,355 sq ft/20,750 sqm in Taoyuan City. The construction, with an approximate cost of TWD 1.59 billion (USD 53 million), signifies substantial growth in data center capacity and a direct boost to the Taiwan data center rack market.

In-Depth Taiwan Data Center Rack Market Market Outlook

The Taiwan data center rack market is set for continued expansion, driven by robust demand from the IT & Telecommunication and BFSI sectors. The focus on high-density computing, edge deployments, and sustainable infrastructure will accelerate the adoption of advanced Taiwan data center rack solutions. Strategic partnerships and technological innovations in areas like intelligent rack management and efficient cooling will further bolster growth. Opportunities in emerging applications like AI and IoT, coupled with ongoing government support for digital transformation, paint a promising outlook for Taiwan data center rack suppliers and related enterprise rack solutions Taiwan. The market is well-positioned for sustained growth and innovation.

Taiwan Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Taiwan Data Center Rack Market Segmentation By Geography

- 1. Taiwan

Taiwan Data Center Rack Market Regional Market Share

Geographic Coverage of Taiwan Data Center Rack Market

Taiwan Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Advent of 5G Network Expansion; Fiber Connectivity Network Expansion in the Country

- 3.3. Market Restrains

- 3.3.1. Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. IT & Telecom Segment expected to hold the major share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Data Center Rack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chun Long Technology Company Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CRXCONEC Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jaunty-Fabricator Ent Ind Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delta Power Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dell Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Black Box Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vertiv Group Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rittal GMBH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eaton Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chun Long Technology Company Ltd

List of Figures

- Figure 1: Taiwan Data Center Rack Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Taiwan Data Center Rack Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Data Center Rack Market Revenue billion Forecast, by Rack Size 2020 & 2033

- Table 2: Taiwan Data Center Rack Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Taiwan Data Center Rack Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Taiwan Data Center Rack Market Revenue billion Forecast, by Rack Size 2020 & 2033

- Table 5: Taiwan Data Center Rack Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Taiwan Data Center Rack Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Data Center Rack Market?

The projected CAGR is approximately 9.56%.

2. Which companies are prominent players in the Taiwan Data Center Rack Market?

Key companies in the market include Chun Long Technology Company Ltd, CRXCONEC Company Ltd , Jaunty-Fabricator Ent Ind Co Ltd, Schneider Electric SE, Delta Power Solutions, Dell Inc, Black Box Corporation, Vertiv Group Corp, Rittal GMBH & Co KG, Eaton Corporation.

3. What are the main segments of the Taiwan Data Center Rack Market?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.13 billion as of 2022.

5. What are some drivers contributing to market growth?

The Advent of 5G Network Expansion; Fiber Connectivity Network Expansion in the Country.

6. What are the notable trends driving market growth?

IT & Telecom Segment expected to hold the major share..

7. Are there any restraints impacting market growth?

Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

July 2023: The Ministry of Digital Affairs announced that the Telecom Technology Center (TTC) has been selected to lead a project in order to improve Taiwan's ability to maintain its digital communications network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Taiwan Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence