Key Insights

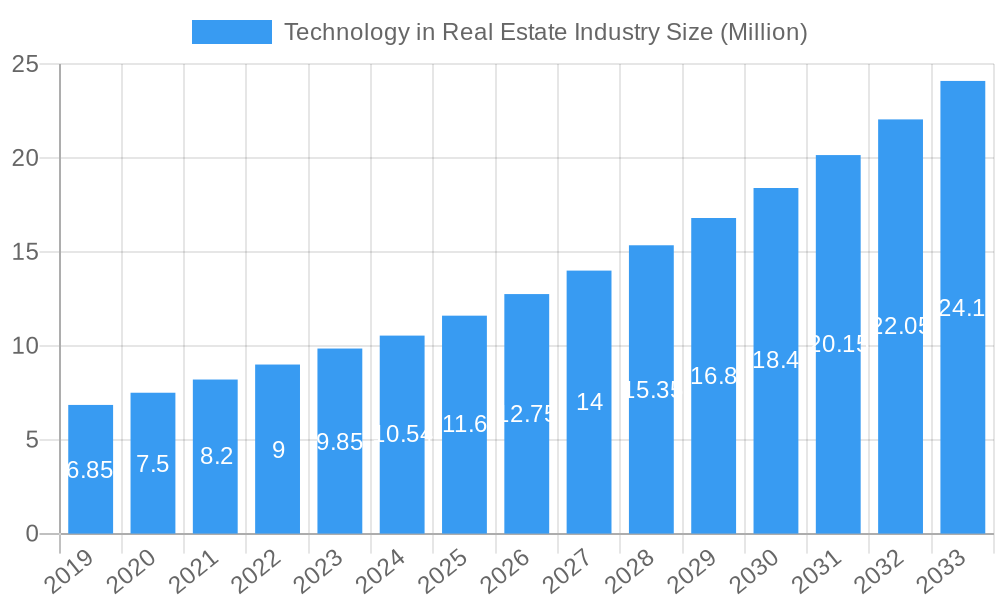

The Technology in Real Estate market is poised for substantial growth, projected to reach 10.54 Million value units by 2025. This robust expansion is fueled by a compelling CAGR of 10.32% anticipated between 2019 and 2033. The digital transformation sweeping across the real estate sector is a primary driver, with a significant emphasis on enhancing operational efficiency, improving customer experiences, and optimizing investment strategies. Cloud deployment models are increasingly preferred due to their scalability, flexibility, and cost-effectiveness, catering to a diverse range of real estate needs. The market's dynamism is further propelled by the integration of advanced solutions such as Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and Business Intelligence (BI) platforms. These technologies are instrumental in streamlining complex processes like property management, financial accounting, and regulatory compliance, thereby improving decision-making and profitability for real estate enterprises.

Technology in Real Estate Industry Market Size (In Million)

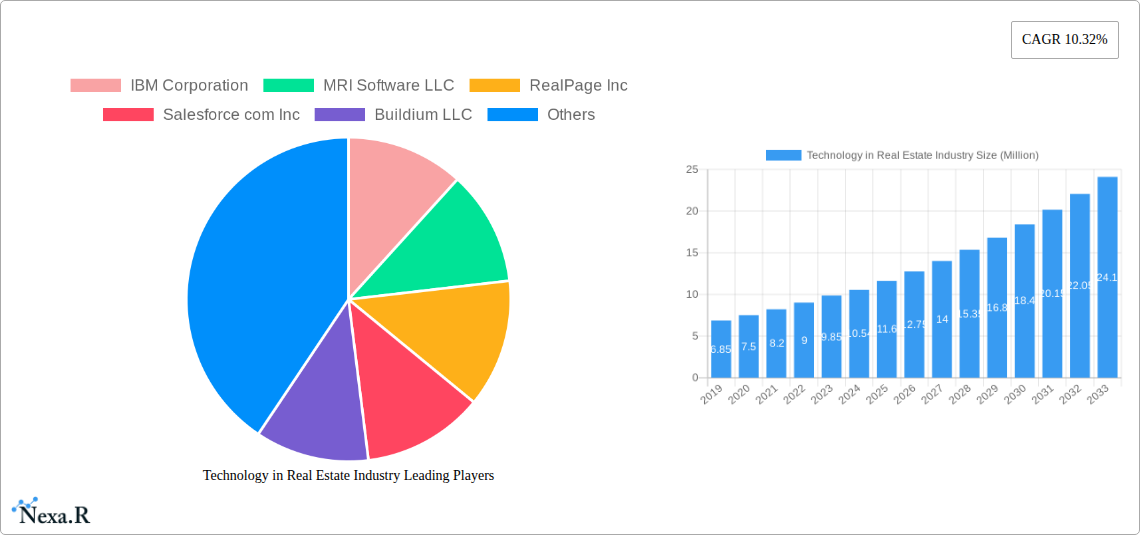

The real estate technology landscape is characterized by a strong trend towards automation and data-driven insights. Companies are leveraging technology to manage vast amounts of property data, predict market trends, and personalize customer interactions. This digital shift is particularly evident in the commercial sector, where the adoption of sophisticated property management software and analytics tools is transforming how assets are acquired, managed, and leased. While the market benefits from powerful drivers like digital transformation and the demand for efficient operations, it also faces certain restraints. The initial investment cost for implementing advanced technologies and the need for skilled personnel to manage and utilize these systems can pose challenges. However, the long-term benefits of increased productivity, reduced operational costs, and enhanced market competitiveness are driving widespread adoption across various segments, from residential to commercial real estate. Key players like IBM Corporation, MRI Software LLC, and Salesforce Inc. are at the forefront of this innovation, offering comprehensive solutions that address the evolving needs of the industry.

Technology in Real Estate Industry Company Market Share

Comprehensive Report: Technology in the Real Estate Industry - Market Dynamics, Growth Trends, and Future Outlook

This in-depth report provides a strategic analysis of the rapidly evolving technology in real estate industry, also known as PropTech. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study offers unparalleled insights into market size, growth drivers, regional dominance, competitive landscape, and future opportunities. Designed for industry professionals, investors, and stakeholders, this report leverages high-traffic keywords and presents data in millions of units for clarity and actionable intelligence, focusing on both the parent market (Technology in Real Estate) and child markets (specific PropTech solutions).

Technology in Real Estate Industry Market Dynamics & Structure

The technology in real estate industry is characterized by dynamic market concentration, driven by continuous technological innovation. Key drivers include the increasing demand for efficiency, transparency, and data-driven decision-making across the entire property lifecycle. Regulatory frameworks are adapting to accommodate digital transactions and data privacy, influencing the adoption of solutions like accounting, compliance, and documentation software. Competitive product substitutes are emerging rapidly, particularly in Customer Relationship Management (CRM) and Business Intelligence (BI), forcing established players to innovate or risk obsolescence.

- Market Concentration: While a few major players like IBM Corporation, Oracle Corporation, and SAP SE hold significant shares, the market also exhibits a thriving startup ecosystem, indicating a moderately fragmented yet consolidating landscape.

- Technological Innovation Drivers: AI, machine learning, blockchain, IoT, and advanced analytics are primary catalysts, enabling predictive maintenance, personalized customer experiences, and optimized investment strategies.

- Regulatory Frameworks: Evolving data protection laws (e.g., GDPR, CCPA) and digital transaction enablement are shaping compliance solutions and investor onboarding processes.

- Competitive Product Substitutes: Cloud-based property management platforms and integrated AI-driven analytics tools are increasingly challenging traditional on-premise solutions.

- End-User Demographics: The shift towards a digital-first approach is prevalent across both Residential and Commercial real estate sectors, with a growing preference for seamless, mobile-accessible services.

- M&A Trends: Mergers and acquisitions are a significant trend, with larger entities acquiring innovative startups to expand their product portfolios and market reach. Deal volumes are expected to remain robust, driven by the pursuit of synergistic technologies and market share expansion.

Technology in Real Estate Industry Growth Trends & Insights

The technology in real estate industry is poised for substantial expansion, driven by escalating digital transformation across all facets of property management and transactions. The market size is projected to grow significantly, with a Compound Annual Growth Rate (CAGR) of xx% from the historical period of 2019–2024 to the forecast period of 2025–2033. Adoption rates for advanced PropTech solutions are accelerating, fueled by the inherent benefits of increased efficiency, reduced operational costs, and enhanced customer satisfaction. Technological disruptions are continuously reshaping the industry, from smart buildings utilizing IoT for energy management to AI-powered property valuation models.

Consumer behavior shifts are a critical factor, with a growing expectation for online accessibility, personalized digital experiences, and transparent dealings. This is propelling the demand for Customer Relationship Management (CRM) and Asset Management solutions that offer seamless client interaction and data visibility. The integration of Enterprise Resource Planning (ERP) systems is becoming crucial for managing complex real estate portfolios. The market penetration of cloud-based solutions continues to rise, offering scalability and flexibility that on-premise systems often lack. Specific metrics like the projected market size in 2025 reaching USD xx million and expanding to USD xx million by 2033 underscore the significant growth trajectory.

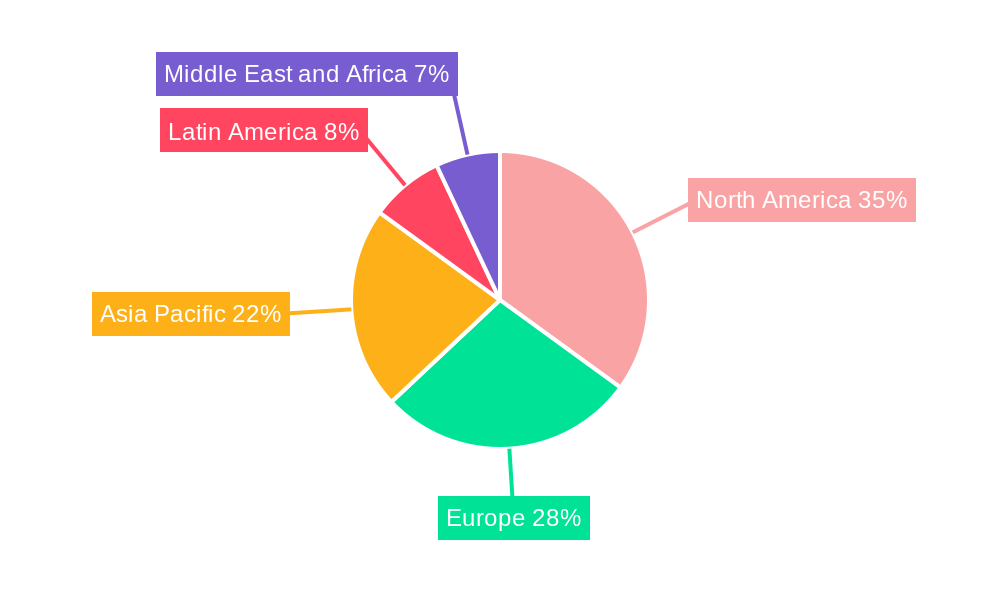

Dominant Regions, Countries, or Segments in Technology in Real Estate Industry

North America and Europe currently dominate the technology in real estate industry landscape, driven by robust economic policies, advanced technological infrastructure, and high adoption rates of digital solutions. The Cloud deployment model is the leading segment, outpacing On-premise solutions due to its scalability, cost-effectiveness, and accessibility. Within solutions, Asset Management and Customer Relationship Management (CRM) are key growth drivers, reflecting the industry's focus on optimizing property performance and enhancing tenant/buyer experiences.

- Dominant Region: North America, with its mature real estate market and early adoption of technology, leads in market share and innovation.

- Dominant Deployment: Cloud solutions are favored for their flexibility and reduced upfront investment.

- Dominant Solution Segments:

- Asset Management: Crucial for optimizing returns, managing maintenance, and tracking property performance.

- Customer Relationship Management (CRM): Essential for lead generation, sales pipeline management, and fostering long-term client relationships.

- Business Intelligence (BI): Enables data-driven insights for strategic decision-making.

- Dominant End User: While both Residential and Commercial sectors are significant, the Commercial sector, with its larger scale and complex operations, often drives the adoption of sophisticated Enterprise Resource Planning (ERP) and Asset Management systems.

- Key Drivers: Strong VC funding, government initiatives promoting digital transformation, and the presence of major real estate technology providers contribute to regional dominance.

- Growth Potential: Emerging markets in Asia-Pacific are showing rapid growth, driven by urbanization and increasing digital literacy.

Technology in Real Estate Industry Product Landscape

The product landscape within the technology in real estate industry is dynamic, marked by continuous innovation and diversification. Solutions range from sophisticated Enterprise Resource Planning (ERP) systems that integrate all business functions to specialized tools for Documentation, Accounting, and Compliance. Customer Relationship Management (CRM) platforms are increasingly incorporating AI for lead scoring and personalized communication. Asset Management software offers advanced analytics for portfolio optimization and predictive maintenance. Unique selling propositions often lie in the seamless integration of these diverse functionalities, creating end-to-end platforms that streamline operations from property acquisition to sales and management. Technological advancements include the integration of blockchain for secure property transactions and AI for enhanced market analysis and tenant experience.

Key Drivers, Barriers & Challenges in Technology in Real Estate Industry

The technology in real estate industry is propelled by several key drivers, including the relentless pursuit of operational efficiency, the demand for data-driven insights, and the evolving expectations of clients for digital-first interactions. Technological breakthroughs in AI, IoT, and cloud computing are enabling more sophisticated solutions. Economic factors like the need to reduce costs and the increasing attractiveness of real estate as an investment class also play a crucial role.

- Key Drivers:

- Demand for automation and efficiency.

- Advancements in AI, IoT, and cloud technologies.

- Investor demand for transparency and ROI.

- Shift towards digital client experiences.

Conversely, the industry faces significant barriers and challenges. High implementation costs, resistance to change from traditional stakeholders, and concerns around data security and privacy can impede adoption. Integration complexities between disparate systems and the need for specialized IT expertise also pose hurdles. Supply chain issues impacting hardware availability are a minor concern, while evolving regulatory landscapes require constant adaptation.

- Key Barriers & Challenges:

- High upfront investment costs.

- Resistance to technological change.

- Data security and privacy concerns.

- Integration challenges with legacy systems.

- Shortage of skilled IT professionals in real estate.

- Evolving regulatory compliance requirements.

Emerging Opportunities in Technology in Real Estate Industry

Emerging opportunities in the technology in real estate industry are abundant, fueled by untapped markets and evolving consumer preferences. The growth of proptech incubators and accelerators is fostering innovation, creating fertile ground for startups to address niche market needs.

- Untapped Markets: Focus on affordable housing tech, senior living technology solutions, and sustainable real estate development platforms.

- Innovative Applications: Development of AI-driven hyper-personalization for tenant services, VR/AR for immersive property tours, and blockchain for fractional ownership and transparent land registries.

- Evolving Consumer Preferences: Demand for smart home integration, flexible workspace solutions, and seamless digital property management across all device types.

Growth Accelerators in the Technology in Real Estate Industry Industry

Several catalysts are accelerating long-term growth in the technology in real estate industry. Strategic partnerships between established real estate firms and technology providers are crucial for co-developing innovative solutions. The increasing adoption of AI and machine learning is driving significant advancements in predictive analytics, property valuation, and risk assessment. Market expansion into emerging economies, coupled with supportive government policies promoting digital infrastructure and innovation, are also key growth accelerators.

Key Players Shaping the Technology in Real Estate Industry Market

- IBM Corporation

- MRI Software LLC

- RealPage Inc

- Salesforce com Inc

- Buildium LLC

- Yardi Systems Inc

- RealSpace Software Ltd

- AppFolio Inc

- Oracle Corporation

- Elinext

- The Sage Group PLC

- SAP SE

Notable Milestones in Technology in Real Estate Industry Sector

- September 2022: HDFC Capital and Invest India launched the HDFC Real Estate Tech Innovators 2022 proptech platform under HDFC Capital's H@ART platform, aiming to recognize innovations in fintech, sales tech, construction tech, and sustainability tech.

- July 2022: DMZ partnered with GroundBreak Ventures to launch applications for a specialized PropTech incubator, fostering startup growth to enhance the real estate sector.

- March 2022: LaSalle Investment Management selected RealBlocks to manage its USD 77 billion global real estate business, including investor onboarding, KYC/AML, and e-signing, facilitating a digital subscription experience.

In-Depth Technology in Real Estate Industry Market Outlook

The future market outlook for the technology in real estate industry is exceptionally promising, characterized by sustained growth and transformative opportunities. The continued integration of advanced technologies like AI, blockchain, and IoT will further revolutionize property management, transactions, and investment strategies. Strategic partnerships and a growing focus on sustainable PropTech solutions will unlock new revenue streams and market segments. The increasing demand for data-driven decision-making and personalized digital experiences will solidify the position of technology as an indispensable component of the modern real estate ecosystem, driving significant market expansion and value creation for stakeholders.

Technology in Real Estate Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Solution

- 2.1. Documentation

- 2.2. Accounting

- 2.3. Compliance

- 2.4. Business Intelligence

- 2.5. Enterprise Resource Planning

- 2.6. Customer Relationship Management

- 2.7. Asset Management

- 2.8. Other Solutions

-

3. End User

- 3.1. Residential

- 3.2. Commercial

Technology in Real Estate Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Technology in Real Estate Industry Regional Market Share

Geographic Coverage of Technology in Real Estate Industry

Technology in Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technologically Transforming the Real Estate Sector and Increasing Demand to Manage Projects; Increasing Adoption of Cloud-based Solution

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with IT Solutions

- 3.4. Market Trends

- 3.4.1. Cloud Type of Deployment is Expected to Account for a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Technology in Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Documentation

- 5.2.2. Accounting

- 5.2.3. Compliance

- 5.2.4. Business Intelligence

- 5.2.5. Enterprise Resource Planning

- 5.2.6. Customer Relationship Management

- 5.2.7. Asset Management

- 5.2.8. Other Solutions

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Technology in Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Documentation

- 6.2.2. Accounting

- 6.2.3. Compliance

- 6.2.4. Business Intelligence

- 6.2.5. Enterprise Resource Planning

- 6.2.6. Customer Relationship Management

- 6.2.7. Asset Management

- 6.2.8. Other Solutions

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Technology in Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Documentation

- 7.2.2. Accounting

- 7.2.3. Compliance

- 7.2.4. Business Intelligence

- 7.2.5. Enterprise Resource Planning

- 7.2.6. Customer Relationship Management

- 7.2.7. Asset Management

- 7.2.8. Other Solutions

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Technology in Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Solution

- 8.2.1. Documentation

- 8.2.2. Accounting

- 8.2.3. Compliance

- 8.2.4. Business Intelligence

- 8.2.5. Enterprise Resource Planning

- 8.2.6. Customer Relationship Management

- 8.2.7. Asset Management

- 8.2.8. Other Solutions

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Technology in Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Solution

- 9.2.1. Documentation

- 9.2.2. Accounting

- 9.2.3. Compliance

- 9.2.4. Business Intelligence

- 9.2.5. Enterprise Resource Planning

- 9.2.6. Customer Relationship Management

- 9.2.7. Asset Management

- 9.2.8. Other Solutions

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Technology in Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Solution

- 10.2.1. Documentation

- 10.2.2. Accounting

- 10.2.3. Compliance

- 10.2.4. Business Intelligence

- 10.2.5. Enterprise Resource Planning

- 10.2.6. Customer Relationship Management

- 10.2.7. Asset Management

- 10.2.8. Other Solutions

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MRI Software LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RealPage Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Salesforce com Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Buildium LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yardi Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RealSpace Software Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AppFolio Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elinext

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Sage Group PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SAP SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global Technology in Real Estate Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Technology in Real Estate Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Technology in Real Estate Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Technology in Real Estate Industry Revenue (Million), by Solution 2025 & 2033

- Figure 5: North America Technology in Real Estate Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 6: North America Technology in Real Estate Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Technology in Real Estate Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Technology in Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Technology in Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Technology in Real Estate Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Technology in Real Estate Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Technology in Real Estate Industry Revenue (Million), by Solution 2025 & 2033

- Figure 13: Europe Technology in Real Estate Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 14: Europe Technology in Real Estate Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Technology in Real Estate Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Technology in Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Technology in Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Technology in Real Estate Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Pacific Technology in Real Estate Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific Technology in Real Estate Industry Revenue (Million), by Solution 2025 & 2033

- Figure 21: Asia Pacific Technology in Real Estate Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 22: Asia Pacific Technology in Real Estate Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Technology in Real Estate Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Technology in Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Technology in Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Technology in Real Estate Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Technology in Real Estate Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Technology in Real Estate Industry Revenue (Million), by Solution 2025 & 2033

- Figure 29: Latin America Technology in Real Estate Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 30: Latin America Technology in Real Estate Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Technology in Real Estate Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Technology in Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Technology in Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Technology in Real Estate Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East and Africa Technology in Real Estate Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East and Africa Technology in Real Estate Industry Revenue (Million), by Solution 2025 & 2033

- Figure 37: Middle East and Africa Technology in Real Estate Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 38: Middle East and Africa Technology in Real Estate Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Technology in Real Estate Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Technology in Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Technology in Real Estate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Technology in Real Estate Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Technology in Real Estate Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 3: Global Technology in Real Estate Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Technology in Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Technology in Real Estate Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Technology in Real Estate Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 7: Global Technology in Real Estate Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Technology in Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Technology in Real Estate Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Technology in Real Estate Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 11: Global Technology in Real Estate Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Technology in Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Technology in Real Estate Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Technology in Real Estate Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 15: Global Technology in Real Estate Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Technology in Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Technology in Real Estate Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Technology in Real Estate Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 19: Global Technology in Real Estate Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Technology in Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Technology in Real Estate Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Technology in Real Estate Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 23: Global Technology in Real Estate Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Technology in Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Technology in Real Estate Industry?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the Technology in Real Estate Industry?

Key companies in the market include IBM Corporation, MRI Software LLC, RealPage Inc, Salesforce com Inc, Buildium LLC, Yardi Systems Inc, RealSpace Software Ltd*List Not Exhaustive, AppFolio Inc, Oracle Corporation, Elinext, The Sage Group PLC, SAP SE.

3. What are the main segments of the Technology in Real Estate Industry?

The market segments include Deployment, Solution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Technologically Transforming the Real Estate Sector and Increasing Demand to Manage Projects; Increasing Adoption of Cloud-based Solution.

6. What are the notable trends driving market growth?

Cloud Type of Deployment is Expected to Account for a Significant Share.

7. Are there any restraints impacting market growth?

High Costs Associated with IT Solutions.

8. Can you provide examples of recent developments in the market?

September 2022: HDFC Capital, the subsidiary of the Housing Development Finance Corporation (HDFC), and Invest India, the Indian government's arm to promote investment, jointly announced the launch of a proptech platform HDFC Real Estate Tech Innovators 2022. Launched under HDFC Capital's HDFC Affordable Real Estate and Technology (H@ART) platform, it will identify, recognize and award innovations in fintech, the sales tech, construction tech, and sustainability tech sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Technology in Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Technology in Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Technology in Real Estate Industry?

To stay informed about further developments, trends, and reports in the Technology in Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence