Key Insights

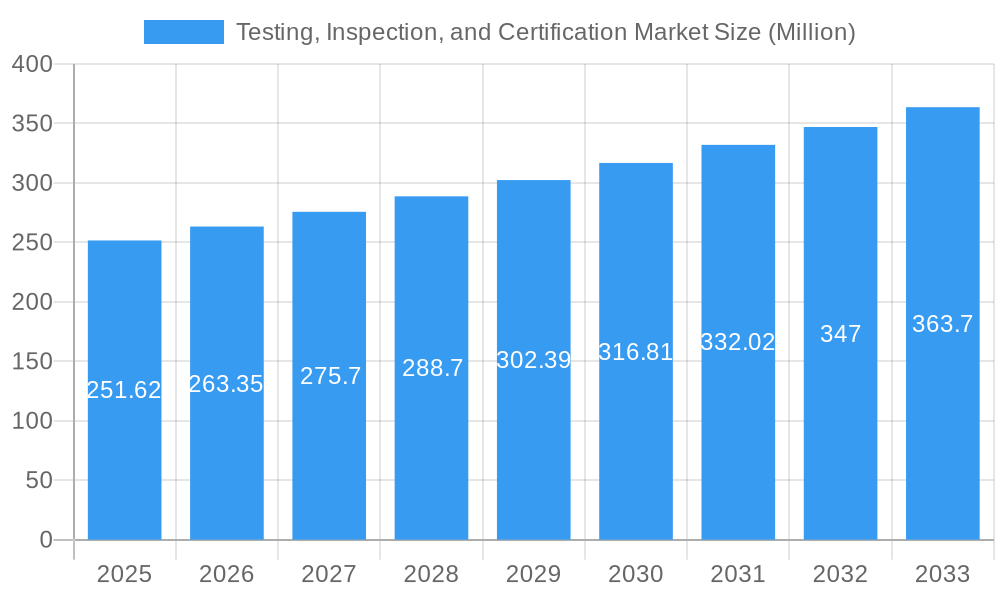

The global Testing, Inspection, and Certification (TIC) market is poised for significant expansion, projected to reach USD 251.62 million by 2025. This robust growth is driven by an escalating demand for product safety, quality assurance, and regulatory compliance across diverse industries. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 4.68% over the forecast period from 2025 to 2033. Key growth catalysts include stringent government regulations, increasing consumer awareness regarding product safety, and the rising complexity of global supply chains. Furthermore, the growing emphasis on sustainability and environmental concerns is fueling demand for specialized TIC services related to environmental impact assessments and green certifications. The expansion of international trade and the need to harmonize standards across different regions also contribute to the market's upward trajectory.

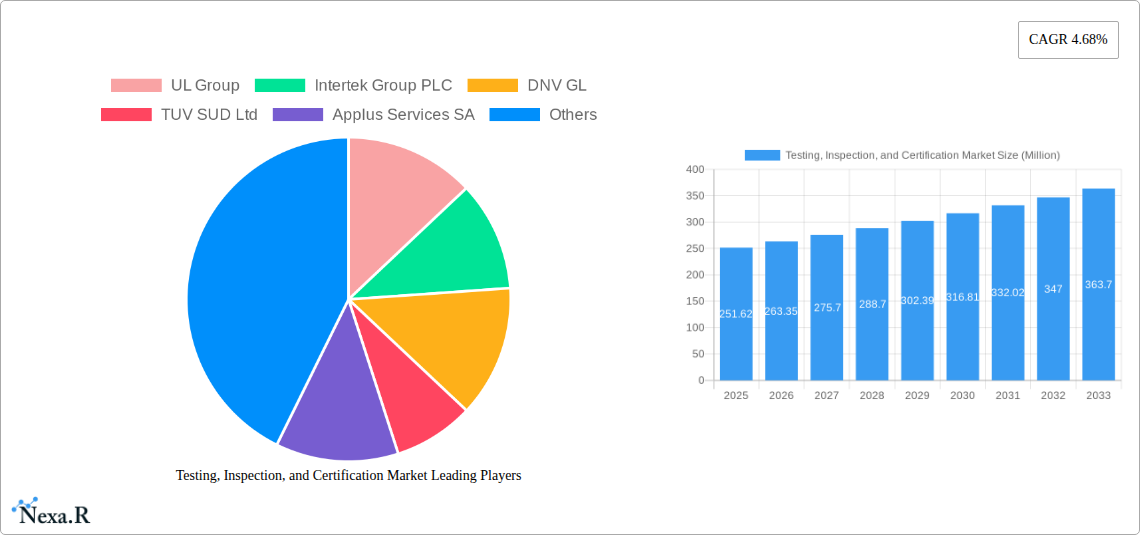

Testing, Inspection, and Certification Market Market Size (In Million)

The TIC market is segmented into Testing and Inspection Services, and Certification Services, with Testing and Inspection expected to dominate due to its broad application across product lifecycles. Sourcing is bifurcated between Outsourced and In-house models, with outsourcing gaining traction due to cost-effectiveness and specialized expertise. The End-user Vertical segment showcases broad adoption, with Consumer Goods and Retail, Food and Agriculture, and Manufacturing of Industrial Goods emerging as major contributors. Emerging trends like the integration of digital technologies, including AI and IoT, in TIC processes are enhancing efficiency and data accuracy. However, challenges such as intense competition and the high cost of establishing advanced testing infrastructure may pose moderate restraints. Leading companies like SGS SA, Bureau Veritas SA, and Intertek Group PLC are actively investing in innovation and strategic acquisitions to maintain their competitive edge and capture a larger market share.

Testing, Inspection, and Certification Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Testing, Inspection, and Certification (TIC) market. Covering the historical period from 2019 to 2024, the base year of 2025, and a detailed forecast period from 2025 to 2033, this study delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, barriers, emerging opportunities, and the strategic positioning of major industry players. With a focus on high-traffic keywords and structured insights, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand the intricate workings and future trajectory of the TIC sector.

The report leverages extensive data and expert analysis to deliver actionable insights, covering critical areas such as consumer goods testing, food safety certification, oil and gas inspection services, construction quality assurance, automotive compliance, aerospace certification, sustainability verification, and regulatory adherence. We also explore the growing influence of digital transformation in TIC, IoT testing, and AI in quality control.

Testing, Inspection, and Certification Market Market Dynamics & Structure

The global Testing, Inspection, and Certification (TIC) market is characterized by a moderately concentrated structure, with a few large multinational corporations holding significant market share, alongside a substantial number of smaller, specialized service providers. This dynamic is fueled by continuous technological innovation, driven by the need for enhanced product safety, quality, and regulatory compliance across diverse industries. Stringent global and regional regulatory frameworks act as both a driver and a barrier, mandating specific testing and certification processes while also creating complexities for market entrants. Competitive product substitutes, while present in some niche areas, are often outpaced by the comprehensive assurance offered by accredited TIC services. End-user demographics are increasingly sophisticated, demanding greater transparency and reliability, pushing TIC providers to offer more advanced and specialized solutions. Mergers and acquisitions (M&A) remain a significant trend, with established players consolidating their market positions and expanding their service portfolios, evidenced by a consistent deal volume in the range of approximately 150-200 M&A transactions annually over the historical period.

- Market Concentration: Dominated by key players, but with significant fragmentation in specialized sub-sectors.

- Technological Innovation: Driven by advancements in automation, AI, and digital platforms for data analysis and reporting.

- Regulatory Frameworks: Strict global standards (e.g., ISO, CE marking) drive demand and influence market entry.

- Competitive Substitutes: Limited direct substitutes for accredited certification and comprehensive inspection services.

- End-User Demographics: Increasing demand for transparency, ethical sourcing, and sustainable practices.

- M&A Trends: Continuous consolidation and strategic acquisitions to enhance service offerings and geographic reach.

Testing, Inspection, and Certification Market Growth Trends & Insights

The Testing, Inspection, and Certification (TIC) market has demonstrated robust growth over the historical period (2019-2024), with an estimated market size of USD 210,000 million in 2024. This expansion is driven by escalating global trade, increasing product complexity, and a heightened focus on consumer safety, environmental protection, and ethical manufacturing. The adoption rate of outsourced TIC services has been steadily climbing as businesses recognize the benefits of specialized expertise, cost-efficiency, and risk mitigation. Technological disruptions, such as the integration of Artificial Intelligence (AI) in data analysis and the rise of the Internet of Things (IoT) necessitating new testing protocols, are reshaping service offerings and creating new revenue streams. Consumer behavior shifts, including a growing demand for sustainable and ethically sourced products, are compelling manufacturers to seek third-party verification, further boosting the certification segment. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is anticipated to be in the range of 6.5% to 7.5%, indicating continued strong market penetration and expansion. By 2025, the market is estimated to reach USD 225,000 million.

- Market Size Evolution: From an estimated USD 190,000 million in 2019 to an anticipated USD 225,000 million in 2025.

- Adoption Rates: Increasing reliance on outsourced TIC services across various industries.

- Technological Disruptions: AI for data analytics, IoT for connected device testing, and digital platforms are key enablers.

- Consumer Behavior Shifts: Demand for sustainability, ethical sourcing, and product transparency driving certification needs.

- Projected CAGR: 6.5% - 7.5% for the 2025-2033 forecast period.

Dominant Regions, Countries, or Segments in Testing, Inspection, and Certification Market

The Transportation (Aerospace and Rail) end-user vertical is emerging as a dominant segment within the Testing, Inspection, and Certification (TIC) market, driven by stringent safety regulations, complex supply chains, and the rapid pace of technological innovation. This segment accounts for an estimated market share of approximately 18-20% of the overall TIC market, with a projected growth rate exceeding the industry average due to significant investments in aerospace manufacturing, high-speed rail development, and the burgeoning electric vehicle market. The increasing demand for lightweight materials, advanced propulsion systems, and autonomous driving technologies necessitates rigorous testing and certification processes. Europe and North America currently lead in this segment due to well-established aerospace and automotive industries and stringent regulatory oversight, but the Asia-Pacific region, particularly China, is rapidly gaining traction with its expanding manufacturing capabilities and significant infrastructure projects.

- Dominant Segment: Transportation (Aerospace and Rail).

- Key Drivers:

- Stringent safety regulations (e.g., FAA, EASA, AIAG).

- Complexity of aerospace and automotive supply chains.

- Rapid technological advancements (EVs, autonomous systems).

- Global infrastructure development in rail and transportation.

- Market Share: Estimated 18-20% of the global TIC market.

- Growth Potential: High, driven by continuous innovation and regulatory mandates.

- Regional Dominance: Europe and North America leading, with Asia-Pacific showing rapid growth.

Within the Service Type, Testing and Inspection Service holds the largest market share, estimated at around 60-65%, due to the fundamental need for quality assurance and safety verification across all product lifecycles and industries. The Sourcing Type is primarily driven by Outsourced services, accounting for an estimated 70-75% of the market, as companies increasingly prefer to leverage specialized external expertise.

Testing, Inspection, and Certification Market Product Landscape

The Testing, Inspection, and Certification (TIC) market's product landscape is characterized by a suite of critical services designed to ensure quality, safety, and compliance. Innovations are focused on developing advanced testing methodologies for emerging technologies like electric vehicles (battery testing, charging infrastructure), renewable energy systems (solar panel efficiency, wind turbine integrity), and smart devices (IoT security testing). Performance metrics revolve around accuracy, reliability, speed of delivery, and the comprehensiveness of reports. Unique selling propositions often lie in accreditations, specialized expertise in niche industries, and the ability to navigate complex international regulatory landscapes. Technological advancements include the application of AI for predictive analytics in failure detection and the use of digital platforms for real-time data monitoring and traceability.

Key Drivers, Barriers & Challenges in Testing, Inspection, and Certification Market

The global Testing, Inspection, and Certification (TIC) market is propelled by several key drivers. Escalating global trade necessitates compliance with diverse international standards, driving demand for testing and certification services. Increasing consumer awareness regarding product safety, environmental impact, and ethical sourcing compels manufacturers to seek third-party validation. Stringent government regulations and industry-specific standards, particularly in sectors like food and agriculture, energy, and healthcare, are fundamental growth catalysts. Technological advancements, such as the need to test new materials, complex electronics, and software, also fuel market expansion.

However, the market faces significant barriers and challenges. The highly fragmented nature of some sub-segments and intense price competition can pressure profit margins. The cost and complexity of obtaining and maintaining accreditations for TIC providers can be substantial. Supply chain disruptions and geopolitical uncertainties can impact the ability to conduct timely inspections and testing. Furthermore, the evolving regulatory landscape requires continuous adaptation and investment in new testing capabilities. Overcoming these challenges requires strategic investment in technology, talent, and a proactive approach to regulatory changes.

Emerging Opportunities in Testing, Inspection, and Certification Market

Emerging opportunities in the Testing, Inspection, and Certification (TIC) market are largely centered around the growing demand for sustainability, digitalization, and specialized niche services. The increasing global focus on Environmental, Social, and Governance (ESG) criteria is creating a significant market for sustainability verification, carbon footprint assessment, and green product certifications. The expansion of the circular economy model presents opportunities in product lifecycle assessments and material traceability services. Furthermore, the proliferation of IoT devices and smart technologies is driving demand for cybersecurity testing and data privacy compliance services. Untapped markets in developing economies, coupled with the need for localized compliance solutions, also represent substantial growth potential.

Growth Accelerators in the Testing, Inspection, and Certification Market Industry

Long-term growth in the Testing, Inspection, and Certification (TIC) market will be significantly accelerated by continuous technological breakthroughs and strategic market expansion initiatives. The widespread adoption of AI and machine learning for predictive maintenance, anomaly detection, and data analytics will enhance service efficiency and value proposition. The development of advanced digital platforms for seamless data integration, remote inspections, and virtual auditing will streamline operations and broaden market reach. Strategic partnerships and collaborations between TIC providers and technology firms will foster innovation and the development of integrated solutions. Furthermore, expansion into emerging markets and the diversification of service offerings to cater to new industries and evolving regulatory demands will act as crucial growth accelerators.

Key Players Shaping the Testing, Inspection, and Certification Market Market

- UL Group

- Intertek Group PLC

- DNV GL

- TUV SUD Ltd

- Applus Services SA

- Kiwa NV

- Element Metech (Exova Group PLC)

- MISTRAS Group Inc

- BSI Group

- SAI Global Limited

- Dekra Certification GmbH

- SGS SA

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

Notable Milestones in Testing, Inspection, and Certification Market Sector

- May 2023: UL Solutions inaugurated a new office in Riyadh, Saudi Arabia, to better serve clients in the region with fire safety, security, and sustainability services. This move supports Saudi Arabia's requirement for local presence and Riyadh's ambition as an international business hub.

- January 2022: Bureau Veritas announced its acquisition of PreScience, a US-based leader in project management/construction management services for transportation infrastructure projects, expanding its North American Buildings & Infrastructure portfolio.

In-Depth Testing, Inspection, and Certification Market Market Outlook

The future outlook for the Testing, Inspection, and Certification (TIC) market remains exceptionally positive, driven by a confluence of accelerating forces. The relentless pursuit of product quality, safety, and regulatory compliance across global industries will continue to be the bedrock of demand. Emerging technologies, particularly in the realms of AI, IoT, and advanced materials, will create new avenues for specialized testing and certification services. The increasing global emphasis on sustainability and ESG compliance represents a significant and growing market segment. Strategic investments in digital transformation and the expansion of service portfolios to encompass nascent industries will be crucial for market leaders. Stakeholders can anticipate continued growth and innovation as the TIC sector adapts to an ever-evolving global landscape.

Testing, Inspection, and Certification Market Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. Sourcing Type

- 2.1. Outsourced

- 2.2. In-house

-

3. End-user Vertical

- 3.1. Consumer Goods and Retail

- 3.2. Food and Agriculture

- 3.3. Oil and Gas

- 3.4. Construction and Engineering

- 3.5. Energy and Chemicals

- 3.6. Manufacturing of Industrial Goods

- 3.7. Transportation (Aerospace and Rail)

- 3.8. Industrial and Automotive

- 3.9. Other End-user Verticals

Testing, Inspection, and Certification Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Norway

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. United Arab Emirates

- 6.3. Qatar

- 6.4. Turkey

- 6.5. Nigeria

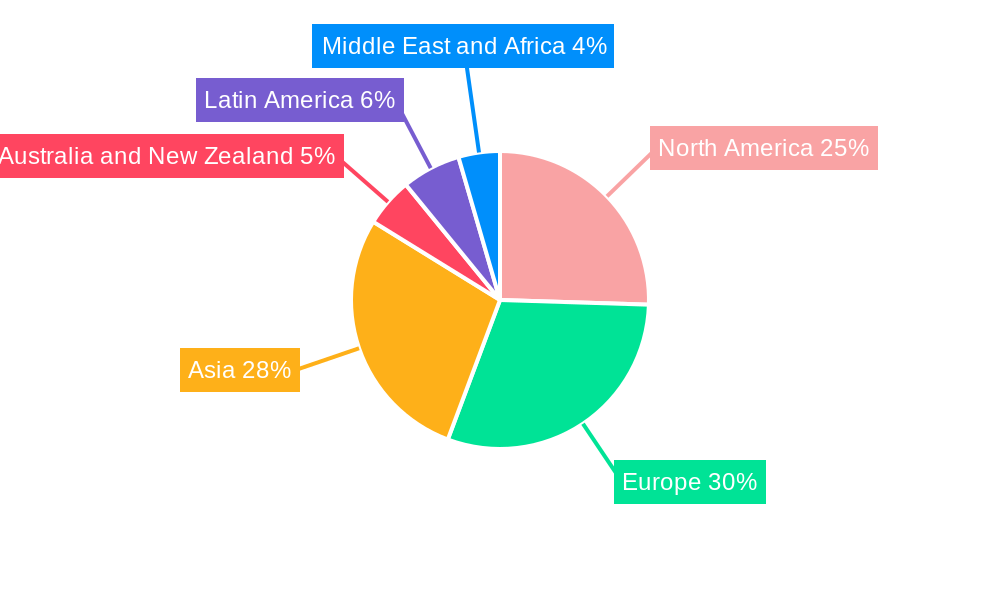

Testing, Inspection, and Certification Market Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market

Testing, Inspection, and Certification Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing incidence of foodborne diseases; Increasing trade in counterfeit and defective pharmaceutical products

- 3.3. Market Restrains

- 3.3.1. Lack of Standards in Applications and Initial Costs

- 3.4. Market Trends

- 3.4.1. Food and Agriculture Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.2.1. Outsourced

- 5.2.2. In-house

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Consumer Goods and Retail

- 5.3.2. Food and Agriculture

- 5.3.3. Oil and Gas

- 5.3.4. Construction and Engineering

- 5.3.5. Energy and Chemicals

- 5.3.6. Manufacturing of Industrial Goods

- 5.3.7. Transportation (Aerospace and Rail)

- 5.3.8. Industrial and Automotive

- 5.3.9. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.2.1. Outsourced

- 6.2.2. In-house

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Consumer Goods and Retail

- 6.3.2. Food and Agriculture

- 6.3.3. Oil and Gas

- 6.3.4. Construction and Engineering

- 6.3.5. Energy and Chemicals

- 6.3.6. Manufacturing of Industrial Goods

- 6.3.7. Transportation (Aerospace and Rail)

- 6.3.8. Industrial and Automotive

- 6.3.9. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.2.1. Outsourced

- 7.2.2. In-house

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Consumer Goods and Retail

- 7.3.2. Food and Agriculture

- 7.3.3. Oil and Gas

- 7.3.4. Construction and Engineering

- 7.3.5. Energy and Chemicals

- 7.3.6. Manufacturing of Industrial Goods

- 7.3.7. Transportation (Aerospace and Rail)

- 7.3.8. Industrial and Automotive

- 7.3.9. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.2.1. Outsourced

- 8.2.2. In-house

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Consumer Goods and Retail

- 8.3.2. Food and Agriculture

- 8.3.3. Oil and Gas

- 8.3.4. Construction and Engineering

- 8.3.5. Energy and Chemicals

- 8.3.6. Manufacturing of Industrial Goods

- 8.3.7. Transportation (Aerospace and Rail)

- 8.3.8. Industrial and Automotive

- 8.3.9. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.2.1. Outsourced

- 9.2.2. In-house

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Consumer Goods and Retail

- 9.3.2. Food and Agriculture

- 9.3.3. Oil and Gas

- 9.3.4. Construction and Engineering

- 9.3.5. Energy and Chemicals

- 9.3.6. Manufacturing of Industrial Goods

- 9.3.7. Transportation (Aerospace and Rail)

- 9.3.8. Industrial and Automotive

- 9.3.9. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Latin America Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 10.2.1. Outsourced

- 10.2.2. In-house

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Consumer Goods and Retail

- 10.3.2. Food and Agriculture

- 10.3.3. Oil and Gas

- 10.3.4. Construction and Engineering

- 10.3.5. Energy and Chemicals

- 10.3.6. Manufacturing of Industrial Goods

- 10.3.7. Transportation (Aerospace and Rail)

- 10.3.8. Industrial and Automotive

- 10.3.9. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Middle East and Africa Testing, Inspection, and Certification Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Testing and Inspection Service

- 11.1.2. Certification Service

- 11.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 11.2.1. Outsourced

- 11.2.2. In-house

- 11.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.3.1. Consumer Goods and Retail

- 11.3.2. Food and Agriculture

- 11.3.3. Oil and Gas

- 11.3.4. Construction and Engineering

- 11.3.5. Energy and Chemicals

- 11.3.6. Manufacturing of Industrial Goods

- 11.3.7. Transportation (Aerospace and Rail)

- 11.3.8. Industrial and Automotive

- 11.3.9. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 UL Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Intertek Group PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 DNV GL

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 TUV SUD Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Applus Services SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kiwa NV*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Element Metech (Exova Group PLC)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MISTRAS Group Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 BSI Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAI Global Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Dekra Certification GmbH

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 SGS SA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 ALS Limited

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Bureau Veritas SA

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Eurofins Scientific SE

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 UL Group

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Testing, Inspection, and Certification Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Testing, Inspection, and Certification Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection, and Certification Market Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 5: North America Testing, Inspection, and Certification Market Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 6: North America Testing, Inspection, and Certification Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Testing, Inspection, and Certification Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Testing, Inspection, and Certification Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Testing, Inspection, and Certification Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Testing, Inspection, and Certification Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Testing, Inspection, and Certification Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Testing, Inspection, and Certification Market Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 13: Europe Testing, Inspection, and Certification Market Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 14: Europe Testing, Inspection, and Certification Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Testing, Inspection, and Certification Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Testing, Inspection, and Certification Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Testing, Inspection, and Certification Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Testing, Inspection, and Certification Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Testing, Inspection, and Certification Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Testing, Inspection, and Certification Market Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 21: Asia Testing, Inspection, and Certification Market Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 22: Asia Testing, Inspection, and Certification Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Testing, Inspection, and Certification Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Testing, Inspection, and Certification Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Testing, Inspection, and Certification Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Testing, Inspection, and Certification Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Australia and New Zealand Testing, Inspection, and Certification Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Australia and New Zealand Testing, Inspection, and Certification Market Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 29: Australia and New Zealand Testing, Inspection, and Certification Market Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 30: Australia and New Zealand Testing, Inspection, and Certification Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Australia and New Zealand Testing, Inspection, and Certification Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Australia and New Zealand Testing, Inspection, and Certification Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Testing, Inspection, and Certification Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Testing, Inspection, and Certification Market Revenue (Million), by Service Type 2025 & 2033

- Figure 35: Latin America Testing, Inspection, and Certification Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: Latin America Testing, Inspection, and Certification Market Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 37: Latin America Testing, Inspection, and Certification Market Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 38: Latin America Testing, Inspection, and Certification Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Latin America Testing, Inspection, and Certification Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Latin America Testing, Inspection, and Certification Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Testing, Inspection, and Certification Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Testing, Inspection, and Certification Market Revenue (Million), by Service Type 2025 & 2033

- Figure 43: Middle East and Africa Testing, Inspection, and Certification Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 44: Middle East and Africa Testing, Inspection, and Certification Market Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 45: Middle East and Africa Testing, Inspection, and Certification Market Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 46: Middle East and Africa Testing, Inspection, and Certification Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 47: Middle East and Africa Testing, Inspection, and Certification Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 48: Middle East and Africa Testing, Inspection, and Certification Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Testing, Inspection, and Certification Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 7: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 13: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 21: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 22: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 29: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 30: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 31: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 34: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Mexico Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 39: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 40: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 41: Global Testing, Inspection, and Certification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: United Arab Emirates Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Qatar Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Turkey Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Nigeria Testing, Inspection, and Certification Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market?

Key companies in the market include UL Group, Intertek Group PLC, DNV GL, TUV SUD Ltd, Applus Services SA, Kiwa NV*List Not Exhaustive, Element Metech (Exova Group PLC), MISTRAS Group Inc, BSI Group, SAI Global Limited, Dekra Certification GmbH, SGS SA, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE.

3. What are the main segments of the Testing, Inspection, and Certification Market?

The market segments include Service Type, Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 251.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing incidence of foodborne diseases; Increasing trade in counterfeit and defective pharmaceutical products.

6. What are the notable trends driving market growth?

Food and Agriculture Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Standards in Applications and Initial Costs.

8. Can you provide examples of recent developments in the market?

May 2023 - UL Solutions has inaugurated a new office in Riyadh better to serve clients in Saudi Arabia and the Middle East. Customers will get fire safety, security, and sustainability services from this facility due to access to vital data and software products, tested theories, and tested science. To comply with Saudi Arabia's requirement that all foreign companies have a local presence to conduct business with the Kingdom and to help the country's aspirations to build Riyadh as a major international business center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence