Key Insights

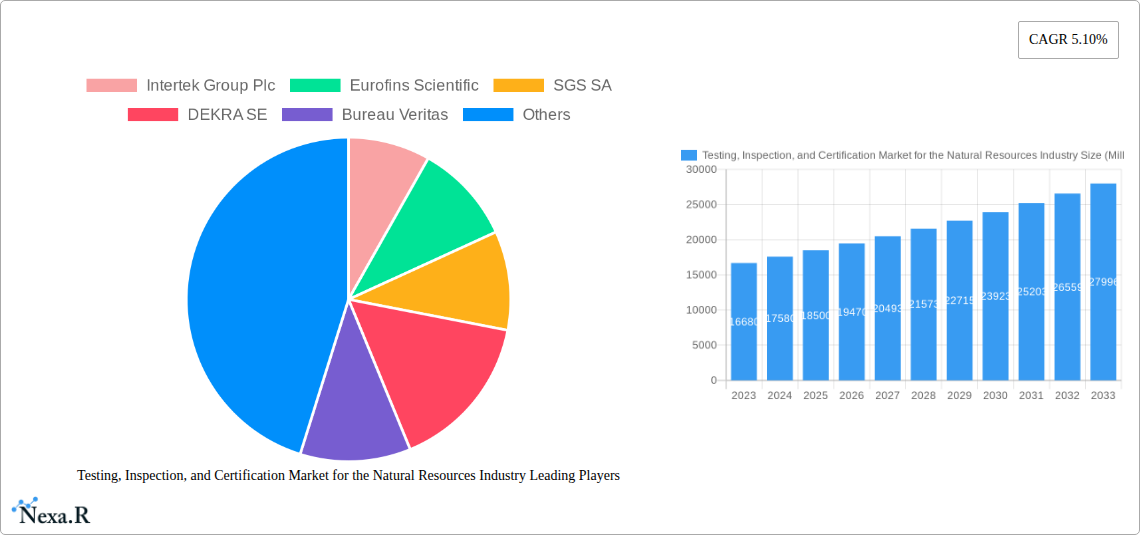

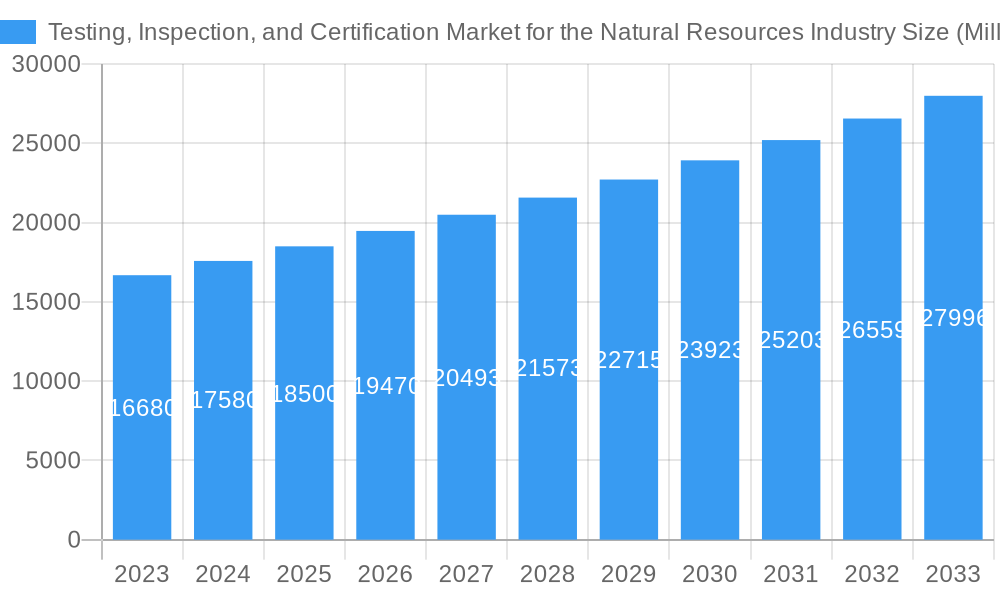

The global Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry is poised for significant expansion, projected to reach a substantial market size of approximately USD 18,500 million by 2025. This robust growth is propelled by a Compound Annual Growth Rate (CAGR) of 5.10%, indicating a healthy and sustained upward trajectory through the forecast period ending in 2033. The industry's reliance on stringent quality control, regulatory compliance, and risk mitigation across diverse natural resource sectors, including chemicals, metals, and mining, serves as a primary growth driver. Increasing demand for ethically sourced and environmentally sustainable materials further amplifies the need for comprehensive TIC services. Outsourced services are expected to dominate this landscape, driven by the desire for specialized expertise, cost-efficiency, and flexibility among natural resource companies.

Testing, Inspection, and Certification Market for the Natural Resources Industry Market Size (In Billion)

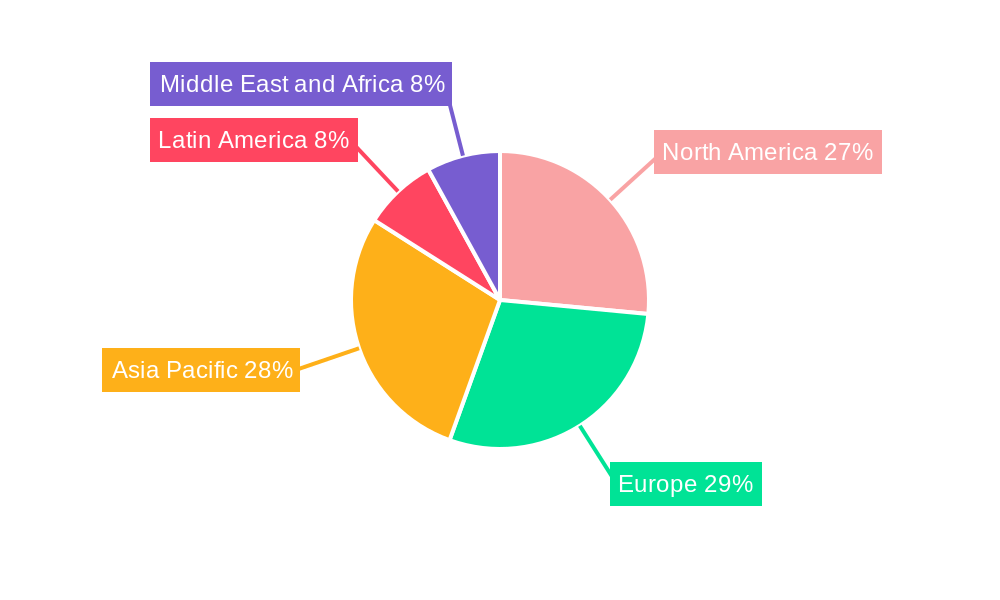

Key trends shaping this market include the growing adoption of digital technologies, such as IoT and AI, for enhanced data analysis and remote inspection, thereby improving efficiency and accuracy. Furthermore, a heightened focus on environmental, social, and governance (ESG) reporting and compliance is driving demand for specialized certifications and audits. However, the market faces certain restraints, including the high initial investment required for advanced TIC technologies and the potential for stringent regulatory changes that could impact operational costs. Geographically, Asia Pacific, particularly China, India, and South Korea, is emerging as a pivotal growth region, fueled by its vast natural resource reserves and escalating industrial activities. North America and Europe remain dominant markets due to established regulatory frameworks and a mature TIC service infrastructure. Major players like SGS SA, Bureau Veritas, and Intertek Group Plc are strategically investing in service expansion and technological innovation to capture market share.

Testing, Inspection, and Certification Market for the Natural Resources Industry Company Market Share

Comprehensive Report: Testing, Inspection, and Certification (TIC) Market for the Natural Resources Industry (2019-2033)

This in-depth report provides a strategic analysis of the Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this research offers critical insights into market dynamics, growth trends, regional dominance, product landscape, and key players. The report focuses on critical segments including Service Type (Testing and Inspection Service, Certification Service), Sourcing Type (Outsourced, In-House), and End-User Verticals (Chemical, Metal and Mining, Other End-User Verticals). With an estimated market size projected to reach XX Million in 2025, this report is an indispensable resource for industry professionals seeking to navigate and capitalize on the evolving global natural resources TIC landscape.

Testing, Inspection, and Certification Market for the Natural Resources Industry Market Dynamics & Structure

The Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry is characterized by a moderately concentrated structure, with a few dominant global players holding significant market share. This concentration is driven by the high capital investment required for advanced laboratory infrastructure and specialized expertise. Technological innovation plays a pivotal role, with advancements in analytical techniques, automation, and digital data management enabling more accurate, efficient, and real-time analysis of natural resources. Stringent regulatory frameworks across various jurisdictions, focusing on environmental compliance, safety standards, and product quality, act as a major demand driver. Competitive product substitutes are limited within the core TIC services, but technological advancements in in-house testing capabilities by larger resource companies pose a potential challenge. End-user demographics are diverse, ranging from multinational chemical and mining corporations to smaller exploration firms, each with varying needs for outsourced TIC services. Mergers and acquisitions (M&A) are a notable trend, as key players consolidate their market position, expand their service portfolios, and gain access to new geographic regions. For instance, recent acquisitions have focused on bolstering capabilities in niche areas like sustainable resource extraction and advanced material testing.

- Market Concentration: Dominated by a few key global TIC providers, with a competitive landscape featuring both large international entities and specialized regional players.

- Technological Innovation Drivers: Advancements in spectroscopy, chromatography, drone-based inspections, AI-powered data analytics, and IoT integration for real-time monitoring.

- Regulatory Frameworks: Growing emphasis on ESG (Environmental, Social, and Governance) compliance, carbon footprint verification, and adherence to international standards for resource extraction and product quality.

- Competitive Product Substitutes: Limited direct substitutes for comprehensive TIC services, though the development of sophisticated in-house analytical capabilities by large corporations represents an indirect competitive force.

- End-User Demographics: A broad spectrum of natural resource companies, including those in the chemical, metal and mining, oil and gas, and agriculture sectors, with varying levels of in-house expertise and outsourcing needs.

- M&A Trends: Strategic acquisitions aimed at expanding service offerings in areas like environmental consulting, digital transformation, and specialized commodity testing, as well as geographical expansion to tap into emerging resource markets.

Testing, Inspection, and Certification Market for the Natural Resources Industry Growth Trends & Insights

The Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry is poised for robust growth, driven by a confluence of escalating regulatory demands, increasing global consumption of natural resources, and a growing emphasis on sustainability and ethical sourcing. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, with the market size expected to expand from XX Million in the base year to an estimated XX Million by the end of the forecast period. This expansion is underpinned by rising adoption rates of advanced TIC services by companies aiming to de-risk their operations, ensure compliance, and enhance their brand reputation. Technological disruptions are profoundly reshaping the landscape, with the integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) revolutionizing inspection processes and data analysis. For example, drone-based inspections equipped with hyperspectral imaging can now provide more detailed and efficient geological surveys. Furthermore, shifts in consumer and investor behavior towards environmentally responsible and ethically sourced products are compelling natural resource companies to seek independent verification of their operations and supply chains. This trend is particularly evident in the demand for carbon footprint verification, water usage audits, and ethical labor practice certifications. The increasing complexity of global supply chains also necessitates rigorous TIC services to ensure quality and traceability from extraction to end-use. The growing demand for critical minerals for renewable energy technologies and electric vehicles is also a significant growth catalyst, as these resources often come with unique extraction and processing challenges requiring specialized TIC. The Chemical segment within end-user verticals is anticipated to exhibit strong growth due to stringent regulations on chemical composition, safety, and environmental impact. Similarly, the Metal and Mining segment is a cornerstone of the market, driven by the need for quality control, safety compliance, and environmental monitoring throughout the mining lifecycle. The "Other End-User Verticals," encompassing sectors like agriculture, forestry, and renewable energy raw materials, are also witnessing increasing reliance on TIC services as global sustainability agendas intensify. Outsourced TIC services continue to dominate, as companies leverage specialized expertise and avoid the high capital expenditure associated with establishing in-house capabilities for a broad range of testing and certification needs.

Dominant Regions, Countries, or Segments in Testing, Inspection, and Certification Market for the Natural Resources Industry

The Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry exhibits significant regional variations in growth and dominance, largely influenced by the concentration of natural resource extraction activities, regulatory landscapes, and economic development. Asia Pacific is emerging as a dominant region, driven by its rapidly expanding industrial base, substantial natural resource reserves, and increasing investments in infrastructure and technology. Countries like China and India, with their vast mining operations and burgeoning chemical industries, are significant contributors to market growth. The region's commitment to modernizing its regulatory frameworks and adopting international standards is further bolstering the demand for TIC services.

Within the Service Type segment, Testing and Inspection Service commands the largest market share, reflecting the fundamental need for quality assurance, safety compliance, and operational integrity across the entire natural resources value chain. This includes a wide array of services such as material testing, environmental monitoring, safety audits, and on-site inspections at extraction sites and processing facilities. The Metal and Mining end-user vertical is a key driver of this dominance, given the inherent risks and complexities associated with extracting and processing various metals and minerals.

Regarding Sourcing Type, Outsourced TIC services are overwhelmingly dominant. Natural resource companies, often operating in capital-intensive and geographically dispersed environments, prefer to leverage the specialized expertise, advanced technology, and independent credibility offered by third-party TIC providers rather than investing heavily in in-house capabilities that may become quickly outdated or are not core competencies. This trend is particularly pronounced in developing economies where establishing extensive in-house testing infrastructure can be prohibitive.

The Chemical end-user vertical is also a significant contributor to market growth, driven by the stringent regulations governing the production, handling, and transportation of chemical substances. The need for precise compositional analysis, impurity detection, and environmental impact assessments fuels a consistent demand for specialized TIC services within this sector.

Key drivers for this regional and segmental dominance include:

- Economic Policies: Government initiatives promoting responsible resource extraction, environmental protection, and industrial modernization in regions like Asia Pacific.

- Infrastructure Development: Significant investments in mining infrastructure, chemical processing plants, and logistics networks in emerging economies, necessitating rigorous quality and safety oversight.

- Resource Abundance: The presence of substantial reserves of minerals, metals, oil, gas, and agricultural commodities in specific regions naturally concentrates TIC service demand.

- Regulatory Stringency: The implementation and enforcement of robust environmental, health, and safety regulations, such as those related to emissions, waste management, and product safety.

- Technological Adoption: The increasing willingness of companies in dominant regions to adopt advanced TIC technologies for improved efficiency and data accuracy.

For example, the Metal and Mining sector's reliance on accurate geological analysis, ore grade determination, and compliance with stringent environmental discharge limits makes Testing and Inspection Services indispensable. In the Chemical sector, ensuring compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations in Europe or similar frameworks globally mandates comprehensive Certification Services. The Outsourced sourcing type prevails due to the cost-effectiveness and specialized knowledge that external providers bring to complex geological, chemical, and environmental challenges faced by natural resource companies.

Testing, Inspection, and Certification Market for the Natural Resources Industry Product Landscape

The product landscape within the Natural Resources TIC market is characterized by a suite of sophisticated services rather than tangible goods. These services are designed to provide assurance of quality, safety, compliance, and sustainability. Key offerings include material characterization, environmental monitoring (air, water, soil), process safety assessments, commodity analysis (e.g., ore grade, chemical composition, fuel quality), and supply chain auditing. Innovations are focused on enhancing the speed, accuracy, and comprehensiveness of these services. For instance, advancements in portable analytical instruments allow for on-site testing, reducing turnaround times. Furthermore, the integration of digital platforms and AI enables predictive analytics for potential issues and more efficient data management. Unique selling propositions often revolve around specialized accreditation, deep domain expertise in specific natural resources, global reach, and the ability to provide integrated solutions covering the entire lifecycle from exploration to end-of-life management. Technological advancements are continuously pushing the boundaries of what can be tested and certified, leading to new applications in areas like rare earth element analysis and bio-based resource verification.

Key Drivers, Barriers & Challenges in Testing, Inspection, and Certification Market for the Natural Resources Industry

The Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry is propelled by several key drivers. Escalating global demand for natural resources, coupled with increasing regulatory pressures for environmental protection, safety, and ethical sourcing, are paramount. The growing focus on ESG (Environmental, Social, and Governance) compliance by investors and consumers further necessitates independent verification of operations. Technological advancements in analytical techniques and digital solutions enhance the efficiency and accuracy of TIC services. Moreover, the drive for supply chain transparency and the need to mitigate risks associated with resource extraction and processing are significant growth catalysts.

However, the market faces notable barriers and challenges. The inherent cyclicality of the natural resources sector can lead to fluctuations in demand for TIC services. The high initial investment required for state-of-the-art laboratory equipment and specialized expertise can be a deterrent for smaller TIC providers and a barrier to entry. Stringent and sometimes conflicting international regulations across different regions add complexity. Furthermore, the industry experiences challenges related to talent acquisition and retention, requiring highly skilled scientists, engineers, and auditors. Supply chain disruptions, particularly for specialized reagents or equipment, can impact service delivery timelines. Intense competition among TIC providers, especially in mature markets, can exert pressure on pricing.

Emerging Opportunities in Testing, Inspection, and Certification Market for the Natural Resources Industry

Emerging opportunities in the Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry are significant and diverse. The increasing global emphasis on decarbonization and renewable energy is creating a surge in demand for TIC services related to critical minerals (e.g., lithium, cobalt, nickel), rare earth elements, and associated raw materials for batteries and renewable technologies. This includes specialized testing for purity and composition. Furthermore, the growing focus on the circular economy presents opportunities for TIC providers to offer services related to recycling, material recovery, and the certification of recycled materials for industrial use. Digitalization and the adoption of Industry 4.0 technologies are opening avenues for innovative TIC solutions, such as AI-powered data analytics for predictive maintenance and risk assessment, drone-based inspections for remote and hazardous locations, and blockchain for enhanced supply chain traceability. The expanding scope of ESG reporting and verification beyond carbon emissions to encompass biodiversity, water stewardship, and social impact offers new service lines. Emerging markets with developing regulatory frameworks and nascent resource industries represent significant untapped potential for TIC service providers to establish early footholds.

Growth Accelerators in the Testing, Inspection, and Certification Market for the Natural Resources Industry Industry

Several critical catalysts are accelerating long-term growth in the Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry. Technological breakthroughs in areas like hyperspectral imaging for remote sensing of mineral deposits, advanced mass spectrometry for trace element analysis, and the widespread integration of AI and machine learning for data interpretation are enhancing the precision and efficiency of TIC services. Strategic partnerships and collaborations between TIC providers, technology firms, and natural resource companies are fostering innovation and expanding service offerings. For instance, collaborations to develop digital twins of mining operations for continuous monitoring and risk assessment are gaining traction. Market expansion strategies, including mergers and acquisitions to broaden geographical coverage and service portfolios, are also key growth drivers. The increasing investor and stakeholder demand for verifiable sustainability claims and responsible resource management is creating a persistent demand for TIC services, embedding them as essential components of corporate strategy and risk mitigation. The global shift towards electrification and green technologies is also a major growth propeller, driving demand for TIC services related to the extraction and processing of minerals vital for these industries.

Key Players Shaping the Testing, Inspection, and Certification Market for the Natural Resources Industry Market

- Intertek Group Plc

- Eurofins Scientific

- SGS SA

- DEKRA SE

- Bureau Veritas

- Kiwa NV

- Element Materials Technology

- CWM International

- Applus+ Group

- TUV SUD

Notable Milestones in Testing, Inspection, and Certification Market for the Natural Resources Industry Sector

- March 2022: SGS expanded its metals and minerals testing laboratory in Spijkenisse, Netherlands. The new facility has the ability to test various minerals and metals, including zinc, copper, lead, gold, and silver concentrate, industrial minerals, intermediate products, and ferrous and high-purity metals. This expansion significantly bolsters SGS's capacity and capabilities in providing crucial analytical services for the metals and mining industry, addressing the growing demand for detailed commodity analysis and quality assurance.

In-Depth Testing, Inspection, and Certification Market for the Natural Resources Industry Market Outlook

The future outlook for the Testing, Inspection, and Certification (TIC) market for the Natural Resources Industry is exceptionally positive, fueled by ongoing global resource demand and an intensified focus on sustainability and responsible extraction. Growth accelerators, including groundbreaking technological advancements in analytical science and digital integration, are enabling more comprehensive and efficient service delivery. Strategic alliances and consolidations within the industry are poised to create more integrated and capable TIC solutions. The escalating importance of verifiable ESG credentials by investors, regulators, and consumers is cementing the role of TIC services as indispensable for risk management and market access. The transition to a low-carbon economy, driving demand for critical minerals, will further underpin market expansion. Consequently, the market is anticipated to witness sustained growth, presenting significant strategic opportunities for TIC providers who can adapt to evolving industry needs and leverage emerging technologies to deliver trusted assurance.

Testing, Inspection, and Certification Market for the Natural Resources Industry Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. Sourcing Type

- 2.1. Outsourced

- 2.2. In-House

-

3. End-User Vertical

- 3.1. Chemical

- 3.2. Metal and Mining

- 3.3. Other End-User Verticals

Testing, Inspection, and Certification Market for the Natural Resources Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Testing, Inspection, and Certification Market for the Natural Resources Industry Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market for the Natural Resources Industry

Testing, Inspection, and Certification Market for the Natural Resources Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Resources; Growing Awareness about Safety and Sustainability in the Natural Resources Industry

- 3.3. Market Restrains

- 3.3.1. Lack of Common Industry Standard Increases the Complexity of TIC Process

- 3.4. Market Trends

- 3.4.1. Metal and Mining Industry to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market for the Natural Resources Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.2.1. Outsourced

- 5.2.2. In-House

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Chemical

- 5.3.2. Metal and Mining

- 5.3.3. Other End-User Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection, and Certification Market for the Natural Resources Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.2.1. Outsourced

- 6.2.2. In-House

- 6.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.3.1. Chemical

- 6.3.2. Metal and Mining

- 6.3.3. Other End-User Verticals

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.2.1. Outsourced

- 7.2.2. In-House

- 7.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.3.1. Chemical

- 7.3.2. Metal and Mining

- 7.3.3. Other End-User Verticals

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.2.1. Outsourced

- 8.2.2. In-House

- 8.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.3.1. Chemical

- 8.3.2. Metal and Mining

- 8.3.3. Other End-User Verticals

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.2.1. Outsourced

- 9.2.2. In-House

- 9.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.3.1. Chemical

- 9.3.2. Metal and Mining

- 9.3.3. Other End-User Verticals

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 10.2.1. Outsourced

- 10.2.2. In-House

- 10.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 10.3.1. Chemical

- 10.3.2. Metal and Mining

- 10.3.3. Other End-User Verticals

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SGS SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DEKRA SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bureau Veritas

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kiwa NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Element Materials Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CWM International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Applus+ Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TUV SUD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 5: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 6: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 7: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 8: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 13: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 14: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 15: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 16: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 21: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 22: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 23: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 24: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 29: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 30: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 31: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 32: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 35: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 37: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 38: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 39: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 40: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 7: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 8: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 13: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 14: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 21: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 22: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 23: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 30: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 31: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 32: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Latin America Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 37: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 38: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 39: Global Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Saudi Arabia Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: United Arab Emirates Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Testing, Inspection, and Certification Market for the Natural Resources Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market for the Natural Resources Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market for the Natural Resources Industry?

Key companies in the market include Intertek Group Plc, Eurofins Scientific, SGS SA, DEKRA SE, Bureau Veritas, Kiwa NV, Element Materials Technology, CWM International, Applus+ Group, TUV SUD.

3. What are the main segments of the Testing, Inspection, and Certification Market for the Natural Resources Industry?

The market segments include Service Type, Sourcing Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Resources; Growing Awareness about Safety and Sustainability in the Natural Resources Industry.

6. What are the notable trends driving market growth?

Metal and Mining Industry to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Common Industry Standard Increases the Complexity of TIC Process.

8. Can you provide examples of recent developments in the market?

March 2022 - SGS expanded its metals and minerals testing laboratory in Spijkenisse, Netherlands. The new facility has the ability to test various minerals and metals, including zinc, copper, lead, gold, and silver concentrate, industrial minerals, intermediate products, and ferrous and high-purity metals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market for the Natural Resources Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market for the Natural Resources Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market for the Natural Resources Industry?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market for the Natural Resources Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence